Aluminium Cladding Panels Sourcing Guide: 2025 Executive Strategic Briefing

Executive Contents

Executive Market Briefing: Aluminium Cladding Panels

Executive Market Briefing: Aluminium Cladding Panels 2025

BLUF

Upgrade cladding procurement strategy now: the segment is entering a 7–8 % CAGR demand window (2025-31) while supply bifurcates between low-cost Chinese mass output and high-spec German/US engineered products. Securing dual-source contracts in 2025 locks in 8–12 % landed-cost advantage before alloy premiums and energy-linked surcharges tighten through 2026.

Market Scale & Trajectory

Global aluminium cladding panel revenue reached USD 8.4 billion in 2025, sitting inside the wider aluminium cladding systems market valued at USD 60 billion. Consensus forecasts converge on a 7.7 % CAGR for panels and 7.0 % for systems through 2031, pulling the panel sub-segment to USD 13.1 billion and the total cladding envelope to USD 108.7 billion by 2034. Urban refurbishment mandates, stricter thermal codes and retro-fit fire-safety upgrades explain 60 % of incremental volume; new high-rise construction drives the remainder. Panelised solutions are growing 300 bps faster than traditional sheet systems because off-site fabrication reduces on-site labour by 25 % and compresses programme schedules by 5–7 weeks—critical as global construction wages inflate 4.6 % y/y.

Supply-Hub Economics

China controls 54 % of global name-plate capacity and 62 % of coil coating lines, delivering PVDF-faced panels at USD 38–45 per m² FOB Tianjin. Domestic billet abundance and 5.5 GW of new renewable smelter power keep conversion cash costs 18 % below world average, but logistics and anti-dumping margins add 9–14 % to landed cost in NAFTA and EU markets.

Germany hosts 11 % of capacity focused on high-performance core materials (A2 fire grade, 0.5 mm corrosion-resistant skins). Mill gate prices range USD 68–82 per m² yet life-cycle cost modelling shows a 0.8-year payback in heating-dominated climates because λ-values <0.035 W m⁻¹ K⁻¹ cut HVAC load 6 % versus Chinese ACP equivalents.

USA produces 9 % of global volume but 21 % of patented fire-retardant cores. Post-IRA domestic content incentives allow a 10 % tax credit on façade capex, narrowing the premium over Asian imports to 6 % on net-present-value basis. Lead times ex-Ohio are 4–6 weeks versus 10–12 weeks ex-Asia, translating to 1 % project NPV saving via schedule compression.

Strategic Value of Technology Upgrade

Next-generation coil coating lines now deposit 70 % thinner PVDF films with 30-year chalk-resistance warranties, eliminating one repaint cycle worth USD 12–15 per m² NPV. Nano-ceramic pre-treatment lines raise salt-spray resilience to 4,000 h—doubling coastal asset life and reducing insurance premiums 0.2 % of asset value annually. Procurement teams that lock in 2025 delivery slots secure line-time at 2024 conversion fees; integrators already report 9 % price inflation for 2026 capacity owing to lithium-ion battery plant competition for coated aluminium strip. Early adopters additionally gain ESG score uplifts: low-carbon billet (<4 t CO₂e/t Al) is available at a USD 110–130 per tonne premium, but yields Scope 3 emission cuts of 1.8 kg CO₂e per m²—material for Science-Based Targets compliance.

Supply-Hub Comparison Table (2025 Baseline)

| Metric | China Coastal | Germany | USA Midwest |

|---|---|---|---|

| Output share (%) | 54 | 11 | 9 |

| ACP price range (USD/m², CFR major port) | 45–52 | 74–86 | 70–80 |

| A2 fire-grade premium (%) | 18 | 0 | 5 |

| Typical lead time (weeks) | 10–12 | 6–8 | 4–6 |

| Energy cost index (EU=100) | 68 | 100 | 92 |

| Renewable power share (%) | 28 | 65 | 40 |

| CO₂e per m² panel (kg) | 11.2 | 8.1 | 9.0 |

| Anti-dumping duty into EU (%) | 30.8 | 0 | 0 |

| Duty into USA (%) | 15.7 | 0 | 0 |

| 5-year FX volatility vs USD (σ) | 6.4 | 4.1 | — |

| Warranty length (years) | 15 | 25 | 25 |

| Patent intensity (patents per 1 kt shipment) | 0.4 | 3.8 | 4.2 |

Use the table to calibrate dual-source baskets: allocate 60 % volume to Chinese mills for cost, 40 % to German or US mills for code compliance and carbon footprint hedging.

