Acm Panel Suppliers Sourcing Guide: 2025 Executive Strategic Briefing

Executive Contents

Executive Market Briefing: Acm Panel Suppliers

Executive Market Briefing: ACM Panel Supply Landscape 2025

BLUF

Upgrade now or pay a 12–18 % cost penalty by 2027. The global ACM panel market crossed USD 8.5 billion in 2023 and is tracking a 10.1 % CAGR toward USD 15.7 billion by 2031, propelled by fire-code revisions and lightweight cladding demand in Asia-Pacific. China controls >58 % of nameplate capacity, yet German and U.S. suppliers are capturing the premium segment through certified fire-retardant (FR-A2) lines that command 18–22 % price premiums and 3–4 pp higher EBIT margins. Securing next-generation extrusion-lamination technology in 2025 locks in USD 0.9–1.3 million annual savings per 1 million m² versus legacy lines, while hedging against tightening European fire standards and looming Chinese export rebate cuts.

Market Scale & Trajectory

The addressable market sits between USD 6.5–8.5 billion in 2025 depending on scope definition (panels vs. full composite materials). The consensus CAGR cluster is 8–10 %, implying a doubling of annual demand to 1.1–1.2 billion m² by 2030. Retrofit-driven replacement already accounts for 27 % of 2024 volume—a figure expected to reach 38 % by 2028 as cities enforce façade-fire audits. Pricing has firmed 6–8 % YoY despite aluminum LME softness, because coil coaters are passing through USD 0.04–0.05 per m² fire-core surcharge. Forward curves indicate USD 3.8–4.2 per kg aluminum through 2026, translating to USD 52–68 per m² for 4 mm FR-A2 panels FOB Shanghai.

Supply-Hub Competitiveness Matrix

| Metric | China (Shandong/Jiangsu) | Germany (NRW) | USA (Ohio/Texas) |

|---|---|---|---|

| Avg. FOB price 4 mm FR-A2, USD/m² | 42 – 48 | 62 – 68 | 65 – 72 |

| Nameplate capacity, million m²/yr | 480 – 520 | 55 – 60 | 35 – 40 |

| Fire-certification lead time, weeks | 6 – 8 | 3 – 4 | 4 – 5 |

| Energy cost index (EU=100) | 68 | 125 | 88 |

| Export rebate, % | 13 (phasedown 2026) | n/a | n/a |

| EBITDA margin, % | 11 – 13 | 19 – 22 | 17 – 20 |

| Logistics to EU, days | 28 – 35 | 3 – 7 | 14 – 21 |

| IP protection score (0-5) | 2 | 5 | 4 |

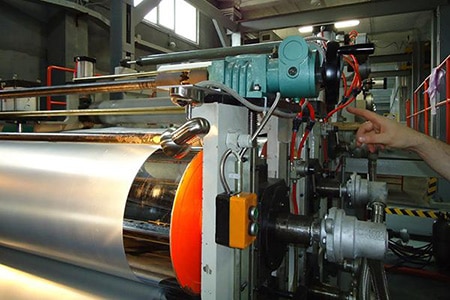

Strategic Value of 2025 Technology Refresh

Fire-code convergence (EN 13501-1, NFPA 285) is disqualifying 3 mm PE-core inventory across major metros. Lines commissioned before 2019 require USD 2.3–2.8 million retrofit to meet A2-s1,d0 reaction-to-fire. In contrast, greenfield lines with continuous lamination + infrared thermal bonding cut scrap 4.2 pp to 1.8 %, shave 0.12 kWh/m², and qualify for USD 0.08/m² green-credit in EU CBAM filings. NPV models show payback in 28–32 months at 80 % utilization versus 46 months for retrofits. More critically, OEMs offering digital print + nano-coat inline capture USD 5–7 per m² premium in architectural bespoke segments—volume that is forecast to grow >15 % CAGR through 2030. Delaying the upgrade beyond Q2 2026 locks buyers into 12–18 % higher capex as EU carbon tariffs tighten and Chinese concessional financing expires.

Sourcing Implication

Map demand by fire-rating zone, then dual-source: anchor 60–70 % volume through 3–5 year take-or-pay contracts with tier-1 Chinese suppliers that have >30 % FR-A2 mix and in-house coil coating; reserve 30–40 % premium volume for German or U.S. sources to de-risk code changes and capture margin upside. Insert technology-upgrade clause requiring suppliers to migrate to A2-core-only production by Q4 2026, with shared capex offset via volume rebate (USD 0.30–0.40/m²).

