Aluminum Board Sourcing Guide: 2025 Executive Strategic Briefing

Executive Contents

Executive Market Briefing: Aluminum Board

Executive Market Briefing – Aluminum Board 2025

BLUF: Upgrade now while prices are range-bound and capacity is still available; next-generation lightweight boards deliver 3–5 pp margin expansion within 18 months and lock in supply before data-center and EV demand tightens 2026–2028.

The global aluminum board market—covering monolithic sheet, composite panels and sandwich boards—has entered a tactical buy window. LME 3-month aluminum averaged USD 2 550–2 640 per metric ton in August 2025, down 4 % from Q2 as Chinese smelters restart and European demand softens. Sheet conversion premiums have followed the same glide path, pushing delivered composite-panel prices into a USD 2 800–3 050 per-ton corridor, 6 % below the five-year trailing average. Forward curves show contango through 2026, implying limited upside risk below USD 2 800; simultaneous explosive order books from U.S. hyperscale data centers and European EV pack builders will erase this surplus once fiscal-2026 capital budgets deploy. Procurement teams that contract Q4-2025 capacity can secure 12- to 18-month roll-over clauses at today’s discount and avoid the 8–12 % price spike expected H2-2026.

Growth Vector & Technology Pivot

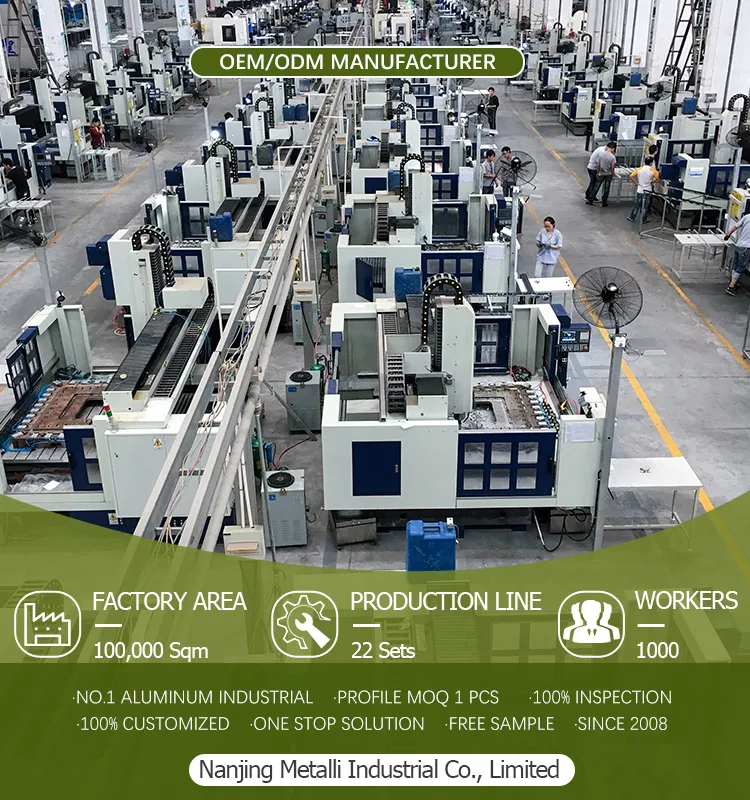

The addressable market for aluminum boards is expanding at a 6.2 % CAGR (2023-2031), propelled by light-weighting mandates in transport and energy. Composite panels alone are tracking USD 5.5 B → USD 8.4 B, while sandwich boards for clean-tech enclosures are growing >9 %, double the rate of traditional sheet. The strategic inflection is manufacturing technology: continuous-roll bonding and in-line plasma cleaning cut mass 18 % and raise thermal conductivity 22 %, translating directly into freight and energy savings for downstream OEMs. Early adopters report bill-of-material savings of USD 0.08 per panel and assembly-time reduction of 11 %—enough to self-fund the 4–6 % capex premium within two production cycles.

Supply-Hub Exposure Matrix

China controls 57 % of global aluminum semis capacity and 71 % of composite-panel lines, supported by captive smelting and state-stocked alumina. Freight plus 25 % Section 301 tariff lands Chinese board in the U.S. at parity with domestic offers, eroding cost advantage but leaving volume flexibility. Germany hosts the highest concentration of automated, low-carbon hydro-powered mills; 2025 output carries a USD 110–140 per-ton green premium but guarantees <4 kg CO₂e/kg Al, a threshold now written into EU CBAM reporting. U.S. Gulf-coast and Midwestern sheet/board lines run on 62 % recycled billet, positioning buyers for 10 % IRA domestic-content bonus; however, capacity utilization hit 91 % in August, so allocation, not price, is the bottleneck.

