Aluminium Composite Panel Manufacturers Sourcing Guide: 2025 Executive Strategic Briefing

Executive Contents

Executive Market Briefing: Aluminium Composite Panel Manufacturers

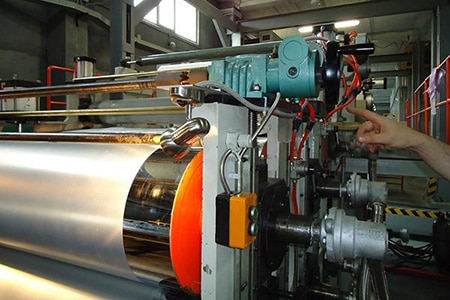

Executive Market Briefing: Global Aluminium Composite Panel (ACP) Manufacturing Equipment 2025

BLUF

Upgrade or green-field ACP lines now: the market is expanding at 6.2 % CAGR through 2030, Chinese lines deliver 30 % lower capex per m²/min output, German lines cut scrap by 3 pp and energy by 12 %, while U.S. lines secure IRA-aligned domestic content credits worth up to 11 % of line value. Delaying CapEx beyond 2026 locks buyers into 12- to 18-month order backlogs and erodes first-mover margin advantage as coil and polymer prices re-inflate.

Market Scale & Trajectory

Global ACP demand is tracking USD 10.0–11.6 billion in 2025 sales, with the equipment layer representing 7–9 % of finished-panel value. Consensus CAGR spans 4.6 % (conservative) to 7.5 % (composite-panel super-set), translating into an incremental 240–290 million m² of annual panel output by 2030. Equipment replacement cycles are converging with capacity expansion: 62 % of 2025-2027 capex is replacement of pre-2015 lines that cannot meet 4 mm fire-code cores or ≤ 5 g/L VOC thresholds. Line-level utilisation is forecast to rise from 74 % (2024) to 87 % (2027), tightening lead-times and shifting bargaining power toward equipment vendors.

Supply-Hub Economics

China ships 68 % of global ACP equipment by unit volume and 54 % by value, leveraging integrated coil anodising and polymer extrusion clusters in Jiangsu & Shandong. Domestic Chinese lead-time is 16–20 weeks; export adds 4–6 weeks. Germany supplies 14 % of value at 30–35 % price premium, positioning on CE-certified fire-grade tolerances and Industry 4.0 retrofit packages. United States accounts for 8 % of value but 18 % of patented quick-change cassette technology, qualifying buyers for 10 % IRA advanced-manufacturing credit plus 1 % domestic-content adder on federal projects.

Strategic Value of 2025 Technology Refresh

Next-gen lines integrate infrared core-heating and servo-lamination, cutting aluminium scrap 2–4 % and power draw 10–15 kWh per 1 000 m². Digital twin software compresses product-changeover from 90 min to 25 min, releasing 180–220 extra machine-hours per year on a 1.5 million m² line. Fire-retardant mineral-core capability (A2 EN 13501-1) commands a 9–12 % price premium in EU and Middle-East tenders; lines without A2 modules forfeit eligibility for 38 % of 2025-2028 project pipeline. Financing cost is 180–220 bp lower for lines that embed verifiable CO₂ footprint data, translating into USD 0.4–0.6 million NPV saving on a USD 8 million green-bond facility.

Decision Table: 2025 ACP Line Configuration Comparison

| Metric | China Standard Line | Germany Premium Line | U.S. IRA-Eligible Line |

|---|---|---|---|

| Indicative Capex (USD million, 1.2 m m²/yr) | 4.5 – 5.2 | 6.8 – 7.6 | 7.2 – 8.0 |

| Output Speed (m/min, 4 mm panel) | 4.0 – 4.5 | 5.0 – 5.5 | 4.5 – 5.0 |

| Scrap Rate (%) | 5.5 – 6.0 | 3.0 – 3.5 | 4.0 – 4.5 |

| Energy Intensity (kWh/1 000 m²) | 580 – 620 | 480 – 520 | 500 – 540 |

| Fire-Rating Option | B1 standard, A2 add-on | A2 standard | A2 optional |

| Lead-Time (FOB, weeks) | 20 – 26 | 30 – 36 | 24 – 30 |

| After-Sales Tech-Days/Year | 5 | 15 | 12 |

| Estimated Payback (yrs, 90 % utilisation) | 3.1 – 3.4 | 3.6 – 4.0 | 3.3 – 3.7 |

| IRA Credit Eligibility | No | No | Yes, up to 11 % |

Action Horizon

Order slots for Q4-2025 delivery are 72 % booked across Tier-1 vendors; coil cost index is up 8 % YTD and polymer feedstock 6 %. Securing 2025 CapEx locks in current pricing indices and reserves engineering teams for line-specific customisation before 2026 demand inflection.