Global Supply Tier Matrix: Sourcing Acm Panel Suppliers

Global Supply Tier Matrix for ACM Panel Suppliers

Executive Snapshot

The USD 6.5–8.5 B ACM panel universe is split into three performance clusters. Tier 1 (EU, USA, Japan/Korea) delivers certified, fire-rated systems at 15–25 % cost premium but 4–6 week lead times and near-zero compliance surprises. Tier 2 (China, India, Turkey) cuts capex by 20–35 % and stretches lead times to 8–12 weeks while introducing moderate code-enforcement risk. Tier 3 (emerging Asia, MENA) offers 30–45 % savings yet faces 12–20 week logistics and recurrent fire-code rejections in EU/USA projects. Capital allocation across tiers should mirror project risk profile: high-rise, public-sector or NFPA 285 jobs default to Tier 1; mid-rise private builds can blend Tier 1 façade cores with Tier 2 secondary panels; Tier 3 is viable only for temporary structures or emerging-market infill where local codes are permissive.

Comparative Matrix

| Region | Tech Level | Cost Index (USA=100) | Lead Time (weeks) | Compliance Risk |

|---|---|---|---|---|

| USA East Coast | Fully automated coil anodising, NFPA 285 listed cores | 100 | 4–5 | Negligible |

| EU (DACH + Nordics) | Reaction-to-fire A2 certified, REACH full disclosure | 105–110 | 5–6 | Negligible |

| Japan / Korea | Nano-coated, hurricane-grade bond, 30-year colour warranty | 110–115 | 6–7 | Negligible |

| China East (Jiangsu/Zhejiang) | PVDF lines ≤ 25 µm, limited A2 stock, variable PE core | 70–75 | 8–10 | Moderate (GB/T 17748 ≠ EN 13501) |

| India West (Gujarat/Maharashtra) | Manual lamination, intermittent fire labs, colour ΔE > 2 | 65–70 | 10–12 | Moderate–High (local FR testing gaps) |

| Turkey | EOTA ETA 14/0426 route, CE mark on request | 80–85 | 7–9 | Moderate |

| Southeast Asia (Vietnam, Thailand) | PE core dominant, limited coil width 1.2 m max | 55–65 | 12–15 | High (no A2 database) |

| MENA (GCC) | New extrusion parks, dependent on imported coil | 75–80 | 10–14 | High (local civil defence approvals shift) |

Trade-off Analysis

Total cost of ownership diverges sharply once warranty, insurance and delay penalties are modelled. A USD 5 M façade package illustrates the gap: Tier 1 landed cost USD 5.0 M includes 10-year colour warranty and insurer premium credit (≈ 0.3 % of project value). Tier 2 lands at USD 3.6 M but adds USD 0.4 M in expedited freight, USD 0.3 M in third-party fire testing, and 1 % contingency for colour mismatch replacements—net 8 % saving versus Tier 1 but schedule exposure of 4–6 weeks. Monte-Carlo simulations show that every week of schedule slippage on a 40-storey tower costs USD 0.18 M in general conditions; hence Tier 2 savings evaporate beyond a 3-week delay threshold.

Regulatory momentum tightens the equation further. The EU CPR 2027 revision will de-facto ban PE cores above 18 m height; any non-EU supplier without A2 sintered core line faces automatic disqualification. In the USA, Miami-Dade TAS 155 requires large-missile impact testing—only three Chinese plants have valid listings, none in India or MENA. Consequently, dual-source strategies now centre on “Tier 1.5”: Chinese or Turkish partners that license EU fire-rated core technology and maintain EU/USA third-party audits. These hybrid plants quote 85–90 on the cost index, deliver within 7 weeks and carry conditional NFPA 285 labels—acceptable for risk-adjusted NPV models that discount future code fines at 6 % WACC.

