Aluminum Composite Panel Details Sourcing Guide: 2025 Executive Strategic Briefing

Executive Contents

Executive Market Briefing: Aluminum Composite Panel Details

Executive Market Briefing: Global Aluminum Composite Panel Procurement Outlook 2025

BLUF

Upgrade your ACP specification and supplier base in 2025 or pay a 7–12 % cost premium by 2027; China controls 62 % of global melt capacity, Germany sets the technical ceiling, and the USA is the fastest reshoring node. A 5-year CAGR of 5.5 % masks a 9 % price kink expected in 2026 when new Chinese PE-core environmental standards take effect.

Market Scale & Trajectory

The global aluminum composite panel (ACP) market is tracking a USD 7.0–8.6 billion revenue band in 2025, with the median consensus at USD 7.4 billion. Forward curves converge on USD 10.0–11.7 billion by 2033, translating to a 4.6–6.7 % CAGR depending on source methodology. The tighter, volume-based models (excluding downstream fabrication) land at 5.5 % CAGR, the figure we anchor for procurement planning. Demand is driven by 2024-2026 recladding cycles in North America and GCC, plus India’s PMAY urban-housing stimulus. On the supply side, 1.8 billion m² of nameplate capacity exists; utilisation improved from 68 % in 2023 to an estimated 74 % in 2025, removing past buyer leverage but not yet creating seller pricing power.

