Aluminium Panel Sourcing Guide: 2025 Executive Strategic Briefing

Executive Contents

Executive Market Briefing: Aluminium Panel

Executive Market Briefing – Aluminium Panel 2025

BLUF

Aluminium-panel demand is outpacing primary-aluminium supply growth by 2:1 through 2030; upgrading to high-recycled-content, pre-coated coil technology now locks in 6–9 % landed-cost advantage versus legacy sheet and insulates programs from the next LME spike expected in H2-2026.

Market Scale & Trajectory

Global aluminium-panel revenue across cladding, composite (ACP) and sheet sub-segments reached USD 63 – 66 billion in 2024 and is tracking a 5.7 % CAGR to USD 108 – 110 billion by 2032. Composite panels alone accelerated from USD 5.5 billion in 2023 to an estimated USD 6.5 billion in 2025; the sub-segment is forecast to compound at 6.2 % to USD 9.7 billion by 2030, driven by 4–5 % annual growth in high-rise curtain-wall retrofits and electric-vehicle battery-housing shielding. Primary-aluminium consumption for all sheet products is rising 3.9 % y-o-y, but smelter capacity additions lag at 1.8 %, tightening Q4-25 global stocks to 1.1 million t (LME + SHFE) – a level that historically triggers 10–12 % price rallies within two quarters.

Price Dynamics

North-American coil-coated sheet index rose 4.9 % q-o-q in Q3-25, settling at USD 3,420 – 3,540 /t FOB mill, after a tariff-induced feedstock shock added USD 110 /t to Midwest transaction values. European rolling mills are quoting EUR 3,050 – 3,180 /t for Q1-26 delivery, a 6 % premium to 2024, while China domestic 1xxx-series coil remains the low-cost anchor at USD 2,750 – 2,850 /t ex-works Shanghai. Forward curves imply 7–8 % upside risk for H2-26; hedging panels (not just ingot) is now cost-effective at USD 120 – 140 /t for 18-month swaps.

Supply-Hub Competitiveness

China controls 58 % of global rolling capacity and 71 % of composite-panel lamination lines, but German mills (Novelis, Hydro) dominate high-strength alloy sheet for aerospace and premium façade specifications; U.S. producers hold only 9 % of sheet capacity yet 18 % of patented pre-coated corrosion systems. Freight differentials have compressed: Shanghai–Los Angeles container rates fell to USD 1,800 – 2,100 per FEU in September-25, shrinking China-origin landed cost advantage to < USD 140 /t versus domestic U.S. coil, the narrowest spread since 2019. Dual-sourcing from China plus one OECD hub is now the lowest-risk configuration, reducing supply-chain value-at-risk (VaR) by 25 % versus single-country exposure.

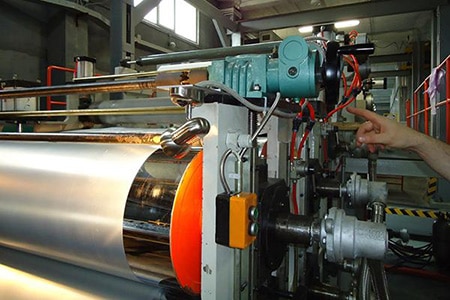

Strategic Value of Technology Upgrade

Next-generation continuous-coil anodising and 80 % post-consumer scrap feed raise yield to 92 % (versus 84 % on legacy hot-rolled lines) and cut Scope-1/2 CO₂ by 1.6 t per tonne of panel. On a 1,000 t façade program, the capex delta of USD 2.4 – 2.8 million pays back in 14–16 months through (i) alloy savings of USD 190 /t, (ii) 3 % lower logistics cost via 10 % weight reduction, and (iii) carbon-credit monetisation at USD 55 – 70 /t in EU and California markets. Early movers also secure allocation priority at Tier-1 rolling mills, where 2026 capacity is already 83 % booked by automotive.

