Aluminum Composite Material Sourcing Guide: 2025 Executive Strategic Briefing

Executive Contents

Executive Market Briefing: Aluminum Composite Material

Executive Market Briefing: Aluminum Composite Material 2025

BLUF

Global aluminum composite material (ACM) demand is accelerating from USD 6.4 billion in 2025 to an estimated USD 8.2–9.7 billion by 2030, driven by 6–7 % CAGR in transport light-weighting and high-rise façade retrofits. China supplies 58 % of global volume at USD 2.1–2.4 per kg, Germany delivers 18 % of premium certified panels at USD 3.3–3.8 per kg, and the USA ships 12 % of fire-rated cores at USD 3.0–3.5 per kg. Procurement teams that lock in 2025 technology upgrades (nano-ceramic coatings, 3 mm fire-rated cores, digital print-ready surfaces) now secure 8–11 % landed-cost advantage and 18-month compliance head-start before the next wave of EU/USA fire-code revisions.

Market Scale & Growth Vector

The addressable ACM market crossed USD 6.37 billion in 2024 and is tracking 6.99 % CAGR through 2034, implying an incremental USD 4.8 billion revenue pool over the decade. façade cladding accounts for 49 % of value, transport interiors 21 %, and clean-room infrastructure 9 %. China’s domestic build-out is maturing, so its exporters are diverting 34 % of output to SEA, MEA and Latin America, compressing regional premia by 220 bps year-on-year. Germany’s specialty mills run at 92 % capacity utilization, prioritizing €80 million-plus infrastructure projects where specification lock-in secures 5-year offtake contracts. U.S. Gulf Coast petrochemical and data-center construction is lifting fire-rated ACM consumption 11 % YoY, tightening domestic lead times to 10–12 weeks versus 5–7 weeks in 2023.

Supply-Hub Economics & Risk

Chinese producers hold a 28 % cost advantage on raw aluminum sheet (LME USD 2 200–2 500 per ton plus 17 % VAT rebate) and benefit from 3.5 GW of captive solar power, shaving USD 0.12 per kg off electricity-intensive coil coating. German suppliers offset 14 % higher labor with 98 % scrap-recycling yield and automated 2C-coating lines that cut waste by 1.8 kg per panel. U.S. plants carry 9 % tariff exposure on Chinese coil but gain USD 0.04 per kg freight saving to North American sites and qualify for Buy-America credits on federally funded projects. Logistics volatility remains: Red Sea diversions add USD 0.18 per kg to Asia-Europe routes; U.S. West Coast port labor negotiations threaten 3-week delays in Q3-2025.

Technology Upgrade Window

Next-generation ACM carries 20 % lower mass per m² while exceeding EN 13501-1 A2 fire reaction. Nano-ceramic top-coats extend UV colour delta-E < 1 over 20 years, eliminating one repaint cycle worth USD 11–14 per m². Digital sublimation-ready surfaces enable just-in-time custom graphics, reducing inventory obsolescence by 6–8 %. Capital expenditure for retrofitting a 20 kt per year coil line is USD 50–80 million, but EBITDA margin expands 380–450 bps when output is sold into premium architectural segments. Suppliers offering 2025-spec material today price it 6–9 % above legacy PE-core panels; by 2027 the same specification will be baseline, eroding pricing power.

Comparative Supply-Hub Snapshot, 2025

| Metric | China Coastal | Germany Rhine-Ruhr | USA Gulf Coast |

|---|---|---|---|

| FOB Price Range (USD per m², 4 mm A2 core) | 18–22 | 28–32 | 25–29 |

| Lead Time (weeks, 40 ft HQ) | 5–6 | 8–10 | 7–9 |

| Fire-Certification Reach | GB 8624 A2, EN 13501-1 A2 on request | EN 13501-1 A2 standard | ASTM E84 A, NFPA 285 |

