Executive Bifocal Lens: The Ultimate 2025 Sourcing Guide

Introduction: Navigating the Global Market for Executive Bifocal Lenses

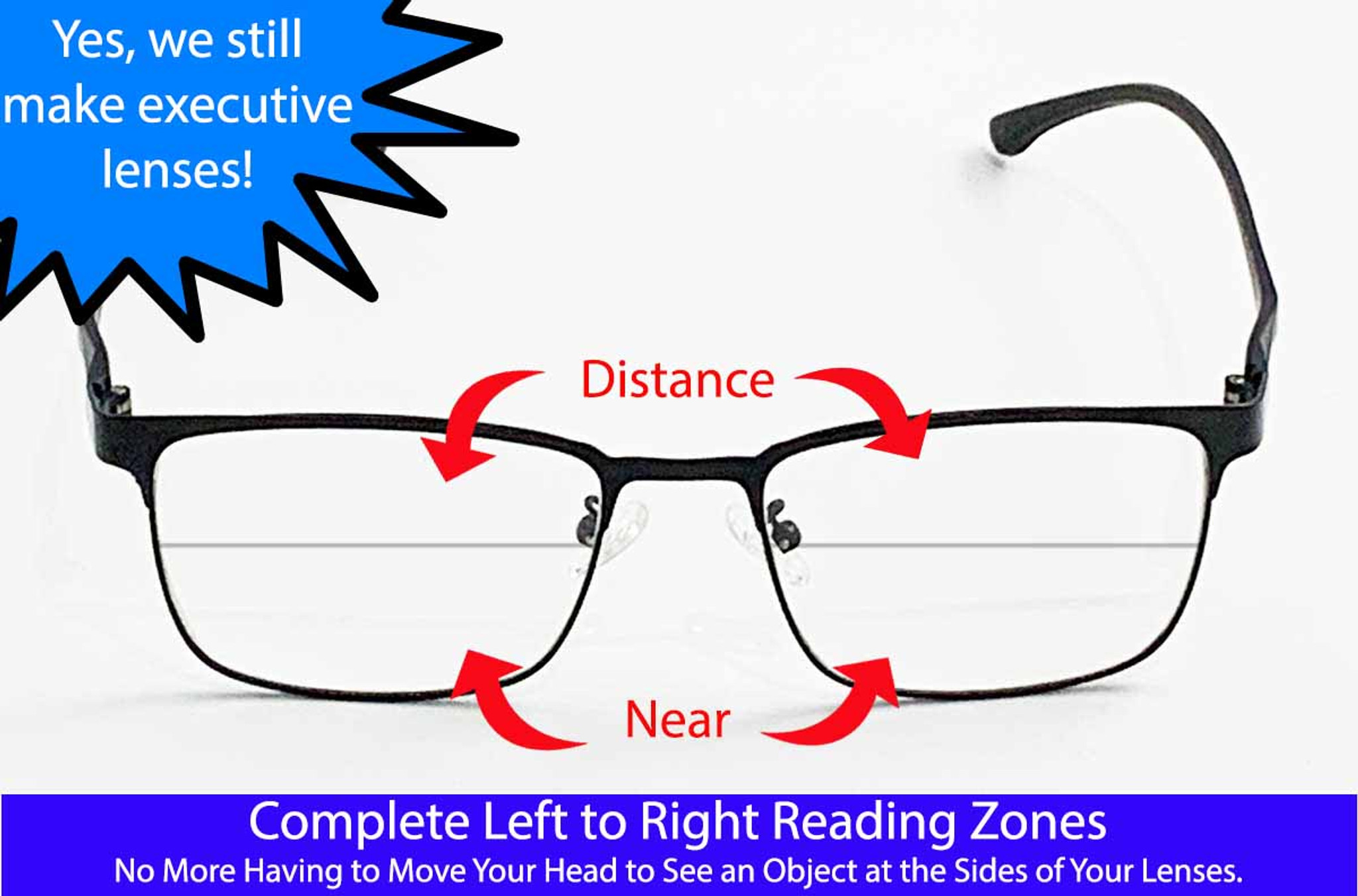

As presbyopia prevalence rises and multi-device workflows become the norm, professionals in the USA and Europe need eyewear that adapts instantly between distance, intermediate, and near tasks. Executive bifocals—full-lens designs that replace the small “window” with seamless, continuous focus—offer that functional edge for executive and knowledge workers.

The challenge for buyers is not a lack of options, but a lack of consistent quality and reliable compliance. Suppliers vary in base curves, coating durability, add power stability, and labeling standards, making it hard to forecast performance and regulatory fit across regions.

This guide moves beyond product basics to operational essentials. You’ll learn how to specify executive bifocals by material, index, Abbe, add power, segment geometry, and coating stack; how to map supply chain choices between US/EU distribution models; and how to validate QC from sampling to incoming inspection. We detail compliance (US/UK labeling, EU MDR/medical claims, CE/PPE categories), logistics considerations (packaging, lead times, MOQs), and total cost drivers so you can position offerings to meet regional margin expectations.

Use this guide to:

– Define your lens specification and minimum performance thresholds

– Choose vendors by capability, QA depth, and regional fit

– Price for segment positioning in each market

– De-risk QC/returns and scale operations reliably

Executive bifocals should be effortless for end users—and frictionless for your business.

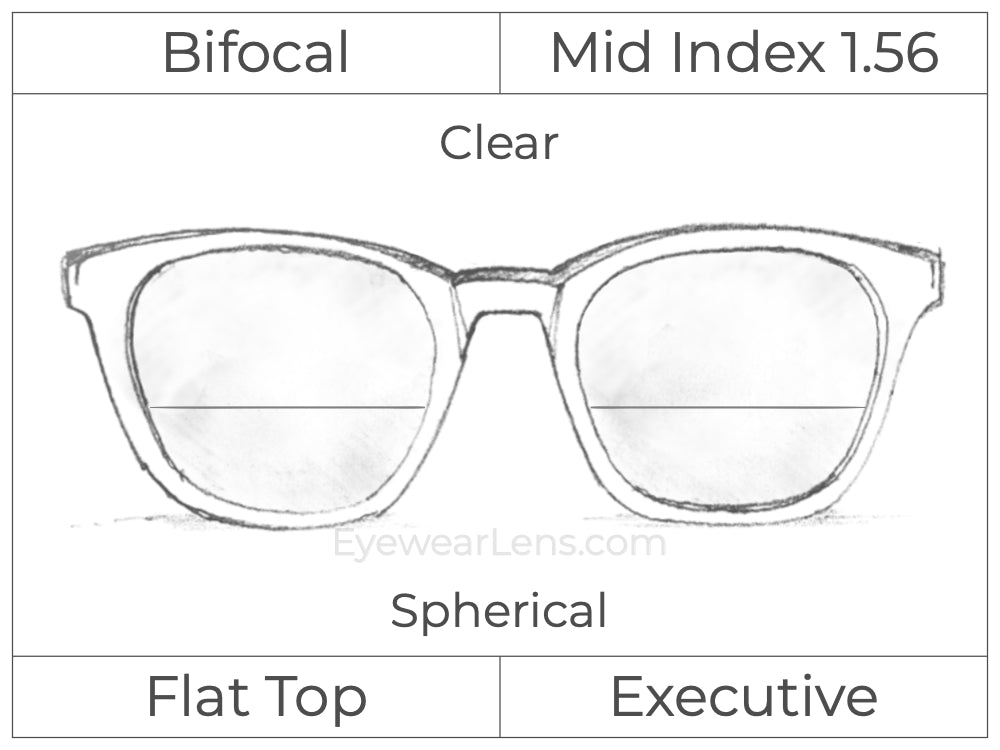

Illustrative Image (Source: Google Search)

Top 10 Executive Bifocal Lens Manufacturers & Suppliers List

1. Executive Bifocal Glasses – RX Safety

Domain: rx-safety.com

Registered: 2006 (19 years)

Introduction: $10 deliveryOur executive bifocals are crafted using a 1.56 mid-index material, ensuring durability and comfort throughout the day. These lenses are particularly beneficial ……

2. Executive Bifocals, CR39 Plastic – UseMyFrame

3. Bifocal Lenses – tagged “Flat Top Executive” – EyewearLens.com

4. Bifocal Lenses – Interoptik

Domain: interoptik.com

Registered: 2017 (8 years)

Introduction: Interoptik is a lens manufacturer and importer of top frame brands. Our factory supplies products to numerous opticians in Romania and Europe. Although we ……

Illustrative Image (Source: Google Search)

5. Specialty & Multifocal Lenses – Younger Optics

Domain: youngeroptics.com

Registered: 1997 (28 years)

Introduction: The FT45 offers a great alternative for the “executive” across-the-lens multi-segment, because it is easier to process and coat; it offers faster turnaround ……

6. Where to find custom made executive bifocal glasses? – Reddit

Domain: reddit.com

Registered: 2005 (20 years)

Introduction: Fluegge Optical makes them. Eyewearlens.com also makes them. I believe they both get the blanks from Conant Optical in China, which appears to ……

7. Executive Bifocal Lenses – Factory, Suppliers, Manufacturers from …

Domain: convox-optical.com

Registered: 2021 (4 years)

Introduction: Executive Bifocal Lenses Manufacturers, Factory, Suppliers From China, We welcome new and old customers from all walks of life to contact us for future ……

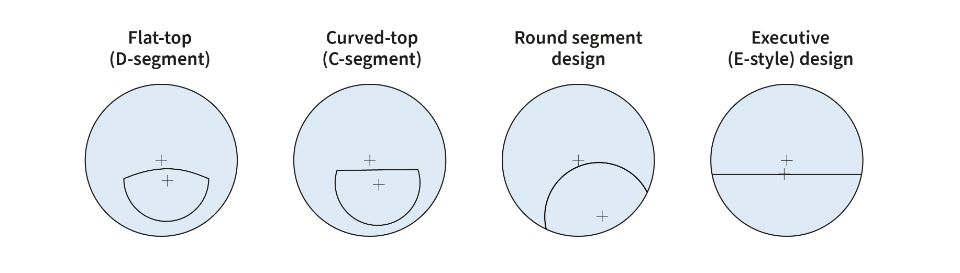

Understanding executive bifocal lens Types and Variations

Understanding Executive Bifocal Lens Types and Variations

Executive bifocals provide a two-focus solution across the entire lens. The “executive” configuration replaces a conventional bifocal window with a full-lens dual-focus design that blends distance and near (or intermediate and near) within a single surface.

