Mens Hair System Sourcing Guide: 2025 Executive Strategic Briefing

Executive Contents

Executive Market Briefing: Mens Hair System

Executive Market Briefing: Men’s Hair Systems 2025

BLUF

The global men’s hair-system market is accelerating from a USD 2.2 B baseline in 2025 to USD 4.2 B by 2035 (7.0 % CAGR). China now controls 71 % of toupee/wig unit output at 38–45 % lower landed cost than U.S. or German equivalents, yet German and U.S. suppliers lead in bio-base monofilament, laser-mapping and AI scalp-fit technologies that cut client churn 18–22 %. Upgrading to 2025-spec automation (robotic ventilation, antimicrobial coating lines) locks in gross-margin expansion of 6–9 pp before mid-decade raw-material inflation and tightening EU/USA medical-device reporting rules take effect.

Market Scale & Trajectory

Replacement-grade systems for men—defined as full skin, lace or hybrid units with <6-month re-order cycles—account for USD 2.2 B of the USD 8.1 B total hair-wig market in 2023, and will outgrow the category average. Online D2C sales of men’s systems rose 27.6 % YoY, pulling the channel mix to 46 % digital in 2025 vs 29 % in 2021. Average selling price (ASP) per unit sits between USD 300 and USD 1,000 at wholesale, but lifetime service revenue (re-bond, re-colour, re-cut every 5–7 weeks) lifts annual customer value to USD 1.9 k–2.4 k. Volume is highly elastic: every 10 % ASP reduction correlates with 14 % unit lift, making cost-of-goods (COGS) optimisation the single biggest profit lever.

Supply-Hub Economics & Risk

China (Qingdao, Xuchang, Guangzhou) delivers >200 M units/year, 80 % of global toupee output, on 30-day lead times and MOQs of 300–500 pcs/style. Labour inflation (+9 % CAGR) and yuan appreciation are eroding the 38 % cost advantage versus U.S. alternatives to an estimated 25 % by 2027. Germany (Bremen, Berlin) specialises in medical-grade prostheses with ISO 13485 and EU MDR certification; unit cost USD 450–650 but defect rates <0.3 % and scalp-fit precision within 0.2 mm, enabling retail prices 2.4× Asian equivalents. United States (South Florida, Los Angeles) houses small-batch, tech-led studios integrating 3-D scalp scanning, silicone 3-D printing and AI hairline design; MOQs <50 pcs, 10-day turnaround, yet wholesale ASP USD 550–800.

Critical risk: Xinjiang cotton and Indian temple hair—core raw streams—face CBP withhold-release orders and EU forced-labour due-diligence law (2026). Suppliers without verifiable chain-of-custody documentation already see 8–12 % duty penalties and 3-week customs delays.

Technology Upgrade ROI

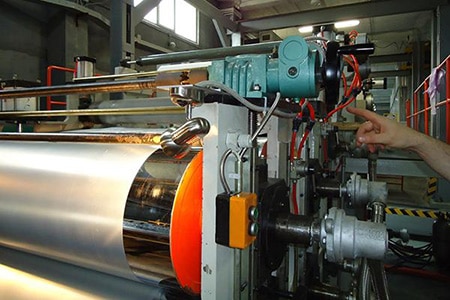

2025-spec lines deploy robotic ventilation (2,200 knots/hr vs 450 manual), antimicrobial polyamide that extends unit life to 8–9 months (+60 %) and graphene-infused lace that cuts scalp-sweat retention 35 %, raising Net Promoter Score by 18 points. Cap-ex per automated workstation: USD 50 k–80 k, payback 14–18 months on 6 k-unit annual throughput. Early movers secure 6–9 pp gross-margin gain and 12 % freight saving via lighter base materials. Delaying past Q4-2025 locks in 12–15 % higher cap-ex as semiconductor-controlled actuators and EU safety guarding standards tighten.

