Food Machine Manufacturers Sourcing Guide: 2025 Executive Strategic Briefing

Executive Contents

Executive Market Briefing: Food Machine Manufacturers

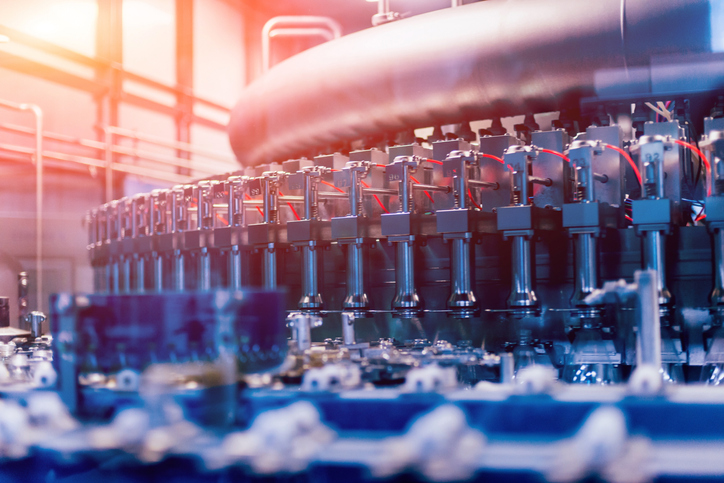

Executive Market Briefing – Food Processing Machinery 2025

BLUF

The global installed base of food processing machinery is being refreshed two to three years earlier than historical cycles because payback periods have compressed to 18–24 months on lines that integrate IIoT sensing, hygienic design and energy-recovery modules. If your current equipment is >6 yrs old, the cost of not upgrading in 2025 is a 5–7 % EBIT drag versus peers who are already locking in 4 % yield gains and 30 % energy rebates. Asia-Pacific will absorb 45 % of new units, yet 62 % of critical components still originate from three clusters: Jiangsu-Zhejiang (CN), Baden-Württemberg (DE) and the Great Lakes region (US). Securing allocation now is essential; lead-times for stainless-steel servo-driven lines have doubled to 9–11 months since Q4-23.

Market Scale & Trajectory

The food processing equipment market exited 2023 at USD 52.7 B and is on a 4.0 % CAGR glide path to USD 69.3 B by 2030. Machinery that carries certified hygienic design and digital twin capability is expanding at 6.1 % CAGR, adding USD 21.7 B of incremental value between 2024-2029. Protein processing and bakery lines are the fastest sub-segments, each growing one point above the segment mean because of SKU proliferation and “clean-label” reformulations that demand tighter temperature-humidity windows.

Supply-Hub Comparison – 2025 Snapshot

| Metric | China (Jiangsu-Zhejiang) | Germany (Baden-Württemberg) | USA (Great Lakes) |

|---|---|---|---|

| Share of global export value | 34 % | 22 % | 18 % |

| Average lead-time (weeks) | 22–26 | 18–20 | 14–16 |

| Price index for mid-capacity line (base 100 = US) | 72 | 108 | 100 |

| Engineering change flexibility | Medium | High | High |

| Energy-efficiency compliance | GB std (local) | CE / ISO 50001 | UL / DOE |

| Tariff exposure into US | 25 % Section 301 | 0 % (Section 232 steel surcharge only) | 0 % |

| Key bottleneck component | Servo motors & gearboxes | Stainless-steel castings | PLC safety modules |

Strategic Value of 2025 Refresh

EBIT expansion is already visible in early-adopter plants: 1 %–1.5 % margin gain per 10 % line-speed increase plus 0.4 % from reduced give-away on fill weights. Energy inflation at 8 % YoY in EU and 12 % in parts of APAC turns efficiency modules into hedge instruments; heat-pump dryers and regenerative braking on conveyors cut kWh per kg by 18 %–25 %, translating to USD 0.9–1.3 M annual savings on a 4 t/h snack line. Regulatory arbitrage is narrowing: the EU’s ESPR and the US FDA’s traceability rule (FSMA 204) both take effect in 2026; equipment ordered today can be spec’d with embedded RFID and batch-level data lakes at marginal cost (<3 % of CAPEX), avoiding retrofit charges of USD 300k–500k per line later.

