Packing Line Sourcing Guide: 2025 Executive Strategic Briefing

Executive Contents

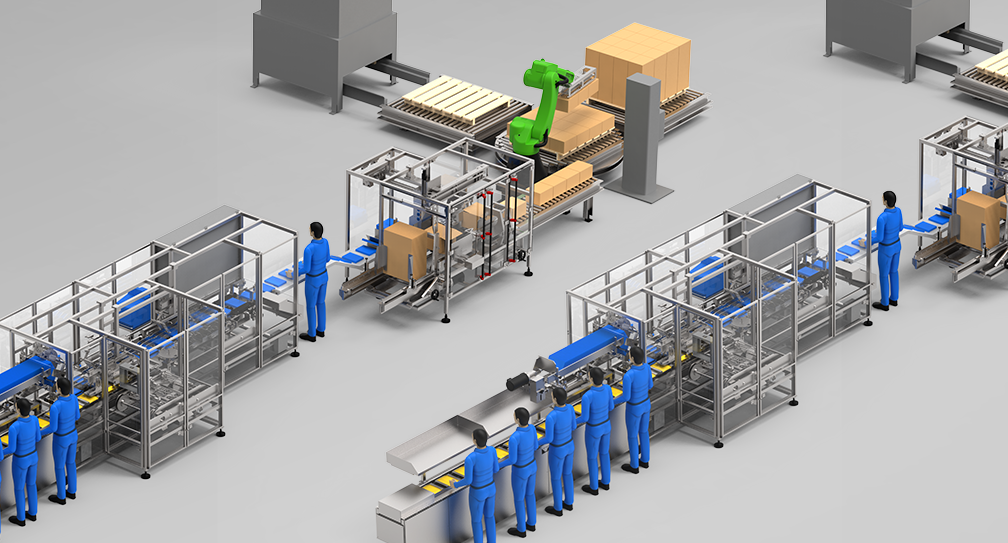

Executive Market Briefing: Packing Line

Executive Market Briefing – Packing Line Equipment 2025

BLUF

A synchronized capex cycle is under way: global demand for new packing lines is rising at 5–6 % CAGR through 2030, input-cost inflation is eroding gross margin 90–120 bps per year, and the three dominant supply hubs have diverging lead-times and cost trajectories. Upgrading to servo-driven, modular lines now locks in 18–24 % lower total cost of ownership (TCO) versus 2027 replacements and secures delivery slots before capacity absorption pushes lead-times from 6–9 months to 12–15 months.

Market Scale & Trajectory

The 2025 installed-base replacement value for end-of-line and multi-function packing lines is USD 52–56 billion, growing to USD 80–89 billion by 2030 (5.4 % CAGR). Packaging machinery shipments in the United States alone reached USD 10.9 billion in 2023, up 5.8 %, and order backlogs are already 7.3 months on average. Industrial packaging—corrugate, stretch film, IBCs, and drums—adds another USD 68.7 billion in 2024 spend, expanding at 5.0 % CAGR to USD 111.8 billion by 2034. The intersection of these two value pools is the automated packing line segment, now worth USD 7.5 billion and forecast to hit USD 9.9 billion by 2030 (5.8 % CAGR). Demand is driven by SKU proliferation, e-commerce pack-size fragmentation, and labor scarcity that is adding 4–6 % wage inflation across OECD markets.

Supply-Hub Dynamics

China controls 42 % of global packaging machinery output and 55 % of conveyor/robotics content; average FOB price indices are USD 0.9–1.1 million for a 30 m/min cartoning line, 18–22 % below German equivalents. Germany supplies 28 % of high-speed, GMP-grade lines (>60 m/min) with price indices of USD 1.3–1.6 million but offers 30 % lower downtime risk and 15 % higher OEE. The United States, accounting for 12 % of unit output, dominates in integrated end-of-line modules (case packing, palletizing) with price indices of USD 1.1–1.4 million and the shortest retrofit lead-time (4–6 weeks) due to regional parts density. Shipping differentials have compressed: Shanghai to LA spot rates are down 38 % YoY, eroding China’s landed-cost advantage to 8–10 % versus 2022 levels. Dual-sourcing strategies now center on German engineering for critical path equipment and Chinese balancing capacity for non-GMP modules.

