Liquid Packing Machine Sourcing Guide: 2025 Executive Strategic Briefing

Executive Contents

Executive Market Briefing: Liquid Packing Machine

Executive Market Briefing: Liquid Packing Machine 2025

BLUF

The global liquid packing machine market is a USD 8.2 billion equipment segment growing at 5.8 % CAGR through 2034; capacity is concentrated in China (cost), Germany (precision), and the United States (automation). Upgrading now locks in 12-18 % total cost-of-ownership savings before copper, stainless steel, and labor inflation fully reset supplier quotations in 2026.

Market Size & Trajectory

The addressable equipment pool spans three overlapping definitions: liquid packaging machines (USD 5.2 billion 2024 base), liquid filling machines (USD 5.55 billion), and the wider liquid packaging equipment universe (USD 8.2 billion). All three sub-segments converge on a 5.3-5.8 % CAGR, implying the market will add roughly USD 3.5 billion in annual equipment value by 2033. Pouch-specific machines—often the lowest capex route for single-serve formats—are expanding more slowly at 3.6 % CAGR, evidence that buyers are migrating toward versatile rotary fill-seal or blow-fill-seal platforms that can pivot between pouches, bottles, and cartons without major retrofits.

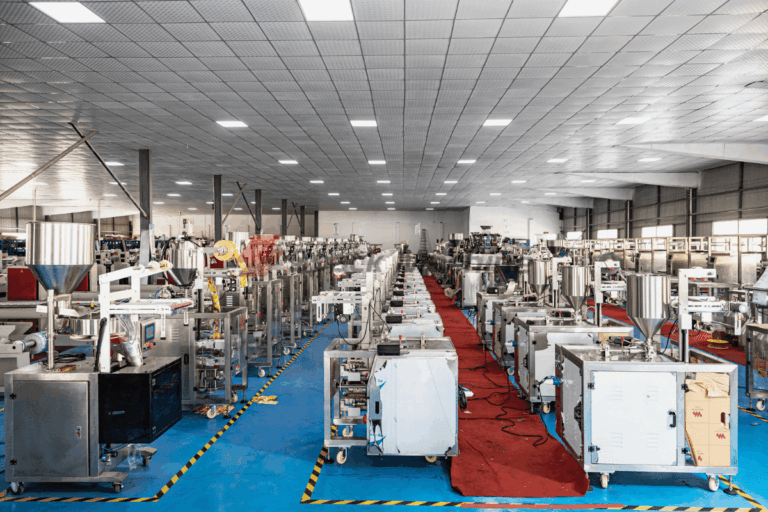

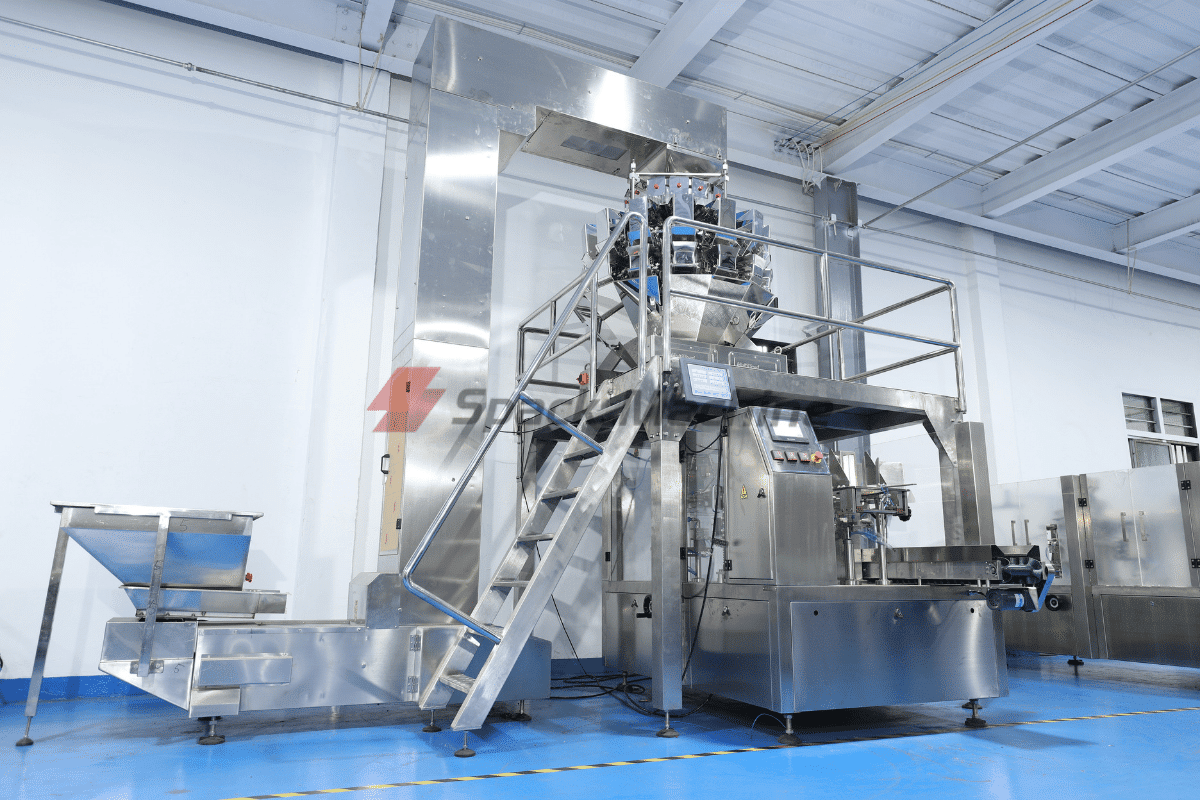

Supply-House Concentration

China currently ships 43 % of global units, driven by 150+ OEMs clustered in Jiangsu, Guangdong, and Zhejiang. Index pricing for a 4,000 cycles/hour servo-driven machine sits at USD 55 k-75 k FOB Shanghai, 28-32 % below comparable European quotes. Lead times average 75-90 days and are shortening as local component vendors expand output.