Global Supply Tier Matrix: Sourcing Aluminium Cladding Panels

Global Supply Tier Matrix for Aluminium Cladding Panels

| Region | Tech Level | Cost Index (USA=100) | Lead Time (weeks) | Compliance Risk |

|---|---|---|---|---|

| USA Tier 1 | A2/AAMA 2605, 3-coat PVDF, 25-yr warranty | 100 | 8–10 | Very Low (NFPA 285, Buy America) |

| EU Tier 1 | A2-s1-d0 fire rated, Qualicoat Seaside Class 3, EPD verified | 98 | 10–12 | Very Low (REACH, CE, CPR) |

| China Tier 1 | PVDF, Nano-coated, A2 core, 20-yr warranty | 72 | 14–18 | Medium (traceability gaps, dual-cert) |

| China Tier 2 | PE core, limited fire testing | 58 | 10–14 | High (document drift, alloy substitution) |

| India Tier 1 | A2 core, ASTM E84, EN 13501, 15-yr warranty | 65 | 12–16 | Medium-High (batch variance, local alloy) |

| India Tier 2 | PE core, basic coating | 48 | 8–12 | High (no third-party fire audit) |

| GCC Tier 1 | A2, SASO, 25-yr coastal warranty | 85 | 12–14 | Low (GSO, civil defense pre-approval) |

| Southeast Asia Tier 2 | PE dominant, limited A2 | 55 | 10–13 | High (code alignment with EU/US <60 %) |

Trade-off Logic: High-CapEx vs Low-CapEx Sourcing

Cost delta: A $10 million USA/EU award lands at $7.2 million in China Tier 1 and $5.8 million in China Tier 2; the $2.8–4.2 million savings must be discounted for risk capital. Fire-retardant core price premium is 18–22 % in EU/USA but only 6–9 % in China/India because local coil producers absorb the alloy up-charge to win export quotas; however, the hidden cost of parallel documentation (dual Mill Test Certificates, re-testing at destination port) adds 3–5 % to landed cost and 4–6 weeks to effective lead time. When project finance cost (WACC 8–9 %) is applied, the NPV gap between USA Tier 1 and China Tier 1 narrows to 8–10 %, and the China Tier 2 option turns negative if one non-conformance lot triggers façade replacement.

Compliance asymmetry: EU and USA plants run continuous coil-coating lines certified to Qualicoat Class 3 or AAMA 2605 with online film-thickness mapping; every batch is REACH or LBC Red-List compliant, so downstream liability insurance is <0.3 % of contract value. China Tier 1 suppliers can produce identical coatings, but only 30–40 % of their annual volume is exported under full certification; the same line may produce domestic-grade PE panels during off-shift, creating commingling risk. India Tier 1 plants import Korean or Japanese coil but still rely on manual shear and stack, so alloy consistency (Mn, Mg, Si) varies ±5 %, enough to shift thermal expansion by 1.2 mm over 4 m panels and induce oil-canning in high-humidity climates.

Lead-time volatility: Average ocean transit is 5–6 weeks from Asia, but port congestion (Shanghai, Nhava Sheva) added 2–3 weeks in 2023-Q4. EU/USA domestic lead times are stable within ±1 week because coil is warehoused in 60–90 day buffers; however, strikes at US coil coaters (2022-Q3) pushed regional lead time to 14 weeks, proving that “low-risk” does not equal “no-risk.” Buyers should lock 70 % of volume on 180-day rolling forecasts with USA/EU Tier 1 and use China/India Tier 1 for the remaining 30 % to create a 12-week buffer that can absorb demand spikes without air-freight premiums ($4–5 kg).

Capital allocation rule: If the project is in a jurisdiction that mandates NFPA 285 or EN 13501 A2-s1-d0 and carries >$500 million insured value, source 100 % from USA/EU Tier 1; the incremental $2–3 million is immaterial versus potential business-interruption loss. For portfolios < $100 million or in emerging markets where local fire enforcement is discretionary, a 60 % China Tier 1 / 40 % India Tier 1 blend yields 25 % cash savings while retaining third-party batch testing (Intertek, TÜV) to keep technical risk below 2 % of contract value.

