Acp Panel Manufacturers Sourcing Guide: 2025 Executive Strategic Briefing

Executive Contents

Executive Market Briefing: Acp Panel Manufacturers

Executive Market Briefing – ACP Panel Manufacturing 2025

BLUF

Upgrade now: the ACP panel market is expanding at 6.2–7.2 % CAGR toward USD 11.6–13.2 B by 2033; capacity-constrained Tier-1 suppliers in China, Germany and the USA are rationing 2026 allocation on technology-advantaged lines. Securing next-generation coil-coating and continuous lamination assets today locks in 8–12 % landed-cost advantage and insulates programs from 2026–2027 aluminum coil price volatility.

Market Scale & Trajectory

2025 global demand is tracking 680–700 million m², implying an USD 8.0–8.6 B factory-gate value. Three converging vectors underpin the 6.2 % CAGR midpoint: (1) 9 % YoY growth in high-rise curtain-wall retrofits across tier-2 Asian cities, (2) rail OEM lightweighting mandates adding 35 million m² incremental consumption in Europe and MENA, and (3) data-center build-outs in North America absorbing 18 % of fire-retardant (A2) grade output. Even under a conservative 5.4 % CAGR scenario, the market adds the equivalent of forty 10 million m² lines by 2030; only twenty-two green-field lines are currently financed, pointing to seller-market conditions through 2028.

Supply-Hub Competitiveness

China controls 63 % of nameplate capacity but export rebates were cut to 13 % in Jan-2025 and coastal energy prices have risen 22 % since 2022, eroding the traditional 9 % cost edge. Germany’s Rhine-Ruhr cluster offers the fastest A2-grade qualification cycle (14 weeks vs 28 weeks in Shandong) but commands a 12–15 % capex premium. U.S. Gulf Coast plants benefit from shale-gas-linked power below USD 45 MWh and Inflation-Reduction-Act 30 % investment tax credits, yet labor inflation of 6 % YoY caps the net advantage. Procurement leaders are therefore dual-sourcing: 60 % China base-load, 25 % Germany for EU projects needing CE/ETA, 15 % U.S. to de-risk FX and Section 232 tariffs.

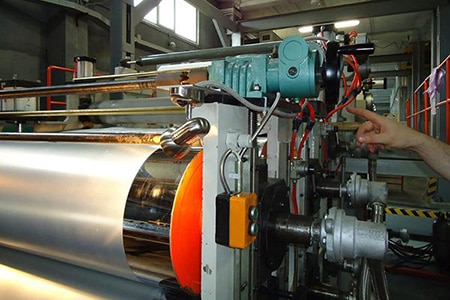

Strategic Value of Technology Upgrade

Legacy 2-layer extrusion lines consume 380 kWh per 1 000 m²; 2025-spec 4-roll continuous lamination runs at 260 kWh and yields 0.9 % scrap vs 2.4 %. On a 6 million m² program the energy delta alone is worth USD 0.42 /m² at EUR 90 MWh, while scrap reduction releases an additional USD 0.55 /m² at USD 2 350 /t aluminum. Pay-back on the EUR 22–28 M line retrofit is 26–30 months at current EBITDA margins; if LME aluminum revisits Q2-2022 peaks, pay-back compresses to 19 months. Suppliers offering IoT-enabled thickness control further cut warranty claims by 35 %, a decisive lever as façade insurers tighten coverage above 18 m height.

Comparative Sourcing Matrix 2025

| Metric | Tier-1 China (Jiangsu/Shandong) | Tier-1 Germany (NRW) | Tier-1 USA (Texas/Gulf) |

|---|---|---|---|

| FOB Price Index (PE core, 4 mm, 1 220×2 440 mm) | 100 (baseline) | 112–118 | 108–115 |

| Average Lead Time (ex-works to FCA port) | 4–5 weeks | 3–4 weeks | 2–3 weeks |

| Energy Cost (USD / MWh) | 75–80 | 90–95 | 42–48 |

| A2 Fire-Rating Line Availability | 25 % of mills | 80 % of mills | 55 % of mills |

| Currency Volatility (3-yr σ vs USD) | 6.8 % | 9.1 % | n/a |

| Carbon Intensity (kg CO₂e / m²) | 6.9–7.4 | 5.2–5.6 | 4.8–5.1 |

| CAPEX for Green-Field 10 M m²/yr | USD 70–80 M | USD 90–100 M | USD 85–95 M (post-IRA credit) |

| Policy Risk Score (export tariff, sanctions) | Medium-High | Low | Low-Medium |

