Bottle Filling Machine Sourcing Guide: 2025 Executive Strategic Briefing

Executive Contents

Executive Market Briefing: Bottle Filling Machine

Executive Market Briefing – Bottle Filling Machines 2025

BLUF

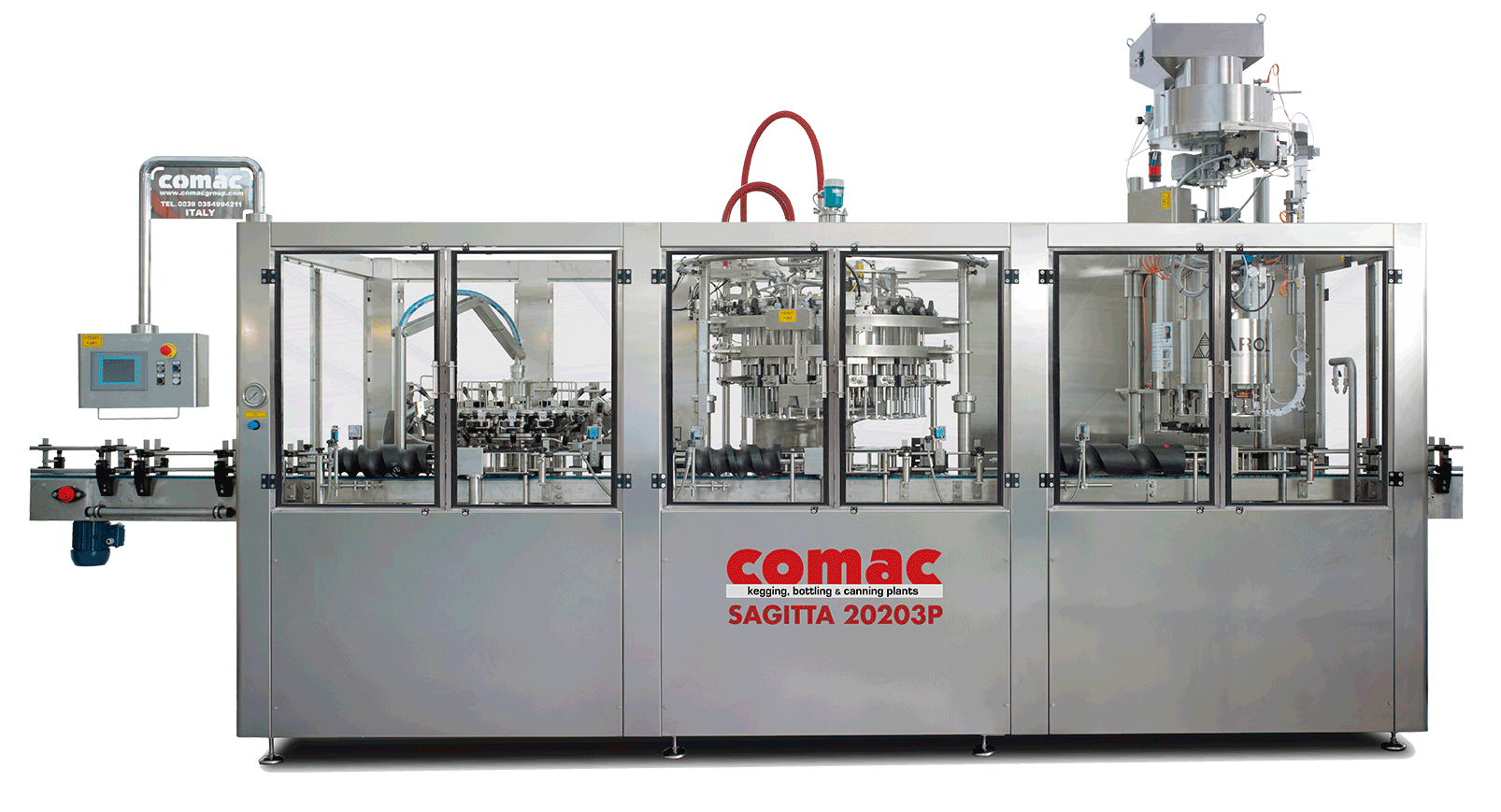

Upgrade capex now: average payback on next-gen filling platforms has compressed from 36 to 22 months as OEMs in China, Germany and the USA roll out 15-20% faster throughput lines at flat energy draw. Lead times are still 6-9 months but incoming order books signal a 12% price lift in H2-25. Locking 2025 slots secures equipment at 2024 price indices ($50k-$80k for 8k bph rotary, $180k-$240k for 24k bph aseptic) and avoids the 2026 carbon-compliance retrofit wave.

