Coral Fleece Fabric: The Ultimate 2025 Sourcing Guide

Introduction: Navigating the Global Market for Coral Fleece Fabric

Coral fleece has become a reliable staple for mid‑market apparel, athleisure, and lifestyle gifting. Yet, “anti‑pill” has become a buyer trap. It is often an marketing claim rather than a tested standard, and it can conceal hidden costs in shrinkage, colorfastness, and MOQs. With supply concentrated across China, Turkey, and select EU mills, global buyers now need precise specs, clear quality proof, and disciplined vendor management.

Use this guide to:

– Map the market and recognize common product types (polar vs coral, anti‑pill vs anti‑static, brushed vs napped).

– Confirm specs: GSM, pile height, stitch density, backing fabric, finish, and color fastness.

– Verify quality: sample workflows, abrasion tests, pilling ratings, and defect control.

– Build sustainability: material inputs (recycled PET, REACH/ZDHC alignment), OEKO‑TEX certifications, traceability.

– Negotiate and secure stable supply: pricing ladders, MOQs, lead times, and logistics to USA/EU.

Snapshot: Typical price ranges (USD, ex‑works, medium weight, plain colors)

| Region | Price per yard | Per‑foot equivalent | Notes |

|—|—:|—:|—|

| USA (e‑commerce sampling) | $13.99 | ~$1.17/ft | Snapshot; small‑quantity unit pricing |

| USA (range from another listing) | $7.99 | ~$0.89/ft | Listed as unit price on similar item |

| EU | Market‑specific | N/A | Confirm with distributor; varies by VAT and duty |

What this guide delivers next: actionable specs and test protocols, a practical risk checklist, supplier red flags, pricing ladders, sustainability options, and a practical sourcing plan to USA/EU delivery.

Illustrative Image (Source: Google Search)

Top 10 Coral Fleece Fabric Manufacturers & Suppliers List

1. Top 4 Chinese Fleece Fabric Manufacturers to Consider for Your …

Domain: kingcason.com

Registered: 2017 (8 years)

Introduction: Suzhou Makeit Technology is a leading flannel fleece fabric manufacturer in China. … Whether you’re looking for polar fleece, coral fleece, or ……

2. Coral Fleece Fabric Manufacturers: China Wholesale Supplier

Domain: tianquantextiles.com

Registered: 2023 (2 years)

Introduction: Looking for high-quality coral fleece fabric manufacturers? Our China-based factory is a leading supplier of premium coral fleece fabric. Contact us today!…

3. High-Quality Coral Fleece Fabric Factory and Suppliers Direct Price

Domain: frontiertextile.com

Registered: 2022 (3 years)

Introduction: High-Quality Coral Fleece Fabric Factory and Suppliers Direct Price | Frontier Tex….

4. Coral Fleece Material Double Sides Brushed Fabric – Ruili Textile

Domain: ruili-textile.com

Registered: 2016 (9 years)

Introduction: Find high quality coral fleece material double sides brushed fabric products on sale today at the official online store of Ruili Textile – the world’s ……

Illustrative Image (Source: Google Search)

5. Fleece Fabrics Wholesale | Nooteboom Textiles

Domain: nooteboomtextiles.com

Registered: 2013 (12 years)

Introduction: Nooteboom Textiles is first-in-line on the European market as a wholesaler in fabrics for ladies- and children’s clothing and home ……

6. China Coral Fleece Fabric Manufacturers, Suppliers, Factory

Domain: haoyangfabric.com

Registered: 2019 (6 years)

Introduction: Haoyang is one of the most professional coral fleece fabric manufacturers and suppliers in China for over 10 years. If you’re going to wholesale high ……

7. Fleece Fabric Manufacturers & Suppliers – Hanyo Textile

Domain: hanyotextile.com

Registered: 2023 (2 years)

Introduction: Hanyo Textile is a reputable Fleece Fabric Manufacturer around you. Changzhou Hanyou Textil is the global destination of choice for fabric enthusiasts….

8. Fleece Fabric Manufacturers – Goodada

Domain: goodada.com

Registered: 2012 (13 years)

Introduction: Top Rated Fleece Fabric Suppliers. KADIR TEKSTIL – Turkey … We specialize in manufacturing polar fleece, coral fleece, fleece blankets and other knitted ……

Understanding coral fleece fabric Types and Variations

Understanding coral fleece fabric Types and Variations

Coral fleece is a color variant of anti-pill polyester fleece rather than a distinct category. For B2B sourcing, it is practical to classify options by fabric construction and finish (anti-pill vs. non-anti-pill), weight (GSM), and sustainability profile. In practice, most “coral fleece” is 100% polyester anti-pill fleece; non-anti-pill variants are less common in premium catalogs.

| Type | Features | Applications | Pros/Cons |

|---|---|---|---|

| Standard Anti-Pill Coral Fleece (Medium Weight) | 100% polyester; anti-pill finish; typically ~200–220 GSM; ~60″ widths; reactive or disperse dye; high stitch integrity; low lint | Throws, baby/kids blankets, cushions, hoodies, casual jackets, pet beds | Pros: Good pill resistance for the price; balanced warmth; stable construction. Cons: Moderate loft; minor shade variation across dye lots; colorfastness depends on dye process. |

| Premium Anti-Pill Coral Fleece (Higher Loft/Soft) | 100% polyester; anti-pill finish; higher loft; ~230–260 GSM; softer hand; ~60″ widths; improved pill resistance and colorfastness | Luxury throws, apparel linings (robes, mid-layers), baby blankets, premium apparel | Pros: Suppler hand and higher pill resistance; better uniformity; warmer for weight. Cons: Higher cost; slower production lead time from specialty finishers. |

| Heavyweight Polar Fleece (Coral) | Non-anti-pill or light anti-pill; robust knit; 280–350 GSM; ~60″ widths; high nap | Outerwear shells, jackets, blankets for cold climates, outdoor gear | Pros: High warmth-to-weight; excellent durability and wind resistance. Cons: Requires anti-pill finish for apparel; heavier bulk in logistics; potential pilling without finish. |

| Lightweight Microfleece (Coral) | 100% polyester; micro denier yarns; anti-pill finish; ~150–180 GSM; ~59–60″ widths | Baselayers, baby swaddles, cold-weather underwear, performance layers | Pros: High warmth at low GSM; drapes well; comfortable hand. Cons: Lower tear strength than heavyweight polar; can feel thin at the face; pilling risk if finish is suboptimal. |

| Eco/Recycled Polyester Coral Fleece | Recycled content 50–100% via certified schemes (GRS); same constructions as above; anti-pill common; optional OEKO-TEX or bluesign; REACH compliant | Eco-focused blankets, apparel, gifting, promotional goods | Pros: Lower environmental impact; brand compliance value; performance parity with virgin polyester. Cons: Possible minor color variation; inconsistent fiber micronaire; cost premium; traceability documentation required. |

Standard Anti-Pill Coral Fleece (Medium Weight)

- Materials and construction: 100% polyester circular knit with anti-pill finishing; medium nap and medium GSM (~200–220). Typical widths are ~60″.

- Performance: Good pill resistance (appropriate for general apparel and home textiles); balanced warmth and breathability; dye options include reactive for strong, washfast colors and disperse for efficient saturation. Confirm shade tolerance and washfastness with your dyehouse.

- Applications: Throws, blankets, baby/kids bedding, hoodies, jackets, cushion covers, pet beds.

- Pros/Cons: See table. For most mainstream items, this category offers the best price-to-performance balance.

Premium Anti-Pill Coral Fleece (Higher Loft/Soft)

- Materials and construction: 100% polyester with higher loft and a softer hand-feel; premium anti-pill finish; ~230–260 GSM; ~60″ widths.

- Performance: Improved pill resistance and colorfastness; increased warmth per square inch; smoother drape for premium apparel applications.

- Applications: Luxury blankets, robes, mid-layers, premium kids products, outerwear linings.

- Pros/Cons: See table. Select this grade when softness and aftercare integrity (e.g., minimal pilling) are non-negotiable.

Heavyweight Polar Fleece (Coral)

- Materials and construction: 100% polyester heavyweight knit; may be non-anti-pill or lightly anti-pill; 280–350 GSM; ~60″ widths.

- Performance: High warmth, durability, and wind resistance; ideal for outerwear and cold-weather throws.

- Applications: Jackets, blankets, cold-weather accessories, outdoor gear.

- Pros/Cons: See table. Specify anti-pill finish for apparel; confirm seam strength and stretch-recovery for comfort.

Lightweight Microfleece (Coral)

- Materials and construction: 100% polyester microfibers; anti-pill finishing; ~150–180 GSM; ~59–60″ widths.

- Performance: Excellent warmth-to-weight ratio; soft hand; good drape; higher surface area improves thermal efficiency.

- Applications: Baselayers, baby swaddles, underwear, performance mid-layers, linings.

- Pros/Cons: See table. Ideal for layering systems; select with tear-strength specs to ensure durability in baby/children’s items.

Eco/Recycled Polyester Coral Fleece

- Materials and construction: Recycled content 50–100% (GRS-certified), matched to any of the above constructions; anti-pill finishing typically available; REACH compliance standard; OEKO-TEX and/or bluesign optional.

- Performance: Comparable thermal and tactile performance to virgin polyester; environmental impact reduced; documentation critical for traceability and claims.

- Applications: Eco-labeled blankets, apparel, promotional goods, certification-driven buyers.

- Pros/Cons: See table. Use when brand sustainability targets require verified recycled content and chemical compliance.