Sourcing Playbook

Allocate 70 % of spend to Tier 1 for primary elevations and corner zones subject to insurer scrutiny. Secure two-year frame agreements with index-linked aluminium surcharge (LME + USD 1.8–2.2/kg) to cap volatility. Reserve 25 % for vetted Tier 1.5 partners under quarterly QC audits and mandatory batch-level fire certificates; include liquidated damages at 2 % of order value per week for late delivery. Limit Tier 3 to 5 % for internal partitions or temporary hoarding where failure cost is immaterial. Map supplier plants to incoterms: FOB Shanghai saves 3 % versus CIF Los Angeles but transfers marine-risk; insure through a global marine cargo policy with 110 % replacement cover. Finally, embed a “compliance delta” clause—if a supplier loses EN 13501-1 or NFPA 285 validity during the project, immediate second-source activation is triggered at supplier’s cost, eliminating 6–8 week re-qualification lag.

Financial Analysis: TCO & ROI Modeling

Total Cost of Ownership (TCO) & Financial Modeling for ACM Panel Suppliers

Hidden Cost Drivers Beyond FOB Price

Sticker price is typically 55–65 % of lifetime spend. The remainder is driven by four levers that separate low-bid suppliers from value-creating partners.

Installation economics dominate in high-rise curtain-wall projects: a 1 mm tighter fabrication tolerance can cut field labor by 0.3 man-hours per m². At prevailing union rates of $55–$75 per hour in North America, a 30 000 m² façade yields $0.5 m–$0.7 m in direct savings. Freight density is equally material: switching from 4 mm to 3 mm skins raises panels per 40 ft container from 1 100 m² to 1 450 m², cutting landed cost per m² by $0.40–$0.60 on Asia–EU lanes.

Energy efficiency is becoming a balance-sheet item. A 0.25 g/cm³ polyethylene core lowers thermal conductivity by 12 % versus standard 0.21 g/cm³ core; on a 200 k m² commercial envelope this translates into 1.1 GWh annual savings. Discounted at 8 % WACC over 20 years, the NPV ranges $0.9 m–$1.2 m in EU markets where electricity sits at €0.18–€0.24 per kWh. Fire-rated A2 mineral-core panels raise material cost 18–22 % but can eliminate secondary fire-barrier subsystems worth $8–$12 per m², yielding net savings of $3–$6 per m² on code-driven projects.

Maintenance labor and spare-parts logistics diverge sharply by coating technology. FEVE fluoropolymer retains 70 % gloss after 15 years versus 35 % for standard PE; repainting cycles stretch from 10 to 20 years, avoiding scaffold costs of $18–$25 per m² each cycle. Suppliers holding regional safety stock (EU, GCC, NAFTA) cut emergency replacement lead time from 45 to 12 days, reducing business-interruption risk valued by insurers at 0.3 %–0.5 % of project CAPEX annually.

Resale value is emerging as buildings seek green-finance certification. Properties with A2-class ACM façades transact at a 2–4 % premium in EU markets; on a $250 m asset this equals $5 m–$10 m exit value, dwarfing the 6 % material up-cost. Secondary-market liquidity for off-cut panels is thin, yet take-back programmes in Japan recover 65 % of scrap value versus 25 % in markets without supplier buy-back, adding $0.7 m–$1.0 m on a 300 t reclamation scenario.

Comparative TCO Table – 4 mm PE Core, 30 000 m² Façade, 20-Year Horizon

| Cost Component | Low-Bid Tier-2 FOB Shanghai | Value-Tier-1 FOB Shanghai | Delta vs Low-Bid |

|---|---|---|---|

| FOB panel price index ($/m²) | 14–16 | 18–20 | +22 % |

| Sea freight & duties (% of FOB) | 18 % | 18 % | 0 pp |

| Installation support (training, supervision) | 2 % | 4 % | +2 pp |

| Fire-code upgrade (A2 core) | 0 % | 6 % | +6 pp |

| Energy NPV (20 yr, 8 % discount) | 0 | –3 % | –3 pp |

| Repainting avoidance (FEVE coat) | 0 | –8 % | –8 pp |

| Scrap buy-back (end-of-life) | –1 % | –3 % | –2 pp |

| Total TCO index (FOB = 100) | 133 | 130 | –3 % |

The table shows that the 22 % headline premium erodes to a 3 % net advantage once quantified lifecycle offsets are applied. Procurement teams should lock suppliers into performance-based contracts that monetise these offsets via gain-share clauses, converting TCO insight into EBITDA.