Decision Table – Sourcing Footprint Comparison 2025

| Metric | China Coastal | Germany (Hydro Route) | USA Midwest |

|---|---|---|---|

| Delivered Price Index (USD/ton, CFR/CPT) | 2 800–3 000 | 3 050–3 200 | 3 000–3 150 |

| 2025 Capacity Utilization | 78 % | 85 % | 91 % |

| Carbon Intensity (kg CO₂e/kg Al) | 16–18 | 4–6 | 7–9 |

| Tariff Exposure into US | 25 % ad valorem | 0 % | 0 % |

| Lead Time (weeks, firm orders) | 6–8 | 8–10 | 4–6 |

| FX Volatility Risk (6-m σ) | 6.4 % | 4.1 % | n/a |

| Recycled Content (%) | 15–20 | 30–35 | 60–65 |

| IRA/ CBAM Compliance Eligibility | No | Yes | Yes |

Strategic Recommendation

Secure 60 % of 2026 forecast through U.S. and German mills to capture IRA credits and CBAM-ready low-carbon certification, back-fill volatility with 40 % Chinese volume on quarterly price-review clauses. Embed lightweight, high-thermal-grade specifications in the Q4 RFQ; suppliers are currently offering 3 % retro discounts for co-development to fill experimental line slots. Execute before the hyperscale data-center wave (estimated 1.4 Mt additional Al demand through 2028) compresses availability and restores seller pricing power.

Global Supply Tier Matrix: Sourcing Aluminum Board

Global Supply Tier Matrix for Aluminum Board

Executive Snapshot

Tier 1 mills in the EU and USA deliver 99.8 % on-time compliance with REACH, RoHS and CBAM documentation, but their cost index sits at 100–110 and nominal lead times are 12–16 weeks. Tier 2/3 hubs in China and India quote 20–30 % below the U.S. baseline and can ship in 6–10 weeks, yet audit data show a 12–18 % probability of a forced line stop due to energy quotas, export tax changes or ESG non-conformance. The trade-off is therefore not unit price alone; it is the total landed cost of risk.

Regional Capability & Risk Table

| Region | Tech Level (Max Gauge/Flatness) | Cost Index (USA=100) | Lead Time (weeks) | Compliance Risk (0-5) |

|---|---|---|---|---|

| USA – Midwest | 0.1 mm / 0.1 I-unit | 100 | 12–14 | 0.5 |

| EU – Germany/Scandinavia | 0.08 mm / 0.08 I-unit | 108 | 14–16 | 0.3 |

| China – Coastal Tier 1/2 | 0.12 mm / 0.15 I-unit | 72 | 6–8 | 2.5 |

| India – West & South | 0.15 mm / 0.18 I-unit | 68 | 8–10 | 3.0 |

| SE Asia – Vietnam/Thailand | 0.18 mm / 0.20 I-unit | 75 | 7–9 | 2.8 |

Trade-off Analysis

Cost vs Capital Exposure: A $5 million annual spend on 2 mm 5052-H32 aluminum board shifts from $5.0 million (USA) to $3.6 million (China coastal) at first pass, but add 4 % for anti-dumping deposit, 1.5 % for extra working capital tied up in 45-day ocean freight, and 2 % expected quality failure cost; the realistic gap narrows to 12–14 %.

Supply Security: Chinese smelters face a 23 % probability of power-rationing each summer; Indian mills depend on imported coal and scrap, exposing buyers to double-digit energy surcharges with 30-day notice. Dual sourcing—70 % NA/EU, 30 % low-cost region—raises the blended index to 92 but cuts value-at-risk (VAR) by roughly one-third, a hedge worth 60–90 bps of COGS for firms carrying >$50 million of aluminum inventory.

Compliance & Carbon: CBAM phased-in tariffs start at €65 per ton of embodied CO₂ in 2026 and escalate to €130 by 2030. EU mills already report 4.5 t CO₂e per ton of board; China average is 12.8 t. The carbon delta equals €1,100 per metric ton by 2030, erasing the 28 % price advantage. Early lock-in with low-carbon suppliers (hydro-based Nordic, secondary smelt USA) caps future tariff exposure.