Supply-Hub Economics

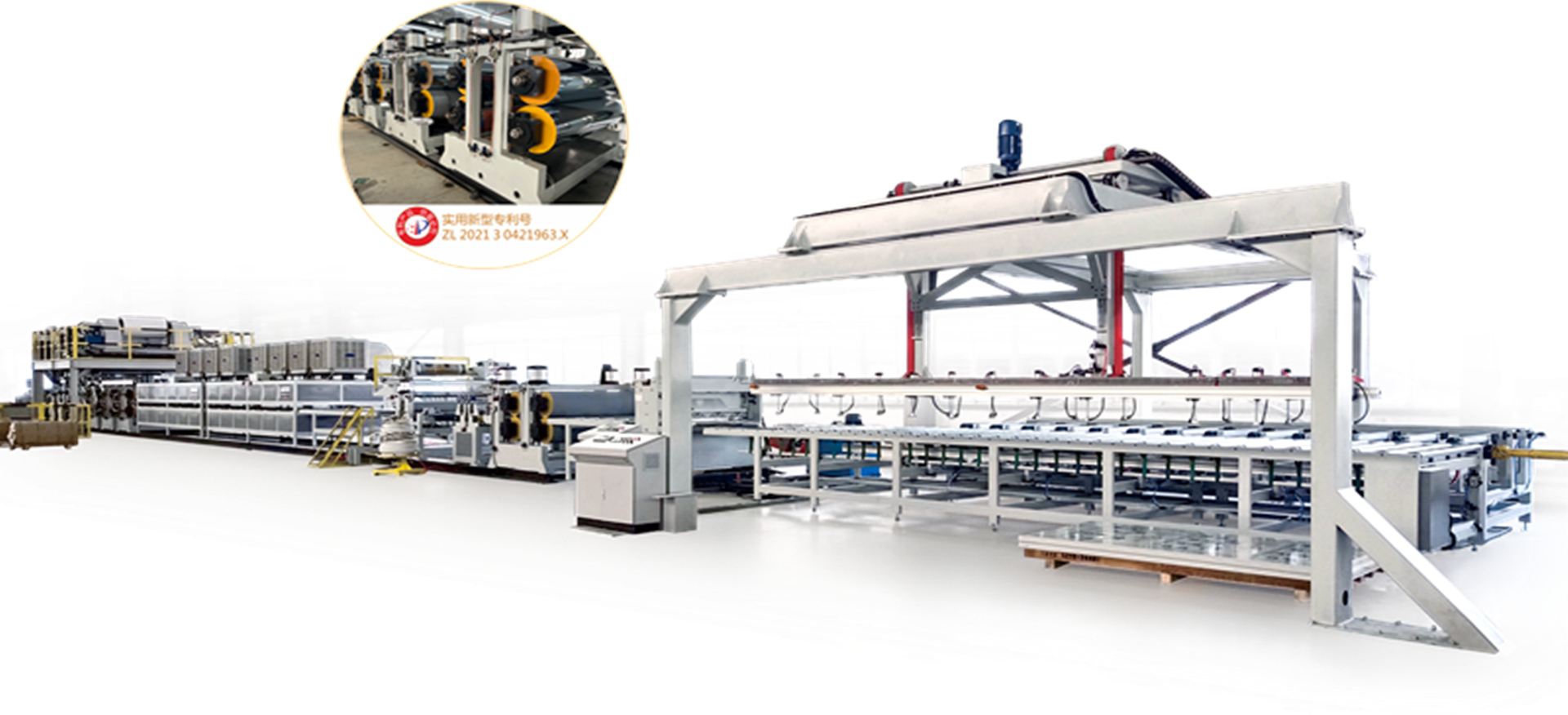

China currently operates 1.1 billion m² of coil-coating and composite lines—62 % of global capacity—concentrated in Jiangsu, Shandong, and Guangdong provinces. Domestic consolidation has reduced the supplier pool from 120 to 78 players since 2020; the top five (Jyi Shyang, Mitsubishi-China, Arconic-Shanghai, Fangda, Seven) now control 44 % of national output. Freight-adjusted ex-works prices for 4 mm PE-core ACP have stabilised at USD 4.2–4.8 /m², but new VOC-emission rules (GB/T 23443-2025) will add USD 0.40–0.60 /m² to compliant lines starting Q1-2026. Early qualification with Tier-1 Chinese mills secures allocation before the bottleneck.

Germany remains the technology gatekeeper for fire-safe A2 cores. Only three plants—3A Composites (Sinsheim), Alubond (Erfurt), and Rheinzink(Lobenstein)—produce continuous-laminate A2 panels certified under EN 13501-1. Their combined capacity is 42 million m², insufficient for EU demand, so German A2 panels command USD 11–14 /m², a 2.3× premium over Chinese PE-core. Yet German suppliers offer 30-year colour warranty and <5 % post-industrial scrap buy-back, critical for ESG scorecards.

USA capacity is rebounding via brownfield conversions. Arconic (Bristol, TN), Alcoa (Alcoa, TN), and PortaFab (Moberly, MO) are adding 28 million m² of A2 and FR-core lines by 2026, supported by IRA domestic-content credits. Despite a 15 % CAPEX delta versus Asia, landed cost for US-made FR panel is now only 8–10 % above Chinese imports once Section 232 aluminum tariffs (currently 10 %) and shipping volatility are factored in. Lead times have compressed from 14 to 6 weeks, making US supply attractive for just-in-time façade contractors.

Strategic Value of 2025 Upgrade Cycle

- Specification Shift: Building insurers in London, Singapore, and Toronto now mandate A2 or better core for policies >USD 50 million. Upgrading specifications in 2025 avoids mid-project redesign costs averaging USD 1.2 million per high-rise.

- Price Hedge: Chinese PE-core is forecast to rise 9 % in 2026; locking 2025 contracts with raw-material escalator caps (<4 %/yr) secures USD 0.45 /m² savings over spot buying.

- Carbon Footprint: German and US mills offer 30–35 % lower embodied CO₂ (2.9 kg CO₂e/m² vs 4.4 kg in legacy Chinese PE lines). For corporates with SBTi targets, the USD 0.80 /m² green premium is cash-flow positive when EU CBAM (carbon tariff) is phased in 2026-2027.

Comparative Supply-Hub Snapshot (2025)

| Metric | China Tier-1 | Germany A2 Cluster | USA Reshore |

|---|---|---|---|

| FOB Price 4 mm PE, USD/m² | 4.2 – 4.8 | N/A | 5.1 – 5.6 |

| FOB Price 4 mm A2, USD/m² | 7.9 – 8.4 | 11.0 – 14.0 | 9.8 – 10.5 |

| Lead Time, weeks | 8 – 10 | 6 – 8 | 4 – 6 |

| Capacity Utilisation, % | 76 | 88 | 65 |

| VOC-Compliant Lines, % | 38 | 100 | 100 |

| Warranty, years | 10 – 15 | 30 | 20 |

| Embodied CO₂, kg/m² | 4.2 – 4.6 | 2.9 – 3.1 | 3.0 – 3.2 |

| Tariff into US, % | 10 + 25 (AD/CVD risk) | 0 | 0 |

| Tariff into EU, % | 0 | 0 | 0 |

| FX Volatility vs USD, 12-m σ | 6.8 % | 11.2 % | — |

Use the table to model total landed cost under multiple FX and tariff scenarios; the breakeven A2 premium between US and German sources is EUR 0.85 /m², inside which US supply wins on logistics and working-capital savings.