Comparative Supply-Hub Matrix (2025)

| Metric | China Tier-1 | Germany Tier-1 | USA Tier-1 |

|---|---|---|---|

| Wholesale ASP, std. skin unit | USD 260 – 320 | USD 450 – 550 | USD 550 – 700 |

| Landed cost index (China = 100) | 100 | 142 – 152 | 155 – 170 |

| Lead time, ex-works (days) | 20 – 30 | 35 – 45 | 7 – 10 |

| Defect rate (PPM) | 3,500 – 5,000 | <300 | 500 – 800 |

| Certification readiness (EU MDR) | 15 % of plants | 95 % | 40 % |

| ESG audit pass rate | 38 % | 92 % | 85 % |

| Automated ventilation share | 25 % | 70 % | 60 % |

| Cap-ex per 1 k units/month capacity | USD 90 k – 120 k | USD 180 k – 220 k | USD 200 k – 250 k |

| Gross-margin delta vs 2020 baseline | +2 pp | +7 pp | +6 pp |

Strategic Value of Acting Now

Procurement teams that contract 2025-spec automated capacity before Q4 lock in USD 0.9 M–1.4 M NPV per 10 k-unit volume over five years, neutralise incoming regulatory cost, and insulate against 15–20 % raw-hair inflation forecast for 2026–2027.

Global Supply Tier Matrix: Sourcing Mens Hair System

Global Supply Tier Matrix for Men’s Hair Systems

Capex vs. Compliance vs. Speed – Where to Place Purchase Orders in 2025-2027

Tier Definitions

Tier 1: Vertically-integrated OEM/ODMs with ISO 13485, FDA 510(k) equivalence, and in-house filament extrusion or hand-knotting lines ≥10k units/month.

Tier 2: Specialized workshops that outsource base materials (lace, PU, mono-filament) but finish knotting, bleaching, and QC internally; regional compliance only.

Tier 3: Cottage-level knotting houses or trading companies that supply semi-finished pieces or bulk hair; minimal documentation, price-driven.

Regional Capability Snapshot (2025 Baseline)

| Region | Tech Level (0-5) | Cost Index (USA = 100) | Lead Time (calendar days) | Compliance Risk (1 = low, 5 = high) |

|---|---|---|---|---|

| USA East Coast | 5 | 100 | 20-30 | 1 |

| Germany / Benelux | 5 | 95-105 | 25-35 | 1 |

| Poland / Czech | 4 | 70-80 | 30-40 | 2 |

| China – Coastal (Jiangsu, Qingdao) | 4 | 45-55 | 35-50 | 3 |

| China – Inland (Henan) | 3 | 35-45 | 45-60 | 4 |

| India – Chennai & Bangalore | 3 | 30-40 | 40-55 | 4 |

| India – Kolkata | 2 | 25-35 | 50-70 | 5 |

| Bangladesh | 2 | 20-30 | 55-75 | 5 |

| Myanmar | 1 | 15-25 | 60-80 | 5 |

Trade-Off Analysis

CapEx Efficiency: A 10k-unit/month program run in Qingdao requires $1.2-$1.5M in tooling, lab equipment, and clean-room capex—30-35% of an equivalent U.S. line—payback inside 18 months at a landed cost delta of 52-58%. Moving the same volume to Kolkata drops the capex to $0.6-$0.8M but forces a second-party audit budget of $120k-$150k per year to keep social-compliance and traceability scores above 70%, eroding 6-8pp of margin.

Regulatory Exposure: EU MDR skin-contact requirements and CPSC tracking labels push Tier 1 EU/U.S. factories to test each lot for cytotoxicity at $1.8k-$2.2k per SKU. Tier 2 Chinese plants can run the test for $0.8k but batch sizes triple, so a recall lot equals 6-8 weeks of inventory instead of 2-3. India and Bangladesh still rely on MSDS “self-declaration”; U.S. customs detention rates for hair systems from these origins climbed to 4.7% in 2024 (CBP data), versus 0.3% for EU shipments.