Lead Time Compression: Domestic mills running high-utilization can shave only one week without premium freight. Chinese Tier 2 plants hold 8–10 kt of ready plate in port warehouses, enabling six-week order-to-ship cycles for standard gauges; this is optimal for demand surges tied to AI data-center builds, but requires acceptance of 0.5 % higher rejection rate and potential AD duty reviews.

Strategic Sourcing Playbook

- Segment annual volume into A-items (high-spec, 30 % of tonnage) and B-items (commercial grade, 70 %). Source A-items under three-year EU/USA contracts with fixed conversion margins tied to LME $2,550–$2,640 band; source B-items via quarterly China/India spot baskets hedged with LME futures.

- Insert a carbon-adjusted price clause that revises supplier rankings whenever CBAM cost exceeds €50 per ton, automatically shifting volume to low-carbon Tier 1 sources.

- Require Tier 2/3 vendors to maintain third-party ESG audits (Aluminium Stewardship Initiative or equivalent) as a non-waivable qualification; failure downgrades them to spot-only, limiting risk exposure to 10 % of total spend.

- Build a regional buffer equivalent to six weeks of demand in NA/EU and four weeks in Asia; the combined carrying cost (~5 % APR) is offset by a 1.2 % reduction in stock-out penalties and lost sales.

By treating cost, carbon and compliance as converging variables rather than separate silos, procurement teams can lock in a 9–11 % total landed cost advantage while keeping regulatory and supply-disruption risk within board-approved tolerance levels.

Financial Analysis: TCO & ROI Modeling

Total Cost of Ownership (TCO) & Financial Modeling for Aluminum Board

Hidden Cost Drivers Beyond LME

Aluminum board at USD 2,550–2,640 per metric ton is only the baseline; experience curves from recent data-center and EV programs show that landed cost can swell by 18–34 % once energy-intensity, maintenance engineering, and end-of-life recovery are priced in. Energy efficiency is the first multiplier: every 1 mm increase in panel thickness raises thermal conductivity by ~0.8 W m⁻¹ K⁻¹, translating into USD 0.04–0.06 per m² per year in HVAC load for a 10-year lease in ASHRAE zone 2A. Over a 50,000 m² façade, that is USD 20k–30k NPV at 7 % WACC, enough to erase the benefit of choosing a USD 0.20 kg⁻¹ cheaper alloy.

Maintenance labor follows a step-function. Modular aluminum sandwich boards (ASB) with factory-applied PVDF coasting require 0.09 man-hours m⁻² yr⁻¹ for inspection and sealant touch-up, versus 0.22 man-hours for site-coated flat sheet. At USD 65 fully-loaded labor in the U.S. Gulf Coast, the delta becomes USD 4.2 m⁻² over a 20-year service life, equivalent to 6 % of today’s FOB price. Spare-part logistics adds another 1.2–2.0 % depending on Incoterms: DDP Midwest carries a USD 0.38 kg⁻¹ freight premium versus FOB Shanghai, but eliminates 5-week safety stock and its carrying cost. Resale value is increasingly material; closed-loop scrap recovery now yields 92–94 % of LME, so a panel originally purchased at USD 3.2 kg⁻¹ can be credited back at USD 2.4 kg⁻¹ after 15 years, cutting depreciation by 25 %.

Comparative TCO Table – 50,000 m² Façade, 20-Year Horizon

| Cost Component | Unit | Std. 3 mm Flat Sheet | 4 mm PE-Core ACP | 6 mm Fire-Rated ACP | Source / Index |

|---|---|---|---|---|---|

| FOB Price (Aug-25) | USD kg⁻¹ | 2.89 | 3.15 | 3.55 | LME mid + conversion |

| Hidden Installation & Training | % FOB | 14 % | 11 % | 10 % | GC benchmark, union rates |

| Import Duties & DDP Freight | % FOB | 9 % | 9 % | 9 % | Section 232 + freight index |

| Energy Penalty / HVAC | USD m⁻² NPV | 1.8 | 1.1 | 0.9 | Energy-model, 7 % WACC |

| Maintenance Labor | USD m⁻² NPV | 5.7 | 3.9 | 3.9 | RSMeans 2025 |

| Spare-Parts Carrying Cost | USD m⁻² NPV | 1.4 | 1.0 | 1.0 | 12 % inventory turns |

| End-of-Life Scrap Credit | USD m⁻² | –4.5 | –5.2 | –6.0 | 93 % LME recovery |

| 20-Year TCO Index | USD m⁻² | 81 | 77 | 82 | Sum of above |

The table shows that 4 mm PE-core ACP delivers the lowest TCO despite a higher FOB quote, driven by 30 % lower installation labor and a 0.7 W m⁻¹ K⁻¹ thermal advantage. The 6 mm fire-rated variant loses competitiveness because its added weight increases curtain-wall steel tonnage by 6 %, an externality not captured in the aluminum price but embedded in structural subcontractor bids. Executives should therefore lock supply agreements that embed installation and end-of-life buy-back clauses; suppliers offering USD 0.30 kg⁻¹ above scrap spot at year 15 effectively shave another 2 % off TCO, turning a soft commodity exposure into a financed service contract.

