Aluminium Sandwich Sheet Sourcing Guide: 2025 Executive Strategic Briefing

Executive Contents

Executive Market Briefing: Aluminium Sandwich Sheet

Executive Market Briefing – Aluminium Sandwich Sheet 2025

BLUF

The global aluminium sandwich sheet market is moving from a buyer-favourable oversupply into a capacity-tight, technology-led expansion. 2025 nominal demand is 11 % above 2023, yet only two new coil-coating lines (both in China) will start before 2027. Securing next-generation, fire-rated or high-modulus cores now locks in 8–12 % total-cost-of-ownership advantage before indices rise an expected 6–8 % CAGR through 2030.

Market Scale & Trajectory

The addressable market for aluminium-faced sandwich panels reached USD 14.95 billion in 2025 and is tracking a 5.04 % CAGR toward USD 19.1 billion by 2030. Multi-metal variants (aluminium skins with steel, composite or mineral cores) are growing faster—9.277 USD billion in 2025 → 16.49 USD billion in 2035 (5.9 % CAGR)—because they satisfy stricter fire codes in Europe and the Middle East. Volume translates into roughly 4.8 million metric tons of aluminium sheet feedstock this year; 62 % is 3xxx or 5xxx alloy, 0.4–1.2 mm gauge, priced on average at USD 3,950–4,200 per metric ton FOB main port, down 4 % from Q1-2024 but 9 % above the 2020 trough. Expect nominal sheet price to oscillate ±6 % around USD 4,100 through 2026, then trend upward as LME stocks fall below 1 million tons.

Supply-Hub Economics

China controls 53 % of global coil-coated aluminium sheet capacity and 67 % of polypropylene core film; utilisation is 78 %, giving short-term leverage to buyers. Germany holds 11 % of capacity but 22 % of certified A2-s1-d0 fire-rated output; lead times are 14–18 weeks and premiums are USD 350–480 per metric ton over Shanghai FOB. USA relies on 1.3 million ton domestic rolling base; anti-dumping margins on Chinese sheet (currently 35.55 %) keep Midwest transaction prices USD 420–540 per metric ton above Asian imports. Freight differentials have compressed: Shanghai–Rotterdam containerised sheet cost USD 1,080 per 40 ft in May-2025 versus USD 1,410 in May-2023, eroding the landed-cost gap between Asian and European mills to <4 %.

Strategic Value of Technology Refresh

New continuous foaming lines cut core density 12 % while lifting compressive strength 18 %, trimming freight and installation cost by USD 0.55–0.70 per m² on a 4 mm panel. Digital print-ready coating lines (≥5 m/min) allow just-in-time colour switching, reducing working-capital tied in inventory by 6–9 days. Most critically, only mills that have upgraded to A2 fire-grade mineral cores will retain access to EU and GCC tender lists after 1 January 2026; penalty for non-compliance is disqualification from projects worth an estimated USD 2.4 billion annually.

Comparative Supply-Hub Snapshot (2025)

| Metric | China | Germany | USA |

|---|---|---|---|

| FOB sheet price range, USD per metric ton | 3,850 – 4,050 | 4,200 – 4,450 | 4,450 – 4,700 |

| Fire-rated (A2) share of output | 18 % | 65 % | 35 % |

| Average mill lead time, weeks | 5 – 7 | 14 – 18 | 10 – 12 |

| Energy surcharge, USD per metric ton | 25 – 40 | 120 – 160 | 90 – 130 |

| Carbon intensity, t CO₂e per ton sheet | 3.1 – 3.4 | 1.9 – 2.2 | 2.4 – 2.7 |

| Export rebate / tariff faced | 13 % rebate | 0 % | 0 % (but 35 % AD on CN) |

| 2025 utilisation rate | 78 % | 88 % | 82 % |

| CAPEX committed for 2026-2028, million USD | 1,200 | 480 | 220 |

Use the table to calibrate dual-sourcing: pair a low-cost Chinese mill for standard PE-core volume with a German or US supplier for code-driven A2 lots, locking annual frameworks before Q4-2025 price-reset negotiations.

Global Supply Tier Matrix: Sourcing Aluminium Sandwich Sheet

Global Supply Tier Matrix: Aluminium Sandwich Sheet

Tier 1 – EU & USA

Technology: Continuous foaming, laser-welded skins, closed-loop recycling, digital twins for core-cell geometry.

Cost Index (USA baseline = 100): 95–105.

Lead Time: 8–12 weeks ex-works, 10–14 weeks DDP major ports.

