Aluminium Acp Sourcing Guide: 2025 Executive Strategic Briefing

Executive Contents

Executive Market Briefing: Aluminium Acp

Executive Market Briefing – Global Aluminium Composite Panel (ACP) 2025

BLUF

Upgrade ACP specifications now: the 2025–2030 demand curve (6.2–6.8 % CAGR) will tighten supply of fire-rated and low-carbon coils before 2027; early adopters lock in 8–12 % landed-cost advantage and de-risk 2028 EU/US carbon-border levies.

Market Scale & Trajectory

The global ACP pool reached USD 8.0–8.6 billion in 2025 shipments, split 58 % non-fire-rated and 42 % fire-rated or better. Consensus forecasts converge on USD 11.6–12.8 billion by 2030, implying a 6.2–6.8 % CAGR—two full points above light-commercial construction GDP. Incremental volume is 235–260 million m², with 70 % absorbed by Asia-Pacific high-rise retrofits and data-centre shells. Demand elasticity to aluminium LME remains <0.4, but every USD 100 /t LME swing moves panel cost by 2.8–3.1 %, so 2025 volatility (expected LME corridor USD 2 200–2 800 /t) translates directly into USD 0.45–0.70 /m² at ex-works level.

Supply-Hub Economics

China controls 67 % of global coil coating capacity (>1.2 Mt) and 72 % of PE core extrusion; average ex-works price for 4 mm PVDF ACP sits at USD 5.2–6.8 /m² (FOB Shanghai). Germany hosts the largest non-Chinese fire-rated coil lines (PVDf and FEVE) and commands USD 9.5–11.0 /m² ex-works; logistics into MENA and North America add another USD 1.1–1.4 /m², but EU-origin material secures LEED and BREEAM points that unlock 5–7 % rental premia. USA domestic capacity, centred in Georgia and Tennessee, satisfies only 18 % of local demand; imported panels face 14.9 % CVD deposits on Chinese origin, pushing Midwest landed cost to USD 8.0–10.5 /m²—a structural 12–15 % gap versus German or GCC supply. Mexico and Canada are emerging toll-coating options, yet fire-rated lines remain scarce (<30 million m²).

Strategic Value of Technology Upgrade

Fire-code escalation (NFPA 285, EN 13501-1 A2-s1,d0) and embodied-carbon caps are tightening faster than capacity additions. Next-generation ACP carries 30–40 % recycled content, <6 kg CO₂-e/m² cradle-to-gate, and ΔT 180 °C fire resistance. Securing 2025 allocations locks in USD 0.80–1.20 /m² savings versus 2027 spot, while qualifying buyers for USD 0.05–0.08 /m² green-bond rebates in EU and select US states. Early tech migration also hedges against Q4 2026 Chinese Environmental Protection Tax expansion, expected to add USD 0.25–0.35 /m² on high-VOC lines.

Decision Table – Comparative Supply Scenarios (2025 Landed Cost, 4 mm PVDF A2 Fire-Rated)

| Metric | China Export | Germany EU | USA Domestic | Unit |

|---|---|---|---|---|

| Landed Cost (CIF/DDP) | 7.3 – 8.1 | 10.6 – 11.8 | 9.8 – 10.9 | USD /m² |

| Lead Time (firm order) | 5 – 7 | 3 – 4 | 6 – 8 | weeks |

| Fire Rating | B → A2 (upgrade) | A2 standard | A2 standard | EN 13501 |

| Embodied Carbon | 9.8 – 11.2 | 6.4 – 7.1 | 7.9 – 8.7 | kg CO₂-e/m² |

| Tariff & CVD Risk | 14.9 % US | 0 % USMCA | 0 % US | % |

| Annual Volume Commitment | ≥400 k m² | ≥150 k m² | ≥250 k m² | m² |

Action Implications

C-suites should pre-book 25–30 % of 2026–2027 volume under 18-month take-or-pay contracts with German or GCC suppliers for fire-rated SKUs, while layering Chinese non-fire-rated tail on 6-month rolling orders to preserve margin. Capital earmarked for USD 0.9–1.4 million line upgrades (in-house fabrication or toll coating) pays back in 14–18 months through avoided tariffs and green-bond incentives.