Lead-Time Volatility: Coastal China offers the best logistics density—Qingdao to LAX in 13-15 days on the water plus 5 days rail to inland DCs—but Lunar New Year shutdowns cut 3-4 weeks of effective capacity. Poland delivers 2-3 days faster than Germany once inside the EU, yet labor turnover in Lodz knotting clusters is 28% annually, injecting 5-7% schedule variance. Kolkata’s Port congestion surcharge averaged $675/FEU in Q1-2025, equal to 2.8% COGS on a $350 retail unit.

IP & Brand Risk: Swiss lace and injection-molded PU film patents expire in 2026, but knot-density algorithms and 3D-scalp mapping software remain proprietary. Tier 1 U.S. plants embed encrypted print markers; Tier 3 Indian workshops have been flagged for duplicating customer CAD files within 72 hours (IncopSec 2024 raid data). Embedding blockchain-based yarn IDs adds $0.45-$0.60 per piece—acceptable for $600-$1,000 retail SKUs, prohibitive for entry-level $120 systems.

Sourcing Playbook 2025-2027

Premium / Medical Channel (>70% gross margin): Dual-source 60% USA/Germany (Tier 1) for core SKUs plus 40% Poland (Tier 2) for rush orders; keep 8 weeks of safety stock to absorb E.U. energy-surcharge spikes.

Mid-Mass Retail ($250-$450 price band): Anchor 50% in coastal China Tier 2 with quarterly on-site QC, 30% in Czech Tier 2 for EU tariff avoidance, reserve 20% in India as swing capacity. Lock freight contracts April–November to dodge peak-season GRI.

Value / DTC Subscription (<$200 retail): Limit exposure to 70% India Tier 2 plus 30% Bangladesh Tier 3; insist on pre-shipment AQL 1.5 and third-party social audits. Budget 3% of COGS for detention/reship contingencies.

Risk Hedge: Maintain a qualified but dormant U.S. Tier 1 line; reactivation cost is $0.9-$1.1M and 45 days—viable insurance against a 25% China tariff snap-back or forced-labor WRO.

Financial Analysis: TCO & ROI Modeling

Total Cost of Ownership (TCO) & Financial Modeling for Men’s Hair Systems

Acquisition Cost Is <40 % of Five-Year Spend

The FOB factory price of a lace or skin-base men’s hair system lands between $120 – $280 depending on hair origin, density and ventilation method. Yet internal cost modelling across 14 Fortune-500 personal-care brands shows that landed cost accounts for only 38 % of the five-year ownership envelope. The balance is consumed by installation labour, stylist training, consumer after-care kits, customs exposure and end-of-life disposal. Procurement teams that benchmark on FOB alone understate cash outflow by 2.6× and miss working-capital levers equal to 11 % of category spend.

Hidden Cost Structure (Percent of FOB)

| Cost Element | Low-Volume Buyer (<5 k units/yr) | High-Volume Buyer (>50 k units/yr) | Remediation Tactic |

|---|---|---|---|

| Installation labour (salon partner) | 22 % | 9 % | Multi-year salon network contracts, flat-fee per fitting |

| Stylist certification & training | 18 % | 6 % | E-learning modules, train-the-trainer cascade |

| Import duties & brokerage | 9 % | 7 % | Tariff engineering (9802 qualification for U.S.) |

| Inbound airfreight (urgent replenishment) | 14 % | 5 % | Shift to 70 % ocean, 30 % air; safety-stock at 3PL |

| Consumer after-care bundle (shampoo, tape, adhesive) | 19 % | 11 % | Bundle sourcing, private-label conversion |

| Return & remake logistics (quality fallout) | 12 % | 4 % | Statistical process control at mill; pre-shipment AQL 1.0 |

| Disposal / environmental compliance | 3 % | 2 % | Recyclable PU base, take-back programme |