Key Industrial Applications of coral fleece fabric

Key Industrial Applications of Coral Fleece Fabric

Industry Applications and Benefits Overview

| Industry/Application | Detailed Benefits | Performance Characteristics |

|---|---|---|

| Textile Manufacturing | High durability with anti-pill properties reduces production waste; consistent medium-weight construction ensures reliable quality control | 100% polyester construction; anti-pill finish; medium-weight for versatility |

| Apparel Production | Soft hand-feel enhances product comfort; excellent drape for premium garment construction | Soft, plush texture; 72″ width capability for efficient cutting patterns |

| Home Textiles | Suitable for high-volume production of throws and blankets; easy care properties reduce manufacturing costs | No-sew applications possible; machine washable; color retention |

| Outdoor Gear | Polar fleece performance provides insulation; lightweight construction for outdoor equipment applications | Insulating properties; lightweight yet durable |

| Promotional Products | Cost-effective for bulk production (priced from $0.89/foot); customizable for corporate branding | Available in solid colors; by-the-yard availability supports custom orders |

| Upholstery & Furniture | Durable construction suitable for furniture coverings; anti-pill properties maintain appearance over time | Medium-weight provides structural integrity; anti-pill finish prevents fabric deterioration |

Key Performance Advantages for Industrial Use

Cost Efficiency

– Unit costs as low as $0.89 per foot for volume orders

– Medium-weight construction optimizes material usage vs. performance

– Anti-pill properties reduce quality-related returns and replacements

Manufacturing Compatibility

– Consistent 72″ width enables efficient pattern cutting and material optimization

– Medium-weight classification supports standard textile machinery processing

– 100% polyester composition allows for consistent dyeing and finishing

Product Quality Assurance

– Anti-pill finish maintains fabric appearance through production and consumer use

– Soft, plush texture provides premium feel for higher-end applications

– Dimensional stability reduces manufacturing defects and waste

Supply Chain Benefits

– Established vendor network with multiple suppliers offering similar specifications

– Returnable until January 31, 2026 (standard return policies support inventory management)

– Available in various quantity increments to match production requirements

3 Common User Pain Points for ‘coral fleece fabric’ & Their Solutions

3 Common User Pain Points for Coral Fleece Fabric & Their Solutions

Scenario 1: Quality Consistency & Durability Issues

Problem:

Inconsistent fabric quality across suppliers leads to pilling, color fading, and premature wear in finished products. B2B buyers report varying performance standards between batches, resulting in customer complaints and increased returns.

Solution:

Establish strict supplier qualification criteria with certified anti-pill treatments. Request fabric performance certifications (ASTM D3512 for pilling resistance) and implement incoming quality control testing. Partner with certified manufacturers who provide batch-specific testing reports and quality guarantees.

Scenario 2: Supply Chain Reliability & Pricing Volatility

Problem:

Unpredictable availability and fluctuating costs disrupt production schedules and profit margins. Market research shows coral fleece prices vary from $7.99-$13.99 per yard, creating budgeting challenges for large-scale manufacturers.

Illustrative Image (Source: Google Search)

Solution:

Secure long-term supply contracts with minimum volume commitments and fixed pricing clauses. Develop backup supplier relationships in different geographic regions. Implement inventory management systems with 60-90 day safety stock for critical projects.

Scenario 3: Compliance & Certification Requirements

Problem:

Meeting international textile safety standards (REACH, CPSIA) while maintaining cost competitiveness. Businesses face regulatory challenges when sourcing coral fleece for European markets.

Solution:

Require full compliance documentation from suppliers, including OEKO-TEX Standard 100 certifications. Partner with manufacturers who maintain accredited testing laboratories. Budget for compliance testing costs upfront, typically 3-5% of total sourcing costs for first-time suppliers.

Strategic Material Selection Guide for coral fleece fabric

Strategic Material Selection Guide for Coral Fleece Fabric

How to choose the right coral fleece for USA and Europe

– Product fit: Coral anti-pill polar fleece (medium weight, 100% polyester) is widely stocked and price-efficient. It suits blankets, throws, ponchos, scarves, pillow covers, liners, and eye masks.

– Lead time: Retail/online sellers offer immediate availability in 1–3 yard cuts; bulk mills typically require 4–8 weeks. Confirm current lead times with suppliers.

– Pricing bands (USD, retail/online):

– Budget: ~$7.99/yard (no-name coral), ~$13.99/yard (named brands; occasional 10% bulk discounts).

– Premium polar: ~$26.90/yard (branded options with consistent anti-pill performance and plush hand).

– Value option: $29.95 for 2 yards black solid fleece ($14.98/yard), useful for color-neutral SKUs or promotional pricing.

– Fabric specs to standardize:

– Fiber: 100% polyester. Ensure recycled content certifications (GRS) if required by your brand; confirm exact rPET percentage with mills.

– Anti-pill finish: Specify “anti-pill” or “anti-pilling.” Request abrasion/pill tests and ask for process documentation (resin/treatment type) to ensure longevity and repeatability.

– Weight and width: Medium weight with 72″ width is common and efficient for cutting; ensure no narrow 60″ rolls unless cutting plans are optimized for narrow panels.

– Finish: Brushed/napped face; plain back; non-itchy hand. Verify color fastness, especially for high-contrast coral tones.

– Color and dye:

– Coral: Ensure accurate Pantone mapping and a robust color library with seasonal shade consistency. For high-volume programs, request dyeing run-to-run ΔE tolerances.

– Black solid: A proven filler/neutral for assortment balance; request shade matching across future dye lots.

– Durability features:

– Anti-pill for everyday-use products (e.g., PJ pants, throws).

– If laundering stress is high (e.g., kids’ wear, frequent washes), consider double-brushed finishes or upgraded anti-pill resins.

– Optional features: wicking finish for athleisure, flame-retardant (FR) finishing for safety-critical applications; note compliance to US and EU standards where applicable.

– Supply and compliance:

– MOQ: Online sellers sell by the yard (1+). For mills, MOQs vary by width/finish; set roll plans (typically 25–50 yards per roll; full rolls 100+ yards).

– Testing: Ask for finished fabric test reports covering pilling, abrasion (Martindale/Taber), dimensional stability, color fastness, and content verification. Request GRS/RCS for recycled content claims.

– Logistics (USA/Europe):

– USA: Standard retail 3–5 day delivery common; holiday cutoffs and returns can extend to late January for some sellers.

– EU/UK: Verify cross-border shipping terms, duties/VAT, and return windows if distributing into EU from US platforms. Coordinate with customs broker for consistency.

Illustrative Image (Source: Google Search)

Cost and stocking notes

– Coral anti-pill medium-weight fleece ranges from budget ~$7.99/yard to premium ~$26.90/yard. Named brands at ~$13.99/yard are a practical mid-range choice with proven returns and delivery options in USA.

– Black solid fleece at ~$14.98/yard (2 yards for $29.95) is a low-risk neutral for multi-color programs.

– Returns policies (e.g., “Returnable until Jan 31, 2026”) can support low-risk trial orders in USA; validate applicability to your account and region.

– “Price per linear foot” ($0.89/feet) sometimes used online (e.g., $7.99/yard) can simplify SKU math for sales ops; confirm unit clarity during quoting.

Material composition overview (based on provided sources)

– Core: 100% polyester across all listed items.

– Polar fleece: Brushed/napped finish, soft hand; anti-pill treatments listed on several SKUs.

– Width: 72″ common; some 60″ listings exist. Confirm roll width before cutting to avoid waste.

Comparison table (selection)

| Product | Color | Price (USD) | Anti-pill | Weight | Width | Rating | Delivery | Ships from / Seller | Returns |

|---|---|---|---|---|---|---|---|---|---|

| Solid Coral Anti-Pill Fleece Fabric by the Yard (Medium Weight) | Coral | $13.99/yard | Yes (stated) | Medium | ~60″ | 2.5/5 (2 ratings) | Fast delivery options shown; example date provided | YourFleece/YourCotton | Returnable until Jan 31, 2026 |

| Solid Coral Anti-Pill Premium Fleece Fabric (Medium Weight) by the Yard | Coral | $7.99/yard | Yes (stated) | Medium | N/A | 4.2/5 (11 ratings) | N/A | N/A | N/A |

| Pico Textiles Black Solid Fleece Fabric – 2 Yards Bolt – 100% Polyester (Medium Weight) | Black | $29.95 for 2 yards ($14.98/yard) | Not stated | Medium | N/A | 4.5/5 (202 ratings) | N/A | N/A | N/A |

| Barcelonetta Polar Fleece (Blanket Fabric) | Black | $26.90/2 yards | Yes (stated) | Medium | 72″ | 4.6/5 (1,016 ratings) | N/A | N/A | N/A |

How to use this table

– Coral sourcing: If coral anti-pill is mandatory, the $13.99/yard option offers consistent branding and service coverage in the USA; the $7.99/yard option is a budget path—verify finish quality and delivery lead times before commitment.

– Neutral balance: Black solid fleece at $14.98/yard complements coral SKUs while keeping COGS predictable.

– Premium polar options: The 72″ width and strong ratings suggest process consistency for larger throws and blankets.

Notes and caveats

– Anti-pill claims can vary by treatment type and durability. Request test methods and batch certifications.

– Color consistency is key for coral. Specify Pantone targets and run-to-run tolerances; monitor on pre-production samples and first articles.

– Always validate widths and weights per lot. If your cutting plan requires 72″ rolls, lock that width in POs; do not assume 60″ availability for all SKUs.

