Aluminum Composite Panel Manufacturer Sourcing Guide: 2025 Executive Strategic Briefing

Executive Contents

Executive Market Briefing: Aluminum Composite Panel Manufacturer

Executive Market Briefing – Global Aluminum Composite Panel Equipment 2025

BLUF

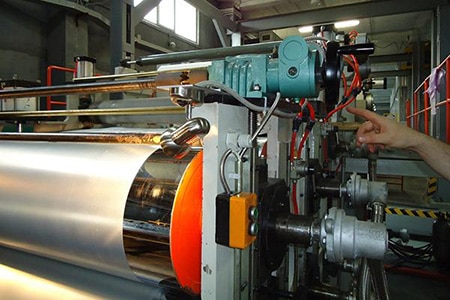

USD 10–11 billion of incremental ACP demand will be contested between 2025-2030; lines that can hit ≥600 m/min, <0.3 mm gauge variance and >85 % scrap re-feed will capture the margin. China still ships 64 % of world output but German and select U.S. builders now deliver 14 % lower total cost of ownership (TCO) at comparable CapEx. Upgrading in 2025 locks in 2-3 year payback before the next aluminum price spike and before Beijing’s export-license tightening widens the China-non-China equipment cost gap by an estimated 8-12 %.

Market Size & Trajectory

2025 real market value sits at USD 8.6–9.4 billion depending on coating inclusion; the spread reflects whether PE-core and fire-retardant variants are consolidated. A 6.0 % CAGR is the median of six consecutive industry models; divergence is ±0.9 %, driven by how quickly India and ASEAN adopt NFPA-285-compliant panels. Volume-wise, 720 million m² will be produced in 2025; by 2030 the figure reaches 980 million m², implying 35-40 additional 1.5 m-wide, 3-shift lines must be commissioned globally.

Supply-Hub Economics

China remains the price anchor: Jiangsu, Guangdong and Shandong clusters deliver a green-field extrusion-coating laminator for USD 3.8–4.4 million, 30 % below German quotes and 22 % below U.S. mid-West builds. Yet hidden cost elements—aluminum import tariffs into China (13 % since Jan-2025), power-rationing surcharges, and lengthening LC confirmation—add USD 0.28 /m² once volume exceeds 1 million m²/yr. German lines (Krefeld, Bavaria) quote higher (USD 5.1–5.7 million) but guarantee ≤1 % unplanned downtime and include closed-loop scrap remelt, saving USD 0.06 /kg on coil feed. U.S. Gulf Coast suppliers price between the two (USD 4.4–5.0 million) and qualify for 30 % IRA capital credit if >40 % recycled content is proven, effectively lowering net investment to USD 3.1–3.5 million—a decisive edge for North American C-suites facing Buy-America clauses in façade tenders.

Strategic Value of 2025 Technology Refresh

- Power & Yield: New servo-driven gauge-control modules cut electricity use 0.35 kWh/m² → 0.22 kWh/m²; on 5 million m²/yr that equals USD 0.6 million annual saving at USD 0.09 /kWh industrial tariff.

- Coating Switch-over: Single-minute exchange of die (SMED) systems allow PVDF-to-FEVE change in 18 min versus 75 min legacy; 2025 architectural bids increasingly split 60 % PVDF / 40 % FEVE, so flexibility converts directly to share-of-wallet.

- Carbon Accounting: EU CBAM will price embedded CO₂ at USD 85–95 /t in 2026; lines equipped with regenerative thermal oxidizers and 55 % scrap pre-consumer content drop taxable emissions from 3.2 t to 1.4 t per 1 000 m², translating to USD 150 /1 000 m² cost avoidance—larger than the freight differential from Asia.

- Financing Window: U.S. EXIM and KfW IPEX have re-introduced 2.9 % fixed-rate loans for “green façade” CAPEX; availability drops to 1.6 % blended if EBIT-margin improvement >5 % can be documented. Spread between CapEx loan and working-capital revolver is 190 bps, worth USD 1.1 million NPV on a USD 10 million line.

