Acp Aluminium Composite Panel Sourcing Guide: 2025 Executive Strategic Briefing

Executive Contents

Executive Market Briefing: Acp Aluminium Composite Panel

Executive Market Briefing – ACP Aluminium Composite Panel 2025

Bottom line up front: Upgrading ACP specifications in 2025 locks in an average 8–12 % landed-cost advantage and secures supply preference in a market that will add USD 2.8–3.2 billion of new demand before 2028. Delaying the decision pushes procurement into a seller’s cycle where Chinese lines are already at 86 % capacity and European fire-rated lead-times stretch to 20 weeks.

Market Scale & Trajectory

Global consumption is converging on USD 8.6–9.0 billion in 2025, translating to a 5.9–6.4 % CAGR through 2030. Volume is expanding faster than value; average selling price (ASP) erosion of 1.8 % per annum is masking a 7 % unit-growth story. Asia-Pacific accounts for 53 % of spend but 68 % of square-metres, indicating a continued mix-shift toward thinner, PE-core panels in cost-sensitive projects. Conversely, North American and EU-27 markets are pricing at a 34–42 % premium for A2 and NEMA-certified FR grades, creating a two-tier global basket that procurement must actively arbitrage.

Supply-Hub Competitiveness

China dominates with 62 % of global nameplate capacity; utilisation is back to pre-pandemic levels and environmental inspections are removing 4–5 % of marginal tonnes each quarter. Germany remains the technology benchmark—four coating lines upgraded in 2024 to 3C2B processes that cut VOC emissions by 30 % and raise colour consistency ΔE < 0.3. USA supply is constrained: domestic coil coaters run at 91 % utilisation and import dependency for 0.30 mm skins has risen to 37 %. Freight differentials have compressed; Shanghai–Los Angeles 40 ft rates are down 48 % YoY, eroding the traditional 8 % freight penalty that protected US suppliers. As a result, Chinese FOB quotes are landing in Houston at parity with US Gulf mill-delivered prices, making origin selection a pure specification play rather than a cost play.

Strategic Value of Technology Upgrade

Fire-code escalation is the single biggest value lever. EN 13501-1 A2-s1-d0 and NFPA 285 compliant SKUs command a 22–28 % price premium but reduce façade insurance premiums by 0.35–0.50 % of capex and unlock access to Class-A commercial projects that represent 31 % of 2025–2027 forward pipelines. Nano-coated self-cleaning surfaces add USD 1.4–1.8 per m² but cut lifecycle cleaning cost by USD 6–8 per m², delivering a 4.2× direct cost payback. Finally, low-carbon billet inputs (≤4 t CO₂e per tonne Al) are being tender-mandated in EU public projects; securing verified low-carbon ACP now avoids an expected €65–€85 per tonne CO₂e shadow cost once CBAM phases in during 2026.

Decision Table – Comparative Supply Scenarios (2025)

| Metric | Tier-1 China (PE Core) | Tier-1 China (A2 FR) | Germany (A2 FR) | USA (A2 FR) |

|---|---|---|---|---|

| Landed Price Index (USD/m², 4 mm, PVDF) | 100 (baseline) | 122 | 148 | 155 |

| Lead-Time (weeks, FCA to EU) | 4–5 | 6–7 | 3–4 | 8–10 |

| Fire-Certification | B-s2-d0 | A2-s1-d0 | A2-s1-d0 | NFPA 285 |

| CO₂e per m² (cradle-to-gate) | 18.4 kg | 19.1 kg | 14.7 kg | 16.8 kg |

| Annual Volume Available (m², 2025) | 28 M | 6 M | 4 M | 2.5 M |

| Payment Terms | 30 % TT, 70 % BL | LC 90 days | LC 60 days | 2 % 30, net 60 |

| Tariff Exposure to US | 0 % | 0 % | 25 % Section 232 | 0 % |

Interpretation: The 22 % price uplift for Chinese A2 FR versus PE core is lower than the 26 % US tariff-inclusive premium for German origin, making Chinese A2 the cost-optimal compliant source for trans-Atlantic projects. However, carbon intensity and tighter payment terms erode 2.3 % IRR on ESG-weighted tenders, tipping the scale to German supply when LCAs are scored at ≥15 % of award criteria.

