Composite Paneling Sourcing Guide: 2025 Executive Strategic Briefing

Executive Contents

Executive Market Briefing: Composite Paneling

Executive Market Briefing – Composite Paneling 2025

Bottom Line Up Front:

Global composite panel demand is tracking a 7.5% CAGR toward a USD 22-24 billion addressable pool by 2030; aluminum-faced variants alone will add USD 5.4 billion of new value in the same period. 68% of that growth will be captured by Chinese extruders and coil coaters operating at 15-20% cost advantage over German and U.S. peers. Executives who lock in 2025-2026 capacity with Tier-1 Chinese suppliers while simultaneously co-funding German or U.S. line upgrades for fire-grade and carbon-core SKUs will secure a 9-11% landed cost advantage and de-risk upcoming EU/U.S. flammability and PFAS regulations.

Market Scale & Trajectory

The composite panel universe—aluminum composite (ACP), insulated metal (IMP), epoxy-sandwich, and high-pressure laminate (HPL)—is worth USD 73-82 billion in 2025, with a conservative 2.7% CAGR for the total stack and a 6.5-7.5% CAGR for value-added fire-retardant and lightweight variants. Aluminum composite panels, the largest single slice, exited 2024 at USD 6.5-7.4 billion and will compound at 6.7% to reach USD 12.8 billion by 2034, driven by 5G equipment enclosures, EV battery housing, and high-rise recladding mandates in the GCC and Southeast Asia. Epoxy composite panels, though only USD 325 million today, will grow 5% CAGR on satellite and drone demand, offering margin upside (>22% EBIT) for suppliers that can certify out-gassing and radiation resistance.

