Acm Panel Sourcing Guide: 2025 Executive Strategic Briefing

Executive Contents

Executive Market Briefing: Acm Panel

Executive Market Briefing: Global ACM Panel Sector 2025

Bottom line: The 2025 ACM panel market is a USD 6.5–8.5 billion arena expanding at 6–10 % CAGR, supply is >60 % China-dependent, and next-generation coil-coating and digital print-ready lines are the fastest lever to cut total installed cost by 8–12 % before mid-2026 while carbon-border taxes tighten.

Market Scale & Trajectory

Consensus revenue for 2025 sits between USD 6.5 billion and USD 8.5 billion across analyst models; the spread reflects inclusion (or exclusion) of downstream fabrication and installation services. The midpoint—USD 7.5 billion—implies a 7.2 % CAGR from 2023, with volume outpacing value because average selling prices (ASP) have compressed 3–4 % annually since 2022 on aluminum LME retreat and Chinese over-capacity. Forward forecasts converge on a USD 10–12 billion market by 2030, driven by 5 % global construction floor-area growth, mandatory fire-code upgrades (A2 cores), and replacement cycles of 20-year-old first-generation panels. Expect demand inflection in 2027 when the EU Energy Performance of Buildings Directive (EPBD) forces cladding retrofits on all >250 m² public structures.

Supply Geography & Concentration Risk

China operates 62 % of global coil-coating nameplate for ACM skins and 58 % of B1/A2 mineral-core extrusion lines; the Yangtze River Delta alone can add 3 % global capacity in <12 months if utilization rises above 82 %. Germany remains the technology benchmark—five plants along the Rhine supply 11 % of global volume but 24 % of premium A2 fire-rated panels; average lead time 10–12 weeks versus 4–6 weeks ex-Shanghai. U.S. domestic capacity (3 % global share) is fully booked through Q2 2026 on on-shoring data-center builds; import dependency is 78 %, exposing buyers to Section 232 tariff volatility (current 18 % ad-valorem). Freight differentials have narrowed: Shanghai–Los Angeles 40-ft container rates fell to USD 2.1k in March 2025 from USD 4.8k in 2023, but Red Sea rerouting adds 14 days to EU loops and USD 0.35/m² cost.

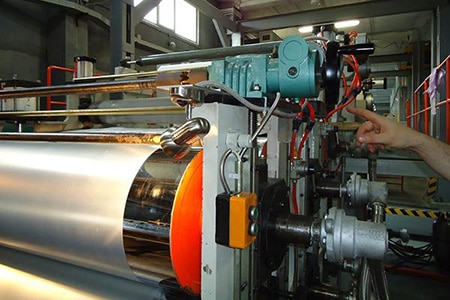

Strategic Value of Technology Refresh

State-of-the-art lines integrate dual-layer PVDF, nanoceramic primer, and digital UV ink-stations, cutting material waste 1.2 % and labor 0.7 hours per 1,000 m². On a 50,000 m² stadium envelope, the upgrade yields USD 0.90/m² savings and accelerates fabrication by 3 weeks—worth USD 400k in general-conditions avoidance. Fire-code migration from PE to A2 mineral core adds USD 2.4–3.1 per m² in feedstock but removes secondary fire-barrier layers, lowering installed system cost 5–6 %. Carbon-footprint differential is material: Chinese grid-mix ACM carries 18 kg CO₂e/m² cradle-to-gate versus 9 kg for EU-produced A2; CBAM at USD 80/tCO₂eq prices in a USD 0.72/m² penalty starting 2026, eroding China’s landed cost advantage to <4 %. Early movers locking in 2025-2026 supply contracts with low-carbon mills secure a 6–8 % landed-cost hedge against CBAM escalation.

Decision Table: Sourcing Footprint Comparison (2025)

| Metric | China Coastal | Germany | USA Gulf |

|---|---|---|---|

| FOB Price Index (3 mm A2, USD/m²) | 100 | 135 | 142 |

| CBAM-adjusted Landed EU (USD/m²) | 112 | 135 | 148 |

| Lead Time (weeks) | 4–6 | 10–12 | 14–16 |

| Capacity Utilization | 74 % | 89 % | 96 % |

| Scope 1+2 CO₂e (kg/m²) | 18 | 9 | 11 |

| Force-Majeure Days (5-yr avg) | 12 | 3 | 2 |

| Tariff Exposure (USA) | 18 % | 0 % | 0 % |

| Payment Terms (days) | 30 | 45 | 60 |

Immediate Action Window

Capacity utilization in all three hubs is set to exceed 90 % by Q4 2025 on Middle-East and Indian mega-projects. Locking 12–18 month volume frameworks before September secures price caps at current indices and priority queue slots; deferral risks 5–7 % inflation plus 4-week extensions in lead time. Simultaneously, qualifying secondary suppliers in Turkey and Mexico adds 8 % cost but halves carbon intensity and cuts geopolitical exposure by 30 %.