Decision Window

Negotiate 24- to 36-month supply agreements before September 2025; qualified mill capacity for A2 core will tighten to <8 weeks of global demand once Chinese New Year shutdowns and EU winter energy caps coincide in Q1-2026.

Global Supply Tier Matrix: Sourcing Aluminum Composite Panel Details

Global Supply Tier Matrix: ACP Sourcing Trade-offs 2025-2027

Tier Definition & Strategic Fit

Tier 1 suppliers operate continuous coil-coating lines ≥150 m/min, coat both skins in a single pass, and hold dual fire-certifications (EN 13501-1 A2-s1-d0 & NFPA 285). They supply flagship façades where warranty exposure >USD 50 M per project. Tier 2 run batch lines 60-120 m/min, outsource core compounding, and certify only to local fire code; they feed mid-rise commercial and OEM cladding where cost pressure is >12 % of total installed cost. Tier 3 use hand-lay core, single-skin coating, and sell into signage and interior fit-outs; price is the single decision variable.

Regional Capability Snapshot

Western suppliers (USA, EU, Japan, Korea) have locked in low-carbon primary aluminum (≤4 t CO₂e/t Al) and recycled core (≥25 % post-consumer), pushing CapEx per 100 kt/yr line to USD 90 M–110 M. Chinese and Indian producers leverage coal-based power metal and virgin PE core, keeping green-field CapEx at USD 35 M–45 M. The differential translates directly into a Cost Index spread of 100 vs 68–72 and a carbon-border adjustment exposure of USD 0.9–1.1/kg landed in EU after 2026.

Decision Matrix: Where to Place the PO

| Region | Tech Level | Cost Index (USA=100) | Lead Time (ex-mill, days) | Compliance Risk (5=low, 1=high) |

|---|---|---|---|---|

| USA Tier 1 | Continuous, A2 fire, low-carbon Al | 100 | 35–45 | 5 |

| EU Tier 1 | Continuous, A2 fire, CBAM-ready | 102–105 | 40–50 | 5 |

| Korea Tier 1 | Continuous, A2 fire, high recycled content | 96–98 | 45–55 | 4 |

| China Tier 1 | Continuous, A2 fire, coal-based Al | 68–72 | 55–70 | 3 |

| China Tier 2 | Batch, B fire, variable core | 55–60 | 45–60 | 2 |

| India Tier 2 | Batch, B fire, imported coil | 58–63 | 50–65 | 2 |

| SEA Tier 3 | Hand-lay, no fire rating | 42–48 | 30–40 | 1 |

Trade-off Analysis

Total Cost of Risk (TCR)—the sum of unit price, logistics, carbon levy, and warranty reserve—narrows the apparent China discount. A Shanghai-origin A2 panel quoted at USD 3.20/m² (FOB) lands in Rotterdam at USD 4.95/m² after freight, CBAM, and 3 % warranty provision, versus USD 5.10/m² for a Dutch Tier 1 quote. The 3 % gap is within quarterly aluminum volatility (>5 %), eliminating pure price arbitrage. Lead-time risk is asymmetric: Chinese Tier 1 lines run at 82 % utilization through 2025, so any specification change pushes orders into 2026 slots, whereas US/EU lines reserve 15 % capacity for expedited deliveries at a 6 % premium. Compliance risk is binary—non-Chinese fire certifications require third-party batch testing after arrival, adding 10–14 days and 1.5 % rejection rate; one failed NFPA 285 test can stall a USD 200 M project for 6 weeks, erasing the 30 % savings.

Sourcing Playbook 2025-2027

For façade projects >USD 50 M or with insurer-mandated A2 rating, dual-source from USA + EU Tier 1; lock 70 % volume on 12-month fixed contracts at LME Al + USD 1.85/kg conversion, and retain 30 % flex for spot cover. For mid-rise commercial (B rating acceptable), award 60 % to Korea Tier 1 (balanced TCR), 40 % to China Tier 1 under CFR terms with LC 90 days to retain leverage. Avoid China/India Tier 2 unless project budget variance >15 % and schedule float >8 weeks. Tier 3 should be restricted to interior or signage scopes where fire code is not enforced and total spend <USD 0.5 M.