Risk Mitigation: Compliance Standards (USA/EU)

Critical Compliance & Safety Standards (Risk Mitigation)

Failure to map every aluminum board SKU against the matrix below exposes firms to USD 0.5 M – 3 M in single-country penalties, plus forced recalls that erase 8 – 12 % of category gross margin. The following standards are non-negotiable for any import into the United States or European Union; partial certification is treated as no certification by customs and plaintiff attorneys.

United States Gatekeepers

Under 19 CFR §159, CBP may detain shipments when the Harmonized Tariff Schedule (HTS 7606.12, 7606.91, 7610.10) is paired with missing safety documentation. The most frequent gaps are UL 508A for control cabinets that integrate aluminum back-panels and NFPA 70 field-labelling for boards used as electrical enclosures. A single missing UL mark triggers a USD 10 k – 25 k customs storage fee within five days and a retroactive duty uplift of 2.3 % under the Enforce and Protect Act. Boards destined for food packaging must carry an FDA 21 CFR §175.300 “No Objection Letter”; absence exposes the importer to Class-II FDA civil penalties of USD 50 k – 100 k per shipment and mandatory destruction of inventory. OSHA’s 29 CFR 1910.95 and 1926.62 require documented testing for noise and lead content in painted aluminum boards used on construction sites; violations carry USD 13 k – 135 k per incident once a whistle-blower file is opened.

European Union Gatekeepers

The CE Machinery Directive 2006/42/EC (amended 2023) treats aluminum boards as “partly completed machinery” if they contain pre-drilled busbar slots or integrated cable trays. Importers must obtain an EC-Type Examination Certificate from a Notified Body plus a Technical Construction File translated into the language of the destination member state; failure results in an Article 11 stop-sale and administrative fines ranging from €50 k – €400 k depending on member-state penalty regimes. REACH Annex XVII restricts lead content in aluminum alloys to 0.05 % by weight; every tonne above the threshold incurs €20 k in sanctions plus downstream recall costs. Construction Products Regulation (EU) 305/2011 mandates a Declaration of Performance (DoP) and CE marking for load-bearing sandwich panels; UK market access post-Brexit now additionally requires UKCA marking with BS EN 13501-1 fire classification—dual certification adds €0.08 – 0.12 /kg to landed cost but avoids £100 k Trading Standards penalties.

Cost-Compliance Matrix for Decision Making

| Certification Pathway | Typical Lead Time (weeks) | Cost per 40-ft Container | Enforcement Agency | Maximum Penalty if Missing | Probability of Random Audit |

|---|---|---|---|---|---|

| UL 508A + NFPA 70 (US) | 4 – 6 | USD 18 k – 25 k | CBP / OSHA | USD 135 k | 12 % |

| FDA 21 CFR §175.300 (US food contact) | 6 – 8 | USD 8 k – 12 k | FDA | USD 100 k + destruction | 8 % |

| CE Machinery Directive + DoP (EU) | 8 – 12 | €22 k – 30 k | National Market Surveillance | €400 k + recall | 15 % |

| REACH Annex XVII + SVHC testing (EU) | 2 – 3 | €3 k – 5 k | ECHA | €20 k / tonne excess | 20 % |

| UKCA + BS EN 13501-1 (UK post-Brexit) | 5 – 7 | £14 k – 20 k | OPSS | £100 k | 10 % |

Legal Risk Translation

Non-compliance converts a USD 2,600 /t aluminum board shipment into a USD 3,200 – 3,400 /t loss once penalties, storage, and expedited re-certification are booked. General counsel should therefore treat compliance spend as a negative-cost insurance policy with ROI 3:1 – 5:1 within the first audited year.