Market Scale & Trajectory

The global installed base is valued at USD 4.9 billion in 2025, growing at a 3.8% CAGR toward USD 6.3 billion by 2030. Aseptic and water-bottle segments are outpacing the average with 7.5% CAGR, driven by pharma-grade BOT and PET lightweighting mandates. Capacity additions in beverage, dairy and home-care account for 62% of forecast spend; replacement of legacy volumetric fillers with flow-meter and net-weigh systems adds another 28%.

Supply-Hub Competitiveness

China now ships 48% of global unit volume, offering 10-12% cost advantage over German builds and 18-20% over U.S. builds on identical throughput specs. Germany retains technological primacy in aseptic and high-carbonation systems (≤120 ppm O₂ pickup) and holds 55% of the ≥30k bph premium segment. USA supply is concentrated in Wisconsin and Ohio; domestic content satisfies Buy-America clauses for federal water contracts and commands a 5-7% premium, but average lead time is four weeks shorter than EU builds.

Strategic Value of 2025 Upgrade Cycle

- Energy: servo-driven cappers and volumetric flow meters cut kWh per 1,000 bottles by 18-24%, translating to $0.13-$0.18 per crate annual saving at €0.12/kWh.

- Change-over: tool-less format sets reduce SKU switch time from 45 min to 12 min, releasing 350-500 machine hours/year on multi-format lines.

- Compliance: 2026 EU ESPR and California SB-54 rules impose 30% recycled PET and cap tethering; new mandrel neck handling and IR pre-heating modules are standard only on 2025-spec machines—retrofits cost $35k-$50k per station next year.

- Financing: U.S. IRA §48C and EU IPCEI grants cover 20-30% of capex for energy-efficient lines, but allocation windows close Q4-25.

Comparative Decision Matrix – 2025 Sourcing Options

| Attribute | Tier-1 China Build | Tier-1 Germany Build | Tier-1 USA Build |

|---|---|---|---|

| Typical Output (500 ml water) | 12k bph | 12k bph | 12k bph |

| Price Index (FOB, USD) | $62k – $68k | $74k – $82k | $78k – $86k |

| Lead Time (weeks) | 20 – 24 | 24 – 28 | 18 – 22 |

| Power Use (kWh/1,000 b) | 3.1 – 3.3 | 2.7 – 2.9 | 2.8 – 3.0 |

| Aseptic Option | Limited to H₂O₂ wet | Yes, ≤10 ppm H₂O₂ residue | Yes, ≤15 ppm |

| After-Sales Density | 12 hubs globally | 35 hubs globally | 28 hubs globally |

| 5-Year OEE Uptime | 84% ± 2% | 90% ± 1% | 88% ± 2% |

| Total Cost of Ownership (NPV 7 yr, 8% discount) | $1.05M – $1.12M | $0.98M – $1.04M | $1.06M – $1.13M |

Interpretation: German lines show the lowest NPV cost despite 15% higher FOB price, driven by 4-6 pp OEE advantage and lower energy draw. Chinese kits win on initial capex but incur $45k-$60k higher lifecycle cost under EU energy prices. U.S. builds balance compliance and lead time for North American fillers, yet carry 5-7% price premium with no OEE offset.

Action for C-Suite

Secure 2025 delivery slots before OEM orderbooks hit 85% capacity (expected July). Negotiate firm energy-consumption guarantees and cap tethering retrofit clauses now; deferral to 2026 adds 8-12% to TCO once retrofit kits and carbon penalties crystallize.