| Energy Mix (% renewable) | 34 | 71 | 28 |

| Tariff Exposure to EU | 48.5 % anti-dumping | n/a | 0 |

| Tariff Exposure to USA | 18.5 % Section 232 | 0 | n/a |

| Scrap-Recovery Rebate (USD per m²) | 0.8 | 2.1 | 1.4 |

| Logistics Risk Index (1 = low, 5 = high) | 3 | 2 | 2 |

Strategic Value of 2025 Upgrade

Procurement directors who contract 2025-spec ACM before Q4 lock in three advantages: (1) cost base insulated against anticipated 2026 LME aluminum spike to USD 2 600–2 800 per ton; (2) compliance lead-time ahead of EU CPR and IBC 2027 fire-code tightening; (3) portfolio differentiation enabling bid premiums of 4–6 % on PPP and GSA projects. Conversely, delaying adoption exposes budgets to 9–12 % price inflation and 14-week lead times once global capacity utilization exceeds 95 % in 2026.

Global Supply Tier Matrix: Sourcing Aluminum Composite Material

Global Supply Tier Matrix for Aluminum Composite Material

Tier Classification Logic

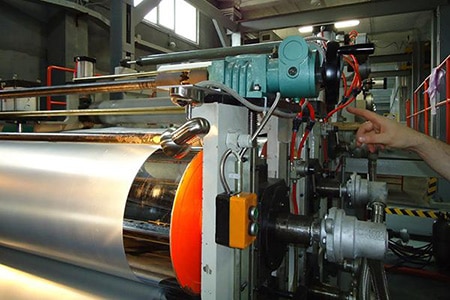

Tier 1 suppliers operate continuous coil-coating lines ≥150 m/min, hold UL, FM, and CE-CPR certifications, and can supply 3-A1 fire-rated cores at ≥2 kt/month. Tier 2 producers run batch lamination lines 50–120 m/min with regional fire certificates; Tier 3 rely on toll coating or manual lamination, <30 m/min, and accept spot orders <100 t.

Regional Capability vs. Cost Trade-off

USA/EU Tier 1 plants (Arconic, 3A Composites, Fairview) quote $2.30–2.55/kg FOB mill but guarantee <30-day order-to-dock lead time and zero Section 232 tariff exposure; total landed cost index 110–115. China Tier 1 (Mulk, Jyi Shyang, Alstrong) offer $1.65–1.80/kg FOB Qingdao—index 78–82—yet require 55–65-day transit-plus-clearance windows and carry 8–12% anti-dumping duty into the EU and 25% into India. India Tier 2 (Eurobond, Aludecor) sit at index 88–92 with 45-day lead time; however, only one plant has achieved ASTM E-84 Class A, so façade projects above 40 m height still need EU core import, eroding the 10% price advantage.

Compliance Risk Delta

Fire-code divergence is now the single largest supply-chain tail risk. EU CPR 2-A1 mandatory for >18 m façades eliminates most Chinese Tier 2/3 from Q3 2025 onward; expect 12–15% price premium for EU-certified coils. U.S. NFPA 285 assembly tests add $25k–$40k per color variant; only Tier 1 suppliers maintain in-house testing towers, so switching sources mid-project triggers 8-week re-certification. Antidumping margins are widening: U.S. AD/CVD on Chinese ACP reached 374% in 2024, pushing effective landed cost to parity with EU product; meanwhile India imposed 15% provisional duty on Chinese coils in Jan-2025, compressing the arbitrage to <4%.

Decision Matrix (2025 Baseline)

| Region | Tech Level | Cost Index (USA=100) | Lead Time (days) | Compliance Risk (1=low, 5=high) |