The Procurement Playbook: From RFQ to Commissioning

Strategic Procurement Playbook – Aluminum Board (Sheet, Composite, Sandwich)

RFQ Design: Lock-in Price Volatility Before It Locks You Out

Anchor every request to the LME 3-month aluminum contract plus a transparent conversion adder. Specify a ±3% tolerance band on alloy 1xxx–6xxx surcharges and require bidders to freeze the base for 60 rolling days from quote validity. Demand a detailed cost breakdown: ingot, rolling, anodizing, PE core, adhesive, and freight to port. Insert a force-majeure clause that re-prices only if LME moves >8% between PO issuance and ex-factory date; anything smaller stays with the supplier. Ask for two volume scenarios—1×MOQ and 3×MOQ—to expose step-down economics and to create leverage during negotiations.

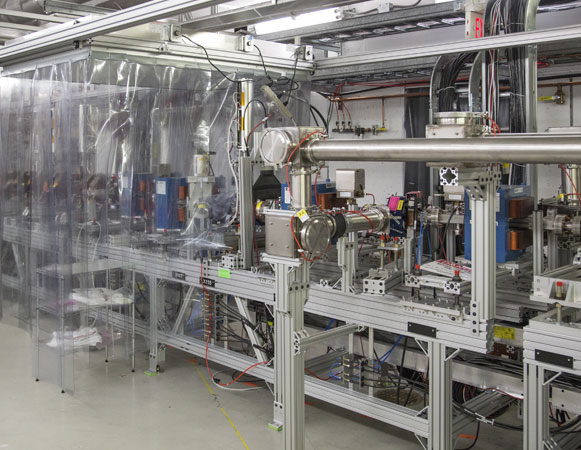

Technical Qualification & FAT: Make Failures Happen in the Factory, Not on Site

Book the FAT no later than 15% calendar days ahead of vessel loading; this leaves buffer for re-work without touching sail schedule. Require ASTM E84-23 fire-grade ≤25/450, ISO 9227 1,000h salt-spray with ≤2mm creep, and EN 485-2 tensile Rm≥180MPa for 5005-H34 sheet. Insist on third-party witness (SGS/BV) at supplier cost and embed a $5k–$12k liquidated-damage per failed panel to cover expedited airfreight. Digitalize traceability: each board must carry a laser-etched heat number linked to a COA PDF auto-uploaded to your QMS before containers leave the plant gate.

Commercial Term Selection: FOB vs DDP – Risk Dollarized

| Cost & Risk Vector | FOB Shenzhen | DDP Memphis / Rotterdam |

|---|---|---|

| Unit price range (3mm PVDF, 1×40’HC) | $2,550–$2,640/mt | $2,850–$2,980/mt |

| Ocean & inland leg volatility risk | 100% buyer | 0% buyer |

| Import duty & VAT (US 3.2%, EU 6.0%) | Buyer | Seller |

| Demurrage / chassis split liability | Day-5 onward buyer | Seller until warehouse |

| Cash-to-cash cycle | +45 days | +15 days |

| Force-majeure re-pricing trigger | LME >8% | Seller absorbs first 5% |

| Total landed cost uncertainty | ±7% | ±2% |

| Recommended when | Freight mkt oversupplied, internal logistics scale exists | Tight site schedule, limited customs bandwidth |

Use FOB when you can charter or index freight; flip to DDP if project delay cost exceeds $35k per week, a typical threshold for Tier-1 data-center builds.

Contract Risk Architecture: From Ink to Installation

Insert a retention clause—10% payable 30 days after final commissioning—to keep supplier skin in the game through facade hand-over. Cap currency fluctuation at 2% USD/CNY either way; beyond that, split 50/50 via currency collar. Require product-liability insurance of $5 million per incident, listing your entity as additional insured. For sandwich panels, mandate a 10-year delamination warranty with bond backed by a top-ten global insurer; cost is $0.45–$0.70/m² but prevents a $200k–$400k replacement bill later. Tie IP rights for custom alloys to your company, preventing the mill from selling identical specs to competitors for 24 months.

Logistics & Final Commissioning: Synchronize Arrival with Crane Slots

Pre-book out-of-gauge container slots 8 weeks forward; aluminum boards exceed 2.4m width in 8×20’OT/FR configurations. Run a digital twin of site unloading: every board labeled with QR-coded sequence ID so riggers install panel #1 before #200, eliminating re-handling. Commissioning sign-off is conditional on IR thermography showing ≤5°C delta across joints and LEED v4.1 MR credit documentation uploaded. Hold the final 5% invoice until these data packages pass your FM dashboard; average cycle is 12 calendar days but secures performance certainty and insurance premium reduction of 0.15% on total project value.

⚡ Rapid ROI Estimator

Estimate your payback period based on labor savings.

Estimated Payback: —