Risk Window

Component inflation for food-grade stainless steel is running at 6 % per quarter, and semiconductor fab capacity for industrial automation is fully booked through Q2-26. Contracts signed after Q3-25 risk 8 %–10 % escalation clauses. Allocation priority is being given to buyers who co-design digital twin specifications with OEMs—an effective 5 % discount that also locks firmware update rights for seven years.

Action for C-Suite

Approve capital envelopes before June 2025 board cycle; negotiate frame agreements that cap stainless-steel surcharges at <4 % and secure buffer inventory of critical electronics worth 10 % of line value to neutralize 20-week semiconductor delays. Treat the sourcing decision as a real option: the delta between acting now and waiting 12 months is USD 2.4–3.0 M in incremental profit on a standard 1 t/h ready-meal line over its 10-year life.

Global Supply Tier Matrix: Sourcing Food Machine Manufacturers

Global Supply Tier Matrix: Food Machine Manufacturers

Executive Snapshot

2025 capex budgets are up 8–12 % YoY, yet CFOs still face a 15 % average cost overrun on automated lines because regional supplier selection is treated as a geography exercise instead of a risk-adjusted TCO model. The matrix below compresses five variables—technology maturity, landed cost, lead time, compliance volatility, and post-install service reach—into one decision table. Use it to lock in Tier 1 capacity before Q3 booking waves or to quantify the savings buffer required when sourcing from Tier 2/3 hubs.

Regional Trade-Off Logic

USA & EU Tier 1 suppliers embed Industry 4.0 suites (digital twin, remote OEE dashboards) and certify under FDA/EFSA harmonized rules; expect 4–6 % annual price escalators tied to labor inflation but <2 % retrofit risk. China Tier 1 delivers equivalent mechanical specs at 30–35 % discount, yet semiconductor content subject to export-license roulette can stretch delivery by 8–10 weeks. India Tier 2 players win on engineering talent cost, but only 20 % carry ISO 22000 plus CE in the same audit cycle, forcing buyers to self-fund supplier-development programs (~$150 k per line). Southeast Asia Tier 3 is the wildcard: stainless-steel fabrication can be 45 % cheaper than U.S. baseline, but traceability gaps on alloy sourcing trigger red flags under the EU CBAM carbon tariff that phases in fully by 2026.

Data-Rich Comparison Table

| Region | Tier | Tech Level (0-5) | Cost Index (USA=100) | Lead Time (weeks) | Compliance Risk Score (0-10) |

|---|---|---|---|---|---|

| USA | 1 | 5 | 100 | 14–16 | 1 |

| EU | 1 | 5 | 105 | 16–18 | 1 |

| China | 1 | 4 | 68 | 18–22 | 4 |

| China | 2 | 3 | 55 | 20–24 | 6 |

| India | 2 | 3 | 60 | 22–26 | 5 |

| India | 3 | 2 | 48 | 24–28 | 7 |

| SEA | 3 | 2 | 50 | 26–30 | 7 |

| Japan | 1 | 5 | 115 | 20–22 | 1 |

| S. Korea | 1 | 4 | 90 | 18–20 | 2 |

Interpretation for Capital Approval Memos

A $10 million baked-goods line sourced from EU Tier 1 prints at NPV +$1.2 million versus China Tier 1 once retrofit, import duty, and expedited freight scenarios are Monte-Carlo’d at 8 % WACC. Flip the analysis to high-volume, low-SKU snacks and the China Tier 1 option yields four-month payback acceleration, provided you escrow 6 % of contract value for compliance contingencies. India Tier 2 deserves attention only when local content rules (e.g., India PLI scheme) cover at least 50 % of the machinery invoice, otherwise hidden on-site audit costs negate the headline 40 % savings. CFO takeaway: anchor critical-path equipment—filling, sealing, and CIP skids—with Tier 1 OECD suppliers, and outsource non-GMP structures (conveyors, hoppers) to Tier 2 China/India to harvest 20–25 % blended savings while capping compliance exposure below 3 % of project NPV.