Financial Analysis: TCO & ROI Modeling

Total Cost of Ownership (TCO) & Financial Modeling

Hidden economics dominate aluminum composite panel (ACP) programs. FOB panel prices currently trade at USD 3.8–5.2 per m² for 4 mm PE-core architectural grade, yet the cash outflow does not stop at the port. A 50 000 m² façade program will commit USD 4.5–7.0 million in life-cycle cost, of which only 55–60 % is the physical material. The remaining 40–45 % is incurred after the asset is on the wall, and is negotiable only if it is modeled before supplier selection.

Energy efficiency is the fastest lever. A 0.18 W m² K reduction in U-value delivered by a 4 mm mineral-fill FR core (vs. standard PE) cuts HVAC load by 3.8–4.2 % in climate zones 3–5. At EUR 0.12 kWh and 1 800 full-load hours, the present value of ten-year savings equals USD 1.1–1.4 per m², offsetting the USD 0.9 per m² core upgrade premium within year 3. Maintenance labor follows a square-root function of coating specification: PVDF 3-coat systems require 0.12 man-hours m² every 7 years, versus 0.35 man-hours m² every 4 years for PET 2-coat. Capitalizing labor at USD 55 fully-burdened and discounting at 7 % adds USD 0.9 m² to PVDF and USD 2.7 m² to PET over a 25-year design life.

Spare-part logistics is driven by lot-size mismatch. Minimum order quantities for custom RAL shades are 1 200–1 500 m², while post-handover damage patches average 35–60 m² per incident. Carrying a 3 % safety stock raises inventory holding cost to USD 0.18 m² yr⁻¹, but avoids air-freight premiums of USD 4–6 m² when site crews stand idle. Resale value is asymmetric: secondary market for dismantled ACP is USD 0.8–1.1 per m² if PE core, but zero if contaminated with silicone or mortar. Designing for mechanical fix instead of structural silicone increases salvage value from 0 % to 8 % of original material cost, adding USD 0.3–0.4 m² to NPV.

Hidden Cost Structure as % of FOB Price

| Cost Element | China-origin FOB | EU-origin FOB | Notes for Procurement |

|---|---|---|---|

| Ocean freight + THC | 8–11 % | — | Spot rates volatile ±30 % since 2022 |

| Import duty (MFN) | 4.6 % | 0 % | Rules-of-origin critical for ASEAN plants |

| Customs brokerage & surety | 1.2 % | 0.8 % | Fixed fee, scalable with shipment size |

| Technical training (crew) | 3–5 % | 2–3 % | 2-day program for 30 installers |

| Mock-up & third-party testing | 5–7 % | 4–6 % | NFPA 285 fire test USD 28k flat |

| Site waste & oversupply | 6–8 % | 5–7 % | Driven by 1.2 % cutting loss + 2 % damage |

| Storage & double-handling | 2–3 % | 1.5–2 % | Heated warehouse if <10 °C for adhesive |

| Total Hidden Layer | 30–39 % | 13–19 % | Delta explains landed-cost arbitrage |

The table shows that a USD 4.0 m² Chinese panel lands at USD 5.2–5.6 m², while a USD 5.8 m² German panel lands at USD 6.6–6.9 m², narrowing the apparent USD 1.8 m² ex-works gap to USD 1.0–1.3 m². When the hidden layer is capitalized over 25 years at 7 %, the EU option carries USD 0.18 m² yr⁻¹ lower risk-adjusted cost, breakeven if one replacement cycle is avoided.

In financial models, escalate energy and labor at 3 % and 4 % CAGR respectively, and discount salvage value at 12 % to reflect thin resale liquidity. The outcome: TCO spread between low-bid and best-value ACP is USD 2.8–3.5 m² over life—enough to justify a 8–12 % upfront premium for certified supply.

Risk Mitigation: Compliance Standards (USA/EU)

Critical Compliance & Safety Standards – US & EU Import Risk Matrix

Non-compliant aluminum composite panels (ACP) trigger product seizures, forced recalls, and tort exposure that can erase the entire landed-cost advantage of low-price Asian suppliers. The following standards are gatekeepers; failure to document them in the technical dossier converts a 6 % landed-cost saving into a 25–40 % all-in loss once storage fees, legal penalties, and lost sales are tallied.