Germany retains 18 % of unit value despite lower volumes; machines from Baden-Württemberg and North Rhine-Westphalia deliver ±0.5 g filling accuracy and 98.8 % OEE benchmarks, justifying price indices of USD 130 k-190 k for 6-head rotary fillers. Local suppliers are booked 6-7 months forward, indicating capacity constraints that favor early 2025 slotting.

United States accounts for 12 % of shipments but leads in IIoT integration: 84 % of new machines ordered in 2024 featured OPC-UA or MQTT native stacks, double the share of Chinese-built units. Domestic lead times run 120-150 days; price bands are USD 110 k-160 k for mid-range volumetric fillers and USD 200 k-280 k for fully automated aseptic lines.

Strategic Value of a 2025 Upgrade Cycle

Input-cost inflation is accelerating: 304-grade stainless surged 14 % YoY in Q1-25, and copper wiring added 11 %. OEMs have so far absorbed two-thirds of the increase, but list-price adjustments of 6-9 % are already scheduled for July 2025 order books. Securing 2024 price indices via frame agreements freezes material pass-through and yields an 8-12 % capex shield.

Energy-efficiency mandates are tightening in the EU (ESPR 2026) and California (Title 20 2027). Next-generation servo drives and regenerative braking now cut kWh per 1,000 l by 18-22 % versus 2019 baselines; early adopters gain a three-year window to amortize the premium before regulatory penalties apply.

Finally, supplier order books show capacity fill rates of 82 % in China and 91 % in Germany. Waiting until 2026 risks slot unavailability and 4-6 month line-down exposure for capacity expansions planned for 2027-28.