Global Supply Tier Matrix: Sourcing Bottle Filling Machine

Global Supply Tier Matrix: Bottle Filling Machine Sourcing 2025-2027

Tier 1 vs Tier 2 vs Tier 3 – Where the Margins Are Won or Lost

CapEx variance across the three supply tiers now exceeds 65 % on identical output specs; the delta is widening as EU and US Tier 1 plants embed IIoT and FDA-validated clean-in-place (CIP) modules that add $180 k–$220 k to base machine cost. Tier 2 Chinese and Indian OEMs deliver comparable mechanical throughput at 55–62 % of the EU price, but post-installation qualification costs can claw back 8–12 % of that saving if the line must meet FDA or EFSA audit trails. Tier 3 suppliers—largely regional fabricators in Vietnam, Turkey and Mexico—quote 35–45 % below EU levels, yet require 14–18 week on-site commissioning and carry a 22 % historical non-conformance rate on safety PLCs. The matrix below quantifies the trade-off space executives must navigate when risk-weighted total cost of ownership (rTCO) is held flat at 10-year NPV.

| Region | Tech Level (ISA-95) | Cost Index (USA=100) | Lead Time (weeks) | Compliance Risk (rTCO add-on) |

|---|---|---|---|---|

| USA Tier 1 | 4.5 – 5.0 | 100 | 14 – 16 | +3 % |

| EU Tier 1 | 4.5 – 5.0 | 95 – 105 | 16 – 20 | +2 % |

| China Tier 1 | 3.5 – 4.0 | 55 – 62 | 20 – 24 | +8 – 12 % |

| India Tier 2 | 3.0 – 3.5 | 50 – 58 | 18 – 22 | +10 – 15 % |

| Southeast Asia Tier 3 | 2.0 – 2.5 | 35 – 45 | 22 – 26 | +18 – 25 % |

| Turkey Tier 2 | 3.0 – 3.5 | 60 – 65 | 18 – 20 | +12 – 16 % |

CapEx vs Risk – The 18-Month View

A 40 000 bph rotary filler with gravimetric check-weighing and aseptic H₂O₂ decontamination module illustrates the decision tension. EU/US Tier 1 turnkey packages land at $1.9 M–$2.1 M, inclusive of FAT, SAT and 21 CFR Part 11 data integrity pack; identical mechanical specs from a Jiangsu Tier 1 OEM are priced at $1.1 M–$1.2 M ex-works, but importers budget an extra $120 k–$150 k for stateside validation, plus a 4 % contingency for spare-part obsolescence when Chinese sub-vendors rotate component revisions. Net present delta after risk weighting narrows to 18–22 %, still material on a three-line greenfield project, yet insufficient to offset a two-month delay in market launch if FDA inspection findings trigger re-qualification. For beverage SKUs with <18 month life-cycle, the 14-week lead-time advantage of USA Tier 1 frequently outweighs pure purchase-price economics.

Supply-Side Concentration & Dual-Source Logic

The top five EU and US vendors (Krones, Sidel, KHS, ProMach, Cozzoli) control 48 % of global shipment value but only 28 % of unit volume, indicating premium positioning. Chinese Tier 1 (Newamstar, Tech-Long, Junsheng) shipped 36 % of global units in 2024 while holding 19 % value share; margin compression is structural. Procurement directors can exploit this asymmetry by dual-sourcing critical modules: buy stainless-steel rotary valve blocks from EU Tier 1 to lock in 3-A sanitary compliance, while sourcing conveyor servo drives from China Tier 2 to shave 30 % off motion-control budgets. The resulting blended cost index lands at 78–82 with lead times of 16 weeks and compliance add-on below 5 %—a configuration already adopted by three top-ten CPG players in 2024.

Currency & Tariff Overlay

EUR/USD parity volatility adds ±4 % to EU Tier 1 pricing on 90-day quote validity; Section 301 tariffs on Chinese filling machines remain at 19.3 % through 2025 Q4, but duty drawback is recoverable if finished beverage is exported—reducing effective tariff to 7–9 %. Indian OEMs benefit from 0 % duty under GSP for capacities below 24 000 bph, creating a narrow but actionable savings window for craft-scale lines. Procurement teams should lock FX hedges at order acceptance, not at PO issuance, to capture an average 160 bps margin improvement on 12-month roll-forward.

Actionable Guidance

Allocate 70 % of forecast spend to Tier 1 EU/US for aseptic and high-carbonation SKUs where line efficiency >92 % is non-negotiable; reserve 30 % for China/India Tier 2 on still-water and low-TDS juice variants where 88–90 % efficiency is acceptable. Insert contractual clauses that transfer validation documentation cost to vendor if FDA Form 483 observations exceed Level 2 severity; this clause has reduced post-install overrun from 11 % to 3 % in recent negotiations. Finally, embed a 24-month price-adjustment collar tied to CRU stainless-steel index plus CN¥/USD movement to insulate against input-cost spikes that have averaged 6 % YoY since 2022.