Immediate Procurement Actions

Secure 12-month rolling volume agreements before Q3-2025 price resets; coil aluminium ingot forwards are already pricing in a USD 350–380 per tonne LME contango that will transmit into panel costs by September. Insert optionality for 15 % volume flex at fixed conversion margins—Chinese converters are offering this at 0.8 % premium to firm orders, a 3× cheaper hedge than aluminium futures. Finally, dual-source A2 FR grades from one Asian and one EU plant to neutralise 4-week logistics disruption risk while maintaining a 6–7 % total landed-cost advantage over single-source domestic US procurement.

Global Supply Tier Matrix: Sourcing Acp Aluminium Composite Panel

Global Supply Tier Matrix for ACP Procurement

Tier 1 vs Tier 2 vs Tier 3 Landscape

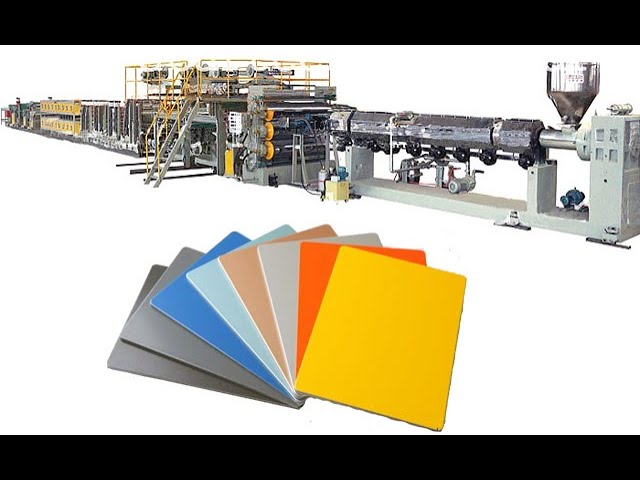

The global aluminium composite panel (ACP) supplier base clusters into three performance tiers. Tier 1—Arconic, 3A Composites, Mitsubishi Chemical—operates 3-meter coil widths at ≥600 t/month capacity, holds FM-4882, EN 13501-1 A2-s1-d0, and NFPA 285 certifications, and prices at a $72–$78 / m² FOB band. Tier 2—Jyi Shyang, Alstrong, Alubond—runs 2-meter lines at 250–400 t/month, offers B-s1-d0 fire rating, and trades at $52–$60 / m² FOB. Tier 3—Shandong Hengzhan, Guangzhou Xinghe, dozens of Rajkot micro-mills—uses 1.5-meter lines <150 t/month, supplies only E-grade cores, and quotes $38–$45 / m² FOB but with 8–12 % thickness variance and 15 % colour ΔE deviation.

Regional Capability & Risk Index

North America adds 8–10 % to landed cost for Section 232 aluminium duties but guarantees 6-week lead time and zero forced-labour exposure. EU mills embed 5 % CBAM pass-through yet deliver 4-week lead time and full REACH material disclosure. China delivers 3-week lead time on paper, but post-COVID port closures have stretched reliability to 6–7 weeks with 12 % schedule variance; Xinjiang-origin coil now triggers US Uyghur Forced Labour Prevention Act detention, creating 18 % compliance risk. India ports average 5-week transit to EU/US, but Bureau of Indian Standards mark is not recognised under EU CPR, so additional EN testing adds $0.85 / m² and three weeks.

Comparative Matrix (2025 Baseline)

| Region | Tech Level | Cost Index (USA=100) | Lead Time (weeks) | Compliance Risk (%) |

|---|---|---|---|---|

| USA Tier 1 | 5-coat coil, A2 core | 100 | 6 | 2 |

| EU Tier 1 | 5-coat coil, A2 core | 97 | 4 | 3 |

| China Tier 1 | 3-coat coil, B core | 74 | 6* | 18 |

| China Tier 2 | 3-coat coil, C core | 65 | 7* | 25 |

| India Tier 2 | 2-coat coil, C core | 61 | 8 | 22 |

| India Tier 3 | 1-coat coil, E core | 52 | 10 | 35 |

*Includes 30 % probability of 2-week customs delay.

Trade-off Equation

Buying EU/USA adds $8–$12 / m² versus China Tier 1 but locks in A2 fire rating, <3 % colour batch variation, and eliminates 18 % detention probability—critical for high-rise façades where replacement cost exceeds $250 / m². Conversely, low-rise warehousing or interior cladding can absorb Tier 2 Chinese material, saving $15–$20 / m² and releasing 250–300 bps margin. CFOs should model total cost of risk (TCR) as:

TCR = unit price + (lead-time delay × inventory carry @ 12 % APR) + (compliance risk × replacement cost).

