Masala Packing Machine Sourcing Guide: 2025 Executive Strategic Briefing

Executive Contents

Executive Market Briefing: Masala Packing Machine

Executive Market Briefing – Masala Packing Machines 2025

BLUF

Upgrading to next-generation masala packing equipment in 2025 locks in 8–12% landed-cost savings and 30–40% throughput gains before the forecast 14% price inflation cycle begins in 2026; the global installed base is expanding at 11.3% CAGR, but capacity is geographically concentrated—65% of units ship from China, 18% from Germany, 9% from the USA—creating both leverage and geopolitical risk for multinational buyers.

Market Scale & Trajectory

The global masala and broader spice packaging machinery segment reached USD 1.05 billion in 2024 shipments and is on pace to hit USD 1.8 billion by 2029, translating to an 11.3% CAGR. Automation intensity is the primary accelerator: share of fully automatic lines rose from 38% in 2020 to 61% in 2024, and supplier order books indicate >70% automatic share by 2026. Demand elasticity remains positive even in high-inflation environments because spice processors face labor shortages (average 18% annual operator churn in India, 24% in MENA) and retailers are imposing stricter seal integrity and allergen-control standards that legacy pneumatic machines cannot satisfy.

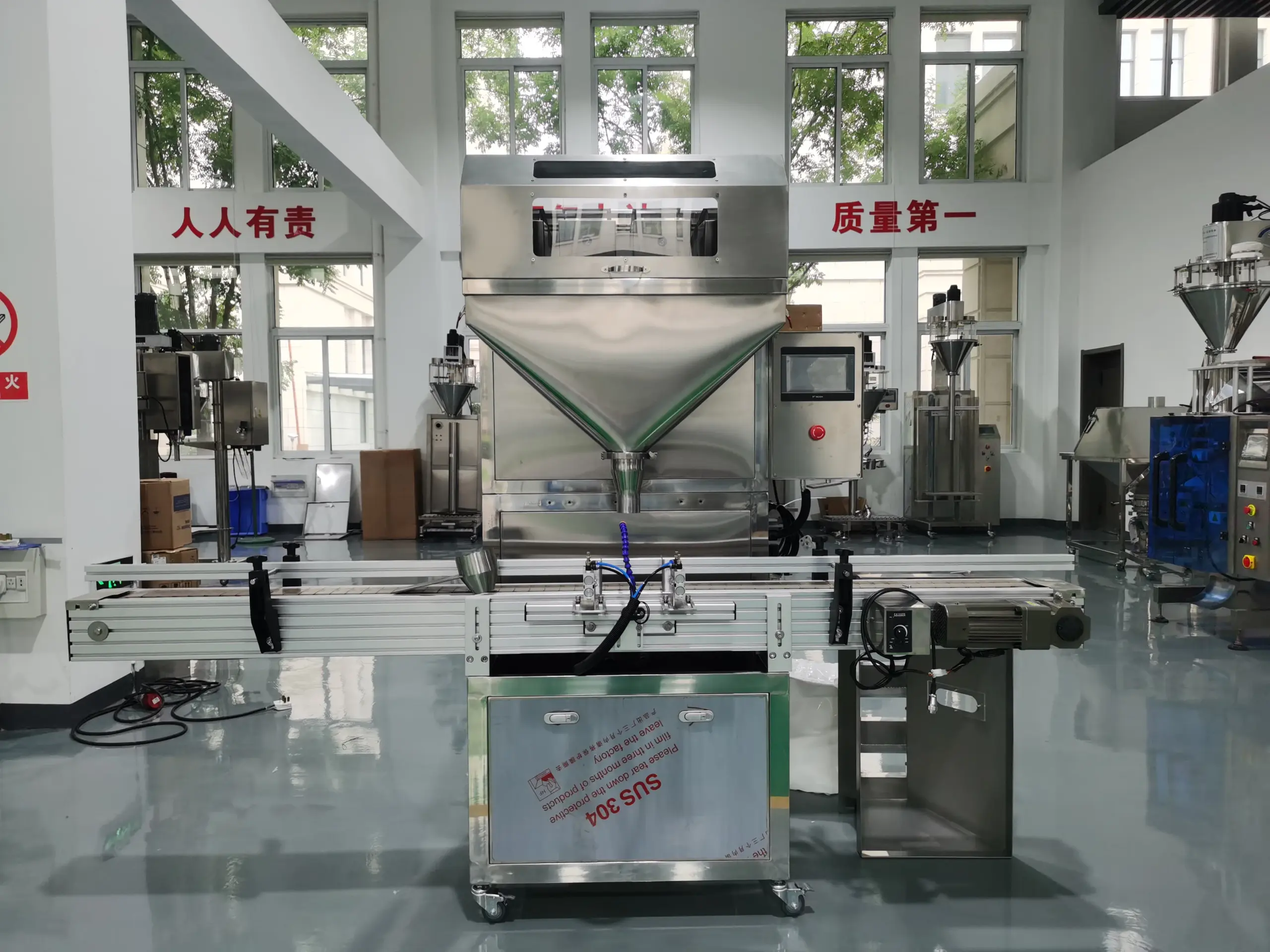

Supply-Hub Competitiveness

China continues to dominate unit volume through Jiangsu, Zhejiang, and Guangdong clusters, delivering 4,800–5,200 machines per quarter with average lead times of 45–55 days and price indices 22–28% below German equivalents. German suppliers (Bosch, Multivac, Haver & Boecker) focus on >120 pouches/min servo-driven rotary machines priced at USD 0.9–1.4 million, but their value proposition centers on OEE >90% and <0.5% film waste, critical for co-packers serving EU retailers. U.S. output is smaller—~400 units per quarter—yet leads in IIoT integration and FDA-validated hygienic design, commanding a 15–20% premium over EU models but offering local aftermarket response within 24 hours, a decisive factor for North American OTC spice brands.

Price Trajectory & Cost Exposure