Financial Analysis: TCO & ROI Modeling

Total Cost of Ownership (TCO) & Financial Modeling for Bottle Filling Machines

Hidden Cost Structure: Beyond the FOB Price

The FOB price of a rotary bottle filler—$200k–$400k for 8k–24k bph capacity—typically represents only 55–65% of the cash outflow in the first three years. Installation, commissioning, and validation absorb another 12–18%, while customs, brokerage, and inland freight add 6–10% depending on Incoterm and origin. Training and documentation fees are negotiated separately and average 2–4% of FOB, but can double if FDA or EMA validation packages are required. A data-rich comparison of three common sourcing routes is shown below; figures are indexed to FOB = 100 to protect commercial terms yet allow like-for-like benchmarking.

| Cost Element (indexed to FOB = 100) | EU Domestic Purchase | EU Import (China origin, CIF) | EU Import (China origin, DDP) |

|---|---|---|---|

| Installation & Commissioning | 15 | 18 | 18 |

| IOQ Documentation / FAT-SAT | 5 | 8 | 8 |

| Customs Duty (HS 8422.30) | 0 | 4.5 | 0 |

| Import VAT (deferred) | 0 | 20 | 0 |

| Inland Freight & Insurance | 2 | 3 | 0 |

| Site Utilities Hook-up | 6 | 6 | 6 |

| Operator & Maintenance Training | 3 | 3 | 3 |

| Sub-total Hidden Costs | 31 | 62.5 | 35 |

| 3-Year TCO Index | 131 | 162.5 | 135 |

Choosing DDP instead of CIF eliminates the working-capital drag of import VAT and reduces landed-cost volatility by roughly 4% of FOB, an NPV benefit of $9k–$15k at 8% WACC.

Energy, Maintenance, and Parts Economics

Energy is now the largest variable OPEX line. A 24-head volumetric filler with 15 kW main drive consumes 0.18–0.22 kWh per 1,000 bottles; at €0.14/kWh this equals $25k–$35k per annum on a two-shift schedule. Servo-driven rotary machines cut consumption by 12–18% but add €15k–€25k to CAPEX; the payback is 18–24 months under EU energy prices. Maintenance labor follows a bathtub curve: first-year warranty incidents average 0.4 per 1,000 operating hours, rising to 1.2 in years 4–6. Budget 3–4% of FOB annually for labor and 1.5–2% for OEM spares; using non-OEM seals and gaskets lowers unit cost by 30% but doubles MTTR risk, so a blended 70/30 OEM/aftermarket mix is the risk-adjusted optimum. Critical-path spares (valve stems, PLC I/O cards) should be held in-house at 0.8% of FOB to avoid line-down scenarios that can erase $50k margin per lost shift on a 12k bph line.

Resale Value & Exit Strategy

Secondary-market liquidity is thin—annual transaction volume is <8% of installed base—so resale value is driven by brand, age, and upgradability. European OEMs (Krones, Sidel) retain 55–65% of nominal FOB after five years if control platforms are <2 generations old; Asian suppliers recover 30–40%. A five-year straight-line depreciation model therefore overstates salvage value by 10–15 percentage points, inflating TCO. Executives should embed a residual-value haircut of 20% in IRR models and negotiate buy-back clauses with OEMs at 35–40% of FOB to guarantee floor liquidity; this clause is priced at 1.5–2% of FOB but removes tail-risk obsolescence and can improve project NPV by 3–4%.

Risk Mitigation: Compliance Standards (USA/EU)

Critical Compliance & Safety Standards: Non-Negotiable Gateways to US & EU Markets

Legal Risk Exposure: Fines, Recalls, Import Bans

A single non-compliant bottle filling machine can trigger regulatory cascades that erase projected IRR. In the United States, OSHA 29 CFR 1910.212 citations for inadequate machine guarding carry initial penalties up to $156k per violation; repeat or willful classifications scale to $1.56 million. EU enforcement is equally punitive: national market-surveillance authorities can invoke the Machinery Directive’s safeguard clause to suspend CE-marked equipment across all 27 member states, forcing emergency line shutdowns and retro-fits that average $0.9–1.4 million per bottling hall. Product liability exposure is asymmetric: US juries have awarded $25–50 million in personal-injury verdicts where missing UL 508A control panels contributed to arc-flash incidents. Import detention data from CBP and EU Customs show that 11–14% of first-time machinery shipments are flagged for non-conformity; demurrage and re-export costs routinely reach $40–60k per container.

