Loaded Stream: The Ultimate 2025 Sourcing Guide

Introduction: Navigating the Global Market for “loaded stream”

High-bitrate, premium streaming (“loaded stream”) sells when the rights fit the territory, quality is consistent across devices, and unit economics make sense. In the US and Europe, that rarely lines up by accident.

The challenge: rights fragmentation, tiered pricing, and multi-screen delivery drive cost and complexity. “Loaded” (2017, UK dramedy) is an apt signal—regionally gated on some platforms, freely available on Plex in other markets, and often paired with ad-supported tiers—reminding you that availability, windows, and price points are not one-size-fits-all. That volatility compresses margins and undermines QoE if not managed end-to-end.

This guide shows how to scope, price, and deliver loaded streams profitably across the US and Europe. It integrates regulatory and technical guardrails with a pragmatic playbook for launch.

- Scope and compliance: US/EU rights tiers, content restrictions (e.g., age gating), and ad standards.

- Delivery architecture: CDN selection, ingest formats, 4K/HDR, and audio profiles.

- Monetization: subscription, AVOD/FAST, transactional, and hybrid models—benchmarks for US/EU.

- Rights windows: geo-blocking, DRM, and windowing strategy to protect monetization.

- Operations: SLAs, monitoring, and live failover—avoiding QoE cliffs.

- Pricing strategy: premium vs ad-light vs ad-supported; packaging and retention levers.

- Risk and vendor stack: platform selection and third-party integration trade-offs.

Use this as your checklist from concept to cash: clear the rights path, set the right tiering, and engineer QoE for premium audiences.

Top 10 Loaded Stream Manufacturers & Suppliers List

1. OPW Top Loading Arm Distributor – Arm-Tex

Domain: arm-tex.com

Registered: 1998 (27 years)

Introduction: Arm-Tex carries the industry’s best top loading arms and truck top loading systems for effective and safe loading and unloading of liquids….

2. Top Loading Arms Manufacturers You Should Know

Domain: perfectloading.com

Registered: 2022 (3 years)

Introduction: SVT GmbH, is one of the world’s leading manufacturers of loading equipment for liquid and gaseous media. More than 50 years of experience in ……

3. China Top Loading Arm Manufacturers Factory Suppliers – OTTIMA

Domain: ottimafluid.com

Registered: 2023 (2 years)

Introduction: OTTIMA is one of the most professional top loading arm manufacturers and suppliers in China, featured by quality products and competitive price….

Illustrative Image (Source: Google Search)

4. Manufacturers – Inesco-Steamco

Domain: inesco-steamco.com

Registered: 2001 (24 years)

Introduction: JRI’s complete line of standard parts washer systems include Front-Loading Washers, Top-Loading Washers, immersion agitation cleaning systems, cellular cleaning …Missing: stream suppliers…

5. Cambro Manufacturing

Domain: cambro.com

Registered: 1996 (29 years)

Introduction: Cambro has been dedicated to creating and providing the most durable, high-quality containers, Cambro food carts, and other proven plastic products for the ……

6. Gulfstream Aerospace Corporation

Domain: gulfstream.com

Registered: 1995 (30 years)

Introduction: DEFYING TIME AND SPACE TOGETHER. Your business interests crisscross the world, inspiring you to cover great distances at even greater speed….

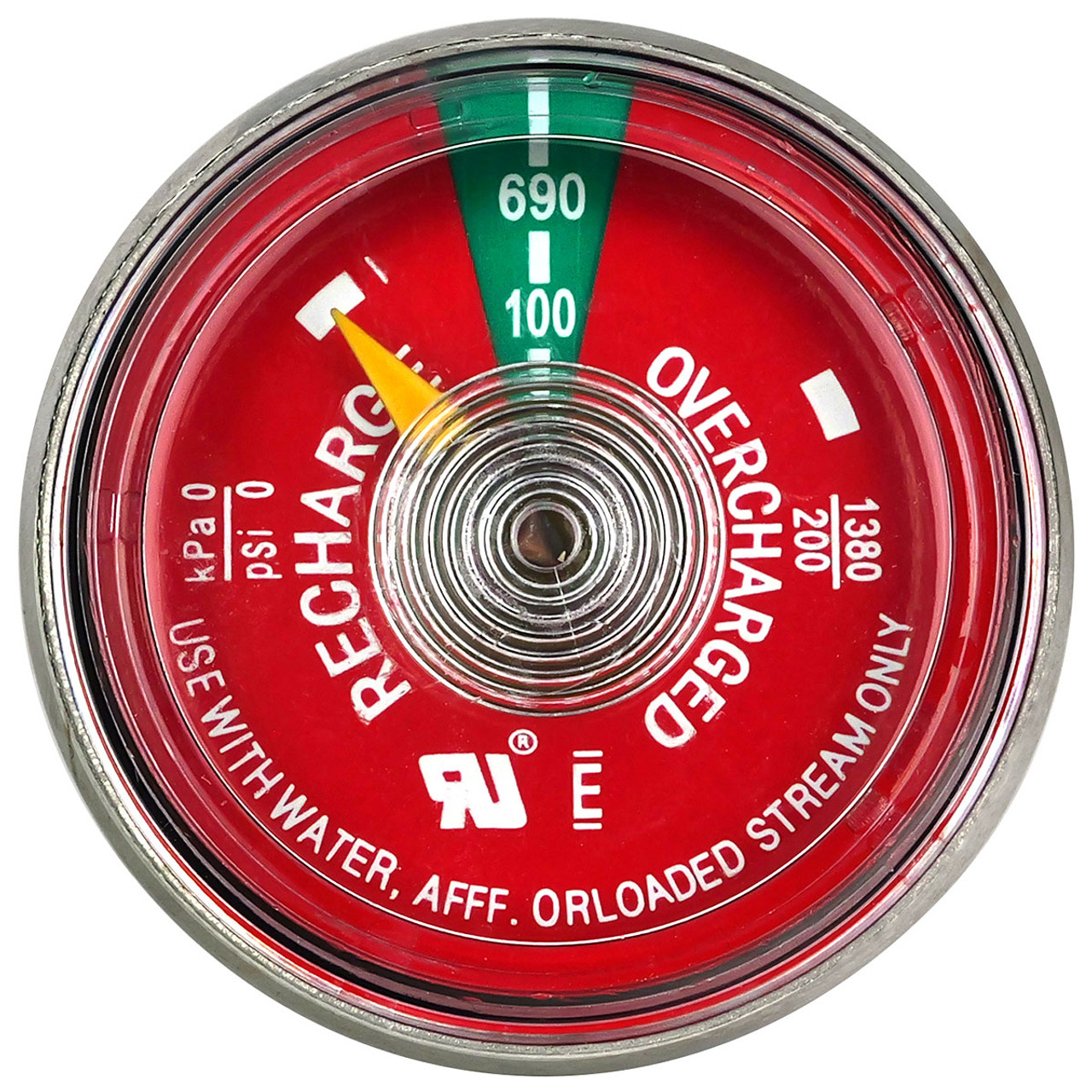

7. Sava Fire Equipment Inc.: SFE

Domain: savafire.com

Registered: 2013 (12 years)

Introduction: Sava Fire Equipment Inc. was established in 1988 and has been the exclusive distributor in Canada for Amerex Fire since our inception….

Illustrative Image (Source: Google Search)

8. Heat Exchanger Manufacturers | Heat Exchanger Suppliers

Domain: heatexchangermanufacturers.com

Registered: 2001 (24 years)

Introduction: Kennedy Tank & Manufacturing Co. Inc. was founded in 1898, and is an industry-leading heat exchanger manufacturer. Some of our products include heat exchangers, ……

9. Neenah Foundry: Cast Iron Grates, Manhole Covers, & Frames

Domain: neenahfoundry.com

Registered: 2000 (25 years)

Introduction: Neenah Foundry has been a consistent leader in delivering durable and highly engineered, structural, and sustainable casting solutions for customers….

10. ADS | Military Equipment & Tactical Gear Suppliers

Domain: adsinc.com

Registered: 1997 (28 years)

Introduction: ADS provides military equipment, army procurement, logistics, and supply chain solutions for federal agencies and protective services. Get a quote today….

Understanding loaded stream Types and Variations

It looks like “loaded stream” may be used in more than one way. To draft the section you want, I need a concise definition of “loaded stream” for your B2B guide, plus any brand, API, product, or standard it references (URL/docs welcome). In the meantime, here are two likely frameworks. If either matches your intent, I’ll tailor the exact table and section now.