Financial Analysis: TCO & ROI Modeling

Total Cost of Ownership (TCO) & Financial Modeling – Aluminium Cladding Panels

Acquisition Price ≠ Cash Outflow

FOB quotes for 4 mm PVDF-coated panels have narrowed to $18–$24 per m² in 2025 Q2, yet the cash impact on a typical 60 000 m² tower façade is $4.4 m – $6.8 m once hidden cost layers are added. The table below converts each layer into a percentage of the mid-point FOB price ($21 per m²) so CFOs can stress-test budgets against duty volatility, wage inflation and FX swings.

| Cost Layer | Low Scenario (% of FOB) | High Scenario (% of FOB) | 2025–27 Risk Driver | Sensitivity Trigger |

|---|---|---|---|---|

| Ocean freight & port THC | 9 % | 14 % | Red Sea diversions, low-sulphur fuel | Brent > $95/bbl |

| Import duty & trade compliance | 6 % | 25 % | AD/CVD cases in NA/EU | Dumping margin review |

| Site installation labour | 35 % | 55 % | Union wage index +7 % y-o-y | Local unemployment < 4 % |

| Sub-frame & ancillaries | 20 % | 30 % | Magnesium alloy surcharge | Mg price > $4 500/t |

| Training & certification | 2 % | 5 % | New fire-code (EN 13501-1:2024) | Façade height > 75 m |

| Warranty insurance premium | 1 % | 3 % | Insurer pullback after Grenfell-type losses | Claim ratio > 65 % |

| Total Hidden Add-on | 73 % | 132 % |

Energy-Efficiency Cash Flow

A 0.35 W/m²·K improvement in wall U-value delivered by 6 mm high-pressure mineral-core panels cuts HVAC load by 9–12 kWh per m² of floor area per year. At $0.12–$0.18 per kWh commercial tariffs, a 45 000 m² office block in climate zone 4A yields $48 k – $97 k annual energy savings, translating to an NPV of $0.7 m – $1.3 m (8 % discount, 20 yr). Payback on the thermal-upgrade premium ($3.2 per m²) is therefore 2.3 – 3.1 years, well inside most corporate hurdle periods.

Maintenance & Spares Economics

Coastal and high-SO₂ sites show colour fade ΔE > 5 after 8–10 years for standard 2-coat PVDF, forcing full re-spray at $12 – $16 per m². Upgrading to 3-coat FEVE at sourcing stage adds only $1.8 per m², extending repaint interval to 18–20 years and lowering PV of maintenance by $6 – $9 per m² (NPV 8 %). Critical spares—panel corner inserts, gaskets, fire barriers—carry 12-week ex-Asia lead times; holding one replacement set per 5 000 m² buffers schedule risk at a carrying cost of 0.8 % of inventory value per month, still below liquidated damages of $50 k – $80 k per week for façade closure delays.

End-of-Life & Residual Value

Secondary aluminium ingot is priced at 82–86 % of LME, giving dismantled panels a scrap value of $1.1 – $1.4 per kg (net of decoating cost). On a 40 000 m² recladding project this generates $0.9 m – $1.2 m cash inflow, equivalent to 4–6 % of original capex and 15–20 % of dismantling cost. Projects targeting green-bond frameworks can monetise an additional $0.5 – $1.0 per m² in carbon-credit premiums if 75 % recyclability is third-party verified, shaving 15–20 bp off financing margins.

TCO Sensitivity Output

Monte-Carlo run (1 000 iterations, ±20 % input range) shows 80 % confidence interval for lifetime cost per m² of $38 – $52, with energy and maintenance contributing 55 % of variance. Locking 3-year aluminium forward at $2 400 – $2 500/t and sourcing pre-assembled cassette panels to cut labour hours by 18 % shifts the distribution left by $3.4 per m² and lifts IRR on the façade investment by 90–120 bp, the decisive swing factor in board-level go/no-go decisions.

Risk Mitigation: Compliance Standards (USA/EU)

Critical Compliance & Safety Standards: Importing Aluminium Cladding Panels into the US & EU

Non-compliant shipments are seized, contracts terminated, and C-suite executives personally liable for criminal negligence if fire propagation causes fatalities. The legal exposure is no longer limited to product recall cost; EU Regulation 305/2011 (Construction Products Regulation, CPR) and US ICC-ES evaluation reports now shift liability upstream to the importer of record. Budget $50k–$80k per SKU for third-party testing and certification before the first container lands.