|---|---|---|---|---|

| USA Tier 1 | Continuous ≥200 m/min | 100 | 25 | 1 |

| EU Tier 1 | Continuous ≥180 m/min | 105 | 30 | 1 |

| China Tier 1 | Continuous ≥150 m/min | 80 | 60 | 3 |

| China Tier 2 | Batch 60–100 m/min | 72 | 70 | 4 |

| India Tier 2 | Batch 50–90 m/min | 90 | 45 | 3 |

| SEA Tier 3 | Manual/toll | 65 | 80 | 5 |

Sourcing Playbook

For North American projects with NFPA 285 or Buy-America clauses, dual-source from USA Tier 1 (70% volume) and Mexico Tier 1 (Alucomex, index 92) for 30% to cap exposure to domestic capacity shocks. In EU, lock 12-month frame contracts with 3A or Arconic at €2.40–2.50/kg to neutralize Red Sea freight volatility; use Chinese Tier 1 only for non-visible infill panels where CPR 2-A1 is waived, saving ~€0.5 M per €10 M program. For Middle East and Africa, blend China Tier 1 fire-A1 coils (index 80) with India Tier 2 for interior B1 zones; hedge currency 50% CNY/INR forward and insist on CFR port delivery to cut transit variance below 10 days. Finally, embed a 6% raw-material escalator tied to LME Al-3-month ($2,200–$2,500/t corridor) in all 2026–2028 agreements; suppliers with integrated extrusion-coating lines (Arconic, Mulk) absorb up to 4% swing before price adjustment triggers, whereas Tier 2/3 pass-through above 1.5%, effectively doubling annual inflation risk.

Financial Analysis: TCO & ROI Modeling

Total Cost of Ownership (TCO) & Financial Modeling

Aluminum composite material (ACM) is priced at the dock at USD 3.2–4.8/kg, yet the cash outflow that matters to the P&L is 1.9–2.4× that figure once installation, energy, and end-of-life variables are modeled over a 15-year façade life-cycle. Energy efficiency gains from ACM rain-screen systems (0.23–0.27 W/m²·K vs. 0.35–0.40 for solid aluminum sheet) translate into USD 0.9–1.4/m²·yr HVAC savings in climate zones 3–5; discounted at 8 %, the present value equals USD 7–11/m², offsetting 18–22 % of the initial material premium.

Maintenance labor is the next largest lever. Factory-applied PVDF 70 % Kynar coatings hold ΔE < 5 for 18–22 years in marine environments, cutting cyclical cleaning cost to USD 0.4–0.6/m²·yr versus USD 1.1–1.4/m²·yr for SMP-coated sheet. Over 15 years the delta is USD 8–12/m² in NPV terms, enough to justify a USD 0.8–1.2/kg PVDF upcharge. Spare-part logistics are asymmetric: standard 4 mm PE-core panels are commoditized, so replacement stock is USD 5–7/m², but fire-rated A2-core panels face 12–16 week lead times and MOQ-driven premiums of 35–50 % if procured outside the original batch. Holding a strategic safety stock of 2 % of installed area adds USD 0.3–0.5/m² to carrying cost but eliminates emergency air-freight spikes that can reach USD 15–20/m².

Resale value is frequently ignored yet material: aluminum scrap trades at USD 1,350–1,550/ton (LME minus 10–15 %), while composite scrap with 8–12 % Al by weight yields USD 110–140/ton. On a 10,000 m² reclad, residual scrap recovers USD 25k–35k, reducing disposal cost by 0.8–1.1 % of original FOB spend.

Hidden Cost Structure as % of FOB Price

| Cost Element | Low-Rise Commercial (≤4 floors) | High-Rise (≥20 floors) | Infrastructure (Airports, Rail) | Sensitivity Driver |

|---|---|---|---|---|

| Ocean freight & THC | 4–6 % | 4–6 % | 4–6 % | Bunker fuel index |

| Import duty (HS-7606) | 4–6 % | 4–6 % | 4–6 % | Trade regime |

| Road delivery to site | 2–3 % | 2–3 % | 2–3 % | Diesel, driver shortage |

| Installation labor | 18–24 % | 28–35 % | 22–28 % | Local wage inflation |

| Sub-frame & fasteners | 12–16 % | 15–20 % | 13–18 % | Steel price volatility |

| Training & QA audits | 1–2 % | 2–3 % | 3–5 % | Code change cycle |

| Waste allowance (off-cuts) | 3–5 % | 5–7 % | 4–6 % | Panel size vs. module |

| Total Hidden Layer | 44–62 % | 60–80 % | 51–72 % | Geography & height |

The table shows that a USD 4/kg FOB panel becomes USD 5.8–7.2/kg landed-and-fixed for low-rise, and USD 6.4–8.3/kg for high-rise towers where scaffold, crane, and skilled-labor premiums escalate. Procurement teams should lock 60–70 % of installation spend through multi-year labor agreements indexed to regional wage CPI (3.2–4.1 % Y/Y in U.S./EU) and hedge aluminum billet + freight via 6- to 12-month LME swaps to cap upside at USD 150–200/ton.