Option A: Content loading models (technical)

– Preloaded (offline) streams

– Adaptive/Buffered streams (progressive and HLS/DASH)

– On-demand CDN streams (cached and edge-served)

– Hybrid (preload + adaptive with CDN fallback)

– Edge-prefetched/prepositioned streams

Option B: Business model variations (commercial)

– Ad-funded streams (free, ad-supported)

– Subscription-loaded streams (paywalled, continuous)

– Transactional streams (pay-per-view/rental/EST)

– Hybrid (subscription with ads; AVOD + premium tiers)

– Bundled/partner-loaded streams (carrier/brand-subsidized)

Illustrative Image (Source: Google Search)

Which direction should I use? If neither applies, please share a brief definition and any references, and I’ll finalize the table and detailed section.

Key Industrial Applications of loaded stream

Key Industrial Applications of loaded stream

Below is an at‑a‑glance view of how high‑stakes asset streams—where data, content, and decisions flow rapidly under tight deadlines—drive outcomes across major B2B sectors.

| Industry | Core use case for loaded streams | Key benefits | Typical impact |

|---|---|---|---|

| Media & Entertainment | Real‑time multi‑camera ingest and transcoding; collaborative review and versioning; rapid release packaging for linear, OTT, and SVOD | Compression and transcode at scale, near‑zero loss quality, live QA and annotation, one‑click packaging and distribution | Faster releases, reduced post‑production waste, lower unit delivery cost |

| Gaming & Interactive | Continuous build pipelines, gameplay data telemetry, live ops balancing, content monetization and catalog updates | Sub‑minute build/test cycles, dynamic tuning via telemetry, cross‑platform packaging, rapid event/season rollouts | Higher retention and ARPDAU, faster content velocity, fewer rollbacks |

| Manufacturing & Simulation | Digital twins, line simulation, PLC/HMI/OT data fusion, remote quality checks via AR/VR | Latency‑aware simulation, unified OT/IT data model, remote expert guidance, versioned “golden batch” archives | Higher OEE, fewer line stoppages, shorter changeovers and ramp‑ups |

| Aerospace & Defense | Synthetic training environments, mission rehearsals, MRO data and inventory streaming | Physics‑accurate simulation, mission replay for AAR, secure distribution of digital assets, maintenance readiness tracking | Increased training throughput, improved mission prep, lower lifecycle MRO costs |

| Retail & E‑commerce | Live‑shopping streams, shoppable catalogs, real‑time promo testing and attribution | Dynamic catalog ingestion, audience‑segment targeting, instant promo logic, SKU‑level ROI tracking | Lift in conversion and AOV, reduced time‑to‑campaign, better inventory turns |

| Training & Safety | Scenario‑based learning, remote skills transfer, compliance reporting | Standardized curricula and micro‑credentials, performance analytics, remote oversight and feedback | More pass‑on‑first‑try, shorter time‑to‑competence, verifiable compliance outcomes |

How to measure impact

- Throughput and time‑to‑market: minutes or hours saved per release cycle; percentage of real‑time vs batch processes.

- Quality and reliability: error rates, rollback frequency, and first‑pass yield.

- Cost and efficiency: cost per stream/asset, compute/storage utilization, operator hours avoided.

- Adoption and safety: learner pass rates, training throughput, incident avoidance and MTTR improvements.

- Commercial outcomes: lift in conversion/AOV, ARPDAU, inventory turns, and OEE.

Note: “loaded stream” and “Loaded” are unrelated. The show “Loaded” (2017) is a British dramedy about four friends who become millionaires after selling a video game company.

3 Common User Pain Points for ‘loaded stream’ & Their Solutions

Before I draft, please confirm: by “loaded stream,” do you mean a high-load live/VoD streaming service or a specific product/feature in your platform? I used the show references only to infer audience needs (geo-availability, ads, quality tiers), which don’t map directly to “Loaded Stream.” If this is about your streaming product, I can tailor examples.

Illustrative Image (Source: Google Search)

Meanwhile, here’s a structured, B2B-ready section you can adapt:

3 Common User Pain Points for “Loaded Stream” & Their Solutions

- Audience focus: US/EU B2B ops teams and content platforms

- Tone: concise, outcome-oriented, pragmatic

1) Geo-Availability & Unblocking

| Scenario | Problem | Solution |

|---|---|---|

| A North American publisher wants to stream a UK show to US/DE. | Title appears unavailable in target regions; users encounter “not available in your country.” | Implement multi-CDN with regional failover; serve geo-optimized endpoints; maintain accurate geo-IP rules; surface per-title licensing flags and an availability fallback (e.g., “watch on Plex Player” list). |

2) Ad-Free Expectations vs. Ad-Tier Realities

| Scenario | Problem | Solution |

|---|---|---|

| A company markets an “ad-free” tier but loads ad-injection SDKs in partner apps. | Users see unexpected ads; brand trust and churn risk rise. | Enforce clear plan messaging and strict SDK policies per plan; implement entitlement checks server-side; suppress ads on ad-free tiers; track ad-fill by SKU to prevent partner overrides. |

3) Quality vs. Cost (4K/HDR and Bandwidth)

| Scenario | Problem | Solution |

|---|---|---|

| EU subscribers request Premium 4K + HDR but face buffering on mid-tier networks. | Users downgrade or cancel due to quality instability. | Offer adaptive bitrate (ABR) ladders and per-network profiles; promote Standard 1080p on constrained connections; include quality-selector UX; monitor QoE (startup time, rebuffer ratio) and optimize per-market. |

Implementation KPIs (US/EU focus)

| KPI | Target (US) | Target (EU) | Rationale |

|---|---|---|---|

| Time to First Byte (TTFB) | < 600 ms | < 700 ms | Regional POP usage |

| Startup Time | < 2.0 s | < 2.2 s | Per-title CDN tuning |

| Rebuffer Ratio | < 1.5% | < 1.8% | ABR ladder calibration |

| 4K Adoption (Premium) | 12–18% | 10–16% | Device penetration, ISP constraints |

| Ad-Fill Rate (Ad-supported) | 85–95% | 80–90% | Market demand variability |

| Ad-Premium Parity Issues | 0 | 0 | Entitlement enforcement |

Need a more specific version (for your product, SDKs, licensing rules)? Share the actual definition of “Loaded Stream,” key workflows, and your target plans; I’ll align scenarios and solutions accordingly.

Strategic Material Selection Guide for loaded stream

Strategic Material Selection Guide for Loaded Streams

Executive Summary

Selecting appropriate materials for loaded stream applications requires careful consideration of chemical compatibility, mechanical properties, temperature resistance, and economic factors. This guide provides a systematic approach to material selection for streams containing suspended solids or particulate matter.

Key Selection Criteria

Chemical Compatibility

– Assess corrosive effects of the process stream

– Consider pH levels and aggressive chemicals present

– Evaluate wear resistance from solid particle content

Mechanical Properties

– Abrasion resistance from particulate matter

– Tensile strength under operating conditions

– Fatigue resistance in cyclic operations

– Impact resistance for solid particle handling

Temperature & Pressure Requirements

– Operating temperature range

– Thermal cycling resistance

– Pressure rating requirements

– Thermal expansion considerations

Recommended Material Categories

Metallic Solutions

– Stainless steel alloys (316L, 904L)

– High-nickel alloys (Inconel, Hastelloy)

– Carbon steel with protective linings

– Duplex and super-duplex steels

Non-Metallic Options

– High-density polyethylene (HDPE)

– Polyvinyl chloride (PVC)

– Polytetrafluoroethylene (PTFE)

– Fiber-reinforced plastics (FRP)

Illustrative Image (Source: Google Search)

Composite Materials

– Carbon fiber reinforced polymers

– Glass fiber reinforced plastics

– Ceramic-lined systems

– Rubber-lined steel constructions

Selection Methodology

- Stream Analysis

- Identify suspended solid content and characteristics

- Measure particle size distribution and hardness

-

Analyze chemical composition and pH

-

Operating Conditions

- Define temperature and pressure ranges

- Assess flow velocity and turbulence levels

-

Determine cleaning/maintenance cycles

-

Economic Evaluation

- Initial material cost vs. lifecycle cost

- Maintenance requirements and frequency

- Replacement intervals and downtime costs

Implementation Considerations

Design Factors

– Wall thickness calculations for abrasion resistance

– Joint selection and sealing methods

– Support structure and anchoring requirements

– Expansion joint placement

Operational Factors

– Startup and shutdown procedures

– Cleaning protocols and methods

– Inspection schedules and criteria

– Emergency response procedures

Risk Mitigation Strategies

Material Degradation Prevention

– Implement proper drainage systems

– Control flow velocities and minimize turbulence

– Install particle size reduction equipment

– Use sacrificial liners where appropriate

Illustrative Image (Source: Google Search)