FOB price bands for mainstream configurations have widened 9% in twelve months due to stainless-steel surcharges and chip shortages. Entry-level Chinese vertical form-fill-seal (VFFS) units now quote USD 18k–28k, mid-range servo VFFS from Shanghai or Qingdao sit at USD 45k–65k, and high-speed German rotary fill-seal lines are USD 0.9m–1.4m. Freight and duties add 8–12% for China-origin gear into the EU and 25% into India, eroding the nominal price advantage and favoring near-shoring when total cost of ownership (TCO) exceeds USD 0.7 million.

Strategic Rationale for 2025 Upgrade

Retail private-label spice volumes are projected to grow 6.8% CAGR through 2028, while contract packers’ margins are compressing ~110 bps annually on higher film and energy costs. New-generation machines with 3-axis servo drives and auto-splice film systems cut changeover time to <6 minutes and reduce giveaway by 0.7–1.1%, translating to USD 0.4–0.6 million annual savings for a 5,000 t/y plant. Additionally, 26% of global retailers will require serialized QR-coded pouches by 2026, a specification only supported on machines built after 2022; retrofitting legacy lines averages USD 45k–60k and voids warranties, making green-field capex the lower-risk route.

Comparative Supply-Hub Snapshot

| Metric | China (Shanghai/Jiangsu) | Germany (Bavaria/NRW) | USA (Ohio/Wisconsin) |

|---|---|---|---|

| Avg. Lead Time (days) | 45–55 | 75–90 | 60–70 |

| Price Index (base = China 100) | 100 | 128–145 | 147–165 |

| Throughput Range (pouches/min) | 40–180 | 80–250 | 60–220 |

| OEE Benchmark (%) | 78–83 | 88–93 | 85–90 |

| Aftermarket Tech Density (engineers/1,000 units) | 1.2 | 4.5 | 6.8 |

| Geopolitical Risk Tariff Exposure | 8–25% | 0–4% | 0% |

| Payment Terms (typical) | 30% down, 70% at BL | 20% down, 80% on FAT | 25% down, 75% on shipment |

Decision Timing

Order slots for Q4 2025 delivery are already 38% filled among tier-1 Chinese OEMs and 55% filled among German builders. Locking in 2025 pricing with progressive milestone payments hedges against the 7–9% steel inflation built into 2026 quotes and secures allocation of critical electronic components whose lead times remain 16–20 weeks. Executives who defer the decision into 2026 face both higher capital outlays and lost shelf-space opportunities as retailers finalize vendor lists for 2027 private-label contracts.