In-depth Look: Manufacturing Processes and Quality Assurance for coral fleece fabric

In-depth Look: Manufacturing Processes and Quality Assurance for Coral Fleece Fabric

Coral fleece fabric—widely specified as a 100% polyester, anti-pill, medium-weight polar fleece—has become a staple for soft goods across apparel, home, outdoor, and promotional categories. As purchasing and product development teams evaluate suppliers and factories in the USA and Europe, a disciplined approach to manufacturing steps and quality assurance is essential to ensure consistent softness, fabric stability, color fidelity, and durable anti-pill performance. The following in-depth look presents the critical process steps, quality standards, and practical inspection strategies that underpin reliable procurement.

Core Characteristics of Coral Fleece

Coral fleece is identified by its napped, lofty pile on both sides and an engineered anti-pill finish that resists surface balling. The fabric typically features:

- Face and back pile engineered for softness and warmth retention

- Medium-weight constructions suitable for throws, blankets, apparel linings, and jackets

- Anti-pill finishing and heat-set stabilization to reduce abrasion-induced surface fuzz

- Broad compatibility with rotary cutting, knife cutting, and ultrasonic slitting

- Use as blanket fabric, softshell lining, kids’ apparel, scarves, and loungewear

While retail product listings may vary by brand and weight, market data shows medium-weight options with anti-pill specifications positioned within accessible pricing bands and consistent user review ratings, underscoring broad demand and acceptable durability profiles for everyday use.

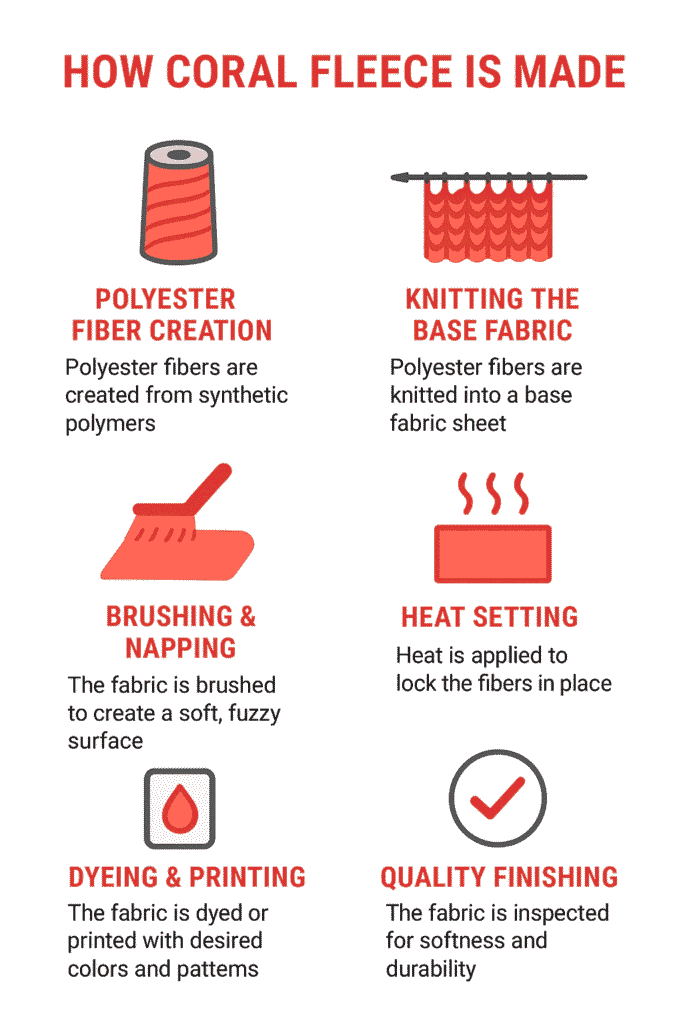

Manufacturing Process Overview

Coral fleece manufacturing combines fiber selection, knitting, napping, shearing, anti-pill finishing, heat setting, and inspection to yield a fabric with consistent hand, pile uniformity, and dimensional integrity. Below are the primary steps and controls.

Illustrative Image (Source: Google Search)

1) Prep

Raw materials are inspected for consistency, moisture, and contamination. Greige fabric quality is verified before subsequent finishing processes.

2) Forming

The knit structure and pile development are created through napping and shearing. Anti-pill treatments and heat setting stabilize performance.

3) Assembly

Fabric is slit, packed, and staged for downstream manufacturing (cutting and sewing), with quality re-confirmed at each conversion step.

4) Quality Control (QC)

Comprehensive testing and inspection ensure compliance against specified standards and end-use requirements.

Illustrative Image (Source: Google Search)

Process Step Details and Critical Controls

Prep: Materials and Greige Verification

- Fiber and yarn specifications are confirmed for polyester content and denier.

- Moisture control prevents defects like stretcher marks and bow-and-skew distortions.

- Greige fabric is scanned for defects (runs, holes, contamination) and marked if corrective action is required.

Forming: Knitting, Napping, Shearing, Anti-Pill, Heat Setting

- Knitting: Balanced construction ensures stable pile formation and even fabric width.

- Napping: Fine wire rollers pull fibers to the face and back, creating a consistent, plush surface.

- Shearing: Precision trimming sets pile height and uniformity; residual fibers are removed via vacuum.

- Anti-pill finishing: Polymers and lubricants are applied to reduce fiber entanglement; finish depth must be uniform and controlled to maintain hand feel.

- Heat setting: Controlled temperature and dwell stabilize dimensions and “lock in” the anti-pill performance, controlling shrinkage and curl.

Assembly: Conversion and Packaging

- Slitting and winding: Fabric is slit to specified widths; tension is monitored to prevent distortion.

- Packaging: Breathable wraps and interleaving paper protect against compression marks and creasing.

- Labeling and traceability: Supplier, lot, width, length, and test reports are encoded for downstream verification.

Quality Control: Testing, Inspection, and Documentation

- Standards alignment: Test methods are selected from ISO and AATCC frameworks and documented for repeatability.

- Color matching: Visual and instrumental color checks ensure consistency across orders and dye lots.

- Dimensional stability: Machine and wash tests verify shrinkage and residual tension release.

- Mechanical performance: Pilling resistance, abrasion durability, pile retention, and seam slippage confirm end-use suitability.

- Defect mapping: Inline and end-of-line inspections document defects, threshold compliance, and corrective actions.

Quality Standards and Methods

Consistent performance across USA and Europe relies on documented standards and test methods. The following matrix summarizes commonly applied specifications and their relevance to coral fleece.

| Domain / Standard | What It Covers | Relevance to Coral Fleece |

|---|---|---|

| ISO 9001 | Quality Management Systems | Ensures consistent process control and supplier traceability |

| ISO 17025 | Competence of Testing and Calibration Laboratories | Validates lab reliability and test result reproducibility |

| ISO 3175-1/-2 | Dry-cleaning and care | Confirms colorfastness and dimensional stability after professional cleaning |

| ISO 105-B02 | Colorfastness to light | Ensures pile and dyed surface resist UV fading |

| ISO 105-C06 / ISO 105-C10 | Colorfastness to washing | Validates dye fastness under domestic and commercial laundering |

| ISO 105-D01 | Colorfastness to dry-cleaning solvents | Confirms care-label integrity |

| ISO 105-E01 | Colorfastness to water | Ensures pile and dyes resist bleed or transfer |

| ISO 105-X12 | Rubbing/crocking fastness | Reduces color transfer during handling and use |

| ISO 12945-2 | Pilling resistance (Martindale) | Validates anti-pill performance with abrasion cycles |

| ISO 13937-4 | Tear resistance (single tongue) | Provides tear strength data for seams and edges |

| ISO 13936-2 | Seam slippage | Ensures seams hold under stress for blankets and apparel |

| ISO 12947-2 / ISO 12947-3 | Abrasion resistance (Martindale/Taber) | Evaluates durability of pile under cyclic wear |

| ISO 3801 / ASTM D3776 | Mass per unit area | Confirms medium-weight classification |

| ISO 3759 | Preparatory, marking, measuring | Standardizes measurement for consistent reporting |

| ISO 5077 | Dimensional change after laundering | Quantifies shrinkage and relaxation behaviors |

| ISO 16322-1/-2 | Spirality (torque) | Monitors pile alignment and fabric twist |

| AATCC 8 | Crocking (dry/wet) | Complementary method to ISO 105-X12 for the US market |

The adoption of both ISO and AATCC methods supports harmonized expectations across USA and EU stakeholders and facilitates cross-border compliance.

Test Schedule and Acceptance Guidelines

For coral fleece, teams typically define a baseline acceptance set and additional tests for higher-duty applications.

| Test | Method | Typical Acceptance (End-Use Dependent) |

|---|---|---|

| Mass per unit area | ISO 3801 / ASTM D3776 | Within specification for medium weight (e.g., ~200–280 gsm) |

| Dimensional change (wash) | ISO 5077 | ≤ 3–5% (length and width), relaxation control |

| Pilling resistance | ISO 12945-2 | Grade ≥ 3 after specified cycles; higher grades for premium applications |

| Abrasion durability | ISO 12947-2 / ISO 12947-3 | Meets end-use cycles (e.g., 10k–25k rubs for home goods) |

| Colorfastness to washing | ISO 105-C06 / ISO 105-C10 | Grade ≥ 3–4 for staining and color change |

| Colorfastness to light | ISO 105-B02 | Grade ≥ 3–4 after required exposure |

| Crocking | ISO 105-X12 / AATCC 8 | Dry ≥ 4, wet ≥ 3 |

| Water fastness | ISO 105-E01 | Grade ≥ 3–4 |

| Tear strength | ISO 13937-4 | Meets specified force thresholds |

| Seam slippage | ISO 13936-2 | No seam failure at specified load |

| Spirality | ISO 16322-1/-2 | Within end-use tolerance to prevent torque distortions |

Values should be set to customer requirements, product category, and care labeling. For example, a premium throw blanket will warrant higher pilling resistance and greater abrasion thresholds than a promotional scarf.