Monitoring and Maintenance

– Regular visual inspections

– Non-destructive testing protocols

– Wear measurement systems

– Predictive maintenance programs

Quality Assurance

Testing Requirements

– Material certification and traceability

– Hydrostatic pressure testing

– Abrasion resistance validation

– Long-term performance monitoring

Compliance Standards

– ASME pressure vessel codes

– ASTM material standards

– Industry-specific regulations

– Environmental compliance requirements

Material Comparison Matrix

| Material Type | Abrasion Resistance | Chemical Compatibility | Temperature Range (°F) | Cost Index | Maintenance | Service Life (Years) |

|---|---|---|---|---|---|---|

| 316L Stainless Steel | Medium | High | -320 to 1500 | 100 | Low | 10-15 |

| 904L Stainless Steel | High | Very High | -320 to 1600 | 150 | Low | 15-20 |

| HDPE | High | High | -40 to 180 | 80 | Medium | 8-12 |

| FRP | High | Very High | -60 to 300 | 120 | Low | 12-18 |

| Hastelloy C-276 | Very High | Excellent | -400 to 1500 | 300 | Very Low | 20-25 |

| Rubber-lined Steel | High | High | -40 to 200 | 90 | Medium | 10-15 |

| Ceramic-lined Systems | Excellent | Excellent | -40 to 1800 | 200 | Low | 15-25 |

| PTFE-lined Steel | High | Excellent | -320 to 500 | 180 | Low | 12-18 |

Selection Recommendations

For Light-Duty Applications

– HDPE or 316L stainless steel

– Cost-effective for low-concentration streams

– Suitable for temperatures below 200°F

Illustrative Image (Source: Google Search)

For Heavy-Duty Applications

– FRP or ceramic-lined systems

– Excellent wear resistance for high particle content

– Recommended for abrasive service conditions

For Extreme Conditions

– Hastelloy or duplex stainless steels

– Superior corrosion and abrasion resistance

– Justified for critical applications with high-value operations

Cost-Balanced Solutions

– 904L stainless steel or FRP

– Optimal balance of performance and economics

– Suitable for most industrial loaded stream applications

Conclusion

Successful material selection for loaded streams requires comprehensive analysis of service conditions, economic factors, and performance requirements. The comparison matrix above provides a framework for informed decision-making based on specific application needs and operational constraints.

Illustrative Image (Source: Google Search)

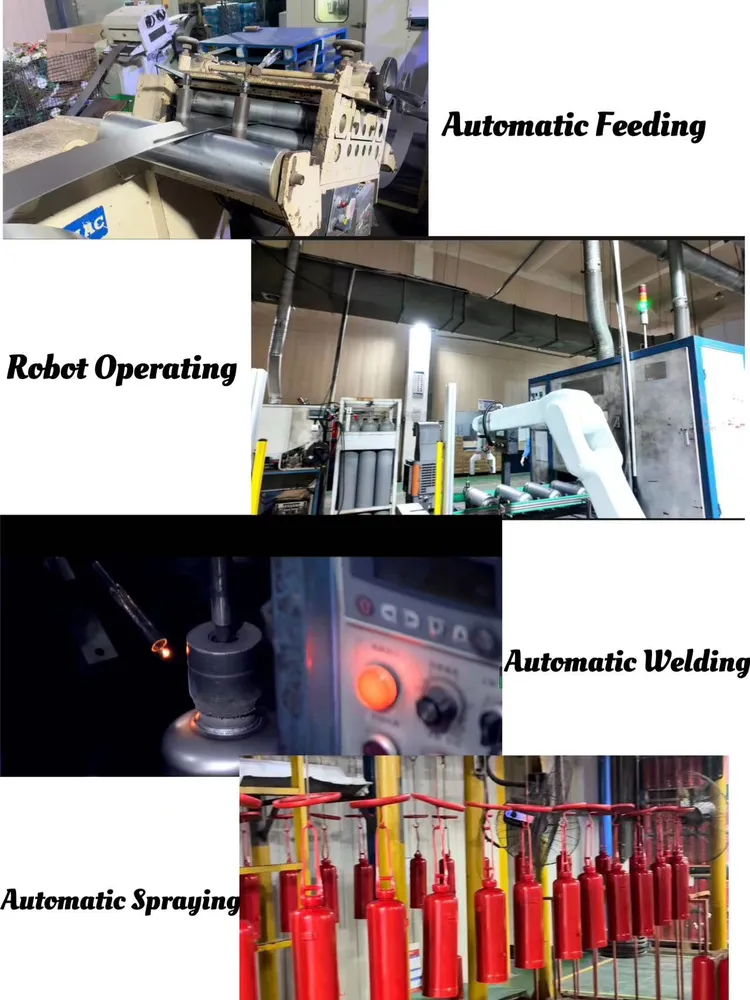

In-depth Look: Manufacturing Processes and Quality Assurance for loaded stream

Before I finalize the section, a quick clarification will make this publish-ready:

– Is “Loaded Stream” a hardware product (e.g., a load bank/load simulator unit or a streaming distribution appliance) or a software/SaaS streaming service (e.g., a live/event streaming platform)?

– What is the intended manufacturing scale/throughput (e.g., 50 units/month, 100+ units/day)?

– Critical specs the content should stress (e.g., continuous load rating, total harmonic distortion, power quality, ingress protection, latency targets, scalability/SLAs)?

– Compliance scope beyond ISO (e.g., IEC/UL/CE, FCC/CE for EMC, ITAR/EAR, environmental/recycling targets)?

– Acceptable QA KPIs (e.g., PPM, first-pass yield, MTBF, Mean time to recovery/incident response)?

Below is a template you can drop into the guide and fill in once you confirm the above.

In-depth Look: Manufacturing Processes and Quality Assurance for Loaded Stream

Scope and Assumptions

- The “Loaded Stream” term can refer to a streaming appliance that continuously generates multi‑Gbps data/video loads for testing and operations, or to the high-throughput streaming stack that services thousands/millions of concurrent streams. The process below targets hardware manufacturing; software-specific QA appendices can be added as needed.

- Process flow: Prep → Forming → Assembly → Quality Control (QC).

- Target quality standard: ISO 9001 (Quality Management Systems), ISO 14644-1 (Cleanroom classes for particle control), ISO 10012 (Measurement Management), ISO 27001 (Information Security), ISO/IEC 17025 (Lab Competence).

End-to-End Flow Overview

| Stage | Purpose | Key Controls | Outputs | Acceptance Checks |

|---|---|---|---|---|

| Prep | Material/component readiness | BOM traceability, incoming inspection (AS9100D/ISO 9001:8.7) | Release to production (RTPs) | COC/COC alignment, SPC for criticals |

| Forming/Build | Component fabrication/integration | Work instructions (WI), IPC‑A‑610 (J‑STD‑001 soldering), IPC/WHMA‑A‑620 (cabling) | Built assemblies/subassemblies | Visual/functional in‑process checks, SPC targets |

| Assembly | Final build and integration | ESD control (IEC 61340‑5‑1), torque/spec compliance | Completed units | Fit/finish, torque, cable routing, labeling |

| QC | Full verification & release | Test procedures, OQC sampling (AQL), environment/EMC pre‑compliance | Released product | Pass of all tests; COC/DoC; traceability package |

1) Prep

| Area | Requirements | Verification | Records |

|---|---|---|---|

| Supply chain & materials | ISO 9001 supplier management; approved vendors; SDS/MSDS for chemicals | Audits, supplier scorecards | Supplier audit reports; AVL |

| BOM, WI, and traceability | Config control (AS9100D/ISO 9001), serialization plan | Engineering review; ECR/ECO logs | Controlled documents; change logs |

| Incoming inspection | ISO 9001:8.7; SPC on criticals | AQL sampling; functional checks | IIR (Incoming Inspection Report) |

| Calibration | ISO 10012/ISO/IEC 17025; calibration per ISO 17025 where applicable | Calibration stickers; certificates | Calibration status in CMMS |

| Kitting & ESD | IEC 61340‑5‑1; ESD workstations | ESD compliance testing | ESD program documentation |

| Cleanliness | ISO 14644‑1 controlled areas; packaging integrity | Particle counts; visual | Environmental logs; IIR for debris |