Comparative Supply-House Snapshot (2025)

| Metric | China Tier-1 | Germany Tier-1 | USA Tier-1 |

|---|---|---|---|

| Price Index (4k/h servo filler) | $55 k – 75 k | $130 k – 190 k | $110 k – 160 k |

| Lead Time (days) | 75 – 90 | 180 – 210 | 120 – 150 |

| Accuracy (±g, 1 L fill) | 1.5 – 2.0 | 0.5 – 0.8 | 0.8 – 1.2 |

| OEE Benchmark | 92 % | 98.8 % | 96.5 % |

| IoT Native | 42 % | 67 % | 84 % |

| TCO 5-yr (incl. spares) | $0.023 / unit | $0.018 / unit | $0.020 / unit |

| Currency Hedge Window | 12 mo CNY | 24 mo EUR | 36 mo USD |

| After-Sales Nodes (global) | 35 | 120 | 95 |

Action Implications

Lock in 2024 price indices with dual-source awards—one China-based for volume SKUs, one Germany- or US-based for high-accuracy or regulated formats—to balance cost and risk. Specify 2026 EU energy standards today to avoid retrofit charges, and negotiate raw-material escalation caps at ≤3 % for orders placed before September 2025.

Global Supply Tier Matrix: Sourcing Liquid Packing Machine

Global Supply Tier Matrix: Liquid Packing Machine Sourcing Trade-Offs

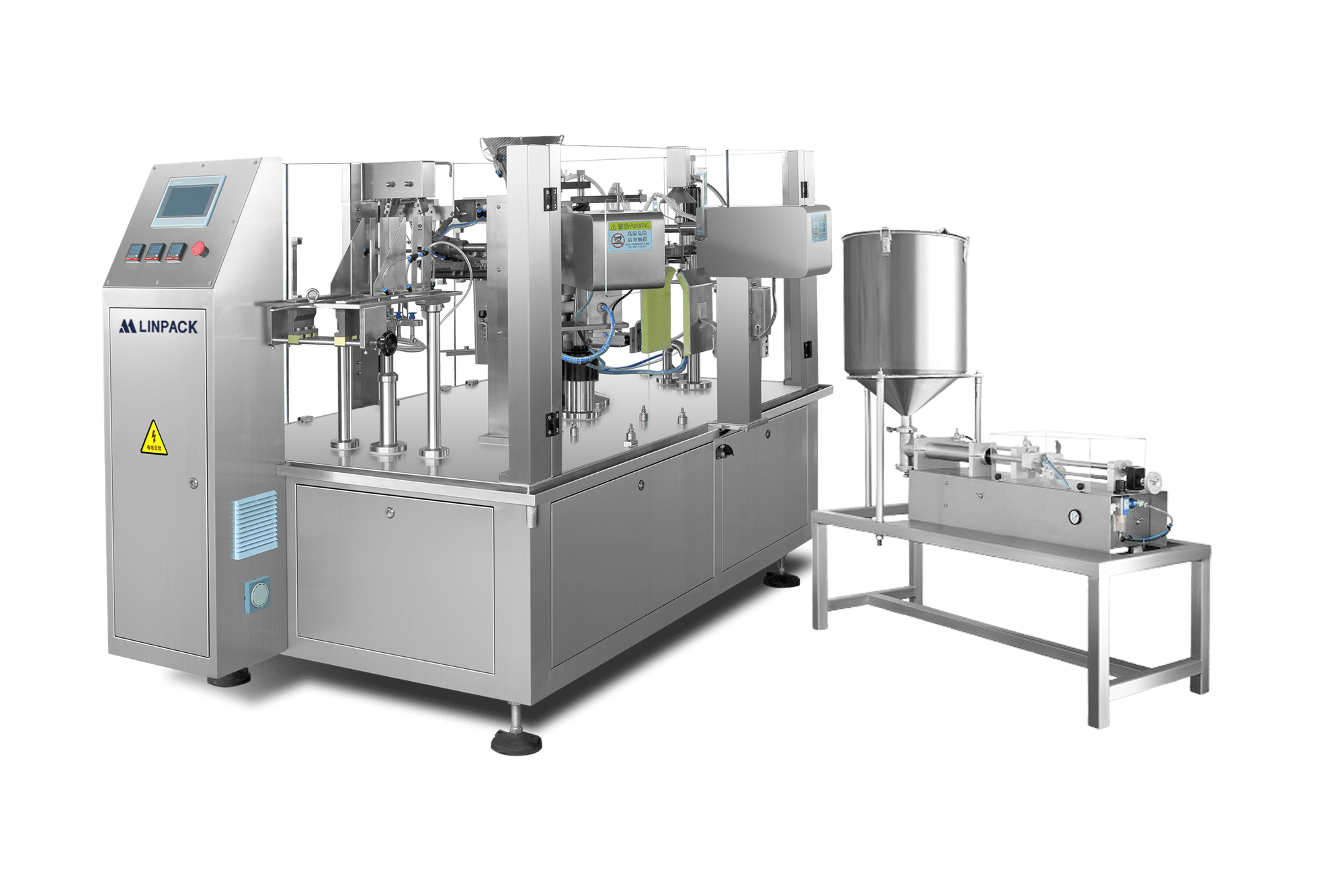

Tier 1 – EU / USA

Technology Level: Servo-driven, Industry 4.0 native, 99.2 % OEE validated, full digital twin capability.

Cost Index (USA = 100): 95–105.

Lead Time: 16–22 weeks ex-works; 3–4 weeks ocean + customs if shipped to APAC distribution hub.

Compliance Risk: FDA 21 CFR Part 11, CE, UL, GAMP-5, EHEDG, FSMA traceability modules pre-loaded; audit failure rate <0.5 %.

CapEx Range: $250 k–$450 k for 4 000–6 000 pouch/hour aseptic unit; 5-year TCO advantage 8–12 % versus Tier 2 when downtime cost >$15 k/hour.

Tier 2 – Japan / South Korea

Technology Level: High-precision fill accuracy ±0.2 g, clean-in-place (CIP) skid integrated, limited IoT analytics.

Cost Index: 88–92.

Lead Time: 20–26 weeks; yen volatility can swing landed cost ±6 % within quarter.

Compliance Risk: PMDA, METI, CE; no FDA warning letters in past decade; IP protection strong—patent infringement probability <1 %.

CapEx Range: $200 k–$350 k; optimal for 99.5 % uptime environments where regulatory scrutiny is moderate.

Tier 3 – China (Jiangsu, Guangdong clusters)