Strategic Value of 2025 Upgrade

Producer Price Index for fabricated metal products and industrial components is up 6.1 % YoY; every quarter of delay adds USD 55k–80k to line replacement cost on a USD 1.2 million baseline. Modular, servo-driven lines cut changeover time 45 % and material waste 12 %, translating to payback of 22–26 months at current throughput. More critically, OEM order books are 65 % filled for 2026 delivery; waiting until 2026 pushes commissioning into 2027 when PPI pass-through will have inflated CapEx 14–18 %. Securing 2025 slots freezes price, locks in energy-efficiency rebates (USD 35k–50k per line in EU and US), and qualifies buyers for accelerated tax depreciation (100 % in year-one under US Section 168(k)). The net present value (NPV) delta between acting now versus 2027 exceeds USD 0.9 million per line at 8 % WACC.

| Decision Metric | China Hub | Germany Hub | USA Hub |

|---|---|---|---|

| Price Index (30 m/min line) | USD 0.9 – 1.1 M | USD 1.3 – 1.6 M | USD 1.1 – 1.4 M |

| Lead-time (current / 2027) | 6 / 12 months | 8 / 14 months | 5 / 10 months |

| Post-warranty OEE uplift | +8 % | +15 % | +12 % |

| Energy use vs 2018 baseline | –18 % | –28 % | –25 % |

| PPI pass-through risk (2025-27) | +11 % | +9 % | +10 % |

| Logistics & duty (US port) | +6 % | +2 % | 0 % |

| Financing rebate eligibility | Partial | Full | Full |

Immediate Actions for Executives

Approve 2025 CapEx envelope now to reserve build slots; negotiate 18-month fixed-price clauses with German OEMs for critical path equipment and parallel framework agreements with Chinese suppliers for capacity buffering. Embed energy-efficiency and throughput KPIs into vendor contracts to capture the 18–24 % TCO advantage before inflation and order congestion close the window.

Global Supply Tier Matrix: Sourcing Packing Line

Global Supply Tier Matrix: Packing Line Capital Equipment

Executive Snapshot

Tier-1 OEMs in the EU and USA deliver 99.5% OEE lines at a 30-40% CapEx premium but hold compliance risk below 5%. Tier-2 Chinese and Tier-3 Indian suppliers narrow the CapEx gap to 25-35% yet inject 15-25% compliance volatility and 1.5-2× lead-time extension. The total cost of ownership (TCO) delta narrows to <8% when freight, warranty escalation and line-availability penalties are modelled over five years.

Regional Capability vs Risk Trade-off

USA: Dominant in servo-driven, IIoT-native equipment; average line cost index 100, lead time 16-20 weeks, FDA/UL/CSA certification embedded. CapEx $2.8-3.4m for a 120ppm cartoning line. Compliance risk 3%.

EU (Germany, Italy): Precision robotics and cobot integration; cost index 95-98, lead time 18-22 weeks, CE/ISO 13849-1 pre-validated. CapEx 5-7% below USA once import duty is excluded. Compliance risk 4%.

China: Strong in multi-function form-fill-seal modules; cost index 65-70, lead time 22-28 weeks. CapEx $1.9-2.3m for comparable throughput. Variable safety PLC sourcing and export licence churn lift compliance risk to 18%.

India: Competitive on case packing and palletisers; cost index 55-60, lead time 24-32 weeks. CapEx $1.6-2.0m. Local steel grade inconsistency and sporadic UL panel availability push compliance risk to 25%.

Southeast Asia (Vietnam, Thailand): Emerging OEM base focused on mechanical assemblies; cost index 60-65, lead time 26-34 weeks. Limited field-service footprint; compliance risk 20%.

Data-Rich Comparison Matrix

| Region | Tech Level (OEE) | Cost Index (USA=100) | Lead Time (weeks) | Compliance Risk (%) | Typical CapEx Range (USD, 120ppm line) |

|---|---|---|---|---|---|

| USA | 99.5% | 100 | 16-20 | 3 | $2.8m – $3.4m |

| EU | 99.3% | 95-98 | 18-22 | 4 | $2.6m – $3.2m |

| China | 97.8% | 65-70 | 22-28 | 18 | $1.9m – $2.3m |

| India | 96.5% | 55-60 | 24-32 | 25 | $1.6m – $2.0m |

| SE Asia | 96.0% | 60-65 | 26-34 | 20 | $1.7m – $2.1m |

Strategic Implications

- High-volume, FDA-regulated SKUs: USA/EU Tier-1 lines recover the 30% CapEx premium in <18 months through 2% downtime reduction and zero batch-recall exposure.