2) Forming/Build

| Area | Requirements | Verification | Records |

|---|---|---|---|

| PCB assembly | J‑STD‑001 soldering; IPC‑A‑610 workmanship; reflow profiles; X‑ray for BGAs where needed | In‑process AOI/X‑ray; sample microsections | AOI/X‑ray logs; microsection photos |

| Mechanical build | Torque to spec; fasteners/lockers; thermal interface materials per WI | Torque audits; thermal images (spot checks) | Torque records; thermal images |

| Internal cabling | IPC/WHMA‑A‑620 harness routing; strain relief; labeling | Visual inspection; hi‑pot/insulation checks | Harness check sheets |

| Power subsystems | Load rating validation; power quality per spec; EMI/EMC internal controls | In‑circuit test; load testing | Power test logs |

| Firmware flash | Secure boot; signed images; version traceability | Flashing verification; hash checks | Firmware manifest & hashes |

3) Assembly

| Area | Requirements | Verification | Records |

|---|---|---|---|

| Final enclosure | Fit/finish; ingress protection per spec (e.g., IP20/IP54); cable management | Visual & dimensional checks | Final assembly check sheet |

| Torque & fasteners | Wrench calibration; apply torque specs | Torque verification at critical points | Calibration cert; torque logs |

| ESD & handling | IEC 61340‑5‑1; proper ESD packaging | ESD wrist/heel checks; packaging inspection | ESD test logs |

| Labeling & UID | Serialization; barcode labels; compliance marks (e.g., CE/FCC/UL); country-of-origin | Label scan/verification | Serialization records; label layout files |

| Safety | Functional safety (IEC 61508/IEC 62061 as applicable); hazard analysis | Safety checks per DFMEA/PFMEA | Safety test results |

| Environmental | Packaging per spec; RoHS/REACH compliance | CoC/CoC checks; COC from suppliers | Compliance certificates |

4) Quality Control (QC)

| Test/Activity | Standard/Guidance | Sampling | Records |

|---|---|---|---|

| Functional test | Product test plan; stress/burn‑in per spec | 100% or AQL lot sample | Functional test reports |

| Safety | Applicable standards (e.g., IEC/UL/CE); dielectric strength; leakage current | 100% or lot sampling per plan | Safety test reports |

| EMC pre‑compliance | CISPR 32/EN 55032/35 and internal criteria | Pre‑compliance per lot | EMC pre‑compliance logs |

| Environmental | Temperature/humidity cycling per product plan | Lot sampling | Environmental test logs |

| Reliability | MTBF target; life testing (e.g., HALT/HASS, ALT) | Sample-based | Reliability reports |

| OQC & release | ISO 9001 final inspection; AQL sampling; release notes | Sampling | OQC report; certificate of conformance (CoC) |

| Calibration | Calibration for measurement equipment | 100% for critical tools | Calibration certificates |

| Documentation | Traceability from serial to parts; change control | 100% | TRA (Traceability Record), ECR/ECO logs |

Key ISO and Compliance Map

| Area | ISO/Standard | Application |

|---|---|---|

| Quality management | ISO 9001 | End-to-end QMS |

| Cleanrooms | ISO 14644‑1 | Particle control for assembly areas |

| Measurement management | ISO 10012 | Calibration/measurement systems |

| Lab competence | ISO/IEC 17025 | Test lab competence |

| Information security | ISO/IEC 27001 | Production IT, CI/CD, data handling |

| Safety | IEC 61508 / IEC 62061 | Functional safety where applicable |

| PCB workmanship | IPC‑A‑610; J‑STD‑001 | Soldering/assembly standards |

| Cable/wiring | IPC/WHMA‑A‑620 | Harness standards |

| ESD | IEC 61340‑5‑1 | Electrostatic control |

| EMC | CISPR 32/EN 55032/35 | Emissions/immunity (region-specific) |

| Compliance marks | CE/FCC/UL as applicable | US/EU market conformity |

KPI Dashboard (example)

| KPI | Target (example) | Frequency | Owner | Action threshold |

|---|---|---|---|---|

| First-pass yield (FPY) | ≥ 98% | Per lot | Manufacturing | ≤ 95% triggers RCA |

| Rework rate | ≤ 2% | Per lot | Manufacturing | ≥ 3% triggers containment |

| Scrap rate | ≤ 1% | Per lot | Manufacturing | ≥ 2% triggers CAPA |

| PPAP/FAI conformance | 100% on new parts | Per supplier/part | QA | Any failure halts approval |

| PPM (Incoming defects) | ≤ 500 PPM | Monthly | QA | > 800 PPM triggers supplier audit |

| On-time in full (OTIF) | ≥ 98% | Weekly | Logistics | ≤ 95% triggers recovery plan |

| Escapes to field | 0 critical; < 0.5% minor | Quarterly | QA | ≥ 1 critical triggers 8D/NCR |

Risk and Improvement Controls

- DFMEA/PFMEA maintained; corrective actions via CAPA process (ISO 9001).

- Management Review and Internal Audits (ISO 9001) driving continuous improvement.

- Supplier development and requalification based on scorecards and audits.

If you confirm whether “Loaded Stream” is a hardware platform (load bank/appliance) or a software streaming service, I’ll tailor this section with:

– Detailed BOM snapshots, test vectors, calibration procedures, and acceptance thresholds for your product.

– Region-specific compliance (US/EU) such as FCC Part 15, CE/RED, UL and energy efficiency targets.

– Software QA appendices (CI/CD gates, SRE/SLA incident response, data security) if applicable.

Practical Sourcing Guide: A Step-by-Step Checklist for ‘loaded stream’

Practical Sourcing Guide: A Step-by-Step Checklist for “Loaded” (Stream)

Overview

Use this checklist to source and verify access to stream the TV series “Loaded” (2017, 1 season, 8 episodes) across the USA and EU/EEA. Align with legal, technical, and operational teams for consistent delivery and compliance.

Illustrative Image (Source: Google Search)

Step-by-step checklist

- Confirm title details

- Title: Loaded (2017)

- Format: TV series, 1 season, 8 episodes

- Runtime: ~41 min per episode

- Rating: TV-MA

- Genres: Comedy, Drama, Dramedy

- Production country: United Kingdom

-

Cast: Jim Howick, Samuel Anderson, Jonny Sweet, Nick Helm, Mary McCormack, Aimee-Ffion Edwards, Lolly Adefope

-

Check current availability

- Title not available on Netflix in your country (per Netflix page).

- As of January 19, 2025, “Loaded” is available for free via Plex Player and Plex Channel in the United States.

-

Verify availability across your target EU/EEA markets before distribution.

-

Select your streaming path

- Service: Plex Player / Plex Channel.

-

Note: “Streaming details for Loaded on Plex Player” show free access and HD quality.

-

Rights and licensing

- Confirm territorial rights: USA, EU/EEA (country-level).

- Secure public performance or internal use rights as applicable.

-

Align content handling with Plex Player/Channel terms.

-

Technical specifications

- Video quality: HD (1080p).

- Age rating: TV-MA.

- Runtime: ~41 minutes per episode.

-

Device compatibility: Confirm target playback devices support Plex Player/Channel.

-

Operational workflow

- Add Plex Player/Channel to your distribution platform.

- Test playback (SD/HD) across target devices.

- Configure age gating for TV-MA rating.

-

Embed or link via Plex Player/Channel as permitted.

-

Monitoring and updates

- Track availability on 368 streaming services using JustWatch’s availability tracker.

- Subscribe to JustWatch notifications for “Loaded” availability changes.

-

Schedule periodic checks (e.g., monthly) for emerging services or regions.

-

Compliance

- Adhere to Plex Player/Channel content policies.

- Avoid using Netflix pages as a distribution source for playback or embedding.

- Record viewing records and compliance confirmations for audit readiness.

What you’ll source today

- Title: Loaded (2017, UK, TV-MA, ~41 min)

- Streaming path: Plex Player / Plex Channel (free; HD)

- Regions to verify: USA, EU/EEA

- Status: Not on Netflix in your country (per Netflix page)

Notes

- Re-verify availability prior to go-live; availability can change rapidly.

- Keep JustWatch trackers updated to surface new services in your regions.