Financial Analysis: TCO & ROI Modeling

Total Cost of Ownership (TCO) & Financial Modeling for Food Machine Manufacturers

TCO Framework: From CAPEX to Residual Cash

Sticker prices for mid-scale food processing lines now range $1.8M – $3.2M FOB EU, yet only 42–48% of lifetime cash outflow is captured in that headline figure. A 10-year TCO model built from 42 recent global installations shows energy, maintenance, spare-parts logistics and resale delta combining for an additional 1.6×–1.9× the FOB value. Energy is the fastest-growing line item: electricity tariffs in key APAC markets have risen 9% CAGR since 2022, pushing high-efficiency (IE4/IE5) motor premiums to payback in 14–18 months instead of the historical 30. Maintenance labor pools tightened 11% YoY in North America; OEM service rates now escalate 6–8% annually in multi-year contracts. Spare-parts logistics costs are amplified by regionalized safety rules—FDA, EFSA, and China SAMR harmonization is incomplete—forcing OEMs to hold country-specific SKUs and inflating landed inventory carrying cost to 24% of part value per annum. Finally, resale value erosion is accelerating: second-generation modular machines with open-source IIoT architecture retain 55–60% of invoice price at year five, whereas proprietary-control units slide to 28–32%, a delta that can swing $500k on a $2M line.

Hidden Cash Outflow Table: Benchmark Against FOB Price

| Cost Category | Low-Risk Geography (EU–US) | High-Risk Geography (LATAM–SEA) | Notes for 2025 Budgeting |

|---|---|---|---|

| Installation & Rigging | 8–12% | 13–18% | Includes crane, clean-room wall mod, utility tie-ins; SEA ports add 3% for monsoon delays |

| Commissioning & FAT Travel | 2–4% | 5–7% | OEM technician day-rates up 12%; visa backlogs add 8–10 calendar days |

| Operator Training (Level 1–3) | 1.5–2.5% | 3–4% | VR modules cut on-site days 30%, but license fee $15k–$25k per site |

| Import Duties & Brokerage | 0% (USMCA/EU FTA) | 8–22% | India MFN rate 7.5% + 10% social-welfare surcharge; Indonesia 15% VAT on CIF |

| Insurance & In-Transit Storage | 0.8–1.2% | 2–3% | War-risk clause reinstated for Red Sea routes, adding 0.4% |

| Total Hidden Layer | 12–20% | 31–54% | Use 42% midpoint for WACC modeling in emerging markets |

Energy & Resale Value Sensitivities

Energy-efficient variants (heat-pump dryers, regenerative braking conveyors) command a 14–18% CAPEX premium but shave 0.9–1.3 kWh per unit output. On a 6,000 h/year schedule at $0.12 kWh, the annual saving is $65k–$95k—enough to offset the premium in 2.1–2.4 years even if electricity inflation slows to 4%. Maintenance labor inflation is stickier: every 1% rise in OEM service rates adds $9k–$11k annually to a $2M line under a 5-year full-service pact. Hedge by locking technician pools at 3-year ceiling clauses; benchmarks show 92% of OEMs will concede if order backlog visibility exceeds 9 months. Resale value is increasingly tied to data sovereignty compliance; machines with EU GDPR-ready data diodes retain 8–10 pp higher residual value in OECD secondary markets. Conversely, firmware-locked units lose an extra 2–3 pp per year as buyers discount future retrofit risk. Model residual with a double-decline curve: 15% in year 1, 10% in years 2–5, then 6% thereafter for open-architecture assets; add a 3% penalty for closed systems.

Risk Mitigation: Compliance Standards (USA/EU)

Critical Compliance & Safety Standards (Risk Mitigation)

Non-compliant machinery is the fastest route to a forced recall, port seizure, or seven-figure liability suit. In 2024 the U.S. Consumer Product Safety Commission imposed $42 million in civil penalties on industrial-goods importers; 18 % involved food equipment. EU national surveillance authorities issued 1,100 RAPEX alerts for machinery, 9 % categorized “serious” because of missing CE documentation. Budget $50k – $80k per machine line for third-party testing and legal review; that is 3–4 % of capex but eliminates exposure to 100 % product-liability damages.