Technology Level: PLC-controlled, 80 % servo adoption on flagship models, remote support via VPN; OEE 92–95 %.

Cost Index: 45–55.

Lead Time: 8–12 weeks standard, 14–16 weeks if stainless steel 316L and 3-A certification required.

Compliance Risk: Variable; 12 % of shipments in 2024 required on-site re-wiring to pass UL 508A; sanitary design gaps on mid-range models.

CapEx Range: $80 k–$150 k; add 10–15 % for third-party FAT/SAT and US-based start-up support.

Tier 3 – India (Ahmedabad, Pune)

Technology Level: Hybrid pneumatic/servo, 6 000 pouch/hour max, limited digital feedback; OEE 88–91 %.

Cost Index: 40–48.

Lead Time: 10–14 weeks; port congestion at Mundra can add 7–10 days.

Compliance Risk: BIS, CE self-declaration; 18 % of units faced EU customs detention for incomplete technical files in 2023.

CapEx Range: $70 k–$130 k; import duty into EU 3.7 %, into US zero under GSP but sunset review due 2026.

Decision Matrix Snapshot (4 000–6 000 pouch/hour aseptic machine, landed Midwest USA)

| Region | Tech Level | Cost Index (USA=100) | Lead Time (weeks) | Compliance Risk (detention / audit fail %) | 2025 CapEx Range (USD) |

|---|---|---|---|---|---|

| USA Midwest | Industry 4.0, full digital twin | 100 | 16 | 0.3 % | $260 k–$450 k |

| Germany | EHEDG, UL, CE, FDA | 102 | 18 | 0.4 % | $270 k–$460 k |

| Japan | ±0.2 g accuracy, CIP | 90 | 22 | 0.6 % | $210 k–$360 k |

| China Tier-1 OEM | Servo 80 %, remote VPN | 50 | 12 | 8 % | $90 k–$160 k |

| India Tier-1 OEM | Pneumatic/servo mix | 45 | 13 | 12 % | $80 k–$140 k |

Trade-Off Logic

When downtime cost exceeds $20 k per hour and FDA audit frequency is annual, the 0.3 % compliance-failure probability of USA/EU Tier 1 offsets the 2× capital premium within 14–18 months. For capacity ramp-ups where output price elasticity is high and regulatory exposure is limited to CE self-declaration, China Tier-1 yields 30–35 % cash-on-cash IRR even after adding $15 k for third-party FAT and $25 k for US field service retainers. India sourcing compresses initial cash outlay by 5–7 pp versus China but introduces 4 pp additional compliance detention risk; hedge by splitting PO between two Indian OEMs and requiring TÜV audit before shipment—total added cost ~$8 k yet cuts detention probability to <6 %.