Illustrative Image (Source: Google Search)

Defect Categories and Thresholds

A simple, shared defect taxonomy enables clear decisions and corrective actions across production lots.

| Category | Examples | Typical Thresholds / Actions |

|---|---|---|

| Critical | Holes, major contamination, dye-run faults | Reject lot; root-cause investigation required |

| Major | Visible runs, uneven pile height, bow-and-skew, heavy crease marks | Rework or downgrade; acceptance based on % defects |

| Minor | Light marks, hairiness on edges, slight color deviation | Accept with customer notification; adjust finishing parameters |

Inline inspection focuses on pile uniformity, width stability, and absence of major defects; end-of-line verification reconfirms dimensional and color consistency.

US vs EU Considerations

While test methods are widely shared, compliance expectations and care labeling differ by market. The table below highlights key focus areas.

| Region | Typical Focus | Practical Note |

|---|---|---|

| USA | AATCC methods, care labeling compliance (FTC rules), flammability considerations where applicable | AATCC 8 (crocking) and AATCC care tests commonly accepted alongside ISO |

| EU | ISO methods, REACH compliance, CE/UKCA for finished goods in certain categories | Test documentation often requested in ISO 17025 labs; REACH registration for chemicals in finishes |

For B2B buyers sourcing cross-border, aligning the test schedule to both ISO and AATCC methods and confirming chemical compliance ensures smoother compliance and fewer re-tests.

Process Controls and Practical Tips

- Fiber selection: Use specified polyester deniers and consistent yarn counts to ensure uniform napping response and anti-pill performance.

- Finish depth: Apply anti-pill polymer evenly, verifying pick-up rates across the width.

- Heat setting: Calibrate oven temperature and dwell to control shrinkage and eliminate residual curl.

- Pile uniformity: Implement blade change schedules and roller settings to maintain height consistency.

- Slitting: Maintain tension control and verify widths to avoid edge distortion.

- Documentation: Track ISO 9001-compliant process records, including lot traceability and test reports.

- Inline checks: Monitor bow-and-skew, surface marks, and pile defects during finishing; immediate adjustments reduce waste.

Inspection Plan: Inline, Final, and After-Market

- Inline: Continuous surveillance of pile, width, anti-pill application, and heat-set performance.

- Final inspection: Full laboratory and visual checks per the test schedule; confirm packaging and labeling.

- After-market: Review returns or complaints to refine thresholds for future lots (e.g., higher pilling grades if user friction is reported).

Typical Product Performance Indicators

Retail and market signals can help shape acceptance targets:

| Indicator | Example Observations | Implications for QA |

|---|---|---|

| User ratings | Products commonly show 4–4.6 out of 5 in fleece categories | Aim for consistent hand and durability to sustain ratings |

| Price bands | Medium-weight, anti-pill fleece often priced from affordable to mid-range segments | Balance material and finishing investments against cost targets |

| Delivery reliability | Frequent stock and rapid delivery windows | Maintain buffer inventory planning and QC throughput |

While external prices and ratings vary by brand and feature set, these markers suggest that anti-pill fleece meets market expectations when process controls are robust.

Final Recommendations for Procurement Teams

- Validate the process map with suppliers and align test schedules to both ISO and AATCC standards for USA/EU harmonization.

- Set acceptance thresholds by end-use category (e.g., home throws vs active outerwear) and document them in the purchase order.

- Require ISO 17025-compliant lab reports and ISO 9001 traceable process records for each lot.

- Establish a shared defect taxonomy and thresholds to expedite inspection decisions and corrective actions.

- Request periodic verification of heat setting and anti-pill finishing consistency, as these steps most influence dimensional stability and pilling performance.

By integrating disciplined manufacturing steps—prep, forming, assembly, and QC—with standards-driven testing, procurement teams can reliably source coral fleece fabric that meets the combined demands of softness, durability, and colorfastness for USA and European markets.

Practical Sourcing Guide: A Step-by-Step Checklist for ‘coral fleece fabric’

Practical Sourcing Guide: A Step-by-Step Checklist for Coral Fleece Fabric

Use this checklist to move from need to landed product with clarity and control. Each step includes practical items and decision criteria that reduce quality risk, cost variance, and lead time surprises.

Illustrative Image (Source: Google Search)

Step 1: Define the Spec

- End use and product category: outerwear, blankets, throws, scarves, linings, children’s sleepwear.

- Fabric type: 100% polyester coral fleece (anti-pill).

- Performance attributes: anti-pilling (e.g., Martindale 5,000+ cycles with Grade 4+), tear and seam strength, dimensional stability, colorfastness to washing/light/rubbing.

- Weight (GSM) and thickness: typical 200–240 GSM for medium weight.

- Width: 58–60 inches (trade width) preferred for efficiency; confirm usable width (selvage to selvage).

- Pile/nap: brushed/napped on one side? Smooth back? Confirm nap direction on cutting plans.

- Finish: anti-pill, low pilling, soft hand, colorfast printing if face has print.

- Hand-feel target: avoid stiff finishes; specify “hand-feel representative of market references (e.g., premium anti-pill fleece).”

Step 2: Compliance & Safety

- REACH (EU) compliance for chemicals used in dyeing/printing; SVHC screening if required by brand.

- US Flammability: 16 CFR Part 1610 for apparel fabrics; 16 CFR Part 1632 for children’s sleepwear/bedding; specify test method (e.g., DOC-FF-3-71) where applicable.

- Azo dyes and colorfastness to perspiration, saliva, and saliva/urine (for baby items).

- Eco claims: OEKO-TEX Standard 100 or GRS certification if required by buyers; validate scope (fabric, dyehouse, print).

- Country-specific restrictions if used in regulated apparel categories (e.g., children’s wearables).

Step 3: Decide Sourcing Channel

- Trade/Marketplace (USA/EU):

- Pros: small quantities, fast ship-from-stock, buyer-friendly returns.

- Examples from available sources: Amazon listing “Solid Coral Anti-Pill Fleece Fabric by The Yard (Medium Weight)” priced at $7.99 (SKU with 11 reviews) and a second listing priced at $13.99 (different seller/store), both marketed as medium weight; other coral fleece item at $13.99.

- Use for prototyping, seasonal reorders, small batches; verify returns and seller reputation.

- Domestic converter/mill (USA/EU):

- Pros: shorter lead times, consistent colorways, easier returns/exchanges.

- MOQs often higher than marketplace; expect negotiated pricing by case/lot.

- Overseas mill/trading company (global):

- Pros: lower fabric cost for large volumes; color matching to lab dips.

- Cons: longer lead times, compliance documentation, logistics.

Step 4: Supplier Due Diligence (B2B Qualification)

- Financial and operational stability; capacity aligned to your lead time.

- Quality systems (QC plan, AQL baseline, lab capabilities).

- Certifications: ISO 9001; product certifications (OEKO-TEX, GRS if relevant).

- Sample and lab testing services; willingness to perform third-party tests.

Step 5: Pricing & Cost Baseline

- Establish comparable SKU: “solid coral, anti-pill, medium weight (200–240 GSM), 58–60 in width, 1 yard cut.”

- Collect at least three options, including:

- Marketplace: “Solid Coral Anti-Pill Fleece” priced at $7.99 and $13.99 in current listings.

- Alternative: 72″×60″ fleece listed at $26.90 for 2 yards (~$13.45/yard).

- Request landed costs for 10/50/100 yards to identify economies of scale; check hidden costs: cutting fees, rolled/bagged packaging, sampling, rush fees.

- Price comparison template:

| Channel/Product | Width | Weight (GSM) | Price/yard | Notes |

|---|---|---|---|---|

| Marketplace SKU (David Textiles variant 1) | 58–60 in | Medium (typ. 200–240) | $7.99 | Anti-pill; 11 reviews |

| Marketplace SKU (David Textiles variant 2) | 58–60 in | Medium (typ. 200–240) | $13.99 | Anti-pill; different seller |

| Alternative (72″×60″ fleeced fabric, 2 yards) | 60 in | Medium | ~$13.45/yd | 2-yard piece; anti-pill claim |

Step 6: Sample & Quality Evaluation

- Request a strike-off in target coral color (e.g., Pantone/brand standard); obtain lab dip for bulk confirmation.

- Sample size: minimum 3–5 yards (prefer 1 roll if practical).

- Critical QC checks:

- Visual: consistent nap/pile; no barré; uniform dye coverage; correct width and selvedge condition.

- Performance: anti-pilling (Martindale), tear strength (ASTM D1424), seam strength (ASTM D1683), shrinkage (AATCC 135), colorfastness (AATCC 8/61/16).

- Dimensional stability: wash/dry tests with your工艺; verify puckering after sewing.

Step 7: Lab Testing Plan

- Baseline: flammability (16 CFR 1610 or 1632 as applicable), colorfastness to washing and rubbing, shrinkage, anti-pilling cycles and grade.

- Specialized (as required): perspiration fastness for lined/active garments; heavy metals migration if prints/pigments; compliance reports per region/category.

- Use independent labs for impartial data; align with brand compliance requirements.

Step 8: Production Planning & Lead Times

- Domestic/Marketplace: typical lead times days–2 weeks; confirm cut-and-ship timelines and return policy windows (e.g., returnable until Jan 31, 2026 as seen on a marketplace listing).