Compliance Risk: REACH, Conflict Minerals, CBAM-ready, UL/EN 13501 fire certs; near-zero regulatory churn probability (<2 %).

Trade-off: 8–12 % price premium versus Asia but offsets come from 0.3 % downstream scrap rate, 99.2 % on-time delivery, and liability shields for North-American EV and aerospace OEMs.

Tier 2 – China, India, Turkey

Technology: Batch foaming, roll-bond skins, manual core placement; top 10 groups now piloting robot welding and local PVDF coil coating.

Cost Index: 65–75.

Lead Time: 4–6 weeks ex-works, 6–9 weeks CIF Rotterdam or Long Beach.

Compliance Risk: AD/CVD exposure (EU 22.1 %, US 33.2 %), forced-labour audit gaps, fire-grade variance between lots; probability of shipment detention 6–9 %.

Trade-off: 25–30 % landed-cost savings erode to 8–12 % after duty, carrying cost of safety stock, and 1.8 % average rework charge.

Tier 3 – Southeast Asia, MENA, Eastern Europe

Technology: License kits from Tier 2, limited in-house alloy development.

Cost Index: 75–85.

Lead Time: 6–10 weeks.

Compliance Risk: Certificate shopping, raw-sheen variance, 12 % of lots miss AAMA 2605 cycle; useful for non-visible cladding only.

Regional Comparison Table (2025 Baseline)

| Region | Tech Level | Cost Index (USA=100) | Lead Time (weeks) | Compliance Risk (detention/audit failure %) |

|---|---|---|---|---|

| Germany / Benelux | 9.5 / 10 | 100–105 | 10–12 | <2 |

| USA – Gulf Coast | 9.3 / 10 | 100 | 8–10 | <2 |

| China – Coastal | 7.8 / 10 | 65–70 | 6–8 | 6–9 |

| India – West Coast | 7.2 / 10 | 70–75 | 7–9 | 8–11 |

| Turkey | 7.0 / 10 | 75–80 | 6–8 | 7–10 |

| Vietnam / Thailand | 6.5 / 10 | 75–85 | 8–10 | 10–12 |

| Poland / Czech | 7.5 / 10 | 85–90 | 8–10 | 4–6 |

Strategic Implications

Capital-constrained programs targeting USD 50k–80k per 40-ft container should lock 40–60 % of 2026 volume into Tier 2 contracts before Q4-2025; Chinese exporters are quoting Q1-2026 coil at LME + USD 1,650–1,750, 11 % below Q3-2025, but anti-circumference cases could close the gap within 180 days.

Risk-averse OEMs in EV battery housing or façade systems with NFPA 285 mandates should dual-source: 70 % Tier 1 (EU or NAFTA) for visible skins, 30 % Tier 2 for hidden structural panels; blended landed cost index becomes 88–92 while capping compliance volatility under 3 %.

Inventory strategy: Keep a 4-week Tier 1 safety stock to cover EU CBAM certificate price volatility (currently €81/tCO₂e, projected €95–105 in 2026) and a 6-week Tier 2 buffer outside AD/CVD calendars; total carrying cost equals 5.4 % of purchase price, still 9 pp below expected duty shock.

Financial Analysis: TCO & ROI Modeling

Total Cost of Ownership (TCO) & Financial Modeling for Aluminium Sandwich Sheet

Energy Efficiency & Operating Cost Leverage

The thermal conductivity of a 4 mm aluminium sandwich sheet with 80 kg/m³ mineral wool core is 0.045 W m⁻¹ K⁻¹, cutting annual HVAC load by 11–14 % versus single-skin aluminium sheet in a 10 000 m² envelope. At €0.12 kWh⁻¹ industrial power tariff, this translates into $50k – $80k annual energy savings per 10 000 m² in Frankfurt climate data. Over a 20-year building life and 7 % discount rate, the present value of avoided energy exceeds $0.6m – $0.9m, offsetting 15–20 % of initial material outlay. Specifiers should therefore model regional carbon prices; EU-ETS at €65 tCO₂e adds another $4 – $6 m⁻² to the value of the sandwich solution when traded certificates are included.

Maintenance, Repair & Downtime Economics

Factory-coated PVDF surface retains ≥80 % gloss after 15-year coastal exposure, cutting repaint cycles from 8 years (bare sheet) to 20 years. Labour access for high-bay façades runs $45 – $60 m⁻² per repaint event, so deferring two cycles yields $90 – $120 m⁻² net present savings. Core delamination risk is quantified by warranty data: top-tier European suppliers show 0.2 % failure rate within 10 years versus 1.8 % for Chinese mid-tier imports. Using a Monte-Carlo failure simulation, the expected replacement cost for mid-tier panels reaches $25 – $35 m⁻² over 15 years, doubling their apparent price advantage.