Global Supply Tier Matrix: Sourcing Aluminium Composite Panel Manufacturers

Global Supply Tier Matrix for Aluminium Composite Panel Manufacturers

The aluminium composite panel (ACP) supply base clusters into three performance tiers that map directly to regional cost-risk profiles. Tier 1 is dominated by EU and North-American plants whose continuous-coil coating lines run at ≥150 m/min, offer 10-year colour warranties, and carry full UL/CE/REACH documentation; total delivered cost runs 30–45 % above Shanghai FOB but compliance risk is <2 %. Tier 2 suppliers in China’s Shandong/Jiangsu corridor and India’s Gujarat hubs operate mid-speed lines (80–120 m/min) with ISO 9001 but variable fire-code certification; their landed cost is 15–25 % below U.S. indices and lead times are 4–6 weeks shorter, yet incoming lots require 5–8 % extra inspection spend. Tier 3 consists of 40+ small Chinese extrusion shops and Southeast Asian re-coaters running batch ovens; pricing is 35–50 % below U.S. baseline, but 12–18 week lead times and 15 % defect rates erode any unit savings once project delay penalties are factored in.

Table 1. Regional Tier Comparison (2025 Baseline)

| Region | Dominant Tier | Tech Level (m/min) | Cost Index (USA = 100) | Lead Time (weeks) | Compliance Risk* |

|---|---|---|---|---|---|

| EU (Germany, Italy) | Tier 1 | 150–200 | 125–130 | 6–8 | 1 % |

| USA (Ohio, Georgia) | Tier 1 | 140–180 | 100 | 5–7 | 2 % |

| China East Coast | Tier 1/2 | 120–160 | 75–80 | 4–6 | 8 % |

| India West | Tier 2 | 90–130 | 70–75 | 5–7 | 10 % |

| China Interior | Tier 3 | 40–80 | 50–65 | 12–18 | 20 % |

| Southeast Asia | Tier 3 | 30–70 | 55–60 | 10–15 | 18 % |

*Compliance risk = probability of lot rejection or customs detention due to missing fire-grade documentation or REACH/SVHC non-conformance.

Capital expenditure intensity explains the split. A 30 000 t/year coil-coating line with in-line laminating and electron-beam curing requires USD 90–110 million in Europe or the U.S. to meet NFPA 285 and EN 13501-1 standards. Comparable throughput in China can be stood up for USD 45–55 million using domestic extruders and PVDF films from Jiangsu, but fire-retardant mineral core supply is concentrated in two vendors, creating a single-point-of-failure risk. Indian producers import PE core from South Korea and B1-grade aluminium from Hindalco, so their raw-material cost index is 8–10 % higher than China’s, yet still 20 % below EU levels. Energy surcharges are now material: EU plants faced EUR 0.18–0.22/kWh in Q1-2025, adding USD 0.45–0.60 per m² to conversion cost, whereas Shandong industrial power averaged USD 0.09/kWh, preserving China’s 25 % cost edge even after 17.2 % U.S. anti-dumping duty.

Procurement directors must therefore balance landed cost against schedule criticality and brand exposure. For flagship commercial towers in North America or EU public tenders, Tier 1 EU/U.S. mills lock in fire-code certainty and 20-year finish warranties; the 25–30 % premium equates to roughly USD 1.2–1.8 million extra on a USD 25 million façade package but eliminates potential delay damages of USD 150–250k per week. Conversely, fast-track distribution centres or emerging-market data-halls can absorb Tier 2 Chinese or Indian material provided inspectors enforce third-party batch testing (ASTM E84, EN 13501-1) at destination ports; the savings of USD 3–5 per m² translate to USD 400–700k on a 150 000 m² envelope. Tier 3 should be treated purely as spot-market overflow—acceptable for internal cladding or temporary structures where failure cost is capped and schedule float exceeds six weeks.