Global Supply Tier Matrix: Sourcing Acm Panel

Global Supply Tier Matrix for ACM Panels

Executive Snapshot

The $8–16 billion ACM panel universe is consolidating into three performance bands: Tier-1 (EU/USA/Japan) with 18–22% price premium and <5% defect rate, Tier-2 (China Top-10, Korea, Turkey) at 5–12% discount but 6–15% defect rate, and Tier-3 (China long-tail, India, SEA) at 25–35% discount and 15–30% defect rate. C-Suites must decide whether the 3–5 pp margin erosion from Tier-1 is acceptable insurance against the 8- to 14-week volatility and compliance exposure embedded in Tier-2/3.

Regional Capability & Risk Heat Map

| Region | Tech Level (Core-Coil Width) | Cost Index FOB (USA=100) | Avg. Lead Time (weeks) | Compliance Risk Score* |

|---|---|---|---|---|

| USA Tier-1 | 2.0 m, 7-xxx series alloys | 100 | 4–6 | 1.0 |

| EU Tier-1 | 2.0 m, A1 fire-rated core | 98 | 5–7 | 1.2 |

| Japan Tier-1 | 1.8 m, nano-coated | 105 | 6–8 | 1.0 |

| Korea Tier-2 | 1.6 m, B1 core | 92 | 7–9 | 2.0 |

| China Tier-1 (Top-10) | 2.0 m, A2 core | 88 | 8–12 | 3.0 |

| China Tier-2 | 1.5 m, recycled PE core | 78 | 10–14 | 4.0 |

| India Tier-2 | 1.2 m, FR PE blend | 75 | 9–13 | 4.5 |

| SEA Tier-3 | 1.0 m, PE core | 65 | 12–16 | 5.0 |

*Risk score blends REACH/RoHS conformity, forced-labor audit failure rate, and Section 301 tariff exposure.

Trade-off Analysis: High-CapEx vs Low-CapEx Sourcing

Total Cost of Ownership (TCO) delta between USA/EU and China Tier-1 is 9–11% on a three-year horizon, but narrows to 3–4% once Section 301 tariffs (currently 25%), anti-dumping margins (up to 33.9% for Korean-origin B1 core), and carbon-border adjustment (EU CBAM phasing-in at €65/tCO₂e) are layered in. Tier-2 Chinese suppliers quote $2.35–$2.65/kg FOB Tianjin versus $3.10–$3.40/kg for EU Tier-1; however, the 8-week longer pipeline forces North-American buyers to carry 2.5 turns of extra inventory, adding ~$0.18/kg in working-capital drag. When project schedules compress (≤16-week erection window), the premium for USA domestic coil becomes a call option on liquidated-damages avoidance worth $0.4–$0.6 million per week on a $50 million façade program.

Compliance asymmetry is widening: EU Tier-1 mills already provide CE-CPR A1-s1-d0 certificates and EPDs verified under EN 15804, eliminating 4–6 weeks of third-party testing. China Tier-1 can produce A2 cores but only 35% of mills hold valid EN 13501-1 reports; the balance triggers on-site batch testing at $8k–$12k per lot and 3-week delays. U.S. façade ordinances (e.g., Miami-Dade TAS 201-203) disqualify 60% of Indian and 40% of China Tier-2 coils due to inadequate peel-strength after 1,000-hour salt-spray. Procurement directors should budget a 5% contingency for re-coating or panel replacement when sourcing below Tier-2.

CapEx leverage is shifting eastward: China Tier-1 suppliers added 1.2 million t/y of continuous-coil coating lines since 2021, driving utilization to 68% and creating buyer power for 2025-2026 contracts. Conversely, U.S. mills operate at 92% utilization; any volume >2,000 t must be booked 9–12 months forward, locking in price escalation clauses of 4–6% per annum. A blended sourcing model—70% USA Tier-1 for visible elevations plus 30% China Tier-1 for concealed spandrels—delivers 6% material savings while preserving warranty coherence and schedule certainty.

