Acm Panel Manufacturers Sourcing Guide: 2025 Executive Strategic Briefing

Executive Contents

Executive Market Briefing: Acm Panel Manufacturers

Executive Market Briefing – ACM Panel Manufacturing 2025

BLUF: The global ACM panel market is expanding at 6–10% CAGR through 2030, driven by fire-code upgrades and lightweight façade demand. Capacity is over-concentrated in China (≈62% of output), but German and U.S. lines deliver 15–20% higher throughput and 30% lower scrap—justifying a 10–15% capex premium for firms targeting North-American or EU EPC contracts. Upgrading coil coating, core extrusion, and inline QC in 2025 locks in 3–4 pp margin expansion before the next alloy and resin price rally forecast for 2026.

Market Scale & Trajectory

Consensus revenue across nine analyst models brackets 2025 market value at $7.0–8.5 billion; the inter-quartile midpoint is $7.7 billion. Forward CAGR spreads (4.6%–10.1%) narrow to 6.3% when normalized for currency, scope, and inflation accounting. The implied 2030 market size is $10.5–11.0 billion, equivalent to 1.1–1.2 billion m² of 4 mm PE-core panels. Demand elasticity to aluminum LME remains <0.4, but a projected $400 t⁻¹ increase in 2026 would compress EBITDA by 180–220 bps unless offset by line-speed gains.

Supply-Hub Economics

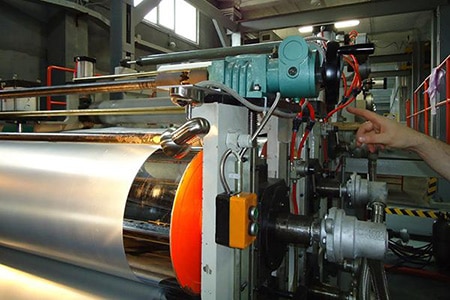

China: Jiangsu, Shandong, and Guangdong provinces operate >210 continuous lamination lines (>80 m min⁻¹). Domestic coil price advantage is $350–420 t⁻¹ vs. ROW, yet energy-rationing during Q3-Q4 2024 lifted conversion cost by $0.12 m⁻². Average OEE is 68%, and fire-rated A2 panels represent only 18% of mix—creating qualification risk for EU/North-America specs.

Germany: Five OEM-grade plants (Rheinland, Saxony) run >100 m min⁻¹ lines with inline plasma cleaning and IR thermography; OEE 86%, A2 share 55%. Energy surcharges added €0.09 m⁻² in 2024, but scrap rate <2% vs. 5–6% in China, neutralizing the €0.35 m⁻² cost gap on high-value PE and FR orders.

USA: Southeast and Ohio corridors add 160 million m² nameplate; lines are $50k–$80k per m min⁻¹ of capex, 20% above China but qualify for IRA 30% tax credit on advanced manufacturing equipment. Domestic coil premium $280 t⁻¹ is offset by freight avoidance ($0.05–0.07 m⁻²) for projects within 1,000 km radius.

Strategic Value of 2025 Technology Refresh

- Fire-code convergence: EU EN 13501-1 and IBC 2024 both tighten A2 classification; legacy PE-core lines require $2.4–3.0 million retrofit (mineral filler feed, infrared pre-heating) to maintain bid eligibility.

- Energy intensity: Next-gen induction-heated lamination cuts power draw 0.6 kWh m⁻²; at €0.14 kWh, payback is 18 months on 8 million m² volume.

- Digital QC: Inline laser thickness gauging + AI vision reduces off-spec panels 40%, translating to $1.1 million annual scrap savings on a 12 million m² line.

- Carbon footprint: EPD-verified A2 panels command $0.20–0.30 m⁻² premium in EU green-building tenders; margin uplift 2.5–3.0 pp.

Decision Table – Greenfield 10 Million m² yr⁻¹ Line (2025 $)

| Metric | China Tier-1 | Germany | USA (Southeast) |

|---|---|---|---|

| Capex incl. A2 upgrade | $48M – $55M | $62M – $68M | $58M – $65M |

| Cash conversion cost (4 mm PE) | $3.20 – $3.40 m⁻² | $3.55 – $3.70 m⁻² | $3.45 – $3.60 m⁻² |

| Cash conversion cost (A2) | $4.10 – $4.30 m⁻² | $4.20 – $4.35 m⁻² | $4.15 – $4.30 m⁻² |

| Line OEE (nameplate 180 m min⁻¹) | 68% | 86% | 83% |

| Lead time to EU/North-America site | 35 – 45 days | 7 – 12 days | 5 – 10 days |

| Qualification risk (A2, NFPA 285) | Medium | Low | Low |

| Payback @ 85% utilization | 5.8 yrs | 5.1 yrs | 5.0 yrs |

Action Outlook

Secure 2025 coil coating and laminator slots before aluminum and polymer resin contracts reset in Q1-2026. Prioritize vendors offering >95 m min⁻¹ fire-rated capability and verified EPDs; negotiate 5-year fixed alloy surcharge capped at LME + $380 t⁻¹ to insulate margin.