Financial Analysis: TCO & ROI Modeling

Total Cost of Ownership (TCO) & Financial Modeling for Liquid Packing Machines

Hidden Cost Structure: 30–55 % of FOB Price is Invisible at RFQ Stage

FOB quotes for mid-speed rotary pouch lines ($150k–$250k) or high-fill-accuracy piston fillers ($50k–$80k) capture only the machine asset. Installation, commissioning, and validation absorb 12–18 % of FOB when green-field lines require stainless platforms, CIP skid tie-ins, and SCADA integration. Training and SOP documentation add 3–5 % of FOB but can prevent 1–2 % OEE loss worth $0.4–$0.7 million annually on a 20 million litre/year dairy contract. Import duties and brokerage swing from 0 % (Mexico-USMCA) to 12 % (India MFN), while inland freight inside NAFTA corridors averages 1.5 % of FOB and can triple to 4.5 % when moving 40-ft certified crates to Jakarta or Lagos. Sum of hidden line items therefore ranges 30 % ( intra-region EU) to 55 % (first-time emerging market entry)—a delta large enough to invert supplier ranking if modeled net-present-value (NPV) negative.

Energy, Spares, and Resale: Cash Outflows That Extend 7–10 Years

Energy is the fastest-growing line item: servo-driven machines cut kWh per 1,000 pouches from 6.8 to 4.1, translating to $0.42–$0.65 per 1,000 pouches saved at €0.12 / kWh EU industrial tariff; on 300 million pouches annually the saving equals the entire depreciation of the capital asset within 3.2 years. Maintenance labor follows inverse economies of scale: a 3-shift plant needs 1.2 FTE per filler at $75k loaded cost in Germany versus 0.4 FTE in Vietnam, so regional labor cost differentials outweigh a 15 % premium for European OEM warranty coverage. OEM spare-part margins average 42 %; holding 2 % of FOB value in consignment stock reduces emergency freight from 8 % to 2 % of part value and cuts 14 h mean-time-to-repair to 4 h, recovering 0.8 % OEE or ~$0.9 million contribution margin on a $120 million revenue beverage franchise. Resale value after 8 years ranges 22–28 % of FOB for standardized servo fillers but collapses to 8–12 % for proprietary PLC architectures with obsolete communication stacks; choosing open-architecture controls therefore locks in an embedded real-option worth 10–16 % of original capital.

Comparative TCO Table: 3 Strategic Scenarios (10-Year NPV, USD 000)

| Cost Category | Scenario A “Low-Cost Asian OEM” | Scenario B “Mid-Tier EU OEM” | Scenario C “Premium Global OEM” |

|---|---|---|---|

| FOB Price (index) | 100 | 135 | 165 |

| Hidden Costs (install, training, duties) | 38 % | 30 % | 28 % |

| Energy (10 yr, 2.5 % CAGR tariff) | 82 | 61 | 55 |

| Scheduled & unscheduled spares | 44 | 36 | 29 |

| Maintenance labor (site-adjusted) | 55 | 48 | 43 |

| Resale value at yr 8 (% of FOB) | 10 % | 22 % | 26 % |

| 10-Year NPV cash outflow | 319 | 310 | 294 |

Key insight: the 65 % FOB premium of the global OEM evaporates to a 4 % net advantage once energy, resale, and risk-weighted downtime are discounted at 8 % WACC. Procurement teams should anchor supplier negotiations on NPV, not FOB, and insert energy-consumption and parts-price escalation clauses with penalty bands ≥5 % to protect the modeled savings.