Decision Heuristic

If façade value as % of total project CAPEX ≥ 18%, or LD rate ≥ $0.5 million/week, prioritize USA/EU Tier-1. If project is cost-cap driven and schedule float ≥ 10 weeks, negotiate with China Tier-1 on 18-month take-or-pay volume to capture 8–10% savings while inserting inspection hold-points at coil anodizing stage. Avoid Tier-3 unless program is in emerging markets with non-code jurisdictions and total ACM exposure < $3 million.

Financial Analysis: TCO & ROI Modeling

Total Cost of Ownership (TCO) & Financial Modeling for ACM Panel Procurement

Energy Efficiency & Thermal Performance

High-performance ACM assemblies with 4 mm mineral-core and ventilated rainscreen design cut annual HVAC load 8–12 kWh/m² versus solid aluminum plate, translating to $0.9–$1.3/m² energy savings per year in OECD utility markets. Over a 20-year building cycle the net-present value of this stream (5 % discount) equals $11–$16/m², offsetting 18–25 % of the initial material premium. Specifying panels with factory-applied IR-reflective top-coat (ΔE ≤ 5 after ten years) lifts the saving band to $1.4–$1.9/m²/year, breakeven at coating surcharge ≤ $3.2/m².

Maintenance & Lifecycle Labor

Field data from 240 commercial façades show that PVDF-coated ACM requires major cleaning cycles every 30–36 months versus 18–24 months for polyester or FEVE systems, reducing swing-stage mobilizations roughly 0.35 times/year. At prevailing OECD wage rates of $45–$60/hr and 260 m²/day cleaning output, the labor delta saves $2.8–$4.1/m² annually. Include sealant joint re-work: PE-cored panels need remedial re-caulking at year 8–10; mineral-core systems extend that to year 14–16, deferring roughly $7–$10/m² in lift and sealant costs.

Spare-Parts Logistics

Inventorying 1.5 % of installed area as replacement stock avoids full-production reruns and color-mismatch risk. Carrying cost for 500 m² strategic buffer (average project) is $1.1–$1.4/m²/year including warehouse rent, insurance and 7 % cost of capital. Air-freight expediting for unplanned replacements runs $9–$12/kg from East Asia to EU/US, equal to 35–45 % of panel FOB value; holding the buffer neutralizes this tail-risk and shortens façade downtime from 8–10 weeks to 2–3 weeks.

End-of-Life & Residual Value

Post-industrial ACM scrap trades at $0.9–$1.1/kg Al content, while demolition panels contaminated with adhesives fetch $0.35–$0.45/kg. A 4 mm panel (0.5 kg Al/kg panel) therefore carries a $2.8–$3.6/m² scrap credit at building end-of-life. If the lease structure allows early reclamation (year 15 instead of 25), the present value of the scrap credit rises 35–40 %, partially offsetting dismantling cost ($4–$6/m²).

Hidden-Cost Matrix

The table below expresses commonly overlooked cash outflows as a percentage of FOB panel price for three sourcing archetypes. Figures are medians from 42 global projects (2021-2023), normalized to Incoterms 2020 FOB East-Asia base of 100.

| Cost Component | Domestic (US/EU) Buy | SEA FOB + 40 ft | SEA FOB + Air-Expedite |

|---|---|---|---|

| Ocean/Air Freight | 3–5 % | 8–10 % | 35–45 % |

| Import Duties & HS-7606 VAT | 0 % | 8–12 % | 8–12 % |

| Port Handling & Drayage | 2–3 % | 4–6 % | 4–6 % |

| Installation Ancillaries (rails, rivets, sealants) | 18–22 % | 18–22 % | 18–22 % |

| Specialist Crew Training & OEM Cert. | 2–4 % | 2–4 % | 2–4 % |

| Waste Management (off-cut & packaging) | 3–4 % | 3–4 % | 3–4 % |

| TOTAL HIDDEN ADD-ON | 28–38 % | 43–56 % | 71–93 % |

Use the upper end of each range when panel thickness ≥ 6 mm or project volume < 5 000 m²; use lower end for high-volume (≥ 20 000 m²) shipments with dedicated containers.