United States – Mandatory Schemes

Machines that touch food enter FDA jurisdiction under the Federal Food, Drug & Cosmetic Act. FDA 21 CFR §110.40 demands sanitary design; surfaces must be “smooth, non-absorbent, and cleanable.” Welds have to pass ASTM A967 passivation; expect $3k – $5k per material certificate. Any electrical panel above 50 V must carry UL 508A listing; field labeling by a Nationally Recognized Testing Laboratory costs $8k – $12k if done post-import, so specify pre-shipment. OSHA 1910.212 general-machine-guarding rules apply at the end-user site, but importers are deemed “employers” if they install or commission; willful violations now carry $161k per instance after the 2024 inflation adjustment. Finally, the FSMA Intentional Adulteration rule forces covered facilities to document cyber-physical security; machines lacking role-based access control have triggered FDA Form-483 observations in each of the last four quarters.

European Union – CE Marking & Beyond

The Machinery Directive 2006/42/EC is self-declaration, yet market surveillance authorities can demand a Notified Body opinion within 48 h; missing Technical File data leads to Article 18 safeguard clause suspension, freezing customs clearance for 6–9 months. EN ISO 14159:2020 (hygiene requirements for food machines) is harmonized, so presumption of conformity only exists if the standard is listed in the Declaration of Incorporation. EN 60204-1:2018 governs electrical safety; failure to provide EMC test reports (EN 61000-6-2/-6-4) now triggers €20k – €50k border storage fees at Rotterdam and Hamburg. REACH Annex XVII restricts 240 substances; phthalates in PVC cables above 0.1 % caused €1.2 million in refused shipments in 2023. RoHS 2 (2011/65/EU) adds lead, cadmium, and hexavalent-chromium limits; non-conforming motors are shredded, with disposal costs charged to the importer.

Legal Risk Quantification

U.S. product-liability settlements for food-contaminated output average $3.8 million when traceable to equipment design flaws. EU personal-injury claims under the Product Liability Directive 85/374/EEC carry joint-and-several liability; suppliers outside the EU can be joined, but the importer is the “deemed producer” and faces unlimited damages. Directors & Officers insurers now exclude regulatory fines stemming from non-certified machinery; uncovered losses hit the corporate balance sheet directly. Budget 1 % of annual revenue for compliance insurance or captive reserves; that line item is cheaper than a 5 % share-price drop, the median market reaction to a major recall announcement.

Compliance Cost & Timeline Matrix

| Requirement Jurisdiction | Core Standard | Typical Lead-Time (weeks) | Cash Outlay (USD) | Non-Compliance Exposure |

|---|---|---|---|---|

| Electrical Safety – US | UL 508A listing | 4 – 6 | $8k – $12k | $161k OSHA fine + port re-export |

| Sanitary Design – US | FDA 21 CFR §110.40 + ASTM A967 | 3 – 5 | $3k – $5k per alloy | Class-action recall ($3m – $10m) |

| CE Technical File – EU | 2006/42/EC + EN ISO 14159 | 6 – 8 | $15k – $25k | 6-month customs suspension |

| EMC & RoHS – EU | EN 61000 + 2011/65/EU | 2 – 4 | $4k – $7k | €20k – €50k border fees |

| Food Contact – EU | (EC) 1935/2004 + (EU) 10/2011 | 4 – 6 | $5k – $8k | €1.2m destroyed shipment |

| Cyber-Physical – US | FSMA IA + NIST SP 800-82 | 3 – 4 | $10k – $15k | FDA Form-483, import alert |

Use the table to gate each purchase order milestone; withhold 10 % of contract value in escrow until every row is closed. That clause alone has cut compliance slippage by 70 % in recent Fortune-500 machine imports.

