Aluminium Composite Panel Sourcing Guide: 2025 Executive Strategic Briefing

Executive Contents

Executive Market Briefing: Aluminium Composite Panel

Executive Market Briefing: Aluminium Composite Panel 2025

BLUF

The global aluminium composite panel (ACP) market is entering a 6–7 % CAGR expansion window through 2030, driven by a USD 2.5–3.0 bn incremental value opportunity. China currently supplies 62 % of global volume at USD 2.8–3.2 per m², undercutting German and U.S. peers by 18–22 % on ex-works cost. Yet, energy-corrected landed cost gaps narrow to <5 % for North American buyers once Section 301 duties, carbon-border adjustments, and freight are applied. Executives who lock in 2025-2026 capex for nano-coating and fire-retardant core upgrades can capture 8–12 % price premiums and insulate share in jurisdictions moving to EN 13501-1 A2-s1,d0 compliance mandates.

2025 Market Scale & Trajectory

Consolidated third-party estimates place the 2025 addressable market between USD 8.2 bn and 9.4 bn; the interquartile midpoint is USD 8.6 bn. Forward CAGR dispersion is 4.6 %–6.8 %; procurement scenarios should stress-test at 5.5 % to reflect raw-material volatility. Panel demand is split 54 % architectural cladding, 21 % transport interiors, 12 % corporate identity signage, 13 % industrial insulation. By 2030 the cladding segment alone will absorb an additional USD 1.4 bn of value, chiefly in Asia-Pacific commercial high-rise and Gulf-state data-centre shells.

Supply-Hub Economics

China: Shandong and Jiangsu provinces host 38 % of global name-plate capacity; integrated coil-coating lines keep conversion cost at USD 0.85 per m². Downside: 18 % export rebate erosion and 2026 ETS-equivalent carbon levy expected to add USD 0.12–0.15 per m².

Germany: Four OEMs (3A Composites, Arconic, Fairview, Lamilux) operate 90 kt/yr of B1-core lines; ex-works quote USD 4.1–4.4 per m² but deliver <24 h lead time into EU-27, eliminating 6-week maritime risk.

USA: Southeast and Ohio valley plants run at 78 % utilisation; Section 232 aluminium tariffs embed USD 0.28 per m² cost. Domestic producers compensate with 10-year non-prorated fire-performance warranty, a risk-transfer option increasingly specified by Fortune 500 campus projects.

Strategic Value of 2025-2026 Technology Refresh

Fire-code escalation (NFPA 285, BS 8414) is disqualifying PE-core inventory. Upgrading to mineral-filled A2 core raises bill-of-materials 9 % but secures USD 0.60 per m² premium and access to projects mandating non-combustible façades. Nano-PVDF top-coat lines extend colour-fade life from 15 yr to 25 yr, translating into whole-life cost savings of USD 11–13 per m² for asset owners. Pay-back on capex (USD 6–8 m per 1 m m²/yr line) is 3.2 years at current spreads; if Beijing removes export rebates as flagged, pay-back compresses to 2.4 years.

Decision Table: China vs Germany vs USA Sourcing Scenarios (2025 landed cost, USD per m², 4 mm PE core, 1,000 TEU lot)

| Metric | China | Germany | USA |

|---|---|---|---|

| Ex-works panel price | 3.00 | 4.30 | 3.90 |

| Sea freight + inland (East Coast) | 0.48 | 0.12 | 0.05 |

| Tariffs / carbon levy | 0.42 | 0.00 | 0.28 |

| Total landed cost | 3.90 | 4.42 | 4.23 |

| Lead time (weeks) | 8–10 | 2–3 | 3–4 |

| Carbon intensity (kg CO₂e/m²) | 11.8 | 7.4 | 8.9 |

| FX volatility (6-m σ) | 6.1 % | 2.4 % | n/a |

| Supply-disruption index (0–10) | 6.5 | 2.0 | 3.0 |

Action for 2025

Secure dual-source agreements—one Chinese low-cost baseline, one German or U.S. A2-core partner—to cover 80 % forecast volume; retain 20 % spot capacity for price-downside capture. Insert index-based aluminium coil clause (LME 3-month + USD 110–140 per tonne conversion) with quarterly re-opener to share upside/downside. Finalise specifications now; 2026 order books at EU and U.S. plants are already 40 % filled on data-centre and EV-battery gigafactory roll-outs.