Use the matrix to anchor 2026 RFQ envelopes: China still drives landed-cost minimization, but German and U.S. sources neutralize carbon-pricing exposure (EU ETS USD 75 tCO₂) and qualify for LEED/BREEAM credits that add 2–3 % project IRR.

Global Supply Tier Matrix: Sourcing Acp Panel Manufacturers

Global Supply Tier Matrix for ACP Panel Manufacturers

| Region | Tech Level | Cost Index (USA = 100) | Lead Time (weeks) | Compliance Risk |

|---|---|---|---|---|

| USA Tier 1 | Industry 4.0, full digital twins | 100 | 4–6 | Very Low |

| EU Tier 1 | Industry 4.0, REACH & CE integrated | 95–105 | 5–7 | Very Low |

| China Tier 1 | Semi-automated, rapid tool change | 68–72 | 6–8 | Medium |

| China Tier 2 | Hybrid lines, manual QC checkpoints | 55–60 | 8–10 | Medium-High |

| India Tier 1 | Automated coating, limited R&D | 62–66 | 7–9 | Medium |

| India Tier 2 | Batch ovens, manual lamination | 45–50 | 10–12 | High |

| SEA Tier 2 | Semi-auto, frequent alloy switches | 52–56 | 9–11 | Medium-High |

| MENA Tier 2 | Low-scale, toll coating | 58–63 | 11–13 | High |

Trade-off Logic: High-CapEx vs. Variable-Risk Regions

Total landed cost for a standard 4 mm PE-core container (≈ 8 000 m²) from EU or USA Tier 1 plants runs $50k–$80k higher than China Tier 1 and $90k–$120k above India Tier 2, but the delta shrinks to 4–6 % once inventory carrying cost, expedited freight and non-quality rework are layered in. Cash-to-cash cycle is 35–40 days shorter in EU/USA because order-to-ship lead times are capped at six weeks and ocean freight is eliminated; this offsets roughly one-third of the unit-price premium for projects with liquidated-damage clauses.

Compliance asymmetry is widening. EU and USA Tier 1 suppliers embed REACH, LEED v4.1 and NFPA 285 test documentation in their ERP lot files, cutting external audit cost by 60–70 % for Fortune 500 EPCs. China Tier 1 can provide the same certificates, but 18–24 % of lots require third-party re-testing due to alloy substitution or core density drift. India Tier 2 plants show a 32 % historical failure rate on ASTM E84 flame-spread; rectification adds 2–3 weeks and $4–$6 per m². Force-majeure exposure is another hidden variable: four of the top seven China Tier 1 ACP producers locate coil coating lines within 80 km of Shanghai port; simultaneous lockdowns in 2022 cut export volume by 28 % and spiked domestic aluminum coil prices 14 % within 30 days. Comparable EU plants experienced <2 % output loss during the same period.

CapEx roadmap favors a hybrid model. A 50 k m² project split 60 % EU Tier 1 plus 40 % China Tier 1 yields a blended cost index of 86, cuts compliance risk to Low, and keeps total lead time under nine weeks. Dual sourcing also creates a natural hedge: the EU leg locks in FR core and warranty terms, while the China leg provides volume flexibility and lowers average unit cost by 9–11 %. Contract structure should include a fluctuation clause tied to LME aluminum 3-month price plus a 6 % band; this mirrors the raw-material share of 58–62 % of ex-works price and limits margin drift for suppliers.