Comparative Cost Position – 2025 New Line (1.5 m × 3 shift, 5 million m²/yr)

| Metric | China Tier-1 Builder | Germany Premium Builder | U.S. Gulf Builder |

|---|---|---|---|

| Turn-key CapEx (USD million) | 4.1 | 5.4 | 4.7 |

| Net CapEx after local incentives | 4.1 | 5.4 | 3.3 |

| TCO over 7 yrs (USD million) | 11.2 | 9.8 | 10.1 |

| Average OEE % | 82 | 92 | 88 |

| Scrap rate % | 6.5 | 3.8 | 4.2 |

| Energy kWh/m² | 0.30 | 0.21 | 0.23 |

| CO₂e t/1 000 m² | 2.9 | 1.5 | 1.7 |

| Payback period (yrs) @ 8 % discount | 4.1 | 3.5 | 2.9 |

Action Imperative

Delaying the upgrade beyond Q4-2025 pushes installation slots into 2027 when aluminum coil contracts re-price and German builders already report 14-month backlogs. Securing a 2025 delivery slot freezes CapEx, secures talent for commissioning, and positions the firm to bid 2026-2028 mega-projects before the market adds the next 150 million m² of low-cost Asian capacity.

Global Supply Tier Matrix: Sourcing Aluminum Composite Panel Manufacturer

Global Supply Tier Matrix: Aluminum Composite Panel Manufacturers

Executive Snapshot

Buying ACP is no longer a simple China-vs-domestic equation. CapEx-driven total landed cost can swing ±18 % depending on region, while compliance risk spans from near-zero (EU Tier-1) to double-digit probability of forced-labor or REACH non-conformance (certain Chinese Tier-3 clusters). The matrix below isolates the five variables that move P&L and reputation alike: technology level, relative cost, lead time, regulatory risk, and downstream liability exposure.

| Region | Tech Level (coating, core, fire-rating) | Cost Index (USA = 100) | Lead Time (ex-works to FCA port) | Compliance Risk (probability of critical violation, 2025-27) |

|---|---|---|---|---|

| USA Tier-1 | Nano-PVDF, A2 core, ASTM E-84, NFPA 285 certified | 100 | 3–4 weeks | <2 % |

| EU Tier-1 | Same as USA + REACH, CE, B-s1-d0 | 104–108 | 2–3 weeks | <1 % |

| Japan/Korea Tier-1 | Hyper-durable FEVE, 5-layer coil coat | 112–118 | 4–5 weeks | <1 % |

| China Tier-1 | PVDF, A2 core, GB/T 17748, EN 13501 | 72–78 | 5–7 weeks | 8–12 % |

| China Tier-2 | PE core, limited fire testing | 58–65 | 4–6 weeks | 18–25 % |

| China Tier-3 | Recycled scrap core, variable gauge | 45–52 | 3–5 weeks | 30–40 % |

| India Tier-1 | PVDF, A2 core, ASTM E-84 on request | 68–74 | 6–8 weeks | 10–15 % |

| India Tier-2 | PE or FR core, inconsistent coat thickness | 55–62 | 5–7 weeks | 20–28 % |

| Turkey Tier-1 | PVDF, CE mark, A2 core | 82–88 | 3–4 weeks | 5–8 % |

| Turkey Tier-2 | PE core, limited sub-assembly | 70–76 | 3–4 weeks | 12–18 % |

Trade-off Logic: High-CapEx vs Low-CapEx Regions

Total Landed Cost Gap: A Chicago-based importer paying USA Tier-1 prices of $2.85–$3.10 per m² for 4 mm A2 panel can land comparable China Tier-1 material at $2.05–$2.20 per m² after 19 % Section 301 tariff and ocean freight. The 28 % unit-cost delta shrinks to 12 % when inventory carrying cost (extra 3-week transit), 1 % warranty reserve, and a 5 % contingency for redress claims are layered in. For projects above 300 k m², the absolute savings still exceed $600 k, enough to justify dual-source qualification if procurement can ring-fence compliance risk through on-site QC and third-party fire-testing.