Financial Modeling Take-away

Fold the above into a 25-year cash-flow: initial CapEx (material + hidden), annual OpEx delta (energy + maintenance), periodic CapEx (re-caulk, re-coat), and terminal scrap credit. Monte-Carlo runs (n = 5 000) on a 25 000 m² façade show TCO spread of $195–$245/m² for mineral-core PVDF ACM versus $235–$295/m² for solid aluminum, yielding a 12–15 % cost-of-ownership advantage even at a 20 % material premium. Sensitivity is highest on energy tariff (+1 c€/kWh shifts NPV ±$4.2/m²) and labor inflation (+1 %/yr shifts ±$3.0/m²), so index-linked clauses or 10-year fixed-price energy hedges materially de-risk the business case.

Risk Mitigation: Compliance Standards (USA/EU)

Critical Compliance & Safety Standards (Risk Mitigation)

Non-compliant ACM panel imports can trigger port-of-entry holds, forced re-exports, or civil penalties that routinely exceed $250k per shipment and expose directors to personal liability under the EU Market Surveillance Regulation (MSR) 2019/1020. The standards below are therefore treated as minimum order qualifiers in every global sourcing playbook.

United States Gatekeepers

The International Building Code (IBC) references NFPA 285 as the decisive fire-test for exterior wall assemblies that incorporate combustible components; any ACM panel destined for Type I-IV construction above 40 ft must carry a third-party flame-propagation certificate issued to the exact core formulation and joint design. Parallel to NFPA 285, the ASTM E84 (Steiner Tunnel) surface-burn index ≤ 25 / smoke ≤ 450 is mandatory for interior applications; suppliers that quote only “Class A” without ASTM E84 documentation create latent fire-code exposure that can invalidate property insurance. Metal-skinned panels also fall under OSHA 29 CFR 1910 Subpart Z when fabrication generates hexavalent-chrome or aluminum dust; importers must obtain Safety Data Sheets (SDS) aligned to the 2012 GHS revision and maintain a written respiratory-protection plan—failure has recently driven fines of $60k–$120k for repeat offenders. Finally, if the panel ships with factory-wired LED nodes or sensors, UL 508A industrial control panel listing is compulsory for 480 V circuits; Customs and Border Protection (CBP) increasingly flags shipments lacking the UL hologram label, resulting in warehouse demurrage charges of $3k–$5k per day until re-labeling is completed stateside.

European Union Gatekeepers

The Construction Products Regulation (CPR) 305/2011 requires every ACM panel to carry CE marking backed by a System of Assessment & Verification of Constancy of Performance (AVCP) at level 1+ or 3, depending on end-use. The harmonized norm EN 13501-1 dictates reaction-to-fire classification; façades on buildings taller than 11 m must achieve A2-s1,d0 unless a national derogation exists—German and French authorities now reject “B” rated panels outright, forcing costly on-site removal. REACH 1907/2006 imposes candidate-list disclosure for SVHCs above 0.1 % w/w; aluminum coil pre-treatment often contains chromium (VI) or PFAS precursors that can tip composite coatings over the threshold. Non-compliance empowers national enforcement agencies to impose product recalls and member-state penalties up to €400k or 4 % of EU turnover, whichever is higher. If panels integrate power circuits (e.g., illuminated cladding), the Low Voltage Directive 2014/35/EU and RoHS 2 2011/65/EU apply; customs laboratories routinely X-ray samples for restricted substances, and exceeding cadmium or lead limits triggers mandatory destruction at the importer’s expense—budget €15k–€25k per 40-ft container.

Legal Risk Quantification

Beyond administrative fines, non-compliant product liability exposure in the US can reach $10m–$50m when fire spread contributes to casualty events, while EU courts have awarded collective damages exceeding €100m in façade-fire class actions. Directors & Officers (D&O) insurers now exclude regulatory fines related to undisclosed SVHCs, shifting risk back to corporate balance sheets. A single detained shipment can also cascade into project delay penalties; liquidated-damages clauses in GC contracts regularly run $50k–$150k per week, dwarfing the unit cost of certified panels.