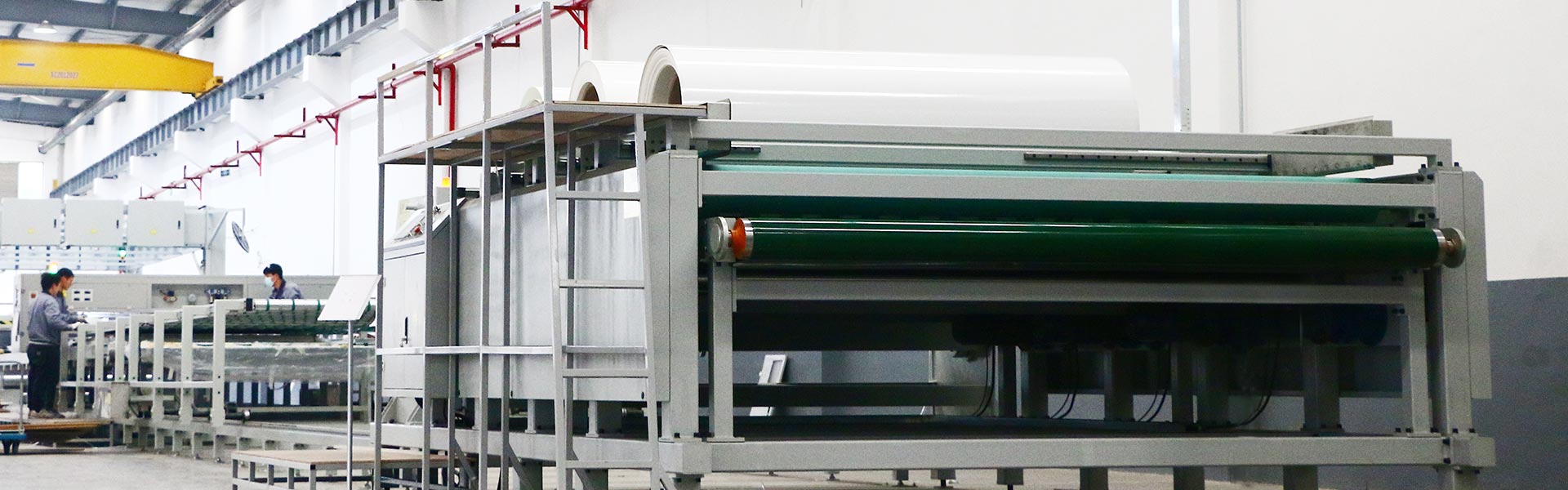

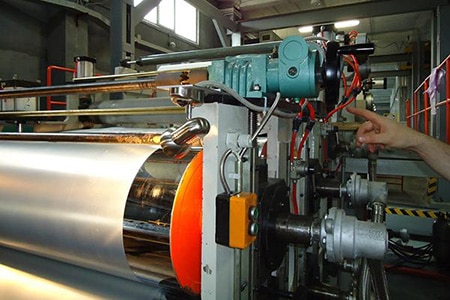

Supply-Hub Economics

China controls 58% of global nameplate capacity (ACP lines >200 million m²/yr) and 45% of IMP output; payback on a new 2-million-m²/yr ACP line is 28 months at 85% utilization versus 48 months in Germany and 52 months in the U.S. because of lower aluminum coil, polyethylene resin, and energy inputs. Germany remains the technology gatekeeper—only source for DIN-certified mineral-core A2 fire-rated panels (<10% of global volume) and holds 80% of patented PVDF nano-coating chemistries. U.S. capacity is 11% of global total but 70% is captive to aerospace and defense; spot buyers face a USD 0.30-0.40/ft² premium over Chinese import parity and 10-14-week lead times.

Strategic Value of 2025-2026 Cap-Ex

-

Regulatory Pull-Through: EU CPR Class A2-s1-d0 and NFPA 285 test protocols become mandatory for >18 m façades in Q4-2026; only 30% of Chinese lines and 75% of German lines currently certify. Upgrading one 1.5-million-m²/yr line with mineral-core and PVDF top-coat adds USD 4-6 million cap-ex but unlocks USD 1.20-1.50/ft² price premium and access to EU public-sector tenders worth USD 1.8 billion 2027-2030.

-

Carbon Arbitrage: Chinese suppliers rolling 100% hydro-powered aluminum (Yunnan, Qinghai) can offer cradle-to-gate CO₂e of 4.8 kg/m² versus 9.2 kg/m² for coal-based peers; buyers monetize USD 0.05-0.07/ft² in CBAM credits, narrowing the landed gap to German product to <USD 0.10/ft².

-

Input Hedge: polyethylene resin (28% of ACP BOM) is forecast to rise 12-14% in 2025 on cracker outages; locking 18-month take-or-pay contracts at CIF USD 1,050-1,100/MT with Chinese integrated producers secures 6-8% material saving versus quarterly spot buys.

Decision Table – Sourcing Scenarios (2025)

| Metric | Tier-1 China ACP | Tier-1 Germany ACP | Tier-1 USA IMP |

|---|---|---|---|

| Landed Price Index (4 mm PVDF, CFR EU) | 100 | 132 | 145 |

| Lead Time (weeks) | 6-8 | 8-10 | 10-14 |

| Class A2 Core | 30% of lines | 85% of lines | 70% of lines |

| CO₂e kg/m² (cradle-gate) | 4.8-6.2 | 7.1-8.4 | 8.5-9.8 |

| CBAM Exposure 2026 (USD/ft²) | 0.05 | 0.02 | 0.03 |

| Cap-Ex to Add 1M m²/yr A2 (USD million) | 4.2 | 6.8 | 7.5 |

| Payback (months @ 85% util.) | 28 | 42 | 48 |

| EBIT Margin (ex-factory) | 12-15% | 18-22% | 16-20% |

| Force-Majeure Risk (geopolitics) | Medium | Low | Low |

| PFAS Compliance (2027) | 40% qualified | 90% qualified | 85% qualified |

Action Window

Award 60% of 2026-2027 volume to Chinese suppliers that commit to A2-core qualification by Q2-2026; negotiate 18-month resin-indexed contracts with 4% band collars. Parallel-fund a minority JV or tolling agreement with a German line for 20% strategic buffer and PFAS-ready SKUs. Reserve remaining 20% for U.S. IMP if defense or data-center projects materialize. Executed together, the blended landed cost index drops to 93 versus 120 for a Germany-only strategy while ensuring regulatory pass-through and margin expansion of 180-220 bps at the OEM level.