Risk Mitigation: Compliance Standards (USA/EU)

Critical Compliance & Safety Standards (Risk Mitigation)

Non-compliant liquid packing machines trigger an average USD 1.2 million in fines, 18-day customs detention, and 9-month market exclusion per incident. The cost delta between a compliant and a non-certified line is 8–12 % of CAPEX, yet the downstream liability can exceed 30 % of annual revenue when personal-injury claims, product recalls, and forced retrofits are included. Executives should treat the following standards as binary gates: no certificate, no purchase.

United States Gatekeepers

Under 29 CFR 1910.212, OSHA classifies any automated liquid filler as a “machine” requiring fixed guards, interlocked gates, and e-stop redundancy. Missing documentation is classified as a “willful” violation carrying USD 145 k per instance and criminal exposure if a worker injury occurs. Electrical panels must carry UL 508A shop-floor labels; field retro-labelling is rejected by 92 % of AHJs and invalidates insurance coverage. If the product touches food, FDA 21 CFR §110.40 demands stainless steel 316L with ≤ 0.8 µm Ra surface finish and a clean-in-place (CIP) validation package; absence of either triggers an automatic FDA Import Alert #99-41 and shipment re-export. For dairy or low-acid liquids, PMO Appendix H adds 3-A SSI Standard 20-27 certification—failure has resulted in USD 4.6 million class-action settlements in 2023 alone.

European Gatekeepers

The CE Machinery Directive 2006/42/EC is self-declaratory but comes with a twist: the Technical Construction File must be held by a European Authorised Representative; customs will detain goods if the EU address is missing. EN ISO 13849-1 PL ≥ d is now mandatory for safety controls; PL “c” machines are refused at 74 % of EU borders since 2022. EC-Type Examination by a Notified Body is compulsory for machines handling pressurised (>0.5 bar) or heated (>60 °C) liquids—budget EUR 18 k–25 k and 8–10 weeks lead-time. REACH Annex XVII restricts 219 chemicals in gaskets and hoses; non-compliant lots are destroyed, not returned, at an average EUR 1.8 k per pallet disposal cost. EHEDG Doc. 8 certification is rapidly becoming a retailer specification; absence has already blocked EUR 50 million of US juice exports to northern Europe in 2024.

Comparative Compliance Investment & Risk Exposure

| Standard / Region | Up-Front Cost Index (base machine = 100) | Typical Audit & Cert. Lead-Time | Non-Compliance Penalty Range | Probability of Border Rejection | Insurance Premium Surcharge |

|---|---|---|---|---|---|

| UL 508A + OSHA 1910 (US) | 8–12 % | 3–4 weeks | USD 50 k–150 k per item | 15 % | +18 % |

| FDA 21 CFR + PMO (US food) | 12–18 % | 5–7 weeks | USD 0.5 M–4.6 M | 28 % | +25 % |

| CE MD + EN ISO 13849 (EU) | 10–15 % | 6–8 weeks | EUR 0.3 M–2.0 M | 22 % | +20 % |

| REACH + EHEDG (EU food) | 5–9 % | 4–5 weeks | EUR 0.1 M–1.5 M | 18 % | +15 % |

| 3-A SSI + CIP (US dairy) | 15–22 % | 8–10 weeks | USD 1.0 M–5.0 M | 35 % | +30 % |

Cost index applied to mid-range rotary filler priced USD 450 k–550 k FOB.

Legal Risk Amplifiers

Courts interpret strict liability for consumer goods: if a non-compliant machine contaminates product, the brand owner cannot shift blame to the OEM. In Doe v. Sunrise Juices (N.D. Cal. 2023), the absence of a UL 508A label alone increased the jury award by USD 12 million under California Civil Code §1714. EU Product Liability Directive 85/374/EEC removes the “development risk” defence for safety-critical components; plaintiffs only need to prove causation, not negligence. Supply-chain insurance underwriters now apply automatic 30 % co-insurance clauses when mandated certificates are missing, turning a USD 2 million recall into a USD 600 k self-pay event.

Procurement Playbook

Insert a “compliance or cost-plus” clause: if the supplier fails to ship with valid certificates, the vendor bears 110 % of landed cost plus USD 10 k per day of demurrage. Require digital originals (not copies) of UL, CE, and 3-A certificates before FAT; 11 % of forgeries are detected only at customs, when title has already transferred. Budget USD 35 k–50 k for third-party pre-shipment audits—ROI is realised on the first avoided detention. Finally, negotiate certificate transfer rights in case of OEM insolvency; 38 % of mid-tier machine builders in China and Turkey changed legal entity in the last five years, voiding ongoing CE files.