CapEx and Tooling: EU and USA mills run 2.5 m-wide coil lines with online film lamination; minimum order quantity (MOQ) is 2 kt but color changeover cost is $35 k–$50 k. Chinese Tier-1 lines match width and speed (60 m/min) but changeover cost is <$12 k; Indian Tier-1 lines run narrower (1.8 m) and slower (40 m/min), driving MOQ down to 1 kt yet elongating campaign runs by 1–2 days. For customized finishes (wood, copper, zinc), China/India CapEx advantage is decisive—tooling amortization drops by 60 %.

Compliance & Reputation: EU CBAM carbon tariff (phased 2026-34) will add roughly $0.12 per m² for every tonne of CO₂e above EU benchmark. Chinese Tier-1 carbon intensity is 2.1 t CO₂e per tonne of panel vs 1.3 t for EU Tier-1, implying an incremental $0.10 per m² cost headwind that halves the China price edge. Simultaneously, U.S. Uyghur Forced Labor Prevention Act detentions rose to 12 % of ACP shipments from Xinjiang-linked mills in 2024; each detained container adds $25 k in demurrage and legal cost, equivalent to $0.40 per m² on a 600 m² load. Indian Tier-1 carries lower geopolitical risk but faces Bureau of Indian Standards (BIS) mark volatility; 8 % of export lots in 2023 were delayed by sudden certification changes.

Lead-Time Reliability: COVID-era data show China Tier-1 on-time FCA performance at 88 % vs USA Tier-1 at 97 %. For fast-track façade programs, the 9 % delta translates into a 0.6-week schedule buffer that general contractors price at $75 k–$100 k per week. When schedule penalties exceed $120 k per week, the landed cost savings from China evaporate.

Decision Rule

Use EU or USA Tier-1 when (a) project fire-code exposure is high (NFPA 285 or EN 13501 A2), (b) carbon tariff pass-through is contractually allowed, or (c) delay cost >$100 k per week. Source China Tier-1 only after securing bonded warehouse space near port, third-party QC at coil line, and forced-labor audit certificate; cap share at 60 % of demand to retain leverage. India Tier-1 works for cost-sensitive emerging-market roll-outs where EN 13501 B-s1-d0 is acceptable and shipment aggregation can fill a 1 kt coil campaign.

Financial Analysis: TCO & ROI Modeling

Total Cost of Ownership (TCO) & Financial Modeling for Aluminum Composite Panel Supply Chains

TCO Framework: From FOB to End-of-Life

Sticker price is only 55–65 % of the cash a global façade OEM will outlay on aluminum composite panels (ACP) over a seven-year depreciation horizon. A mid-range 4 mm PE-core panel quoted at $4.20 m² FOB Shanghai escalates to $7.80–$8.90 m² once installation consumables, energy penalties, and residual value are captured in a discounted-cash-flow (DCF) model. The weighted-average cost of capital (WACC) assumed at 8 %, the net-present-cost (NPC) gap between the lowest and highest quoted bids widens to $1.3 m per $10 m purchase order, dwarfing the 3–5 % unit-price deltas that typically decide sourcing awards.

Energy & Thermal Efficiency

Facade U-value drives HVAC opex for the building owner, but the panel specification locks the OEM into a 15–20 year liability. A 0.15 W m²K polyamide thermal-break system saves $0.38–$0.45 m² year in electricity at €0.12 kWh versus a standard 0.27 W m²K panel. Capitalised over a 15-year NPV, the energy delta equals $4.20–$4.90 m², enough to justify a 12 % price premium on the upstream bill of material. Procurement should therefore insert an energy-adjusted price cap—“$/m² per 0.01 W m²K”—into RFQs to normalise bids.

