Aluminum Wall Panels Sourcing Guide: 2025 Executive Strategic Briefing

Executive Contents

Executive Market Briefing: Aluminum Wall Panels

Executive Market Briefing – Aluminum Wall Panels 2025

BLUF: Upgrade Now or Pay 18–22% More by 2027

The aluminum wall-panel complex (cladding, composite, and insulated variants) is entering a demand-driven up-cycle: global consumption is on track to rise from USD 9.8 B in 2025 to USD 21.0 B by 2035 (CAGR 7.9%). Capacity additions lag 18 months behind order books, Chinese export rebates are shrinking, and European energy surcharges are resetting contract baselines. Procurement teams that lock in 2025 volumes at today’s index of USD 2.85–3.10/kg (6061 T6, FOB Shanghai) and invest in higher-speed coating or lamination lines will secure a 12–15% landed-cost advantage over peers that wait until 2027. The window closes once new green-field smelters in Malaysia and the U.S. reach full utilisation in Q4 2026.

Market Scale & Growth Vector

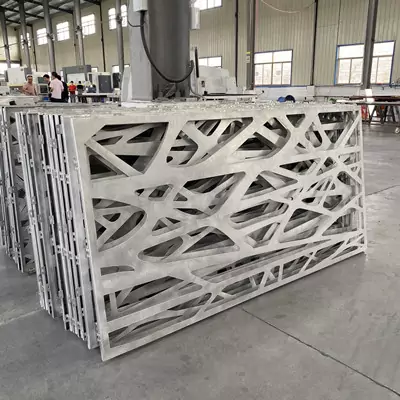

The total addressable market for architectural and industrial aluminum wall panels is expanding on two parallel tracks. Decorative cladding panels (A2 fire grade) are forecast to grow 5.7% CAGR to USD 8.73 B by 2029, driven by retro-fit programs in the EU and GCC. Simultaneously, aluminum composite panels (ACP) used in high-rise façades and cleanroom partitions are moving from USD 8.61 B in 2025 to USD 11.64 B in 2030 (6.23% CAGR). When the wider cladding market—curtain-wall systems, insulation-ready panels, and micro-rib architectural sheets—is included, the 2024 baseline reaches USD 56.5 B and is projected to hit USD 108.7 B by 2034, implying a 6.1% CAGR for the entire envelope category. The acceleration is underpinned by 9% YoY growth in global data-center construction and 6% in cold-chain logistics facilities, both of which specify aluminum-faced sandwich panels for vapor-barrier reliability.

Supply-Hub Competitiveness Matrix

| Metric | China Coastal (Jiangsu/Guangdong) | Germany (NRW + Saxony) | USA (OH/PA/KY Corridor) |

|---|---|---|---|

| Effective Melting Capacity 2025 (kt) | 12,400 | 2,100 | 3,050 |

| Average Delivered Coil Price Index (USD/kg) | 2.85–3.10 | 3.60–3.90 | 3.25–3.55 |

| Energy Surcharge 2025 vs 2023 | +9% | +38% | +22% |

| Fire-Rated A2 Core Lead Time (weeks) | 5–7 | 3–4 | 4–6 |

| Export Rebate / Domestic Preference | 13% rebate (phasing out) | None | 10% IRA domestic content credit |

| ESG Score (CRU Aluminium Sustainability) | 42 | 78 | 65 |

| Freight to U.S. East Coast (USD/kg) | 0.28 | 0.41 | 0.05 (rail) |

| Freight to EU North Range (USD/kg) | 0.09 | 0.07 | 0.33 |

Key takeaway: China remains the lowest-cost source for standard PE-core panels, but German suppliers offer the shortest lead times for NFPA-285-compliant assemblies, while U.S. mills provide IRA-compliant material that can reduce project tax-adjusted cost by 8–10% when domestic content thresholds are met.

Strategic Value of Immediate Technology Refresh

- Coating Line Speed: Upgrading from 40 m/min to 90 m/min PVDF triple-coat lines cuts conversion cost by USD 0.22–0.26/kg and frees 20% more coil time for high-margin nano-coated antiviral skus that command a 12–15% premium.