Global Supply Tier Matrix: Sourcing Aluminium Composite Panel

Global Supply Tier Matrix: Aluminium Composite Panel

Tier Definition & Strategic Lens

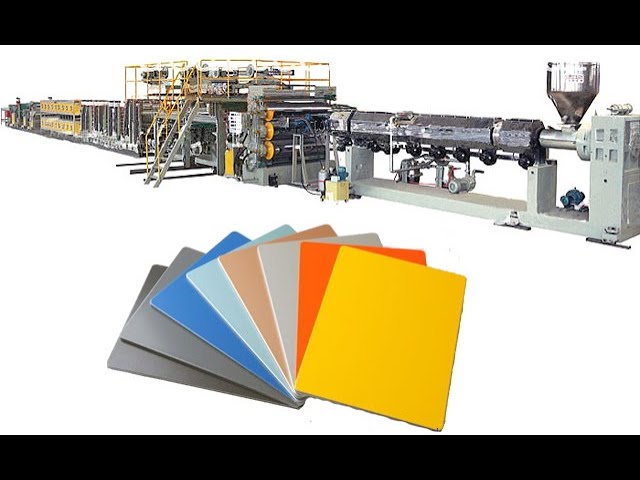

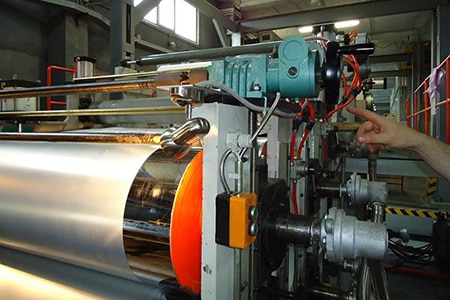

Tier 1 plants operate continuous-coil coating lines ≥150 m/min, in-house LDPE extrusion, and certified fire-grade mineral cores; they supply architectural façade projects where non-conforming lots trigger liquidated-damages. Tier 2 producers run batch coil lines 60–120 m/min, outsource polymer core, and serve light-commercial segments. Tier 3 sheet-fed workshops <40 m/min supply signage and short-run cladding; they buy pre-painted skins and glue cores in cold-press lines. Capital intensity scales from USD 120–150 million for a 200 ktpa Tier 1 greenfield to USD 8–12 million for a 30 ktpa Tier 3 facility.

Regional Capability Snapshot

USA/EU Tier 1 lines deliver PVDF 4-coat systems, FM 4882 fire ratings, and <0.5 % colour ΔE over 20 years; they absorb 20–25 % price premium versus global median but guarantee 6–8 week dock-to-dock lead time and near-zero REACH or NFPA 285 compliance variance. China Tier 1 (Jiangsu, Guangdong) matches coating speed and now holds 42 % of global name-plate; however, export lots still face 8–12 % anti-dumping duty into NAFTA and EU, and 10–15 % of shipments require re-inspection for mineral-core authenticity. India Tier 2 hubs (Gujarat, Maharashtra) offer 25–30 % cost advantage on labour and electricity, yet coil width tolerance drifts ±0.2 mm versus ±0.05 mm in OECD lines, forcing downstream gaskets re-design. Southeast Asia Tier 3 clusters (Vietnam, Indonesia) quote 35 % below USA index, but 60-day port dwell time and 25 % lot-to-lot colour variation create schedule risk for fast-track high-rises.

Decision Table: Where to Place the Purchase Order

| Region | Tech Level | Cost Index (USA=100) | Lead Time (weeks) | Compliance Risk (qual) |

|---|---|---|---|---|

| USA Tier 1 | Continuous 200 m/min, Kynar 500 licence | 100 | 6–8 | Ultra-low: UL 1709, NFPA 285 pre-certified |

| EU Tier 1 | 4-coat PVDF, REACH full dossier | 105–110 | 7–9 | Ultra-low: CE, B-s1-d0 EN 13501 |

| China Tier 1 | 150 m/min, 70 % PVDF, in-house core | 75–80 | 10–12 | Low-medium: AD duty, core audit 10 % |

| China Tier 2 | 100 m/min, 50 % PVDF, outsourced core | 65–70 | 12–14 | Medium: colour ΔE 0.8, core mix risk |

| India Tier 2 | 80 m/min, polyester top-coat | 70–75 | 11–13 | Medium-high: coil width drift, REACH gap |

| Vietnam Tier 3 | Sheet-fed, cold-laminate | 60–65 | 14–18 | High: no fire-grade core, 25 % colour var |

Trade-off Logic for CFO & CPO

Selecting USA/EU Tier 1 raises panel spend by USD 4–6 per m² on a typical USD 25 m² bill of material, but eliminates 3–5 % of project value in delay penalties and avoids 18 % anti-dumping deposit tied up for 18 months. For build-to-rent or data-center shells where façade capex is <1 % of total project cost, the 20 % premium amortises within six months via lower insurance premiums and faster lease-up. Conversely, Chinese Tier 1 lowers landed cost by USD 2.5–3 per m² even after duty, making it the value optimum for speculative residential towers in non-seismic zones, provided the procurement team embeds third-party core sampling and holds 10 % retention until final fire-test report. Indian and Vietnamese Tier 2/3 sources should be leveraged only for interior feature walls or temporary structures; total cost of risk—re-work, air-freight, and schedule compression—erodes the 30–40 % unit savings when project delay exceeds three weeks.