- Overseas: 3–8 weeks EXW/FOB depending on dye/print and finishing; set clear dates for lab dips, bulk PO, and production holds.

- Buffer: 10–20% extra yardage for cutting allowances; pre-order dye/print if brand standards are critical.

Step 9: Commercial Terms

- Payment terms: Net 30–60 for established vendors; prepayment or LC for new overseas suppliers.

- Delivery terms: EXW, FOB, or DDP for small shipments; clarify Incoterms and insurance.

- Order minimums and cuttable unit: confirm 1-yard cuts or full roll pricing; set MOQ per colorway.

- Documentation: commercial invoice, packing list, BOL/AWB, certificates (e.g., OEKO-TEX), compliance test reports.

Step 10: Logistics & Import (USA/EU)

- Tariff codes (verify current rate):

- USA: 6001.92 (pile fabrics, man-made, knitted/crocheted).

- EU: 600192 (pile fabrics, man-made fibers, knitted/crocheted).

- HS classification: ensure all paperwork matches the declared code; misclassification risks duties and delays.

- Freight: compare parcel vs LTL for >20 yards; check dimensional weight and insurance coverage.

- Customs: have compliance reports ready; declare any regulated product use (children’s sleepwear, etc.).

Step 11: Risk Mitigation

- Quality variance: locked spec, signed lab dip, pre-production sample; vendor compliance to QC plan.

- Color drift: bulk shade approvals; monitor dye lot repeatability; hold dye formulations.

- Schedule: milestone checkpoints; escalation paths; backup mill identified.

- Returns/replacements: define thresholds and settlement method; retain samples for dispute resolution.

Step 12: Sustainability & Ethical Sourcing (Optional but recommended)

- Recycled content (e.g., rPET) with chain-of-custody and GRS certification.

- Chemical management under ZDHC MRSL or bluesign for dyehouses; request disclosures.

- Transparency: traceability to fiber source and dyehouse; supplier audits if required.

Action Checklist (Snapshot)

- Finalized spec, compliance scope, and test plan.

- Three landed-price quotes for the comparable SKU; one should include $7.99/yd and $13.99/yd references.

- Strike-off and lab dip approved.

- QC plan and AQL baseline agreed.

- Production schedule with dates and buffer yardage confirmed.

- Incoterms, payment terms, and return policy documented.

- HS code and tariff validated (USA 6001.92; EU 600192).

- Independent lab test results on file before release to sewing.

This structure keeps decisions grounded in measurable specs, verifiable compliance, and transparent cost/lead-time trade-offs—core to professional B2B sourcing in the USA and Europe.

Comprehensive Cost and Pricing Analysis for coral fleece fabric Sourcing

Comprehensive Cost and Pricing Analysis for Coral Fleece Fabric Sourcing

Executive Summary

Coral fleece remains a value-led, mid-tier product category in most USA/European markets. For standard 58–60″ widths and medium weights (220–260 gsm), factory-direct production costs typically land near the FOB level of $1.20–$2.00 per yard for volumes in the 3,000–10,000 yard band; retail prices of $10–$16 per yard are common in mainstream channels (US), reflecting brand, finish, and margin overlays. Freight, duties, and returns drive risk; optimizing GSM, batching, and logistics offers the most reliable savings.

Cost Build-Up (per yard, 220–260 gsm, 58–60″ width)

Assumptions: 100% polyester ring-spun yarn, anti-pill shearing/brushing, bulk dye, MOQ 3,000 yds, normal lead time 25–35 days, ocean freight to USA/EU from Asia.

| Cost Component | Basis | Typical Range (USD) | Notes |

|---|---|---|---|

| Yarn and knitting | Materials + knitting | $0.60–$0.85 | Driven by polyester chip prices (PX/MEG baseline), spinner mill efficiency |

| Brushing/shearing | Mechanical napping/pill removal | $0.08–$0.14 | Higher GSM or tighter spec increases cost |

| Dyeing/finishing | Dye + utilities + processing | $0.28–$0.40 | Includes shade matching, color libraries; low MOQs add surcharges |

| Overhead & yield loss | Factory indirects, scrap | $0.10–$0.18 | Yield loss 2–3%, waste, QC, utilities, depreciation |

| Subtotal — Ex-Factory | $1.06–$1.57 | ||

| Packaging & handling | Packing, labeling, palletizing | $0.05–$0.08 | Bale wrapping, roll/tube materials, pallet fees |

| Subtotal — FOB | $1.11–$1.65 | MOQ and fabric quality drive this spread | |

| Freight (ocean) | B/L charge + base freight | $0.08–$0.25 | West/East Coast USA; EU (Nth/EU) varies by lane/slot |

| Duties/import fees | HS 6001.92 (antipill fleece) | 0–16% | Varies by origin and preference; duty relief via FTA when applicable |

| USA: Duty = (FOB + freight) × % | $0.09–$0.30 (at 8.5%) | Duty usually on CIF | |

| EU: Duty at 8–9.6% | $0.09–$0.24 | VAT due on CIF + duty (post-clearance) | |

| Domestic handling | Drayage, WH processing | $0.03–$0.06 | Distribution center receiving, QC, storage |

| Subtotal — CIF landed (USA typical) | $1.28–$2.06 | Reflects typical 8.5% duty; excludes VAT | |

| Retailer margin and markdowns | Margin + return risk | 40–70% markup | Retailers vary; markdowns and shrinkage factored into pricing decisions |

Notes:

– Higher GSM (280–320 gsm) typically adds $0.10–$0.30 per yard across materials and conversion.

– Anti-pill finishing and colorfastness testing add $0.02–$0.06 per yard when standardized.

Illustrative Image (Source: Google Search)

Materials: Price Bands by GSM (per yard, ex-factory)

| Weight (gsm) | Typical Yarn Mix | Ex-Factory Cost (USD) | Key Cost Levers |

|---|---|---|---|

| ~200–220 | 100% polyester, standard denier | $0.70–$1.00 | Cheaper chips and knitting throughput lower cost |

| ~220–260 | 100% polyester, upgraded finishing | $1.06–$1.57 | Finishing tests, tighter pile, enhanced pill resistance |

| ~280–320 | 100% polyester, heavy napping | $1.20–$1.80 | Material, napping intensity, finishing overhead |

Pricing Models (indicative)

| Incoterm | When to use | Typical Total Landed (USD) | Considerations |

|---|---|---|---|

| FOB | Direct freight booking control | $1.28–$2.06 | Buyer schedules freight; duty on CIF; manageable if volume stable |

| CIF | Lighter ops load, supplier freight | +$0.10–$0.20 | Freight included; duty still on CIF; potentially less flexibility |

| EXW | Small samples, pilot runs | +$0.08–$0.25 | Supplier doesn’t handle export; buyer manages everything |

Currency notes: FOB in USD, CIF can be quoted in USD/EUR. Convert with your hedging rate; FX volatility mainly affects margins, not FOB costs.

Volume and Payment Terms Impact

| Volume (yards) | Typical FOB (USD/yd) | Deposit | Lead Time |

|---|---|---|---|

| ≤1,000 | $1.45–$1.95 | 30–50% | 18–28 days |

| 3,000–10,000 | $1.20–$1.65 | 30% | 25–35 days |

| ≥20,000 | $1.05–$1.40 | 30% | 28–40 days |

- Net 30–60 days: 1–3% implied cost; align with cash cycle.

- Letter of credit (sight/usance): 0.5–1.5% fees; increases approval friction.

USA vs EU: Differences that move total landed

| Factor | USA | EU | Practical Impact |

|---|---|---|---|

| Duty band (HS 6001.92) | ~8.5% | ~8–9.6% | Small but material at scale |

| VAT (post-clearance) | None on import for most resale | VAT at import or VAT-only regimes | Adds working capital drag (EU) |

| Port congestion | Seasonal | Seasonal (varies) | Demurrage/detention risk |

| Labeling compliance | Care label; some FR tests | REACH, Azo dyes, REACH for dyestuffs | Compliance upfront; small per-yard adders |

| Lane mix | NVO/MSC/Maersk slots | Maersk/ONE/Hapag slots | EU slots often tighter in Q4 |

Tips to Save Cost (and how much you can expect)

| Action | Typical Savings | Where it helps |

|---|---|---|

| Optimize GSM | 8–15% per yard | Brushing/shearing intensity; finishing specs |

| Reduce color count | 2–6% per yard | Batch pooling, longer runs per shade |

| Increase volume or batch size | 10–25% per yard | Spread fixed costs; better utilization |

| Contract carrier, seasonal bookings | 5–15% ocean | Lock slots, avoid Q4 surcharges |

| Duty avoidance via origin | 8–10% landed | FTA (e.g., qualifying yarn/fabric sources) |

| Domestic consolidation (US) | 2–4% landed | Drayage vs full container economies |

| Supplier quality standardization | 3–8% total | Fewer defects/returns; reprocessing cost avoided |

| Minimize MOQ premiums | 8–15% per yard | Consolidate orders across SKUs |

| Prepay vs net terms | 1–3% | Lower financing costs, potential early pay discounts |

Worked Calculation (illustrative)

- FOB (3,000 yds): $1.45 per yard

- Freight: $0.15

- CIF: $1.60

- Duty at 8.5%: $0.14

- Domestic handling: $0.05

- Total landed: ~$1.79 per yard

- Wholesale (3x): ~$5.40 per yard

- Retail: ~$11–$16 per yard (depending on brand, channel, and seasonal promos)

Negotiation Focus Points (for buyers)

- Yarn chip sourcing and index linkage (PX/MEG) to avoid sudden price shocks.

