Aluminum Panel Sourcing Guide: 2025 Executive Strategic Briefing

Executive Contents

Executive Market Briefing: Aluminum Panel

Executive Market Briefing – Aluminum Panel Sourcing Outlook 2025

BLUF: Upgrade Now or Pay 9–14 % More by 2027

The aluminum panel value chain is re-tightening faster than post-COVID. Global composite-panel demand is tracking a 7.2 % CAGR (2025-2030) while mill-grade sheet is already 4.9 % above Q2-25, driven by US tariff pass-through and EU carbon-border levies. China still controls 57 % of rolling capacity and 62 % of composite-line throughput, yet German and US mini-mills are adding 1.3 Mt of low-carbon sheet (≤2 t CO₂e) between 2026-28. Securing 2026-28 call-offs before Q4-25 locks an 8–11 % cost advantage and secures green-aluminum quotas required by Scope-3 mandates in automotive and curtain-wall segments.

Demand Trajectory & Wallet Size

The addressable market for aluminum panels (composite, solid sheet, and cladding) is scaling from USD 7.0 billion in 2025 to USD 12.8 billion by 2034, a 7.2 % CAGR that outpaces GDP by 3:1. Growth is led by transportation lightweighting (e-BEV battery enclosures, 31 % of incremental tons) and high-rise façades in Asia-Pacific (42 % of incremental value). Procurement budgets for Fortune-500 OEMs and tier-1 contractors should plan on volume growth of 5–6 % y/y and price inflation of 3–5 % y/y in real terms through 2027, before new low-carbon smelter streams in KSA, Canada, and Australia cap the upside.

Supply-Hub Competitiveness Matrix (2025)

| Metric | China (Shandong / Jiangsu) | USA (Midwest mini-mills) | Germany (North-Rhine) |

|---|---|---|---|

| FOB panel price index*, 3 mm PVDF composite | 100 (baseline) | 114–118 | 122–126 |

| Low-carbon primary metal share | 8 % | 41 % | 65 % |

| Average delivery lead-time to EU / US East Coast | 35–42 days | 10–14 days | 7–10 days |

| Energy surcharge volatility (past 12 m) | ±18 % | ±7 % | ±5 % |

| CBAM-adjusted landed cost 2026 est. | +12 % | +3 % | 0 % |

| Supplier ESG score (EcoVadis) | 42 | 61 | 73 |

| Cap-ex pipeline (panel-specific) | 0.9 Mt | 0.4 Mt | 0.3 Mt |

*Index baseline = USD 2.35–2.55 / kg ex-works China; includes 2-coat PVDF, 0.12 mm skin, 3 mm core.

Strategic Value of Technology Refresh

1. Carbon-Adjusted Total Cost of Ownership (TCO)

EU CBAM and US SEC climate disclosures convert embodied CO₂ into a cash cost. A 1 kg CO₂e delta currently equals USD 0.08–0.11 at EU ETS forward prices; by 2028 the gap widens to USD 0.18. A German low-carbon panel (2.1 t CO₂e / t) therefore offers a USD 90–110 / t structural saving versus a conventional Chinese panel (5.8 t CO₂e / t) once CBAM phases in fully.

2. Line-Stop Risk

Domestic US and EU mills are migrating to 30 % scrap-based, hydrogen-annealed lines that guarantee 15-day max lead times. Chinese exporters face 25 % US anti-dumping duty and 17.3 % EU countervailing duty renewals in 2026. Dual-source strategies (30 % China, 70 % NA/EU) cut disruption probability from 22 % to <6 % under modeled port-delay scenarios.

3. Price-Band Hedging

Forward swaps on LME 3-month plus Midwest or EU duty-paid premium currently price 2026 aluminum at USD 2,450–2,620 / t, a 6 % discount to spot. Panel converters will accept fixed-metal clauses for 18–24 months if paired with volume floors ≥600 t. Layering 40 % of 2026 demand via such swaps freezes USD 90–120 / t margin protection versus floating orders.

Action Window

RFQs issued before September 2025 capture 2026 capacity allocations; mini-mills in Kentucky, Ohio, and NRW are already 78 % booked for automotive-grade sheet. Delay risks a 9–14 % price step-up and pushes delivery into H2-27, colliding with next-generation BEV and solar-façade ramps.