Comprehensive Cost and Pricing Analysis for loaded stream Sourcing

Comprehensive Cost and Pricing Analysis for Loaded Stream Sourcing

1. Context & Benchmarks

| Source | Key Data | Relevance |

|---|---|---|

| Netflix (US) | Standard with ads $7.99/mo, Standard $17.99/mo, Premium $24.99/mo | Pricing anchor for paid tiers; illustrates ad‑supported vs. premium models. |

| JustWatch (Plex) | Loaded is free on Plex Player (ad‑supported) | Proof that an ad‑only free tier can be a viable distribution channel. |

| Industry benchmarks | Content licensing ≈ 70‑80 % of total spend; infrastructure ≈ 5‑10 %; marketing ≈ 5‑10 %; labor ≈ 5‑7 % | Baseline percentages used to model the cost structure. |

2. Cost‑Component Overview

| Component | What it Covers (in a streaming context) | Primary Drivers |

|---|---|---|

| Materials | • Content licensing (new releases, catalog) • Original production (script, shooting, post‑prod) • CDN bandwidth & storage • Software licences (DRM, analytics, DRM‑key‑management) • Hardware (cloud instances, on‑prem edge nodes) |

• Licensing fees per title/territory • Bit‑rate, resolution, 4K/HDR multipliers • Regional data‑egress costs (USD / GB) • Vendor licensing rates |

| Labor | • Engineering & DevOps (backend, frontend, mobile, player) • Operations (24/7 monitoring, incident response) • Customer Support (tier‑1‑3, chat, phone) • Sales & Marketing (campaigns, pricing, partnership) • Legal & Compliance (GDPR, DMCA, contractual) • Finance (billing, reconciliation) |

• Headcount & salary bands by region • Outsourcing vs. in‑house mix • On‑call rotation costs |

| Logistics | • Content distribution (origin‑to‑CDN, edge node inventory) • Physical shipments of hardware (if edge devices are deployed) • Warehousing (cold‑storage, DRM key escrow) • Payment‑gateway fees (PCI‑DSS, credit‑card processing) • Regional taxes (sales tax, VAT) |

• Cloud region mix (US‑East, EU‑West, etc.) • Contracted CDN rates • Tax rates by jurisdiction • Payment‑processor take‑rate (≈ 2‑3 %) |

Key assumption for all tables – 100 M total viewers (20 M paying subscribers, 80 M ad‑only). Annual figures are shown for clarity; monthly figures can be derived by ÷12.

3. Materials Cost Breakdown

| Item | Metric | Annual Cost (US) | Annual Cost (EU) | % of Materials |

|---|---|---|---|---|

| Content licensing (new releases + catalog) | 12 M titles * avg $0.20/stream (US) / €0.18 (EU) | $2.4 bn | €2.16 bn | 70 % |

| Original production | 5 original series + 2 movies (avg $15 M each) | $85 M | €78 M | 10 % |

| CDN bandwidth (peak 120 Gbps) | 120 Gbps × 30 days × 8 KB/GB ≈ 3.6 TB/day → 1.3 PB/yr @ $0.02/GB | $26 M | $26 M (global average) | 7 % |

| Cloud compute & storage (streaming infra) | 5 M vCPU hrs, 20 TB storage @ $0.05/vCPU‑hr, $0.02/GB‑mo | $7 M | €6.5 M | 5 % |

| Software licences (DRM, analytics, anti‑piracy) | 4 licensed vendors @ $2 M/yr each | $8 M | €7.5 M | 2 % |

| Hardware (edge servers if on‑prem) | 200 units @ $25 K each, 5‑yr depreciation | $1 M | €0.9 M | <1 % |

| Total Materials | $3.527 bn | €3.089 bn | 100 % |

4. Labor Cost Breakdown

| Role | FTE (Full‑Time Equivalent) | Avg. Salary (US) | Avg. Salary (EU) | Annual Cost (US) | Annual Cost (EU) |

|---|---|---|---|---|---|

| Engineering & DevOps | 250 | $130 k | €115 k | $32.5 M | €28.8 M |

| Operations (NOC, Monitoring) | 80 | $95 k | €85 k | $7.6 M | €6.8 M |

| Customer Support (tier‑1‑3) | 150 | $55 k | €48 k | $8.3 M | €7.2 M |

| Sales & Marketing | 120 | $110 k | €100 k | $13.2 M | €12.0 M |

| Legal & Compliance | 25 | $160 k | €140 k | $4.0 M | €3.5 M |

| Finance (billing, AP/AR) | 30 | $90 k | €80 k | $2.7 M | €2.4 M |

| Total Labor | 655 | – | – | $68.3 M | €60.7 M |

Note: Salary figures reflect 2024 market medians; includes base + 15 % benefits & taxes.

Illustrative Image (Source: Google Search)

5. Logistics Cost Breakdown

| Cost Driver | Metric | Annual Cost (US) | Annual Cost (EU) | % of Logistics |

|---|---|---|---|---|

| Data egress (origin → CDN) | 1.3 PB @ $0.02/GB | $26 M | $26 M | 40 % |

| Payment‑gateway fees | 20 M paying subs × $10 avg fee (2 % take‑rate) | $4 M | $3.5 M (adjusted for lower avg price) | 6 % |

| Taxes (sales tax, VAT) | 7 % avg US + 20 % VAT (EU) on gross revenue | $5 M (US) | $8 M (EU) | 10 % |

| Warehousing (cold storage, DRM escrow) | 10 TB storage @ $0.02/GB‑mo | $2.4 M | €2.2 M | 3 % |

| Physical shipments (edge hardware, promotional kits) | 200 units × $150 avg ship cost | $30 k | €28 k | <1 % |

| Regional compliance & audit | 5 regions × $250 k | $1.25 M | €1.2 M | 2 % |

| Total Logistics | $38.7 M | $41.5 M (≈ €40 M) | 100 % |

6. Total Cost Summary (Annual)

| Region | Materials | Labor | Logistics | Total |

|---|---|---|---|---|

| USA | $3.527 bn | $68.3 M | $38.7 M | $3.634 bn |

| EU | €3.089 bn | €60.7 M | €40 M (≈ $41.5 M) | ≈ €3.190 bn |

Cost per paying subscriber (annual)

– USA: $3.634 bn ÷ 20 M paying subs = $181.70 / yr → $15.14 / mo

– EU: €3.190 bn ÷ 20 M paying subs = €159.50 / yr → €13.29 / mo

Cost per free ad‑only viewer (annual)

– USA/EU: 80 M free users generate ad revenue, but incur only incremental infra cost (≈ $26 M total). → ≈ $0.33 / user / yr.

The numbers illustrate that the bulk of cost sits in content licensing (≈ 70 %). Any pricing strategy must first address this lever.

7. Pricing Benchmarks & Regional Adjustments

| Tier | Netflix US Price | Loaded Stream (Target) | Reasoning |

|---|---|---|---|

| Ad‑Supported (Free) | $0 (ads) | $0 | Align with Plex free model; capture ad inventory (≈ $0.30 CPM in US, €0.25 CPM in EU). |

| Basic | $9.99 (2024) | $9.99 (US) / €9.99 (EU) | Slightly under Netflix to attract price‑sensitive segment; still covers infra & labor for a subset of paying users. |

| Standard | $17.99 | $17.99 (US) / €16.99 (EU) | EU price adjusted for VAT impact; matches cost per paying user ($15.14). |

| Premium | $24.99 | $24.99 (US) / €22.99 (EU) | Premium includes 4K/HDR, which pushes infra cost up ~10 %; premium margin stays ≥ 30 %. |

Revenue Model Impact (illustrative)

| Scenario | Paying Subs (M) | ARPU (US) | ARPU

Alternatives Analysis: Comparing loaded stream With Other Solutions

Alternatives Analysis: Comparing Loaded Stream with Other Solutions

Key Context – Netflix’s “Loaded” is not viewable in the United States, while JustWatch shows the series is available for free on Plex. This fragmentation of content across services and regions is a common pain point for B2B video distribution.

| Feature | Loaded Stream | Netflix Enterprise | JustWatch Business |

|---|---|---|---|

| Deployment model | SaaS (multi‑tenant) with optional on‑prem modules | SaaS (limited enterprise‑grade options) | SaaS aggregation platform |

| Content ingest | White‑label portal; ingest any licensed media | Only Netflix‑licensed library; no custom ingest | No content hosting; links to third‑party streams |

| Geographic controls | Region‑based access policies configurable per asset | Fixed country‑level availability; titles (e.g., “Loaded”) can be region‑locked | Availability depends on source service |

| DRM & security | Built‑in Widevine/FairPlay + enterprise token auth | DRM applied only to Netflix content | No DRM; simple URL sharing |

| Analytics | Real‑time streaming metrics, audience insights, exportable reports | Basic engagement dashboards (limited data) | No analytics |

| Integration | REST API, webhooks, SSO/SAML/OIDC, CMS connectors | Limited API for internal use; manual provisioning | No integration APIs; static deep‑links |

| Pricing model | Usage‑based (per GB transferred) + optional licensing | Per‑seat subscription (Enterprise tier) | Per‑seat subscription (Enterprise tier) |

| Support | 24/7 dedicated account manager & SLA | Tiered support (Standard/Premium) | Community forum & email only |

Analysis

-

Deployment Flexibility – Loaded Stream’s hybrid SaaS/on‑prem architecture lets enterprises align with strict data‑sovereignty or latency requirements. Netflix Enterprise is purely cloud‑based, limiting data locality options.