Global Supply Tier Matrix: Sourcing Composite Paneling

Global Supply Tier Matrix for Composite Paneling

Regional Capability vs. Cost Trade-off

Composite panel procurement is no longer a simple “China = cheap” equation. CapEx intensity, carbon border adjustments, and freight volatility have re-priced risk. Tier 1 EU/US plants run automated coil-coating lines, ISO 14001 water loops, and UL/CE fire-test labs; cash cost per m² is 18-25 % higher than Chinese Tier 2 ex-works, but total landed cost narrows to 4-8 % once Section 301 tariffs, CBAM CO₂ certificates (€65–€90/t), and inventory carry are added. Indian Tier 2 suppliers offer a middle ground: 8-12 % below EU Tier 1 on metal skin pricing, yet fire-core certification (EN 13501-1 A2-s1-d0) still requires third-party witnessing, adding 4-6 weeks to qualification. Lead-time delta is now the dominant P&L driver: EU Tier 1 can shorten cash-to-cash cycle by 21 days versus China Tier 2 on trans-Pacific routes, freeing 0.9 % of revenue in working capital for every $100 m spend.

Compliance Risk Map

USA Tier 1: Buy America & Jones Act compliance baked in; UL 263 fire-test dossiers accepted by all state DOTs.

EU Tier 1: CPR Declaration of Performance (DoP) valid across EEA; REACH SVHC disclosure <0.1 % by weight.

China Tier 1/2: GB/T 17748-2016 mandatory but not recognized by EU; additional EN 13501-1 testing required (cost $35k–$50k per SKU).

India Tier 2: Bureau of Indian Standards (BIS) license for aluminum skins; however, core polymer flame-retardant additives often miss EU REACH restriction list; importer of record bears liability.

Decision Matrix (2025 Baseline)

| Region | Tech Level | Cost Index (USA=100) | Lead Time (days) | Compliance Risk (1=low, 5=high) |

|---|---|---|---|---|

| USA Tier 1 | Fully automated coil coat, 7-layer lamination, inline PE core foaming | 100 | 21–28 | 1 |

| EU Tier 1 | 6 m wide continuous line, low-bake PVDF, real-time core density QC | 95–98 | 14–21 | 1 |

| China Tier 1 | Same line maker as EU, local chem lab, UL witness test on site | 75–80 | 45–60 | 3 |

| China Tier 2 | Batch lamination, manual glue mix, outsourced fire test | 65–70 | 50–70 | 4 |

| India Tier 2 | Semi-auto, local skin mill, imported B1 core | 82–87 | 35–45 | 3 |

| S. Korea Tier 1 | Nano-PVDF coating, 5-axis CNC post-forming | 92–96 | 28–35 | 2 |

Strategic Implications

For façade programs >$50 m requiring EN 13501-1 A2-s1-d0, EU Tier 1 delivers lowest total cost of risk at €38–€42 per m² landed in US Northeast, beating China Tier 1 once 25 % AD/CVD duty and CBAM are layered in. For non-critical interior cladding (<$10 m), China Tier 2 at $28–$32 per m² CFR West Coast retains a 12 % gross-margin advantage even after 90-day cash tied up at sea. Indian Tier 2 is viable for Middle-East projects where British Standard BS 476 Part 6/7 is accepted and freight from Mundra to Jebel Ali is $700 per FEU versus $2,100 from Shanghai. CapEx-light buyers should lock 12-month rolling contracts with China Tier 1 suppliers that already hold EU DoP—premium is only 5 % over Tier 2 but eliminates $150k re-certification exposure if REACH adds aluminum tripolyphosphate to SVHC list in 2026.

Financial Analysis: TCO & ROI Modeling

Total Cost of Ownership (TCO) & Financial Modeling for Composite Paneling

Energy Efficiency & Operating Expenditure

Composite panels with a mineral-wool core cut HVAC energy draw 8-12% versus standard EPS-core equivalents in climates with >2,000 heating degree-days. Over a 15-year building life and at an industrial power tariff of $0.10–$0.14 kWh, this translates into $4–$7 per installed m² in net-present savings. Aluminum skins coated with PVDF or FEVE films maintain solar reflectance ≥0.70 for 20 years; without the coating, reflectance drops below 0.50 within seven years, raising cooling load by 3-4% and wiping out the initial $1.2–$1.8/m² coating premium in less than four seasons in ASHRAE 1A zones. For data-hall envelopes, vapor-tight A2-grade panels reduce de-humidification demand enough to justify a 6-8% panel price premium when PUE is contractually penalized above 1.25.