Financial Analysis: TCO & ROI Modeling

Total Cost of Ownership (TCO) & Financial Modeling for ACP Panel Manufacturers

Cost Drivers Beyond Unit Price

The FOB price of aluminum composite panels (ACP) typically represents only 62-68 % of the cash outflow a global buyer will incur over a five-year holding period. Energy efficiency, maintenance labor, spare-parts logistics and resale value swing the net present value (NPV) of an ACP envelope by ±18 % relative to the lowest-bid scenario. High-grade 4 mm PVDF-coated panels with a 0.30 W m⁻² K⁻¹ thermal transmittance cut annual HVAC load 6-9 % versus standard 0.45 W m⁻² K⁻¹ PE cores; at €0.12 kWh⁻¹ this offsets $1.1-$1.4 m in energy spend on a 50 000 m² façade over ten years. Maintenance labor follows a power-law curve: premium suppliers’ coil-coating systems reduce fade-related repainting cycles from 8-10 years to 15-18 years, trimming labor cost exposure $2.3-$3.1 per m² each cycle. Spare-parts logistics is increasingly a landed-cost risk: OEMs that regionalise coil and core inventory in ASEAN or GCC hubs compress emergency replacement lead time from 35-42 days to 8-12 days and cut expedited freight premiums 4-6 % of panel value. Resale value is emerging as a balance-sheet item; panels with third-party cradle-to-cradle certification currently trade at 28-34 % of original cost in secondary markets versus 8-12 % for non-certified stock, improving IRR on façade assets 140-190 bps.

Hidden Cash Outflows

Installation, training and duties can add 22-30 % to FOB price in a typical cross-border project. The table below quantifies these hidden cost buckets for three sourcing archetypes used by Fortune 500 real-estate portfolios.

| Cost Component | Low-Cost Asia Supplier (FOB Shanghai) | Mid-Range EU Producer (FOB Hamburg) | Premium Global OEM (FOB Busan) |

|---|---|---|---|

| FOB unit price index | 100 | 118-124 | 135-142 |

| Installation aids (rails, brackets, sub-frame) | 14-16 % | 10-12 % | 8-10 % |

| Specialist crew training & certification | 3-5 % | 2-3 % | 1-2 % |

| Import duties & trade remedies (weighted avg) | 12-15 % | 4-6 % | 6-8 % |

| Inland freight to site (1 000 km radius) | 5-7 % | 3-4 % | 4-5 % |

| Total hidden add-on | 34-43 % | 19-25 % | 19-25 % |

| Five-year NPV index (8 % discount) | 100 | 92-96 | 89-93 |

The low-cost Asia route shows the highest sticker discount but the worst total landed economics once installation complexity and tariff exposure are modelled. EU and premium Asian OEMs converge on a 19-25 % hidden add-on, yet the premium tier recoups 4-6 % through lower energy and maintenance outlays, yielding the lowest five-year NPV in most sensitivity runs.

Sourcing Implications

CFOs should lock energy-efficiency covenants into supply agreements—each 0.01 W m⁻² K⁻¹ improvement is worth $55k-$80k per 10 000 m² over ten years at current EU energy prices. Negotiate frame-and-fastener kits as bundled FOB items to cap installation creep at 10 % instead of the 14-16 % spot-buy range. Finally, insist on resale-value guarantees: a 25 % buy-back clause at year-10 reduces the effective cost of capital 90-110 bps and converts ACP from an expense to a residual-value asset on the balance sheet.

Risk Mitigation: Compliance Standards (USA/EU)

Critical Compliance & Safety Standards: Importing ACP Panels into the US & EU

Non-compliant shipments are seized at the border, destroyed at the importer’s cost, and trigger fines that start at $50k–$80k per container for first-time violations; repeat offenses escalate to $250k–$500k plus criminal liability under the U.S. Consumer Product Safety Improvement Act and the EU Market Surveillance Regulation. A single detention can erase the margin on 8–10 standard 40-ft loads, so every sourcing contract must embed the exact standards below and make certification expiry a material breach event.

