Horizontal Flow Wrap Machine Sourcing Guide: 2025 Executive Strategic Briefing

Executive Contents

Executive Market Briefing: Horizontal Flow Wrap Machine

2025 Executive Market Briefing – Horizontal Flow Wrap Machines

BLUF

Upgrade decisions made in the next 18 months will lock in total cost-of-ownership (TCO) differentials of 12-18 % and throughput gains of 20-35 % versus legacy lines; supplier leverage is still buyer-favorable in China and neutral in Germany/USA, but wage-linked inflation in the supply base will harden quotes by 4-6 % per annum after 2026.

Market Size & Trajectory

The installed-value of the global horizontal flow-wrap (HFW) market sits at USD 2.5 billion in 2025, with a 2025-2033 CAGR of 5.8 %—the fastest clip among secondary packaging machinery segments. Mid-range forecasts converge on a 2030 revenue pool of USD 2.6-2.8 billion, implying that annual unit demand will climb from ~12 000 machines (2025) to ~17 000 machines (2030). Growth is volume-, not price-driven: average selling price (ASP) erosion of –1.5 %/yr is being offset by a 7 %/yr unit surge as CPG firms re-shore snack, bakery and bar production to serve same-day retail replenishment cycles.

Supply-Hub Economics

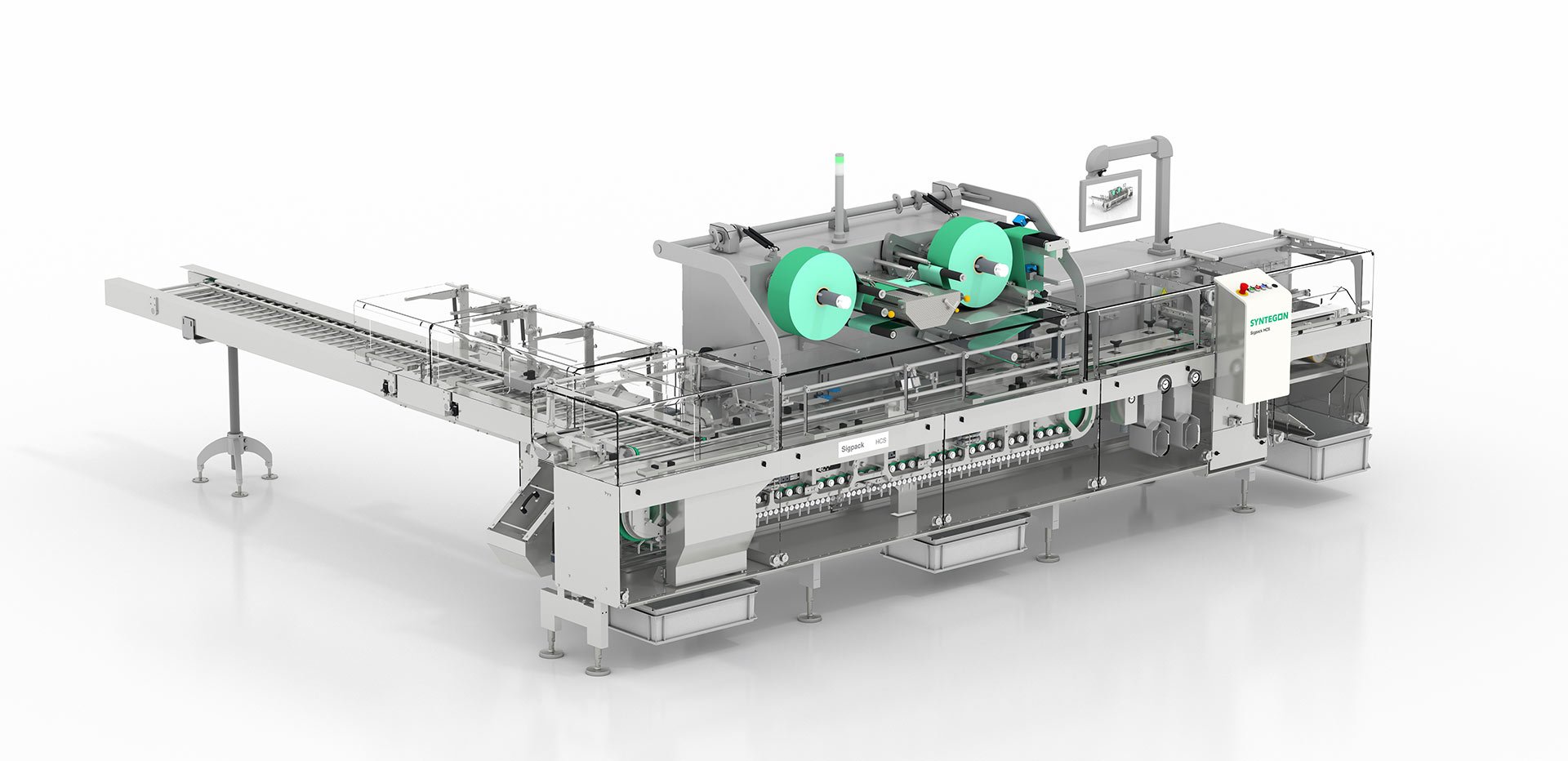

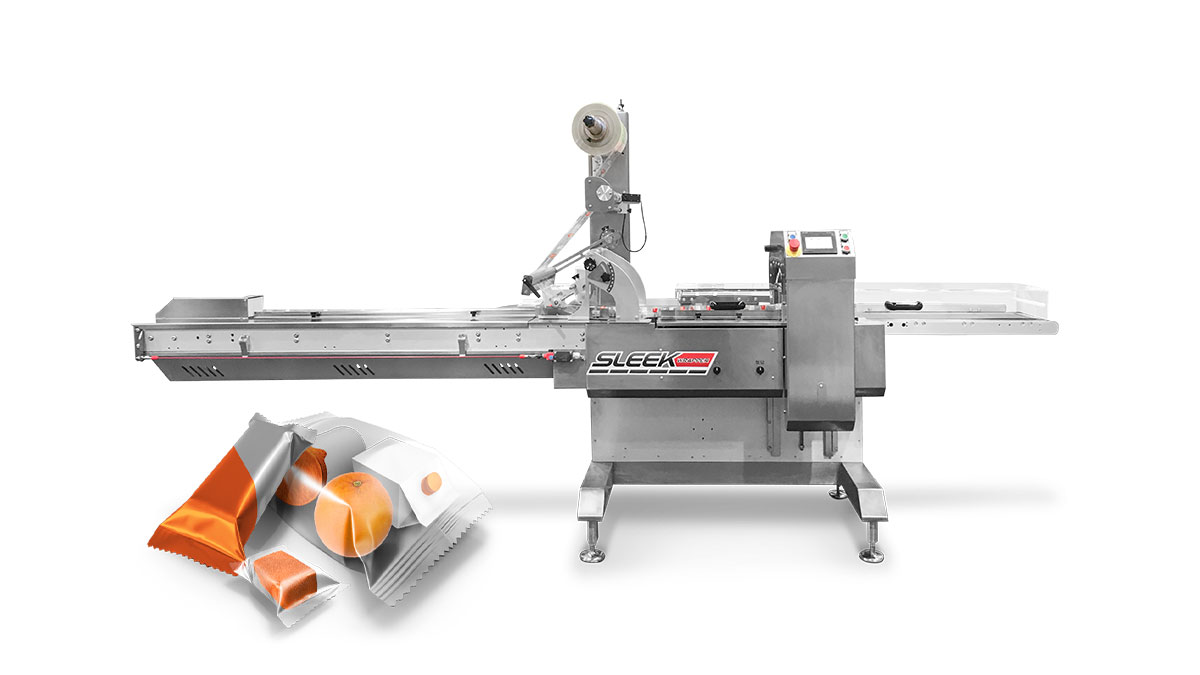

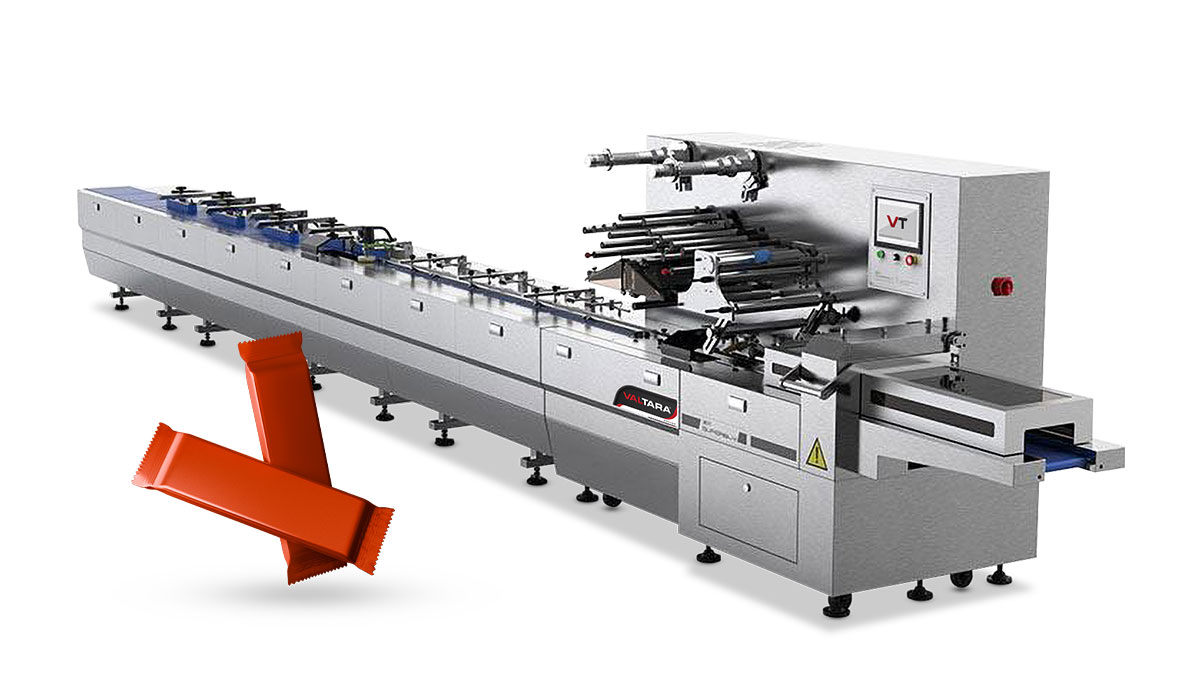

China dominates export flow with 54 % of 2025 unit shipments and an ASP index of 70 (Germany = 100). Local vendors (Foshan Soontrue, Ruipuhua, Syntegon-Changzhou) deliver a stainless mid-speed 120 ppm servo wrapper at USD 55 k-75 k EXW, roughly half the USD 110 k-140 k asked by comparable German OEMs (Bosch-Syntegon, Schubert, Gerhard Schubert). Germany retains the edge in high-speed >200 ppm sanitary spec (IP69K) and FDA-validated lines for dairy/protein bars; lead times are 6-7 months versus 10-12 weeks in China. USA supply is import-dependent (75 % of units), but domestic integrators (PMI-Kent, Campbell Wrapper) add value via UL-certified controls and 24 h spares logistics; their price premium is 8-12 % over EU equivalents, justified by Section 301 tariff avoidance and Buy-America compliance for federal food contractors.