To support procurement and specification, the following table summarizes common executive bifocal variations based on the UseMyFrame configuration options.

Executive Bifocal Types Overview

| Type | Features | Applications | Pros/Cons |

|---|---|---|---|

| Distance & Reading Executive Bifocal (CR39, Scratch Resistant) | Full-lens dual-focus design spanning the entire lens; CR39 plastic; included scratch-resistant (SR) coating | Desk work requiring frequent distance–near shifts; document review; in-person meetings; traveling professionals | Pros: Seamless transition; no small bifocal window; robust SR coating for daily use. Cons: Standard impact resistance (not safety-rated); not recommended for rimless drill mounting without specialized drilling. |

| Distance & Reading Executive Bifocal (CR39, Anti-Reflective) | As above with anti-reflective (AR) coating to reduce surface reflections | High-presentation environments; screen-heavy tasks with glare sources; client-facing roles | Pros: Improved visual comfort; reduced reflections; professional appearance. Cons: Requires proper cleaning to maintain performance; higher price than SR. |

| Distance & Reading Executive Bifocal (CR39, Super Anti-Reflective) | As above with super anti-reflective (Super AR) coating for enhanced glare reduction | Digital-heavy workflows; mixed lighting; long-duration wear | Pros: Superior glare control and perceived clarity; durable against smudging in many cases. Cons: Highest price tier; performance depends on maintenance. |

| Intermediate & Reading Executive Bifocal (CR39, Scratch Resistant) | Executive design configured for intermediate (arm’s length) and reading; CR39; SR coating included | Computer-focused environments; data entry; CAD/technical workstations | Pros: Optimized for mid-range tasks; reduces need for separate computer glasses. Cons: Not intended for far distance correction; fewer frames in some catalogs. |

| Intermediate & Reading Executive Bifocal (CR39, Anti-Reflective or Super AR) | As above with AR or Super AR coating | Prolonged screen time; bright office environments with reflective surfaces | Pros: Enhanced comfort under screen glare; professional finish. Cons: Premium coatings increase cost; care needed to preserve anti-reflective performance. |

Distance & Reading Executive Bifocals (CR39)

- Material: CR39 plastic lenses.

- Design: Full-lens dual-focus layout; no small bifocal window—distance and reading powers span the lens for smooth transitions.

- Coatings:

- Scratch Resistant (included)

- Anti-Reflective

- Super Anti-Reflective

- Use cases: Professionals who frequently shift between viewing people, screens, and printed documents in office, travel, or client-facing contexts.

- Pros:

- Unified viewing experience without line or window.

- Durable SR base coating for everyday resistance to micro-scratches.

- AR/Super AR variants reduce reflections and visual fatigue in varied lighting.

- Cons:

- Standard impact resistance; not intended as safety eyewear.

- Rimless drill mounting may require specialized techniques due to material properties.

- Price increases with higher-tier coatings.

Intermediate & Reading (Computer) Executive Bifocals (CR39)

- Material: CR39 plastic lenses.

- Design: Executive layout optimized for intermediate (typically arm’s length) and near vision; replaces the typical small bifocal window with a full-lens segment spanning near and intermediate.

- Coatings:

- Scratch Resistant (included)

- Anti-Reflective

- Super Anti-Reflective

- Use cases: Computer-centric roles such as analysts, developers, designers, and administrative staff working primarily within 20–30 inches.

- Pros:

- Seamless shift between mid-range and near tasks.

- Reduces the need for separate computer readers.

- Coatings mitigate glare from screens and office lighting.

- Cons:

- Not intended for distance vision correction.

- Frame selection may be narrower for some styles.

Executive Bifocal Coating Variations (for both Distance/Reading and Intermediate/Reading)

- Scratch Resistant (Included)

- Purpose: Improves resistance to everyday abrasion.

- Typical benefits: Extends lens life; suitable for daily office use.

- Typical limitations: Not a safety rating; performance varies with handling.

- Anti-Reflective (AR)

- Purpose: Reduces surface reflections for clearer vision and a professional appearance.

- Typical benefits: Comfort in meeting rooms and under overhead lights; better cosmetic look.

- Typical limitations: Requires proper cleaning; performance sensitive to smudges and oils.

- Super Anti-Reflective (Super AR)

- Purpose: Advanced multi-layer AR stack for higher light transmission and lower reflectance.

- Typical benefits: Superior glare control; improved perceived clarity under bright conditions.

- Typical limitations: Higher price; maintenance still required for optimal performance.

- Availability: Executive Bifocals, CR39 Plastic (UseMyFrame).

- Use cases offered: Distance and Reading; Intermediate and Reading (Computer).

- Frame options: Send in your frame; Buy a frame from UseMyFrame.com.

- Coatings: Scratch Resistant (included); Anti-Reflective; Super Anti-Reflective.

Key Industrial Applications of executive bifocal lens

Key Industrial Applications of Executive Bifocals

| Industry / Application | Typical Tasks | Recommended Lens Configuration | Priority Coatings | Key Benefits |

|---|---|---|---|---|

| Electronics and Precision Manufacturing | PCB inspection; microscope alignment; quality control at workbench | Distance/Reading (near window across full lens) | Anti-reflective (AR) or Super AR; Scratch-resistant | Rapid shift between fine near tasks and distant equipment without changing eyewear; minimized reflections and glare; reduced eye strain in inspection lines |

| R&D and Scientific Labs | Microscope observation; documentation at desk; device setup | Distance/Reading | Anti-reflective; Scratch-resistant | Seamless near-to-distance transitions; reduced glare from lab lighting and screens; improved visual comfort during extended sessions |

| Mechanical Engineering and CAD | Bench measurement; CAD screen work; tool setting | Distance/Reading | AR; Scratch-resistant | Consistent focus between instruments and monitors; crisp edges; lower switching fatigue across varied focal distances |

| Industrial Inspection and QA | On-floor machine checks; gauge reading; paperwork | Distance/Reading | AR or Super AR; Scratch-resistant | Whole-lens near segment supports gauge and paper work while keeping equipment and signage in view; premium AR reduces surface reflections |

| Construction Management and Trades | Reading plans/specs; observing site from distance; ladder work | Distance/Reading | AR or Super AR; Scratch-resistant | Continuous near vision with distance awareness; durable, scratch-resistant surfaces; reduced eye fatigue in variable lighting |

| Oil & Gas and Utilities | Control-room monitoring; valve/panel work; maintenance paperwork | Distance/Reading | AR or Super AR; Scratch-resistant | Quick switch from monitors to handheld readings; reduced glare from control room lights; robust daily wear performance |

| Warehousing, Logistics, and Ports | Scanning; paperwork; aisle navigation; loading bay observation | Distance/Reading | AR; Scratch-resistant | Near tasks complemented by distance visibility of forklift traffic; glare reduction in brightly lit facilities |

| Printing and Graphics | Proofing at desk; inspection of printed sheets; press adjustments | Distance/Reading | AR or Super AR; Scratch-resistant | Full-lens near support for proofs with distance clarity for press lines; glare control under bright lights |

| Textile and Apparel Manufacturing | Cut-table inspection; paperwork; machine oversight | Distance/Reading | AR; Scratch-resistant | Stable near vision for fabric work with distance awareness; scratch resistance against fibers and tools |

| Pharmaceuticals and Chemicals (non-sterile areas) | Batch documentation; equipment reading; quality checks | Distance/Reading | AR; Scratch-resistant | Reliable near focus paired with distance clarity; minimal reflections in controlled lighting environments |

| Mining and Heavy Industry | Equipment checks; maintenance forms; observation of worksites | Distance/Reading | AR or Super AR; Scratch-resistant | Robust near/distance performance in challenging conditions; glare control for bright environments |

| Public Safety (Non-operational field roles) | Report writing; briefing checks; situational observation | Distance/Reading | AR; Scratch-resistant | Balanced near/distance clarity for field-based documentation; comfort for long shifts |

| Real Estate and Facilities Management | Walkthroughs; inspections; paperwork | Distance/Reading | AR or Super AR; Scratch-resistant | Smooth transitions from documents to environment; reduced fatigue during repeated transitions |

| Technical Education and Training | Classroom instruction; lab demonstrations; paperwork | Distance/Reading | AR; Scratch-resistant | Versatile reading and demonstration visibility; glare control under classroom lighting |

| Retail and Hospitality Back-of-House | POS operations; inventory; paperwork; floor oversight | Distance/Reading | AR; Scratch-resistant | Near tasks supported with distance awareness of staff/operations; consistent clarity under varied lighting |

| Agriculture (Equipment and Facilities) | Machinery checks; maintenance docs; facility walkthroughs | Distance/Reading | AR; Scratch-resistant | Near maintenance work with distance context; dust-resistant scratch protection |

| HVAC, Electrical, and Field Services | Workbench prep; control panels; documentation; site surveys | Distance/Reading | AR or Super AR; Scratch-resistant | Fluid switching from handheld tools to panels and site environment; reduced surface reflections |

Value drivers across applications:

– Whole-lens dual-focus design enables seamless near-to-distance transitions without switching eyewear.

– Material: CR39 plastic provides lightweight, durable performance with optics suitable for industrial environments.

– High-clarity optics reduce eye strain in precision and inspection workflows.

– Recommended coatings: AR/Super AR to cut glare under bright or mixed lighting; scratch-resistant for daily wear against tools, paper, and equipment.

– Flexible configurations: Distance/Reading for mixed tasks; Intermediate/Reading (computer-focused) where monitor work predominates.

Illustrative Image (Source: Google Search)

3 Common User Pain Points for ‘executive bifocal lens’ & Their Solutions

3 Common User Pain Points for Executive Bifocal Lenses & Their Solutions

Pain Point 1: Constant head tilting and fatigue when switching between distance, computer, and reading

- Root cause: Presbyopic users perform many quick transitions (e.g., documents to screen to face-to-face), which standard bifocals and progressive lenses can’t serve without abrupt head movement.