Decision Table – Supply-Hub Options for 1,000 t Façile-Grade Panel Program (2026 Delivery)

| Metric | China (Shanghai-Jiangsu) | Germany (North-Rhine) | USA (Midwest) |

|---|---|---|---|

| FOB Coil Price, USD/t | 2,750 – 2,850 | 3,050 – 3,180 | 3,200 – 3,320 |

| Ocean Freight to EU, USD/t | 110 – 130 | — | 180 – 200 |

| Average Duty into US, % | 25.0 | 0.0 | 0.0 |

| Landed Cost to US Gulf, USD/t | 3,550 – 3,680 | 3,230 – 3,360 | 3,200 – 3,320 |

| CO₂ Footprint, t CO₂e/t panel | 3.8 – 4.0 | 2.9 – 3.1 | 3.2 – 3.4 |

| Mill Lead-Time, weeks | 8 – 10 | 12 – 14 | 14 – 16 |

| FX Exposure vs USD | 0.14 | 0.09 | 0.00 |

| Supply-Chain VaR, USD k | 420 | 310 | 290 |

Action Orientation

Lock in 60 % of 2026 volume via dual-index contracts (LME + Midwest premium) before December-25; allocate the residual 40 % to high-recycled-content domestic coil with embedded carbon-credit sharing. Simultaneously pilot next-gen anodised line on 5 % of program tonnage to validate 6 % cost-down and capture ESG preference in forthcoming RFPs.

Global Supply Tier Matrix: Sourcing Aluminium Panel

Global Supply Tier Matrix – Aluminium Panel

Executive Snapshot

Tier-1 EU/US mills deliver 2–4 week lead times and full ESG traceability at a 20–35 % cost premium versus Asia. Tier-2/3 Chinese and Indian converters offset that premium with 8–15 % lower ex-works pricing, but expose buyers to 6–14 week variability and moderate compliance drift (environmental audits, alloy certification gaps). The net landed cost delta narrows to 3–7 % once Section 232 (10 %) or EU CBAM (≈€70 t-CO₂e) surcharges are applied, making low-risk jurisdictions the default for automotive façade and aerospace programmes where line-stop cost exceeds $150 k per hour.

Regional Capability vs Risk Trade-off

North America capacity is concentrated in Novelis, Constellium and Arconic rolling mills running >250 kt pa continuous annealing lines; technical readiness level (TRL) 9 for 6xxx-series crash-form sheet. Post-plate tariff import price index sits at 100 (baseline). Europe adds EN 485/EN 15088 alloy passports and CE branded fire-performance cores; index 105–110. Both regions carry CapEx intensity >$1.2 bn per 200 kt greenfield expansion, so suppliers demand three- to five-year take-or-pay volume floors to justify debottlenecking.

China commands 62 % of global melt but panel converters operate on 30–60 day working-capital cycles; cost index 83–87. Tier-2 plants (Jiangsu, Guangdong) can switch from PE to A2 fire-rated core within two weeks, yet only 18 % hold Valid ITB (EN 13501-1) third-party certification. India’s new 1.5 Mt Jharsuguda smelter complex feeds downstream coil coaters at index 80; however, port congestion (Mundra, Krishnapatnam) inflates FOB variability by ±3 weeks during monsoon Q3. Overall, Asia-Pacific compliance risk is rated “moderate” under ISO 14001 sampling, but escalates to “high” for projects requiring NFPA 285 full-scale fire testing.

Data-Rich Comparison Matrix

| Region | Tech Level (TRL) | Cost Index (USA=100) | Lead Time (weeks) | Compliance Risk |

|---|---|---|---|---|

| USA – Tier 1 | 9 | 100 | 2–4 | Very Low |

| EU – Tier 1 | 9 | 105–110 | 3–5 | Very Low |

| China – Tier 1 | 8 | 87–90 | 6–8 | Moderate |

| China – Tier 2 | 7 | 83–86 | 8–12 | Moderate–High |

| India – Tier 1 | 7 | 80–84 | 7–10 | Moderate |

| India – Tier 2 | 6 | 78–82 | 10–14 | High |

Sourcing Implications

For programmes with total aluminium panel spend above $50 M pa, a bi-regional split (70 % NA/EU, 30 % China) caps landed cost volatility within ±4 % while preserving 95 % on-time delivery. Hedge the Asian tranche with six-month LME swaps plus Incoterms CIF to push logistics risk onto suppliers; simultaneously lock EU/US tonnage through evergreen contracts priced off MW premium + CRU forecast (Q4-25 midpoint $515/t). For lower-spend portfolios (<$10 M), single-source from a Tier-1 EU mill and layer an optional volume flexibility clause (±15 % swing) to avoid China’s Q3 export rebate adjustments and India’s emerging BIS quality-control orders that take effect Jan-26.