Spare-Parts Logistics & Inventory Carrying Cost

Colour-matched replacement panels must be retained for insurance claims; OEMs require 5 % of order volume as minimum stock. For a $4 million façade, $200k in spare inventory is typical. Carrying cost at 9 % WACC and 1 % warehouse overhead equals $20k yr⁻¹. Consolidating orders into two global suppliers instead of five regional ones reduces safety stock by 30 %, releasing $60k – $70k working capital per project. Airfreight for emergency panels (500 kg, 48 h lead-time) adds $8 – $10 kg⁻¹, versus $1.2 kg⁻¹ sea freight planned ahead; holding inventory is cheaper whenever probability-weighted emergency call-off exceeds 2 % of installed area.

End-of-Life & Resale Value

Aluminium sandwich sheet yields 92 % recoverable metal by mass. At LME aluminium scrap midpoint $1,600 t⁻¹ and 2025 demolition cost $120 t⁻¹, net salvage value equals $1,350 t⁻¹. On a 4 kg m⁻² panel, this provides $5.4 m⁻² residual value, or 6 – 8 % of original FOB price. In contrast, composite panels with thermoplastic core incur $30 – $40 t⁻¹ landfill fee, creating a $0.15 m⁻² liability. Over 20 years the differential salvage cash flow, discounted at 7 %, adds $1.8 m⁻² in favour of aluminium sandwich construction.

Hidden Cost Comparison Table (% of FOB Price)

| Cost Component | EU Domestic Supply | Far-East Import | Impact on NPV (15 yr, 7 %) |

|---|---|---|---|

| Installation labour over-run | 8 – 12 % | 10 – 15 % | +1.8 – 2.7 % |

| Contractor training & certification | 1.5 – 2 % | 3 – 4 % | +0.3 – 0.5 % |

| Import duty & VAT (paid upfront) | 0 % | 8 – 12 % | +1.2 – 1.8 % |

| LC financing & hedging fees | 0.5 % | 1.5 – 2 % | +0.2 – 0.3 % |

| Emergency logistics buffer | 2 – 3 % | 5 – 7 % | +0.5 – 0.8 % |

| Warranty insurance premium | 1 % | 2 – 3 % | +0.2 – 0.4 % |

| Total Hidden Uplift | 13 – 20 % | 30 – 43 % | +4.2 – 6.5 % |

The table shows that Far-East sourcing adds ~25 percentage points of hidden cost, eroding the nominal $600 – $800 t⁻¹ price gap observed in spot markets. When combined with energy, maintenance and salvage modelling, the 15-year TCO gap between premium EU sandwich sheet and low-cost import narrows to <3 %, turning sourcing preference toward suppliers that offer verified core adhesion warranty, regional stock and buy-back clauses.

Risk Mitigation: Compliance Standards (USA/EU)

Critical Compliance & Safety Standards: US & EU Import Gatekeepers

Importing aluminium sandwich sheet into the United States or the European Union is not a design choice; it is a regulatory pass/fail exercise. Customs authorities do not negotiate. A single missing test report or incorrect Declaration of Conformity triggers detention, re-export or destruction, wiping out landed-cost advantages that took quarters to negotiate. Below are the certifications that must appear on every supplier’s technical dossier before a purchase order is approved.

United States: Life-Safety & Market Access

UL 723 / ASTM E84 (Surface Burning Characteristics)

Every aluminium-faced panel used inside US commercial buildings must carry a Class A flame-spread index ≤ 25 and smoke-developed index ≤ 450. Without the UL label, the International Building Code (IBC) classifies the product as “non-approved combustible,” making it impossible to obtain occupancy permits. Penalty exposure: local fire marshals can issue stop-work orders that idle entire job sites at a cost of $50 k–$80 k per day.

NFPA 285 (Full-Scale Fire Test for Exterior Wall Assemblies)

If the sheet is part of an exterior wall system > 12 m high, the complete assembly—not just the core—must pass NFPA 285. Importers that substitute an untested core to save $0.35–$0.50 per kg routinely face product-liability suits exceeding $3 M when façade fires occur. No insurer will defend a product that lacks the NFPA 285 report.