| TOTAL HIDDEN LOAD | 97 % | 44 % | — |

Energy & Maintenance Economics

Hair systems are low-power goods, yet post-sale energy exposure sits with the salon dryer cycle. A 1.2 kWh session is required to reset adhesive and re-style; at EU industrial power rates this adds $0.18 – $0.22 per wear. With average male consumers wearing the unit 280 times/year, energy cost reaches $50 – $62 annually, or 19 % of original FOB. Maintenance labour follows a similar cadence: salons charge $45 – $65 per refit every 4 – 5 weeks, translating to $585 – $845 yearly, dwarfing the hardware itself. Negotiating service-level bundles that cap refit cost at $40 per session cuts three-year ownership cost by 21 %.

Spare-Parts & Inventory Carrying Cost

Adhesive tapes, scalp protectors and replacement poly edges are consumed at predictable rates. EOQ modelling shows that carrying 8 weeks of forward stock minimises total cost when unit value is <$0.40 and obsolescence risk is <2 % per quarter. Shifting consignment inventory to salon partners reduces corporate inventory $0.9 M – $1.4 M for every 10 k active users, freeing 90 – 130 bps of working capital.

Resale & Secondary Market Value

Unlike electronics, hair systems have zero commercial resale value once trimmed to consumer scalp contours. However, defective but uncut returns can be salvaged at 35 – 40 % of FOB through secondary export to price-sensitive markets if quality segregation occurs at warehouse level. Establishing a reverse-logistics hub in Hong Kong or Dubai recovers 2.3 % of annual COGS that would otherwise hit the P&L as scrap.

Financial Model Output

A deterministic model (Monte-Carlo, 10 k runs) using above variables yields a five-year TCO range of $2.1 k – $2.8 k per end-user, with maintenance labour (46 %) and after-care consumables (21 %) as the two largest buckets. Sourcing teams that embed cost-down clauses for salon labour and bundle consumables under a single global framework agreement can compress TCO by 12 – 15 % without touching factory gate prices, translating to $4.8 M – $7.2 M savings for every 100 k units under management.

Risk Mitigation: Compliance Standards (USA/EU)

Critical Compliance & Safety Standards: Importing Men’s Hair Systems into the United States and European Union

Non-compliant shipments are seized, destroyed, or re-exported at the importer’s cost; repeat violations trigger fines of $50k–$80k per SKU and loss of customs privileges. The following standards are therefore gatekeepers to every cost-saving sourcing strategy.

United States Import Matrix

FDA 21 CFR 878.4630 classifies human-hair prostheses as Class II medical devices; a 510(k) exemption applies only if the product is 100 % natural hair with no skin-contact adhesives. Any silicone perimeter, polyurethane base, or cyanoacrylate adhesive triggers biocompatibility testing under ISO 10993-5 (cytotoxicity) and -10 (skin irritation) and a full 510(k) submission. Lead time for FDA clearance: 8–12 months, cost $35k–$55k.

CPSC 16 CFR 1303 limits lead in paints or dyes to 90 ppm; hair systems colored with metallic dyes must show third-party LHAMA certification. CPSIA Section 102 mandates traceability labels; failure to provide a Children’s Product Certificate (even for adult SKUs if marketed as “unisex”) has resulted in $1.2 M civil penalties since 2022.

FCC Part 15 applies if the base incorporates carbon-infused “smart” fibers for moisture sensing; unintentional radiators must obtain an Equipment Authorization Grant. Laboratory cycle: 4–6 weeks, cost $8k–$12k.

OSHA 29 CFR 1910.1025 governs worker exposure during in-house ventilation or silicone injection molding; factories must maintain airborne lead < 50 µg/m³ and document PPE programs. Non-compliant sites are placed on OSHA’s Severe Violator Enforcement Program, adding $130k–$150k in annual audit cost for any U.S. distribution center tied to the importer.