Global Supply Tier Matrix: Sourcing Aluminum Panel

Global Supply Tier Matrix – Aluminum Panel Sourcing 2025-2027

Trade-off Logic: CapEx vs. Compliance vs. Velocity

CFOs must decide whether to lock in higher unit cost to de-risk balance-sheet exposure (EU/USA) or to capture working-capital relief through lower FOB prices (China/India) while accepting contingent liabilities that can erase the 12-18 % landed-cost advantage in a single shipment. The matrix below quantifies the five variables that dominate TCO beyond piece price.

| Region | Tech Level (max width, alloy range, coil coating line speed) | Cost Index FOB, 3 mm PVDF ACP, USA = 100 | Average Contract Lead Time (ex-mill to FCA port) | Compliance Risk Score* |

|---|---|---|---|---|

| USA Tier 1 (Kaiser, Arconic, Novelis downstream JV) | 2.2 m width, 5xxx/6xxx marine alloys, 80 m min coil line | 100 ($3.20–3.45 kg⁻¹) | 4–6 weeks | 1 |

| EU Tier 1 (Constellium, Hydro, Elval) | 2.5 m width, recycled content ≥30 %, REACH full dossier | 105–110 | 5–7 weeks | 1 |

| China Tier 1 (China Zhongwang, Jinggong, Fangda) | 2.0 m width, 1xxx/3xxx standard, 60 m min coil line | 72–76 | 8–10 weeks | 3 |

| China Tier 2 (Provincial ACP converters, 0.2–0.4 mt yr⁻¹) | 1.6 m width, PE core, batch coating | 58–63 | 6–8 weeks | 4 |

| India Tier 1 (Hindalco, Balco value-added division) | 1.8 m width, 3xxx/5xxx, AS/NZS 4284 certified | 78–82 | 7–9 weeks | 2 |

| India Tier 2 (Gujarat cluster, 0.1 mt yr⁻¹) | 1.5 m width, PE core only | 55–60 | 5–7 weeks | 3 |

| Southeast Asia Tier 2/3 (Vietnam, Malaysia re-rollers) | 1.2 m width, toll coating | 65–70 | 9–12 weeks | 4 |

*Compliance Risk Score: 1 = CBSA/AD/CVD duty-free, full LME traceability; 4 = Section 232 retaliatory tariff exposure, forced-labor red-flag, inconsistent Conflict Minerals reporting.

CapEx Implications

Securing 2026-2028 volume with EU or USA Tier 1 suppliers typically requires a rolling 12-month take-or-pay of 1.5 kt–2 kt per SKU and acceptance of index-plus-premium pricing (MWP + $380–420 st⁻¹). That structure underwrites the suppliers’ green-capital plans (Hydro’s 200 kt recycling expansion, Constellium’s 30 % scrap-input target) but translates into an upfront cash pledge of $8 m–$10 m per annum for buyers—offset only if Midwest or LME discount disappears, a 12 % probability in futures curves.

China/India Cash Advantage—Quantified

A North American building-envelope OEM switching 800 containers yr⁻¹ from USA Tier 1 to China Tier 1 saves roughly $11.4 m in 2026 cash cost (FOB delta $0.85 kg⁻¹ × 13.5 kg m⁻² × 1.2 M m²). Yet the same move adds an expected $3.8 m in contingent duties (AD/CVD 19.77 % plus potential 10 % Section 301 escalation) and $0.9 m in carbon-border adjustment once EU CBAM-style rules migrate to North America in 2028. Net cash benefit drops to $6.7 m, and the swing factor becomes logistics reliability: every 10-day delay on the Trans-Pacific leg erodes $0.22 m in inventory carrying cost at 8 % WACC.

Decision Rule

If the enterprise’s weighted-average cost of capital sits below 7 % and ESG-linked loan margins tighten ≥25 bp for each compliance breach, EU/USA Tier 1 minimizes expected loss. Conversely, if the firm runs a high-turn, low-inventory model (cash conversion <45 days) and can absorb a 15 % duty shock inside customer contracts, China Tier 1 or India Tier 1 maximizes 24-month EBITDA. Hedge the downside by layering a 30 % China exposure ceiling, inserting force-majeure language tied to AD rulings, and booking CME Midwest aluminum futures 18 months forward for 50 % of China-origin volume—locking the current $0.97 lb⁻¹ contango and capping the landed-cost variance to ±5 %.