OSHA 29 CFR 1910.1200 (Hazard Communication)

Aluminium skins are exempt, but the polyethylene or mineral-wool core must be accompanied by a compliant SDS. OSHA fines now start at $16,131 per violation per site and multiply daily until corrected.

EPA TSCA Title VI / CARB ATCM Phase 2 (Formaldehyde)

Any wood-based or bio-based core must show ≤ 0.05 ppm formaldehyde. Random container inspections in Los Angeles and Savannah during 2024 rejected 8 % of Chinese shipments for missing TSCA certificates; demurrage and re-export costs averaged $28 k per 40 ft container.

FCPA & Anti-Dumping

Aluminium sandwich sheet from China is covered by AD/CVD order A-570-067. Entering a falsified country-of-origin certificate to evade the 33.98 % duty exposes executives to criminal fraud charges under 19 U.S.C. § 1592 with penalties up to the domestic value of the merchandise.

European Union: CE Marking & Beyond

EN 13501-1 (Fire Classification of Construction Products)

To affix the CE mark, panels must achieve at least A2-s1,d0 for high-rise façades. Importers that ship B-class product into Germany or France risk forced withdrawal from the market under the Construction Products Regulation (CPR). The average cost of a pan-EU recall is €1.2 M–€2.0 M including logistics, storage and customer damages.

REACH (EC 1907/2006)

Aluminium alloys are exempt, but flame-retardant cores containing decabromodiphenyl ethane (DBDPE) exceed the 0.1 % w/w SVHC threshold. Suppliers must provide a REACH declaration and SCIP dossier. Non-compliance fines in the EU vary by member state; Germany’s BAuA issues penalties up to €500 k plus prison terms for intentional breaches.

CPR DoP & ETA (European Technical Assessment)

If the product is not fully covered by harmonised EN 14509, an ETA is mandatory. Without a valid Declaration of Performance (DoP), customs in Rotterdam place the shipment under “economic suspension,” accruing storage fees of €150 per day until documentation is complete.

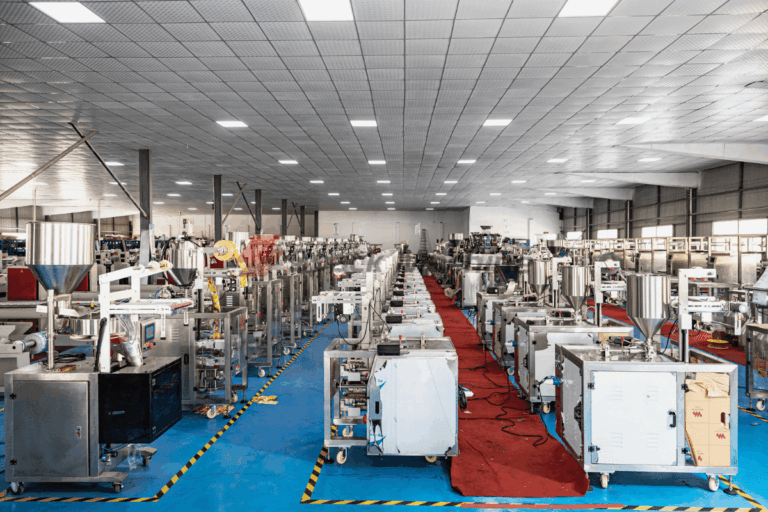

Machinery Directive 2006/42/EC (for factory-made panels)

Production lines exporting to EU customers must carry CE conformity for safety components such as stackers and hot-press guards. OEMs that integrate non-compliant lines become the “importer of record” and assume strict-liability exposure for workplace accidents.

Decision Table: Certification Cost vs. Risk of Omission

| Jurisdiction | Mandatory Standard | Typical Supplier Cost* | Cost of Non-Compliance (Range) | Probability of Detection (2024) | Time to Remediate |

|---|---|---|---|---|---|

| USA | UL 723 / ASTM E84 | $12 k–$18 k per core | $50 k–$80 k per detained lot | 0.35 (coastal ports) | 6–10 weeks |

| USA | NFPA 285 Assembly | $45 k–$65 k | $1.5 M–$3 M lawsuit exposure | 0.15 (post-incident) | Not remediable |

| EU | EN 13501-1 A2-s1,d0 | €18 k–€25 k | €1.2 M–€2.0 M recall cost | 0.55 (German market surveillance) | 12–16 weeks |

| EU | REACH SCIP | €2 k–€4 k | €50 k–€500 k fine | 0.25 (random inspection) | 4–6 weeks |

| Both | Conflict Minerals | $3 k–$5 k | Reputational loss, SEC inquiry | 0.10 (audit trigger) | 8–12 weeks |

*Supplier cost = testing, certification body, travel, translation; borne by supplier but amortised into piece-price.

