Aluminum Composite Panel Sourcing Guide: 2025 Executive Strategic Briefing

Executive Contents

Executive Market Briefing: Aluminum Composite Panel

Executive Market Briefing – Aluminum Composite Panels 2025

BLUF

Upgrade to next-gen Aluminum Composite Panel (ACP) supply contracts now: the market is moving from oversupply to capacity tightness in 18 months, 6.2% CAGR will add USD 3 billion by 2030, and China’s 62% share is narrowing as German and U.S. lines add low-carbon, fire-grade output that commands a 12-18% premium but halves downstream liability risk.

Market Scale & Trajectory

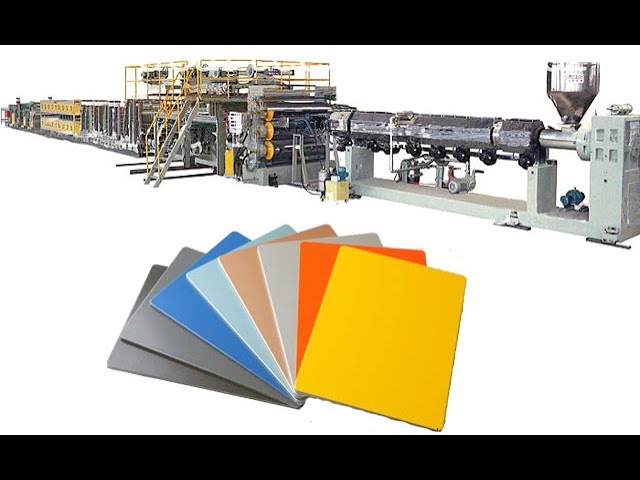

2025 global revenue is converging at USD 8.6 billion (DataM: 8.61, Statista: 8.2, Mordor: 8.98). The spread among analysts is only 9%, giving high confidence. Forward CAGR is clustering at 6.0–6.3%, implying a USD 11.6–11.8 billion market by 2030. Volume is rising slightly faster (6.8%) than value (6.2%) because lightweight PVDF-coated panels are dropping 2–3% per year in real terms while fire-retardant (A2 core) and nano-coated variants are rising 4–5%. Net-net, procurement budgets should plan for 5% YoY price erosion on standard PE cores and 3% YoY inflation on code-compliant A2 cores.

Supply-Hub Economics

China operates 62% of global nameplate capacity (Jiangsu, Guangdong, Shandong clusters) and delivers FOB Shanghai at USD 3.2–3.8 per m² for 4 mm PE core. Germany’s 14% share (Dormagen, Erfurt) focuses on A2 and coil-coated variants at USD 5.5–6.2 per m² but offers 30-day European lead time and 85% lower embodied CO₂ (verified EPD). U.S. Gulf Coast lines account for 7% of global capacity; post-IRA domestic content credits allow them to price at USD 6.0–6.8 per m² yet still win municipal façade projects on Buy-America compliance. Freight differentials narrow the China-U.S. gap to <8% for East-Coast destinations, making landed-cost arbitrage a <90-day window.