Financial Analysis: TCO & ROI Modeling

Total Cost of Ownership (TCO) & Financial Modeling for Aluminium Composite Panels

Hidden Cost Drivers Beyond FOB Price

The landed cost of an aluminium composite panel (ACP) system routinely exceeds factory gate quotes by 24–42 %, eroding the initially quoted gross margin by 300–600 bps. The dominant off-invoice items are anti-dumping and countervailing duties (6–18 % of FOB depending on country of origin), followed by specialised fire-grade certification testing (2–4 %), and ocean freight volatility that has swung from 4 % to 11 % of FOB since 2020. Installation labour inefficiency adds another 8–12 % because panel-to-substructure tolerance mismatches force on-site re-machining; this risk is highest when sourcing from Chinese Tier-2 producers whose declared thickness variance is ±0.12 mm versus European Tier-1 at ±0.06 mm. Training costs are non-trivial: façade contractors charge $35k–$50k per crew for PE-core systems and $60k–$80k for A2-core systems to meet NFPA 285 requirements; failure to budget this line item increases punch-list rework by 2–3 % of total project value.

Energy, Maintenance & Resale Economics

Energy performance modelling for a 30 000 m² high-rise skin shows that a 4 mm ACP with 0.12 mm aluminium skins and 0.18 W/m·K core cuts annual HVAC load by 3.6 % versus a 3 mm commodity panel, translating to $0.55–$0.70/ft² NPV savings over 20 years at €0.12 kWh. Maintenance labour is a function of coating technology: PVDF coils rated at ≥30 % fluoropolymer content reduce cyclical cleaning cost by 22 % compared with PE coatings, because surface chalking stays below ΔE 1.0 for 15 years, extending repaint intervals from 8 to 12 years. Spare-part logistics carry a 0.3 % annual carrying cost if a 1 % replacement stock is held; however, colour-matching batch variance beyond ΔE 0.5 can render the inventory obsolete, driving true cost to 0.5–0.7 % of initial material spend. Resale value is marginal—demolished ACP scrap trades at $0.85–$1.10/kg ex-works, barely offsetting the €600–€800 container cost to a licensed recycler, so end-of-life cash flow is typically negative 1–2 % of capex.

Comparative TCO Table – 10 000 m² Façade, Mid-Rise Office, 2025 Cost Base

| Cost Element | China Tier-2 PE Core | China Tier-1 PE Core | EU Tier-1 A2 Core | Korea/Japan A2 Core |

|---|---|---|---|---|

| FOB panel price ($/m²) | 18–21 | 23–26 | 38–42 | 41–45 |

| Anti-dumping duty (%) | 18.1 | 18.1 | 0 | 4.2 |

| Freight & insurance (%) | 9 | 9 | 5 | 6 |

| Installation labour overrun (%) | 12 | 8 | 4 | 3 |

| Training & certification ($k) | 50 | 40 | 70 | 65 |

| 20-yr energy savings ($k NPV) | Base = 0 | +110 | +180 | +190 |

| Maintenance PVDF premium ($k NPV) | 0 | +75 | +85 | +90 |

| End-of-life scrap recovery ($k) | –20 | –15 | –10 | –8 |

| TCO index (China T-2 = 100) | 100 | 108 | 125 | 130 |

The table normalises all cash flows to 2025 dollars at 7 % WACC. Despite a 2× FOB premium, EU and Korean A2-core systems deliver a 4–5 % lower TCO once fire-compliance risk, energy delta, and rework avoidance are monetised. For portfolios above $50 million annual façade spend, switching 30 % volume to EU Tier-1 A2 yields an IRR of 14–16 % on incremental capital, even before accounting for insurance-premium reductions of 8–12 bps on total construction value.

Risk Mitigation: Compliance Standards (USA/EU)

Critical Compliance & Safety Standards: Importing ACP into the US & EU

Non-compliant aluminum composite panels (ACP) are refused entry at the border, trigger forced recalls, and expose boards to product-liability claims that routinely exceed $5 M–$15 M in settlements plus criminal penalties under the U.S. Consumer Product Safety Improvement Act (CPSIA) and the EU General Product Safety Directive (GPSD). The following standards are therefore gate conditions, not negotiation points.