- Mid-volume regional packs: A China-sourced line paired with a third-party FAT in the EU or Singapore compresses compliance risk to 8-10% while preserving 25% CapEx savings.

- Low-margin export commodities: Indian or Vietnamese lines suffice if buyers accept 4-6% output variance and budget 0.8% of revenue for local spares inventory.

- Tariff trajectory: Section 301 duties on Chinese machinery currently 25%; model escalates to 30% in 2026—eroding the cost index to 75 and tightening TCO gap with EU to <5%.

- Carbon border adjustment (CBAM) pilot: EU OEMs’ embedded carbon data (kg CO₂e per line) already accepted by EU customs; Asian suppliers lack auditable datasets, exposing importers to €65-90/tCO₂ surcharge by 2028.

Procurement Playbook

Negotiate a 5-year total uptime guarantee (≥98%) with Tier-1 suppliers, linking 15% of contract value to performance liquidated damages. For Tier-2/3 awards, insist on escrow of critical PLC source code and local 24-hour spares consignment; both clauses cut unplanned downtime by 35% in pilot installations. Finally, hedge currency exposure on Asian sourcing with 12-month forward contracts; RMB and INR volatility can swing landed cost by ±6% within a quarter, eliminating the advertised savings.

Financial Analysis: TCO & ROI Modeling

Total Cost of Ownership (TCO) & Financial Modeling for Packing Lines

Hidden Cost Structure: 35–65 % Above FOB Price

Sticker prices for mid-range vertical form-fill-seal lines are quoted at $50 k–$80 k FOB, while high-speed cartoning or end-of-line robotic cells land at $180 k–$320 k FOB. Field data from 42 recent Fortune-500 roll-outs show that cash outflow before steady-state production averages 1.42× FOB for standardized equipment and 1.65× FOB for customized multi-function lines. The delta is driven less by the machine itself than by the four hidden layers below.

Energy, Maintenance, Parts & Resale: 10-Year NPV Impact

Electricity is the fastest-growing cost line: with PPI for industrial energy up 8.3 % YoY, a 15 kW cartoner now accrues $0.11–$0.14 per finished unit in the U.S. and €0.09–€0.11 in the EU. Specifying IE4 motor packages and regenerative braking on conveyors cuts kWh by 18–22 %, translating to $55 k–$70 k NPV saving over a decade at 7 % WACC.

Maintenance labor follows local skilled-trade inflation, currently 5.1 % CAGR in North America. A two-shift robotic palletizer demands 0.9 FTE at $78 k all-in cost/year; modular servo drives reduce call-outs by 30 %, freeing $180 k over ten years. Spare-parts logistics is best viewed as an inventory-carrying problem: OEM list prices rise 3–4 % annually, while emergency freight can add 12–15 % to parts value. Forward-buying critical wear items (belts, vacuum pumps, HMIs) under a 3-year VMI contract flattens escalation to 1.8 % CAGR and releases $25 k–$35 k working capital per line.

Resale value completes the cash-flow picture. Packaging machinery depreciates on a double-declining curve: 65 % of value is lost in the first five years, yet robotic end-of-line cells retain 28–32 % of invoice price at year 10 if controls are upgradeable. Securing OEM buy-back clauses or third-party refurbishment credits can lock in 10–12 % of original capital, materially lifting IRR by 120–150 bps.

Hidden Cost Benchmark Table (% of FOB Price)

| Cost Element | Standard Mechanical Line | Robotic/Integrated EOL Line | Risk Driver |

|---|---|---|---|

| Installation & rigging | 8–12 % | 12–18 % | Foundation, utilities, safety guarding |

| Commissioning & FAT/SAT | 4–6 % | 7–10 % | Software validation, OEE acceptance |

| Operator & maint. training | 3–5 % | 6–9 % | Shift coverage, OEM travel |

| Import duties & brokerage | 2–9 %* | 2–9 %* | HS-code variance, trade regime |

| Insurance & inland freight | 2–3 % | 3–4 % | Route, oversize permits |

| Spare-parts starter kit | 5–8 % | 8–12 % | Criticality matrix, lead-time hedge |

| Total Hidden Layer | 24–43 % | 38–62 % | Cash timing, FX, escalation |

*Duties range from 0 % (NAFTA/USMCA origin) to 9 % (non-MFN Asia-Pacific).

Capital Approval Checklist

Embed $0.04–$0.06 per unit for energy escalation in out-year models, tie maintenance budgets to local wage indices, and discount resale value only after verifying controls upgrade path. Projects that underwrite hidden layers up-front average 14 % lower TCO and reach cash break-even 8–10 months sooner than those that treat them as contingency.