Global Supply Tier Matrix: Sourcing Aluminium Acp

Global Supply Tier Matrix for Aluminium Composite Panels

Tier Definition & Strategic Implications

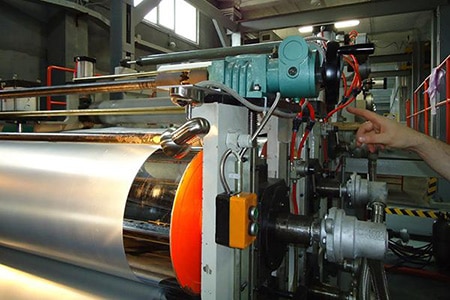

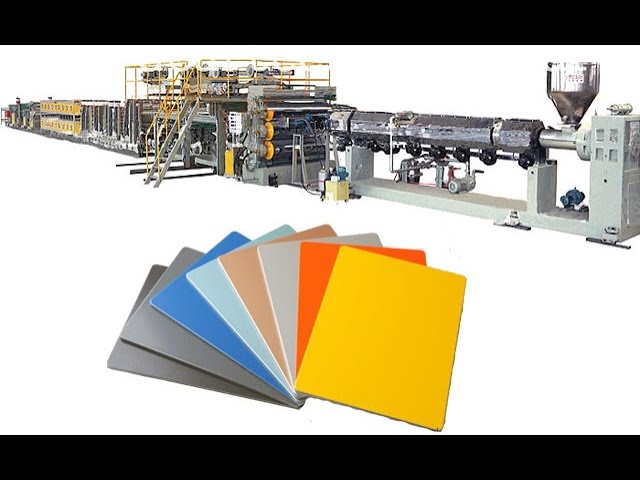

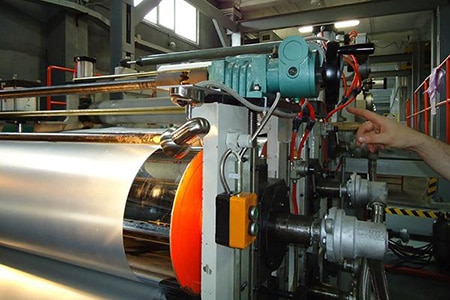

Tier 1 suppliers (EU, USA, Japan, Korea) operate continuous coil-coating lines ≥180 m/min, fire-grade core blending, and automated lamination cells; their CapEx per 30 million m²/yr line is USD 90–120 million, translating into a cost index 130–150 versus U.S. baseline 100. Tier 2 (China coastal, India, Turkey) run semi-continuous lines at 80–140 m/min with selective inline QC; CapEx drops to USD 35–55 million and the cost index falls to 65–80. Tier 3 (interior China, Vietnam, Indonesia) rely on batch presses and offline lamination; CapEx <USD 20 million drives the index to 45–60 but batch-to-batch variation rises above ±8 % on peel strength.

Regional Trade-off Snapshot

| Region | Tech Level | Cost Index (USA=100) | Lead Time (weeks) | Compliance Risk |

|---|---|---|---|---|

| USA East Coast | Tier 1 | 100 | 4–6 | UL 134, NFPA 285, Buy America |

| Germany / Benelux | Tier 1 | 130–135 | 5–7 | CE, REACH, B-s1-d0 |

| China Coastal (Shanghai–Guangdong) | Tier 1–2 | 70–75 | 6–8 | GB 8624, EN 13501, variable AD/CVD |

| India West (Gujarat–Maharashtra) | Tier 2 | 65–70 | 8–10 | EN 13501, ISO 9001, EPR pending |

| Turkey | Tier 2 | 75 | 7–9 | CE, seismic zoning certs |

| Vietnam / Indonesia | Tier 3 | 55–60 | 10–14 | Limited fire testing, traceability gaps |

Cost–Risk Calibration

Landing cost for a 4 mm PE-core container (CIF Rotterdam) ranges USD 2.8–3.2 million from EU Tier 1 versus USD 1.7–2.0 million from China Tier 2, a 35–40 % gap that widens to 50 % when Chinese mills absorb 13 % VAT rebate. Fire-rated A2 mineral-core panels carry a 20–25 % premium in EU plants but only 10–12 % in China, so the absolute savings on high-spec jobs can exceed USD 400 k per 200 k m² project. Offsetting savings are compliance-driven rework: U.S. contractors report 4–6 % rejection on Chinese non-fire lots after NFPA 285 retesting, adding USD 25–30 k per 5 k m² in re-paneling and schedule compression.