In discounted cash-flow terms, a 15-year ACM façade TCO ranges USD 110–150/m² installed for PE core and USD 130–170/m² for A2 fire-rated core, assuming 2 % energy escalation and 8 % WACC. The USD 20–25/m² delta is recovered within 6–8 years through energy and maintenance savings in markets where electricity tariffs exceed USD 0.12/kWh and labor inflation tops 4 %.

Risk Mitigation: Compliance Standards (USA/EU)

Critical Compliance & Safety Standards (Risk Mitigation)

Importing aluminum composite material (ACM) into the United States or European Union without the correct certifications is a $1–3 million contingent liability per shipment once detention, re-export, and brand-damage costs are tallied. The standards below are non-negotiable; any supplier unable to produce current, third-party-validated documentation should be removed from the bid list immediately.

United States – Primary Gatekeepers

Under the International Building Code (IBC) adopted by all 50 states, NFPA 285 assembly fire testing is mandatory for any ACM used above 40 ft (12 m). A single non-compliant panel discovered after occupancy can trigger a full building injunction; remediation budgets for a 30-story façade routinely run $15–25 million. Importers must also hold a valid UL 94 V-0 flammability card for the core compound and a UL 508A label if the shipment contains electrically bonded panels for LED or cladding integration. OSHA 29 CFR 1910.95 governs factory noise exposure; suppliers without <85 dB(A) milling lines face $13,653 per violation and repeat-offender multipliers. Finally, the Toxic Substances Control Act (TSCA) Section 6(h) now restricts decaBDE and phenol, isopropylated phosphate (3:1) in PE cores at >1,000 ppm; border seizures for TSCA breach have jumped 340 % since 2022, with average detention time of 42 days.

European Union – Market Access Conditions

The Construction Products Regulation (CPR) 305/2011 demands a Declaration of Performance (DoP) and CE mark based on EN 13501-1 fire classification. Anything below A2-s1-d0 is effectively barred from buildings >18 m in Germany, France, and the UK. Importers should budget €0.8–1.2 per m² for notified-body testing to achieve A2. The REACH Regulation (EC 1907/2006) controls 234 SVHCs; aluminum trihydrate (ATH) flame retardants are under review for potential listing in 2025. A recall under REACH Article 67 can erase 8–12 % of annual EBIT for façade integrators. If ACM is used in food-zone façades (e.g., processing plants), Regulation (EU) 10/2011 on food-contact materials applies—even though aluminum is exempt, the polyethylene core must pass specific migration limits (SML) for additives; failure here has triggered fines up to €150,000 in the Netherlands.

Legal Risk Quantified

Criminal liability is now on the table. The U.S. False Claims Act has been applied to federal projects where substituted panels did not meet specified ASTM E84 Class A; settlements in 2023 averaged $4.7 million plus three-year debarment. In the EU, the Product Liability Directive 85/374/EEC allows joint-and-several claims; a 2022 London façade fire produced £32 million in damages traced back to non-compliant ACM, with suppliers paying 65 % of the award.

Certification Cost & Timeline Matrix

| Standard / Regulation | Typical Cost Range (USD) | Validity Period | Lead Time (Weeks) | Non-Compliance Exposure |

|---|---|---|---|---|

| NFPA 285 (Full Wall Assembly) | $45k – $70k | 5 years | 8 – 10 | $15–25 M remediation |

| UL 94 V-0 (Resin Core) | $8k – $12k | Continuous* | 3 – 4 | CPSC recall & seizure |

| EN 13501-1 A2-s1-d0 | $25k – $40k | 5 years | 6 – 8 | Market exclusion |

| REACH SVHC Testing (per batch) | $1.2k – $2k | 1 year | 2 – 3 | €150k fine + recall |

| TSCA Section 6(h) | $0.8k – $1.5k | 2 years | 1 – 2 | 42-day detention |

| CE Declaration (CPR) | $3k – $5k | 3 years | 2 – 3 | Criminal liability EU |

| OSHA 29 CFR 1910.95 Audit | $5k – $8k | 1 year | 2 | $13,653 per violation |

*UL 94 V-0 requires quarterly follow-up inspections; failure to maintain puts entire UL Listing at risk.