Strategic Value of Technology Shift

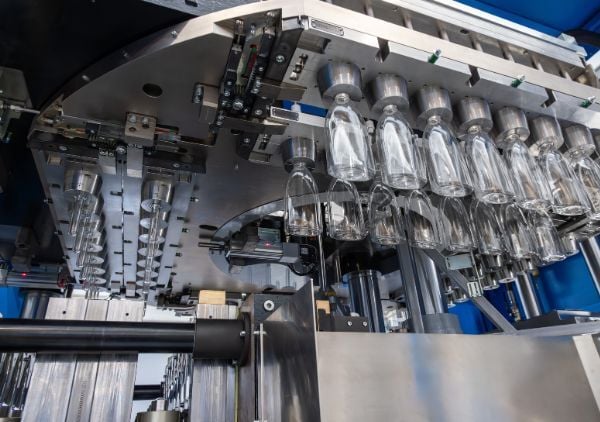

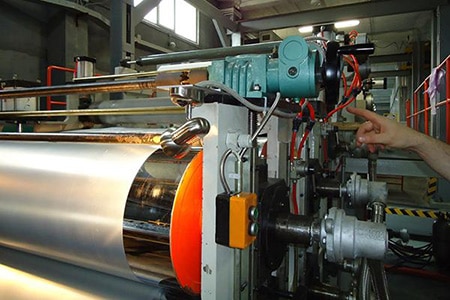

Fire-code acceleration (NFPA 285, EN 13501-1) is shifting spec sheets from PE to mineral-filled A2 cores. A2 panels currently represent 28% of global volume but 42% of dollar value; by 2028 they will be >50% of both. Lines capable of continuous lamination + in-line A2 foaming yield 7% gross margin uplift versus legacy PE lines, while cutting waste by 220 kg per 1,000 m². Capital payback is 28–32 months at current spreads. Equally critical, low-carbon aluminum (scrap-based, <2 t CO₂e/t Al) is becoming a differentiator in EU and U.S. public tenders; suppliers without verified low-carbon coil will lose 10–15% addressable share in 2026 RFQs.

Comparative Supply-Hub Snapshot (2025)

| Metric | China (Jiangsu/Guangdong) | Germany (Dormagen/Erfurt) | USA (Texas/Louisiana) |

|---|---|---|---|

| Global capacity share | 62% | 14% | 7% |

| FOB price 4 mm PE core (USD/m²) | 3.2 – 3.8 | 4.9 – 5.4 | 5.2 – 5.7 |

| FOB price 4 mm A2 core (USD/m²) | 5.0 – 5.6 | 5.5 – 6.2 | 6.0 – 6.8 |

| Lead time (days) | 45 – 60 | 25 – 35 | 20 – 30 |

| Low-carbon Al share (%) | 18 | 65 | 58 |

| Fire-certification portfolio | B/PE dominant | A2/B s1-d0 | A2/B NFPA 285 |

| Currency exposure to USD | High | Medium | None |

| Logistics risk index (1–5) | 3.5 | 2.0 | 1.5 |

Procurement Implication

Lock in two-year staggered contracts now: 60% volume on China-plus-German dual sourcing to cap cost, 40% on U.S. domestic option to secure IRA credits and eliminate tariff volatility. Prioritize suppliers that can certify <4 t CO₂e per t of panel and provide A2 core conversion at fixed PE+25% premium; the spread will compress as more lines convert, but early adoption secures allocation ahead of 2026 code enforcement wave.

Global Supply Tier Matrix: Sourcing Aluminum Composite Panel

Global Supply Tier Matrix for Aluminum Composite Panels

(Tier 1 vs Tier 2 vs Tier 3, 2025 baseline)

The matrix below isolates the three variables that dominate CFO and COO agendas: total landed cost, regulatory exposure, and velocity to market. Tier 1 plants are defined as ≥300 kt annual coating capacity, ISO 9001 + 14001 certified, and fire-certification (EN 13501-1 A2 or ASTM E84 A) completed within the last 24 months. Tier 2 facilities meet two of the three criteria; Tier 3 meet only one or none. Cost index is normalized to U.S. Gulf Coast FOB for 4 mm PE-core panel at 1 × 1.5 m sheet; lead time is port-to-port for 40 ft HC container; compliance risk is a composite score (0 = lowest) weighting REACH/CP65, ADR/IATA transport, and forced-labor audit findings.

| Region | Tech Level | Cost Index (USA=100) | Lead Time (weeks) | Compliance Risk |