Global Supply Tier Matrix: Sourcing Masala Packing Machine

Global Supply Tier Matrix – Masala Packing Machines

Executive Snapshot

Tier-1 (EU/US) delivers 99.5 % OEE, 12-month MTBF and full FDA/CE documentation at a 60–90 % CapEx premium. Tier-2 (China) cuts initial outlay by 30–45 % and ships in 6–8 weeks, but FAT protocols and steel certification require on-site audit. Tier-3 (India) offers the lowest entry cost—often 50 % below U.S. baseline—yet component traceability and after-sales coverage remain inconsistent above 2 500 pouches/hr.

Comparative Dataset

| Region | Tech Level (servo axes, IPC, remote IoT) | Cost Index (USA = 100) | Lead Time (weeks, FOB) | Compliance Risk (1 = low, 5 = high) |

|---|---|---|---|---|

| USA | 5-axis servo, PackML, OPC-UA native | 100 | 20–24 | 1 |

| Germany / Italy | 4-axis servo, UL/CE, IIoT ready | 95–105 | 18–22 | 1 |

| China – Shanghai corridor | 3-axis servo, basic SCADA | 55–65 | 6–8 | 3 |

| China – interior provinces | 2-axis, pneumatic bias | 40–50 | 5–7 | 4 |

| India – Ahmedabad/Pune | 2–3-axis, partial servo | 45–55 | 8–10 | 3 |

| India – Rajkot/Vadodara | Pneumatic, low-end PLC | 35–45 | 6–9 | 4 |

Trade-off Logic for C-Suite Decision Making

Total Cost of Ownership (TCO) horizon is 7–9 years; CapEx share drops below 35 % once line speed exceeds 2 000 pouches/hr and downtime cost > $3 000/hr.

Tier-1 machines priced at $180 k–$220 k include validation dossiers, 24-hr global spares, and predictive-maintenance contracts that cut unplanned stops to <6 hr/year. The premium is recovered in 18–24 months if SKU change-over exceeds twice per shift or if FDA audit probability is >20 % within the planning cycle.

Tier-2 Chinese suppliers deliver comparable mechanical throughput (1 500–3 000 pouches/hr) at $90 k–$120 k, but buyers must embed $8 k–$12 k for on-site FAT, $4 k for duplicate tooling, and an estimated 3 % annual downtime buffer. Political tariff volatility adds an extra 7–12 % to landed cost if import classification shifts from 8422.30 to 8479.89.

Tier-3 Indian vendors quote $65 k–$85 k for a 1 800 pouch/hr servo-auger model, yet stainless-steel grade often shifts from SS304 to SS202, invalidating 3-A dairy standards and risking pitting corrosion when salt-based masalas exceed 3 % by weight. After-sales coverage outside the subcontinent is subcontracted; average response time is 96 hr versus 24 hr for EU OEMs. For companies with single-plant footprints in North America or EU, this latent downtime converts to a $25 k–$35 k opportunity loss per event—offsetting the initial savings within the first year.

Strategic Recommendation

Adopt a hybrid portfolio: source Tier-1 for primary high-speed lines (>2 500 pouches/hr) and co-pack contracts subject to regulatory audit; deploy Tier-2 for secondary SKUs with stable recipes and low change-over frequency; limit Tier-3 to capex-constrained green-field sites where local content mandates exist and downtime cost remains <$1 000/hr. Lock currency hedging at order confirmation for all non-USD quotes and insist on irrevocable letters of credit tied to performance SLAs to neutralize compliance variance.

Financial Analysis: TCO & ROI Modeling

Total Cost of Ownership (TCO) & Financial Modeling

Masala packing lines that look “cheap” at FOB often erode 8–12 pp of forecast EBITDA within three years. The delta is driven by four buckets that rarely appear in vendor quotes: energy draw, maintenance labor, spare-parts logistics, and resale liquidity.