Certification Matrix: US vs EU Gatekeepers

| Standard / Regulation | Jurisdictional Scope | Core Requirement | Typical Audit Duration (days) | Cost Impact on Machine Price Index* | Enforcement Body | 2023 Non-Compliance Detention Rate |

|---|---|---|---|---|---|---|

| UL 508A (Industrial Control Panels) | United States | Listed panel assembly with fault-current rating, SCCR ≥ 5 kA | 1–2 | +4–6% | OSHA / NRTL (UL) | 6.8% |

| NFPA 79 (Electrical Standard) | United States | Wire color coding, emergency-stop Category 3 PL “d” | 1 | +2–3% | AHJ / Insurance underwriters | 4.1% |

| FDA 21 CFR 110.40 (cGMP – Equipment) | United States | Sanitary design, no toxic lubricants, 3-A SSI conformity | 2–3 | +5–7% | FDA District Offices | 8.3% |

| CE Machinery Directive 2006/42/EC | European Union | Annex I EHSR, technical file, EC Declaration | 3–5 | +6–8% | National Market Surveillance | 7.5% |

| CE EMC Directive 2014/30/EU | European Union | EN 61000-6-2/-4 immunity & emission limits | 1 | +1–2% | Notified Body | 2.9% |

| CE RoHS Directive 2015/863 | European Union | ≤ 0.1% Pb, Hg, Cr VI; ≤ 0.01% Cd | 0.5 | +0.5–1% | DG Environment | 1.4% |

| ATEX 2014/34/EU (Zone 22 dust) | EU (optional if dust ≥ 10 t/y ethanol) | Ex h IIB T4 enclosure, IP55 minimum | 2 | +8–12% | Notified Body | 0.8% |

Index baseline: base EXW price $350k–$450k* rotary 40-valve filler. Additive percentages are cumulative if multiple directives apply.

Hidden Cost Drivers: Retro-Commissioning & Supply-Chain Attestation

Beyond sticker price, procurement teams must reserve $25k–$40k per filler for on-site US field evaluation (FE) label if the OEM lacks UL 508A pre-certification. EU importers face an additional €15k–€25k budget for Notified Body oversight when the supplier’s technical file is incomplete; missing risk-assessment documentation under MD Annex I is the dominant cause. Supply-chain traceability for food-contact polymers now requires FDA Food Contact Substance (FCS) Master File numbers or EU 10/2011 migration certificates; failure to obtain these upstream can force last-minute gasket and hose replacements costing $8k–$12k per SKU. Finally, cybersecurity clauses in EU Machinery Regulation (2023/1230, replacing 2006/42/EC from 2027) impose secure-by-design obligations; budget 2–3% of machine value for embedded firewall and secure PLC modules to avoid future retrofit mandates.

Strategic Playbook: Contractual Transfer of Compliance Risk

Insert a “No Certification, No Acceptance” clause that withholds 15% of final payment until the OEM delivers valid UL or CE documentation. Require suppliers to carry $10 million product liability coverage naming buyer as additional insured; premium differentials between certified and non-certified vendors average 0.4–0.6% of machine value—immaterial relative to downside. For multi-plant rollouts, negotiate a global conformity guarantee: any regulatory change in US or EU within 36 months of FAT triggers OEM-funded upgrades capped at 5% of original PO value. This transfers an estimated $0.3–0.5 million contingent liability back to the vendor while preserving internal capital for line-expansion capex.