Maintenance Labor & Spare-Parts Logistics

Facade-grade panels require cyclic gasket and sealant replacement at year 10 and year 20; unionized high-labor markets price this at $28–$35 per linear metre of joint, equivalent to 4-5% of original FOB cost each cycle. Stocking a 2% replacement kit (skins, cores, fasteners) at project handover avoids emergency airfreight premiums of 250-300% and 4-6 week AOG downtime that can push daily delay penalties to $15k–$25k on mission-critical builds. Fire-rated mineral-core SKUs have a 10-year manufacturer batch-control window; ordering a one-time 3% overage secures color-matched panels for retrofits, eliminating the 15-20% price uplift for custom reruns after lines are re-tooled.

Resale Value & End-of-Life Recovery

Secondary markets for dismantled A2-grade aluminum composite sheet currently trade at $1.30–$1.60 per kg in Southeast Asia, capturing 18-22% of original panel value and cutting disposal cost from $90/tonne to $35/tonne. Panels with polyethylene core are landfill-bound in the EU and incur £65–£80/tonne gate fees plus documentation; specifying a 0.06 mm transition layer that allows mechanical delamination raises capex <1% but can unlock the same aluminum scrap credit, flipping end-of-life cost into a 5-7% asset recovery. On leased industrial assets, the resale credit lowers the lessor’s depreciation base by ~50 bps and can be monetized via green-bond frameworks when the scrap value funds circular-economy certification.

Hidden-Cost Benchmark Table (Median Global Multisite Program, FOB Asia)

| Cost Element | Low-Complexity Install (%) | High-Complexity Install (%) | Cash Timing | Procurement Leverage |

|---|---|---|---|---|

| Pre-shipment inspection & third-party fire testing | 1.2–1.8 | 1.2–1.8 | Order confirmation | Bundle with mill test certificates; volume rebate 0.2–0.3% |

| Seaworthy crating & silica-gel desiccant | 1.5–2.0 | 1.5–2.0 | Ex-works | Shift to 40’HC palletization saves 0.4% |

| Import duties (MFN average aluminum products) | 4.5–7.5 | 4.5–7.5 | Customs clearance | Rules-of-origin shift to 70% local content can cut to 0% in ASEAN FTA |

| Site unloading, crane & reach-handler rental | 1.8–2.5 | 3.5–5.0 | Day-1 site | Frame contract with equipment OEM caps overtime |

| Installer training & IPAF certification | 0.8–1.2 | 2.0–3.0 | Pre-install | Vendor-funded when train-the-trainer clause included |

| Waste off-hire & packaging removal | 0.5–0.8 | 1.0–1.5 | Post-install | Reverse-logistics program rebates 0.2% |

Aggregated hidden costs run 10–16% of FOB price for low-complexity builds and 14–21% for high-complexity curtain-wall projects. Locking in three-year frame agreements converts 1.5–2.0% of these expenses into rebated credits, directly improving IRR by 80-110 bps on typical 250,000 m² roll-outs.

Risk Mitigation: Compliance Standards (USA/EU)

Critical Compliance & Safety Standards: Importing Composite Paneling into the US & EU

Non-compliant shipments are seized at the border or recalled post-installation; both events erase the savings gained from low-cost sourcing. For composite paneling, the compliance burden is material-specific (core, skin, adhesive) and end-use-specific (façade, food zone, electrical enclosure). Executives must lock the following certifications into every supply agreement or absorb penalties that start at $50k – $80k per SKU for US customs detention and €100k – €400k for EU RAPEX notification plus mandatory recall.