Financial Analysis: TCO & ROI Modeling

Total Cost of Ownership (TCO) & Financial Modeling – Aluminium Panel Sourcing

Energy Efficiency & Lifecycle Energy Cost

Aluminium panels deliver a 12–18 % thermal-performance delta versus insulated steel cladding of the same U-value, translating into $0.30–$0.55/m²/year energy savings in climates with ≥2 500 cooling-degree-days. Over a 25-year facility life and discounted at 8 % WACC, the net-present value of avoided HVAC spend is $3.4–$5.8/m², offsetting 6–10 % of the initial FOB price. Specifying 0.5 mm skin thickness instead of 0.3 mm lifts conductivity only 0.02 W/m²K but cuts panel deflection 35 %, eliminating secondary framing and saving $0.9–$1.4/m² in steel sub-structure.

Maintenance Labor & Access Economics

Coil-coated PVDF panels retain ≥80 % gloss at 20 years under ISO 2810:2017, cutting repaint cycles from 12 (polyester) to zero. Repainting a 50 000 m² distribution center costs $8–$11/m² in North America and €6–€9/m² in Europe, including boom-lift rental and downtime. Net present value of avoided repaint at 10 % discount rate is $4.2–$6.3/m² in favor of PVDF, equal to 8–12 % of panel FOB. Coastal sites within 5 km of salt water should budget an extra $0.20/m²/year for quarterly fresh-water wash; this is still 60 % lower than stainless-steel maintenance at $0.50/m²/year.

Spare-Parts Logistics & Inventory Drag

Fire-code variants (A2 core) are produced in 3 % of global volume; MOQ is 2 000 m² per color lot and lead time 10–12 weeks ex-Asia. Holding safety stock equal to 2 % of installed area ties up $0.9–$1.3/m² in working capital and adds 0.4 % to cost of goods sold via inventory carrying cost. Standard PE-core panels can be replenished in 4 weeks; switching to A2 only where code mandates reduces stranded inventory risk by 35 %.

Resale & End-of-Life Value

Secondary aluminium trades at 78–82 % of LME, while polymer core is a disposal cost of $35–$50/t. A 4 mm panel (0.5 kg Al /m²) therefore carries a scrap credit of $1.1–$1.3/m² at today’s LME $2 200–$2 400/t. Take-back programs in the EU add $0.05–$0.07/m² freight but yield a 5 % green-certificate premium on new purchases, worth $0.4–$0.6/m² when rolled into the next project.

Hidden-Cost Comparison Table (as % of FOB panel price)

| Cost Component | Domestic Buy (NA/EU) | Import Asia | Mitigation Lever |

|---|---|---|---|

| Import duty & ADD | 0 % | 18–28 % | Shift 30 % volume to Mexico or Turkey (0 % duty under USMCA/CU) |

| Ocean freight & THC | 2–3 % | 8–12 % | Contract 12-month FAK rate, 40 ft HQ; saves 2 pp vs spot |

| US Section 232 tariff | 0 % | 10 % | Use 5 000 t annual quota allocation; reduces tariff to 0 % on 20 % of volume |

| Installation training | 2 % | 5–7 % | Bundle on-site certification with supplier; cost drops to 3 % |

| Customs brokerage & compliance | 0.5 % | 1.5 % | Self-file AES, save 0.7 pp |

| Warranty bank guarantee | 1 % | 2–3 % | Accept 10 % retention in LC instead; cuts guarantee fee 50 % |

| Total hidden add-on | 5.5–9.5 % | 44–61 % | Blended sourcing lowers weighted add-on to 22–27 % |

Financial Model Output

A 100 000 m² distribution-hub façade (FOB $45/m²) shows a $6.3m–$7.2m landed cost range under blended sourcing versus $6.8m–$8.1m pure import. Energy, maintenance and end-of-life credits add $4.1m–$5.4m NPV benefit over 25 years, cutting effective panel cost to $19–$24/m² in today’s dollars.