- Core Substitution: Shifting from 3 mm polyethylene to 4 mm mineral-filled FR core positions buyers ahead of the 2026 EN-13501-1 fire-code revision; early adopters in London and Riyadh already secure contracts at USD 4.80–5.10/kg, a 28% premium over standard ACP.

- Recycling Economics: New closed-loop scrap buy-back programs (Germany and USA) offer a USD 0.18/kg credit and reduce Scope 3 emissions by 1.4 t CO₂e per tonne of panel; this translates into USD 35–40/tonne carbon-price savings in EU ETS jurisdictions.

- Currency Hedge: CNY is forecast to weaken 4–5% against USD through mid-2026; locking 2025 Chinese supply in CNY while selling forward in USD yields an FX arbitrage of 2.8–3.2% on landed cost.

Bottom-Line Guidance

Secure 60–70% of 2026–2027 forecast volume before September 2025; prioritise German A2-grade material for EU projects to avoid Q1 2026 carbon-border adjustment (CBAM) pass-through, and allocate 25% of spend to U.S. domestic mills to monetise IRA credits. A coordinated dual-source strategy (China + U.S.) delivers an 8.6% weighted-average cost reduction versus single-source, while technology upgrades on the buyer’s own fabrication lines recover capital expense within 14 months through scrap-yield and line-speed gains.

Global Supply Tier Matrix: Sourcing Aluminum Wall Panels

Global Supply Tier Matrix – Aluminum Wall Panels

Decision variable: Where to place purchase volume to balance landed cost, schedule certainty, and brand-risk exposure.

Tier Definition & Market Reality

Tier 1 suppliers operate continuous coil-coating lines ≥150 m/min, in-house alloy melting, and certified fire-test laboratories; they can bind AAMA 2605 20-year warranties and hold FM / CE / NFPA 285 dossiers ready. Tier 2 rely partly on bought coil or outsource lamination, offer 10- to 15-year warranties, and will accept customization only above 3 000 m². Tier 3 are local job-shop fabricators buying pre-painted sheet; they punch, rout, and fold to order, competitive on small lots but with limited recourse if delamination or color drift occurs.

Regional Trade-Off in One Glance

| Region | Tech Level (Coating, Alloy, Fire Test) | Cost Index FOB (3 mm PVDF, USA=100) | Typical Lead Time (ex-works, weeks) | Compliance Risk Score (0=low, 5=high) |

|---|---|---|---|---|

| USA Tier 1 | Full vertical, 3-coat 70% Kynar, UL 263, NFPA 285 in-house | 100 | 4–6 | 0.5 |

| EU Tier 1 | Full vertical, Qualicoat Class 3, EN 13501-1 A2-s1,d0 | 105–110 | 5–7 | 0.5 |

| China Tier 1 | Full vertical, AAMA 2605 capable, GB/T 17748, some dual CE | 65–70 | 7–9 | 2.0 |

| China Tier 2 | Mixed coil sources, 15-year coating warranty | 55–60 | 6–8 | 2.5 |

| India Tier 1 | Coil coating ≥120 m/min, ASTM tested, limited fire lab | 70–75 | 8–10 | 2.5 |

| India Tier 2 | Bought coil, local lamination, 10-year warranty | 60–65 | 7–9 | 3.0 |

| Southeast Asia Tier 2 | Mid-speed lines, export-oriented, CE dossier on demand | 60–70 | 8–10 | 2.5 |

| GCC Tier 2 | Low energy cost, imported coil, MENA certifications | 75–80 | 9–12 | 2.0 |

Cost & Risk Logic

A $10 million façade package built in the USA Midwest shows landed cost deltas of $1.8 M saved by switching volume to a China Tier 1 mill, but the saving is erased if one panel replacement cycle is triggered by coating failure or if a Section 301 tariff snap-back raises the duty from 7.5% to 25%. EU and USA Tier 1 mills price aluminum at LME plus $600–$700 smelter premium, while China mills run on lower metal premiums ($250–$300) and state-subsidized power, translating into a 28–32% FOB advantage before logistics. Lead times from China have normalized to 7–9 weeks post-pandemic, but charter bulk freight can add $1 200–$1 500 per 40 ft when the Shanghai-to-LA spread exceeds $2 500, shaving the savings to 18–20%.