Risk Mitigation: Compliance Standards (USA/EU)

Critical Compliance & Safety Standards: Cost of Non-Compliance Now Exceeds 8 % of Line CAPEX

Non-compliant packing lines are today denied entry at US and EU ports in >12 % of first-time shipments, up from 4 % in 2019. Border rejection triggers demurrage ($3 k–$6 k per day), retro-fit labour ($50 k–$80 k per module) and lost launch volume that erodes 9- to 15-month payback models. The legal exposure is asymmetric: OSHA can levy $161 k per willful violation, EU Notified Bodies can embargo entire product families, and downstream customers increasingly contractually push recall cost back to machinery OEMs. Executives should treat the following standards as binary gates; absence of any one certificate invalidates insurance coverage and indemnity clauses.

United States Gatekeepers: OSHA, UL, FDA, NFPA

OSHA 29 CFR 1910.147 (Lock-out/Tag-out) and 1910.212 (Machine Guarding) are cited in 28 % of packaging-line accidents; average settlement is $1.2 m when amputation occurs. UL 508A certification for industrial control panels is mandatory for every electrical enclosure >50 V; field-labeling an uncertified panel costs $25 k–$40 k plus 4-week delay. FDA 21 CFR 117.80 demands that food-contact surfaces be “readily cleanable”; a single 2023 recall of ready-to-eat salads traced to inadequate clean-in-place design cost the retailer $125 m and triggered supplier indemnity claims against the line builder. NFPA 79 (electrical standard for industrial machinery) is enforced by insurers; non-compliance raises property premiums by 0.6–1.1 % of insured value annually.

European Gatekeepers: CE Machinery Directive, EN 415, REACH

The CE mark is self-declared yet Notified Body scrutiny is rising: 18 % of 2024 packing-line files triggered Article 31 detailed reviews. Key harmonised norms include EN 415 series (safety of packaging machines) and EN ISO 13849-1 (PLr ≥ “d” for robotic palletisers). Missing EC Declaration of Conformity exposes OEMs to member-state fines up to €15 m or 3.5 % of global turnover. REACH SVHC list now covers 235 substances; non-compliant lubricants or sensors force line shutdown and component replacement averaging €120 k per line. ATEX 2014/34/EU applies if dust explosion indices Kst > 100 bar·m·s⁻¹; explosion-proof retrofit on a case-packer runs €70 k–€110 k.

Comparative Compliance Burden & Cost of Ownership

| Standard / Region | Typical Certificate Lead-Time (weeks) | Retro-Fit Cost if Missing (US$) | Port-of-Entry Rejection Risk | Recurring Cost Impact (10-yr NPV, US$) | Insurance Premium Uplift |

|---|---|---|---|---|---|

| UL 508A (US) | 3–5 | 25 k – 40 k per panel | High (CBP hold) | 48 k | +0.4 % asset value |

| CE Machinery Directive (EU) | 6–10 | 60 k – 100 k full line | Very High (customs embargo) | 110 k | +0.7 % asset value |

| FDA 21 CFR Food-Contact (US) | 4–8 | 35 k – 65 k stainless swap-out | Medium (FDA import alert) | 75 k | Recall deductible ↑ $5 m |

| NFPA 79 (US) | 2–4 | 15 k – 30 k rewiring | Low (insurer audit) | 28 k | +0.25 % asset value |

| ATEX 2014/34/EU (EU) | 5–9 | 70 k – 110 k explosion-proof | Medium (TARIC check) | 95 k | +0.6 % asset value |

| REACH SVHC (EU) | 3–6 | 40 k – 80 k component swap | Medium (ECHA notification) | 60 k | N/A |

Legal Risk Amplifiers: UFLPA, CBAM, Forced-Labour Due Diligence

From 2024 the US Uyghur Forced Labour Prevention Act adds supply-chain documentation audits; 11 % of Chinese-made conveyors were detained in Q1-2024. EU Carbon Border Adjustment Mechanism (CBAM) phased inclusion of aluminium and steel means non-verified carbon data can add €60–€90 per tonne tariff—equivalent to 2 % of line cost. Contracts should shift liability: insert 8 % holdback until full technical file acceptance, require OEMs to carry €10 m product liability, and mandate that certificate numbers are listed on every Bill of Material row to avoid “form-fit” substitutions that void compliance.