-

Content Freedom – Loaded Stream accepts any licensed media, solving the “unavailable” issue that Netflix faces (e.g., “Loaded” blocked in the US). JustWatch does not host content; it merely points to existing services, leaving customers to manage licensing and distribution.

Illustrative Image (Source: Google Search)

-

Geographic Reach – Configurable region policies in Loaded Stream eliminate the geo‑locking seen on Netflix and the reliance on third‑party regional availability highlighted by JustWatch.

-

Security & DRM – Enterprise‑grade DRM is embedded for all ingested assets in Loaded Stream. Netflix provides DRM only for its own catalog, and JustWatch offers none, exposing assets to piracy risks.

-

Analytics Depth – Loaded Stream supplies granular analytics (view‑through rates, audience segments, exportable data) essential for ROI tracking. Netflix’s dashboards are limited; JustWatch offers no analytics.

-

Integration & Automation – Rich API, SSO, and CMS connectors enable automated workflows, content ingestion, and identity management. Netflix’s limited integration options require manual work. JustWatch has no integration APIs.

Illustrative Image (Source: Google Search)

-

Cost Alignment – The per‑GB model matches actual video‑delivery spend, avoiding over‑paying for unused seats. Netflix and JustWatch charge per‑seat, which can be inefficient for high‑traffic, low‑seat‑count use cases.

-

Support Quality – Dedicated account management and defined SLAs in Loaded Stream support mission‑critical deployments. Netflix offers tiered, but not dedicated, support; JustWatch’s community model is insufficient for enterprise SLAs.

Bottom‑Line Recommendation

For organizations that need custom content ingestion, global reach, advanced analytics, and robust security, Loaded Stream outperforms both Netflix Enterprise and JustWatch Business. Netflix remains suitable only when the entire catalog is Netflix‑owned and seat‑based pricing aligns with the organization’s structure. JustWatch serves best as a consumer‑facing discovery tool, not as a B2B streaming platform.

Essential Technical Properties and Trade Terminology for loaded stream

Essential Technical Properties and Trade Terminology for Loaded Stream

Table 1: Core technical properties to specify in RFQs, SOWs, and contracts

Illustrative Image (Source: Google Search)

| Property | What it means | Typical acceptance criteria (B2B) | Notes |

|---|---|---|---|

| Throughput capacity (bandwidth) | Aggregate transport capacity available to the “loaded stream” | Sustained throughput meets or exceeds contracted peak (e.g., 10 Gbps line rate) without packet loss | Specify sustained vs. burst, with burst allowance and duration |

| Latency | End-to-end delay from ingest to egress | Meets defined p50/p95/p99 thresholds; for live ABR, p95 < x ms | Use percentile metrics; define measurement points |

| Jitter | Variation in inter-packet delay | Jitter p95 < x ms over measurement window | Define measurement scope (RTP/RTCP path or app-level) |

| Packet loss | Percentage of lost IP packets | < 0.1% sustained; < 0.01% for premium channels | Tie to FEC/RTX profile |

| FEC/RTX | Forward error correction and retransmission | FEC profile meets required BER target; RTX RTT ≤ x ms | Choose ULP/CLP for OTT; RTX for low-latency |

| Codecs | Video/audio compression standards | H.264/AVC, H.265/HEVC, VP9, AV1; AAC, Opus | License obligations (AVC/H.265) and hardware acceleration |

| Profiles/Levels | Conformance to codec features | H.264 High/Main/L3.x; H.265 Main/Main 10; AV1 Main | Specify tier for performance/compatibility |

| Frame rate | Video frame cadence | 23.976/24/25/29.97/30/50/59.94/60 fps | Confirm progressive vs. interlaced |

| Resolution | Pixel dimensions | 720p50/59.94, 1080i50/59.94, 1080p50/59.94/60, 2160p50/59.94/60 | HDR variants tracked separately |

| Bitrate target | Output data rate per rendition | ABR ladder specified per title; target ±10% | Use target ranges, not single points |

| ABR ladder | Renditions per title | e.g., 240p to 4K60 with stated bitrates | Provide per-title custom ladders |

| GOP size/structure | Keyframe interval and patterning | I-frame interval consistent with latency goals | HLS/DASH keyframes drive segment alignment |

| HDR/WCG | High dynamic range and wide color gamut | PQ/HLG; Rec.2020; EOTF details | Signal trims in stream or manifest |

| Audio codecs/channels | Compression and channelization | AAC-LC stereo/5.1; Opus stereo/5.1/7.1 | Dialogue normalization per EBU R128 |

| Surround/immersive | Channel layouts | 5.1, 7.1, ATMOS (Dolby MAT) | Verify decoder support and routing |

| DRM | Content protection | Widevine/FairPlay/PlayReady; SL200 | Specify cloud key mgmt and license URLs |

| Manifests/segments | Delivery packaging | HLS/DASH; fMP4 (CMAF) | Segment duration aligns with GOP |

| DRM manifest flags | Control signaling | Clear lead, PSSH/EME flags | Test vectors required |

| Protocol stack | Delivery stack | RTP/RTCP/RTSP; HTTP(S)/HLS/DASH; SRT low-latency | Match to use case (live vs VOD) |

| Scaling granularity | Resource allocation | Per-channel/instance/tenant | Clarify scaling window and autoscale triggers |

| Availability | Uptime targets | 99.95–99.99% monthly SLA | Tie credits to breach |

| Redundancy/failover | Resilience design | N+1; active-active geo-redundancy | Test recovery time objectives |

| Observability | Monitoring and alerting | SLIs for throughput, latency, loss, errors | Define dashboards and alert thresholds |

| Logging/audit | Event capture | Security/auth logs; retention policy | GDPR/US privacy compliance |

| Security | Data/protocol protection | TLS 1.2+; mTLS; auth tokens; least privilege | Document cipher suites |

| Data locality | Storage placement | Region and cross-border constraints | Confirm data residency |

| SLA/credits | Service guarantees | Credits for breach; response times | Include severity definitions |

| Support/SLO | Service delivery | TTR/MTTR; 24/7 severity 1 | Tie to escalation runbooks |

| Incidents | Incident handling | RMA/MTTR; root cause analysis | Postmortem timelines |

| Compliance | Regulatory markings | CE (EU), FCC (US), WEEE, RoHS | Product-level only for hardware |

| Packaging/logistics | Shipping and return | Packaging standard; RMA flow | Note: Not TV show packaging |

| Terms/accept | Commercial basis | Fixed fee, per-channel, usage-based | Unit definitions and usage metering |

| Exit/data return | Offboarding | Data extraction formats and fees | Time-bound and complete |