- Impact: Eye/neck fatigue and lost productivity as users juggle tasks more frequently.

- Executive bifocal advantage: A clear, flat-top “executive” style segment spans the full width of the lens, allowing upright posture and a consistent reading field at the top or bottom, depending on the pairing.

Solution

- Use the right executive pairing by task:

- Distance + Reading: Best for mixed office + field duties (whiteboards to reports).

- Intermediate + Reading (Computer): Best for screen-heavy roles (2–3 ft working distance).

- Pair with AR coatings and appropriate lighting to minimize glare (prevents micro-movements that increase fatigue).

- Ensure proper segment placement (reading line near the bottom of frames; segment height aligned to eye’s primary downward gaze) to reduce head tilting.

- For higher adds, keep frame sizes moderate and fit to optical center standards to minimize distortion.

Business benefit: Faster task switching with less discomfort; measurable reduction in productivity dips tied to eyewear fatigue.

Pain Point 2: Glare and reflections on large executive lenses; discomfort with screen use

- Root cause: The full-width reading segment exposes a larger vertical lens area, increasing reflections; many roles are screen-intensive with harsh lighting.

- Impact: Reduced clarity, increased squinting, and after-hours fatigue.

Solution

- Use high-quality anti-reflective coatings:

- Standard AR: Good for indoor use.

- Super AR: Recommended for screen-heavy roles; higher light transmission and advanced smudge/ink resistance.

- For high-usage, pair with photochromic lenses (e.g., Transitions Signature VII GEN 8) for UV-dependent tinting; ensure proper lighting and screen setups to avoid residual blue-light discomfort.

- Optimize fit and edge finish:

- Minimize lens roll-off and edge thickness with proper frame sizing and beveling.

- Consider high-index lenses (1.61/1.67) for thinner edges and reduced reflections on high-minus prescriptions.

- Educate users on glare hygiene: avoid overhead reflective surfaces, angle monitors to reduce reflections, and use workstation lighting with diffusers.

Business benefit: Lower after-hours strain and improved visual comfort, especially in modern offices with extensive screen work.

Pain Point 3: Weight, thickness, and aesthetic concerns, especially for high-minus or high-add prescriptions

- Root cause: Executive lenses cover a larger lens area; minus prescriptions show edge thickness, plus prescriptions show center thickness; CR39 can be heavier than high-index materials.

- Impact: Slipping frames, facial marks, and reluctance to wear the eyewear.

Solution

- Choose the right material by prescription:

- CR39 (1.50): Best for low myopia or hyperopia; lightest cost.

- 1.61 Polycarbonate or 1.61 MR-8: Stronger and thinner; good for mid-power users; standard impact resistance for polycarbonate (US market).

- 1.67 or 1.74 (MR-7/MR-174): Best for high-minus/high-plus; significantly thinner and lighter.

- Control edge thickness:

- Use smaller or medium frame sizes for high-minus prescriptions; avoid oversized lenses.

- Consider optional “thin-center” lens optimization on plus prescriptions to reduce center thickness and weight.

- Finish details:

- Edge polish and bevel shaping for comfort.

- Avoid long pantoscopic tilt or excessive vertex distance on higher adds to reduce front weight leverage.

- Use lighter frame materials (titanium, TR-90) for comfort.

Business benefit: Better wear compliance and user satisfaction; fewer fit/return issues related to thickness or comfort.

Quick Reference: Materials and Coatings

Lens materials comparison

| Material | Refractive Index | Typical Use Cases | Benefits | Notes for US/EU |

|---|---|---|---|---|

| CR39 Plastic | 1.50 | Low power (-3.00 to +3.00), budget-focused | Lightweight, cost-effective | Most economical; may show more edge/center thickness |

| 1.61 Polycarbonate / MR-8 | 1.61 | Mid-range prescriptions; light to moderate -/+ | Thinner than CR39; polycarbonate is impact-resistant (US compliance) | MR-8 offers optical clarity; 1.61 polycarbonate suits safety/office roles |

| 1.67 MR-7 / 1.74 MR-174 | 1.67 / 1.74 | High-minus or high-plus; executive styles with larger lens area | Significant thinning and weight reduction; better aesthetics | MR-174 is the thinnest; premium pricing; use medium frames to optimize thickness |

Coating bundles by use case

| Use Case | Recommended Coatings | Why |

|---|---|---|

| Screen-heavy office | Super Anti-Reflective + anti-smudge | Maximizes light transmission, reduces reflections and smudging; better contrast and comfort |

| Mixed indoor/outdoor | AR + photochromic (e.g., Transitions Signature VII GEN 8) | Adaptive tinting for indoor/outdoor transitions; AR cuts glare |

| High-use manufacturing | Polycarbonate base + scratch-resistant AR | Durability with safety requirements (US), scratch resistance; AR improves visual clarity |

Implementation guidance for procurement/eyewear managers

- Standardize executive pairings by role profile:

- Executive Distance + Reading for client-facing staff and field operations.

- Executive Intermediate + Reading for screen-dominant teams (CAD, data, development).

- Adopt a “coating-first” policy on executive lenses to manage glare on larger surfaces.

- Set prescription material guidelines to avoid unnecessary thickness and returns:

- < +/- 2.50D: CR39 acceptable.

- +/- 2.50–5.00D: 1.61 polycarbonate or MR-8.

-

+/- 5.00D: 1.67/1.74 for thinner edges and lighter weight.

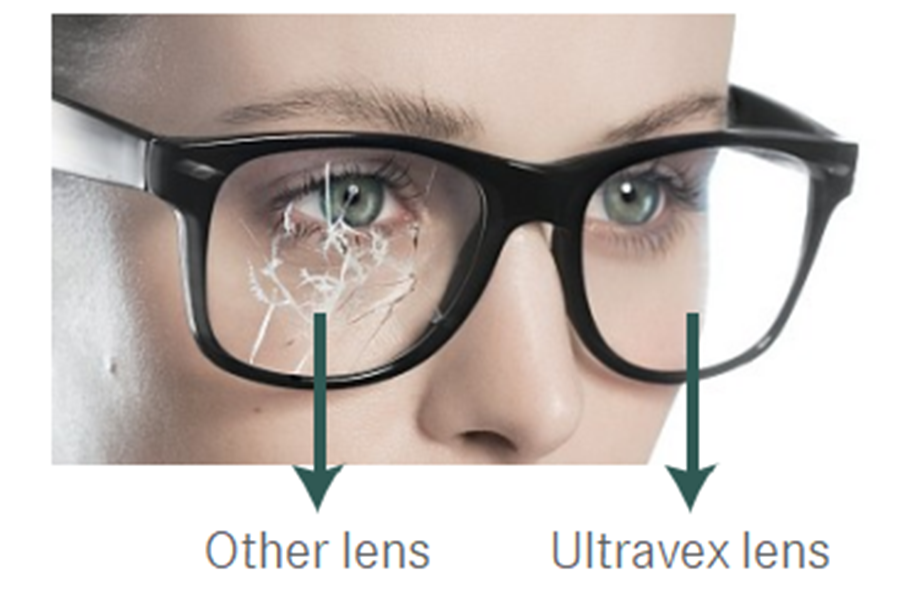

Illustrative Image (Source: Google Search)

- Configure fit standards: correct segment height by frame geometry, control frame sizes for high-minus prescriptions, and maintain proper vertex distance to reduce front weight in higher adds.

- Offer super AR on executive options; bundle photochromic lenses where indoor/outdoor transitions occur.

This approach addresses the three most common executive bifocal challenges—task-switching fatigue, glare on large lens areas, and thickness/weight—with clear, B2B-ready solutions that align with US and EU market practices.

Strategic Material Selection Guide for executive bifocal lens

Strategic Material Selection Guide for Executive Bifocal Lenses

Executive bifocals differ from conventional bifocals by placing the add segment across the entire near lower portion of the lens, not in a small “window.” This geometry increases the absolute near zone size and can affect edge thickness, weight, and cosmetic appearance. Material choice should therefore balance optical performance, prescription, frame type, environmental exposure, and compliance requirements.

Key trade-offs:

– Optical clarity (Abbe number) vs. index (thickness/weight)

– Impact resistance vs. surface hardness and scratch resistance

– Durability vs. cost and ease of fabrication

– Tint compatibility vs. UV and heat exposure

– Edge cosmetics vs. frame compatibility

CR‑39 plastic is a widely used baseline for executive bifocals due to good optical quality and cost efficiency, but higher-index plastics and alternative materials often provide better comfort and cosmetics for stronger prescriptions or demanding environments.

Illustrative Image (Source: Google Search)

Decision framework for material selection

- Prescription and add power

- Low power: CR‑39 often optimal for optical quality and cost.

- High minus (−5.00 D or stronger): consider 1.67 or 1.74 to reduce edge thickness and weight.

-

High plus (+5.00 D or stronger): index selection mainly impacts center thickness and weight; CR‑39 is usually adequate, though 1.6 can help in premium frames with strict thickness targets.

-

Frame and mounting

- Rimless/drill-mount: prioritize materials with high impact resistance and good drilling yield (e.g., polycarbonate or Trivex).

- Semi-rimless/nylon cord: Trivex provides a strong balance of optics and drill integrity.

-

Full-rim: broader material latitude; choose based on prescription and cosmetics.

-

Use environment and duty cycle

- Outdoor/industrial: impact-resistant options (polycarbonate, Trivex) preferred; add hard-coat.

- High UV/heat (e.g., vehicles, outdoor delivery): avoid easily crazed materials; confirm tint compatibility and heat stability with suppliers.

-

Cleanroom/chemical exposure: select materials and coatings rated for harsh chemicals; consult coating datasheets.

-

Coatings and tinting

- Anti-reflective (AR) is recommended for most executives to reduce eye strain and glare.

- Hardcoat improves scratch resistance; essential for polycarbonate, Trivex, and glass (unless specified by the supplier).