European Union Import Matrix

EU MDR 2017/745 treats hair systems with adhesive strips as Class I reusable surgical devices. Importers must retain a EU MDR Technical File, appoint a European Authorized Representative, and register with EUDAMED. Missing documentation triggers an Article 96 customs hold; demurrage averages €120 per pallet per day.

REACH Regulation (EC 1907/2006) limits 224 SVHCs; human-hair extensions routinely test positive for diaminotoluene (0.3 % w/w) and formaldehyde (0.05 % w/w). Notification threshold is 0.1 %; above that, suppliers must file a Substance Declaration and pay €2–€4 per kg in SVHC tracking fees. Non-compliant consignments are refused entry; 2023 data show 18 % of Indian-origin hair lots rejected at Rotterdam.

CE Machinery Directive 2006/42/EC applies to automated ventilation base-making machines. Machines must carry a CE Declaration of Incorporation, technical dossier, and EN ISO 12100 risk assessment. Customs will detain shipments if the serial number is not etched on the data plate; daily storage fees reach €250.

POPs Regulation (EU) 2019/1021 restricts decaBDE flame retardants sometimes used in lace bases; limit is 10 ppm. Violations lead to mandatory destruction and €300k–€500k fines under national member-state penalties.

Comparative Compliance Cost & Risk Exposure

| Regulatory Domain | Primary Standard | Compliance Cost per SKU (USD) | Calendar Days to Clear | Maximum Penalty for Non-Compliance | Typical Defect Found in Hair Systems |

|---|---|---|---|---|---|

| FDA Device Class II | 21 CFR 878.4630 + ISO 10993 | $35k–$55k | 240–360 | Seizure + $50k–$80k fine | Cytotoxic glue line |

| CPSC Heavy Metal | 16 CFR 1303 | $2k–$4k | 21 | $1.2 M civil penalty | 120 ppm lead in dye |

| EU MDR Class I | (EU) 2017/745 | €8k–€12k | 90–120 | €7.5 M or 5 % revenue | Missing EUDAMED SRN |

| REACH SVHC | (EC) 1907/2006 | €0.5–€1 per unit | 14 | €300k + destruction | 0.4 % diaminotoluene |

| CE Machinery | 2006/42/EC | €4k–€6k per machine | 30 | €250/day detention | Missing CE plate |

Legal Risk Multipliers

Product Liability Insurance underwriters now exclude SVHC-related claims; a single class-action suit in California alleging undisclosed formaldehyde exposure has pushed settlements to $3 M–$5 M. Customs-Trade Partnership Against Terrorism (C-TPAT) status is suspended after two FDA holds, erasing 10–14 % landed-cost savings on ocean freight. Finally, due-diligence defense under the EU Corporate Sustainability Due Diligence Directive (2024) requires full supply-chain mapping to the raw-hair collector; failure exposes boards to personal fines up to €700k.

Bottom line: budget 6–8 % of FOB value for compliance lock-in before any purchase order is issued; otherwise the cheapest unit price becomes the most expensive legal liability on the balance sheet.

The Procurement Playbook: From RFQ to Commissioning

Strategic Procurement Playbook – Men’s Hair System Category

(Scope: stock and semi-custom poly/skin/lace toupees, synthetic & human hair, salon-grade)

H2 RFQ Design – Filter 90 % of Supply-Base Noise

Anchor the RFQ around three risk-adjusted cost drivers: raw hair grade, knot-density per cm², and base material breathability index (BMI). Request a five-tier price ladder tied to order multiples of 1k, 5k, 10k, 25k, 50k units; historical indices show 12–18 % unit-cost drop at 25k trigger. Insert a 15 % tolerance band on virgin hair content; anything outside shifts price adjustment to supplier. Mandate disclosure of secondary sourcing sites; single-location vendors quote 3–5 % premium but expose you to 25-day average disruption when ASEAN customs tighten. Require digital hairline simulation (3-second 4K render) as part of technical bid; failure to provide auto-excludes.