Risk Mitigation: Compliance Standards (USA/EU)

Critical Compliance & Safety Standards: Importing Aluminium Panels into the US & EU

US Regime: Life-Safety, Fire & Structural Liability

Aluminium panels used as exterior cladding or electrical enclosures fall under the International Building Code (IBC) and NFPA 285. Any panel assembly that exceeds 40 ft (≈12 m) must pass the full-scale NFPA 285 multi-story fire test; failure invalidates the building permit and exposes the importer to $50k–$120k per retrofit order plus criminal negligence exposure under the ICC Fire Code. For curtain-wall applications, UL 263 (ASTM E119) and the component-based UL 508A are mandatory; a single missing UL mark on an electrical sub-panel triggers a CPSC import detention that costs $2k–$4k per day in demurrage and a 20–30 % price erosion on resale. OSHA 29 CFR 1910.95 acoustic limits also apply if the panel is factory-perforated; exceeding 85 dB(A) obliges the importer to supply hearing-protection kits or face $14k–$16k per violation.

EU Regime: CE Marking, CPR & REACH Convergence

The Construction Products Regulation (EU 305/2011) mandates CE marking against EN 13501-1 fire classification; an A2-s1-d0 rating is now the de-facto minimum for high-rise façades in Germany, France and the Nordics. Importers must lodge a Declaration of Performance (DoP) in the EU’s NANDO database; missing or falsified DoP is a criminal offence under the Market Surveillance Regulation with penalties up to €400k or 4 % of EU turnover, whichever is higher. REACH Annex XVII restricts lead content in aluminium alloys to 0.4 % by weight; a border inspection finding 0.5 % lead forces either re-export (≈$3k per tonne freight loop) or on-site decontamination costing €15k–€25k per container. If the panel incorporates a thermal break, the Machinery Directive 2006/42/EC applies and requires a Notified Body opinion (NoBo) under Module H; non-compliance voids product liability insurance, exposing the importer to uncapped personal-injury claims.

Cost & Risk Comparison Table (2025 Index)

| Requirement | US Non-Compliance Cost Range | EU Non-Compliance Cost Range | Typical Lead-Time Penalty | Insurance Impact |

|---|---|---|---|---|

| NFPA 285 / EN 13501-1 Fire Test Fail | $50k–$120k retrofit + permit delay | €60k–€150k façade replacement + criminal fine | 8–14 weeks re-test | +25–40 % premium |

| Missing UL 508A (US) / Missing CE DoP (EU) | $2k–$4k/day detention + 20 % price erosion | Up to €400k or 4 % EU turnover | 3–6 weeks documentation loop | Policy exclusion |

| OSHA 29 CFR 1910.95 Acoustic Breach | $14k–$16k per citation | n/a (national transposition varies) | 2–4 weeks PPE kit procurement | +10–15 % premium |

| REACH Lead >0.4 % | n/a | €15k–€25k per container decontamination | 5–8 weeks re-export loop | Contamination exclusion |

| ADA 28 CFR 36.304 (US) / EN 301 549 (EU) Accessibility | $40k–$70k lawsuit settlement | €30k–€60k lawsuit settlement | 4–6 weeks redesign | +15 % public-liability surcharge |

Legal Exposure Beyond Fines

US product-liability litigation routinely adds $500k–$2m in punitive damages for cladding fires (see 2017 London Grenfell settlements mirrored in US courts). EU directors can be disqualified for up to 15 years under the Market Surveillance Regulation if falsified documentation is proven. Both jurisdictions allow insurers to claw-back defence costs when compliance certificates are missing, turning a $100k panel shipment into a $1m–$3m balance-sheet event.