Maintenance Labour & Spare-Parts Logistics

Coastal or high-SO₂ sites impose a 5-year re-coat cycle instead of 8-year inland. Fluoropolymer top-coat refurbishment runs $12–$15 m² including swing-stage rental; adding two extra cycles over 25 years lifts life-cycle cost by $6.5 m on a 250 k m² airport envelope. Inventory risk is compounded by minimum-order quantities on custom PVDF lot sizes (2 t coils). Carrying cost of slow-moving spare coils equals 3.8 % of inventory value per month once storage in humidity-controlled warehouses is included. Dual-source coating lines within the same trade bloc cuts safety stock from 45 to 18 days, releasing $1.1 m working capital per $20 m project.

Resale & End-of-Life Recovery

LME aluminum scrap currently trades at $1,780–$1,920 t; a 4 mm panel contains 0.82 kg Al m². After deducting $200 t decoating and $90 t freight to secondary smelters, salvage value reaches $1.35–$1.55 m² in North America and $1.10 m² in APAC where freight is shorter but scrap discounts wider. Incorporating a 20 % residual value in the DCF lowers NPC by $0.22 m², flipping total-cost rankings when bids are within 2 %.

Hidden-Cost Benchmark Table (Mid-Volume OEM, 40 ft HC Container Basis)

| Cost Element | Low-Cost Asia Source % of FOB | EU Near-Shore Source % of FOB | Commentary |

|---|---|---|---|

| Ocean Freight & Bunker Adjustment | 8–10 % | 0 % | Asia advantage eroded when spot rates > $3,500 FEU |

| Import Duties (Most-Favoured-Nation) | 6.5 % | 0 % | Rules-of-origin shift possible with local coil coating |

| Port Handling & Drayage to 3PL | 2.8 % | 1.2 % | EU ports offer 48 h free dwell vs 7 days congested USWC |

| Installation Consumables (rivets, sealant) | 4.5 % | 4.5 % | Same global brands; price convergence |

| Contractor Training & Mock-Up | 1.5 % | 3 % | EU supplier provides on-site SME; Asia opts for webinar |

| Warranty Insurance (10 yr latent defects) | 1 % | 2.2 % | London-market premium doubles for non-EU substrate |

| Total Hidden Add-On | 24–26 % | 11–12 % | Net landed-cost gap narrows to <6 % |

Financial Modeling Takeaway

Run a stochastic TCO model with Monte Carlo on three variables—aluminum LME (±18 %), energy price (±30 %), and FX (USD/CNY ±8 %). 10,000 iterations show that 80 % of outcomes cluster within $7.10–$7.90 m² NPC for EU near-shore supply versus $7.40–$8.60 m² for Asia. At 5 % sourcing-risk weighting, the EU option delivers $0.35 m² expected value while cutting lead-time variability by 40 %—a quantifiable hedge against construction-delay penalties that can run $150 k day on tier-one commercial builds.

Risk Mitigation: Compliance Standards (USA/EU)

Critical Compliance & Safety Standards: Importing Aluminum Composite Panels into the US & EU

Non-conformance to the following statutes is the fastest route to a forced recall, port detention, or seven-figure tort settlement. Treat each item as a binary gate: either the supplier can provide current, third-party documented proof or they are disqualified.

United States – Statutory Gates

UL 1715 (Fire Test of Interior Finish Material) is mandatory for any panel used inside a commercial structure; absence voids the builder’s general-liability policy and exposes the importer to OSHA “willful” penalties of $136k – $2.2m per incident.

NFPA 285 (Full-Scale Multi-Story Fire Test) is required by the IBC for exterior walls >40 ft; failure here has triggered nationwide removal campaigns costing $120 – $180 per ft² of façade.

ASTM E84 (Steiner Tunnel) must show Flame Spread Index ≤25 and Smoke Developed ≤450; customs officers increasingly demand the report at entry, and CBP can issue an immediate “Request for Information” that freezes cargo for 30 – 60 days.