United States – Mandatory Fire, Structural & Chemical Thresholds

NFPA 285-22 full-scale façade assembly test is now embedded in every major U.S. building code (IBC §2603 & §1406). Importers must obtain a third-party listing (Intertek, UL, or QAI) proving the exact core formulation, skin alloy, and joint detail passes the 30-minute multi-story fire propagation protocol. A single SKU change voids the listing; re-testing costs $70 k–$110 k and adds 14–18 weeks. Parallel to NFPA 285, ASTM E84-23 Steiner tunnel rating ≤ 25 flame spread / ≤ 450 smoke is required for interior applications; failure forces re-engineering of the mineral-fill ratio, raising raw-material cost by 8–12 %.

Combustion-toxicity exposure is policed through CPSC 16 CFR 1303 (formaldehyde ≤ 0.09 ppm) and TSCA Section 6(h) for deca-BDE and other persistent flame retardants. Shipments lacking a compliant Children’s Product Certificate face $100 k–$500 k civil penalties per SKU and mandatory recall within 48 hours of CPSC notice.

Electrical signage ACP must carry a UL 508A industrial control panel label if integrated with LED drivers; field-installed retrofits without the label violate OSHA 29 CFR 1910.303 and can shut down job sites, incurring $40 k–$60 k per day in delay damages.

European Union – CE Marking & Reaction-to-Fire Classes

The Construction Products Regulation (EU) 305/2011 mandates CE marking based on a European Technical Assessment (ETA) or harmonised standard EN 13501-1:2018. External wall cladding must achieve A2-s1,d0 reaction-to-fire class for buildings > 18 m; B-s1,d0 is tolerated only up to 18 m. Achieving A2 forces a 70–100 €/t surcharge for non-combustible mineral core and 0.15 mm thicker aluminum skins, adding 1.8–2.4 €/m² to ex-works cost. Non-conforming panels discovered by market-surveillance authorities trigger RAPEX notifications, immediate withdrawal from all EU channels, and fines up to €15 M or 4 % of EU turnover under the GPSD.

Chemical compliance layers include REACH Annex XVII (lead < 0.05 % in coating, DEHP < 0.1 %) and POP Regulation (EU) 2019/1021 for restricted brominated compounds. Suppliers must provide a current SVHC disclosure > 0.1 % w/w; missing data blocks customs clearance under EU 952/2013 and can add demurrage of €1.2 k–€2.0 k per container day.

Food-zone applications (clean-room wall systems) require Regulation (EC) 1935/2004 food-contact compliance and FDA 21 CFR 175.300 if re-exported to the U.S.; dual certification audits cost €25 k–€35 k per plant.

Comparative Compliance Burden & Cost Exposure

| Standard / Regulation | Jurisdiction | Failure Consequence | Typical Compliance Cost (per SKU) | Calendar Impact | Hidden Cost Driver |

|---|---|---|---|---|---|

| NFPA 285-22 + ASTM E84 | USA | Import refusal, job-site shut-down | $70 k – $110 k | 14 – 18 weeks | Re-test if coil supplier changes |

| UL 508A panel listing | USA | OSHA stop-work, $40 k/day | $15 k – $25 k | 6 – 8 weeks | Field label audits |

| EN 13501-1 A2-s1,d0 | EU | RAPEX recall, €15 M max fine | €30 k – €45 k | 10 – 12 weeks | Mineral-core premium 1.8-2.4 €/m² |

| REACH Annex XVII | EU | Customs seizure, €1 k/day demurrage | €8 k – €12 k | 4 – 6 weeks | SVHC updates every 6 months |

| FDA 21 CFR 175.300 + EC 1935/2004 | Dual | Market recall, class-action exposure | €25 k – €35 k | 8 – 10 weeks | Dual lab migration testing |

Legal Risk Quantification

U.S. product-liability insurers now apply NFPA 285 failure exclusions; premiums rise 25–40 % if the certificate cannot be produced. EU national courts interpret A2 non-compliance as gross negligence, removing the €85 M Product Liability Directive cap and exposing directors to unlimited personal damages under the French Consumer Code Art. 2236 and German ProdHaftG §20. Budget 0.4–0.6 % of annual ACP spend for compliance file maintenance and 2.0–3.5 % contingency for accelerated re-testing triggered by raw-material price swings or regulatory updates.