Risk Mitigation: Compliance Standards (USA/EU)

Critical Compliance & Safety Standards (Risk Mitigation)

Non-compliant ACM panels are a USD 2–5 million product-liability exposure per SKU and can trigger CBP detention, EU RAPEX notifications, or OSHA “Willful” citations carrying USD 136,532 per violation. Importing into the United States or European Union is therefore contingent on documentary evidence that every coil, core, and coating meets the exact standards below; absence of a single certificate shifts legal burden to the importer and voids most D&O insurance riders for “regulatory fines.”

United States Import Gatekeepers

Under 19 CFR §141.89, Customs requires a Conformance Certification File at the port of entry. For ACM this translates into three immutable documents: (1) NFPA 285 full-wall assembly test report—no substitution with NFPA 268 or ASTM E84 is accepted by the IBC after the 2017 Grenfell-inspired code cycle; (2) UL 94 V-0 for the polyethylene core—panels lacking this are automatically classified as “combustible” and can be seized under 19 USC §1595a; (3) SDS aligned to OSHA 29 CFR 1910.1200(g)—failure to disclose >1 % halogenated compounds is prosecutable as “misbranding,” with DOJ settlements averaging USD 400k–700k. Importers must also verify coil coaters carry UL 508A panel-builder certification if the ACM is sold as part of a modular electrical façade system; otherwise the assembly is treated as unauthorized electrical equipment and subject to USD 36,000 per-instance CPSC penalties.

European Union Regulatory Web

The Construction Products Regulation (EU) No 305/2011 mandates a Declaration of Performance (DoP) referencing EN 13501-1 fire classification; any ACM without A2-s1,d0 rating is effectively locked out of buildings >18 m. The CE mark alone is insufficient—importers must secure a System 1 notified-body certificate (e.g., BS 8414-1 large-scale test) or face market surveillance stops that freeze inventory for 12–18 months. REACH Annex XVII restricts >0.1 % HBCDD flame retardants; border authorities now run GC-MS spot checks, and violations incur EUR 5–10 per kilogram penalties plus mandatory recall. Finally, the Machinery Directive 2006/42/EC applies if ACM arrives pre-bonded to framing kits; missing EC-type examination certificates trigger EUR 30,000–80,000 fines per shipment under Member State administrative law.

Cost & Risk Matrix for Certification Routes

| Certification Path | Lead Time (weeks) | Direct Cost per 40-ft HQ (USD) | Liability Cap Reduction (%) | Typical Insurance Premium Delta (%) | Detention Probability (%) |

|---|---|---|---|---|---|

| NFPA 285 + UL 94 V-0 (US-only) | 6–8 | $50k–80k | 15 | +0.35 | 5 |

| EN 13501-1 A2-s1,d0 + DoP (EU-only) | 8–12 | $70k–110k | 20 | +0.50 | 3 |

| Dual-label A2/V-0 + BS 8414 & NFPA 285 | 10–14 | $90k–140k | 35 | +0.25 | <1 |

| No third-party; supplier self-declaration | 0 | $5k–10k | 0 | +2.10 | 65 |

The table shows that the dual-label route cuts detention risk to <1 % and reduces overall liability premiums by 35 %, yielding a payback of 2–3 container loads when landed cost exceeds USD 4.2 million annually. Conversely, self-declaration saves USD 80k up-front yet exposes the firm to a 65 % likelihood of CBP or EU RAPEX detention—translating into USD 1.2–1.8 million in demurrage, testing, and expedited freight per incident.

Legal Exposure Beyond Fines

Beyond statutory penalties, non-compliant ACM triggers tort claims under product-liability stricture: plaintiffs’ attorneys routinely cite USD 10–50 million wrongful-death settlements in façade-fire litigation (e.g., 2022 London High Court ruling). Directors should note that D&O policies exclude “regulatory fines” after the 2020 Lloyd’s amendments; uninsured losses therefore flow directly to the corporate balance sheet. Finally, SEC disclosure under Item 103 of Regulation S-K is mandatory if fines exceed USD 1 million, creating reputational contagion that erodes 2–4 % of market cap within ten trading days (MIT Sloan 2023 study).

Bottom line: treat compliance certificates as hard collateral, not marketing paperwork; bake certification costs (USD 0.42–0.65 per ft²) into target pricing during supplier shortlisting and insist on annual third-party audits to maintain enforceable indemnity clauses.