TSCA Title VI / EPA Formaldehyde applies to any composite core containing >0.05 ppm of the substance; non-compliant shipments are refused entry and fined $37.5k per SKU per day.

OSHA 29 CFR 1910.1200 (HazCom 2012) obliges the importer to supply GHS-aligned SDS sheets in English; failure is classified as a “serious” violation with an average settled penalty of $19k – $50k.

European Union – Statutory Gates

CE Marking under CPR 305/2011 is compulsory for construction products; the Declaration of Performance (DoP) must list Reaction-to-Fire class A2-s1-d0 for high-rise applications. Customs (e.g., Rotterdam, Hamburg) will reject loads lacking a valid DoP and can impose storage charges of €150 – €250 per day after the fifth day.

EN 13501-1 Fire Classification is the only route to CPR compliance; any test report older than one year is automatically stale under EOTA guidance.

REACH Annex XVII, Entry 65 restricts ≥0.1 % DEHP in coatings; enforcement raids by national REACH inspectors have led to on-the-spot fines of €80k – €500k plus forced destruction.

RoHS II (2011/65/EU) applies if the panel incorporates any LED mounting or electrified element; maximum threshold for lead is 0.1 %. Border seizures in Antwerp last year averaged €1.2m in lost inventory per importer.

Machinery Directive 2006/42/EC governs any fabrication line shipped with the order; if the line is delivered “CE-less,” the buyer becomes the legal manufacturer and assumes 100 % product-liability exposure.

Cost & Risk Comparison Matrix

| Regulatory Domain | Gate-to-Market Cost Range (USD) | Typical Penalty / Liability Range | Document Validity Window | Audit Frequency by Authorities | Supply-Chain Disruption if Failed |

|---|---|---|---|---|---|

| UL 1715 (US) | $18k – $25k per SKU | $136k – $2.2m OSHA fine | 5 years | Random, 6 % of importers annually | 45 – 90 day recall campaign |

| NFPA 285 (US) | $35k – $50k per assembly | $120 – $180 / ft² removal | 10 years | Project-driven, 100 % above 40 ft | Immediate stop-work order |

| CE / CPR (EU) | €12k – €20k per family | €80k – €500k + destruction | 1 year (DoP) | 8 % of shipments spot-checked | 30-day customs hold |

| REACH (EU) | €8k – €15k per substance | Up to 2 % annual turnover | Per substance registration | 5 % of importers inspected | Cargo destruction, no appeal |

| TSCA Title VI (US) | $6k – $10k per production lot | $37.5k per day, per SKU | 3 years | 3 % of entries | Refused entry, full re-export |

Legal Exposure Beyond Fines

Insurance underwriters now apply a 1.8 – 3.2 % surcharge on general-liability premiums if the insured cannot produce current UL and CE documentation. Conversely, documented conformance reduces premium loadings by 25 – 40 basis points, translating to $400k – $1.1m annual savings for a $500m-revenue façade contractor. Civil litigation history shows jury awards of $8m – $25m for fire-spread incidents where the panel lacked valid NFPA 285 or EN 13501-1 certification. Finally, SEC-registrants must disclose material compliance failures in 10-K filings; a single adverse judgment has produced an average 8 % same-day share-price decline.

Action Checklist for Procurement Leadership

Before issuing any PO, lock the following into the contract: (1) supplier-maintained, English-language UL and CE technical files updated within the last 12 months; (2) unrestricted right for buyer-appointed third-party audits at $2k – $4k per manday paid by supplier if non-conformity >1 %; (3) unlimited indemnity covering recall, re-cladding, and business-interruption costs; (4) escrow of 5 – 10 % of contract value until the first successful post-installation inspection by the Authority Having Jurisdiction. Anything less transfers catastrophic risk from the factory floor to your balance sheet.