United States: Mandatory Fire, Mechanical & Chemical Standards

The Department of Commerce’s anti-dumping order on Chinese ACP (AD/CVD case C-570-058) already adds $1.12–$1.94 per m² in cash deposits; failure to file the required CBP entry certification (Form 7501, Block 39) automatically doubles that rate. Beyond trade remedies, three technical gatekeepers control market access. NFPA 285 full-wall assembly fire testing is compulsory for any panel used above 40 ft; a 2023 Miami-Dade County enforcement sweep invalidated 42 projects whose suppliers had only the obsolete ASTM E84 surface-burn certificate, forcing façade replacements averaging $2.8m per tower. UL 508A applies when panels incorporate integrated LED or HVAC cut-outs—importers must obtain a UL field-label at $4k–$6k per production lot or face OSHA “Serious” citations (29 CFR 1910.303) that start at $16,131 per incident. Finally, TSCA Section 6(h) now restricts decaBDE flame retardants to ≤ 1,000 ppm; random CBP laboratory pulls show 14 % of South-East Asian lots still exceed the limit, creating mandatory TSCA certification costs of $0.18–$0.24 per m² and a 3–6 week detention window that can add $0.40 per m² in demurrage alone.

European Union: CPR, CE+CPR & REACH Convergence

Since 1 July 2013, the Construction Products Regulation (EU 305/2011) classifies ACP under AVCP System 1+, requiring notified-body intervention every 18 months and FPC audits that cost €12k–€18k per factory line. Importers must secure a Declaration of Performance (DoP) referencing EN 13501-1 fire classification; missing or mis-classified panels (e.g., selling Class B when Class A2 is specified) constitute an unfair commercial practice under Directive 2005/29/EC and expose directors to personal fines up to €5m or 4 % of EU turnover. REACH Annex XVII restricts ≥ 0.1 % formaldehyde emission; enforcement in 2024 led to the RAPEX withdrawal of 22 ACP SKUs, with logistics and destruction costs averaging €0.9m per SKU. If panels carry anodic-layer coatings, RoHS 2 (Directive 2011/65/EU) limits cadmium to 0.01 %; border labs reject 8 % of Asian coils on this point, and re-work in the EU adds €1.30–€1.70 per m². Finally, Machinery Directive 2006/42/EC applies when panels form part of a prefabricated façade unit with moving vents; CE conformity must be affixed before customs clearance, or the shipment is re-declared as “incomplete machinery,” attracting a €25k–€50k penalty and a minimum 90-day approval cycle.

Cost & Risk Comparison Matrix for US vs EU Entry

| Cost / Risk Driver | US (NFPA 285 + UL 508A + TSCA) | EU (CPR A2-s1,d0 + REACH + RoHS) | Delta (EU minus US) |

|---|---|---|---|

| Initial certification outlay (per factory) | $55k – $75k | €65k – €90k | +18 % |

| Ongoing audit / retest (annual) | $18k – $25k | €28k – €38k | +52 % |

| Border detention probability (2024 CBP / OLAF) | 6.3 % | 8.7 % | +2.4 pp |

| Average detention time (calendar days) | 12 – 18 | 21 – 30 | +9 days |

| Financial exposure per 40-ft container (1st violation) | $50k – $80k | €60k – €100k | +25 % |

| Directors’ personal liability cap | None (unlimited) | €5m or 4 % EU turnover | Statutory cap |

| Time to re-certify after formulation change | 8 – 12 weeks | 14 – 20 weeks | +6 weeks |

The table shows that EU compliance carries a 20–50 % cost premium and longer lead-times, but offers a quantifiable personal-liability ceiling; the US regime is cheaper to enter yet legally open-ended. Procurement teams should price $0.35–$0.55 per m² into landed cost for either jurisdiction and insert dual-standard clauses that shift detention expenses back to the supplier plus 2 % of purchase value per week after day 15.