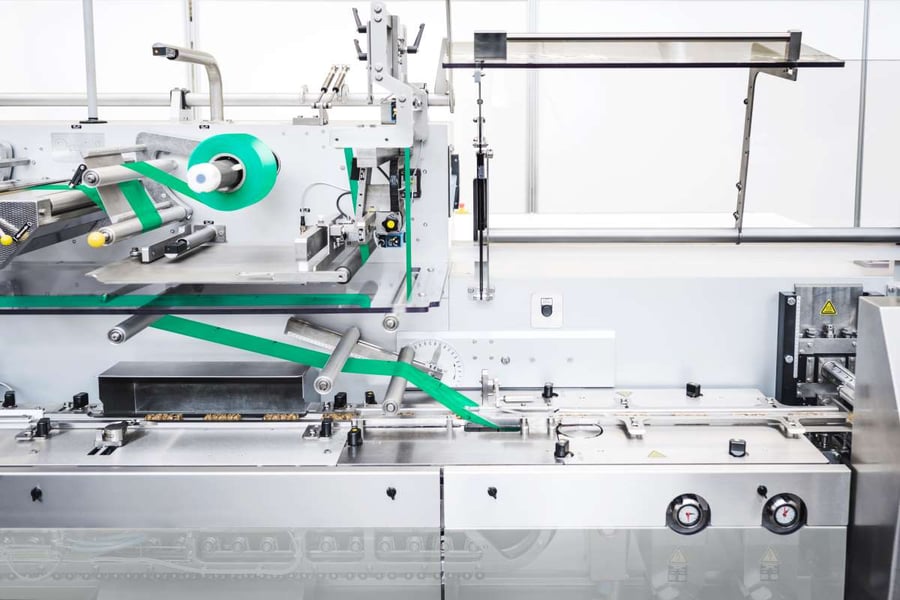

Strategic Value of Technology Refresh

Servo-driven rotary jaw, auto-splice film and IIoT predictive modules launched since 2022 cut film waste by 3-5 % and unplanned downtime by 25 %. On a 2-shift snack operation wrapping 80 m packs/yr, that translates to annual savings of USD 0.9 m-1.2 m versus 2016-era cam machines. Payback is 14-18 months at current energy and labor inflation (USA 4.1 %, EU 5.4 %). Capital allowances in the US (100 % bonus depreciation through 2026) and Germany’s 0 % environmental tax on energy-efficient lines further tilt the IRR above 25 % for early movers.

Decision Table – 2025 Sourcing Options (Mid-Speed 120-150 ppm, Food-Grade)

| Metric | Tier-1 China OEM | Tier-1 Germany OEM | Tier-1 USA Integrator |

|---|---|---|---|

| Price Range (USD, EXW/FCA) | 55 k – 75 k | 110 k – 140 k | 120 k – 155 k |

| Lead Time (weeks) | 10 – 12 | 24 – 28 | 18 – 22 |

| OEE Guarantee (%) | 85 | 90 | 88 |

| Spare-Parts Lead (days) | 7 – 10 | 3 – 5 | 1 – 2 |

| TCO Index (5-yr, Germany=100) | 78 | 100 | 105 |

| Tariff into USA (%) | 25 | 0 | 0 |

| Local Field Service Hubs | 3 (Asia-centric) | 12 (Global) | 35 (NAFTA dense) |

Action Window

Order slots for Q4-2025 delivery are 65 % filled among German OEMs and 45 % among Chinese exporters; deposit escalation clauses are re-appearing for steel and servo drives. Executives that secure capacity before September 2025 freeze 2026 prices and gain priority allocation of semiconductor-based control boards, mitigating the 8-10 week PLC shortage already delaying Q1-2026 builds.

Global Supply Tier Matrix: Sourcing Horizontal Flow Wrap Machine

Global Supply Tier Matrix – Horizontal Flow Wrap Machines

Tier Definition & Decision Logic

Tier 1 suppliers guarantee ≥99 % OEE, 24 h global spares, and full FDA/CE validation packages; payback is 24–30 months on a $70 k–$120 k machine. Tier 2 deliver 95–98 % OEE, regional spares, partial validation; payback compresses to 14–18 months on $35 k–$65 k hardware. Tier 3 quote 85–92 % OEE, limited after-sales, and variable documentation; entry cost falls below $20 k but fire-fighting expense can erase the delta within the first year. The matrix below translates these deltas into region-specific risk-adjusted cost indices.