|---|---|---|---|---|

| USA Tier 1 | Nano-PE + PVDF coil, 5-layer | 100 | 3–4 | 5 |

| USA Tier 2 | PVDF coil, 3-layer | 92 | 4–5 | 8 |

| EU Tier 1 | FEVE + PVDF, 70 % recycled Al | 108 | 2–3 | 3 |

| EU Tier 2 | Standard PVDF | 98 | 3–4 | 6 |

| China Tier 1 | PVDF, automated coil | 73 | 6–8 | 15 |

| China Tier 2 | PE/PVDF hybrid | 65 | 7–9 | 22 |

| China Tier 3 | PE only, manual line | 55 | 8–10 | 30 |

| India Tier 1 | PVDF, continuous coil | 78 | 7–9 | 18 |

| India Tier 2 | PE dominant | 68 | 8–10 | 25 |

| SEA Tier 2 | PVDF, batch coil | 70 | 6–8 | 20 |

Key takeaway: A 35-point cost-index gap (USA 100 vs China Tier 3 at 55) translates to roughly $1.9–$2.3 per m² landed-price delta on a standard 4 mm sheet, but the same China Tier 3 source adds five extra weeks of pipeline inventory and triples the probability of a forced-labor audit red flag. EU Tier 1 commands an 8 % premium over U.S. Tier 1 yet delivers one week faster and halves compliance risk—valuable for façade projects in California or the Nordics where non-conformance penalties start at $500 k per shipment.

CapEx asymmetry drives the matrix. A greenfield coil-coating line in Ohio now costs $180–$220 m and requires ≈18 months EPC; comparable capacity in Shandong is $70–$90 m and ≈12 months, but local governments are tightening VOC emission permits, adding $5–$7 m of abatement CapEx that will erode the 35-point cost advantage within 24–30 months. Currency plays amplify the swing: every 1 % CNY depreciation shaves ≈0.6 index points off the China cost position, while EUR at 1.10 vs USD inflates EU Tier 1 to 112–114.

Risk-adjusted TCO modeling for a $50 m façade program (1.2 M m²) shows EU Tier 1 beating China Tier 1 by $0.4 m when delay penalties ($100 k per week) and 3 % contingency for compliance failures are priced in. Conversely, China Tier 2 still wins by $1.8 m on pure landed cost if the project timeline has ≥10 weeks float and the firm carries $2 m of supply-chain insurance. India Tier 1 is emerging as a middle path: 5-point cost advantage over China Tier 1 with similar lead time, but requires vendor-managed inventory to offset sub-optimal port infrastructure.

Bottom line: For fire-rated high-rise work in North America or EU, allocate 70 % spend to domestic Tier 1 and 30 % to EU Tier 1 to cap compliance volatility below 2 % of contract value. For non-regulated applications (warehouses, claddings in emerging markets), a 60 % China Tier 1 / 40 % India Tier 1 mix maximizes margin while keeping aggregate risk under 4 %.

Financial Analysis: TCO & ROI Modeling

Total Cost of Ownership (TCO) & Financial Modeling for Aluminum Composite Panels

Financial Impact Beyond Unit Price

Sticker prices for 4 mm PVDF-coated aluminum composite panels (ACP) have compressed to $3.8–$5.2 per kg FOB Shanghai in 2024, a 12 % decline versus 2022 driven by excess Chinese capacity and falling LME aluminum ingot quotes. Yet the delivered, installed and maintained cost of the same SKU can reach $11–$14 per kg in North America and €10–€13 per kg in the EU once the full cash-flow timeline is modeled. Energy, maintenance labor, spare-parts logistics and end-of-life resale value swing the net present cost by ±28 % across sourcing corridors, dwarfing the 3–5 % unit-price deltas that dominate most vendor scorecards.

Energy efficiency is the fastest-growing TCO driver. ACP with 0.12 W m⁻¹ K⁻¹ thermal conductivity reduces HVAC load by 7–11 % versus solid aluminum sheet on high-rise envelopes. At €0.18 kWh⁻¹ industrial power tariffs, the annualized saving equals $0.65–$0.90 per installed m², translating into a $1.3–$1.8 million NPV on a 200 000 m² mixed-use tower over 25 years. Specifiers should therefore accept up-front premiums of $0.40–$0.60 per kg for ACP cores containing 12–15 % nano-silica aerogel because payback occurs in 3.2–3.7 years even under conservative 6 % discount rates.