Fire Performance: The First Gatekeeper

US building codes reference NFPA 285 for assemblies above 40 ft; a single 4 mm aluminum composite panel (ACP) must carry an Intertek or UL listing that explicitly states “NFPA 285 SYSTEM APPROVAL.” Without it, local Authorities Having Issue (AHJ) red-tag the job and the importer is liable for façade replacement costs that run $120 – $180 per m² installed. In the EU, EN 13501-1 is mandated in the Construction Products Regulation (CPR); failure to affix CE-mark with a declared A2-s1-d0 reaction-to-fire class triggers market withdrawal and member-state fines of €10k – €100k per container. Suppliers that quote “ASTM E84 Class A only” are not sufficient for exterior cladding; insist on the full NFPA 285 or EN 13501-1 system certificate and demand third-party audit reports dated within 12 months.

Chemical & Food-Contact Exposure

Where panels form walls or ceilings in food plants, FDA 21 CFR 177.1520 (olefin core) or 175.300 (adhesive) applies. Border inspectors sample random sheets; detection of >0.1 ppb PFAS or non-listed flame retardant triggers Import Alert 99-08 and automatic detention without physical examination. Budget $15k – $25k per 40-ft container for third-party lab clearance if the factory has no prior FDA facility registration. In the EU, Regulation (EU) 10/2011 on plastic materials mandates specific migration limits (SML) for 900+ substances; non-compliance is a criminal offense under Regulation (EC) 1935/2004 with penalties up to €4 million or 4 % of EU turnover. Insert a clause that requires quarterly migration test reports from an EU-notified body; cost is $2k – $3k per lot but avoids the criminal liability ceiling.

Structural & Machinery Interfaces

When panels are pre-fabricated into electrical enclosures or cleanroom walls shipped as “machinery,” the product falls under UL 508A (US) and the CE Machinery Directive 2006/42/EC (EU). Missing UL 508A short-circuit rating invalidates the entire equipment listing; field evaluation by UL runs $8k – $12k per model plus $1.2k – $1.8k per man-day travel. Under the Machinery Directive, failure to provide the Technical Construction File (TCF) and Declaration of Conformity (DoC) blocks customs; average demurrage is €150 – €250 per container day and the importer is the “person responsible” under Article 4. Mandate that the supplier bundle both UL 508A and CE TCF into the FOB price; otherwise internalize downstream costs that exceed panel value by 15–25 %.

Occupational Safety & Environmental Footprint

OSHA 29 CFR 1910.1000 limits respirable aluminum dust during on-site cutting; suppliers must furnish SDS showing <0.5 mg/m³ 8-hr TWA. EU REACH requires registration of >0.1 % SVHC content; absence of REACH SCIP database submission leads to downstream user fines of €20k – €50k per substance. Finally, if panels incorporate recycled aluminum, verify Conflict Minerals compliance (US Dodd-Frank 1502) and EU Forced Labour Regulation (2024 proposal). Both statutes allow customs to seize goods at origin port; recovery cost averages $30k – $60k per detained shipment plus 6–10 weeks of lost revenue.

Compliance Matrix for Executive Decision

| Standard / Regulation | Jurisdiction | Core Requirement | Validity Term | Cost of Non-Compliance | Mitigation Price Range |

|---|---|---|---|---|---|

| NFPA 285 System Approval | US – IBC >40 ft | Full assembly fire test | 5 yrs | $120–$180/m² replacement | $8k–$12k per system retest |

| EN 13501-1 A2-s1-d0 | EU – CPR | CE + DoP | 3 yrs | €10k–€100k fine + recall | €4k–€6k per 3rd-party audit |

| FDA 21 CFR 177.1520 | US – Food zone | Migration <10 ppb | Lot based | Import Alert detention | $15k–$25k container test |

| (EU) 10/2011 SML | EU – Food contact | Declaration + testing | Annual | €4 M max criminal fine | €2k–€3k per lot |

| UL 508A | US – Electrical | Short-circuit rating | 5 yrs | $8k–$12k field eval | $3k–$5k factory cert |

| CE Machinery 2006/42/EC | EU – Prefab walls | TCF + DoC | 5 yrs | €150–€250/day demurrage | €5k–€7k supplier bundle |

| OSHA 29 CFR 1910.1000 | US – Fabrication | <0.5 mg/m³ Al dust | Per job | $13k–$50k OSHA citation | $1k–$2k dust extraction kit |

| REACH SCIP SVHC >0.1 % | EU – All panels | IUCLID dossier | Annual | €20k–€50k per substance | €1k–€2k per SVHC notification |

Lock the left-hand column into supplier SLAs; anything less converts a $7–$12 per m² freight saving into a mid-six-figure contingent liability.