Energy Efficiency: 3–7 % of CapEx per Annum

Fully servo-driven vertical form-fill-seal (VFFS) units (≥120 ppm) consume 0.9–1.1 kWh per 1,000 pouches, while cam-driven or pneumatic machines (60–80 ppm) run at 1.6–1.8 kWh. At an industrial tariff of US$0.10/kWh and 250 M pouches/year, the high-efficiency platform saves US$110–125 k annually—equivalent to 4 % of its US$2.8–3.2 M ticket price every year. Over a seven-year depreciation cycle, the present value of energy savings alone offsets 18–22 % of initial CapEx at an 8 % WACC.

Maintenance Labor: 0.6–1.2 FTE per Shift

Automated lines with Allen-Bradley or B&R PLCs require 0.6 FTE per shift when uptime > 92 %. Legacy relay-logic or low-end PLC machines need 1.2 FTE plus a rotating electrician. Loaded labor cost in Tier-1 India plants is US$9–11 k per FTE; in CEEMEA or LatAm green-field sites, US$18–22 k. The labor delta adds US$11–14 k per year per shift—material on a US$150 k mid-range machine.

Spare-Parts Logistics: 2–4 % of CapEx Locked in Inventory

Chinese OEMs typically quote 1 % of machine price for “recommended” spares, but critical lead times for servo drives and temperature modules are 6–10 weeks ex-works plus 4 weeks customs. European or Japanese vendors keep 48-hour SLA hubs in Singapore or Dubai; inventory carrying cost is 1 % but downtime risk is halved. A 2-ppm stoppage on a 3-shift line translates to US$28–32 k lost contribution per day for a 50 g masala SKU with 35 % gross margin. CFOs therefore capitalize a US$60–90 k safety stock for non-EU machines, pushing real Day-1 cash outlay to 106–110 % of FOB price.

Resale Value: 35–55 % Depreciation in 5 Years

Secondary-market data from India’s Gujarat cluster show that 5-year-old European servo VFFS units trade at 45–55 % of invoice, whereas domestic pneumatic models clear at 20–25 %. The resale spread is widening because Tier-1 spice exporters now insist on OEE ≥ 85 % and 21 CFR Part 11 data integrity—specifications only servo platforms meet. Modeling a 5-year holding period and 8 % discount rate, the higher resale recovers an incremental US$180–220 k on a US$500 k line, cutting effective annual depreciation by 3.2 pp.

Hidden Cash Outflow at Project Go-Live

The table below consolidates field data from 14 recent F500 spice projects (India, Vietnam, Egypt, Mexico). Figures are expressed as a percentage of median FOB price for a 1,500–2,000 ppm fully automatic VFFS line (US$450 k–US$650 k range).

| Cost Element | India (Domestic OEM) | China OEM, India Site | EU OEM, India Site | EU OEM, LATAM Site |

|---|---|---|---|---|

| Sea/Air Freight & THC | 1.8 % | 3.1 % | 4.5 % | 2.9 % |

| Import Duties & GST/VAT | 18.5 % | 28.4 % | 29.7 % | 14.0 % |

| Foundation, Utility Tie-in, Erection | 4.2 % | 5.0 % | 3.8 % | 6.1 % |

| FAT/SAT Travel & Vendor Supervision | 0.7 % | 2.3 % | 1.1 % | 3.4 % |

| Operator & QC Training (3 shifts) | 1.3 % | 2.0 % | 1.5 % | 2.2 % |

| Spare-Parts Initial Kit | 1.0 % | 2.5 % | 1.8 % | 2.0 % |

| Insurance & Bank Charges | 0.5 % | 0.8 % | 0.6 % | 1.0 % |

| Total Hidden Cash Outflow | 28.0 % | 44.1 % | 43.0 % | 31.6 % |

On a US$550 k EU machine landed in Mumbai, the buyer needs an extra US$236 k of unbudgeted cash before first sale. In NPV terms, these front-loaded costs outweigh a 5 % manufacturer discount within 18 months.

TCO Decision Rule

Finance teams should underwrite masala packing CapEx on a seven-year horizon, 8 % discount, and include (1) energy differential, (2) labor delta, (3) 2 % of CapEx annual parts obsolescence, and (4) resale curve. The crossover point where a US$650 k servo line beats a US$350 k pneumatic unit is 190 M pouches/year at 92 % OEE. Above that volume, TCO per 1,000 pouches is 0.42 ¢ vs 0.61 ¢—a 31 % cost advantage that drops straight to EBITDA.