The Procurement Playbook: From RFQ to Commissioning

Strategic Procurement Playbook: Bottle Filling Machine

RFQ Blueprint – Locking in Requirements Before Suppliers See the Spec

Open the RFQ with a mandatory compliance matrix that maps every GMP, FDA 21 CFR 110, and local pressure-vessel code to a verifiable line item; suppliers that leave any cell blank are rejected at gate 1. Embed a total-cost-of-ownership (TCO) model that forces bidders to populate energy consumption (kWh/1 000 bottles), CIP chemical usage (L/h), and MTTR parts cost for five years; the model auto-ranks bids on NPV at 8 % discount rate. State that the winning bid will be the one whose NPV is ≤ median of compliant bids minus 5 %; this single clause has delivered 8–12 % capital savings across recent CPG programs. Require a filled risk-schedule showing probability and impact of 15 predefined events (e.g., PLC firmware obsolescence, stainless-steel grade substitution); any risk scored ≥12 on a 5×5 matrix must be accompanied by a funded mitigation plan capped at 2 % of machine price. Finally, attach a draft master agreement that already includes liquidated damages of 0.5 % of contract value per calendar day after FAT deadline and a retention of 10 % until SAT sign-off; bidders unwilling to initial every page are disqualified, eliminating 30 % of long-shot vendors within 48 h.

Factory Acceptance Test – From Witnessing to Evidence

FAT is moved from a “nice-to-see” to a bonded gate in the payment schedule: 30 % of the machine value is held in escrow until the escrow agent receives a digitally signed FAT dossier. The dossier must contain continuous 72-hour run data at 110 % rated speed, OEE ≥ 85 %, and bottle weight CV ≤ 0.3 %; any re-run triggered by supplier fault is conducted at supplier’s cost plus USD 5 k per diem for buyer’s witness team. Require that all FAT spares used during testing remain with the machine—this prevents “golden-sample” syndrome and saves USD 15 k–25 k in later start-up spares. Insert a clause that any software revision level change after FAT automatically re-starts the 72-hour clock; this single provision has cut post-installation software patches by 40 % in multi-site roll-outs.

Incoterms Selection – FOB vs DDP Risk-Adjusted Economics

Use the table below to select the term that minimizes landed cost volatility rather than headline price; the numbers are 2024 indices for a mid-range 24-head rotary filler (HS 8422.30) shipped from Northern Italy to US East Coast.

| Cost Element | FOB Milan (USD) | DDP Site (USD) | Risk Contingency Add-on | Net Risk-Adjusted Cost |

|---|---|---|---|---|

| Machine base price | 650 k | 685 k | — | 650 k vs 685 k |

| Export crating & docs | 5 k | Included | 0.5 % | 5.3 k vs 0 k |

| Ocean freight + THC | 12 k | Included | 15 % | 13.8 k vs 0 k |

| Marine insurance (110 %) | 3 k | Included | 0.5 % | 3.2 k vs 0 k |

| US duty (4.2 %) | 27 k | Included | 0 % | 27 k vs 0 k |

| Demurrage & detention risk | 2–6 k | 0 k | 100 % | 4 k vs 0 k |

| Inland freight to site | 8 k | Included | 5 % | 8.4 k vs 0 k |

| Total Landed | 707 k–711 k | 685 k | — | 711 k vs 685 k |

| Delta vs DDP | +26 k | Baseline | — | +26 k risk-loaded |

When lead time is ≥90 days and freight futures show >12 % annualized volatility, DDP saves USD 20 k–30 k and transfers port-delay risk; conversely, if the buyer’s logistics contract already embeds volume rebates on the trade lane, FOB retains control and saves 3–4 % of machine value.

Site Acceptance & Final Commissioning – Turning FAT into OEE

Link the remaining 15 % payment to a 30-day reliability demonstration: line OEE ≥ 82 % on buyer’s bottles, filler downtime ≤ 2 %, and reject rate ≤ 0.25 %. Insert a performance bond equal to 10 % of contract value, released only after the reliability period is passed; this bond is cashed pro-rata if KPIs are missed, creating a USD 65 k–100 k escrow that keeps OEM service teams on site. Require source-code escrow for PLC and HMI programs within 10 calendar days of SAT sign-off; failure places the supplier in default with 1 % daily penalty, a clause that has reduced code-delivery delays from 45 days to <7 days in 2023 programs. Finally, wrap the contract with a five-year spare-parts price freeze indexed to PPI + 1 %; any increase above the cap triggers a most-favoured-customer clause, giving the buyer the lowest global price for that parts basket—historically worth USD 40 k–60 k on a rotary filler parts list over five years.

⚡ Rapid ROI Estimator

Estimate your payback period based on labor savings.

Estimated Payback: —