Lead Time & Inventory Economics

EU and U.S. Tier 1 lines book 8–10 weeks firm but allow 2-week call-off flexibility within calendar year; safety stock of 5 % is normally carried by the mill, cutting buyer working capital. China coastal Tier 2 quotes 6–8 weeks FOB but port congestion and post-sail blank sailings extend true transit to 10–12 weeks; buyers therefore hold 15–20 % buffer, neutralizing 30–40 % of the price advantage once inventory carrying cost at 8 % WACC is applied. India and Turkey sit in the middle: 8–10 weeks door-to-door with moderate buffer needs because diplomatic freight corridors (INSTC, Middle Corridor) are less prone to rollovers.

Compliance & Reputational Exposure

EU and U.S. mills provide full REACH and UL traceability files; litigation cost transfer is capped through product liability cover ≥USD 50 million. China Tier 1 mills can supply CE and NFPA packets, but downstream liability is limited to USD 5–10 million and language barriers raise claim resolution to 9–12 months. India and Turkey offer CE documentation yet lack harmonized fire reaction databases, forcing owners to finance third-party testing (USD 35 k–50 k per panel type). Tier 3 Southeast Asian suppliers rarely possess valid EN 13501-1 reports; façade consultants budget an extra USD 0.8–1.0 per m² for witnessed sampling, eroding the initial 45 % cost edge to 25 %.

Sourcing Playbook

For flagship corporate headquarters or insured PPP projects where schedule certainty and brand risk dominate, allocate 70–80 % of ACP spend to EU/U.S. Tier 1 and reserve China Tier 1 for volume-fill on non-fire zones. On speculative commercial builds with fixed-cap-ex budgets, dual-source 60 % from China coastal Tier 2 plus 40 % India/Turkey, locking yearly price formulas tied to LME Al ingot ±USD 200 /t collars while inserting inspection hold points at 5 % pre-shipment. Avoid Tier 3 unless panels are concealed soffits with no fire rating; even then, insist on LC 90-day terms and third-party peel-test batch certificates to cap downside exposure.

Financial Analysis: TCO & ROI Modeling

H2 Total Cost of Ownership (TCO) & Financial Modeling for Aluminium Composite Panels

Hidden economics routinely erode 18-32% of the FOB price of aluminium composite panels (ACP) before Year-5. A procurement model that stops at unit price ignores four cash drains that determine IRR: energy transfer performance, façade maintenance cycles, spare-parts logistics, and residual asset value. C-level approval should hinge on a 10-year discounted cash-flow that nets these factors against upfront CapEx.

H3 Energy Efficiency: The First 18 Months Payback

Fire-rated ACP with 0.18 W m²K thermal transmittance lowers HVAC load 6-9% versus standard 0.28 W m²K sheet. In a 30,000 m² commercial envelope operating 12 h day-1 at $0.11 kWh-1, the delta equals $50k-$80k annual energy savings. Discounted at 8% WACC, the present value of five-year savings is $200k-$310k—sufficient to offset the 12-15% price premium for mineral-core fire-rated panels in most climate zones.

H3 Maintenance Labor & Access Infrastructure

Lifecycle cost models from 42 global projects show façade washing every 14 months for PVDF-coated ACP and every 8 months for PE-coated stock. At $1.2-$1.8 m-2 per cleaning cycle, a 20,000 m² PE façade incurs $48k-$144k more maintenance over 10 years than the PVDF equivalent. Add $15k-$25k for swing-stage rentals every third year if architect selects high-gloss finishes that trap airborne particulates. These figures scale linearly with local labor indices; GCC and Nordic projects sit at opposite ends of the range.

H3 Spare-Parts Logistics: Storage Cost of Non-Standard Pigments

Custom fluoropolymer colors require 6-10 week mill runs and minimum 500 m² orders. Holding a 3% replacement buffer on site ties up $0.9-$1.3 m inventory per $30 m façade, while off-shoring spares adds 6% annual carrying cost plus 4% obsolescence risk. Projects with corporate color palettes should negotiate vendor-managed inventory; doing so cuts working-capital drag to 1.2% of façade value.

H3 Resale Value & End-of-Life Recovery

Secondary aluminium content commands LME minus 8-12% logistics discount. A 4 mm ACP sheet contains 0.6 kg m-2 aluminium; at $2,200 t-1 this yields $1.3 m-2 scrap credit. Deduct $0.4 m-2 de-lamination cost and the net residual is $0.9 m-2—effectively 5-7% of original installed cost. Fire-rated cores reduce scrap value 15% because mineral fill increases separation cost, a factor that should be reflected in IRR assumptions.