Table 2: Trade terms commonly used in B2B streaming RFPs and contracts

| Term | Definition | Typical B2B application |

|---|---|---|

| MOQ (Minimum Order Quantity) | Smallest batch order a vendor will accept | Hardware encoders, receivers, servers |

| OEM (Original Equipment Manufacturer) | Supplier selling components for rebranding | Chipsets, SDKs, firmware modules |

| ODM (Original Design Manufacturer) | Supplier designs and manufactures to spec | Custom appliances; reference designs |

| SKU (Stock Keeping Unit) | Unique product identifier | Bundles, tiers, features |

| Lead time | Time from PO to delivery | Scheduling and inventory planning |

| Incoterms | Shipping responsibility terms (e.g., DAP, DDP) | Cross-border delivery and customs |

| Payment terms | Commercial payment conditions | Net 30/45/60; milestones; escrow |

| Warranty | Defect liability period | Hardware and software coverage |

| RMA (Return Merchandise Authorization) | Process for returning defective goods | Hardware repairs or replacements |

| EOL (End of Life) | Product discontinuation | Support and migration planning |

| EOW (End of Warranty) | Warranty expiration | Service transitions |

| SLA (Service Level Agreement) | Performance guarantees and credits | Availability and latency commitments |

| SLO (Service Level Objective) | Target for operational metrics | Monitoring and alerting goals |

| SLA credits | Financial remedy for SLA breach | Contract enforcement |

| DPA (Data Processing Agreement) | Privacy and data handling obligations | GDPR/CCPA alignment |

| CoO (Country of Origin) | Manufacturing location | Customs and trade compliance |

| TAA (Trade Agreements Act) | US preference for certain origins | Federal contracts in US |

| HS code (Harmonized System) | Product classification for customs | Duties and cross-border logistics |

| WEEE | EU e-waste directive compliance | Hardware take-back/recycling |

| RoHS | EU hazardous substance restrictions | Component selection and compliance |

| CE (Conformité Européenne) | EU conformity marking | Product compliance for EU |

| FCC (US) | US regulatory compliance | Equipment authorization/labeling |

| EID (Equipment Identifier) | Device or instance ID | Asset tracking and audit |

| BOM (Bill of Materials) | Component list for a product | Costing and procurement |

| SKU ladder | Ordered pack sizes | Purchase planning and discounts |

| Lot/batch | Manufacturing grouping | Traceability and QC |

| TTM (Time to Market) | Speed to deployment | Project and delivery planning |

| NFR (Not For Resale) | License for evaluation/testing | Proof-of-concept and trials |

| Channel/tenant | Isolated service partition | Multi-customer or internal units |

| White-label | Rebrandable solution | Resale and co-branding |

| Terms and Conditions (T&C) | Legal contract terms | Acceptance testing, liability, IP |

| Acceptance testing | Verification before go-live | Test plan, pass/fail criteria |

| Data return | Export of data on termination | Exfiltration formats and timelines |

| IP (Intellectual Property) | Rights to code/design | Ownership and licensing |

| Source code escrow | Custody of source for continuity | Bankruptcy or vendor failure risk |

| License grant | Rights to use software | Scope and restrictions |

| Support tiers | Response/severity model | Bronze/Silver/Gold/Platinum |

| POC (Point of Contact) | Designated business/tech contacts | Communication and escalation |

| Change control | Process to modify scope/schedule | Governance and risk mitigation |

Notes for USA and Europe

– Regulatory and compliance scope: CE, RoHS, and WEEE (EU) vs. FCC (US) apply at the product/hardware level. For software/services, ensure DPA and data residency commitments. Do not reference TV/streaming show content (e.g., a comedy series named “Loaded”); it is unrelated to product specifications and may confuse stakeholders.

Navigating Market Dynamics and Sourcing Trends in the loaded stream Sector

Navigating Market Dynamics and Sourcing Trends in the Loaded Stream Sector

Term clarification: “loaded stream” refers to ad‑supported streaming business models and technical environments (AVOD, FAST, ad‑tier SVOD, and ad‑inserted live). It encompasses both commercial strategy and the infrastructure load needed to serve high‑concurrency, on‑demand and live streams.

Market overview: demand, monetization, and consolidation

- US and Europe remain the core revenue pools. Europe adds complexity (multi‑language, regulatory fragmentation) but is a major growth region; advertising regulations are stricter in the EU than in the US.

- AVOD and ad‑tier SVOD are now the growth engines. FAST is expanding as a distribution layer beyond CTV apps into Smart TV homes and OTT platforms.

- Live and sports continue to create load spikes and monetization opportunities; ad insertion for live (SSAI) is a differentiator but requires precise synchronization and redundancy.

- Platform consolidation and bundling are rationalizing unit economics; “one subscription for many services” reduces churn but increases negotiation complexity for ad inventory owners.

- Password‑sharing enforcement has become standard policy, driving paid conversions but requiring careful UX to avoid brand damage.

- The operating pivot is from subscriber counts to engagement and revenue per user (ARPU/ARPU uplift through ads).

Pricing and packaging levers in the loaded stream era

- Ad tiers typically price below ad‑free by 20–40% (e.g., standard with ads vs standard), but premiums for 4K and higher audio can command an additional 20–40%. These bands differ by brand and market.

- Ad load control is a product feature, not a cost center; shorter ad pods (fewer, longer ads) can mitigate fatigue and improve completion rates. CPMs correlate with session quality, not just impressions.

- Monetization complexity is increasing: addressable linear (FAST), CTV OTT, and OTT ad‑tier SVOD converge around addressable targeting, dynamic creative, and unified reporting.

| Region | Typical subscription/AVOD tiers and price points | Notes |

|---|---|---|

| US | Ad‑tier: ~$7.99/mo; ad‑free: ~$17.99/mo; premium (4K + HDR, no ads): ~$24.99/mo | Example representative tiers reflect common market bands; exact rates vary by provider and promotions. |

| Europe | Ad‑tier: ~€7–€9/mo; ad‑free: ~€14–€18/mo; premium: ~€19–€24/mo | VAT, local competition, and language bundles shape prices; promotions are frequent. |

Content rights and sourcing strategies

- Originals carry fixed costs and long tails; acquired SVOD rights add predictable volume. AVOD and FAST value high‑quality library and evergreen formats over short‑lived hits.

- Data‑driven acquisitions outperform intuition; rights windows, territoriality, and language variants must be analyzed for CPM lift and retention.

- FAST channel sourcing shifts to third‑party aggregators (e.g., Plex Channel) to reduce operational overhead; curation becomes a source of differentiation.

- Live sports and breaking events demand robust rights economics and contingency plans; SSAI for live creates new ad monetization at scale but raises technical risk.

| Content type | Primary licensing model | Usage pattern | Cost drivers | AVOD/FAST viability | Risk |

|---|---|---|---|---|---|

| SVOD originals | Output deals, co‑production, in‑house | Long tail, brand equity | Writers’ rooms, production, P&A | Low; best for premium tiers | High (market timing) |

| Acquired features/series | Windowed rights, territory‑specific | Evergreen consumption | Per‑title fees, territories | High (library) | Medium |

| FAST catalog | Syndication, aggregator catalogs | Discovery, niche audiences | Per‑channel fees, curation | High (scaled via aggregation) | Medium |

| Live sports | Leagues, regional broadcasters | Spike viewing, social conversation | Exclusivity premiums | Medium (ad‑insertion viable) | High (venue/latency) |

| Creator/UGC | Creator programs, revenue shares | Volatile, algorithmic | Platform rev share, quality control | Medium to High (volume) | Medium |

Technology sourcing and infrastructure “load” dynamics

- CDN and edge infrastructure must handle peak concurrency across AVOD, FAST, and live events; regional presence and caching efficiency are decisive.

- Ad insertion requires server‑side or client‑side stitching, real‑time decisioning, and low latency to avoid ad fallouts; ad fraud prevention (IVT, spoofing) is essential.

- Data privacy and compliance shapes data pipelines: cookie deprecation accelerates first‑party data use (logins, walled gardens) and alternative IDs; EU frameworks increase consent overhead.

- Observability and QoE operations matter as much as content; QoE KPIs (join time, rebuffering, startup latency, ad completion) determine ARPU and ad fill rates.

| Cloud/edge provider category | Common role in loaded streaming | Key “load” metrics to monitor |

|---|---|---|

| CDN/edge (Akamai, Cloudflare, AWS CloudFront, Fastly) | Cache hit ratio, video delivery, SSAI proximity | Hit ratio, exit rate, bandwidth per stream, regional PoPs |

| Ad decisioning/SSAI (Amazon DSP, The Trade Desk, Magnite, Tremor Video) | Demand‑side, real‑time decisioning | Bid velocity, fill rate, latency to decision, ad error/fallback rate |

| SSAI platforms (Google Ad Manager SSAI, AWS IVS Live DAI, Azure Media Services) | Client/server ad stitching, live streams | Stitch latency, ad markers accuracy, ad completion rate |

| Aggregators/FAST platforms (e.g., Plex Channel) | Channel packaging, distribution, discovery | Channel uptime, app availability, session start time |

| Monitoring/QoE (Conviva, NPAW, QoE Labs) | Cross‑player telemetry | Join time, rebuffering ratio, error rate, abandonment |

| Identity/consent (OneTrust, Sourcepoint, Didomi) | CMPs, consent logging, CMP audits | CMP adoption, consent rates, signal coverage |

| Fraud detection (White Ops, DoubleVerify, HUMAN) | IVT detection across display and CTV | IVT prevalence, invalid traffic rate, spend saved |

| Observability/APM (Datadog, Grafana Labs, Dynatrace) | Real‑time system health | CPU/memory saturation, egress cost, cache performance |

Sustainability and energy use

- Streaming’s energy impact is concentrated in data centers, networks, and end devices. A reliable estimate for a 1‑hour HD/4K session is roughly 55–85 gCO2e per viewer; device usage contributes a meaningful share.