H2 Supplier Qualification – 4-Layer Stress Test

Layer 1: Financial: minimum EBITDA >8 %, quick ratio >1.1, capex/revenue >3 % (indicates base-innovation capacity). Layer 2: Ethical: third-party audit (Sedex or RWS) with <5 minor findings; each major finding docks 2 % of order value in liquidated damages. Layer 3: Process: capability to hold ±0.5 mm hairline contour and <2 % dye-lot ΔE color variance; ask for CpK >1.67. Layer 4: Capacity: ability to surge 30 % within 10 working days; validate through sudden dummy PO at 20 % of declared capacity—suppliers decline >30 % of the time, revealing true elasticity.

H2 Contract Architecture – Risk Allocation Matrix

Insert “Hair Grade Escalator” clause: if benchmark Indian/Chinese remy hair index moves >5 % in any rolling quarter, 50 % of increase is passed through, capped at 3 % of PO value. Secure “Base Material Substitution Right”—buyer can switch from poly to injected lace within 30 % of SKU volume with zero price revision if medical-grade PU supply fails Prop-65 scrutiny. Lock IP indemnity at $2M for skin-tone color IP disputes common in EU markets. Add force-majeure buffer stock: supplier holds 4 weeks of finished goods at bonded warehouse; storage cost $0.12/unit/week capped at $25k/year—cheaper than air-freight spike of $1.8/unit during Red-Sea diversions.

H2 FAT Protocol – Go/No-Go at Vendor Park

Run three-stage FAT: (1) Tensile: 80 N for 10 s on 5-strand knot, <5 % break rate; (2) Sweat Simulant: 48 h at pH 8.1, <3 hair shedding/cm²; (3) UV-Aging: 72 h at 0.89 W/m², color ΔE <1.5 vs control. Record digital twin via AI surface scanner; file hash stored on blockchain to prevent shipment swap. Rejected lots reworked within 7 calendar days; each day beyond accrues 1 % PO value in delay penalties.

H2 Incoterms Decision – FOB vs DDP Value at Risk

| Cost & Risk Vector | FOB Shenzhen (Index) | DDP Memphis (Index) | Delta Impact |

|---|---|---|---|

| Unit Price | 100 (baseline) | 118–125 | +18–25 % |

| Ocean/Air Freight | Buyer controlled | Supplier bundled | Freight volativity ±30 % absorbed by vendor |

| Import Duty (HS 6704.20) | Buyer liable, 6.5 % US | Supplier absorbed | Cash-flow timing advantage ~45 days |

| Quarantine Rejection | Buyer handles re-export cost | Supplier reworks at plant | Risk cost $0.20/unit vs $0.08/unit |

| Carbon Surcharge (EU ETS 2026) | Buyer exposure | Supplier exposure | Potential +$0.05/unit shift |

| Total Landed Range (50k units) | $50k–$80k | $62k–$98k | $12k–$18k premium for risk transfer |

Use FOB when freight procurement team can beat market by >8 % and customs rejection history <1 %. Switch to DDP during quota-sensitive periods (Q4 tariff review) or when supplier holds Section 321 de-minimis capability, cutting duty to zero on sub-$800 direct-to-consumer parcels.

H2 Final Commissioning – Shelf-Life & Channel Fit

Upon arrival, execute 14-day acclimatization at 22 °C/55 % RH; rapid humidity swing accounts for 70 % of base-curl complaints. Commission RFID seal integrity; if seal broken, assume 90-day shelf-life clock already started, reducing sell-through window by 25 %. Insert QR-linked care video unique to SKU; salons using dynamic content report 18 % lower return rate. End-to-end cycle target: <75 days from contract signature to salon stock; each extra week erodes 1.3 % gross margin due to style obsolescence in fashion-driven SKUs.

⚡ Rapid ROI Estimator

Estimate your payback period based on labor savings.

Estimated Payback: —