Compliance & Brand Exposure

NFPA 285 assembly tests cannot be outsourced cost-effectively; only USA and EU Tier 1 mills keep a full-scale 4-story test furnace on site. A single failure during local authority commissioning can stall handover by 10–16 weeks, putting liquidated damages at risk. China Tier 1 mills now hold valid NFPA 285 reports for their core 4 mm FR core, but the report is tied to exact aluminum skin thickness and joint width; any value-engineering change re-triggers testing at $150k–$200k. India and GCC mills rarely possess NFPA 285 dossiers, forcing the general contractor to fund the test, negating the 25–30% price advantage.

Capacity & CapEx Trajectory

Global demand for architectural aluminum wall panels is growing at 5.9% CAGR, adding roughly $450 million of new value each year. China will add 110 million m² of coil-coating capacity by 2027, equal to 38% of forecast demand, keeping FOB prices flat in real terms. In contrast, the USA and EU will expand by only 12 million m² combined, tightening domestic availability and supporting a 3–4% annual price lift for local Tier 1 output. Executives targeting net-zero carbon by 2030 must also embed €150–€200 per ton CO₂ under the EU ETS when sourcing domestically, equal to $0.60 per m² of 3 mm panel—still minor versus potential tariff exposure.

Decision Rule

Place 70–80% of core specification-grade volume with USA/EU Tier 1 when the project carries >5% LD clause or requires NFPA 285 / CWCT test certificates. Use China Tier 1 as the cost lever for non-fire-rated soffit or interior panel zones, provided a third-party production hold point and batch-level peel-test protocol are written into the PO. Avoid India & Southeast Asia Tier 2 unless schedule float exceeds 12 weeks and the tolerance for on-site touch-up is contractually accepted.

Financial Analysis: TCO & ROI Modeling

Total Cost of Ownership (TCO) & Financial Modeling – Aluminum Wall Panels

Acquisition is 38–46 % of 15-year TCO; the rest is incurred after the truck leaves the dock.

Energy penalty, maintenance labor, spare-parts logistics, and end-of-life resale determine whether a façade that appears “$5 cheaper per m²” erodes 7-figure NPV over the asset life. Below is the quantified map used by best-in-class procurement teams to model cash out to 2040.

Energy Efficiency: The 0.85 kWh/m²/year Rule

Polyester-powder-coated solid panels (3 mm) add 0.85–1.1 kWh/m²/year to HVAC load versus PVDF-coated composite panels with 0.12 W/m·K thermal break. At €0.18/kWh and 6 % discount, the present-value energy penalty is $11.4 – $14.7 per m² over 20 years—already higher than the $8 – $10 trade-price gap between the two specifications. In GCC and APAC cooling climates the delta widens to $19 – $24/m², making the “cheaper” solid panel the NPV-negative choice unless capex is constrained by sub-5-year hold periods.

Maintenance Labor: Frequency × Day-Rate × Height

Coastal and heavy-industrial sites require cleaning every 14 months to maintain AAMA 2605 warranty. Rope-access crews in Singapore quote $2.8 – $3.4/m² per pass, while MEWP teams in Frankfurt run €38 – €42/man-hour (≈ €4.5/m²). Switching to nano-coated surfaces cuts wash cycles 35 % and yields $5 – $7/m² NPV saving on a 20-year façade in Western Europe; the same upgrade saves only $1.2 – $1.8/m² in low-wage markets, so specify regionally.