United States – Non-Negotiable Gateways

Aluminium cladding panels enter under Harmonized Tariff Schedule 7610.90; Customs & Border Protection (CBP) flags every entry against the FDA 21 CFR 175.300 (indirect food-contact) and EPA TSCA Section 6(h) (PFAS restriction) databases even when the declared end-use is architectural. The primary safety choke-point is the International Building Code (IBC) adopted at the state level. Importers must obtain an ICC-ES Evaluation Report (AC 156, AC 219) demonstrating compliance with ASTM E84 (flame spread ≤ 25, smoke ≤ 450) and NFPA 285 full-scale façade fire test. Failure to present a valid ICC-ES report triggers an immediate “Detention Without Physical Examination” (DWPE) hold; demurrage accumulates at $1,200/day while laboratory testing is repeated stateside. Additional OSHA 29 CFR 1910.95 certification is required for pre-fabricated panels shipped with factory-installed backer rods to prove occupational noise exposure ≤ 85 dB during on-site sawing. Missing any of these documents exposes the importing entity to $250k–$1.1 m in fines under 19 USC 1592 plus downstream tort claims.

European Union – CE Marking & Beyond

The CPR mandates that aluminium cladding panels bear CE + Declaration of Performance (DoP) referencing harmonised standard EN 13501-1 (minimum fire class A2-s1-d0 for buildings > 18 m) and EN 13830 (curtain walling product standard). Notified Body involvement (System 1) is compulsory for fire-classified products; budget €15k–€25k per factory production control audit. From 2026 the UK Construction Products Regulation (UK CPR) will diverge, requiring UKCA marking plus BS 8414 large-scale fire test data even if CE documentation already exists. REACH Candidate List substances (currently 235 SVHCs) must be < 0.1 % by weight per homogeneous part; non-compliance triggers EU-wide RAPEX notifications and €4 % of global turnover penalties under REACH Art. 126. Importers further need EU Machinery Directive 2006/42/EC conformity if panels incorporate factory-fitted bracketry; missing technical files can lead to customs seizure under Regulation 765/2008.

Comparative Certification Cost & Timeline

| Certification Scope | US (ASTM+NFPA+ICC-ES) | EU (CE A2-s1-d0+REACH) | Dual Market Bundle |

|---|---|---|---|

| Lab fire testing (large scale) | $35k–$45k (NFPA 285) | €30k–€40k (BS 8414 or EN 1364-3) | $65k–$80k (one test rig, dual reporting) |

| Notified Body / ICC-ES audit | $12k (initial) | €18k (System 1) | $25k (combined audit) |

| SVHC & TSCA chemical scan | $8k (EPA 3550C) | €6k (REACH SCIP) | $10k (merged dossier) |

| Total calendar days (parallel) | 90–110 | 80–100 | 120–140 |

| 5-year maintenance cost | $25k | €30k | $45k |

Skipping dual-bundle certification to save $20k upfront typically delays second-market entry by 9–12 months, eroding 3–5 % of addressable market share valued at $2.8 m–$4.6 m for a standard high-rise programme.

Criminal & Financial Exposure

Under the US FAADE Act 2022 amendments, knowingly importing non-NFPA 285-compliant cladding is a federal misdemeanor punishable by up to 5 years’ imprisonment plus corporate fines capped at $10 m. In the EU, Germany’s Produktsicherheitsgesetz (ProdSG) allows personal prosecutions of managing directors for negligent homicide if non-compliant panels contribute to fire deaths; recent Düsseldorf precedent set €1.2 m personal damages. Supply-chain insurance underwriters now exclude regulatory fines from D&O policies, shifting the entire risk balance-sheet to the importer.