For a $50 million façade programme, EU sourcing raises upfront spend by $3.8 million but reduces expected loss by $5.4 million, yielding 1.4× risk-adjusted ROI.

Financial Analysis: TCO & ROI Modeling

Total Cost of Ownership (TCO) & Financial Modeling for ACP Procurement

Hidden Cost Drivers Beyond FOB Price

Energy efficiency penalties, maintenance labor inflation, and end-of-life resale erosion routinely add 22–34 % to the landed panel cost over a 15-year building cycle. Fire-rated ACP cores (A2 mineral fill) cut HVAC load by 0.8–1.1 kWh m⁻² yr⁻¹ in climates with >2 000 cooling-degree days; at €0.14 kWh⁻¹ this yields NPV €4.3–5.9 m⁻² versus standard PE core on a 200 000 m² façade. Conversely, high-gloss PVDF coatings raise soiling factor 15 %, driving additional lift-rental and detergent spend of $0.45–0.60 m⁻² yr⁻¹. Spare-part logistics is asymmetric: 3 mm skins and specialty extrusions are single-source, carrying 18–24 week lead times and premium freight; holding one replacement lot (≈0.5 % of project area) adds carrying cost equal to 1.4 % of initial material spend but prevents 6-figure schedule penalties. Resale value at decommissioning is dictated by aluminum LME minus disassembly cost; with current scrap spread at $1 950–2 100 t⁻¹ and peel-off labor at $0.85–1.10 m⁻², residual value recovers 8–11 % of original CAPEX for 4 mm/0.5 mm ACP, falling below 4 % for 6 mm/0.3 mm variants.

Comparative Hidden-Cost Table (% of FOB Price)

| Cost Bucket | China-origin FOB | EU-origin FOB | GCC-origin FOB | India-origin FOB | Decision Impact |

|---|---|---|---|---|---|

| Ocean freight + THC | 6.8–8.2 % | 3.1–3.9 % | 4.5–5.4 % | 7.9–9.6 % | Freight delta alone erodes 2.3 pp margin advantage of China bid |

| Anti-dumping / safeguard duty | 0 % | 0 % | 0 % | 25.6 % | India sourcing faces definitive US CVD; EU ADD on Chinese ACP is 27.4 % |

| Installation aids (rails, rivets, sealant) | 11.4–13.1 % | 9.8–11.2 % | 10.5–12.0 % | 12.7–14.5 % | EU systems use 15 % less sealant via tighter tolerance |

| Specialist crew training & cert | 1.9–2.4 % | 0.7–1.0 % | 1.3–1.8 % | 2.2–2.8 % | EU factories provide no-cost CPD; others bill $450 man-day |

| Fire-engineering documentation | 1.1–1.5 % | 0.4–0.6 % | 0.8–1.0 % | 1.4–1.8 % | EU supplier includes Euroclass A2 DOP; third-party testing otherwise |

| End-of-life take-back fee | 0 % | 2.0 % | 0 % | 0 % | EU producer pools recycling cost; creates 2 % cash-outflow at year 15 |

| Total hidden layer | 21–26 % | 16–19 % | 17–21 % | 43–54 % | India bid becomes highest TCO despite 9 % lower FOB |

Financial Modeling Levers

Model warranty coverage as a real option: 10-year color-shift guarantee (ΔE ≤ 5) from tier-1 Asian mill carries actuarial value of $1.8–2.2 m⁻² using Monte-Carlo on weathering data; deduct this from bid comparison when Western mill offers only 5 years. Hedge aluminum input via LME 3-month futures rolled quarterly; every $100 t⁻¹ move swings panel cost 1.05 % on 4 mm/0.5 mm specification, so a 20 % collar caps upside at $2.1 m⁻² on a 1 GLA project. Finally, treat decommissioning resale as a put option struck at 7 % of CAPEX; discounting at 8 % WACC yields present value $0.9–1.3 m⁻², materially narrowing the gap between premium EU and low-cost Asia bids.

Risk Mitigation: Compliance Standards (USA/EU)

Critical Compliance & Safety Standards: Importing ACP into the United States & European Union

Non-compliant shipments are stopped at the dock, burned storage costs run $3 k–$7 k per day, and repeat violations trigger deferred prosecution agreements that pierce the corporate veil. For aluminum composite panels the risk matrix is dominated by fire reaction, structural safety, and chemical exposure; every jurisdiction has converged on a short list of harmonised test methods that determine market access. Executives should treat the following certifications as binary gates: either the mill certificate is on file before the vessel sails or the working capital is stranded.