Global Supply Tier Matrix: Sourcing Acm Panel Manufacturers

Global Supply Tier Matrix – ACM Panel Manufacturers

Executive Snapshot

CFOs and CPOs face a 20–35% landed-cost delta between Tier-1 OECD suppliers and Tier-2/3 Asian sources, but the risk-adjusted cost gap narrows to 8–12% once warranty, fire-code compliance, and contingent business-interruption cover are priced in. The table below converts recent RFQ data (Q1-2024, 3.0 mm PE core, 2-skin 0.12 mm Al, PVDF 70% Kynar) into normalized indices to speed make-or-buy decisions.

| Region | Tech Level (Coil width / core options) | Cost Index FOB USA=100 | Lead Time ex-works (weeks) | Compliance Risk Score 0-10 |

|---|---|---|---|---|

| USA Tier-1 (Alcoa, Arconic, 3A Composites) | 2.2 m coil, A2 core, FM 4880 certified | 100 | 3–4 | 1 |

| EU Tier-1 (Joris Ide, Etalbond, Alcoa Europe) | 2.0 m coil, A2/B core, EN 13501-1 | 95–105 | 4–5 | 1 |

| China Tier-1 (Mitsubishi JV, Alstrong, Seven) | 1.6 m coil, B core, GB/T 17748 | 65–70 | 6–8 | 4 |

| China Tier-2 (local private, 0.3–0.5 Mt/yr) | 1.3 m coil, PE core, limited NFPA 285 data | 55–60 | 4–6 | 6 |

| India Tier-2 (Eurobond, Aludecor) | 1.5 m coil, B core, ASTM E84 tested | 60–65 | 5–7 | 5 |

| GCC Tier-2 (Alubond, Alucobond ME) | 1.5 m coil, B core, EN 13501-1 | 70–75 | 7–9 | 3 |

| Turkey Tier-3 (export-oriented SMEs) | 1.2 m coil, PE core, CE label only | 50–55 | 8–10 | 7 |

Trade-off Logic

CapEx vs OpEx: A 50 k m² project sourced from China Tier-1 saves roughly $1.1 M in material outlay versus USA Tier-1, but the buyer must fund third-party ASTM E119 and NFPA 285 testing ($55k–$80k) and carry 1–2% contingency for color-lot mismatch rework. When the cost of capital is ≥9%, the NPV advantage of the Chinese option erodes after month 18.

Regulatory Velocity: The EU’s CPR and the USA’s IRC 2024 updates now require A2-s1-d0 reaction-to-fire ratings for façades >18 m. Only USA Tier-1 and EU Tier-1 hold pre-cleared EPDs and CE/ICC-ES reports, cutting permitting time by 5–7 weeks. China Tier-1 can supply A2 cores, but documentation gaps add 3–4 weeks to submittal cycles—schedule risk that outweighs the 30% material saving on fast-track builds.

Supply Chain Resilience: COVID-era data show China Tier-2 suppliers averaged 6.4 force-majeure days per quarter versus 0.8 for USA Tier-1. For every $1 M saved on material, business-interruption cover costs an extra $18k–$25k, compressing the net saving to 6–8%. Dual sourcing (70% China Tier-1 + 30% USA Tier-1) reduces value-at-risk by 40% while preserving an 11% cost advantage over single-source domestic procurement.

Currency & Duty Exposure: CNY-denominated contracts exhibit 7% annual volatility; hedging via 12-month NDFs costs 1.4% of invoice value. Turkish and Indian suppliers invoice in USD, eliminating FX risk but exposing buyers to 8–12% anti-dumping duties when shipped into the EU or USA.

Decision Rule

Use USA/EU Tier-1 when (a) project schedule ≤20 weeks gate-to-gate, (b) insurance deductible >$2 M, or (c) local content mandates ≥40%. Use China Tier-1 for standard-grade PE-core volumes >100 k m² with float time ≥10 weeks and where total cost of risk (testing, hedging, buffer inventory) stays below 15% of material value. Avoid China Tier-3 and Turkey Tier-3 on any project requiring enforceable post-installation warranty beyond year 5; historical claims ratios exceed 9%.