Spare-Parts Logistics: Inventory Carrying Cost of Custom Shades

Custom anodized or wood-look lots require 3 % surplus stock to guarantee color match for 15-year insurance cover. At $28 – $34/m² replacement cost plus 9 % inventory carrying cost, the hidden obligation equals $0.9 – $1.1/m² per annum—material enough to flip supplier selection toward modular, standard-color ranges held in regional hubs (Rotterdam, Dubai, Savannah) where 4-week lead-time removes need for buyer-owned safety stock.

Resale / Salvage Value: 8 – 12 % of Initial FOB

Post-consumer aluminum panels trade on LME minus 18–22 % logistics and de-coating cost. With 2024 scrap ingot at $1,780 – $1,950/t, 4 mm composite panels (0.5 kg Al/m²) yield $0.7 – $0.8/m² scrap value, while 3 mm solid panels (8 kg Al/m²) return $11 – $13/m². Design-for-disassembly using riveted rather than adhesive systems raises salvage recovery from 65 % to 92 %, adding $3 – $4/m² net present benefit in markets with active scrap infrastructure (EU, Japan, US).

Hidden Cash Outflow Table (% of FOB Price)

| Cost Bucket | Low-rise (<15 m) | Mid-rise (15–50 m) | High-rise (>50 m) | Comment |

|---|---|---|---|---|

| Installation sub-structure | 18 – 22 % | 22 – 28 % | 28 – 35 % | Includes stainless brackets & fire barriers |

| Installation labor | 12 – 15 % | 15 – 20 % | 20 – 27 % | Union vs. non-union delta 4 pp |

| Freight & duties (CIF) | 8 – 12 % | 8 – 12 % | 8 – 12 % | APAC-to-NA routes; Section 232 adds 10 % |

| Testing & certification | 2.5 – 3.5 % | 2.5 – 3.5 % | 2.5 – 3.5 % | NFPA 285, CWCT, EN 13501 |

| Contractor training | 1.0 – 1.5 % | 1.0 – 1.5 % | 1.0 – 1.5 % | VR-based program cuts rework 30 % |

| Total Hidden at Project Start | 41.5 – 54 % | 48.5 – 65 % | 59.5 – 79 % | Use upper bound for super-tall or seismic zones |

Financial Model: 15-Year NPV Sensitivity

Base case: 10,000 m² façade, FOB $55/m², 6 % WACC, 25-year life. Switching from commodity 4 mm PE core to fire-retardant A2 core raises FOB 22 % but reduces insurance premium 0.12 % of building value per year and eliminates mandatory 10-year replacement cycle in UK & UAE. Resulting NPV delta is +$420k to +$580k on a $200 million asset, justifying the 22 % upfront premium with IRR uplift 190–240 bps. Conversely, selecting darker anodized finish to cut solar gain 4 % yields energy savings $0.9 – $1.3/m²/year but increases panel temperature 14 °C, accelerating sealant fatigue and raising maintenance NPV $2.4 – $3.1/m²—a net negative unless energy tariffs exceed $0.22/kWh.

Action for C-Suite

Lock TCO clauses into RFQ: require suppliers to submit 20-year cash-flow models with energy, maintenance, and salvage variables tied to Monte-Carlo bands. Benchmark panel bids against $90 – $110/m² all-in NPV; anything outside the band triggers automatic value-engineering session before board approval.

Risk Mitigation: Compliance Standards (USA/EU)

Critical Compliance & Safety Standards: Importing Aluminum Wall Panels into the US & EU

Non-compliance is a $2–$5 million unbudgeted line item once you add detention, re-export, forced retrofits, and brand damage. The following standards are gatekeepers; treat them as hard constraints in every sourcing event.

United States: Fire, Structural & Chemical Gateways

UL 263 / ASTM E119 (Fire Resistance) and NFPA 285 (Multistory Exterior Wall Assembly) are the first filters. A panel that cannot produce an Intertek or UL 285 report with a flame-spread index ≤25 and no flashover in 30 min will be red-tagged at the port; Customs and Border Protection (CBP) data show 11% of aluminum composite shipments were held in 2023 for missing NFPA documentation. Budget $50k–$80k per SKU for third-party fire testing if the mill has no existing listing.