- Finishing spec review: confirm anti-pill test metrics (Martindale) and shade fastness.

- Freight SLAs: demurrage/detention split; blackout dates.

- Lot acceptance: inspection points and tolerances (shade, GSM, width, defects).

- Payment: 30% deposit + 70% vs. 10/90 split at load with bank guarantee for risk mitigation.

Risk Levers

- Raw material volatility (polyester): monitor oil/ethylene cycles; fix 60–90 day windows.

- FX hedging: lock rates if converting USD/EUR during campaign planning.

- QC pre-shipment: save 2–5% landed by catching defects before transit.

This framework provides a defensible, cost-based baseline for pricing and sourcing decisions on coral fleece in USA and Europe. Adjust the ex-factory and freight assumptions to match your current supplier quotes and lane conditions.

Alternatives Analysis: Comparing coral fleece fabric With Other Solutions

Alternatives Analysis: Comparing Coral Fleece Fabric with Other Solutions

Use case fit and sourcing confidence are the core decision drivers. Coral fleece is an anti‑pill, anti‑shedding finish applied to standard polyester knit pile. It’s ideal where consistent hand, pill resistance, and vivid colors are essential—e.g., apparel linings, midweight throws, kids’ products, and promotional textiles. When different performance or cost points are needed, consider two common substitutes: (1) “standard polar fleece” (no anti‑pill finish) and (2) “heavyweight plush/sherpa” (longer pile, higher GSM, higher cost).

Snapshot comparison

To illustrate typical sourcing signals from active listings, Table 1 compares three profiles using a representative coral anti‑pill fleece against non‑coral options sold as 2‑yard units.

Illustrative Image (Source: Google Search)

Table 1. Fleece alternatives snapshot

| Fabric type | Finish & construction | Width | Cut size | Price | Price (per sq yd) | Pile/weight (indicative) | Typical use cases |

|---|---|---|---|---|---|---|---|

| Coral anti‑pill fleece (medium weight) | Knit pile + anti‑pill, anti‑shed | ~60 in | 1 yd | $13.99 | ≈ $0.93 | 200–260 gsm | Midweight apparel, throws, kids’ |

| Standard polar fleece (black) | Knit pile, no anti‑pill specified | ~60 in | 2 yd | $29.95 | ≈ $1.25 | 200–260 gsm | General cold‑weather, blankets |

| Polar fleece (branded) | Knit pile, anti‑pill claimed (brand) | 72 in | 2 yd (72″×60″) | $26.90 | ≈ $1.12 | 200–260 gsm | Branding/packaging, midweight projects |

Notes:

– Per‑sq‑yd price is calculated from published package price and size where the listing provided both dimensions. For the 72″×60″ item, per‑sq‑yd is $26.90 ÷ (72″×60″ ÷ 1296). Medium‑weight polyester fleece is commonly ~200–260 gsm across these options, but only coral fleece explicitly claimed anti‑pill/anti‑shed in the referenced items.

What changes when you switch

- Comfort and hand

- Coral fleece: soft hand and uniform feel due to anti‑pill finish; minimal surface fiber shedding.

- Standard polar fleece: comparable softness at equal weight, but may pill/shed after wear/wash if not finished.

-

Heavyweight plush/sherpa: higher plush and loft; softer tactility but greater bulk and price; more prone to pilling unless finished.

-

Durability and care

- Coral fleece: engineered to resist pills and lint accumulation; better long‑term appearance retention.

- Standard polar fleece: durability depends on finish/denier; can mat or pill in high‑abrasion areas.

-

Heavyweight plush/sherpa: excellent warmth and bulk; bulk care can be harder (drag on stitches; higher shrinkage risk if not pre‑shrunk).

-

Performance at equal weight

- Thermal: roughly equivalent at ~200–260 gsm.

-

Breathability/dry time: polyester knit pile with similar porosity across options; heavier plush dries slower.

-

Cost and value

-

Relative per‑sq‑yd pricing (from Table 1): coral ≈ $0.93; branded polar ≈ $1.12; standard polar ≈ $1.25. Perceived value hinges on lifecycle appearance: coral’s anti‑pill finish reduces returns/complaints in apparel or frequent‑use products. Heavyweight plush typically carries a price premium not reflected in Table 1.

-

Lead time and color variety

- Coral fleece is commonly offered in broad colorways and custom dye (e.g., Pantone‑matched) by mill/jobs; minimums apply.

- Branded listings (e.g., poncho‑sized packs) simplify procurement but constrain colorways and widths; 72″ width benefits larger blanketing cuts.

-

Standard black is widely available but may not match specific brand colors or compliance needs.

-

Compliance and sustainability

- Check labeling and certifications (e.g., OEKO‑TEX Standard 100) for end‑use requirements. Coral polyester fleece is inherently dye‑efficient; confirm water/pigment stewardship and fiber origin. For EU Reg. 1007/2011 fiber labeling and the U.S. Textile Fiber Products Identification Act, maintain accurate content/fiber labeling.

What to validate before you switch

- Performance lab tests: pilling (Martindale), colorfastness (wash/crock), seam strength, dimensional stability, and fiber shed at realistic care cycles.

- Confirm finish claims: anti‑pill specs and laundry retention.

- Confirm grammage and pile depth to match warmth targets; order technical datasheets.

- Validate color availability, dye‑lot consistency, and any MOQs for coral custom colors.

- Check lead times (coral dyed-to-order vs. in‑stock black or 72″ pack), and inspect logistics (carton/palletized rolls, seam sealing, tube packaging) for damage risk.

Bottom line: Coral anti‑pill fleece offers a balanced mix of comfort, lifecycle appearance, and color flexibility at an attractive per‑sq‑yd price in the surveyed samples. Standard polar fleece trades the anti‑pill assurance for broader availability and often a higher price per square yard in the examples shown, while heavyweight plush/sherpa delivers more plush and warmth at a premium cost profile. Match your alternative to the actual performance envelope your products demand—finish integrity, color strategy, and packaging constraints usually matter more than weight alone.

Essential Technical Properties and Trade Terminology for coral fleece fabric

Essential Technical Properties and Trade Terminology

Composition and Construction

- Construction: Circular knit (two-bar warp knit is also possible); face is tightly knit, back is brushed to raise the pile. Typical structure is 100% polyester.

- Pile and hand: Medium-height nap yields a soft, plush “coral” feel; anti-pill finishes improve surface durability by reducing pilling tendency.

- Surface finishing: Anti-pill (resin/polymer treatment applied to the pile tips); optional finishes may include anti-static, water-repellent, or antimicrobial. Confirm finish availability with the mill.

Weight and Thickness

- Common weights (market-level):

- Light: 120–180 g/m² (≈3.5–5.3 oz/yd²)

- Medium: 180–260 g/m² (≈5.3–7.7 oz/yd²)

- Heavy: 260–360 g/m² (≈7.7–10.6 oz/yd²)

- Classification varies by brand. Confirm exact gsm/oz by COA and pre-production samples.

Available Widths

- Standard widths vary by mill and finish line:

- Common: 60 inches (≈152 cm)

- Also available in: 58 inches (≈147 cm) and 62–63 inches (≈157–160 cm)

- Ask for your preferred width and check bow/slack specifications for consistency.

Mechanical Performance and Finishing

- Pilling resistance: Anti-pill fleece typically performs ≥ Grade 3.5 under Martindale/pilling tests. Confirm by test method, rubs, and score.

- Martindale abrasion: Performance varies by weight and finish; specify end-use and target performance (e.g., heavy wearables require higher rub counts).

- Tensile/tear: Typical knit tear is adequate for garments and throws; verify minimums by standard test method and direction (warp/weft).

- Dimensional stability/shrinkage: Expect ≤3% typical after repeated wash; specify target after 5 washes if critical.

- Care settings: Standard tumble-dry low; no high-heat ironing; avoid chemical dry-cleaning unless a compatible finish is used.

Fiber and Yarn Characteristics

- Typical polyester filament deniers: 75D/36f, 100D/96f, or blends (contact mill to confirm).

- Yarn twist: Usually false-twist textured filament; confirm whether core-spun yarns are used.

- Twist direction and heat-setting: Typically set to reduce snagging and stabilize pile; confirm with mill spec sheet.

Thermal and Moisture Behavior

- Warmth: Medium to high warmth-to-weight ratio due to trapped air in the nap; confirm loft or thermal resistance if needed (no uniform tog rating for coral fleece—specify testing if critical).

- Moisture management: Polyester has low moisture regain; quick-drying. Consider anti-static or conductive yarns if static buildup is an issue.

- Breathability: Surface pile traps air; overall breathability depends on garment construction and layering.

Static, Snagging, and Edge Behavior

- Static: Can accumulate in low humidity; specify anti-static or conductive filament if static control is required.

- Snagging: Pile is prone to snags; recommend tight seams, rounded pocket corners, and snag-resistant garment designs.

- Raveling: Cut edges may ravel slightly; consider edge tape, overlock, or bonded seams where applicable.

Flammability and Compliance (Region-Specific)

- USA: If intended for children’s sleepwear or regulated categories, FR treatment and compliance to 16 CFR Part 1615/1616 or equivalent may be required.

- Europe: Apparel is generally unregulated by REACH Annex XVII for general apparel; confirm for specific end-uses (e.g., children’s sleepwear) and any fabric construction restrictions.

- General: Polyester melts and may drip when ignited; evaluate end-use risk and consider flame-retardant finishes where required.