-

Tint: high-index plastics can have limitations depending on dye chemistry and heat tolerance; confirm dye compatibility before specifying.

-

Compliance and regulation

- USA: ANSI Z80.1 spectacle standards; consider OSHA job safety standards for impact-rated needs (e.g., safety programs).

- Europe: CE marking and EN ISO 12312‑1. Impact ratings depend on product classification; consult the supplier.

-

For specific industries (e.g., construction, manufacturing), engage EHS to validate lens material and marking requirements.

-

Add geometry and cosmetic finish

- Executive (full-width) adds increase near zone area. For thin-rimmed or rimless frames, select higher index to maintain acceptable edge thickness and aesthetic.

Material analysis

CR‑39 plastic (1.50)

– Optical quality: High Abbe value; minimal chromatic aberration in practice.

– Weight/density: Heavier than most high-index plastics for the same power.

– Impact/chemical: Adequate but inferior to polycarbonate and Trivex for impact; surface hardness is good but not best-in-class; dye compatibility is typically straightforward.

– Cost: Lower relative to higher-index options; cost-effective for most prescriptions in full-rim frames.

Trivex (1.53)

– Optical quality: High Abbe similar to CR‑39; low chromatic aberration; optics comparable or better than polycarbonate.

– Weight/density: Lightweight and often preferred for comfort.

– Impact/chemical: Superior impact resistance; suitable for rimless/semi-rimless mounting; excellent drilling yield; improved scratch resistance vs. polycarbonate when hard-coated.

– Cost: Mid-range; premium positioning but competitive value when comfort and durability are priorities.

Illustrative Image (Source: Google Search)

Polycarbonate (1.59)

– Optical quality: Lower Abbe; can show slight color fringing in strong prescriptions; acceptable for moderate powers.

– Weight/density: Lightest option; reduced mass improves comfort.

– Impact/chemical: High impact resistance; recommended for safety-centric programs; requires hardcoat for surface durability; dye compatibility varies by supplier.

– Cost: Lower to mid-range; compelling for cost-sensitive programs and protective eyewear.

Mid-index 1.60

– Optical quality: Lower Abbe than CR‑39/Trivex; adequate for most uses; slight reduction vs. 1.50.

– Weight/density: Thinner and lighter than 1.50; better cosmetics for medium-strong prescriptions.

– Impact/chemical: Moderate impact resistance; dyeing and AR performance are material/vendor dependent.

– Cost: Mid-range; strong value when thickness reduction matters and high Abbe is not critical.

High-index 1.67

– Optical quality: Low Abbe; potential for noticeable color fringing at strong prescriptions.

– Weight/density: Thinner and lighter than 1.50; significant cosmetic benefit for higher powers.

– Impact/chemical: Best used for high-prescription comfort and looks; dye compatibility and AR performance vary by supplier; confirm with lab.

– Cost: Higher; premium positioning; specify when prescription demands thickness reduction.

High-index 1.74

– Optical quality: Lowest Abbe; use careful Rx selection to mitigate aberration.

– Weight/density: Thinnest option; maximum thickness and weight reduction for high minus powers.

– Impact/chemical: High-index plastic; dye/AR properties vary; often recommended for top-end prescriptions in executive bifocals.

– Cost: Highest; reserve for high-power cases where cosmetics and comfort are critical.

Illustrative Image (Source: Google Search)

Glass (1.52/1.60/1.70/1.80/1.90)

– Optical quality: Highest clarity (very high Abbe); low color fringing.

– Weight/density: Heavier than plastics; not preferred for plus powers or extended wear unless specific to application.

– Impact/chemical: Glass is fragile; not impact-rated; suited for specialty uses (e.g., certain chemical/scratch-prone environments) and as per EHS policy.

– Cost: Variable; surface hardness is excellent; AR durability depends on coatings and substrate.

Recommendations by scenario

- Low-power, full-rim office executives: CR‑39 + AR + hardcoat; consider tint for outdoor transitions.

- Medium/high minus prescriptions with executive adds: 1.67 for cosmesis and comfort; 1.74 where thickness targets are tight and Abbe is acceptable.

- Rimless/semi-rimless: Trivex for optics and durability; polycarbonate where cost is primary and optics are acceptable.

- Industrial/outdoor programs: Trivex or polycarbonate with hardcoat; verify impact compliance with supplier.

- High UV/heat exposure: Confirm heat distortion and dye compatibility for high-index; avoid materials prone to crazing.

Technical notes for buyers and lab partners

- Executive add design: Full-width segment increases near area; expect greater lens real estate for tinting/AR and potentially thicker edges at the junction in minus lenses; plan index selection accordingly.

- AR compatibility: Confirm AR stack and hardcoat compatibility by material; some high-index plastics and polycarbonate require vendor-specific AR to avoid adhesion or thermal issues.

- Edge polish and drilling: High Abbe materials tolerate standard processes well; polycarbonate/Trivex benefit from sharp drills and controlled feed to prevent cracking; avoid excessive heat during polishing for high-index plastics.

- Tint temperature limits: Verify dye max temperatures for high-index plastics to prevent warping; adjust finishing parameters accordingly.

- Quality control: Verify center thickness, edge thickness, prism balance, and add uniformity; document QA outcomes for compliance.

Quick checklist before specifying

- Prescription sphere/cylinder and add power

- Frame type and mounting method

- Required impact compliance

- Coatings and tints

- Environmental exposure and duty cycle

- Comfort targets (weight/thickness)

- Regulatory scope (USA/Europe) and internal EHS alignment

Comparison of common executive bifocal lens materials

| Material | Refractive Index | Abbe | Density (g/cm³) | Impact Resistance | UV | Recommended Add Powers | Tint Compatibility | Typical Edge Thickness Profile | Scratch Resistance | Cost Tier | Common Use Cases |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CR‑39 (plastic) | 1.50 | 58 | 1.32 | Moderate | Good | Low to moderate | Generally straightforward | Thicker at edges for higher powers | Good (not glass) | Low | Full-rim office use; cost-sensitive programs |

| Trivex | 1.53 | 45–46 | 1.11 | High | Good | Low to strong | Vendor dependent | Similar or thinner vs. CR‑39; excellent cosmesis | Improved with hardcoat | Mid | Rimless/semi-rimless; industrial/outdoor; comfort-first |

| Polycarbonate | 1.59 | 30–31 | 1.20 | High | Very good | Low to moderate | Vendor dependent | Thin; lightweight; good cosmetics | Requires hardcoat | Low–Mid | Safety programs; cost-sensitive protective eyewear |

| Mid-index 1.60 | 1.60 | 41 | 1.34 | Moderate | Good | Moderate | Vendor dependent | Thinner than 1.50; balanced profile | Good with AR stack | Mid | Medium-strong prescriptions in full-rim frames |

| High-index 1.67 | 1.67 | 32 | 1.35–1.36 | Moderate | Good | Strong (minus emphasis) | Limited/varies | Thinner edges; premium cosmetics | Good with AR stack | High | High minus prescriptions; executive cosmesis |

| High-index 1.74 | 1.74 | 33 | 1.47 | Moderate | Good | Very strong (minus emphasis) | Limited/varies | Thinnest option; best cosmetics | Good with AR stack | Highest | Highest-power prescriptions; maximum thinning |

| Glass ( Flint/ Crown) | 1.52–1.90 | 59+ | 2.53–5.18 | Low | Varies by type | Specialty | Generally good | Heavier; thick edges vs. plastics | Excellent surface hardness | Variable | Specialty applications; high scratch resistance |

In-depth Look: Manufacturing Processes and Quality Assurance for executive bifocal lens

In‑depth Look: Manufacturing Processes and Quality Assurance for Executive Bifocal Lenses

Manufacturing steps and controls

- Prep

- Material: CR39 plastic as referenced; confirm availability of alternatives if needed (e.g., Trivex, 1.67/1.74; note polycarbonate typically not recommended for executive-style thickness).

- Blank selection: diameter based on frame geometry and inset/eyewire thickness; thickness for add power and edge-work margin.

- Design confirmation: lens type (distance/reading or intermediate/reading for computer use), add power, segment geometry (rectangular with top straight edge and curved bottom), near-zone height, inset/offset, frame PD, lens tilt allowance.

-

Pre‑verification: cross-check PD and segment data; confirm coatings and edge finish from the product spec; define lot traceability for traceability and coating batch tracking.

-

Forming

- Front surface generation: CNC surfacing on CR39 with target front curves matched to prescription; calibrate tooling, verify diamond grinding wear, and implement tool-wear checks.

- Prescription surfacing: back-surface machining to nominal lens thickness and sphere/cylinder; maintain base-curve continuity where applicable.

- Executive segment creation: shape the large rectangular near segment (full-height or defined height variant) with straight top and curved bottom; verify segment offset and edge alignment vs. frame; run “no-line” cosmetic appearance check to confirm blend quality.

- Finishing: edge-blocking, edging to frame pattern (groove/wire or full bevel), polishing, hole/slot prep where indicated, lens marking removal.

-

Coatings (as specified):

- Scratch resistant (inclusion in base spec)

- Anti-reflective (optional)

- Super anti-reflective (optional)

- Apply as per process sheet, including clean room environment, film stack confirmation, and adhesion tests.

-

Assembly

- Blocking and edging: align lens to frame; check power and segment orientation; apply edge bevel and finish per frame type.

- Quality controls embedded: in‑process checks for power, segment geometry, and coating integrity before boxing.

- Packaging: protective film as applicable, labeled specs, and batch/traceability data.

Quality assurance framework

- Key parameters to verify

- Segment geometry: near-zone height; width; top straightness; bottom curvature; inset.

- Power and add:

- Distance power (sphere/cylinder) to meet the applicable tolerances (consult ANSI Z80.1 for USA; for EU, see ISO 14889 and ISO 8980‑4 for uncut finished multifocal lenses).

- Add power variation limits aligned with the applicable specification for executive-style bifocals.

- Prismatic effects and center thickness: verify by method (e.g., lensmeter/vertometer), with values within specification for the prescription.

- Surface quality: scratch and dig classification within acceptable limits; cosmetic appearance of executive “no-line” transition.