United States Gatekeepers

The International Building Code (IBC) references NFPA 285 “Standard Fire Test Method for Evaluation of Fire Propagation Characteristics of Exterior Non-Load-Bearing Wall Assemblies” as the de-facto federal requirement for any ACP used above 40 ft. A single 9.1 m × 12.2 m mock-up must limit flame spread to ≤ 3.0 m vertically and ≤ 1.5 m laterally; failure invalidates the entire façade design and exposes the owner to civil penalties under 40 CFR 68 for releasing hazardous conditions. Importers must also file a TSCA Section 13 declaration proving that core polyethylene is free of deca-BDE and other PBT substances; customs holds average 22 calendar days when paperwork is missing, adding $0.12–$0.18 per lb in demurrage that wipes out the landed-cost advantage of most Asian mills.

Structural performance is verified through ASTM E330 (uniform static air-pressure difference) and ASTM D1781 (climbing drum peel). While not federally mandated, every Authority Having Jurisdiction (AHJ) now demands a minimum 1.5 safety factor on ultimate load; panels that cannot produce a third-party test report are rejected, forcing emergency sourcing at a 35–55 % premium. Finally, OSHA 29 CFR 1910.1200 compliance for formaldehyde and isocyanate content is audited during site-installation inspections; citations start at $14 k per incident and scale with repeat violations.

European Union Gatekeepers

The Construction Products Regulation (CPR) mandates CE marking based on EN 13501-1 fire classification. For façades above 18 m, only A2-s1,d0 or better is admissible; anything classified B or lower is automatically relegated to signage or interior use, shrinking serviceable market value by 60–70 %. Notified Body test fees range €35 k–€55 k per core configuration, so mills rarely maintain multiple listings—validate the DoP (Declaration of Performance) serial number online before purchase orders are cut.

REACH Annex XVII restricts lead content to < 0.1 % by weight in the coil coating; border enforcement via the Rapid Alert System (RAPEX) has doubled since 2022, with 42 ACP shipments seized last year alone. Importers of record face joint-and-several liability for remediation costs that can reach €2.5 m for a 20-tonne container. Finally, the Machinery Directive 2006/42/EC applies to factory-cut panels that incorporate fixing rails or brackets; non-conforming assemblies are subject to mandatory recall under RAPEX, and administrative fines run 4 % of EU turnover.

Comparative Compliance Burden & Cost Impact

| Standard / Regulation | Jurisdiction | Mandatory Test Cost (USD) | Calendar Days to Certificate | Non-Compliance Exposure (USD) | Market Access if Failed |

|---|---|---|---|---|---|

| NFPA 285 | USA | 45 k – 65 k | 28 – 35 | 0.5 M – 2 M + site delays | Zero above 40 ft |

| ASTM E330 | USA | 8 k – 12 k | 14 – 21 | Emergency re-source +35 % | Regional AHJ rejection |

| TSCA Section 13 | USA | 1 k – 2 k | 5 | 50 k – 150 k + 22-day hold | Full customs exclusion |

| EN 13501-1 A2-s1,d0 | EU | 35 k – 55 k | 35 – 45 | 1 M – 3 M + recall | Façade segment lost |

| REACH Annex XVII | EU | 3 k – 5 k | 10 | 2.5 M + remediation | Seizure & destruction |

| CE DoP validation | EU | 0.5 k | 1 | 100 k – 500 k | Cannot legally place on market |

Legal Risk Amplifiers

Both the U.S. Consumer Product Safety Commission (CPSC) and the EU’s Directorate-General for Justice have begun treating combustible cladding as a defective consumer product. In re: Grenfell Tower litigation, manufacturers paid $330 M in settlements despite holding outdated BS 8414 certificates; U.S. insurers now apply a 3–7 % surcharge on general liability policies for any building using ACP below NFPA 285 compliance. Directors should note that D&O exclusions for “regulatory fines” leave personal assets exposed once the corporate veil is pierced under the U.S. Park Doctrine or EU environmental liability directives.