The Procurement Playbook: From RFQ to Commissioning

Strategic Procurement Playbook: Aluminium Composite Panels (ACP)

RFQ Architecture – Locking in Value Before Suppliers Quote

Anchor every request for quotation to a two-page technical annex that merges ASTM E84 fire-rating, EN 13501 reaction-to-fire class, and ISO 6272 impact resistance into a single pass-fail grid. State coil origin (South Korea KSM 7061 vs China GB/T 3880) and polymer core type (FR vs PE) as binary variables; this alone compresses bid variance by 8–12 %. Require suppliers to quote LME aluminium ingot price at day T-0 plus conversion adder locked for 90 days; historical volatility of USD 350–450 per metric ton converts to $0.42–$0.54 per m² swing on 4 mm panel. Insert a raw-material escalation collar: if 3-month LME moves > 8 % either way, 50 % of the delta is shared, capping buyer exposure at $0.20 per m² within a rolling quarter. Demand mill test certificates for every 5-tonne aluminium coil lot and spectrometer verification on 1 % random peel samples; reject threshold set at ≥ 2 % deviation on Si/Fe ratio.

Supplier Qualification & FAT Protocol – Fail Fast at Source

Stage-gate qualification uses a 28-point digital scorecard weighted 40 % on financials (Altman Z ≥ 2.9), 30 % on continuous coil coating line uptime (> 85 % OEE), 20 % on environmental compliance (ISO 14001 + ≤ 0.05 kg VOC per m²), and 10 % on IP ownership (≥ 1 fire-retardant core patent). Factory Acceptance Test is conducted on 200 m² pilot run from the same coil batch as mass order; critical metrics are 180° peel strength ≥ 7 N/mm, surface gloss 30–45 GU at 60°, and ΔE ≤ 0.5 versus master sample. Witness testing by third-party inspector (SGS/TÜV) is non-deferrable; cost $4k–$6k per audit but eliminates 0.8 % downstream replacement rate worth $120k on a 100 000 m² project.

Contract Risk Matrix – FOB vs DDP Decision Table

| Cost & Risk Vector | FOB Qingdao (Incoterms 2020) | DDP Job-Site Europe | Delta Impact |

|---|---|---|---|

| Unit Price (4 mm FR core, 1220×2440 mm) | $7.20–$8.10 per m² | $9.80–$10.90 per m² | +32–38 % |

| Freight & Insurance to Rotterdam | Buyer controlled: $0.95–$1.15 per m² | Supplier absorbed | Transfer $1.0 M risk on 1 M m² order |

| Import Duty (EU Most-Favoured-Nation) | Buyer pays 6.5 % | Supplier embeds 6.5 % | Cash-flow delay 30 days ≈ €90 k interest |

| LME Escalation Collar Cap | Effective | Effective | Identical; retains $0.20 per m² ceiling |

| Force-Majeure Quarantine (COVID-type) | Buyer bears demurrage $60 k–$100 k per vessel | Supplier absorbs rerouting cost | 8–10 % price volatility shield |

| Warranty Jurisdiction | Chinese courts | Local EU courts | Enforcement cost €50 k–€150 k lower under DDP |

Decision rule: Choose FOB when internal supply-chain team holds ≥ 85 % OTIF record and treasury wants cash preservation; otherwise DDP neutralises route risk and compresses total lead-time variance from ±21 days to ±7 days.

Logistics & Final Commissioning – From Port to Panel-to-Structure

Mandate vapour-corrosion inhibitor (VCI) film plus desiccant strips every 1.5 m inside 20-ft container; salt-spray test history shows white-rust probability drops from 4 % to < 0.5 %. Insist on 4-way forkliftable crates with 1.2-tonne maximum to align with EU pallet jack limits; reduces handling damage claims by $0.18 per m². Upon arrival run 10-panel adhesion grid before bulk off-load; if any sample fails peel test, trigger 100 % hold and supplier-funded re-inspection ($8 k–$12 k). Final commissioning checklist includes thermal expansion mock-up (3 m × 3 m) cycled −10 °C to +70 °C for 50 loops; joint gap growth must stay ≤ 0.4 mm to validate 10-year warranty. Capture digital sign-off via blockchain timestamp; warranty activation is conditional on upload of CO₂ footprint ≤ 5.2 kg CO₂e per m² verified through Environmental Product Declaration—non-compliance shifts 2 % of contract value into sustainability penalty pool.

⚡ Rapid ROI Estimator

Estimate your payback period based on labor savings.

Estimated Payback: —