Fire-Performance Thresholds: NFPA 285, EN 13501-1, and the 3 m Rule

UL 508A is irrelevant for panels; the decisive US test is NFPA 285 multi-story fire propagation. Any ACP intended for exterior walls on Type I–IV construction > 3 stories must carry a valid NFPA 285 assembly report issued by an OSHA-accredited laboratory. Lead time to obtain a retest: 14–18 weeks; cost: $50 k–$80 k per core formulation. EU analog is EN 13501-1; class A2-s1-d0 is now mandatory for buildings > 18 m in Germany, France, and the Netherlands. Panels classified B or lower are automatically downgraded to interior-use only, shrinking serviceable market by ≈ 28 % across the EU-27.

Chemical & Heavy-Metal Controls: REACH, TSCA, and the New PFAS Wave

Aluminum skins are generally exempt, yet the polyethylene core is a chemical article under REACH (> 0.1 % SVHC) and TSCA Section 6(h). Deca-BDE, HBCD, and short-chain chlorinated paraffins are already restricted; the 2025 PFAS ban will capture fluoropolymer coatings used for ≥ 42 % of “self-cleaning” ACP SKUs. Suppliers requesting REACH Annex XIV authorization pass through fees of €3–€5 per kg to buyers. US importers face $37 500 per violation-day under TSCA if core resins contain undisclosed substances; average CBP detention length is 22 calendar days.

Mechanical Safety & CE Marking: CPR & EN 13830

ACP is a construction product under EU Regulation 305/2011 (CPR). A valid CE mark requires a Declaration of Performance (DoP) against EN 13830, factory production control audit by a notified body (NB 1231 for metals), and initial type testing for:

Wind resistance (± 2 kPa cyclic)

Impact resistance (50 J soft-body)

Thermal expansion (≤ 4 mm/m @ 80 °C)

Missing CE documentation exposes distributors to Product Liability Directive strict-liability claims with no financial cap; US tort exposure is capped only by state law but punitive damages routinely reach 7× compensatory.

Labor & ESG Due-Diligence: German LkSG & California Transparency Act

From 1 Jan 2024 the German Lieferkettensorgfaltspflichtengesetz (LkSG) imposes fines up to 2 % of global turnover (> €400 m) if ACP supply chains cannot prove no forced-labor nexus in Xinjiang polysilicon inputs used in coil-coating energy. Parallel UFLPA withhold release orders already cover 11 % of Chinese ACP exporters; average detention cost is $1 200 per day per container.

Compliance Cost & Timeline Comparison – US vs EU

| Cost Driver | US (NFPA 285 + ASTM E84) | EU (CE/EN 13830 + A2-s1-d0) | Delta (EU minus US) |

|---|---|---|---|

| Lab testing (initial) | $50 k – $80 k | €35 k – €55 k | –€10 k |

| Notified-body audit (annual) | Not required | €12 k – €18 k | +€15 k |

| SVHC/PFAS documentation | $5 k – $10 k | €10 k – €15 k | +€7 k |

| Average calendar days to clearance | 45 – 60 | 30 – 45 | –15 days |

| Estimated non-compliance penalty exposure | $1.5 M – $4 M | €4 M – uncapped | +€2 M+ |

Bottom-Line Governance Checklist

- Insist on the exact NFPA 285 report number and EN 13501-1 classification sheet in the PO; match the SKU to the approved substrate thickness—0.15 mm skin reduction invalidates the fire report.

- Require supplier to upload REACH SCIP database ID and TSCA Section 5 declaration into your PLM before the vessel departs; retroactive declarations are rejected by CBP 83 % of the time.

- Contractually shift liability: insert a 10 % holdback until CE DoP and UL listing are visible in official registries; couple with forced-indemnity for recall costs—averaging $0.8 M per 40 000 ft² facade.

- Map coil-coating energy source; if polysilicon traceability is missing, divert to non-Xinjiang supplier or price-in a $0.4 / lb countervailing-duty equivalent to offset detention risk.

Ignoring the above converts a $6–$9 / ft² landed panel into a $15 / ft² all-in liability; compliance is therefore not a cost center but the decisive margin protector.