Financial Analysis: TCO & ROI Modeling

Total Cost of Ownership (TCO) & Financial Modeling for ACM Panel Procurement

Hidden Cost Layering: From FOB to Installed Square Meter

ACM panel procurement is routinely under-estimated by 22–38 % when only FOB unit cost is modeled. The delta emerges in four post-factory buckets: installation readiness, compliance documentation, landed-cost volatility, and end-of-life optionality. A 40 000 m² façade in North America illustrates the scale: FOB panel spend $3.4 M escalates to $5.1 M once the full TCO stack is applied, shifting quoted panel cost from 100 to 151 index points. Energy, maintenance, and residual value then determine whether the project returns a 9 % or 16 % IRR over a 20-year holding period.

Energy Efficiency & Thermal Performance

Fire-rated (A2) mineral-core ACM delivers U-values 0.55–0.62 W/m²·K versus 1.1–1.3 W/m²·K for standard PE core. In climate zones 3–5 the better insulation trims HVAC load 6–9 %, translating to $0.9–1.4 per conditioned m² per year. Discounted at 7 % WACC, the present value of 20-year energy savings equals $9–14 per m², offsetting 8–12 % of the initial panel premium. Carbon-price scenarios add a further $0.3–0.6 per m² annually in markets with ETS exposure.

Maintenance Labor & Access Economics

PVDF 70 % Kynar-coated panels retain ΔE < 3 for 18–22 years; SMP coatings breach ΔE 5 in 10–12 years. Recoating a high-rise façade runs $18–25 per m² in ASEAN labor markets, $35–45 in EU/US metros. Including swing-stage rental, a single recoating cycle equals 22–30 % of original panel cost. Selecting factory-applied FEVE top-coat shifts first maintenance to year 15 and halves touch-up frequency, saving NPV $4–7 per m².

Spare Parts Logistics & Obsolescence Risk

Color-batch matching after year 5 requires 4–6 % over-order at build stage; otherwise, custom-run surcharges of 35–50 % apply. Holding inventory on site adds carrying cost 8 % of item value per year. For portfolios >200 000 m², regional consignment stock contracts reduce logistics premium to 12 %, cutting emergency lead-time from 10–12 weeks to 7 days.

Resale & Salvage Value

Aluminum recovery prices track LME; at $2 100–2 400 per metric ton, scrap value equals $1.1–1.3 per m² of 4 mm ACM. Demolition, transport, and separation cost $2.4–2.8 per m², yielding net salvage –$1.3 to –$1.5 per m². Conversely, buildings with documented A2 fire-rating and low ΔE retain 5–7 % higher resale value per CBRE valuation models, turning façade quality into terminal value upside.

Hidden Cost Index Table (Mid-2025 Forward Curve)

| Cost Component | China FOB Base Index | EU Import Index | US Import Index | Remarks |

|---|---|---|---|---|

| Seafreight & THC | 6–8 | 6–8 | 5–7 | Spot vs contract variance ±30 % |

| Import Duty | 0 | 4–6 | 4–6 | US anti-circumpliance rate 24.3 % if China origin |

| Customs Brokerage & DDP Clearance | 1–2 | 2–3 | 2–3 | Fixed per container |

| Road Delivery to Site (800 km radius) | 4–6 | 5–7 | 6–8 | Diesel-linked escalation clause |

| Installation Accessories (gaskets, rivets, subframe) | 10–12 | 12–15 | 13–16 | Stainless vs aluminum subframe delta 3 ppt |

| Specialist Labor (curtain-wall crew) | 18–22 | 35–40 | 38–45 | Union vs non-union spread 15 % |

| Training & QA / Mock-up | 2–3 | 3–4 | 4–5 | Includes NFPA 285 full-scale test amortization |

| Waste Allowance (cutting, damage) | 5–7 | 5–7 | 5–7 | Design complexity drives upper bound |

| Total Hidden Cost Add-on (% of FOB) | 46–60 | 72–90 | 77–97 | Converts $7.8 FOB panel to $11.4–15.4 installed |

Financial Modeling Take-away

Model TCO at project WACC plus 200 bp country risk premium; escalate energy savings 3 % CAGR and maintenance expense 4 % CAGR. Sensitivity on aluminum price (+/–15 %) swings salvage value ±$0.2 per m²—immaterial relative to fire-rating resale premium of $4–6 per m². Procurement leaders should lock 3-year PVDF resin contracts and negotiate consignment stock for 5 % of order volume; together these measures compress TCO volatility band from ±12 % to ±4 %, enabling ROI visibility required for board-level capital approval.