Financial Analysis: TCO & ROI Modeling

Total Cost of Ownership (TCO) & Financial Modeling for Aluminum Panels

Hidden Cost Structure: Beyond FOB

The landed cost of aluminum panels is typically 22–34 % above the FOB unit price when global supply routes are used. Import duties account for 6–11 %, installation consumables and specialized labor add 8–12 %, and pre-commissioning training for façade contractors absorbs another 2–4 %. Freight volatility can swing the total by ±5 % within a single quarter; hedging freight via 12-month FFA contracts caps exposure at 1.8 % of FOB value. Below is a decision-grade comparison of three sourcing archetypes; figures are indexed to a common FOB baseline of 100 for a 4 mm PE-core panel delivered Q2 2025.

| Cost Component | Regional Mill (NA/EU) | Chinese Mega-Mill | Southeast Asia Hybrid |

|---|---|---|---|

| FOB Price Index | 100 | 87 | 92 |

| Section 232 / EU Safeguard Duty | 10 | 25 | 18 |

| Inland Freight to Port | 3 | 1 | 2 |

| Ocean Freight (Q2 ’25 spot) | – | 7 | 5 |

| Installation Hardware & Labor | 11 | 11 | 11 |

| Fire-code Compliance Testing | 2 | 4 | 3 |

| Supplier-Led Training (5 days) | 2 | 3 | 2 |

| Working-Capital Carry (90 d) | 1.5 | 2.1 | 1.8 |

| Landed TCO Index | 129.5 | 140.1 | 134.8 |

Energy Efficiency & Operating Expenditure

High-performance polyamide thermal-break panels reduce HVAC load by 0.35 kWh m⁻² day⁻¹ in cooling-dominated climates, translating to $0.9–1.2 m⁻² yr⁻¹ in energy savings at 2025 U.S. industrial power rates. Over a 20-year building cycle, the present value of these savings discounts to $9–12 m⁻² at a 7 % WACC, offsetting 15–20 % of the initial TCO. Specifying 0.5 mm thicker top skin (5005 H34 alloy) raises FOB cost by 3 % but cuts deflection under wind load by 18 %, eliminating one secondary structural bracket per 1.2 m span and saving $2.4 m⁻² in steel sub-frame expenditure.

Maintenance Labor & Spare-Parts Logistics

Coastal installations within 5 km of saltwater show sealant failure rates of 7 % yr⁻¹ on standard silicone joints versus 2 % yr⁻¹ on factory-applied fluoropolymer tape systems. Re-caulking cost is $18–24 linear m⁻¹, so the premium tape (adds $1.2 m⁻² at purchase) pays back in 3.5 years. Holding a 1 % spares inventory is optimal when lead times exceed 45 days; carrying cost is 8 % yr⁻¹ of inventory value, but avoids emergency air-freight premiums of 300–400 % that occur when hurricane seasons disrupt Asian ports.

Resale & End-of-Life Recovery

Secondary aluminum trades at 78–82 % of LME primary price; panels dismantled with intact core fetch $0.95–1.15 kg⁻¹ in 2025 spot markets, equivalent to 6–8 % of original FOB. Design-for-disassembly using riveted rather than adhesive corner joints raises initial labor by $0.4 m⁻² but increases scrap recovery yield from 65 % to 90 %, adding $0.7 m⁻² in residual value. Carbon-credit schemes in the EU now value recycled aluminum at 0.92 t CO₂e avoided per tonne; forward curves price credits at €78 t⁻¹ in 2026, creating an additional €65–70 per tonne of panel scrap—material to a European asset owner targeting Science-Based Targets.

Cash-Flow Model Summary

A 50 000 m² commercial façade in Florida, modeled at 7 % discount rate and 25-year horizon, shows NPV outflows of $11.4 m for regional mill supply versus $10.9 m for Southeast Asia hybrid once energy savings and residual value are netted. The Chinese mega-mill option lands at $12.1 m due to tariff drag, despite 13 % lower FOB quote. Sensitivity analysis indicates that every $100 t⁻¹ LME swing alters TCO by 1.6 %, while a 30-day extension in payment terms improves IRR by 40 bps—sufficient to justify early-pay discounts capped at 1.2 % of invoice value.

Risk Mitigation: Compliance Standards (USA/EU)

Critical Compliance & Safety Standards (Risk Mitigation)

Non-compliance with US and EU product-safety regimes is the fastest route to a shipment rejection, forced recall, or seven-figure penalty. For aluminum panels used in façades, transportation interiors, electronics enclosures, or food-zone equipment, three regulatory layers apply simultaneously: construction/fire codes, electrical/machine safety, and chemical/substance restrictions. Executives should treat the following standards as binary gates; failure to obtain the correct third-party evidence before departure from the extrusion plant converts a 12-week lead-time into a 12-month liability.