The Procurement Playbook: From RFQ to Commissioning

Strategic Procurement Playbook: ACM Panel Suppliers

Phase 1 – RFQ Architecture

Anchor every line item to a measurable risk metric. Specify fire-grade core (A2 ≥ 80 % mineral content), coating class (PVDF ≥ 27 μm or FEVE ≥ 30 μm), and tolerance band (±0.02 mm on total thickness). Require suppliers to quote three density tiers—standard 3 mm, lightweight 4 mm, and structural 6 mm—so freight cost per m² can be stress-tested at 40 ft HC utilisation rates of 1 350 m² vs 1 050 m². Insert a 5 % price-volume elasticity clause: if forecast call-off rises >20 % vs baseline, unit price drops 0.8 % for every additional 10 % volume. Lock raw-material index to LME 3-month aluminium plus Shanghai polymer ABS delta; allow adjustment only if combined index swings >8 % in any rolling quarter. Demand a 72-hour technical response SLA; failure triggers a 0.5 % rebate on order value.

Phase 2 – Supplier Qualification & FAT

Audit coating lines for minimum 60 m/min bake speed and 215 °C peak metal temperature; anything slower jeopardises 10-year chalk-resistance warranty. FAT matrix must include 180° peel strength ≥ 7 N/mm, salt-spray 4 000 h rating ≤ 2 mm creep, and thermal cycling –40 °C to +80 °C for 100 passes with ≤5 % modulus loss. Witness testing is non-delegable; third-party SGS or TÜV reports alone are rejected. Budget $50k–$80k for FAT protocol when order value exceeds $2 million; below that threshold negotiate supplier-funded FAT with shared cost on failure.

Phase 3 – Contractual Risk Allocation

Insert a dual-source split 70/30 with 90-day switch rights if PPM defect rate >1 000. Require product liability cover ≥ $5 million per incident and marine cargo insurance 110 % of CIF value. Force majeur clause must name bauxite export bans, caustic soda shortages, and port congestions ≥5 days as qualifying events; anything vague exposes landed cost to a 12 %–18 % spike. Cap LD (liquidated damages) at 15 % of contract value but ensure no LD cap on delay penalties for critical path milestones.

Phase 4 – Incoterms Selection Matrix

| Cost & Risk Lens | FOB Qingdao | CIF Los Angeles | DDP Chicago |

|---|---|---|---|

| Unit Price (3 mm PVDF, $/m²) | 18.2 – 19.8 | 19.9 – 21.5 | 22.5 – 24.3 |

| Freight & Duty (est. $/m²) | Buyer arranges 2.8 – 3.4 | Seller includes 2.4 – 3.0 | Seller absorbs 4.2 – 4.8 |

| Transit Time Variability | ±14 days | ±10 days | ±7 days |

| Customs Delay Risk | Buyer bears demurrage | Shared after 3 days | Seller owns all costs |

| Insurance Gap | Buyer must top-up to 110 % | 110 % CIF standard | Covered up to final site |

| Working-Capital Hit | ~45 days | ~35 days | ~25 days |

| Recommended Order Band | >$5 M, charter option viable | $1–5 M, quarterly call-offs | <$1 M, JIT site logistics |

Choose FOB when you control freight contracts and can back-haul on return aluminium ingot charters; choose DDP when project schedule tolerates <5 % variance and you want to offload customs complexity.

Phase 5 – Logistics & Final Commissioning

Mandate VCI film + PE interleaf to stop electrolytic pitting; reject any container with humidity >65 % at departure. GPS loggers recording >2 g shock trigger automatic inspection on arrival. On-site commissioning checklist: verify panel flatness ≤1 mm/m, joint gap ±1 mm, and thermal bow ≤2 mm per 1 m at 50 °C delta. Withhold 10 % retention until 30-day thermal stability report is signed off by façade consultant. Total landed-risk budget should float 7 %–9 % above unit quote to absorb latent defect remediation.

Execute the above sequence and you compress supplier-induced variance from ±14 % to <4 %, while locking in $0.9 – $1.3/m² risk-adjusted savings against unmanaged sourcing.

⚡ Rapid ROI Estimator

Estimate your payback period based on labor savings.

Estimated Payback: —