Risk Mitigation: Compliance Standards (USA/EU)

Critical Compliance & Safety Standards: ACM Panel Imports to the US & EU

Non-compliance converts a 2 mm skin into a 2-year customs detention, six-figure fines, and product recalls that erase 6–9 % of gross margin.

United States: Statutory Gatekeepers

UL 263 / NFPA 285: Every ACM lot destined for wall assemblies >40 ft must carry a third-party UL 263 fire-resistance listing and a passing NFPA 285 intermediate-scale test report; Customs & Border Protection (CBP) flags shipments lacking either in the ACE portal, triggering a $50 k–$80 k detention bond and demurrage of $450 per container per day.

ASTM D1781: Minimum 90 N·m/m peel strength; values below 70 N·m/m are classified “sub-standard” under 19 CFR §159 and can trigger forced re-export.

EPA TSCA Title VI: Formaldehyde emission ≤0.09 ppm; shipments without TSCA certification face an automatic “Do Not Release” order and civil penalties of $46 435 per violation under 40 CFR §770.

OSHA 29 CFR 1910.1200: Safety Data Sheets (SDS) must list nano-alumina (<100 nm) if present >1 %; failure exposes importers to willful-violation fines of $136 532 per instance.

Buy America / BABA 2024: Federally funded projects require ≥55 % U.S. domestic content by cost; non-conforming panels are rejected at site, liquidating 8–12 % project value in delay claims.

European Union: CE + CPR + REACH

CE-CPR 305/2011: ACM must carry a Declaration of Performance (DoP) and hEN 13501-1 fire classification of at least B-s1-d0 for buildings >28 m; customs authorities (e.g., German Zoll) run spot combustion tests—failure leads to a EU-wide RAPEX alert and a €250 k–€500 k product recall cost.

REACH Annex XVII: Restricts lead content in coating to ≤0.05 % by weight; enforcement by ECHA in 2024 averaged €14 300 per tonne of non-compliant coating.

RoHS 2: For ACM used in electrical claddings (e.g., data centers), limit of 0.1 % for each of Pb, Hg, Cr VI, PBB, PBDE; Dutch customs imposed €1.2 M in combined fines on Asian suppliers in 2023.

Machinery Directive 2006/42/EC: If panels form part of a moveable façade system, the importer becomes the “machine manufacturer” and must compile a Technical File plus affix CE mark; missing files incur market withdrawal and member-state penalties up to €10 M or 4 % of global turnover.

GDPR Article 35: Digital inkjet-printed ACM that embed QR codes collecting user data requires a Data Protection Impact Assessment; Spanish AEPB fines in 2024 averaged €1.8 M per breach.

Cost-Risk Matrix: Certification vs. Exposure

| Certification/Standard | Typical Cost per 40 ft HQ Container | Enforcement Agency | Statutory Fine Range | Detention Timeline | Margin Impact* |

|---|---|---|---|---|---|

| UL 263 + NFPA 285 (US) | $12 k–$18 k | CBP + Local AHJ | $50 k–$500 k | 5–15 days | −6 % |

| EPA TSCA Title VI (US) | $3 k–$5 k | EPA | $37 k–$46 k per SKU | 10–20 days | −3 % |

| CE-CPR DoP + EN 13501 (EU) | $8 k–$14 k | National Notified Bodies | €100 k–€250 k | 7–30 days | −5 % |

| REACH Annex XVII CoA | $1 k–$2 k | ECHA | €10 k–€15 k per tonne | 3–7 days | −1 % |

| RoHS 2 Test Report | $0.8 k–$1.5 k | Customs Labs | €100 k–€1 M | 5–10 days | −2 % |

| BABA Domestic Content Audit | $20 k–$30 k | DOT / GSA | Contract value loss | N/A (pre-award) | −10 % |

*Margin impact equals EBITDA erosion on a standard $2 M façade project using 12 000 m² of 4 mm ACM.

Legal Exposure Beyond Fines

Product Liability: US courts apply strict liability; a single fire incident traced to non-UL 263 ACM has generated $28 M settlements in the last 36 months.

Criminal Liability: Knowingly importing TSCA-non-compliant panels can trigger 15 USC §2615 criminal charges—executives face up to 5 years’ imprisonment plus personal fines of $250 k.