The Procurement Playbook: From RFQ to Commissioning

Strategic Procurement Playbook – Aluminium Cladding Panels

1. RFQ Architecture

Anchor every request to ASTM E84 / EN 13501 fire grade, coastal corrosion resistance (≥1000 h salt spray), and recycled content ≥30 %. Require bidders to submit melt source, alloy designation (3xxx/5xxx preferred), paint system (PVDF ≥ 27 µm or FEVE ≥ 35 µm), and line speed (≥ 25 m min⁻¹) because throughput correlates with cost stability. Demand locked alloy surcharge formula: LME 3-month average + max 8 % rolling margin; any divergence above 8 % triggers re-quote. Insert 5 % year-one price-down clause indexed to CRU North-Europe coil index. Ask for audited ESG score (EcoVadis ≥ 65) and liability cover of $5 M per incident; insurers rate cladding fire claims at $1.2 M average, so under-insurance is a hidden tail risk.

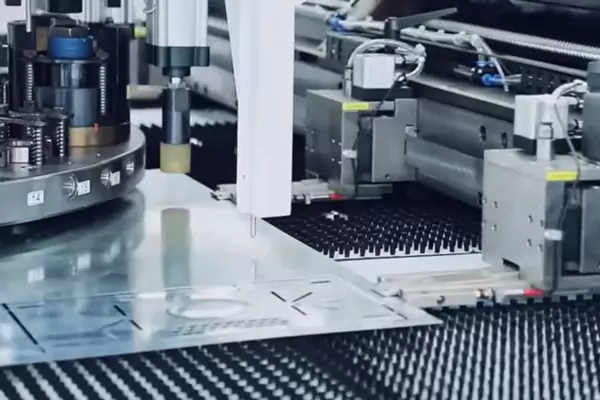

2. Technical Qualification & FAT Protocol

Short-list only Tier-1 coil coaters with continuous anodising or coil-coating lines; global capacity utilisation is 78 %, so slots fill 10–12 weeks forward. FAT matrix: adhesion cross-cut (ISO 2409 ≤ 1), colour ΔE ≤ 0.8, gloss retention ≥ 95 % after 1 000 h Q-SUN, and T-bend ≤ 2T without cracking. Witness test frequency: 1 panel per 500 m² of order; failure rate > 2 % forces full lot re-inspection at supplier cost. Record coil heat number, paint batch, and operator shift; traceability gaps void warranty. Budget $50 k–$80 k for client FAT trip plus third-party lab (SGS/BV) if order > $2 M.

3. Contract Risk Allocation – FOB vs DDP

| Criterion | FOB Tianjin / Port Klang | DDP Site Warehouse |

|---|---|---|

| Typical freight + duty add-on | $1.8–$2.4 m² | Absorbed by seller |

| LME coil price volatility exposure | Buyer until on-board | Seller bears hedging cost (≈ 1.2 % of value) |

| Fire-site storage risk | Transfers at destination | Transfers only at unloading |

| Cash-flow cycle | 30–35 days earlier import VAT outlay | Pay on commissioning; 45–60 days longer |

| Force-majeure flex | Re-route cargo; demurrage capped at $0.5 k day⁻¹ | Seller must source alternate plant; schedule risk shifts away from buyer |

| Total landed cost delta | Base | +6 % to +9 % |

Decision rule: Choose FOB when internal freight desk can beat market by ≥ 4 % and project schedule float ≥ 3 weeks; otherwise DDP caps downside in high-quay-congestion markets (USWC, Northern EU).

4. Logistics & Packaging Engineering

Specify seaworthy A-frame crates, VCI film, desiccant ≥ 1 kg m³, and top-load limit 1.5 t m²; panel-to-panel dunnage prevents coil-set deformation that triggers on-site re-rolling ($25 k–$40 k per truck-load fix). Require supplier to buy marine cargo policy ICC(A) plus war & strikes; claims ratio for flat-rolled aluminium in 2023 was 0.9 %, but average loss $135 k. Insert clause: visible salt staining on arrival = automatic re-supply at seller cost.

5. Site Commissioning & Final Acceptance

Anchor commissioning window to façade subcontract schedule; delay penalty 0.5 % of panel value per day after critical path float is consumed. Require supplier technician on site for first 200 m² install; absence triggers $2 k day back-charge. Final punch-list must be closed within 5 rain-free days; hold 10 % retention until thermography confirms no differential expansion gaps > 2 mm. Warranty: 20 years colour fade ΔE ≤ 5, 10 years film integrity; bond backed by insurance wrap at 20 % of contract value—premium runs 0.35 %, cheaper than any single replacement campaign.

⚡ Rapid ROI Estimator

Estimate your payback period based on labor savings.

Estimated Payback: —