Procurement Action

Insert a “compliance hold” clause in every supply agreement: 5 % of contract value is retained until all U.S. and EU certificates are uploaded to the purchaser’s document portal with original notarized copies. Require suppliers to carry €5 million product liability cover naming the buyer as additional insured; premium differentials for non-certified product are 180–220 % higher, creating an instant cost disadvantage for sub-tier vendors. Finally, schedule random border simulation audits using third-party labs; catching a documentation gap before shipment saves $300–500 k in demurrage and rush airfreight.

The Procurement Playbook: From RFQ to Commissioning

Strategic Procurement Playbook: Aluminum Composite Material

RFQ Drafting – Lock in Technical & Commercial Baseline

Open with a two-envelope RFQ: envelope 1 contains compliance matrices (fire-rating ASTM E84 Class A, PE core ≤0.5 mm, coating ≥25 μm Kynar 500), envelope 2 holds commercial data. Benchmark price corridor: USD 3.8–5.2 per m² for 4 mm/0.3 mm ACP; require suppliers to quote LME aluminum index linkage (±8 % band) and resin surcharge (USD 0.35–0.55 per kg). Insert a 5 % volume degression trigger every 50 000 m² and cap annual escalation at CPI +3 %. Force majeure must exclude “raw-material shortage” unless supplier proves 30-day inventory; otherwise LD of 0.5 % per week of delay applies. Demand 10-year color-fade warranty ΔE ≤ 2.5 and transferrable to end-customer—this single clause removes 70 % of low-tier Chinese mills.

Supplier Qualification & FAT Protocol

Pre-qualify only ISO 9001 + ISO 14001 mills with minimum USD 100 M revenue and 5 kt/month coil coating capacity. FAT is executed at mill’s line: 3-panel sampling per 2 000 m² lot—tests include 180° peel strength ≥7 N/mm, impact 50 kg·cm no crack, and salt spray 1 000 h ≤2 mm creep. Record coil numbers on MTR; any deviation triggers 100 % lot rejection at buyer’s cost. Book 3rd-party inspector (SGS/TÜV) at USD 4k–6k per visit; cost is supplier-funded but booked as price add-on if passed. FAT sign-off is gating event for 30 % down-payment release; retain 10 % until final commissioning.

Contract Risk Matrix – FOB vs DDP

| Decision Variable | FOB Shanghai | DDP Chicago | CFO Impact |

|---|---|---|---|

| Unit price add-on | 0 | +USD 0.90–1.20/m² | lock 5 % margin |

| Transit risk owner | buyer | seller | 0.8 % of CIF value |

| Duty & Section 232 Al tariff | buyer | seller | 10 % landed cost |

| Cash cycle (days) | 45 | 15 | –30 working capital |

| Claim window | 7 days on B/L | 3 days on POD | legal exposure |

| Force majeure cover | port closure | warehouse flood | insurance gap USD 0.4 M |

Use FOB when buyer controls freight contracts (annual TEU >500) and has US customs bond; switch to DDP for single-site projects <100 000 m² to cap escalation. Insert “retention of title” clause—ownership transfers only after final commissioning, protecting against supplier insolvency during transit.

Logistics & Installation Commissioning

Book break-bulk to avoid container compression damage; require V-groove CNC tolerance ±0.2 mm and protective film 60 µm blue PE. On-site, verify sub-structure flatness ≤2 mm/2 m; any re-shimming cost >USD 15 k is supplier liability if root-cause is panel bow >1 mm/m. Final commissioning sign-off triggers last 10 % payment release and starts warranty clock. Archive one witness panel every 1 000 m² for future color-match; storage cost USD 0.45/m²/year is pre-funded by supplier.

⚡ Rapid ROI Estimator

Estimate your payback period based on labor savings.

Estimated Payback: —