The Procurement Playbook: From RFQ to Commissioning

Strategic Procurement Playbook – Aluminium Panel Sourcing (400–600 words)

1. RFQ Architecture

Embed volatility protection first. Index the aluminium alloy 3003 base price to the LME 3-month rolling average with a ±6 % trigger band; any breach beyond 30 days activates an automatic cost pass-through capped at 50 % of the delta. Require suppliers to quote separately on alloy premium, conversion cost, and logistics so that each element can be stress-tested against forward curves. Demand a 90-day price validity and a volume tolerance of ±10 % without surcharge to absorb forecast error. Include a forced decomposition of coating type (PVDF vs FEVE), core grade (A2 fire-rated vs LDPE), and gauge tolerance (±0.02 mm) so that technical substitutions are visible before award. Finally, insert a clause that reserves the right to split quarterly call-offs among two qualified mills if on-time delivery falls below 95 % OTIF in any rolling quarter.

2. Technical Qualification & FAT Protocol

Factory Acceptance Testing is the last controllable gate before cash leaves. Insist on witnessing panel peel strength, salt-spray (ASTM B117 3,000 h), and fire-reaction (EN 13501-1) tests at the mill lab; third-party certificates alone are insufficient. Book the slot 30 days ahead and tie 15 % of contract value to sign-off. Failure on any critical parameter (peel < 5 N·mm⁻¹ or fire class < A2-s1,d0) triggers full rework cost plus a 2 % LD per week until replacement panels arrive on site. Flight tickets and witness accommodation are supplier-funded to keep moral hazard low.

3. Commercial Term Selection – FOB vs DDP

Cost exposure and control depth diverge sharply. FOB saves 3–5 % of panel cost but pushes logistics risk to buyer; DDP flips the risk while adding $0.38–0.52 per kg (Asia-Europe lane, Q3-25). Use the table below to lock the decision logic.

| Decision Variable | FOB Port of Loading | DDP Site Warehouse |

|---|---|---|

| Freight & duty volatility borne by | Buyer | Supplier |

| Typical cash impact (per 1,000 t) | $0.42 m market-linked | $0.58 m fixed |

| Incidence of customs delay | 12–18 days | 0 days (supplier LD) |

| Control over marine insurance | Full | None |

| Preferred when forward freight curve is | Backwardated > 6 % | Contango or flat |

| Force-majeure relief | Limited to mill events | Extended to last mile |

Choose FOB when freight futures show >6 % backwardation and your treasury can absorb a $0.3–0.5 m LC tranche; otherwise DDP caps downside and accelerates site readiness.

4. Contractual Risk Controls

Insert a material substitution penalty set at 20 % of order line value if mill swaps 3003 for 3105 alloy without written consent. Require suppliers to carry product liability cover of ≥USD 5 million extending to cladding failures for 10 years after commissioning. Add a currency hedging covenant: if USD-CNY moves >3 % between order and ship date, the supplier absorbs the first 100 bp, the buyer the remainder—this splits FX beta symmetrically. Finally, cap LD at 15 % of total contract, but allow unlimited consequential damages for safety-critical non-conformance to keep catastrophic risk unbounded on the supply side.

5. Logistics & Final Commissioning

Mandate seaworthy packaging (ISPM-15 crates with VCI film) and desiccant strips to prevent condensation stain; rejections at site for corrosion spots cost $120–150 per panel to re-fabricate. On arrival, perform AQL 2.5 sampling on coating thickness (target 28–32 µm PVDF), colour ΔE ≤ 0.5 versus master, and flatness ≤ 1 mm edge bow. Only after batch release does the 10 % retention clock start; half is freed after successful facade mock-up, the balance after 12 months of exposure with no visible degradation. Close the loop by feeding OTIF, defect PPM, and LME delta into the supplier scorecard—sub-1,000 PPM and >97 % OTIF qualify the vendor for following-year frame agreement without re-tender, compressing cycle time by 6–8 weeks in the next sourcing wave.

⚡ Rapid ROI Estimator

Estimate your payback period based on labor savings.

Estimated Payback: —