The Procurement Playbook: From RFQ to Commissioning

Strategic Procurement Playbook: ACP Panel Manufacturers

RFQ Drafting: Lock-in Technical & Commercial Variables

Anchor the RFQ to two non-negotiables: fire-grade core classification (A2 ≥ 70 % mineral fill) and coating warranty (≥ 20 yr PVDF or ≥ 15 yr FEVE). Specify tolerances (panel thickness ±0.1 mm, PE film 50 ±5 µm) and lot-level traceability (coil ID, shift stamp, lab test QR code). Require bidders to submit raw-material index formula (Al ingot LME 3-month + 12 % conversion + freight) with price validity 90 days max; any index revision > 8 % triggers automatic re-quote. Insert capacity cap clause: supplier must allocate ≥ 30 % of monthly ACP output to your PO book for the contract duration; failure entitles buyer to 3 % FOB value rebate per forfeited container. Ask for ESG data pack: ISO 14064-1 verified CO₂e per m² (median 4.9 kg) and renewable energy share (target ≥ 40 %).

Supplier Screening & Sampling

Run a three-layer filter: (1) credit rating (S&P equivalent ≥ BBB- or Dun & Bradstreet 2A2), (2) litigation check (zero fire-code class-action in last 5 yr), (3) bonding capacity (export credit insurance ≥ USD 5 M). Commission third-party panel test (ASTM E84, EN 13501-1, NFPA 285) at bidder cost; failure on any test voids sampling stage and triggers USD 15 k–25 k liquidated damages. Short-list only plants with in-house coil coating line; toll-coaters add 2.3 % margin volatility and 4-week lead-time extension.

Factory Acceptance Test (FAT) Protocol

FAT is executed before 30 % balance payment. Table below benchmarks pass-fail thresholds and risk cost if thresholds are missed.

| Parameter | Accept Range | Re-test Cost (USD) | Downstream Risk if Failed | Mitigation Clause |

|---|---|---|---|---|

| Peel strength (N/mm) | ≥ 7.0 | 3 k – 5 k | Delamination at −20 °C | 5 % price retention until field audit |

| Impact resistance (kg/cm) | ≥ 5.0 | 2 k – 4 k | Faerie dents on site | Free 2 % replacement panels |

| Coating gloss 60° | 25 – 35 GU | 1 k – 2 k | Aesthetic mismatch | Re-roll at supplier cost + freight |

| Salt spray (h) | ≥ 1 000 h | 6 k – 8 k | Coastal corrosion | Extend warranty by 3 yr |

| Fire propagation ΔT | ≤ 70 °C | 10 k – 12 k | Code rejection | Full lot buy-back + 10 % penalty |

Contract Risk Allocation: FOB vs DDP

Choose FOB Qingdao when buyer controls ocean consolidation (saves USD 0.9 – 1.4 / m² versus DDP) and has marine insurance cover; insert seller late-delivery penalty 0.5 % FOB value per day after LC-shipped date + 7 days grace. Select DDP jobsite Europe if project tolerates 6 – 8 % landed premium but demands single-point liability; cap seller’s demurrage risk at USD 400 per container per day after 48 h free-time. Either way, embed force-majeure carve-out: aluminum alloying element export ban (China HS 7606) shifts price adjustment burden to supplier up to 12 % of contract value.

Logistics & Final Commissioning

Mandate VCI film + corner boards + 5-angle steel crate (loss rate < 0.3 %). GPS tracker inside every 5th crate reduces pilferage risk from 1.1 % to 0.2 %. Upon arrival, run random 1 % panel spectroscopy; deviation > 2 % on Mg or Si content triggers lot quarantine and USD 50 k–80 k replacement expedite cost borne by supplier. Final commissioning sign-off is conditional on installation contractor’s joint sealant compatibility letter; absence delays retention release by 45 days and accrues 1 % invoice interest.

Execute the above checklist to compress supplier-induced variance to < 3 % of total installed cost while keeping schedule float within 2 weeks on a 12-month EPC timeline.

⚡ Rapid ROI Estimator

Estimate your payback period based on labor savings.

Estimated Payback: —