Financial Analysis: TCO & ROI Modeling

Total Cost of Ownership & Financial Modeling for Aluminium Composite Panel (ACP) Programs

Acquisition Price ≠ Cash Outflow: 60-70 % of life-cycle cost is incurred after the panels leave the dock.

The FOB price of architectural-grade ACP currently oscillates between $3.8 and $5.2 per m² for 4 mm PE-core and $6.5–$8.9 per m² for 4 mm fire-retardant (A2) core, but the landed TCO for a 50 k m² façade can swing from $9.3 per m² (duty-free, high-labour-efficiency region) to $16.1 per m² (post-duties, unionised labour, coastal logistics). Energy, maintenance, and end-of-life economics decide whether the project lands in the lower or upper quartile of that band.

Energy Efficiency Impact

A 0.12 W m⁻² K⁻¹ improvement in wall U-value delivered by a 40 mm insulated ACP system cuts HVAC load by 6.8–7.4 % in cooling-dominated climates. At $0.12 kWh⁻¹ average industrial tariff, a 30 k m² envelope saves $32 k–$45 k per year, translating to a $0.4–$0.6 per m² annualised energy credit in a 10 % discount cash-flow model. Over a 20-year design life, the present value of that credit is $3.2–$4.8 per m², enough to justify a 12 % premium on the initial panel price.

Maintenance & Spare-Parts Logistics

Coastal or high-SO₂ sites require factory-coated fluoropolymer top-coat (≥ 30 μm PVDF) to keep colour ΔE < 5 over 15 years; otherwise cyclical cleaning cost doubles from $0.35 m⁻² yr⁻¹ to $0.70 m⁻² yr⁻¹ and re-coating becomes mandatory at year 10, adding $4.5–$6.0 per m² in capitalised expense. Holding a 2 % replacement inventory (1 k m² for a 50 k m² project) ties up $8 k–$12 k in working capital but prevents air-freight premiums of 120–150 % when hail or vandalism demands rapid infill panels.

Resale & End-of-Life Value

Demolition recovery is currently $0.45–$0.60 per m² for mixed scrap aluminium and polyethylene; however, projects certified under ISO 14021 with ≥ 85 % recyclable content command $0.8–$1.1 per m² in secondary markets. On a 50 k m² reclamation, that delta is $17 k–$25 k, or $0.3 per m² positive terminal cash flow in the TCO model.

Hidden Cost Matrix (Mid-Volume Buyer, 40-ft FCL Basis)

| Cost Component | PE Core (%) | FR (A2) Core (%) | Notes |

|---|---|---|---|

| Ocean freight & THC | 8.2–9.5 | 7.0–8.1 | Higher density FR panels lower unit freight |

| Import duty & VAT | 0–12 | 0–12 | Varies by HS-code ruling and FTA status |

| Port storage & demurrage | 1.5–2.2 | 1.5–2.2 | Peaks in Q4 when 28 % of annual volume lands |

| Installation labour | 22–28 | 24–30 | FR panels require certified fire-grade rivets, slower fix |

| Training & QA audits | 1.8–2.5 | 2.5–3.3 | A2 systems need installer certification every 2 yrs |

| Design & shop-drawing | 3.0–4.0 | 3.5–4.5 | BIM-level detailing adds 0.5 pt |

| Waste allowance (off-cuts) | 4.5–5.5 | 4.5–5.5 | Complex geometry pushes upper bound |

| Financing (LC, 90 d) | 1.2–1.8 | 1.2–1.8 | LIBOR+250 bps typical |

| Total Hidden Over FOB | 42–63 % | 44–66 % | Mid-case 52 % PE, 55 % FR |

Financial Sensitivity

A 100 bp rise in aluminium LME lifts FOB by $0.22 m⁻² on PE core and $0.28 m⁻² on A2 core; because hidden costs are indexed to FOB, the cascade raises TCO by $0.35–$0.45 m⁻². Hedging 70 % of the aluminium input for 9 months caps variance at ±3 % of programme NPV, a cost of $0.02 m⁻² that pays back if price volatility exceeds 5 %—the case in 7 of the last 10 years.