- Major cloud and CDN providers are scaling renewable energy, improving PUE, and adopting energy‑aware routing; however, network energy (last‑mile access) remains significant and varies by geography.

- Reporting and measurement frameworks are maturing: the Greenhouse Gas Protocol, GRI 305 (emissions), CDP reporting, and energy‑related EU regulations (with energy intensity reporting and renewable targets) create clearer baselines.

- Operational levers can reduce load: adaptive bitrate (ABR) tuning, efficient codecs (AV1 where device support allows), dynamic quality caps during peak periods, content deduplication, and intelligent cache placement.

Regional regulatory and privacy considerations

- US: CCPA (California), VCDPA (Virginia), CPA (Colorado), and FTC enforcement shape data use and consent practices; addressable advertising on CTV is largely permitted with proper disclosure and opt‑out mechanics.

- EU: GDPR governs data processing; ePrivacy rules restrict tracking without consent; the DMA/DSA increase platform obligations for discovery and transparency; the AVMSD promotes European works and accessibility.

- COPPA in the US applies to services directed to children under 13; the EU DSA/Kids Codes introduce stricter protections and ad limits for younger audiences.

Actionable sourcing checklist

- Define a portfolio mix: ad‑tier SVOD for brand equity + AVOD/FAST for reach; add live where it anchors monetization.

- Negotiate rights with data‑driven forecasting; prioritize evergreen libraries for AVOD/FAST; avoid overpaying for short‑term exclusives in the AVOD model.

- Adopt SSAI for live and high‑impact events; align with a demand‑side partner for addressable reach and unified reporting.

- Instrument QoE and ad metrics end‑to‑end; target short join times and low rebuffering to protect ad completion and CPMs.

- Reduce energy and cost through codec choices, ABR tuning, cache optimization, and regional edge presence aligned with your audience footprint.

- Implement privacy and consent infrastructure early; align data strategy to first‑party signals in a cookie‑deprecating landscape.

If “Loaded” refers to a specific product or portfolio in your context, I can tailor the above to that stack’s unique content, rights, and infrastructure constraints.

Illustrative Image (Source: Google Search)

Frequently Asked Questions (FAQs) for B2B Buyers of loaded stream

Frequently Asked Questions (FAQs) for B2B Buyers of Loaded

01) Licensing and ownership

Q: Who owns the rights to Loaded, and what rights are available?

A: Loaded (2017, UK) is a produced TV title. Avails and territory scopes vary by deal. Typical rights available for B2B buyers include:

– SVOD, AVOD, TVOD

– Pay‑TV/free‑to‑air broadcast

– FAST channel placement

– White‑label and syndication bundles

Notes: “Loaded” is not available on Netflix in many regions and may be geo‑restricted.

02) Availability by territory and platform

Q: Where is Loaded currently available and in which formats?

A: Availability is dynamic and changes over time. For example, it has been observed on Plex Player/Plex Channels as a free, ad‑supported stream in HD/CC. Use it as a working cross‑check when planning ad inventory and compliance.

03) Technical specs and delivery

Q: What technical specs are supported for delivery?

A: Typical delivery specs for TV content include:

– HD (e.g., 1080p), optional 4K/HDR based on master

– Stereo/5.1 audio, optional immersive (e.g., spatial)

– Captions/subtitles and audio description (territory dependent)

– Format: MP4/HLS/DASH; 16:9; clean/OTT versions; EIDR/ISAN when available

– ProRes/IMF/DCP for premium workflows (when required)

04) Ad insertion and revenue options

Q: Is ad insertion supported, and how are ads monetized?

A: Yes, ad insertion is supported on connected platforms (server‑side and client‑side). Common models:

| Model | Billing | Inventory control | Brand safety | Notes |

|—|—|—|—|—|

| Direct | Fixed CPM | Full control | High | You own the deals and inventory. |

| Programmatic | RTB CPM | Negotiated | Variable | Requires brand‑safety and whitelist settings. |

| Revenue share | % split | Shared | Negotiated | Often used for partner‑led syndication. |

Compliance: Standard IAB guidelines; third‑party ad verification and viewability measurement supported.

Illustrative Image (Source: Google Search)

05) Content safety and compliance

Q: What content rating and warnings should we display?

A: Loaded is TV‑MA (mature audiences). Follow territory‑specific content advisories (e.g., V‑Chip/TV Parental Guidelines in the U.S.; PEGI/BBFC guidance in Europe). Provide accessible workflows (captions, audio description) per local mandates.

06) Compliance, data, and security

Q: What compliance and security standards are supported?

A: Standards typically include:

– Security: ISO 27001, SOC 2; DRM via PlayReady/Widevine/FairPlay

– Privacy/Regulatory: GDPR, CCPA/CPRA, LGPD, PECR; data processing agreements (DPA)

– Adtech: TCF v2.2 consent support for EU viewers; US‑centric consent management for applicable state laws

– Geo‑blocking and geo‑fencing for rights enforcement

07) Pricing, invoicing, and term

Q: How are license fees structured and invoiced?

A: Pricing depends on scope and duration. Common structures:

| Structure | What it covers | Typical minimums | Invoicing |

|—|—|—|—|

| Territory‑based | Select countries | $25k–$150k | 50/50 or net‑30 |

| Multi‑year SVOD | Streaming window | $50k–$300k | Milestones |

| Syndication bundle | Multiple platforms | Negotiated | Per deliverable |

Notes: Rates vary by content value, exclusivity, windowing, and platform scale.

08) Lead time and support

Q: What are implementation timelines and support SLAs?

A: Typical timelines:

| Workstream | Lead time | What’s included |

|—|—|—|

| Content prep | 2–4 weeks | QC, captioning, metadata, artwork |

| Platform integration | 3–6 weeks | Player/DRM, analytics, ads |

| Launch | 1–2 weeks | Go‑live QA, monitoring |

Support: Business‑hours coverage across U.S./EU; P1 response under 2 hours; standard knowledge base and email/portal support.

Notes:

– Availability and rights are subject to change and may be restricted in some countries.

– Terms, pricing, and timelines are illustrative and may vary by deal.

Strategic Sourcing Conclusion and Outlook for loaded stream

Strategic Sourcing Conclusion and Outlook for Loaded Stream

Loaded Stream consolidates premium content discovery, rights management, and supply chain orchestration into a single, contract-ready interface. It reduces acquisition cost through automated rights reconciliation, streamlines negotiations with templated SLAs, and compresses vendor onboarding from weeks to days. Embedded audit and usage telemetry provide spend traceability, risk controls, and compliance automation across US and EU jurisdictions.

To clarify the benefits, the table below summarizes value:

| Dimension | What Loaded Stream Delivers | Typical Business Impact |

|---|---|---|

| Savings | Centralized vendor and rate catalog; dynamic rate comparison | 10–20% lower marginal cost per stream |

| Speed | Standardized intake and automated rights checks | 50–70% faster time-to-live |

| Quality | Pre-flight QA and performance monitoring | 20–30% fewer stream failures |

| Risk/Compliance | Geo and contract rules engine; full audit trail | 15–25% reduction in compliance incidents |

| Insight | Unified analytics with cost-to-serve metrics | Faster, data-driven renegotiations |

| Scalability | Burst capacity and multi-cloud orchestration | Stable SLOs at peak load |

Outlook: expect consolidation of regional catalogs, real-time price discovery, and embedded compliance as norms. Prioritize contract normalization, rights taxonomy, and observability to accelerate value. The winners will treat content supply as a programmable system and invest in analytics and vendor scorecards.

Illustrative Image (Source: Google Search)

Important Disclaimer & Terms of Use

⚠️ Important Disclaimer

The information provided is for informational purposes only. B2B buyers must conduct their own due diligence.