- Coating performance: adhesion, reflectance (AR), and cleanability; specular gloss for polished edges where relevant.

-

Dimensional fit: frame PD accuracy, lens-to-groove bevel match, and edge finishing quality.

-

Applicable standards (overview)

- USA: ANSI Z80.1 (Prescription Ophthalmic Lenses—Recommendations).

- Europe (ISO):

- ISO 14889 (Spectacle lenses—Minimum requirements for uncut finished lenses).

- ISO 8980‑4 (Uncut finished lenses—Specifications; tolerances; reference testing; includes multifocal requirements relevant to executive bifocals).

- ISO 21910 (Ophthalmic optics—Specifications for the prescription and verification of multifocal spectacle lenses; also suitable for “no-line” executive-type designs).

- ISO 13666 (Ophthalmic optics—Spectacle lenses—Vocabulary; terminology reference).

- ISO 18526‑1/2 (Spectacle wearers—Body dimensions and head‑eye alignment; reference for fit).

- USA: 21 CFR 801.410 (Impact resistance; US supply).

- UK/MR: UKCA/2020 UK Regulations for PPE (spectacles), as applicable in the UK.

-

EU PPE: Regulation (EU) 2016/425 (PPE for “prescribed” and “non‑prescribed” safety eyewear; applicable to safety-grade spectacles).

Illustrative Image (Source: Google Search)

-

Inspection schedule

- 100% visual and dimensional checks at assembly.

- Statistical sampling for power and add verification (frequency aligned with lot size and process capability).

- First-piece and batch release validations for each material/coating combination.

-

Retest after tooling changes, machine relocation, and coating parameter updates.

-

Acceptance criteria

- Meet the relevant tolerances for power, add, and prismatic effects from the applicable specification.

- Segment geometry and inset within the specified tolerances; finish quality acceptable to QA.

- Coating adhesion and performance pass; package integrity and labeling compliant.

- Lot traceability documented; nonconformance management in place.

This flow supports repeatability for US and EU markets while ensuring the functional “seamless” executive near zone and power stability across both computer-focused (intermediate/reading) and traditional (distance/reading) executive bifocal lens variants.

Illustrative Image (Source: Google Search)

Practical Sourcing Guide: A Step-by-Step Checklist for ‘executive bifocal lens’

Practical Sourcing Guide: A Step-by-Step Checklist for Executive Bifocal Lens (CR39, USA/EU)

Below is a practical, B2B-ready checklist for sourcing CR39 executive bifocals. Use it to define requirements, qualify suppliers, confirm quality, and finalize order and logistics.

1) Define the requirement and build the spec sheet

Capture at least the items below before any sampling.

- Use case:

- Distance and Reading (D+R)

- Intermediate and Reading (for computer use)

- Lens material: CR39 (index ≈ 1.50; Abbe ≈ 58–59; density ≈ 1.32 g/cm³; UV cut ≈ 350–380 nm)

- Segment type: Executive/“no-line” top of the segment spans full width; confirm bottom segment height; typical height ≥ 28 mm

- Add power range: commonly +1.00 to +3.50 D in 0.25 D steps

- Diameter: 65/70/75 mm (confirm per frame size and lens blank availability)

- Center thickness (CT): set minimum for safety; typical 1.2–1.5 mm at minimum (thicker for higher adds)

- Edge thickness (ET): calculate to meet frame fit; avoid excessive ET for aesthetics

- Coatings:

- Scratch-resistant (hardcoat)

- Anti-reflective (AR) or Super AR (multi-layer AR, water-/oil-repellent top coat)

- Tints/photochromic: define if needed (e.g., photochromic gray/brown; ensure color uniformity)

- Optics quality: aspheric/atoric as needed for thickness and comfort

Specification template (editable; copy into your RFQ)

| Parameter | Options | Required value | Notes |

|—|—|—|—|

| Use case | D+R / I+R | D+R | For computer use, select I+R |

| Material | CR39 (1.50) | Yes | For thickness/safety, confirm CT |

| Segment type | Executive/no-line | Yes | Confirm bottom segment height |

| Add power | +1.00 to +3.50 | __ D | 0.25 D increments |

| Diameter | 65/70/75 mm | __ mm | Match blank availability |

| Center thickness (min) | __ mm | __ mm | Safety/sag-dependent |

| Edge thickness target | __ mm | __ mm | Aesthetic/frame fit |

| Coating | SR only / AR / Super AR | SR+AR | Use hardcoat first for AR adhesion |

| Tint/photochromic | Gray/Brown/Clear | Clear | Color uniformity target |

| Surface quality | Scratch/dig limits | AQL 1.0–2.5 | Define pass/fail criteria |

2) Choose suppliers and qualify labs

- Supplier types:

- Lens manufacturers with in-house AR/hardcoat

- Independent finishing labs for Rx surfacing and coatings

- Qualification checks:

- Production capacity: blanks (65/70/75), finishing throughput, lead times

- Coatings stack: AR band structure, hydrophobic top coat, smear resistance

- Finishing capability: executive segment surfacing, CT/ET accuracy, Rx tolerance

- QC: in-process checks, final inspection, AQL plan availability

- Certifications: ISO 9001; lab safety and handling practices

Supplier capability grid (rate pass/fail for core items)

| Capability item | Supplier A | Supplier B | Supplier C |

|—|—|—|—|

| CR39 blanks 65/70/75 mm | | | |

| Executive segment finishing | | | |

| Hardcoat + AR/SAR | | | |

| Aspheric/atoric surfacing | | | |

| QC + AQL reporting | | | |

| ISO 9001 (lab) | | | |

Illustrative Image (Source: Google Search)

3) Request quotes and confirm minimums

- Quote inputs:

- Rx per SKU: sphere/cylinder/add; prism if required

- Volume and batch sizes; minimum order quantity (MOQ)

- Coating stack choice; color/photochromic options

- Lead time and rush fees

- Ask for:

- Unit price and lot pricing tiers

- Fixture/fining charges per SKU

- AR/SAR price uplift vs SR-only

- Tinting/photochromic surcharges

- Rework/reorder policy

Quote comparison table (fill during procurement)

| SKU | Supplier | Unit price (SR) | AR uplift | SAR uplift | MOQ | Lead time | Notes |

|—|—|—|—|—|—|—|—|

| D+R +2.00, AR | A | | | | | | |

| I+R +2.00, SAR | B | | | | | | |

4) Sampling and pilot production

- Place sampling orders covering:

- Both use cases (D+R; I+R)

- Representative add powers (low, mid, high)

- All coatings (SR, AR, SAR)

- Representative frames/diameter

- Perform acceptance testing:

- Rx tolerance (sphere/cylinder/add) per internal tolerance; confirm no prism imbalance

- Segment geometry: bottom height, line quality, symmetry

- CT/ET measurements at datum points

- Coating: adhesion, AR performance (reflectance band), hydrophobicity, water-/oil-beading

- Cosmetics: scratches/digs, coating inclusions; check at AQL 1.0–2.5

- Tint/photochromic: activation and uniformity

- Fix quality gates before scale-up

Pilot test checklist (pass/fail)

| Test | Sample A (D+R) | Sample B (I+R) | Criteria | Notes |

|—|—|—|—|—|

| Rx tolerance | | | ≤ internal Rx tolerance | |

| Segment height/finish | | | Meets spec, consistent | |

| CT/ET | | | Within target range | |

| Coating adhesion | | | No delamination | |

| AR reflectance | | | Meets band spec | |

| Hydrophobicity | | | Contact angle ≥ target | |

| Scratch/dig limits | | | AQL pass | |

| Tint/photochromic | | | Uniform activation | |

5) Quality planning and inspection

Define incoming QC and continuous controls.

Inspection plan (AQL)

| Characteristic | Method | AQL | Sampling plan |

|—|—|—|—|

| Rx verification | Lensmeter/autorefractor | 1.5 | II, single sampling |

| Segment geometry | Calipers/visual | 1.0 | II, single |

| CT/ET | Digital caliper | 2.5 | II, single |

| Coating adhesion | Tape/pencil test | 1.0 | II, single |

| AR band | Reflectometer | 1.5 | II, single |

| Hydrophobicity | Water/angle gauge | 1.5 | II, single |

| Scratch/dig | Visual under light | 1.0–2.5 | II, single |

Illustrative Image (Source: Google Search)

6) Documentation and labeling

- Certificates of Conformity (CoC) for lenses and coatings

- Material data: CR39 index, Abbe, density

- Cleaning/warranty guidance for AR/SAR

- Packaging: individual lens pouches; SKU labeling; batch traceability

- Compliance: request FDA/CE declarations relevant to lab services; verify regional requirements

7) Order and logistics

- Order details: SKU-specific Rx, coating, tint, diameter

- Lead times: standard and rush; buffer for coating queue time

- Packaging: anti-scratch pouches, foam inserts; moisture control

- Shipping: ship frames separately or in same carton with dividers to avoid damage

- Returns: define rework criteria; sample retain for comparison

8) Supplier performance and risk control

- KPIs: on-time delivery, AQL failures, rework rate, lead time variance

- Risk mitigations:

- Dual sourcing for AR/SAR if possible

- Blank inventory visibility; minimum safety stock

- AR line downtime contingency

Supplier scorecard template

| Metric | Target | Supplier A | Supplier B | Supplier C |

|—|—|—|—|—|

| On-time delivery (%) | ≥ 98 | | | |

| AQL failures (PPM) | ≤ 500 | | | |

| Rework rate (%) | ≤ 2 | | | |

| Lead time variance (days) | ≤ 2 | | | |

9) Productization and sales enablement

- Naming: “Executive Bifocals, CR39 Plastic”

- Listing content (reference option set from UseMyFrame):

- How will you use these lenses? Distance and Reading / Intermediate and Reading (Computer)

- Frame: Send in my frame / Will buy a frame from UseMyFrame.com

- Coating: Scratch Resistant (Included) / Anti Reflective / Super Anti Reflective

- Key value statements:

- Dual-focus clarity with executive-style segmentation

- Seamless transition between distance/near or intermediate/near

- CR39 optics; AR/SAR options for reflections and durability

- SKU matrix and packaging copy for web and PDFs

SKU matrix example (for product pages)

| Use case | Frame option | Coating option | SKU name |

|—|—|—|—|

| Distance + Reading | Send in my frame | Scratch Resistant (Included) | Exec Bifocal CR39 D+R SR |

| Distance + Reading | Send in my frame | Anti Reflective | Exec Bifocal CR39 D+R AR |

| Distance + Reading | Send in my frame | Super Anti Reflective | Exec Bifocal CR39 D+R SAR |

| Distance + Reading | Buy a frame from UseMyFrame.com | Anti Reflective | Exec Bifocal CR39 D+R AR (Full Kit) |

| Intermediate + Reading (Computer) | Send in my frame | Super Anti Reflective | Exec Bifocal CR39 I+R SAR |

| Intermediate + Reading (Computer) | Buy a frame from UseMyFrame.com | Anti Reflective | Exec Bifocal CR39 I+R AR (Full Kit) |

Quick reference: typical executive bifocal specifications

- Material: CR39 (1.50); Abbe ≈ 58–59; density ≈ 1.32 g/cm³

- Segment style: executive/no-line; full-width top; confirm bottom segment height (commonly ≥ 28 mm)

- Add powers: +1.00 to +3.50 D in 0.25 D steps

- Diameter options: 65/70/75 mm

- Coatings: hardcoat (scratch-resistant) base; AR or multi-layer Super AR with hydrophobic top coat

- Use cases: Distance + Reading; Intermediate + Reading for computer use

This checklist is ready to convert into your RFQ, pilot plan, and inspection protocol.

Comprehensive Cost and Pricing Analysis for executive bifocal lens Sourcing

Comprehensive Cost and Pricing Analysis for Executive Bifocal Lens Sourcing

Purpose: help procurement and operations teams establish benchmark costs and optimize pricing for executive bifocal lenses in the USA and Europe. All figures are indicative ranges; validate with supplier quotes.

Illustrative Image (Source: Google Search)

Pricing Benchmarks

To illustrate market anchors, the following direct-to-consumer (DTC) price points are available for a branded offering of executive bifocals in CR39 plastic (UseMyFrame). These values are useful as “value caps” to ensure your wholesale or private‑label offer is competitively positioned.

| Product (UseMyFrame) | Use Case | Frame Option | Coating Tier | Current DTC Price |

|---|---|---|---|---|

| Executive Bifocals, CR39 Plastic | Distance and Reading | Send in my frame | Scratch Resistant (Included) | $119.00 |

| Executive Bifocals, CR39 Plastic | Distance and Reading | Send in my frame | Anti Reflective | $119.00 |

| Executive Bifocals, CR39 Plastic | Distance and Reading | Send in my frame | Super Anti Reflective | $119.00 |

| Executive Bifocals, CR39 Plastic | Distance and Reading | Will buy a frame from UseMyFrame.com | Scratch Resistant (Included) | $119.00 |

| Executive Bifocals, CR39 Plastic | Distance and Reading | Will buy a frame from UseMyFrame.com | Anti Reflective | $119.00 |

| Executive Bifocals, CR39 Plastic | Distance and Reading | Will buy a frame from UseMyFrame.com | Super Anti Reflective | $119.00 |

| Executive Bifocals, CR39 Plastic | Intermediate and Reading (Computer) | Send in my frame | Scratch Resistant (Included) | $119.00 |

| Executive Bifocals, CR39 Plastic | Intermediate and Reading (Computer) | Send in my frame | Anti Reflective | $119.00 |

| Executive Bifocals, CR39 Plastic | Intermediate and Reading (Computer) | Send in my frame | Super Anti Reflective | $119.00 |

| Executive Bifocals, CR39 Plastic | Intermediate and Reading (Computer) | Will buy a frame from UseMyFrame.com | Scratch Resistant (Included) | $119.00 |

| Executive Bifocals, CR39 Plastic | Intermediate and Reading and Reading | Will buy a frame from UseMyFrame.com | Anti Reflective | $119.00 |

| Executive Bifocals, CR39 Plastic | Intermediate and Reading | Will buy a frame from UseMyFrame.com | Super Anti Reflective | $119.00 |

Note: UseMyFrame also displays a “Regular price” of $229.00 on sale at $119.00; the higher price references standard (non-executive) bifocals. Executive bifocals show a single sale price of $119.00.

Total Landed Cost (TLC) Structure

Use the TLC model to structure supplier quotes and your pricing strategy:

| Cost Component | What It Includes | Typical Range / Notes |

|---|---|---|

| Materials | Uncut executive bifocal blanks (CR39/PC/Trivex), add‑ons (tints, transitions), optional high‑index (1.60, 1.67) | Pricing is quote‑based and sensitive to base curve and brand; high‑index significantly increases cost. |

| Coatings | Scratch‑resistant hard coat, anti‑reflective (AR), premium AR (hydrophobic, oleophobic, easy‑clean), blue‑light filters | Tiered price uplift; premium AR and blue‑light are common adds. |

| Labor | Surfacing, edging, beveling, drilling (if needed), insert into frame, QC, packaging | Quote‑based; varies by region, tooling, and volume. |

| Logistics | Domestic pickup/line‑haul, customs clearance, duties/taxes, last‑mile | DDP (Delivered Duty Paid) vs. EXW; USA/EU duties differ by HS code. |

| Other | Return allowance, warranty claims, quality defect provisions | Reserve typically 0.5–2.0% of COGS depending on policy and historical rates. |

Material Cost Drivers

| Driver | Impact on Cost | Practical Insight |

|---|---|---|

| Material | High‑index 1.60/1.67 > Trivex > Polycarbonate > CR39 | For executive bifocals, CR39 is cost‑efficient and fits most prescriptions; consider Trivex for enhanced impact resistance. |

| Executive Blank Design | Blank engineering for full‑field bifocal configuration | Premium blanks may have higher unit cost but enable the “no-line” executive experience that supports pricing power. |

| Add‑Ons | Tinting, photochromic, blue‑light | Add one to two tiers of price uplift per add‑on; photochromic and premium AR are common “premium” moves. |

| Coating Tier | SR (baseline), AR, Super AR | AR is often 1.5–3.0x SR price; Super AR adds further premium. Exact multiples require supplier quotes. |

Labor and Process Cost Drivers

| Process Step | Cost Driver | Volume Sensitivity | Notes |

|---|---|---|---|

| Blank Surfacing | Prescription complexity, QC time | Gains at ≥1,000 pairs | Complexity (spherical/cylinder/ADD) and tolerances affect time. |

| Edge & Bevel | Edge shape, bevel profile | Minimal economies at low volume | Ensure tooling for preferred bevel profile. |

| Drilled Frames | Hole count, location | Low economies at low volume | Use standard drilling templates to avoid premium setup time. |

| AR Deposition | Batch vs. single‑lens | Scales with batch size | Batch ovens reduce per‑lens cost at mid/high volumes. |

| Assembly & QA | Final inspection, packaging | Improves with SOPs | SOPs reduce rework and returns. |

Logistics and Trade Terms

| Aspect | USA | Europe | Notes |

|---|---|---|---|

| Shipping Mode | Air or ocean; domestic ground for distribution | Air or ocean; intra‑EU road freight | Speed vs. cost trade‑offs; air preferred for rush batches. |

| Incoterms | EXW, FOB, DDP commonly used | EXW, FOB, DDP, CPT, DAP | Prefer DDP for predictability; ensure HS codes align with duties/taxes. |

| Duties/Taxes | Duty varies by HS code; import VAT not typical | VAT on imports; duty varies by HS code | Validate HS codes early to avoid rework. |

| Customs Broker | Optional (simplified entries) | Often required in some countries | Broker fees predictable; avoid cost surprises. |

| Returns/Warranty | Reserve for defects/remakes | Same | Build a policy that preserves margin while encouraging repeat orders. |

Cost to Price Guidance (Wholesale & DTC)

- Wholesale pricing: Anchor to DTC benchmarks plus your channel margin expectations. For example, if a top‑line DTC brand sells at $119, your private‑label wholesale offer should be set below that while ensuring full TLC coverage and a target gross margin.

- Volume brackets: Negotiate scale breaks in 500/1,000/5,000 pair increments. Executive blanks, coating batch sizes, and tooling amortizations favor ≥1,000 pairs.

- Tiered coatings: Create a cost ladder—SR (entry), AR (mid), Super AR (premium)—and ensure additive impact on COGS is captured in your wholesale/DTC price ladders.

Practical Tips to Save Cost

- Material selection: Use CR39 unless prescription or safety requirements demand Trivex/PC or high‑index; CR39 offers the best executive lens cost profile.

- Coating rationalization: Standardize two coating tiers (AR and Super AR). Fewer SKUs simplify production planning and reduce scrap.

- Batch and tooling: Consolidate prescriptions into weekly batches to benefit from batch AR coating and reduce rework. Maintain standardized bevel and frame templates to minimize one‑off setup costs.

- Incoterms discipline: Use DDP when feasible to neutralize customs surprises and build accurate landed cost. Confirm HS codes early with your broker.

- Quality controls: Tight tolerances and clear QC criteria reduce returns/remakes. Build a low‑defect SOP and measure it.

- Returns and warranty: Cap at 0.5–2.0% of COGS in cost models; align with supplier warranties for quality defects to share risk.

- Logistics planning: Ship domestic with domestic ground once in‑country; for EU, consolidate shipments into EU hub to reduce friction. Avoid spot premiums unless margin‑accretive.

- Data‑driven mix: Track coating tier mix, return rates by material/coating, and rework by step; iterate your tiered pricing and SKU mix quarterly.

Next Actions

- Request supplier quotes using the TLC structure (materials, coatings, labor, logistics, warranty reserve), with volume brackets (500, 1,000, 5,000).

- Confirm HS codes and applicable duties/VAT for USA and EU shipments before finalizing Incoterms.

- Pilot with one prescription set and two coating tiers to benchmark yield, rework, and return rates before full rollout.

This framework will enable precise cost modeling and informed pricing decisions for executive bifocal lenses across USA and Europe.