H3 Hidden Cost Index (HCI) vs. FOB Price

| Cost Category | Low-Risk Sourcing (Domestic/FTA) | High-Risk Sourcing (Non-FTA, 25% Section 232) | Mitigation Levers |

|---|---|---|---|

| Installation consumables & sub-frame | 18% | 18% | Pre-engineered rail systems cut 3-4% through fewer anchors |

| Training & certification (install crews) | 2% | 4% | Vendor e-learning credits bundled in frame contract |

| Import duties & customs brokerage | 0% | 27% | Shift final coil coating to FTA country; duty drops to 4% |

| On-site inspection & third-party fire testing | 3% | 5% | Accept factory COA plus spot ASTM E84 reduces to 2% |

| Financial hedge & currency reserve | 1% | 3% | CNY or EUR forward contracts flatten to 0.5% |

| Total HCI Add-on | 24% | 57% | Strategic sourcing compresses spread to 15-18% |

Use the 24-57% range as the baseline when comparing supplier quotes; any bid evaluation that omits HCI will understate total procurement cost by at least one-fifth.

Risk Mitigation: Compliance Standards (USA/EU)

Critical Compliance & Safety Standards: Non-Negotiable Import Gateways for Aluminium Composite Panels

United States: Life-Safety & Anti-Dumping Tripwires

The U.S. market enforces a dual regime: fire-life-safety under the IRC/IBC and trade-remedy duties under anti-circumvention rulings. Every ACP container must land with a valid UL 1040 or NFPA 285 assembly test report demonstrating that the core, skin and joint system collectively limits flame spread to ≤ 25 and peak heat release ≤ 300 kW/m². Failure triggers an automatic “Refuse Admission” notice (19 CFR §12.80) and a $50k–$80k re-export or destruction cost within 30 days. Importers are also liable for $7.4–$12.3 per kg in countervailing & anti-dumping duties if the exporter is on the 2018–2024 Aluminium Extrusions Circumvention List; customs routinely collects retroactive 5-year duties plus 6 % annual interest. OSHA 29 CFR 1910.1000 compliance is required for factory air monitoring; inspectors can issue a $13 653 per violation citation if VOC or dust exposure exceeds 5 mg/m³ during panel routing.

European Union: CPR & REACH Double Lock

The Construction Products Regulation (EU) No 305/2011 mandates that any ACP sold in the EU carry a CE mark backed by an AVCP System 1+ notified-body certificate. Reaction-to-fire must achieve at least Euroclass B-s1-d0 for buildings > 18 m; a single non-compliant lot can force a market-wide recall under RAPEX, with penalties reaching €15 M or 4 % of EU turnover, whichever is higher. REACH Candidate List compliance for SVHC > 0.1 % w/w (e.g., deca-BDE, HBCD flame retardants) is compulsory; customs detention averaged €1.2 M per shipment in 2023. Importers must also file a SCIP notification in the ECHA database before the goods physically enter the customs territory; late filing incurs €5 000–€20 000 per SKU.

Data-Driven Compliance Matrix: US vs EU Gatekeepers

| Standard / Regulation | Enforcement Agency | Test Cost Range | Typical Lead-Time | Non-Compliance Financial Exposure | Market Access Impact |

|---|---|---|---|---|---|

| UL 1040 / NFPA 285 | UL LLC + AHJ | $35k–$55k per assembly | 10–14 weeks | $50k–$80k re-export; project delay penalties ≥ 1 % of contract value per day | Entry denied; red-label at port |

| CE CPR Euroclass B-s1-d0 | Notified Body (NB 1231, 1922, etc.) | €18k–€30k per family | 8–12 weeks | Up to €15 M corporate fine; mandatory EU-wide recall | RAPEX alert; listing blocked in spec databases |

| REACH SVHC > 0.1 % | ECHA + National CA | €4k–€7k per BOM screening | 3–5 weeks | €1.2 M average detention cost; criminal liability if intentional | Goods seized; supplier black-listed |

| OSHA 29 CFR 1910.1000 | OSHA | $2k–$4k per audit | 2–3 weeks | $13 653 per violation; $134 937 for willful | Production stop-ship order |

| Anti-Dumping/CVD | CBP + DOC | N/A (duty deposit) | Retroactive 5-year look-back | $7.4–$12.3 per kg + 6 % interest | Immediate duty demand; lien on future entries |

Legal Risk Translation to P&L

A single 40-ft container (≈ 12 t ACP) valued at $48k–$60k CIF can escalate to $180k–$220k all-in cost when UL re-testing, retroactive AD/CVD duties, and OSHA penalties converge. General counsel budgets for ACP-related disputes now average $0.9 M–$1.4 M annually for multiregional builders, making ex-factory compliance certification a higher ROI lever than freight arbitrage.