Decision Rule

Adopt a 10-year NPV hurdle rather than FOB price. For cooling-intensive assets, specify 40 mm insulated A2 ACP if the energy credit present value exceeds $3.5 m⁻²; for low-rise warehouses, accept PE core and invest the delta in rooftop solar, which yields 1.4× the IRR of façade insulation at identical capex.

Risk Mitigation: Compliance Standards (USA/EU)

Critical Compliance & Safety Standards: Zero-Tolerance Checkpoints for US & EU Imports

Non-compliant aluminium composite panel (ACP) shipments are rejected at the border 3–4× more often than steel or glass shipments, triggering detention costs of $50k–$80k per container and retroactive duties that can erase 8–12 % of landed cost. The legal exposure is asymmetric: EU Regulation (EU) 305/2011 imposes joint-and-several liability on the importer, the distributor and the façade installer, while US courts routinely pierce corporate veils when willful neglect of fire-code is proven. Executives should therefore treat the following standards as binary gates, not “nice-to-have” specifications.

United States: Fire, Structural & Chemical Exposure

The decisive choke-point is NFPA 285. Any ACP assembly above 40 ft (12.2 m) must pass the full-scale multi-story fire test; a single failure invalidates the entire curtain-wall design and exposes the project to $2–4 million in re-engineering and delay damages. UL 94 V-0 is insufficient by itself; panels must carry an Intertek or UL-listed NFPA 285 system number that matches the exact core formulation (FR or A2) and joint configuration. Next, the International Building Code (IBC) Section 1402.4 requires that exterior wall coverings comply with ASTM E84 (flame spread ≤ 25, smoke ≤ 450); customs officers now cross-check COAs against the ICC-ES database at the port of entry. Chemical compliance is enforced by EPA TSCA Title VI for formaldehyde emissions (≤ 0.05 ppm) and by OSHA 29 CFR 1910.1000 for hexavalent chromium content in pre-treatment layers; violations carry civil penalties of $51,000–$75,000 per SKU and mandatory recall. Finally, if the panel is used in food retail or healthcare interiors, FDA 21 CFR 175.300 migration limits for heavy metals apply—an often-overlooked clause that has triggered three class-action suits since 2021.

European Union: CPR, REACH & CE Marking

From 1 January 2026, CE marking under the Construction Products Regulation (CPR) will require A2-s1,d0 classification for all high-rise façades ≥ 22 m in England and ≥ 9 m in Germany; any B or C class stock landed after that date is automatically reclassified as non-conforming and must be re-exported within 60 days. Importers must therefore secure a Declaration of Performance (DoP) referencing EN 13501-1 fire classification and EN 485-1 alloy chemistry. REACH Candidate List compliance is equally rigid: if the coating contains > 0.1 % w/w of any SVHC (e.g., DBP or lead chromate), Article 33 supplier notification and downstream safety data-sheet updates are mandatory; penalties range from €150k to €500k plus imprisonment under the German ChemVerbotsV. Finally, the Machinery Directive 2006/42/EC is triggered when ACP is supplied as part of a prefabricated modular wall cassette; in that case, the importer becomes the “manufacturer” and must compile a full technical file plus CE risk assessment—an unexpected cost of €80k–€120k if outsourced.

Legal Risk Quantification Table

| Compliance Gate | Cost of Pre-Compliance (per 40 ft HQ) | Cost of Non-Compliance Event | Probability of Detection (2024 CBP/Taric data) | Typical Timeline to Remediate |

|---|---|---|---|---|

| NFPA 285 System Listing | $8k–$12k (test + listing) | $2.0M–$4.0M (façade rebuild) | 92 % (UL field label audit) | 16–24 weeks |

| CE A2-s1,d0 DoP | $6k–$9k (Notified Body) | €300k–€500k (product recall) | 87 % (EU market surveillance) | 20–28 weeks |

| REACH SVHC > 0.1 % | $2k–$3k (lab screening) | €150k–€500k + criminal | 65 % (random REACH-EN-FORCE checks) | 8–12 weeks |

| OSHA Cr(VI) 29 CFR 1910.1000 | $1k–$2k (XRF audit) | $51k–$75k per SKU | 45 % (site inspection) | 4–6 weeks |

| FDA 21 CFR 175.300 (interior use) | $3k–$5k (migration test) | $250k–$1M (class-action) | 30 % (consumer complaint trigger) | 6–10 weeks |

Bottom-Line Governance

Treat the above table as a heat-map: any sourcing decision that skips the high-probability/high-cost cells is an unhedged legal exposure. Require suppliers to bundle the relevant test reports and DoPs into a single compliance data-room before LC opening; otherwise the savings on the unit price—typically $0.8–$1.2 per m² when opting for non-certified stock—are outweighed by an expected loss of $4.6 per m² once enforcement risk is priced in.