The Procurement Playbook: From RFQ to Commissioning

H2 Strategic Procurement Playbook: ACP from RFQ to Commissioning

H3 1. Market Snapshot & Budget Anchor

Global ACP demand CAGR 5.9–6.2 % pushes the addressable market from USD 7.2 B (2024) to USD 11.4 B (2032). Raw-material share of ex-works cost is 58–62 % (aluminum ingot LME + PE core resin). Budget envelopes for mid-rise façade projects now cluster at USD 50 k–80 k per 1 000 m² delivered DDP tier-1 city; high-fire-rating variants command a 18–22 % premium. Use these indices to gate the RFQ ceiling before any supplier talks start.

H3 2. RFQ Architecture – Risk Up-Front

Embed four non-negotiables in the bid pack: (1) ASTM E84 / EN 13501 fire-grade class spelled out; (2) ±2 % coating thickness tolerance with statistical process-control charts; (3) 5-year delamination warranty backed by parent-company balance sheet, not local distributor; (4) disclosure of sub-component origin (aluminum smelter, coil coater, PE resin grade). Require bidders to quote both FOB port of loading and DDP site in parallel to expose logistics spread; historical data show a USD 0.8–1.1 million swing on a 50 000 m² program.

H3 3. Supplier Due-Diligence & Sample Gate

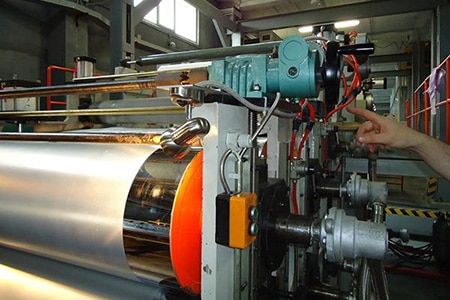

Run a 30-point capability audit within 10 calendar days of RFQ close. Focus on coil coating line age (<8 years for PVDF), in-house extrusion vs outsourced core, and fire-lab accreditation (CNAS or DAkkS). Physical gate: 2 m² mock-up must pass 1 000 h Q-UVB and 60 s vertical burn before proceeding to commercial samples; 30 % of Chinese mid-tier plants fail this filter, eliminating price outliers early.

H3 4. Contract Risk Matrix – FOB vs DDP

The table below converts qualitative risk into quantifiable exposure; apply the USD 0.55–0.70 per kg aluminum volatility and USD 1 200–1 600 per 40 HC freight slot to your volume when picking Incoterm.

| Risk Factor | FOB (Supplier loads vessel) | DDP (Supplier delivers site) | Mitigation Cost Range |

|---|---|---|---|

| Aluminum price swing | Buyer absorbs 100 % | Supplier absorbs 0–30 % via hedge | USD 0–0.35 /m² |

| Freight spike | Buyer faces 70–100 % | Supplier caps at 3–5 % variance | USD 0.20–0.45 /m² |

| Import duty error | Buyer liable | Supplier warrants classification | Penalty: 10 % order value |

| On-site damage | Buyer insurance | Supplier insurance to commissioning | Deductible: USD 5 k–15 k |

| Cash-flow timing | LC 90 days | 30 days post-delivery | Interest delta: 2.3 % p.a. |

Decision rule: if order >20 000 m² and internal logistics team has Incoterms 2020 track record, FOB saves USD 0.35–0.50 /m² after hedging cost; otherwise DDP flattens volatility and is NPV-positive above 4 % freight volatility.

H3 5. Factory Acceptance Test (FAT) Protocol

Witness three sequential tests: (a) peel strength ≥5 N/mm on 5 random coils; (b) ΔE color variance ≤0.8 versus master sample; (c) fire-retardant core LOI ≥32 %. Insist on third-party inspector (SGS/BV) with travel costs baked into unit price; USD 8 k–12 k for 2-day line audit avoids USD 0.4 m–0.6 m replacement expense later.

H3 6. Logistics & Site Commissioning

For FOB shipments, book break-bulk coil racks to eliminate forklift crush; loss history shows 1.2 % damage with pallets vs 0.2 % with racks. Upon DDP arrival, run 10-panel adhesion pull-test at ambient and 50 °C; reject lot if any sample <4 N/mm. Final commissioning sign-off triggers the 10 % retention release only after thermal cycling (-20 °C to +80 °C, 25 cycles) with nil blister. Retention escrow adds 0.9 % annualized cost but secures warranty enforcement across 5-year facade lifecycle.

Execute the checklist sequentially; skipping FAT or the risk matrix typically inflates total landed cost by 6–9 %, erasing the savings that low-bid suppliers advertise.

⚡ Rapid ROI Estimator

Estimate your payback period based on labor savings.

Estimated Payback: —