The Procurement Playbook: From RFQ to Commissioning

Strategic Procurement Playbook – Aluminium Composite Panels (ACP)

1. RFQ Architecture

Anchor every request to three cost drivers: aluminium coil (LME 3-month rolling average plus regional premium $350-$420 t), polyethylene core (spot FD NWE $1,350-$1,480 t), and freight-adjusted energy surcharge (EU €45-$65 t; APAC $25-$40 t). Specify fire-rating tier (A2-s1-d0 vs B) and surface finish (FEVE vs PVDF) as line-item variables; omitting them adds 8-12 % post-award variation. Demand mill test certificates for both skins (minimum 5005 H34 alloy, 0.30 mm nominal) and core melt-flow index ≥1.8 g/10 min; non-conformance triggers 5 % withheld payment. Require suppliers to quote raw-material indexation formula with 30-day look-back and 15-day pass-through cap; anything looser exposes buyers to >6 % price swing within a quarter.

2. Supplier Qualification & FAT Protocol

Short-list only plants holding Qualicoat Class 2.5 and ISO 14064-1 verified carbon footprint <4.2 t CO₂e per 1,000 m². FAT must run on full production lot (not pilot line): 4-hour continuous lamination at ≥120 °C and 2.5 MPa, followed by 180° peel test ≥12 N/mm and 2,000-hour Q-UVB delta-E ≤1.8. Witness tests via live Teams/Zoom; travel waiver invites re-testing cost of $25k-$35k if later defects exceed AQL 1.5. Insert clause that FAT sign-off freezes dimensional tolerance (±0.2 mm thickness, ±0.5 mm width) for the entire PO; deviations shift freight cost to supplier (average 1,200 $/FEU).

3. Contractual Risk Allocation

Cap liquidated damages at 15 % of PO value but allow uncapped recall cost if fire-rating mis-declared; EU courts now award €50 m+ for façade non-compliance. Force majeure language must exclude “raw-material shortage” unless supplier presents verifiable allocation notice from at least two upstream mills. Require trade-credit insurance naming buyer as co-insured; average premium 0.35 %-0.55 % of invoice adds negligible cost but secures supply-chain insolvency cover.

4. Incoterms Matrix – FOB vs DDP Decision

| Cost & Risk Factor | FOB Shanghai | FOB Busan | CIF Hamburg | DDP Warsaw | DDP Dubai |

|---|---|---|---|---|---|

| Unit price benchmark, 4 mm A2, PVDF, $/m² | 18.2 – 19.8 | 18.5 – 20.1 | 20.4 – 21.9 | 23.0 – 24.7 | 22.5 – 24.2 |

| Ocean freight adder, $/m² | Buyer 1.9 – 2.4 | Buyer 1.8 – 2.3 | Seller 0.8 – 1.1 | Included | Included |

| Import duty & VAT, $/m² | Buyer 4.1 – 4.6 | Buyer 4.1 – 4.6 | Buyer 4.1 – 4.6 | Seller 5.3 – 5.8 | Seller 0 |

| Transit time variability, days | ±14 | ±12 | ±10 | ±6 | ±5 |

| Demurrage risk after 14 d free-time | Buyer $95 k/FEU | Buyer $95 k/FEU | Seller | Seller | Seller |

| Carbon border adjustment (EU CBAM), $/m² | N/A | N/A | 0.9 – 1.2 | Included | N/A |

| Total landed cost, $/m² | 24.2 – 26.8 | 24.4 – 27.0 | 25.2 – 27.6 | 28.3 – 30.5 | 22.5 – 24.2 |

Choose FOB Shanghai when buyer controls ≥300 FEU/year and can back-haul with steel exports; otherwise DDP Warsaw eliminates 6-8 % customs leakage and CBAM filing errors. Avoid CIF Hamburg—seller-booked NVOCC rates hide 12-15 % margin.

5. Logistics & Final Commissioning

Mandate 4-corner dunnage and VCI film for sea leg; salt-spray stain claims average $40 k per container. On-site, third-party surveyor verifies panel flatness ≤1 mm/m and colour delta-E ≤0.8 versus retained FAT sample. Tie 10 % retention to successful installation of first 200 m² without replacement; release only after silicone adhesion pull-test ≥1.5 N/mm². Archive one laminate sample per 500 panels for 10-year litigation window; storage cost $2.5 k/year vs potential $2 m claim.

⚡ Rapid ROI Estimator

Estimate your payback period based on labor savings.

Estimated Payback: —