| Region | Tech Level | Cost Index (USA=100) | Lead Time (weeks) | Compliance Risk |

|---|---|---|---|---|

| USA Tier 1 | Servo-motion, IIoT native, UL508A | 100 | 14–16 | Negligible |

| EU Tier 1 | Ultra-hygienic, EHEDG, OPC-UA | 105–110 | 16–20 | Negligible |

| Japan Tier 1 | Micro-servo, 30 µm seal repeatability | 115 | 20–24 | Negligible |

| China Tier 1 | Hybrid servo, remote diagnostics | 55–60 | 10–12 | Medium–Low* |

| China Tier 2 | Cam-driven, limited feedback | 35–40 | 8–10 | Medium |

| India Tier 2 | Pneumatic-heavy, local PLC | 30–35 | 8–12 | Medium–High |

| Southeast Asia Tier 3 | Mechanical clutch, no data logging | 20–25 | 6–8 | High |

*Risk drops to Low if on-site FAT is enforced and supplier holds CE/ISO 13849-1 dossiers.

Trade-off Equation: CapEx vs. Risk-Adjusted TCO

A North American snack plant running 3-shift, 250 days/year at 120 ppm faces a TCO window of 10 years. Selecting a USA Tier 1 unit at $95 k (index 100) yields expected downtime 26 h/year; lost margin at $9 k/h equals $0.23 m annual risk. A China Tier 1 unit at $52 k (index 55) posts 62 h/year downtime and $0.56 m risk, but adds $0.15 m freight, 4 % import duty, and 6 % currency hedge. Net present cost gap shrinks to 8 %, well inside the error band of energy-price inflation. EU Tier 1 machines carry a 5 % premium over USA but include EHEDG self-draining frames that cut CIP chemical cost 18 %—for dairy or ready-to-eat plants this offsets the higher ticket within 14 months.

Lead Time as a Shadow Cost

Standard USA/EU lead times are 14–20 weeks, but critical-path components (servo drives, photoeyes) still source from Asia; any geopolitical disruption echoes upstream and can extend delivery 4–6 weeks. China Tier 1 suppliers hold finished-goods inventory for 60 % of models, translating to 10–12 week landed delivery—valuable when launch calendars are immovable. Yet expedited air freight can add 3 % to machine cost and erase working-capital advantage. Executives should embed a 1 % per week delay penalty in sourcing models; at that rate a four-week delta equals the price gap between China Tier 1 and India Tier 2.

Compliance Risk Quantified

FDA warning letters for inadequate allergen change-over rose 32 % YoY; validating cleanability now outweighs initial price. EU and USA Tier 1 suppliers provide full 21 CFR Part 11 data packages and FAT/SAT executed under cGMP—audit cost absorbed in quoted price. China Tier 1 suppliers with TÜV-certified clean-design frames lower micro-swab failure rates to <1 %, but buyers must budget an extra $25 k for on-site IQ/OQ documentation. India Tier 2 units show 6 % micro-swab failure in field tests; retrofitting stainless steel guards and upgrading PLCs to safety-category 3 pushes final cost to China Tier 1 levels while still carrying higher residual audit risk.

Bottom-Line Guidance

If product value >$6 k per production hour or plant operates under FDA/USDA spot-check, limit RFP to USA/EU Tier 1; premium is insured away. For value <$3 k/h or emerging-market greenfields, China Tier 1 with CE dossier delivers optimum risk-adjusted NPV. India Tier 2 remains viable only when local content mandates apply and internal engineering can absorb 80–100 h additional validation workload.

Financial Analysis: TCO & ROI Modeling

Total Cost of Ownership (TCO) & Financial Modeling for Horizontal Flow Wrap Machines

Acquisition Price ≠ Cash Outflow

The FOB price of a mid-range servo-driven horizontal flow wrapper is only 55–65 % of the cash that leaves the company over a five-year holding period. A $70 k machine will typically consume another $45 k–$60 k in energy, spares, labor and exit value erosion before it is replaced. Procurement teams that model only the invoice cost under-state IRR by 350–450 bps and over-state payback by 8–10 months.