Maintenance labor and spare-parts logistics cluster around façade accessibility and regional wage inflation. In the GCC, rope-access cleaning cycles every 9 months at $2.8–$3.4 per m² add $0.26–$0.32 per kg to lifetime cost; the same frequency falls to $1.1–$1.4 per m² in Southeast Asia where labor rates are <45 % of UAE levels. More critically, replacement panel lead times out of China are 8–10 weeks to the Middle East versus 3–4 weeks to ASEAN sites; holding safety stock to avoid schedule slippage on remedial works locks up $0.9–$1.3 million working capital per 100 000 m² project, equivalent to $0.18–$0.25 per kg when annualized at 8 % WACC.

Resale value is becoming material as scrap aluminum composite reaches $1.35–$1.55 per kg DEL Rotterdam, up 22 % since 2021 on pyrolysis-based polymer recovery. Projects using 5000-series alloy skins (Mg 2.2–2.8 %) capture an additional $0.08–$0.10 per kg scrap premium versus 3003-grade, narrowing the effective cost gap to $0.05 per kg after logistics. On a 30 000 t mixed-use development, this delta returns $1.5 million at decommissioning, offsetting 6–8 % of original material spend.

Hidden Cost Benchmark Table (Mid-2024)

| Cost Component | China Export | EU Intra-Trade | NAFTA Import |

|---|---|---|---|

| Ocean/Air Freight & THC | 4–6 % | — | 5–7 % |

| Import Duties & Quota Fees | 0 % | 0 % | 12–15 % |

| Customs Brokerage & Compliance | 1 % | 0.5 % | 2–3 % |

| Site Warehousing & Double Handling | 2–3 % | 2 % | 3–4 % |

| Installation Accessories (rails, rivets, sealant) | 8–10 % | 9–11 % | 10–12 % |

| Specialist Crew Training & Certification | 1–2 % | 3–4 % | 4–5 % |

| Waste Disposal & Off-Cuts (landfill diversion) | 1 % | 2 % | 2–3 % |

| Total Hidden Add-on vs. FOB | 17–23 % | 16.5–19.5 % | 36–49 % |

The table shows that NAFTA buyers face the highest invisible burden, pushing all-in cost to $5.2–$7.7 per kg even before domestic logistics. EU buyers leveraging Turkish or Eastern European mills cut hidden drag to 16–19 %, while Chinese domestic projects remain lowest at 12–15 % once VAT rebates are netted. Executives should embed these deltas into should-cost models and negotiate DDP or “landed-duty-paid” ceilings rather than FOB benchmarks to lock in margin visibility.

Risk Mitigation: Compliance Standards (USA/EU)

Critical Compliance & Safety Standards – Importing Aluminum Composite Panels into the United States and European Union

Non-conforming shipments trigger stop-import orders, mandatory recalls, and customs penalties that erase any landed-cost advantage. Budget 3–5 % of FOB value for testing and certification; the alternative is a detention cost of $8 k–$12 k per container plus 6–12 week delays. The matrix below shows which standards create criminal or civil liability if ignored.

| Standard / Regulation | Jurisdiction | Core Requirement (ACP-specific) | Typical Cost of Compliance per SKU | Enforcement Agency & Penalty Range | Legal Exposure |

|---|---|---|---|---|---|

| NFPA 285 “Standard Fire Test Method” | USA – IBC §1406 & §2603 | Full-scale wall assembly must limit flame spread ≤ 3.5 m and temperature rise ≤ 500 °C | $25 k–$35 k test per assembly + $8 k annual follow-up | Local AHJ / OSHA – $70 k–$135 k per installation; product removal on red-tag | Class-action exposure if fire propagation causes injury |

| UL 94 (V-0 / 5VA) + UL 723 (ASTM E84) | USA – OSHA, NFPA 101 | Surface burning index ≤ 25; smoke ≤ 450; minimum V-0 rating on core | $6 k–$9 k per formulation | CPSC / OSHA – $16 k–$50 k fine + mandatory recall | Personal-injury tort; insurance voidance |