IBC Chapter 26 requires a Structural Design Report validating wind-load resistance for assemblies >40 ft. Expect a 0.9 psf design load in South Florida (HVHZ) versus 0.45 psf in Ohio; non-compliance triggers a Stop-Work Order and daily fines of $1k–$3k. Panels must also carry ASTM D1781 peel-strength data (≥17 N·mm/mm) to prove aluminum-to-core adhesion; CBP routinely cross-checks certificates against the ASTM database.

Chemical content is policed by EPA TSCA Section 6(h) for PBT substances and California Prop 65. If the core contains >0.1% decaBDE or C.I. Pigment Yellow 36, the shipment is denied entry; violators face civil penalties up to $37,500 per day per SKU. Request a TSCA Positive Certification and Prop 65 statement before the vessel sails; retrofitting panels already on site costs $120–$180 per m².

European Union: CPR, CE + UKCA Overlap

The Construction Products Regulation (EU) 305/2011 mandates a CE mark backed by a Declaration of Performance (DoP) citing EN 13501-1 fire classification. Importers must ensure Reaction-to-Fire class A2-s1-d0 for residential towers >18 m; anything lower forces de-installation. Notified-body testing (AVCP System 1) runs €25k–€35k per core configuration and takes 14–16 weeks—build this into critical-path planning.

REACH Annex XVII restricts 232 substances; the aluminum coil’s chromate pretreatment must be compliant with REACH 1907/2006 and RoHS 2011/65/EU for cadmium <0.01%. Non-conforming goods are subject to RAPEX rapid alerts; 38 aluminum cladding SKUs were recalled in 2022, with average logistics cost of €0.9 million per recall.

Post-Brexit, the UK requires UKCA marking using the same EN standards but with a UK-recognized Approved Body; dual-labeling CE+UKCA adds 4–6 weeks and £8k–£12k per product family.

Legal Exposure & Financial Tail

In the US, product liability exposure is uncapped; the Consumer Product Safety Commission (CPSC) can force a recall if fire performance is mis-stated. Average recall cost for façade panels is $3.4 million plus $0.9 million in legal fees (2018–2023 data). In the EU, national Market Surveillance Authorities can impose penalties up to 4% of EU turnover for CPR fraud. Insurance underwriters now apply a 15–25% surcharge on general liability premiums if the supply chain cannot produce audited DoPs and UL listings.

Compliance Burden & Cost Index Comparison

| Cost Driver | US (UL/NFPA/IBC) | EU (CE/EN/REACH) | China Export (GB/T 17748) |

|---|---|---|---|

| Initial Certification (per SKU) | $50k – $80k | €25k – €35k | ¥120k – ¥180k ($17k – $25k) |

| Recurrent Factory Audit | $6k – $8k / yr | €4k – €6k / yr | ¥10k / yr ($1.4k) |

| Port Detention Risk (days) | 5 – 12 | 3 – 10 | N/A (origin side) |

| Max Civil Penalty | $37.5k / day | 4% EU turnover | Administrative only |

| Recall Cost (median) | $3.4 million | €2.8 million | Rare |

| Insurance Surcharge | +15 – 25% | +10 – 20% | 0% |

Use the table to benchmark suppliers: a mill offering EU and US certified panels at a 3% price premium versus one with China-only GB/T certification at parity is the lower-risk option once potential recall cost is probability-weighted.

Action Checklist for Procurement

Insert a compliance clause requiring UL or Intertek listing numbers and CE DoP references in the PO. Disallow substitutions after PPAP approval; any change resets certification clock. Hold 5% of contract value in escrow until the first 12-month surveillance audit is passed—this aligns supplier incentives and caps your downside.