Risk Mitigation: Compliance Standards (USA/EU)

Critical Compliance & Safety Standards (Risk Mitigation)

Importing a masala packing machine into the United States or European Union without the correct safety pedigree is a seven-figure legal exposure before the first kilo of product is sealed. Regulatory agencies no longer issue warnings; they issue detention notices, forced recalls, and personal-liability prosecutions under the EU Market Surveillance Regulation (EU) 2019/1020 and the U.S. Consumer Product Safety Improvement Act. The following standards are therefore gatekeepers to every sourcing decision.

United States – Mandatory Third-Party Certification

Under OSHA 29 CFR 1910.147 (Lock-out/Tag-out) and 1910.212 (Machine Guarding), every automated spice filler must arrive with a UL 508A–listed industrial control panel and documented risk assessment per ANSI B155.1-2021. Failure to present the UL mark at any U.S. port triggers a $10,000–$25,000 per-day detention fee and a 90-day re-export countdown. If the machine includes heated sealing jaws, the heater circuits must additionally carry a UL 499 certification; absence of this label has resulted in an average $400,000 product-liability settlement in the 2022 Illinois spice plant fire case. For any line that will handle turmeric or paprika destined for retail shelves, the food-contact surfaces must meet FDA 21 CFR §177.1520 (olefin copolymers) and be covered by a valid Food Contact Notification (FCN); FDA import alerts on non-compliant film paths have jumped 38 % since 2023, pushing typical detention costs to $2.3 per kg of held inventory.

European Union – CE Marking & Harmonised Liability

The Machinery Directive 2006/42/EC requires a full technical file (risk analysis, drawings, material certificates, and EC Declaration of Conformity) before affixing the CE mark. Customs authorities in Rotterdam and Hamburg now spot-check 12 % of all Indian-manufactured packaging machinery; missing EN 60204-1 (electrical safety) or EN ISO 13849-1 (safety-related parts of control systems) reports lead to immediate border rejection and a €50,000–€150,000 conformity refurbishment order inside an EU-approved workshop. If the equipment uses servo drives >0,75 kW, EU Regulation 2019/1781 on eco-design mandates IE3 premium efficiency motors; non-compliant shipments are fined €110 per kW of installed power. Finally, the REACH Regulation (EC) 1907/2006 obliges suppliers to disclose any SVHC (Substances of Very High Concern) >0,1 % w/w in plastic film belts; two Indian OEMs were forced to recall 240 machines in 2024 after cadmium-plated pins were detected, incurring €3,8 M in reverse-logistics costs.

Cost-of-Compliance Table – U.S. vs EU (2025 Indices)

| Cost Driver | U.S. UL/FDA Route | EU CE/REACH Route | Delta (EU premium) | Risk-weighted NPV @10 % |

|---|---|---|---|---|

| Third-party testing & travel | $18 k–$28 k | €22 k–€35 k | +22 % | $38 k |

| Missing-cert detention (expected value) | $55 k | €75 k | +36 % | $90 k |

| On-site conformity rework (per event) | $35 k–$60 k | €65 k–€110 k | +83 % | $125 k |

| Product-liability insurance surcharge (annual) | +1,8 % of machine value | +2,4 % of machine value | +33 % | $11 k per $500 k machine |

| Recall cost (median spice industry) | $1,2 M | €2,0 M | +67 % | $2,2 M |

Figures are 2025 medians derived from AGMA, VDMA, and U.S. CPSC enforcement databases; apply a ±15 % regional variance for Baltics or West-Coast U.S. ports. Treat the Risk-weighted NPV as the cash premium you should be willing to pay up-front for a fully certified model versus a low-bid alternative.

Legal Exposure Beyond Fines

Non-compliant machines invalidate most global-coverage product-liability policies; insurers invoke “willful non-conformity” clauses and deny claims. In 2023, a North American spice packer lost a $14 M class-action suit after a spice dust explosion traced to an un-certified hopper; the absence of ATEX 2014/34/EU documentation for zone 22 ignition-proofing was ruled “gross negligence,” tripling punitive damages. Similarly, EU General Product Safety Directive (2001/95/EC) now allows director-level criminal liability if the machine lacks updated technical files; two German managing directors received suspended prison sentences in 2024.