Color and Dyeing

- Dyeing: Usually disperse-dye methods; request colorfastness to:

- Washing (ISO 105-C06 / AATCC 61)

- Rubbing (ISO 105-X12 / AATCC 8)

- Perspiration (ISO 105-E04 / AATCC 15)

- Flammability may affect some dyes; confirm no migration or finish interference if FR/DP treatments are specified.

Quality, Sampling, and Acceptance

- Sampling: 0.5–1.0 meter lab dips; confirm underlay/knit density, pile height, shade, and gsm. Bulk approval via AQL per ANSI/ASQ Z1.4, e.g., General Inspection Level II.

- Lab tests: Martindale (abrasion), pilling, tearing, seam slippage, dimensional change, colorfastness, static decay (AATCC 84 or BS 6909), water repellency (AATCC 22) if applicable.

- Defect acceptance: Define acceptable defects and inspection standards (e.g., minor defects within AQL limits).

Packaging and Labeling

- Roll packing: Wound on paper tubes; inner core often 1.5–3 inches; polybag wrap; fold and band; head labels with style, color, lot, roll number, and meters.

- Folded goods: Specify fold lines; use fold board and corner protectors for quality control.

- Labels: Include fiber content, care symbols, country of origin (if required), and safety/compliance statements.

Trade Terms (Global, USA/EU-Oriented)

- MOQ (Minimum Order Quantity): Typically set per color per finish; confirm minimum run length (meters/yards) and re-order policy.

- OEM/ODM: Custom colors, widths, gsm, finishes, and private labeling are commonly available; confirm feasibility and lead time.

- Sampling lead time: 5–10 business days depending on finish and lab dye availability.

- Production lead time: 20–40 days ex-factory from PO and lab-dip approval; may vary with season and capacity.

- Lead time (delivery): Ocean freight typically 20–35 days; air freight 7–15 days after warehouse departure.

- Payment terms: L/C, T/T, D/P, CAD, net terms for established accounts; deposits or partial prepayments may apply.

- Pricing terms: Ex-works (EXW), Free on Board (FOB), Cost and Freight (CFR), or Delivered Duty Paid (DDP). Define Incoterms in the PO.

- Pricing basis: Price per meter or yard based on width and gsm; volume discounts and price stabilization across rolls; confirm whether pricing is for finished goods or unfinished fabric.

- Packaging cost: Separate or included; specify roll length (e.g., 30–40 meters/roll), tolerance (+/- 5%), and total roll quantity per PO.

- Color matching: Delta-E tolerances (e.g., ≤1.5–2.0 on CIELab); confirm lightboxes and viewing conditions.

- Shrinkage tolerance: Specify % variation (e.g., ≤3% across length/width) and wash cycles used for acceptance.

- Defects policy: Claims accepted within defined days of arrival on verified test reports and batch samples; specify remedies (replacement or credit).

- Certification and audits: Oeko-Tex Standard 100, REACH SVHC screening, ISO 9001/14001; if required, provide certificates during onboarding.

- Compliance statements: Avoid restricted substances (e.g., AZO dyes, PFAS where applicable); confirm compliance to Proposition 65, California requirements, or EU 1007/2011 fiber labeling as applicable.

- Documentation: Invoice, packing list, CO, test reports, safety data sheets for finishes, and compliance certificates upon request.

Notes on Availability and Customization

- Widths: Check inventory for 58/60/62-inch widths and 150/155/160 cm equivalents; confirm any “usable width” after edge trim.

- Customization: Anti-pill level, FR treatment, DWR finish, antimicrobial, and anti-static can be integrated; verify compatibility with dyeing and garment processing.

- Dimensional tolerances: Typical gsm tolerance is ±5%; width tolerance often ±1–1.5 inches. Confirm acceptance limits in the PO.

Navigating Market Dynamics and Sourcing Trends in the coral fleece fabric Sector

Navigating Market Dynamics and Sourcing Trends in the Coral Fleece Fabric Sector

At a glance

- Demand remains resilient across home, athleisure/outdoor, and gifting, driven by softness, warmth, and color breadth; coral is a high-visibility, trend-driven shade in seasonal palettes.

- Sourcing is concentrated in China, Bangladesh, and Turkey; nearshoring to Mexico and Portugal offers lead-time and compliance advantages for EU/US buyers.

- Sustainability is moving from “nice to have” to baseline: recycled polyester (rPET), bluesign/GRS, OEKO-TEX, and low-phenol (or halogen-free) finishes are increasingly required.

- Price anchors: consumer retail on Amazon suggests $0.74–$2.67/ft (medium-weight anti-pill fleece). B2B wholesale for similar quality typically sits lower but varies with MOQ, recycled content, certifications, and finish.

- Microfiber shedding, PFC/halogenated chemistries, and PFAS/PFOS are active scrutiny areas; PFAS-free and low-shed constructions are advantageous for market access.

- Compliance: OEKO-TEX Standard 100 (and potentially MADE IN GREEN) for chemical safety; GRS and bluesign for recycled and environmental claims; EU Ecolabel for sustainability marketing claims.

Demand and market drivers

- End-use resilience:

- Home textiles: blankets, throws, cushions (premium softness in bright, decorative colors like coral).

- Outdoor and athleisure: mid-layers and casualwear, where thermal comfort and anti-pill durability matter.

- Promotional/merchandising: scarves, beanies, branded “cozy” items, tie blankets.

- Performance drivers:

- Anti-pill, anti-static, and easy-care properties; colorfastness for bold corals (often via higher-gauge knitting and surface finishing).

- Breathability and warmth-to-weight balance in medium-weight constructions (commonly 240–300 gsm).

- Buyer behavior:

- Preference for predictable hand and shade consistency; compliance-ready fabrics to reduce QC friction.

- Sustainable attributes increasingly part of product specs and supplier qualification.

Price landscape and positioning

Price signals from consumer retail imply a reasonable floor and ceiling for similar quality in B2B; actual wholesale prices depend on MOQ, recycled content, certifications, and finish.

| Segment | Example price anchors | Notes for B2B positioning |

|---|---|---|

| Consumer retail (Amazon) | ~$7.99–$13.99 per yard; ~$26.90–$29.95 for 2-yard bolts | Corresponds to ~$0.74–$2.67 per linear foot; typically anti-pill, 100% polyester, medium weight; includes fulfillment margins and small-batch pricing. |

| B2B wholesale (medium-weight anti-pill coral fleece) | Typically below retail references; varies by MOQ and spec | Buyers commonly source below consumer price levels; however, rPET content, GRS/bluesign, PFAS-free, and anti-pill grades can lift pricing relative to commodity polyester. |

- How to quote:

- Quote per yard and per kilogram to allow transparent GSM/meter conversions.

- Publish MOQs, lead time, finish options, and any shade-lot restrictions to reduce back-and-forth.

Supply chain and sourcing trends

- Core origins: China (largest capacity and shade breadth), Bangladesh (cost-efficient knitting/finishing), Turkey (EU-proximate knit capacity).

- Nearshoring:

- Mexico: shorter lead times to USA; competitive pricing for solid-color basics.

- Portugal: strong knit/finish ecosystem aligned with EU compliance and traceability; attractive for premium or eco-forward buyers.

- Lead-time and logistics:

- Typical lead times: knit 2–3 weeks; dye/finish 2–4 weeks; sampling 1–2 weeks.

- Air vs sea: air accelerates small MOQs and color match runs; sea reduces costs for bulk but lengthens lead time.

- Trade policy and logistics considerations:

- Anti-dumping/countervailing duties (AD/CVD) for certain Chinese textiles vary by product class; verify applicability to polyester knit fabrics.

- US Section 301 tariffs on Chinese imports remain in place for many textile categories; consider duty-optimized country splits or bonded storage.

- Carbon Border Adjustment Mechanism (CBAM) will increase cost transparency for EU-bound shipments from higher-emission supply chains; prioritize mills with cleaner energy/chemistry.

- Textile labeling and chemical regulations (REACH in the EU; state-level rules in the US; emerging EPR and PFAS restrictions) favor suppliers with documented OEKO-TEX/REACH compliance and low-chemical programs.

Sustainability and compliance

| Attribute | Why it matters | Typical proof/claim support | Considerations for buyers |

|---|---|---|---|

| Recycled content (rPET) | Reduces virgin polyester demand and energy/carbon intensity | GRS certificate (incl. percentage and chain-of-custody); in-house PCR statements | Verify percentage and mass-balance for partial blends; align with sustainability claims (avoid greenwashing). |

| Chemical safety | Market access, especially in EU; mitigates restricted substance risk | OEKO-TEX Standard 100; OEKO-TEX MADE IN GREEN (adds traceability); bluesign partner status; Azo-free disperse dyes | Require current certificates; consider APEO-free and PFAS-free specifications for performance finishes. |

| PFAS/PFOS | Regulatory tightening in the EU (e.g., REACH restrictions) and US state actions (e.g., TSCA) | Supplier declaration of PFAS-free; lab testing for fluorinated compounds | Build PFAS-free language into POs; evaluate hydro/oleo performance trade-offs if any. |

| Water/energy/chemicals | Compliance, consumer trust, and CBAM exposure | bluesign (partner mill), OEKO-TEX STeP, transparent mill data | Request EHS disclosures; prefer low-liquor-ratio dyeing, closed-loop processes, and renewable energy use. |

| Microfiber shedding | Environmental and consumer concerns | Low-shed fabrics; lab tests for fiber release; tighter weaves | Consider double-knit structures or denser knits for shedding reduction where end-use permits. |

| EU Ecolabel (optional) | Premium sustainability credential | Validated ecological benchmarks across fibers, chemistry, and performance | Useful for marketing and institutional buyers; may narrow supplier pool but enhances differentiation. |

Quality and performance drivers

- Anti-pill performance: influenced by yarn quality (e.g., regular or microfiber polyester), twist, and finishing; higher gauges and well-tuned napping/raising improve surface durability.