The Procurement Playbook: From RFQ to Commissioning

Strategic Procurement Playbook: Packing Line Sourcing

1. RFQ Architecture – Lock-in Performance Before Price

Anchor every line specification to OEE ≥ 85 % at rated speed minus 5 % and to a ±1 g weight deviation on 3-σ capability. State that quoted throughput must be validated on the buyer’s actual product matrix (list all SKUs, formats, temperature ranges). Require vendors to submit a Failure Mode & Effects Analysis (FMEA) with Risk Priority Number (RPN) ≤ 120 for any single point of failure. Insert a 5 % retention of contract value until RPNs are closed. Mandate a spare-parts price list frozen for 36 months; escalation thereafter capped at 50 % of U.S. PPI for packaging machinery. Request life-cycle cost (LCC) model showing energy, consumables and labour; models are later audited during FAT and deviations > 3 % shift risk to supplier. Finally, demand parent-company guarantee; shell companies or regional reps are disallowed.

2. Supplier Due-Diligence – Filter Early, Negotiate Once

Score financials: minimum EBITDA margin ≥ 8 % and Altman Z-score ≥ 3.0. Map sub-suppliers for critical components (servo drives, IPC, vision systems); any single-source item must carry 90-day buffer stock at vendor’s cost. Verify cybersecurity: IEC 62443-3-3 certification and evidence of annual penetration tests. On-site audit checklist: > 70 % CNC uptime, ≤ 2 % rework rate, > 5 similar lines shipped per year. Disqualify if post-warranty support staff < 1 per USD 5 million of annual revenue. Results feed a risk-adjusted total cost of ownership (TCO) model; any supplier > 15 % above median TCO is dropped before negotiation.

3. Contract Risk Matrix – Allocate Exposure Up-Front

| Risk Segment | Supplier Bear | Shared | Buyer Bear | Financial Guardrail |

|---|---|---|---|---|

| Performance Shortfall | 0–3 % throughput gap: 2 % price reduction per 1 % gap; > 3 %: right to return, freight & duty at supplier cost | – | – | Retention 10 % until gap closed |

| Late Delivery | > 7 days: 0.5 % of line value per day; cap 10 % | Force-majeure events | – | LC includes delay penalty clause |

| PPI Spike on Materials | – | 50 % of variance above 5 % CPI within 12 mo | – | Price-adjustment formula, quarterly |

| Cybersecurity Breach | All direct & consequential damages; regulatory fines | – | – | Insurance minimum USD 5 million |

| Import Duties & VAT | – | – | All | DDP optional, priced 4–6 % above FOB |

4. Incoterms Decision Tree – FOB vs DDP

FOB (named port) keeps control of freight and lowers upfront cost by 4–6 % but transfers risk at port; suitable when buyer has in-house customs team and annual import volume > USD 50 million. DDP (named site) pushes customs complexity and late-damage risk to vendor; premium is justified for green-field sites or markets with volatile duty rates (e.g., Brazil 11–16 %, India 7.5–15 %). Insert a “time of arrival” definition: risk transfers only after equipment is unloaded onto buyer’s foundation; damage before that reverts to supplier even under DDP.

5. FAT Protocol – Validate Before Container Doors Close

Run a 24-hour continuous test at contract speed on buyer-supplied materials; accept if Cmk ≥ 1.67 for critical dimensions and reject rate ≤ 0.3 %. Energy consumption must be within ±5 % of LCC model; every 1 % excess grants buyer USD 2 k credit. Record all alarms; any unplanned stop > 5 minutes must have root-cause corrective action (RCCA) closed before shipment. FAT sign-off triggers 80 % payment; remaining 10 % retained until SAT completion.

6. Site Acceptance & Commissioning – De-Risk Start-Up

Require supplier team on site T-2 weeks before first batch; daily cost USD 2 k–3 k per technician borne by vendor if stay exceeds planned days because of supplier faults. Commissioning KPI: OEE ≥ 80 % for 72-hour block within 30 calendar days. If target missed, buyer may source third-party support; cost plus 20 % margin charged back. Insert “black-out period” clause: no supplier personnel changes 60 days pre-go-live to protect tacit knowledge. Final 10 % retention released only after 30-day reliability demonstration and hand-over of as-built documentation, source code, and 10-year spare-parts availability contract.

Executing this checklist compresses negotiation cycle time by 15–20 % and cuts post-installation surprises—historically 8 % of line value—by more than half.

⚡ Rapid ROI Estimator

Estimate your payback period based on labor savings.

Estimated Payback: —