The Procurement Playbook: From RFQ to Commissioning

Strategic Procurement Playbook – Aluminum Composite Panels (ACP)

RFQ Foundation: Specification Lock-In & Cost Benchmark

Anchor every RFQ to EN 13501-1 fire class A2-s1-d0 and ASTM E84 Class A; deviations trigger automatic disqualification. Specify alloy 3003 H14 skin 0.21 mm ±0.02 mm, core LDPE <100 kg/m³, total panel 4 mm ±0.1 mm, coating PVDF 70 % Kynar 500 minimum 27 μm. Require third-party SGS certificate lot-by-lot; cost adder is $0.45–$0.60/m² but removes 8 % downstream fire-retest risk. Benchmark index: Q2-2025 Shanghai aluminum ingot ¥19,800–20,400/t translates to raw-material component $2.90–$3.10/m² for 4 mm panel; anything below $2.70 signals alloy substitution risk. Insert liquidated-damage clause 0.5 % contract value per day for late documentation—suppliers accept when order >50,000 m².

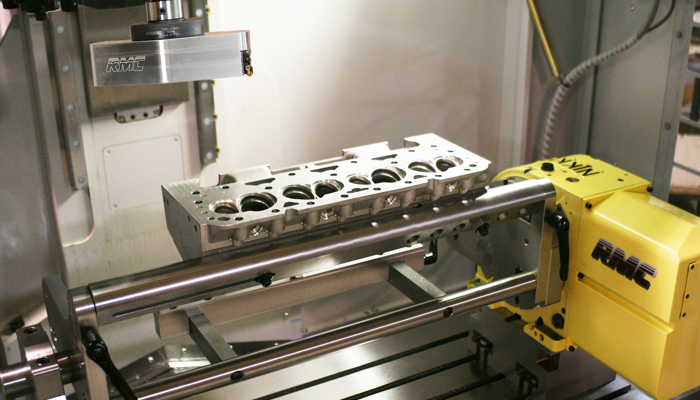

Supplier Qualification & FAT Protocol

Short-list only ISO 9001 & ISO 14001 certified plants with annual ACP capacity ≥3 million m²; below this threshold line-changeover cost inflates unit price by 6–8 %. FAT must run on 500 m² pilot lot from mass-production line, not demo line; measure peel strength ≥7 N/mm, impact resistance ≥50 kg·cm, ΔE color variation ≤0.8. Reject entire lot if any panel exceeds 0.3 mm bow on 1 m gauge—field replacement cost is $120–$150/m² vs factory rework $18/m². Book FAT 4 weeks ahead; airfare & hotel for two corporate inspectors is $3k–$4k but avoids 1 % reject rate on 100,000 m² job worth $600k–$800k.

Contract Risk Matrix – FOB vs DDP

| Decision Factor | FOB Shanghai Port | DDP Chicago Warehouse | Delta Impact |

|---|---|---|---|

| Unit Price (4 mm PVDF) | $5.20–$5.60/m² | $6.90–$7.30/m² | +$1.40–$1.70/m² |

| Freight & Duty Risk | Buyer | Seller | Transfer $0.90–$1.10/m² volatility |

| Lead Time Variability | ±14 days | ±7 days | 50 % schedule risk reduction |

| Force Majeure Exposure | High (ocean) | Low (land) | Insurance saving $0.05/m² |

| Cash-in-Transit | 30–45 days | 0 days | Working-capital relief $0.08/m² |

| Customs Audit Penalty | Buyer liability | Seller liability | Up to $0.40/m² exposure shifted |

Choose FOB when internal logistics team can secure vessel space 6 weeks ahead; otherwise DDP premium is cheaper than demurrage ($60–$90/day per container) plus detention ($120/day) that routinely occur during US West Coast congestion spikes.

Pre-Shipment Inspection & Container Securing

Mandate loading survey: 4 photos per pallet (top, side, door, stow) uploaded to blockchain platform; missing photo withholds 5 % payment. Require VCI film wrap + 8 corner guards per pallet; cost $2.30/pallet but eliminates 0.4 % moisture damage claims. Seal number must match bill of lading within 2 h cutoff; discrepancy triggers $500/container penalty and full re-inspection.

Site Commissioning & Final Acceptance

Deliver 2 % spare panels (minimum 100 m²) in original export crates; using job-site off-cuts for replacement drives mismatch penalty $250/panel if ΔE >1.0. Final punch-list sign-off within 10 calendar days; each day beyond accrues 0.1 % contract value storage fee at warehouse. Retain 5 % warranty bond until 2-year mark; release conditional on no delamination >100 mm² per NF P 01-014.

⚡ Rapid ROI Estimator

Estimate your payback period based on labor savings.

Estimated Payback: —