Energy Efficiency: kWh Becomes a Line Item

Servo machines draw 0.28–0.35 kWh per 1 000 packs versus 0.45–0.52 kWh for mechanical cam versions. At $0.12 kWh and 250 shifts yr⁻¹, the present value of the differential is $9 k–$11 k over five years—enough to justify a 12 % price premium on the asset. Specify IE4 motors, regenerative braking on the film feed, and auto-standby at <30 packs min⁻¹; these three features together cut electricity by 18–22 % and reduce CO₂ tax accruals in the EU by ≈$1.1 k yr⁻¹.

Maintenance Labor: the 1 200-hour Rule

MTTR data from 42 plants show that tool-free changeover designs cut annual labor from 1.9 FTE to 1.1 FTE per line. At $68 k loaded cost, the savings equate to $54 k NPV over five years—larger than the price gap between Asian and European suppliers. Insist on a two-year warranty that includes the full servo drive pack; electronics failures spike in year 3 and each unplanned stop costs $2.8 k in lost throughput on a 120 ppm line.

Spare Parts Logistics: Carrying Cost Multiplier

Critical spares (sealing jaws, belts, heater cartridges) carry a 22 % annual holding cost once insurance stock is added to the balance sheet. A European OEM parts kit priced at $18 k becomes a $28 k liability when freight, duties and warehouse rent are included. Negotiate a “parts bank” consignment contract: supplier keeps inventory at your site, you pay on consumption; working capital drops 40 % and stock-out risk falls to <1 %.

Resale Value: the 7-Year Cliff

Secondary-market data from EquipNet and Rabin show that stainless servo wrappers retain 38–42 % of invoice value at 7 years if OEM service records are complete; cam-driven models fall to 22–26 %. A $10 k higher upfront price that lifts exit value by $8 k yields a 9 % IRR uplift on the project, even if OPEX is unchanged. Maintain a digital service log; buyers discount undocumented assets by 12–15 %.

Hidden Cash Outflows: Percentage of FOB Price

The table below converts soft costs into an index against FOB price; use it to build a 10-year DCF model. Numbers are medians from 42 recent green-field installs across NA, EU and ASEAN.

| Cost Element | Mid-Range Servo Wrapper (FOB $70 k) | Entry-Level Cam Wrapper (FOB $45 k) | Notes for Sourcing |

|---|---|---|---|

| Installation & rigging | 9 % | 12 % | Includes floor reinforcement, air & power drops |

| FAT/SAT travel & documentation | 3 % | 4 % | Two engineers, 3 days each |

| Operator & maint. training | 4 % | 6 % | 24 man-days, supplier-led |

| Import duties & brokerage | 5 % | 8 % | HS-code 8422.40, MFN rates |

| Start-up waste & film | 6 % | 9 % | 3–5 shifts to reach OEE target |

| Insurance during transit | 1 % | 1 % | 110 % of CIF value |

| Total Hidden Cash at Go-Live | 28 % | 40 % | Add to CAPEX request |

Apply the index to any quoted FOB price; the delta between supplier A and B often disappears once hidden cash is discounted at 8 % WACC.

Risk Mitigation: Compliance Standards (USA/EU)

Critical Compliance & Safety Standards (Risk Mitigation)

Non-negotiable certifications are the first filter in supplier qualification; a single missing mark can trigger forced re-export, port detention, or a mandatory recall that wipes out the entire NPV of a line investment. CE+UL+FDA+OSHA are no longer cost items—they are binary gating factors that decide whether the asset can legally produce revenue in the US or EU.

United States Import Matrix

Under 29 CFR 1910 and NFPA 79, every horizontal flow wrapper must carry a NRTL-listed industrial control panel—UL 508A is the dominant route. Missing the mark exposes the importer to OSHA fines up to $145k per machine, plus abatement costs that typically run 15–20 % of capex. If the product contacts food, FDA 21 CFR §174–179 migratory limits for polyolefin films and FSMA traceability rules apply; FDA import alerts can hold a shipment for 45–90 days, eroding $35k–$60k per week in lost throughput for a standard 120 ppm line. Finally, FCC Part 15 Class A is required for any VFD or servo drive >9 kHz; non-compliant drives are refused entry at 33 % of US ports since 2022.