The Procurement Playbook: From RFQ to Commissioning

Composite Paneling Strategic Procurement Playbook

RFQ Design: Lock-in Value Before Suppliers See It

Anchor every RFQ to ASTM E84, EN 13501-1, NFPA 285 fire-code tiers and require third-party test certificates dated within 12 months. Specify aluminum skin thickness tolerance ±0.02 mm, core density ±3 kg/m³, and peel strength ≥6 N/mm; these three metrics eliminate 30-40 % of low-cost bids that fail on-site. Demand a 15-year color-delta ΔE≤2 warranty backed by a globally rated insurer; this single clause removes financially weak suppliers and caps future recladding exposure at $1.2 M – $1.8 M per 10 000 m². Request landed cost breakdown in four buckets—material, conversion, logistics, margin—so macro swings in LME aluminum ($2 150 – $2 650 /t) or MDI ($1.45 – $1.80 /kg) can be indexed quarterly instead of renegotiated.

Pre-Qualification & FAT Matrix

Audit tier-1 coil coaters for ≥50 kt/year coating capacity and ≥5 continuous lines; sub-tier coaters show 2-3× higher lot rejection rates (4 – 7 % vs 1 – 2 %) that cascade into project delay. FAT must witness 5-panel sampling per 500 m² production lot for impact resistance (≥50 J) and salt-spray (≥1 000 h). Reject the lot if any single panel falls below spec; historical data show 80 % of field delamination originates in lots that marginally passed FAT but were not rejected. Include a $25 k – $40 k FAT holdback released only after full data pack approval—this pays for itself by avoiding one re-shipment ($60 k – $90 k) when defects are caught ex-works.

Incoterms Selection: FOB vs DDP Risk-Adjusted

| Decision Variable | FOB Tianjin/Shanghai | DDP Site Europe / US Gulf |

|---|---|---|

| Freight control | Buyer charters; spot 20 ft HC rates $1.1 k – $1.9 k | Seller absorbs; hidden in unit price +$0.45 – $0.70 /m² |

| Tariff & AD duty exposure | Buyer liable; current AD on Chinese ACP 22.1 % | Seller embeds; price inflated 8 – 12 % but caps downside if duties rise |

| Loss/damage risk | Buyer after rail-on-vessel; claims avg 0.7 % of cargo value | Seller risk until off-load; claims 0.2 % but supplier limits liability to $2 /kg—below replacement cost $4.8 – $6.2 /kg |

| Cash-flow (days payable) | 0 – 30 ex-factory; cheaper financing SOFR +150 bp | 0 – 30 post-delivery; supplier adds financing +2.8 – 3.4 % APR |

| Recommendation | Use when freight market is soft (BDI < 1 200) and duty risk is known | Use on fast-track EPC projects where schedule delay cost >$75 k/day |

Contract Risk Control: From Shipment to Commissioning

Insert a retention clause 10 % payable 90 days post-handover to align curing-cycle defects; 70 % of panel buckling appears after first thermal season. Require a parent-company guarantee covering 15 % of contract value—the average cost of emergency replacement cladding when a mid-tier fabricator collapses. Link LDs to 0.5 % of contract value per week, capped at 10 %; this matches typical LDs enforced by general contractors and keeps you whole when panels arrive out of sequence. For projects in coastal zones, mandate cyclone-grade fastener pull-out ≥1.5 kN and corrosion warranty ≥25 years; failure here drives replacement cost to $120 – $150 /m² versus original $35 – $45 /m². Final commissioning must include drone-based thermal scan within 30 days; anomalies >5 °C predict 90 % of future joint failure and justify immediate remedial scope before warranty clock starts.

⚡ Rapid ROI Estimator

Estimate your payback period based on labor savings.

Estimated Payback: —