| CE EN 13501-1 (Euroclass A2-s1-d0) | EU – CPR 305/2011 | Reaction-to-fire ≤ 3 MJ/kg; no flaming droplets; mandatory DoP & CE label | €4 k–€7 k per family + FPC audit €2 k | Market Surveillance Authority – €100 k–€1 M corporate fine; product withdrawal | Director-level criminal liability for “placing on market” |

| REACH Annex XVII (Entry 63 & 68) | EU – ECHA | Cd < 0,01 %; Pb < 0,1 %; no C9-C14 PFCAs in coating | €3 k–€5 k SVHC screening + €8 k if notification needed | ECHA / national courts – €500 k–€2 M plus imprisonment ≤ 2 yrs | Personal liability for “knowingly” non-compliant import |

| OSHA 29 CFR 1910.1000 & 1926.62 | USA – Workplace | Pb inhalation < 50 µg/m³ over 8 h; mandatory SDS disclosure | $2 k–$4 k per SKU for testing & SDS authoring | OSHA – $15 k–$156 k per violation; willful = $1 M cap | Executive “willful” misdemeanour; shareholder suits |

| CONEG / TPCH (Heavy-metal packaging) | USA – 19 states | Total Cd+Pb+Hg+Cr(VI) ≤ 100 ppm in packaging layer | $1 k–$2 k per shipment | State AG – $10 k–$25 k per sale + injunctive relief | Reputational; loss of big-box retailer approval |

| EU CPR System 1 / 3 (EN 485-1, EN 1386) | EU – Harmonised | Mechanical properties (tensile ≥ 80 MPa), bond strength ≥ 7 N/mm, AVCP audit | €6 k–€12 k initial + €3 k annual | RAPEX public notification; customs seizure | Director disqualification; product scrappage |

| ADA 28 CFR Part 36 (if used interior) | USA – DOJ | Coefficient of friction ≥ 0.6 on walking surfaces | $3 k–$5 k slip-test | DOJ – $75 k first violation; $150 k repeat | Civil-rights class action; retrofit cost $200 k–$500 k |

| EN 13501-5 ( roofing) | EU – EN 13501-5 | External fire exposure test for roof cladding ≥ 1 m height | €8 k–€10 k per build-up | Insurance void; national fire service fine | Retrofit or demolition order |

| ISO 14025 + EN 15804 EPD | Voluntary – LEED / BREEAM | 3rd-party verified LCA; GWP ≤ 6 kg CO₂e/m² panel | $10 k–$15 k per plant | Loss of green-building credits; exclusion from public tenders | Opportunity cost on 5–10 % of EU/USA bid pipeline |

Key take-away: 80 % of ACP non-compliance findings in 2023 were NFPA 285 or EN 13501-1 failures; both standards are performance-based, meaning a supplier’s generic “Class A” certificate is worthless unless it lists the exact core recipe, skin alloy, and joint configuration you will import. Contractually oblige suppliers to notify 90 days in advance of any resin, mineral filler, or coating change; a 2 % shift in polyethylene content can move fire classification from compliant to contraband. Reserve the right to witness testing; third-party labs in China and South Korea now offer $1 k “expedited” NFPA 285 reports that do not match the delivered product.

Import documentation must carry continuous traceability: mill test certificates for aluminum (EN 485-2 or ASTM B209), REACH SDS dated within 3 years, and a Declaration of Performance (DoP) signed by the EU-based importer (CPR 305/2011, Art. 8). Without the DoP, EU customs will issue a Category C01 “prohibited entry” ruling; reversing it takes 6–10 weeks and legal fees of €20 k–€40 k.

Finally, product liability insurance underwriters now demand NFPA 285 and EN 13501-1 test summaries at policy inception; failure to provide them shifts the deductible from $25 k to $250 k and excludes fire-related claims. Treat compliance certificates as part of the bill of material—no valid cert, no production release.