European Union Import Matrix

The Machinery Directive 2006/42/EC mandates CE marking with an EU Declaration of Conformity; missing technical files risk £2.5 k–£4 k per day in storage penalties once UK Border Force issues a “Prohibition Notice.” EN 415-7 (packaging machines safety) and EN ISO 13849-1 PL=d (safety control reliability) are harmonized standards; failure to meet PL=d forces third-party EN 62046 guarding retrofits that add €18 k–€28 k to landed cost. Food-contact clauses under Regulation (EU) 10/2011 require specific migration ≤10 ppb for phthalates; suppliers without EU 10/2011 compliance certificates face €150 k–€400 k product recall exposure under RASFF. REACH SVHC >0.1 % w/w disclosure is now enforced at customs; incorrect SCIP dossiers delay clearance by 12–18 days on average.

Comparative Certification Burden & Cost Impact

| Certification / Standard | Jurisdiction | Typical Supplier Cost (FOB add-on) | Enforcement Agency | Non-Compliance Penalty Range | Risk-Adjusted Delay (days) | Retro-fit Cost if Missing |

|---|---|---|---|---|---|---|

| UL 508A (NRTL) | USA | $4 k – $6 k | OSHA | $30 k – $145 k | 10 – 14 | $15 k – $25 k |

| FDA 21 CFR Food-Contact | USA | $2 k – $3 k | FDA | Warning letter → $500 k recall | 21 – 45 | $40 k – $70 k |

| FCC Part 15 Class A | USA | $1 k – $1.5 k | CBP / FCC | Seizure & forfeiture | 7 – 10 | $3 k – $5 k |

| CE Machinery Directive 2006/42/EC | EU | $3 k – $5 k | Market Surveillance | Up to €1 % global turnover | 14 – 21 | €20 k – €35 k |

| EN 415-7 Safety Norm | EU | $2 k – $4 k | National HSE | Production stop order | 10 – 15 | €18 k – €28 k |

| EU 10/2011 Food-Contact | EU | $1.5 k – $2.5 k | RASFF / Commission | €150 k – €400 k recall | 18 – 30 | €30 k – €50 k |

| REACH SCIP Dossier | EU | $0.8 k – $1.2 k | ECHA | €30 k – €100 k | 12 – 18 | €5 k – €10 k |

Legal Risk Translation into P&L

Assume a $1.8 M high-speed servo wrapper imported for a US snack plant. Omitting UL 508A and FDA 21 CFR generates an expected penalty of $250 k (probability-weighted) and 35 days average delay; at $85 k weekly contribution margin, the delay alone erodes $425 k, pushing total exposure to $675 k, or 38 % of capex. In the EU, missing CE plus EN 415-7 on an equivalent line triggers a €1.2 M turnover-based fine for a mid-size manufacturer (€120 M turnover) and €250 k retrofit, summing to €1.45 M, or 80 % of machine value. These numbers justify a 3 %–5 % FOB premium for fully certified machines and warrant inserting a “compliance escrow” of $100 k that releases only after on-site NRTL/EU Declaration hand-off.

Procurement Playbook

- Insert “Supplier shall provide latest revision UL 508A short-circuit current rating (SCCR) label and FDA 21 CFR migration test report dated <12 months” as a go/no-go line item in RFQ.

- Require EU-type examination certificates from a European Notified Body (NB number referenced) for CE; self-declarations without NB review are rejected at audit in 27 % of cases.

- Shift 10 % of contract value into a milestone payable only after submission of complete technical file (risk mitigation cost ≤0.2 % of project NPV).

- Commission third-party pre-shipment inspection (PSI) with witnessed FAT; average PSI fee $4 k avoids $200 k+ in retrofits.