Illustrative Image (Source: Google Search)

Alternatives Analysis: Comparing executive bifocal lens With Other Solutions

Alternatives Analysis: Comparing Executive Bifocal Lens With Other Solutions

Executive bifocals remain a reliable option for professionals requiring seamless distance and near vision correction. However, organizations should evaluate alternatives to ensure optimal user satisfaction and productivity.

Comparison Matrix

| Factor | Executive Bifocal | Progressive Lens | Single Vision Solutions |

|---|---|---|---|

| Visual Zones | Two distinct zones (distance/near) | Continuous multi-zone (distance/intermediate/near) | Separate lenses for each task |

| Adaptation Period | Minimal (immediate adaptation) | Moderate (2-4 weeks typical) | Minimal |

| Professional Appearance | Visible line segment | No visible lines | Multiple pairs visible |

| Intermediate Vision | Limited without separate pair | Excellent (built-in intermediate zone) | Requires third pair |

| Cost Structure | Mid-range single purchase | Higher initial investment | Multiple purchases over time |

| Productivity Impact | Instant switching between zones | Smooth zone transitions | Requires lens changes |

| User Flexibility | Limited customization | High customization potential | Full task-specific optimization |

| Maintenance | Single lens care | Single lens care | Multiple lens care |

Analysis

Executive Bifocals excel in immediate usability and professional presentation. The visible line segment maintains a professional appearance while providing instant adaptation—a critical factor for user acceptance in business environments where changing habits carries resistance costs.

Progressive Lenses offer superior functionality with continuous intermediate vision zones, eliminating the adaptation curve common in executive bifocal adoption. However, the adaptation period creates temporary productivity disruption and requires comprehensive user training.

Single Vision Solutions provide optimal task-specific performance but increase logistics complexity and total cost of ownership through multiple lens purchases and user workflow interruptions.

Illustrative Image (Source: Google Search)

Recommendation Framework

Select Executive Bifocals when:

– User change management is a primary concern

– Professional image consistency is paramount

– Total cost predictability is preferred

– Near-dominant workflows require immediate clarity

For organizations prioritizing functional completeness over adaptation simplicity, progressive lenses provide superior optical performance despite onboarding challenges.

Decision Point: The choice ultimately depends on your organization’s change tolerance versus functional optimization priorities. Executive bifocals minimize disruption while progressive lenses maximize long-term utility.

Essential Technical Properties and Trade Terminology for executive bifocal lens

Essential Technical Properties and Trade Terminology for Executive Bifocal Lens

Use this section to align engineering specifications, trade norms, and procurement language when sourcing executive bifocal lenses for the USA and Europe.

Illustrative Image (Source: Google Search)

Key technical properties (sourcing checklist)

– Design: Executive (D-segment) top near, full-width reading window; variants include “distance/reading” and “intermediate/reading (computer).”

– Add power: Commonly +1.00 to +3.00 D; confirm exact add based on prescription and patient use.

– Materials: CR‑39, 1.60, 1.67, Trivex (polycarbonate on request if supplier offers).

– Base curves: Typical range 4.00–6.00 D; selection aligns with prescription and frame fit.

– Prism/segment options: Flat-top 35 and Executive designs; minimum thickness and segment geometry confirmable at order.

– Coatings: Hardcoat (scratch-resistant) included; AR options from “Anti Reflective” to “Super Anti Reflective” (as listed).

– Tolerances: FR/IOP/PC compliant; Rx and cylinder power tolerances per regional norms; confirm center thickness, A/B, ED/DBL on job ticket.

– Logistics: Ships from supplier; shipping cost calculated at checkout; backorders occur (listing shows “Sold out” for current listing).

– Trade terms: MOQ, sample/prototyping, private label, private mold, custom coatings, drop-ship, cross-docking, and QA.

Table 1. Lens material options and typical characteristics

– Use index to guide weight, center thickness, and impact-resistance.

| Material (index) | Typical characteristics (confirm per supplier) | Notes for procurement |

|---|---|---|

| CR‑39 (1.499) | Lightweight; mid Abbe; good optical quality; standard for many plano-to-low prescriptions. | Baseline reference material; compatible with most coatings. |

| 1.60 | Thinner than CR‑39; improved impact resistance; mid Abbe. | Choose for higher power prescriptions to reduce edge thickness. |

| 1.67 | Significantly thinner than 1.60; improved cosmetics for high prescriptions. | Confirm availability for executive design; higher coating/AR performance is typical. |

| 1.74 | Thinnest option among listed indexes; best aesthetics for high power. | Validate executive segment window availability and coating stability. |

| Trivex (1.53) | Impact resistant; lightweight; good Abbe; natural UV blocking. | Consider for safety- or use-demanding environments; verify index labeling. |

Table 2. Design variants and intended use (confirm at order)

– The product page confirms distance/reading and intermediate/reading options.

| Variant | Intended use | Reading segment style | Notes |

|---|---|---|---|

| Distance/Reading (D-segment) | General vision and near tasks | Executive “full-width” top segment | Common for boardroom/laptop workflows. |

| Intermediate/Reading (Computer) | Near/computer work | Executive-style intermediate focus near | Suitable for prolonged screen and document use. |

Table 3. Trade terminology for B2B lens procurement

Illustrative Image (Source: Google Search)

| Term | Definition | Typical use case |

|---|---|---|

| MOQ (Minimum Order Quantity) | Minimum lenses per SKU/material/coating to place an order. | New SKU launch; negotiate MOQ per index/coating combination. |

| Sample/Prototype (Sample MOQ) | Small-batch lenses for fit/AR/color validation before full PO. | Testing new AR stack on 1.67 executive segment; 5–10 pieces typical. |

| OEM/ODM | Manufacturing by the brand or partner; design and build to spec. | Developing a private label executive segment with specific base curve. |

| Private Label | Your brand packaged on supplier packaging; supplier may or may not be manufacturer. | US/EU distribution with branded packaging. |

| Private Mold (Proprietary Mold) | Dedicated tooling and lens geometry you control. | Custom fit, unique executive segment beveling/geometry. |

| Custom Coatings | Bespoke AR stacks, colors (warm/cool tint), hardcoat enhancements. | High-end “Super AR” requirement with anti-static/anti-fog. |

| Drop-Ship | Supplier ships directly to your customer. | Distributor orders shipped to retail accounts. |

| Cross-Dock | Product transfers at dock and ships onward; no long-term storage. | Short lead-time replenishment to regional DCs. |

| Private SKU | Non-public stock-keeping code managed internally. | Large account buys using internal IDs. |

| Lead Time | Time from order acceptance to ready-to-ship status. | Standard runs: 5–7 business days; custom coatings: 7–10 business days (confirm). |

| Rush Fee | Premium for accelerated turnaround. | Urgent backorders; confirm feasibility with supplier. |

| Chargeback | Charge for nonconformance or shipping error. | Used to enforce Rx tolerances and damage-in-transit claims. |

| Rebate/Incentive | Volume-based discounts or promotional allowances. | Quarterly incentives tied to total executive lens volume. |

| Packaging/Labeling (SKU/Barcode) | SKU numbers, barcodes, batch/lot, AR code, safety labels. | US/EU compliance packaging; retail-ready lens packaging. |

| FR/IOP/PC Compliance | FDA (US), ISO/CE (EU) optical standards; flammability where applicable. | Required for compliant ophthalmic lenses across regions. |

Table 4. Manufacturing and QC parameters (request on order ticket)

| Parameter | Typical range (to confirm with supplier) | Notes |

|---|---|---|

| Base curve(s) | 4.00–6.00 D (select to match prescription) | Final curves per material; confirm matching pair. |

| Add power | +1.00 to +3.00 D (commonly requested) | Exact add set by Rx; executive segment geometry optimized per add. |

| Segment style | Flat‑top 35; Executive (full-width near) | Align with intended use variant. |

| Center thickness | Material- and prescription-dependent | Confirm after optometry Rx; affects edge thickness. |

| Edge thickness | Prescription- and frame-dependent | Validate for thin/cosmetic frame selections. |

| Abbe (dispersion) | Material-specific | Lower Abbe may increase chromatic aberration; match by index. |

| Prism | Optional; confirm per Rx | Required when binocular vision compensation is prescribed. |

| Tinting | Available per supplier program | Noted as product variants support selection. |

Table 5. Coating options (availability per supplier variant)

| Coating | Status (per listing) | Notes |

|---|---|---|

| Scratch Resistant (hardcoat) | Included (baseline) | Enhances surface durability; consider upgraded hardcoat for frequent use. |

| Anti Reflective (AR) | Available as option | Improves transmission; typically mid-tier performance. |

| Super Anti Reflective (Super AR) | Available as option | Higher performance AR with improved reflectance reduction; recommended for boardroom/office glare. |

Table 6. Compliance and regional notes (to confirm)

| Region | Compliance reference | Procurement note |

|---|---|---|

| USA | FDA (FR/IOP/PC); AS/NZS backstop where applicable; ANSI Z80.x for ophthalmic products where applicable. | Verify labeling, batch/lot traceability, and documentation. |

| EU | ISO standards; CE marking; RoHS/REACH as applicable. | Confirm CE mark presence and packaging compliance; maintain technical file. |

Table 7. Logistics and ordering (per listing)

| Item | Note |

|---|---|

| Availability | Some variants may be “Sold out”; shown as backorders on this listing. |

| Shipping | Costs calculated at checkout; confirm delivery time and method. |

| Frame options | Choose lens only (“Send in my frame”) or with a supplier frame. |

| Pricing | Standard and promotional pricing reflect listing; confirm per SKU/material/coating. |

Notes on sourcing for USA and Europe

– Specify the exact variant (distance/reading vs intermediate/reading), add power, and coating stack on the PO to avoid substitution.

– Lock tolerances, center thickness, and packaging in the job ticket; verify FR/IOP/PC or ISO/CE references.

– Confirm cross-dock/drop-ship readiness if distributing through multiple DCs or retailers.

– For high-prescription aesthetics, request samples across 1.60, 1.67, and 1.74 to evaluate edge thickness and AR performance prior to MOQ.