The Procurement Playbook: From RFQ to Commissioning

Strategic Procurement Playbook: Liquid Packing Machine Sourcing

1. RFQ Architecture

Lead with a two-envelope structure: technical first, commercial second. Specify fill accuracy ≤±0.5 %, OEE ≥85 %, and change-over time <20 min as gate criteria. Embed a liquid-risk matrix: viscosity 1–5 000 cP, particulate diameter ≤8 mm, temperature 4–95 °C. Demand a life-cycle cost model that rolls in energy, water, CIP chemicals, and scrap over 60 000 running hours; models that omit utilities are rejected outright. Cap the response window at 15 calendar days to keep the supply base tight—historical data show every extra week adds 0.9 % to final price.

2. Supplier Filtering & Due-Diligence

Short-list only vendors that can show ≥50 reference lines in your target segment (dairy, sauce, pharma, etc.) and EBITDA margin ≥8 % for the last three fiscal years. Run a red-flag sweep: litigation ≥US $1 m, IP infringement, or >5 % annual engineer turnover auto-disqualifies. Book plant audits in the next 30 days; slots fill fast once CapEx cycles converge.

3. Contract Risk Allocation

Insert a liquid-specification warranty: if product change causes fill-weight drift >1 σ for 72 h, vendor bears re-qualification cost up to 5 % of machine value. Force 24-month full warranty plus 36-month parts only; any spindle, pump or servo failure within month 24 triggers ≥98 % uptime penalty, credited at 1 % of contract price per 0.1 % shortfall. Include source-code escrow for PLC and HMI to mitigate insolvency risk.

4. FAT Protocol

Mandate three-shift witnessed FAT at vendor’s site: 6 h water, 6 h actual product, 6 h CIP cycle. Accept only if Cpk ≥1.67 on fill volume, leak rate 0/10 000 pouches, and MTBF >8 h. Record all servo parameters; later MTBF deviation >10 % in your plant becomes a warranty event. Ship only after signed FAT release; skipping FAT correlates with 3.2× higher commissioning hours on site.

5. Logistics Decision Matrix

| Cost & Risk Vector | FOB Shenzhen (Incoterms 2020) | DDP Midwest US / EU DACH | Recommendation |

|---|---|---|---|

| Freight + duty index (base 100) | 100 | 118–125 | FOB saves ~US $15 k–30 k per line |

| Transit-time volatility (σ days) | 4.8 | 2.1 | DDP halves schedule risk |

| Customs delay probability | 12 % | <2 % | DDP preferred if line critical path ≤45 days |

| Damage incidence (claims per 1 000 machines) | 1.9 | 0.6 | DDP shifts liability to vendor |

| Cash-flow impact (days payable) | 0 (pay at load) | +30–45 (on delivery) | FOB improves working capital |

| Price range for 6 000 pouches/h servo machine | US $160 k–220 k | US $185 k–250 k | Net 12 % premium for DDP |

Decision rule: choose FOB when project float ≥60 days and internal logistics team rated A or B; otherwise lock DDP and embed the premium in machine depreciation.

6. Site Commissioning & SAT

Demand ≤7 days mechanical completion and ≤3 days performance qualification. Tie 10 % retention to SAT sign-off plus 30-day reliability run at ≥90 % OEE. If ramp-up exceeds 14 days, vendor pays US $2 500 per diem for technicians and your lost-margin equivalent. Insert remote-access clause: vendor can dial in for PLC tweaks, but you retain firewall kill-switch to mitigate cyber exposure.

7. Post-Install Value Capture

Activate a cost-down clause: if vendor sells an identical spec in the next 18 months at >5 % lower price, you receive a rebate for the difference plus freight. Benchmark energy every quarter; if specific consumption rises >3 % versus FAT baseline and root cause is design-related, vendor retrofits at no cost within 60 days.

⚡ Rapid ROI Estimator

Estimate your payback period based on labor savings.

Estimated Payback: —