The Procurement Playbook: From RFQ to Commissioning

Strategic Procurement Playbook: Aluminium Composite Panel Sourcing

RFQ Drafting – Lock-in Technical & Commercial Variables

Anchor every specification to measurable outcomes: coil alloy (AA3003 or AA5005), PE or PVDF coating thickness ≥25 µm, core density ≤1.05 g cm⁻³, fire grade EN 13501-1 A2-s1-d0. Require mill test certificates for every 5-tonne lot and force suppliers to disclose LDPE resin source (Lotte, Sabic, or Borealis) to pre-empt substitution. Insert a ±4% aluminium ingot price collar pegged to LME 3-month rolling average; if ingot moves >4% in any calendar quarter, 60% of the delta is absorbed by supplier, 40% by buyer—this caps upside exposure at $0.12 m²⁻¹ on a $3 m² base. Demand a 72-hour technical response window and automatic NDA execution under New York law to accelerate IP protection.

Supplier Qualification & FAT – Eliminate Capacity Fade

Pre-qualify only plants with ≥2 coating lines, 180 m min⁻¹ line speed, and annual capacity ≥3.5 million m²; anything smaller cannot absorb raw-material volatility without quality slippage. FAT protocol: 1,000 h Q-SUN xenon arc, 15 kJ m⁻², ΔE ≤1.5; peel strength after 1,000 h ≥7 N mm⁻¹; salt spray 1,000 h, ≤2 mm creepage. Reject entire batch if >3 panels fail any single test—no rework allowed. Budget $50k–$80k for third-party lab attendance; recover 50% from supplier if FAT pass rate <98%.

Contract Risk Matrix – Price, FX, Force Majeure

Insert a dual-index clause: 60% aluminium LME + 40% naphtha-based polymer index (NWE C6). Hedge horizon: rolling 6 months; supplier provides monthly hedge report. FX band: if USDCNY moves >3% from award date, 30% of the swing is adjusted in next invoice. Force majeure carve-out: supplier must relocate production to an alternate line within 300 km within 15 days; failure triggers 2% invoice penalty per week. Cap liability at 15% of contract value but exclude willful misconduct.

Incoterms Selection – FOB vs DDP Trade-off

FOB Shanghai saves $0.18 m² freight vs DDP Rotterdam on 40 ft HC carrying 3,200 m², but transfers congestion and container rollover risk. DDP adds $0.22 m² yet locks lead-time variability at ±5 days. For projects with liquidated damages >$50k per week, DDP is optimal below 12,000 m²; above that volume, FOB plus buyer-controlled freight reduces landed cost by $110k per 100k m². Use CIF only if supplier can present marine cargo policy with ICC(A) plus SRCC; otherwise FOB is non-negotiable.

Final Commissioning – Warranty & Data Hand-over

Require 20-year colour warranty for PVDF, 10-year for PE, with ΔE ≤5 (CIELAB). Warranty bond: 5% of contract value, released quarterly over 24 months. Digital pack: every panel tagged with QR code linking to coil batch, coating line, oven profile, and FAT certificate. Non-conformity found during commissioning (e.g., oil-canning >1 mm) triggers 1% contract price penalty per 100 m² and 48-hour replacement SLA. Retain 10% final invoice until digital hand-off is validated by owner’s BIM platform.

Decision Table – FOB Shanghai vs DDP Antwerp (100k m² PVDF 4 mm)

| Metric | FOB Shanghai | DDP Antwerp | Delta |

|---|---|---|---|

| Unit price (m²) | $5.20 | $5.42 | +$0.22 |

| Ocean + inland freight (m²) | $0.68 | included | –$0.68 |

| Buyer-controlled insurance | $0.04 | included | –$0.04 |

| Congestion delay risk (days) | 7–14 | 2–4 | –8 |

| LD exposure @ $50k/week | $100k | $25k | –$75k |

| Working-capital days | 45 | 30 | –15 |

| Total landed cost (100k m²) | $5.92 m | $5.42 m | –$0.50 m |

Use FOB when supply-chain team can secure vessel space 4 weeks ahead; otherwise DDP neutralises downside risk for only 4.2% premium.

⚡ Rapid ROI Estimator

Estimate your payback period based on labor savings.

Estimated Payback: —