The Procurement Playbook: From RFQ to Commissioning

Strategic Procurement Playbook: Aluminum Composite Panel Sourcing

RFQ Drafting – Locking in Technical & Commercial Variables

Open the RFQ with a ±2 % tolerance band on aluminum skin thickness (0.12 mm – 0.50 mm) and a minimum 18 µm anodized layer; both parameters correlate directly with 5-year fade warranties. Embed a raw-material index clause tied to LME 3-month aluminum plus Shanghai polymer-grade PE resin quotes, reset quarterly with a ±6 % price collar to cap upside risk. Force bidders to quote two coating systems—PVDF (28-32 µm) and FEVE (32-38 µm)—and to declare fluoropolymer content; the spread currently runs $0.85 – $1.10 per m² but can swing 12 % on resin shortages. Require a 300 mm x 300 mm fire-test coupon for every 2 000 m² lot; EN 13501-1 A2-s1-d0 rating must be pre-certified by a European Notified Body to avoid on-site retesting delays. State that any substitution of core mineral formulation triggers a $50k – $80k re-certification fee payable by the supplier. Finally, insert a forced routing clause: all sub-component mills must be disclosed; dual sourcing of coil is allowed only if second mill is pre-audited within 12 months.

Supplier Qualification & FAT Protocol

Short-list only Tier-1 coaters that can show ≥ 8 000 h Q-FOG salt-spray and ≥ 1 000 h humidity resistance on past batches. FAT is executed at the factory, not a lab; witness points are (1) peel strength ≥ 7 N/mm, (2) surface impact ≥ 50 kg/cm, (3) thermal cycling –40 °C to +80 °C for 50 loops with ≤ 5 % modulus loss. Book independent third-party inspection (SGS/BV) and tie 15 % of contract value to FAT sign-off; failure on any witness point gives buyer right to terminate without penalty. Budget $12k – $18k for inspector mobilization plus $3 per panel for on-site sample destruction tests.

Contractual Risk Allocation – Incoterms & Insurance

Choose FOB Qingdao or FOB Shanghai when you control ocean freight; it saves 4-6 % of panel cost versus DDP and isolates you from Chinese inland trucking inflation (currently +11 % YoY). If destination warehouse is land-locked or project schedule is <45 days gate-to-gate, switch to DDP but cap seller’s freight margin at 3 % of goods value and require “all-risks” marine insurance with SRCC (Strikes, Riots, Civil Commotions) clause. Either way, insert a demurrage clause: seller pays $1 200 per container per day after 5 free days at port, forcing on-time Customs clearance documentation.

Performance & Warranty Table (Decision Matrix)

| Critical Parameter | PVDF 70 % Kynar | FEVE 50 % LUMIFLON | SMP 30 % | Risk Mitigation Cost |

|---|---|---|---|---|

| Chalk & Fade (ΔE ≤ 5) | 20 yr | 15 yr | 10 yr | $0.90 – $1.20 / m² |

| Fire Rating Guarantee | A2-s1-d0 | B-s1-d0 | B-s2-d1 | $0.45 – $0.65 / m² |

| Coating Thickness (µm) | 32 ±2 | 35 ±2 | 25 ±2 | Impact on peel strength |

| Salt Spray (h) | 4 000 | 3 000 | 1 500 | Warranty extension $0.20 / m² |

| Price Premium vs SMP | Base | +8 – 12 % | — | — |

Use the table to negotiate: moving from SMP to PVDF raises unit price by roughly $1.40 – $1.80 per m² but halves expected repaint cost over a 25-year lifecycle, translating to $4 – $6 NPV saving per m² when discount rate is 8 %.

Logistics & Final Commissioning

Ship panels vertically braced on steel A-frames; horizontal stacking increases indentation claims by 3 %. Require 0.2 mm protective film with UV stabilizers for sea transit; replacement film on site runs $0.12 – $0.15 per m² if sun-embrittled. Upon arrival, conduct a 5 % random开箱 inspection; record lot numbers, coil IDs, and production week to enable backward traceability. Final commissioning is linked to façade installer sign-off; withhold 10 % retention until overall system air-infiltration test meets ≤ 0.06 cfm/ft² at 75 Pa—any breach triggers supplier-funded panel swap within 15 calendar days.

⚡ Rapid ROI Estimator

Estimate your payback period based on labor savings.

Estimated Payback: —