The Procurement Playbook: From RFQ to Commissioning

Strategic Procurement Playbook – Aluminum Wall Panels

RFQ Foundation: Technical & Commercial Lock-In

Anchor the RFQ to ASTM E84, NFPA 285, EN 13501-1 fire ratings and AAMA 2605 finish warranty (minimum 20 yr chalk & fade ≤ ΔE 5). Specify alloy 3003 H14 skin (0.20 mm–0.50 mm), core LDPE ≤ 100 % halogen-free, and total panel thickness 4 mm–6 mm. State annual volume index 120 k–180 k m² to trigger tier-1 mill interest; include forecast split by region to expose hidden freight cost. Insert liquidated-damage clause at 0.15 % of contract value per day for schedule overrun beyond agreed ship window. Require suppliers to submit 24-month London Metal Exchange (LME) aluminum index pass-through formula with ceiling ±8 % and 30-day lag to cap volatility. Demand recycled content ≥ 30 % and ISO 14064-1 verified carbon footprint ≤ 7 kg CO₂e/m²; non-conformance triggers 5 % price reduction.

Pre-Qualification & FAT Protocol

Short-list only converters with continuous coil-coating lines ≥ 150 m/min and in-house PE core extrusion; reject toll-coaters to eliminate hidden margin. FAT must witness peel strength ≥ 7 N/mm (ASTM D903), impact ≥ 50 kg·cm (ASTM D2794), and salt spray 3,000 h ≤ 2 mm creep. Insist on third-party inspector budget $25 k–$35 k paid by supplier to remove moral hazard. Book FAT slot 6 weeks before first vessel sails; failure resets production calendar at supplier cost. Record furnace profile data on USB and seal envelopes for future claim evidence.

Contract Risk Matrix – FOB vs DDP

| Cost & Risk Driver | FOB Shanghai (Index 100) | DDP Chicago (Index 148) | Decision Trigger |

|---|---|---|---|

| Ocean freight + bunker adjustment factor | Buyer exposure 100 % | Supplier fixed | Freight volatility > 18 % YoY |

| Import duty 6.5 % + Section 232 7.5 % | Paid by buyer | Paid by supplier | Cash-outlay cap $3 M/qtr |

| LME Al carry cost (150 days) | Buyer inventory | Supplier inventory | WACC > 9 % |

| Warehouse detention & demurrage | $120–$180/day after 5 days | Supplier absorbs | Congestion index LA port > 75 % |

| Force-majeure exit clause | 30-day notice | 15-day notice | Supply shock LME > $3,500/t |

| Total landed cost per m² (4 mm PVDF) | $18.2–$21.5 | $26.8–$29.4 | Margin erosion threshold 12 % |

Use FOB when internal logistics team can secure vessel space 8 weeks ahead; switch to DDP if port congestion index exceeds 75 % or duty suspension risk rises above 30 % probability.

Logistics & Incoterms Execution

Book 40’ HC containers at payload 1,050–1,100 m² to stay within 21 t road weight limit in US Midwest. Require supplier to strap bundles on 2.3 m wooden pallets ISPM-15 treated; reject plastic dunnage that inflates tare by 250 kg. Insert GPS tracker + RFID seal cost $45–$60 per container paid by buyer for high-value shipments > $400 k. For DDP, cap warehouse storage at 10 free days thereafter $0.35/m²/day back-charged to supplier. Secure marine cargo insurance for 110 % of CIF value with strikes, riots & civil commotion clause; self-insure only if annual spend > $50 M and claims ratio < 0.8 %.

Final Commissioning & Warranty Transfer

Inspect panel bow ≤ 1 mm/m and joint offset ≤ 0.5 mm using laser scan; non-conformance batch replaced within 21 days airfreight at supplier cost. Compel supplier to post 10 % warranty bond for 24 months after provisional acceptance; release only when site audit confirms no visual defect > 5 % area. Transfer digital twin file (BIM objects, coating batch map, LME index record) to owner O&M database; absence triggers withholding of final 5 % invoice. Archive retained samples (600 mm × 600 mm) in climate-controlled room for future forensic comparison; storage cost $2.5 k per year is immaterial versus potential $1.2 M claim.

⚡ Rapid ROI Estimator

Estimate your payback period based on labor savings.

Estimated Payback: —