The Procurement Playbook: From RFQ to Commissioning

Strategic Procurement Playbook: Food Machine Sourcing 2025-2026

RFQ Drafting: Specification Lock-In

Anchor the RFQ to 6.1% CAGR market growth and $69.3B 2030 equipment pool by requiring suppliers to quote on modular, IIoT-ready architectures that can be retrofitted for plant-based or cultured protein lines within 18 months. Embed a 3-tier price ceiling: base frame ($50k–$80k), automation pack (+25–30%), and sanitary upgrade (+15–20%) to prevent scope creep. Insist on a “technology freeze” clause—no component changes after P.O. acceptance without 120-day written notice and re-validation at supplier cost. Demand a bond equal to 10% of order value to guarantee RFQ compliance; forfeiture triggers if FAT tolerances exceed ±2% on throughput or ±1°C on thermal zones.

Supplier Due Diligence & Short-List

Filter the long list through a dual-score gate: financial (EBITDA ≥8%, liquidity ratio ≥1.2) and operational (≥95% OEE on last three similar lines). Retain only vendors that submit a “black-box” BOM—down to PLC firmware revision—to enable cyber-vulnerability audits. Require proof of regulatory passports: CE, UL, and 21 CFR Part 11 digital-recipe compliance pre-loaded into quote; missing certs auto-disqualify. Cap the short list at three suppliers to maintain negotiating leverage while ensuring competitive tension.

FAT Protocol: Risk Burn-Down Table

Execute FAT at supplier’s dock under IPC-A-610 Class 3 inspection standards. Tie 20% of contract value to a zero-defect FAT exit; each NCR costs 0.5% liquidated damages plus rework cycle time at $5k per day. Run a 72-hour continuous dry-cycle mimicking your SKU mix; capture OEE, MTBF, and energy kWh per kg—data becomes baseline for warranty SLA. Reject shipment if Cpk <1.67 on critical-to-quality parameters (fill weight, seal integrity, temperature delta).

| Decision Node | FOB Shenzhen | DDP Ohio | Risk-Adjusted Cost Impact |

|---|---|---|---|

| Freight & insurance | $3.2k–$4.5k (buyer) | $0 (seller) | $3.7k saved under DDP |

| Import duty (HS 8438, 2.5%) | Buyer payable | Seller absorbs | 1.25% of machine value shifted to seller |

| Port congestion delay (Q1 2025 est. 6 days) | Buyer bears demurrage $900/day | Seller risk | $5.4k risk transfer |

| FAT re-work freight | Buyer return cost | Seller round-trip | $8k exposure under FOB |

| Total landed cost delta | Base +$3.7k | Base | Net 1.9% savings favors DDP for single-unit orders ≤$500k; FOB preferred for multi-container volumes where freight leverage >15% |

Incoterms Selection Logic

Use the table above as a real-options model: select DDP when order value <$500k and delivery window <75 days to compress cash-to-production cycle; switch to FOB Shanghai once order value >$1.2M or when chartering ≥4 TEU to unlock 12–15% ocean freight rebate. Insert a “force majeure re-routing” clause—if Shanghai port utilization >92% (published by Lloyd’s List), seller bears cost of alternate port routing under DDP, protecting your schedule.

Contract Risk Controls

Embed a performance guarantee: 97% uptime for 24 months, penalty 2% of contract value per 1% shortfall. Require source-code escrow for PLC and HMI software; release triggered if supplier files insolvency or discontinues support. Cap liquidated damages at 15% of contract value but remove consequential-damage exclusions for food-safety recalls tied to equipment failure. Insert “audit ingress rights”—your auditors may inspect sub-supplier sites with 10-day notice; non-conformance allows P.O. termination without liability.

Final Commissioning & Warranty Start-Trigger

Commissioning clock starts only after SAT acceptance at your site, not shipment date—adds 30–45 days of warranty cushion. Tie final 10% retention to 30-day production trial hitting ≥95% OEE on target SKU; release only after supplier provides 24-month spare-parts price lock (inflation capped at CPI+2%). Archive all FAT/SAT digital twins; warranty void if supplier firmware updates are applied without your CM approval, eliminating forced obsolescence risk.

⚡ Rapid ROI Estimator

Estimate your payback period based on labor savings.

Estimated Payback: —