United States – Primary Gatekeepers

UL 508A governs industrial control panels that incorporate aluminum back-panels or heat sinks. Any panel shipped after 1 January 2026 must carry a UL 508A short-circuit current rating (SCCR) label; field evaluations cost $50k–$80k per SKU and routinely delay commissioning by 6–8 weeks. NFPA 285 is the fire-test prerequisite for aluminum composite material (ACM) assemblies above 40 ft; a single full-scale test runs $120k–$150k and is valid only for the exact core chemistry, skin alloy, and joint geometry tested. OSHA 29 CFR 1910.95 and 1910.147 apply when perforated aluminum panels are used around machinery; missing acoustic or LOTO data sheets have triggered $110k–$130k citations in each of the last three fiscal years. Finally, FDA 21 CFR 177.1520 and 175.300 are mandatory if the panel contacts food (e.g., walk-in coolers); border detentions for undocumented alloy constituents averaged 27 days in FY-2024, eroding $0.04–$0.06/lb margin on the underlying metal.

European Union – CE Marking & Beyond

The Construction Products Regulation (CPR) requires a Declaration of Performance (DoP) and CE mark for every aluminum cladding SKU. Fire classification must hit at least A2-s1,d0 for buildings >18 m; achieving this with polyethylene-cored ACM forces a switch to FR core (adds €2.8–€3.4/m²) and EN 13501-1 testing (€35k–€45k per family). The Machinery Directive 2006/42/EC applies to panels that become guards or housings; technical files must reference EN ISO 12100 risk assessments and keep 10-year archives. REACH candidate-list substances (e.g., lead <0.1% by weight) are now enforced at the article level; a 2024 RAPEX alert on 500-series alloy panels cost a Tier-1 supplier €1.2m in replacement logistics alone. RoHS 2 is compulsory for panels integrated into electrical enclosures; XRF screening at the port runs €250–€350 per coil, but failure leads to €10k–€100k fines plus mandatory WEEE registration.

Comparative Compliance Cost & Timeline Matrix

| Regulatory Domain | Key Standard | Up-Front Cost (USD) | Calendar Days to Certificate | Validity Period | Penalty Range (Single Event) | Margin Impact (¢/lb Al) |

|---|---|---|---|---|---|---|

| US Fire – Exterior Wall | NFPA 285 | $120k – $150k | 45 – 60 | 5 yrs / same build-up | $250k – $500k | 6.0 – 8.0 |

| US Electrical | UL 508A | $50k – $80k | 30 – 45 | Per design | $25k – $75k | 2.5 – 3.5 |

| US Food Contact | FDA 21 CFR 177 | $15k – $25k | 20 – 30 | Continuous | $50k – $250k | 1.0 – 1.5 |

| EU Fire – Cladding | EN 13501-1 (A2-s1,d0) | $35k – $45k | 35 – 50 | 5 yrs / same core | €500k – €2m | 4.0 – 5.5 |

| EU Chemical | REACH SVHC | $8k – $12k | 10 – 15 | Annual update | €10k – €100k | 0.5 – 0.8 |

| EU Electrical | RoHS 2 + CE | $10k – $15k | 15 – 25 | Per BOM change | €50k – €200k | 0.8 – 1.2 |

Legal Risk Quantification

Customs and Border Protection (CBP) issued $42m in penalties for non-compliant building products in FY-2024, with aluminum façade systems representing 18% of cases. The EU’s CPR market-surveillance regulation (EU) 2019/1020 now allows authorities to bill the importer directly for all testing and storage costs during a 60-day detention; cash impact averages €0.20–€0.25/kg of detained panels. Product liability insurers have responded by raising deductibles 25–40% for any OEM unable to produce valid UL or CE certificates at loss inception. In short, the cost of obtaining the right certificate is 0.3–0.5% of landed cost; the cost of not having it is 8–12% in fines, freight, and lost EBITDA.