- Color fastness and brilliance: coral’s intensity requires quality disperse dyes, good dye-cycle controls, and appropriate setting; check wash, rub, and light fastness ratings for brand specifications.

- Hand and loft: medium-weight fabrics (typically ~240–300 gsm) balance warmth and drape; finishing processes (brushing, shearing) fine-tune tactile appeal.

- Dimensional stability: adequate pre-shrinking and heat setting; ensure pilling test protocols match intended end-use (e.g., ASTM D3512, Martindale pilling).

Risk and scenario planning

| Risk | Likely impact | Mitigation strategy |

|---|---|---|

| Fiber input cost volatility (oil/ethylene) | Price swings for polyester and recycled content | Index-based contracts or quarterly pricing reviews; consider blended virgin/recycled specs to hedge. |

| Capacity constraints in peak seasons | Lead time stretch, QC congestion | Pre-book capacity, stagger shade schedules, and maintain safety stock in core colors (including coral). |

| Environmental/chemical shifts (PFAS, REACH updates) | Compliance risk and claims challenges | Keep specs up to date; require PFAS-free, OEKO-TEX/MADE IN GREEN; conduct periodic lab verification. |

| Claims scrutiny (greenwashing) | Reputational risk and regulatory exposure | Ensure certificates match product; align marketing with verifiable standards (e.g., GRS, OEKO-TEX, bluesign). |

| Regional policy (AD/CVD, CBAM, Section 301) | Duty and cost escalation | Optimize sourcing by origin; route shipments to leverage preferential/lower-duties or nearshoring. |

Actionable sourcing checklist

- Define performance: GSM range, anti-pill grade, pilling ratings, and colorfastness targets (wash/rub/light).

- Specify sustainability: rPET percentage (GRS-backed), PFAS-free language, preferred OEKO-TEX/MADE IN GREEN or bluesign-aligned partners.

- Set lead time: knit and finish durations; plan sampling cycles; confirm expedited options (air freight for first runs).

- Lock in pricing: quote per yard and per kg; clarify MOQ, shade-lot policy, and rework process.

- Pre-clear compliance: EU Ecolabel (if applicable), REACH/TSCA obligations, and PFAS restrictions; document certifications and keep COAs/COC.

- QC guardrails: conduct lab checks for fiber content, GSM, pilling, fastness, and dimensional stability before bulk release.

Sustainability snapshot and forward outlook

- Recycled polyester penetration is steadily increasing; expect more buyers to require GRS coverage and transparent PCR claims.

- PFAS-free performance finishing is moving toward the baseline in the EU, with US states following; suppliers investing in halogen-free chemistry gain an edge.

- Microfiber mitigation—tighter constructions, low-shed treatments, and better end-of-life guidance—will increasingly feature in corporate sustainability programs.

- EU Ecolabel and bluesign will serve as proof points for institutional and premium brands; using these credentials to anchor “coral” seasonal drops can support higher acceptance rates.

History brief

Coral fleece emerged from the broader family of synthetic fleeces popularized in the late 20th century, with polyester knit structures and brushing finishing achieving soft loft and warmth. As textile chemistries advanced, anti-pill finishes and higher-gauge knitting improved durability—key to maintaining coral’s vivid appearance and tactile appeal—while recent supply chains have expanded recycled inputs and tightened chemical controls in response to EU and US regulatory trends.

Frequently Asked Questions (FAQs) for B2B Buyers of coral fleece fabric

Frequently Asked Questions (FAQs) for B2B Buyers of Coral Fleece Fabric

What are the standard specifications for coral (anti-pill) fleece?

- Content: 100% polyester (typical), anti-pill finish

- Weight (GSM): 180–260 gsm; “Medium weight” commonly ~200–240 gsm

- Width: 58–60 in (147–152 cm)

- Yarn/Finish: 100–200 denier filament yarns; brushed/napped; anti-pill (pile/loop-sheared)

- Common construction: Circular knit (polar/Microfleece) or warp knit (coral), napped on face/back

- Notes: Width tolerance ±2%; weight tolerance ±5%; directional pile affects shade and nap direction

What is the MOQ and how soon can you ship?

- MOQ (plain colors): Typically 300–800 yards per color (dye-lot), subject to machine width

- MOQ (custom dyeing): Often 1,000–2,000 yards per color, plus color lab dips and strike-offs

- Lead times:

- Stock colors/anti-pill: 2–5 business days to ship after payment confirmation

- Fresh dye lots: 10–20 business days to dye + 2–5 days to ship

- Packaging:

- Rolls: Rolled on tubes, polybag + label; inner/outer wrap options available

- Folded yardage: Standard 1–2 yard folded packs upon request

- Pallets: Standard 36–48 in pallets; custom pack density and banding available

How do you substantiate anti-pill claims and colorfastness?

- Anti-pill testing:

- ASTM D3512 (Tumble, random tumble pilling)

- ISO 12947-2 (Martindale abrasion, 2 kPa, “no holes”)

- Typical acceptance: ≥Grade 4 after 30 min (ASTM D3512) or no holes at set cycles (ISO 12947-2)

- Colorfastness:

- Wash: ISO 105-C06 (A1, M/C cycles, grade ≥4 on shade change; grade ≥3–4 on staining)

- Light: ISO 105-B02 (xenon-arc, grade ≥4 recommended for apparel)

- Rub: ISO 105-X12 (dry ≥4; wet ≥3–4)

Note: Anti-pill performance is a finishing attribute; actual results vary with abrasion level, construction, and end-use. Provide test reports and target acceptance levels with RFQs to align expectations.

Illustrative Image (Source: Google Search)

Is coral fleece compliant for apparel and kidswear in the USA/EU?

- USA

- Flammability: 16 CFR Part 1610 (general apparel) and 16 CFR Part 1615/1616 (children’s sleepwear, where applicable)

- California Prop 65: Compliance to state chemical exposure limits; MSDS/SDS and declarations available

- CPSIA (for children’s items): Third-party testing for lead, phthalates, and applicable chemical restrictions

- EU

- REACH/SVHC: Compliant to current European Chemical Agency restrictions; declarations provided

- Azo dyes: Compliant to EN 14362-1/2 (no restricted amines)

- Oeko-Tex Standard 100 or Bluesign Approved: Available upon request for applicable product lines

- Flammability: No single EU-wide flammability standard for apparel; ensure product-specific risk assessment and labeling per destination

What color options and dyeing services do you offer?

- Coral palette: Stock “Coral 186C” (近似 equivalent to Pantone 186 C/TCX) and related warm reds with matching targets

- Matching and sampling:

- Pantone/Swatch matching (provide TCX/TPX numbers or customer swatches)

- Color lab dips: 2–3 strike-offs per color (typical 2–3 weeks lead time)

- Lab dips: Color codes and 10×10 cm cut are provided; approval required before bulk

- Batch-to-batch consistency: Shade control via datamatch on calibrated light booth (D65/10°)

- Special effects: Heather/corruption, colorblock stripes, embossed pile, anti-static finish (additional lead time and MOQ)

What is the difference between polar fleece and coral fleece?

- Polar fleece: Usually mid-heavy to heavy weight (250–350+ gsm), thicker/nappier, higher loft

- Coral fleece: Generally lighter to medium (180–260 gsm), fine/narrow pile loops, slightly denser face with softer hand; often used for throws, apparel, and soft accessories

- End-use: Coral fleece is versatile for adult apparel, blankets, and accessories; polar fleece is favored for outdoor/cold-weather and higher-loft needs

What are the core mechanical properties I should expect?

- Abrasion (ISO 12947-2, 9 kPa, wool abrasive): Typically ≥20,000 cycles to no holes (construction-dependent)

- Seam slippage (ISO 13936-2): ≤6 mm at 180 N (recommended for apparel uses)

- Dimensional change (ISO 5077, 40°C):

- Warp: −3.0% to −6.0%

- Weft: −3.0% to −6.0%

- Pilling resistance (ASTM D3512): ≥Grade 3–4 typically expected; specify target acceptance

- Fiber content: 100% polyester (standard)

How should I specify and price for a bulk RFQ?

- Include: End-use, target GSM, width, anti-pill target (e.g., ≥Grade 4), required tests (ASTM/ISO), color specs (Pantone/swatch), quantity per color, packaging (roll vs folded), labeling, delivery windows, Incoterms (EXW, FOB, CIF, DAP), and port/destination.

- Pricing basis:

- Per yard or per meter; minimum billing increment 0.25 m

- Sample yardage: Small orders available for sampling pre-production

- Payment terms: Net 30 available with approved credit; LC/Western Union supported

- Freight estimation: Provide destination and desired service (ground/sea/air)

- Notes:

- “Anti-pill” is a finish claim—specify test standards and acceptance levels

- Dye-lot control: Provide target Lab values (Lab*) for critical colors

- Care labels: Recommend tumble low, do not iron the pile, do not bleach, wash cold/40°C

If you would like, I can provide current availability, stock coral color codes, and a preliminary price grid tailored to your target spec and volume.

Strategic Sourcing Conclusion and Outlook for coral fleece fabric

Strategic Sourcing Conclusion and Outlook for Coral Fleece Fabric

Coral fleece remains a profitable, high-touch category for premium outerwear, athleisure, and homewares in the US/EU. Retailers favor anti-pill, medium-weight constructions; consumers equate coral with warmth and comfort. Margin resilience depends on disciplined sourcing, predictable lead times, and compliance by design.