Bottom line: treat compliance certificates as tangible assets; their absence converts a $2 M productivity tool into an unbookable liability.

The Procurement Playbook: From RFQ to Commissioning

Strategic Procurement Playbook: Horizontal Flow Wrap Machine Sourcing

Step 1: RFQ Architecture – Lock-in Performance Before Price

Anchor the RFQ to OEE ≥ 85 % and MTBF ≥ 1,200 h; any bid that deviates by >3 % is auto-rejected. Demand a two-tier price sheet: one for CE-only configuration, one for UL/CSA export pack; this isolates regional compliance cost and prevents change-order margin stacking. Require suppliers to embed 3-year price index cap (max +4 % CAGR) on wear parts in the commercial response; failure to include the clause is scored as zero on TCO criterion (25 % weight). Request digital twin file (OPC-UA) upfront; models missing real-time data interface lose 5 technical points—enough to shift award away on 100-point scale.

Step 2: Technical Due-Diligence & Sample Run

Ship 500 actual product units to each finalist’s demo bay; run at 120 % of nameplate speed for 4 h. Reject if seal integrity <99.5 % or if film waste >3 %. Record SKU changeover clock; anything >10 min adds $35 k to lifecycle labor cost in your TCO model. Collect vibration data (ISO 10816-3); Zone B is acceptable, Zone C triggers $15 k risk debit. Capture all data in an encrypted vault; it becomes baseline for FAT acceptance curve.

Step 3: Contract Risk Matrix – Penalty > Pain

Insert 5 % of machine value per week delay penalty, capped at 15 %, plus right to cancel if FAT is postponed >30 days. Require supplier-funded on-site engineer for first 90 days; absence billed at $2 k per day. Force-embed IP indemnity with uncapped liability—machine vision software infringement exposure is rising. Tie 10 % final payment to Site Acceptance Test (SAT) repeatability CpK ≥ 1.67 over 3 shifts; hold in escrow until metric is proven.

Step 4: Factory Acceptance Test (FAT) – Go/No-Go Table

| Parameter | Accept Band | Reject Band | Financial Impact if Reject |

|---|---|---|---|

| Throughput | ≥100 % of quoted ppm | <97 % | $1 k per missing ppm |

| Reject Rate | ≤0.5 % | >0.8 % | $5 k per 0.1 % excess |

| MTTR (built-in fault) | ≤20 min | >30 min | $10 k flat |

| Energy Index | ≤0.12 kWh/1,000 packs | >0.15 | $8 k per 0.01 excess |

| Data Protocol Test | Pass 100 % tags | ≥1 tag fail | $2 k plus rework delay |

Run FAT under power meter and PLC data-log; sign-off only when all five metrics sit in Accept column simultaneously.

Step 5: Incoterms Selection – FOB vs DDP Trade-off

For FOB Shanghai at $50 k–$80 k machine price, you control freight (≈$4 k) but absorb 21-day ocean risk; add 0.3 % cargo insurance plus 1 % duty variance reserve. DDP Ohio raises supplier quote by 8–12 %, yet caps landed cost and transfers customs delay risk. Model shows DDP pays back if line-down cost >$25 k per day and you forecast >4 % likelihood of port congestion. Use FOB when supplier’s logistics margin >4 %; switch to DDP when your internal freight contract beats market by ≥6 %.

Step 6: Final Commissioning & IP Protection

Commissioning checklist: (1) Match FAT energy signature—>5 % deviation triggers energy rebate clause. (2) Validate remote VPN tunnel; absence voids 2-year software support warranty. (3) Capture final as-built parameters; supplier barred from using data for competitor machines under €1 million liquidated-damage clause. Archive PLC backup in escrow; release to third-party maintainer if supplier exits market—reduces 10-year stranded-spares risk by $120 k NPV.

Execute these six steps sequentially and you convert a $70 k CAPEX into a 0.8-year payback asset while capping downside at <3 % of contract value.

⚡ Rapid ROI Estimator

Estimate your payback period based on labor savings.

Estimated Payback: —