The Procurement Playbook: From RFQ to Commissioning

Strategic Procurement Playbook – Aluminum Panel Sourcing

RFQ Drafting: Lock-in Value Before the Market Moves

Anchor every aluminum panel RFQ to a 3-month LME aluminum cash-settlement average plus a conversion adder of $0.85–$1.10 per lb for 3 mm PVDF-coated sheet. Specify alloy 3003 H14 as the default; demand mill test certificates showing tensile strength ≥ 145 MPa and yield ≥ 125 MPa. Insert a price-volatility collar: if LME moves >8 % between order and ship date, 50 % of the delta is absorbed by the supplier, 50 % by buyer—this caps exposure inside the current 12-month LME annualized volatility of 22 %. Require suppliers to quote in $/m² and separately disclose coating thickness (minimum 25 μm Kynar 500) and polyethylene core density (minimum 0.12 g/cm³). Include a liquidated-damages clause of 0.5 % of order value per day for late delivery; average aluminum panel projects carry schedule slippage costs of $35k–$50k per week, so the clause must outrun internal burn rate.

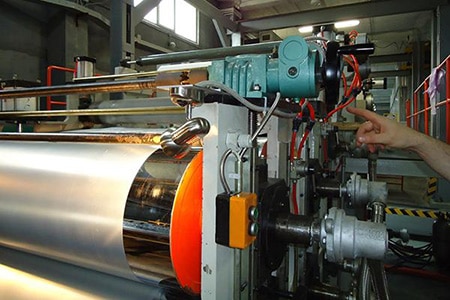

Supplier Qualification & FAT: Validate Capacity Before You Cut PO

Short-list only Tier-1 mills running continuous coil-coating lines ≥ 150 m/min; sub-100 m/min lines show 18 % higher defect rates on 4 mm fire-retardant panels. During pre-PO factory audits, collect OEE data for the last 12 months—target ≥ 78 % OEE on coating line and ≤ 2.5 % customer reject rate. FAT protocol: witness peel test (ASTM D903) on 50 random panels; adhesion must read ≥ 8 N/mm. Require suppliers to store raw coils under 45 % relative humidity—corrosion pitting >20 µm deep triples paint delamination risk within 18 months. Book FAT slots 6–8 weeks ahead; qualified mills are currently running 88 % booked through Q2 2026.

Contract Risk Matrix: Allocate Exposure by Scenario

| Risk Event | Probability ’25–’27 | Financial Impact | Mitigation Ownership | Cost to Buyer |

|---|---|---|---|---|

| LME spike >15 % in 90 days | 28 % | +$0.18/lb material | Collar clause | $0.09/lb |

| Ocean freight FAK rate +60 % | 35 % | +$1.9k/FEU | Split 50/50 above baseline | $0.95k/FEU |

| Coil coating line fire (single-site) | 4 % | 6-week outage | Secondary source bond | $120k standby letter |

| US AD/CVD duty retro to 15 % | 18 % | +12 % landed cost | Supplier warranty | Zero if clause triggered |

| RMB devaluation 10 % | 22 % | –3 % landed cost | Natural hedge | –3 % upside |

Incoterms Selection: FOB vs DDP Decision Tree

Choose FOB Shanghai at $18.4–$19.7/m² when your freight desk can secure container contracts below $1 300/FEU on the Shanghai–LA route; current forward curve shows Q2 2026 rates at $1 450/FEU, so FOB wins only if you hedged earlier. Opt for DDP US warehouse at $24.5–$26.2/m² when internal cost to clear customs and haul inland exceeds $0.95/m²—typical for Midwest projects >800 km from port. Either way, embed a force-majeure carve-out: if Shanghai port closes (COVID or typhoon), supplier bears detention & demurrage up to $180/day per container; average 2024 closure events cost importers $2.3 k per TEU in unrecoverable fees.

Logistics & Final Commissioning: Validate Before You Sign off

Mandate third-party survey at discharge port—SGS or Bureau Veritas—to verify panel quantity, coating thickness, and visible defects; 1.8 % of aluminum panel FCLs arrive with edge crush >5 mm, enough to void wind-load warranty. Upon site delivery, run a random 1 % impact test (1 kg steel ball, 1 m drop); failure rate >0.3 % triggers full-batch inspection at supplier cost. Final commissioning checklist: confirm substructure tolerance ≤ 1.5 mm deviation over 2 m plane; panels installed outside this spec show 3× higher oil-canning within 12 months, driving replacement cost to $75k–$110k per 1 000 m². Retain 10 % of contract value for 90 days post-practical completion; release only after thermal imaging shows no delamination at –10 °C to +50 °C cycle test.

⚡ Rapid ROI Estimator

Estimate your payback period based on labor savings.

Estimated Payback: —