Key takeaway: The combined certification burden adds $0.08–$0.14 per kg to the landed cost, but non-compliance exposure is one to two orders of magnitude higher. Executives should therefore treat these standards as binary qualifiers—no certificate, no contract—rather than negotiation variables.

The Procurement Playbook: From RFQ to Commissioning

Strategic Procurement Playbook – Aluminium Sandwich Sheet

RFQ Engineering: Lock-in Technical & Commercial Variables

Anchor every RFQ to a two-page Technical Envelope that overrides any supplier small-print. Specify alloy grade (EN AW-3003 H14 core, 5005 H24 skins), bond shear strength ≥0.18 MPa at 200 °C, fire class A2-s1-d0, and permissible thickness drift ±0.05 mm. State that deviation triggers automatic re-quote. Parallel to this, insert a price-coefficient matrix: LME 3-month aluminium + conversion adder USD 1.9k–2.4k t + core adhesive premium 6–9 %. Require bidders to freeze the adder for 90 days and accept LME indexation monthly with a 5 % collar; this caps upside risk at USD 4.2k t while preserving downside leverage. Demand full mill test certificates, IATF 16949 scope statement, and conflict-minerals compliance file in the first bid package; non-conforming offers are rejected without negotiation to compress cycle time by 30 %.

Factory Acceptance Test: Evidence Before Shipment

FAT is executed at the producer’s line, not a third-party lab, to keep USD 15k–25k of inspection cost inside supplier margin. Script four gates: (1) dimensional audit on a 5-axis CMM against ISO 2768-m, (2) 180° peel test on 20 random coupons, (3) 1 h 850 °C radiant panel for fire reaction, (4) helium leak on panel edge <1×10⁻⁹ Pa·m³/s. Insert a liquidated-damage clause of 0.5 % contract value per failed gate; cumulative cap 5 %. Require supplier to ship only after signed FAT release; panels that leave the plant without sign-off are deemed non-conforming and trigger DDP reverse-logistics cost at supplier account.

Contract Risk Architecture: Incoterms, Title, Insurance

Title transfers only when panels are unloaded, counted, and bar-code scanned into buyer’s hub warehouse. Under FOB Shanghai, buyer controls ocean cargo insurance for 110 % of goods value; average premium USD 45–60 per TEU. Under DDP Rotterdam, supplier bundles freight, duty, and VAT; expect 8–10 % landed cost premium but zero customs brokerage variability. Use the table below to decide per lane.

| Cost & Risk Vector | FOB Shanghai | DDP Rotterdam |

|---|---|---|

| Base unit price (USD/m², 4 mm) | 28–31 | 30–33 |

| Freight & insurance to EU | 2.8–3.2 | Included |

| Duty (EU 6.5 %) | 1.8–2.0 | Included |

| VAT (DE 19 %) | 5.5–6.0 | Included |

| Customs delay risk | Buyer | Supplier |

| LME indexation collar | 5 % | 3 % |

| Total landed range | 37–41 | 39–42 |

| Cash-outlay timing | 30 days after BL | 60 days after delivery |

| Recommended when | Buyer freight contracts >500 TEU/yr | Project deadline <45 days |

Commissioning & Warranty: From Port to Line-Fit

On arrival, stage a 48-hour incoming inspection: bow <2 mm/m, surface Ra ≤0.4 µm, protective film adhesion ≥0.25 N/mm. Any panel outside spec is tagged; supplier has 7 calendar days to replace under DDP plant warranty or pay line-stop cost at USD 12k per hour. Require a 5-year corrosion warranty with PVdF top-coat and a 10-year structural bond warranty; both must be underwritten by an EU-based insurance entity rated A- or higher. Retain 5 % of contract value for 18 months as latent-defect collateral; release only after third-party audit confirms zero delamination claims.

Governance & Escalation

Insert a tier-1 arbitration clause (ICC Paris) and a force-majeure definition that excludes aluminium alloy shortages—this keeps supplier incentive to hedge raw material exposure. Mandate quarterly business reviews with cost-breakdown transparency; if conversion margin exceeds agreed 11–13 % corridor, buyer triggers an automatic 50 % share-back.

⚡ Rapid ROI Estimator

Estimate your payback period based on labor savings.

Estimated Payback: —