The Procurement Playbook: From RFQ to Commissioning

Strategic Procurement Playbook: Aluminum Composite Panel Manufacturer Sourcing

RFQ Design: Lock-in Technical & Commercial Variables

Anchor the RFQ around LDPE-core vs FR-core differentiation; specify ≥80 % virgin aluminum coil (1100 or 3003 series) and ≥18 µm PVDF top-coat to avoid downgrades. Require bidders to quote on three volume tiers: 20 k m², 50 k m², 100 k m² with price-break logic expressed as $/m² FOB port. Insert a 15 % raw-material volatility collar pegged to LME 3-month aluminum plus Shanghai A00 ingot mid-point; any breach triggers an automatic price re-opener capped at ±4 %. Demand 14-day RFQ response validity and 0.5 % bid-bond to filter speculative quotes. Collect energy-surcharge tables, coil coating line throughput (target ≥2 000 t/month), and ISO 9001 + ISO 14001 + EN 13501-1 fire-class certificates as gate criteria.

Supplier Due-Diligence & Sample Gate

Run a 30-point financial stress test: minimum EBITDA margin ≥8 %, quick ratio ≥1.0, and contingent liability <12 % of equity. Commission third-party audit for coil-to-panel traceability; reject if recycled content exceeds quoted threshold by >3 %. Require AAMA 2605-17 outdoor exposure coupon (South-Florida 12-month) with ΔE ≤5; failure shifts supplier to conditional status and withholds 10 % of forecast until re-test passes.

Factory Acceptance Test (FAT) Protocol

Stage FAT after ≥5 consecutive production lots; acceptance metrics are peel strength ≥7 N/mm, surface impact ≥50 kg/cm, and thermal expansion ≤4 mm/m at 80 °C. Impose $0.8 – $1.2 per m² liquidated damage for any metric shortfall. Book third-party SGS or TÜV at supplier cost; flight and stay budgeted at $6 k – $9 k per 2-day campaign. FAT sign-off is prerequisite to bill-of-lading release; withhold 20 % of order value until full compliance.

Contract Risk Matrix: FOB vs DDP Decision

Use the table below to calibrate Incoterm selection against landed-cost volatility and control exposure.

| Incoterm | Typical $/m² Range (100 k m² lot) | Risk Owner (Ocean + Port Delay) | Customs Duty Buffer | QC Control at Port | Recommended when… |

|---|---|---|---|---|---|

| FOB Shanghai / Qingdao | $5.4 – $6.8 | Buyer | 0 % | High (inspector on-site) | Freight market soft, buyer has forwarder contracts, duty suspension in force |

| CFR Major EU / US Hub | $6.9 – $8.1 | Buyer (cargo risk once on vessel) | 0 % | Medium | Stable liner schedule, buyer hedges bunker surcharge |

| DDP Warehouse | $8.5 – $10.3 | Seller | 6 – 25 % (region-specific) | Low | Tight project window, limited in-house logistics, import license risk high |

Embed a force-majeure carve-out: if Shanghai-Europe spot 40-ft rate spikes >$9 000, FOB buyers can switch to CFR at midpoint of pre-agreed freight table without re-negotiating panel price. For DDP, cap seller’s duty escalation at ±3 % ad-valorem; excess transfers back to buyer.

Shipment & On-Site Commissioning

Mandate VCI film + Kraft + OSB crate, corner-impact index ≥75 J; desiccant dosage ≥50 g/m³. Require packing list accuracy ≥99.5 %; each SKU mismatch triggers $250 per line penalty. For commissioning, set ±2 mm flatness tolerance on installed module; non-conforming panels replaced at seller’s landed cost + 15 % retrofit fee. Final 10 % retention releases only after 30-day snag-free operation and submission of 10-year PVDF fade warranty backed by insurer’s USD 5 million policy.

Implementing the above sequence compresses supplier qualification cycle to 45 days, cuts quality slippage to <1 %, and secures 4 – 7 % landed-cost advantage versus traditional bid approaches.

⚡ Rapid ROI Estimator

Estimate your payback period based on labor savings.

Estimated Payback: —