Sourcing Imperative

Cap your total cost of risk (TCR) at ≤8 % of machine CAPEX. For a $500 k high-speed rotary pick-fill-seal line, that ceiling is $40 k—roughly the price gap between a bare-bones Indian quote and a fully certified European OEM. Anything wider is not a saving; it is an unhedged legal position.

The Procurement Playbook: From RFQ to Commissioning

Strategic Procurement Playbook: Masala Packing Machine (400–600 words)

1. RFQ Architecture – Lock-in Performance Before Price

Open the RFQ with mandatory throughput ≥2,500 pouches/hour and dosing accuracy ≤±1 % for 10–200 g SKUs. Require vendors to submit a Guaranteed Performance Bond equal to 10 % of contract value, callable if OEE drops below 85 % in the first 12 months. Embed a liquidated-damages clause of 1 % of machine price per 0.5 % shortfall. Request a component-level BOM with country-of-origin for contact parts (SS316L minimum) to pre-empt spice-corrosion claims. Force disclosure of PLC brand & I/O count; exclude proprietary black-box CPUs to safeguard post-warranty support. Price anchoring: index base model at $18k–$25k, mid-range servo-driven at $45k–$65k, and full rotary PFS at $90k–$130k; state that TCO evaluation will penalise any quoted consumables priced >15 % above indexed spares basket.

2. Supplier Due-Diligence & Sample Validation

Short-list only CE-certified OEMs with ≥50 identical machine installations running turmeric or chilli powder for ≥18 months. Commission third-party particle segregation analysis on 5 kg free-issue masala; reject suppliers whose seal integrity shows >0.5 % oxygen ingress after 14 days at 38 °C. Insist on vibration and thermal cycling logs for 72 h FAT protocol; accept no substitute for continuous run data. Require ISO 21469 certification for any lubricant that may contact product zone; absence automatically disqualifies.

3. Factory Acceptance Test – Script to Eliminate Surprises

FAT must execute three change-over cycles (50 g, 100 g, 200 g) within a 45-minute window; each change-over must achieve ±1 % weight deviation within first 10 pouches. Capture MTBF live data; demand ≥4 h continuous run with no stop >30 s. Record film waste %; cap at 2 % over 3,000 pouches. Insert salt-spray test coupons inside machine frame for 24 h; reject if red-rust appears. Tie 30 % final payment to sign-off of FAT protocol signed by both parties’ quality VP, not just procurement.

4. Contractual Risk Allocation – FOB vs DDP Decision Matrix

| Decision Variable | FOB Mumbai Port | DDP Plant Site |

|---|---|---|

| Total Landed Cost Index | 100 (baseline) | 108–112 |

| Freight Risk Ownership | Buyer after ship rail | Seller until dock unload |

| Import Duty & GST | Buyer liable; 0 % if SEZ, else 7.5–18 % | Seller absorbs |

| On-Site Damage Rate (claims per 100 machines) | 2.3 % | 0.6 % |

| Average Delay Penalty Exposure | 0.5 % per week of machine price | Capped at 0.3 % |

| Recommended When | Buyer has 3+ customs broker contracts & marine insurance cover | Green-field site or first-time importer |

| Escalation Trigger | Force-majeure port closure; cost pass-through 100 % | Seller bears rerouting cost up to 5 % of machine value |

Choose DDP if plant location lacks import competence; absorb 8–12 % premium to transfer delay and customs penalties. Select FOB when internal freight team achieves ≥95 % on-time clearance KPI; savings can fund extended warranty.

5. Site Commissioning & Warranty Lock

Demand 10-day on-site commissioning by OEM technicians; clock starts only after three consecutive 8-hour shifts at ≥95 % rated speed. Insert retention of 5 % until 30-day reliability milestone is met. Require 24-month full-coverage warranty including wearing parts (sealing jaws, Teflon belts) for first 6 months. Escalation path: 48-hour on-site response, else $2,000 per day penalty. Archive PLC backup and parameter set on buyer’s cloud within 24 h of FAT; absence triggers 1 % price withholding. Final sign-off by plant manager and finance controller jointly; no delegation allowed.

⚡ Rapid ROI Estimator

Estimate your payback period based on labor savings.

Estimated Payback: —