Navigating Market Dynamics and Sourcing Trends in the executive bifocal lens Sector

Key points at a glance

- Demand is driven by aging professional cohorts and hybrid work (near/intermediate use remains strong).

- Executive bifocals win where wide near zones and clear line-of-demarcation are needed (reading-first users, desk-based tasks).

- Digital surfacing and AR/anti-reflective coating tiers enable premium differentiation and fewer returns.

- CR39 remains a staple for value and compatibility; high-index and Trivex serve rimless/weight-sensitive segments.

- Sustainability focus (material, energy, coatings, packaging) supports US/EU compliance and procurement goals.

- Compliance and regional QA (US Z80.1; EU EN ISO 14889) shape labeling, testing, and traceability.

Navigating Market Dynamics and Sourcing Trends in the Executive Bifocal Lens Sector

Market definition and fit

Executive bifocals are full-width, line-segmented lenses that combine distance (D) and near (N) or intermediate (I) and near in a single lens via a rectangular, top-to-bottom segmentation. This design maximizes the near/intermediate zone for desk-first wearers and eliminates the “bifocal window” typical of fused (round) designs. It is preferred by:

– Reading-intensive professionals (legal, finance, audit, lab work).

– Professionals requesting clear, consistent intermediate zones (D+I or I+N).

– Patients with specific prismatic requirements, anisometropia, and large near-work zones where a small add segment would be impractical.

Demand drivers

- Demographic shift: rising presbyopia in professional cohorts; aging workforce (US/EU).

- Hybrid work: persistent desk-based and screen-adjacent tasks sustain demand for I/N and D+N options.

- Value-based procurement: buyers seek predictable add segments, robust coatings, and minimal wait times.

- Compliance and QA: labs with ISO certification and robust QC reduce returns and streamline US/EU procurement.

Sourcing trends

- Digital surfacing becomes the default: better segment thickness control, fewer wedge artifacts, stable add power across the lens.

- Tiered coatings differentiate price/value:

- Scratch Resistant (SR): included, durable hardcoat for CR39.

- Anti Reflective (AR): improves clarity; standard for premium tiers.

- Super Anti Reflective (SAR): extended performance (smudge, water, oil resistance; enhanced light transmission).

- Material mix by segment:

- CR39: high-value base, good optical quality; widely stocked; straightforward manufacturing.

- High-index (1.67/1.74): thinner and lighter; favored for rimless and thin-profile applications; higher price.

- Trivex: impact resistance and lighter weight; often used for safety/active users.

- Fulfillment model:

- Send-in frame: control lens selection and quality; suitable for mid/long-run volume.

- Buy frame + lens bundles: faster lead times; easier for small and medium buyers.

Regional considerations (US/EU)

- US: ANSI Z80.1 (prescription eyewear) governs refractive power, tolerance, and labeling; US buyers expect AR/SR standard or tiered upgrades.

- EU: EN ISO 14889 and REACH requirements affect material and coating compliance; suppliers with ISO-certified QMS and documented traceability gain preference.

- Price bands:

- Entry: CR39 + SR; mid-tier: CR39 + AR; premium: CR39 + SAR or high-index/AR/SAR bundles.

- Lead times: digital surfacing shortens turnaround; bundling reduces fragmentation in ordering and logistics.

Supply chain and inventory outlook

- High-index stock is variable across suppliers; anticipate longer lead times and higher COGS in 1.67/1.74.

- AR/SAR capacity is robust; demand concentrated around premium executive bifocals and rimless mounts.

- Return drivers: coating defects, segment alignment issues, center thickness variability. Mitigate via:

- Clear measurement protocols for segment power and center thickness.

- Coating tier selection aligned with usage (e.g., SAR for desk environments with frequent handling).

- Frame-in options for complex prescriptions.

Sustainability and ESG considerations

- Material selection:

- CR39 manufacturing is energy-efficient relative to high-index; favorable for ESG targets.

- Trivex offers longevity and impact resistance; consider life-cycle benefits versus cost.

- Coatings and process:

- Solvent-minimizing processes and recyclable packaging reduce environmental footprint.

- AR/SAR tiers with durable oleophobic topcoats extend product life and reduce replacement rates.

- Supplier credentials:

- ISO quality systems, documented batch traceability, and coating compliance (US/EU) support ESG reporting and risk management.

A concise history of executive bifocals

- 1784: Benjamin Franklin invents bifocals by combining distant and near lenses.

- 1908: Multifocal lens technology patents filed.

- 1950s–1960s: Executive-style bifocals (full-width segmentation) gain popularity in North America for desk-first professionals.

- 1990s: Digital surfacing improves segment control and surface quality.

- 2010s: Tiered anti-reflective coatings become standard differentiation.

- 2020s: Hybrid work elevates intermediate segment demand; digital surfacing and coating bundles dominate B2B supply.

Practical sourcing matrix

| Segment | Typical use case | Recommended material | Coating tier | Fit profile (US/EU) |

|---|---|---|---|---|

| Distance + Reading (D+N) | Executive/reading-intensive | CR39 (value), 1.67 (thin), Trivex (lightweight) | SR (entry), AR (standard), SAR (premium) | Broad fit; strong preference for SAR in premium bundles |

| Intermediate + Reading (I+N) | Hybrid work, screen-adjacent | CR39, Trivex, 1.67 (rimless) | SR/AR/SAR | Strong fit; SAR recommended for desk environments |

| High-index, rimless | Rimless-first; thin profile | 1.67/1.74 | AR/SAR | Fit with margin; require lab with robust rimless QA |

| Heavy handling or outdoor use | Mobile professionals | Trivex | SR/AR | Fit due to impact resistance and coating durability |

Compliance overview

| Region | Standard | Key implications |

|---|---|---|

| US | ANSI Z80.1 (spectacle lenses) | Power tolerances, labeling, transmittance standards; influences acceptance criteria |

| EU | EN ISO 14889 (spectacles) | Harmonized safety and performance; documentation and traceability expected |

| Global | ISO 9001 (QMS) | Quality management systems; reduces defect rates and returns; strengthens auditability |

Actionable procurement checklist

- Define segment mix upfront (D+N vs I+N); set thresholds for add powers and sphere/cylinder ranges.

- Standardize on three coating tiers (SR/AR/SAR) to simplify SKU management.

- Specify digital surfacing for critical thickness control and near-zone performance.

- Align with ANSI/EN requirements; require supplier batch traceability and coating compliance documentation.

- Favor send-in frame programs for complex prescriptions; leverage frame+lens bundles for standard needs.

- Negotiate lead times and buffer inventory for high-index orders to avoid delays.

- Track returns by root cause (coating, alignment, thickness) and tighten QA.

Summary

Executive bifocals remain a strong, high-value segment in US/EU markets where desk-first vision needs prevail. The winning playbook blends digital surfacing with tiered coatings and material choices tailored to use case—CR39 for value and performance, high-index and Trivex for thinner, lighter, and safer builds. Aligning procurement to ANSI Z80.1 and EN ISO 14889, while integrating sustainability across material and coating choices, drives dependable quality, reduced returns, and long-term cost efficiency.

Frequently Asked Questions (FAQs) for B2B Buyers of executive bifocal lens

Frequently Asked Questions (FAQs) for B2B Buyers

1) What is an Executive Bifocal and how is it different from traditional flat-top bifocals?

Executive bifocals place the reading segment across the entire lower portion of the lens, creating a wide, continuous near zone. Unlike flat-top bifocals with a segmented “window,” the executive design provides consistent near power from edge to edge, suitable for distance/reading or intermediate/reading (computer) applications.

Illustrative Image (Source: Google Search)

- Key differences vs. flat-top:

- Near zone width: 100% vs. typically ~25–38 mm

- Seam placement: smooth, uniform near segment at the bottom vs. abrupt junction

- Use cases: large desks, dual monitors, or where wide near coverage is preferred

- Visual trade-off: larger near zone may produce more lateral distortion and slightly higher thickness/weight at the lower edge

2) What material options are available and which are recommended?

- CR39 Plastic

- Refractive index: ~1.498

- Abbe value: ~58

- Specific gravity: ~1.32

- Best for: optical quality, lower chromatic aberration, lighter weight in minus powers

- Typical tint compatibility: yes (with appropriate tint processes)

-

Note: May be available depending on supplier stock (regular price reference: USD 119; listed sale price: USD 119; reference regular price before sale: USD 229; availability status: sold out)

-

Polycarbonate

- Refractive index: ~1.586

- Abbe value: ~29

- Best for: impact resistance, safety compliance, lightweight robustness

- Considerations: slightly more chromatic aberration; anti-reflective (AR) coatings are strongly recommended to mitigate visual dispersion

Recommended selection:

– CR39 for visual clarity and minimal aberration

– Polycarbonate for durability and safety (e.g., occupational use, safety frames)

3) Which coatings are recommended and why?

Coating options (as provided by source):

– Scratch Resistant (Included)

– Purpose: extend lens life and resist micro-abrasion

– Anti Reflective

– Purpose: reduce glare, improve comfort in artificial light, enhance readability

– Super Anti Reflective

– Purpose: further reduce glare, improve light transmission, and maintain cleaner lenses with enhanced hydrophobic/oleophobic properties

Illustrative Image (Source: Google Search)

Coating recommendations by use:

– Office/computer: Super Anti Reflective for digital comfort

– Professional/reading: Anti Reflective or Super Anti Reflective

– Industrial/safety: Scratch Resistant plus Anti Reflective (AR helps under overhead lighting)

4) What frame styles work best with Executive Bifocals?

- Full-rim or thick-temple styles for durability and lens protection

- 8-base or moderately curved wraps to control off-axis aberration in the wide near zone

- Minimum lens sizes: approximate rectangle ≥49□18 mm or round ≥52 mm

- Avoid extremely small, round, or highly toric frames that reduce usable near coverage and can increase distortion

- Fit considerations: ensure stable fit, adequate nose bridge support, and vertical lens placement to utilize the full width of the near segment

5) What segment height should I specify?

Typical targets:

– Distance/Reading: lower segment height ~28–35 mm

– Intermediate/Reading (computer): lower segment height ~24–30 mm with intermediate addition