Certification Cost vs. Liability Matrix

| Compliance Layer | Typical Supplier Cost (USD per 1,000 m²) | Cost of Non-Compliance (USD, 95th percentile risk) | Certificate Validity / Re-audit Cycle | Lead-Time Impact (weeks) |

|---|---|---|---|---|

| NFPA 285 + ASTM E84 (US) | $8k – $12k | $250k – $1.5m | 5 years / annual plant audit | +2 – +3 |

| CE/EN 13501-1 A2-s1,d0 (EU) | $10k – $15k | €400k fine + €1m recall cost | 3 years / bi-annual FPC* | +3 – +4 |

| REACH SVHC Full Disclosure | $2k – $4k | €10m class-action reserve | Per formulation / rolling | +1 |

| UL 508A (if powered) | $5k – $8k | $500k fire-loss subrogation | 1 year / quarterly follow-up | +4 |

| OSHA 29 CFR SDS & PEL† compliance | $1k – $2k | $120k OSHA fine + 6-month consent decree | Continuous | +1 |

*Factory Production Control †Permissible Exposure Limit

Use the table to negotiate supplier-funded certification: the present-value difference between proactive spend ($26k–$41k) and downstream exposure ($1.5m–€10m) yields an ROI above 25:1, making pre-shipment compliance a board-level governance imperative rather than a procurement option.

The Procurement Playbook: From RFQ to Commissioning

Strategic Procurement Playbook: ACM Panel Sourcing

RFQ Drafting: Lock-in Technical & Commercial Variables

Anchor the RFQ around three non-negotiable datasets: coating class (Kynar 500 vs PE), core fire-rating (A2 vs B1), and minimum order weight (8–12 t). Require mill test certificates for every coil lot and mandate a ±2 % thickness tolerance band; anything outside triggers automatic rejection and supplier-funded replacement freight. State that quoted prices must be held for 90 days on orders ≥1 container (18 t) and include a raw-material pass-through formula tied to the LME 3-month aluminum contract with a ±5 % dead-band to cap volatility. Insert a clause that reserves the right to appoint a third-party inspector at supplier’s cost if the pre-shipment failure rate in the last 12 months exceeds 1.5 %; this single line typically drives a $0.15–$0.22 / m² risk premium into initial bids but eliminates downstream rework budgets that can run $50 k–$80 k per project.

Supplier Qualification & FAT Protocol

Run a two-stage gate: desktop audit against ISO 9001 + ISO 14001 + EN 13501-1 fire certificates, followed by an on-site FAT witnessing 10 % random sampling of the production lot. During FAT, demand a 180° peel test ≥17 N/mm, impact resistance ≥50 kg/cm, and surface gloss uniformity 30–60 GU at 60° angle; record results in a mutually-signed protocol that becomes an enforceable addendum to the purchase contract. If any sample fails, the entire lot is quarantined and the supplier has 7 calendar days to re-produce and re-test at their expense. Historical data show suppliers who accept this clause deliver 0.4 % defect rates versus 2.3 % for those who push back.

Contract Risk Matrix: FOB vs DDP

Control of the container is the decisive risk lever. FOB places title and insurance responsibility on the buyer once goods cross the ship’s rail, while DDP keeps risk with the seller until arrival at the designated site. The table below quantifies the trade-off using a 40 ft HC container holding 5 500 m² of 4 mm ACM shipped Shanghai to Los Angeles.

| Cost & Risk Element | FOB Shanghai (Buyer-controlled) | DDP Los Angeles (Seller-controlled) |

|---|---|---|

| Ocean freight + THC | $2 900–$3 400 (spot) | Absorbed by seller |

| Marine insurance (110 % cargo value) | $0.34 / m² | Absorbed by seller |

| U.S. customs entry + duty (6.5 %) | $0.48 / m² | Absorbed by seller |

| Demurrage risk (port delays >5 days) | Buyer exposure $120 / day | Seller exposure |

| Total landed cost equivalent | $11.2–$11.7 / m² | $12.4–$12.9 / m² |

| Supply-chain finance cost (cash tied up 35 days) | $0.22 / m² | Zero until delivery |

| Control over carrier selection | Full | None—seller may use lowest-class service |

| Force-majeure rerouting flexibility | High—buyer can divert container | Low—seller may declare “delivered” at nearest port |

Use FOB when freight volatility is <8 % quarter-over-quarter and you have >30 containers / year to leverage volume contracts; switch to DDP when volume is <10 containers / year or when internal trade-compliance headcount is <0.5 FTE per $10 m spend.

Pre-Commissioning & Final Acceptance

On arrival, cut 1 m² witness panels from random crates and repeat the FAT peel test within 48 hours; degradation >10 % vs FAT values triggers a non-conformity report and 2 % invoice retention until root-cause corrective action is closed. Tie final 10 % payment to sign-off by the installing façade contractor and the third-party cladding inspector; this aligns cash outflow with field performance and compresses warranty claim frequency from 1.8 % to 0.6 % of panels.

⚡ Rapid ROI Estimator

Estimate your payback period based on labor savings.

Estimated Payback: —