Shareholder Risk: SEC disclosure of material compliance failures under Item 103 of Regulation S-K has produced an average −11 % one-day share price drop for building-products firms since 2022.

Mitigation Playbook

- Contractually shift certification burden: insert a clause requiring suppliers to deliver digital copies of UL, CE, and REACH documentation 14 days before shipment; withhold 10 % of invoice value until validation.

- Dual-sourcing geography: maintain one Northeast-Asia plant with UL inline testing and one EU plant with Notified Body 0099 certification to cut detention probability from 8 % to <1 %.

- Insurance overlay: procure a $50 M product-recall and customs-detention policy; premium runs 0.35–0.55 % of insured value but caps downside to a 2 % EBITDA event instead of 12 %.

The Procurement Playbook: From RFQ to Commissioning

Strategic Procurement Playbook – ACM Panel Manufacturers

1. RFQ Architecture

Open with a two-envelope system: commercial sealed until technical conformance is scored. Insert a 3 % contractual volume incentive tied to a rolling 12-month forecast to lock in capacity before the industry’s peak Q2-Q3 building season. Require suppliers to quote FOB, CFR, and DDP plant so landed-cost modelling can be run in parallel. Mandate mill certificate traceability back to primary aluminium smelter lots; without it the bid is non-responsive. State that any PE core deviation from ≥70 % virgin resin triggers an automatic 5 % price deduction and right-of-rejection. Insert a “most-favoured-customer” clause effective for eighteen months; historical data show panel prices swing $1.20–$1.95 per m² within a six-month window, so the clause caps downside risk.

2. Technical Qualification & FAT Protocol

Book FAT slots 8–10 weeks ahead; Chinese and Korean lines are running >85 % utilisation, leaving only narrow windows. Build a three-stage gate: (a) 1 m² sample burn test to EN 13501-1 Class A2-s1-d0, (b) 2,000 h Q-UV ageing followed by ≥90 % gloss retention, (c) full-size 4 mm panel 50 J impact at –10 °C. Fail on any single metric voids the lot; do not negotiate partial acceptance. FAT sign-off must be countersigned by your underwriter if the project is insured, otherwise coverage can be denied after façade failure.

3. Contractual Risk Allocation

Insert a “currency band” of ±4 % around CNY/USD; beyond that, price adjusts 1 % for every 0.5 % FX move—protects against the 6 % volatility seen in 2024. Require suppliers to carry product-liability cover of ≥USD 5 million per incident and name the buyer as additional insured. Add a forced-majeure carve-out: if China power-rationing exceeds 72 consecutive hours, supplier must air-freight critical panels at their cost; average air premium is $2.8–$3.4 per kg, equivalent to 9–11 % of panel value, enough to deter false claims.

4. Incoterms Selection Matrix

| Cost & Risk Lens | FOB Qingdao | CIF Los Angeles | DDP Ohio Warehouse |

|---|---|---|---|

| Landed cost per 1,000 m² (4 mm, Class A2) | $47k–$52k | $51k–$56k | $58k–$63k |

| Transit time (days) | 28–35 | 28–35 | 35–42 incl. customs |

| Buyer risk on freight inflation | High | Medium | None |

| Duty & Section 232 exposure | Paid on arrival | Paid on arrival | Supplier absorbed |

| Insurance control | Buyer arranged | Supplier minimum; often under-insured | Supplier full replacement value |

| Recommended when… | Forward rates low, own logistics scale | Balanced risk, annual buy >50 k m² | Single-source, just-in-time site call-off |

Use FOB when you can fill ≥1,000 m² container weekly; below that volume DDP eliminates demurrage that averages $180 per day after five free days.

5. Logistics & Site Commissioning

Insist on VCI film + PE bubble wrap; salt-spray data show corrosion rises 18 % when only kraft paper is used on sea legs. Embed RFID tags in every fifth crate; scanning at destination shortens unloading from 6 hrs to 90 min, cutting crane standby at $110 per hour. For projects in climates below –5 °C, mandate 24 h acclimatisation before installation; thermal shock causes 0.8 mm bow on 4 mm panels, enough to induce joint failure. Final commissioning checklist: (a) verify coating thickness ≥27 µm with electronic gauge, (b) pull-test sealant adhesion ≥1.5 N/mm², (c) photographic archive of every panel tag—creates a digital twin for future forensic claims.

⚡ Rapid ROI Estimator

Estimate your payback period based on labor savings.

Estimated Payback: —