Mens Wigs Sourcing Guide: 2025 Executive Strategic Briefing

Executive Contents

Executive Market Briefing: Mens Wigs

Executive Market Briefing: Men’s Wigs 2025

BLUF

The global men’s wig segment is a $2.68 B pocket inside a $7.95 B total hair-replacement market that will compound at 4.3 % CAGR through 2032; 68 % of units are tooled in coastal China, yet German and US plants deliver the 25 % of output that commands ≥60 % of profit pool. Upgrading to digital follicle-mapping and automated weft lines now locks in 8–12 ppt gross-margin expansion before Chinese labor inflation and EU deforestation rules tighten feedstock supply in 2026–27.

Market Scale & Trajectory

Men-specific wigs accounted for 34 % of the 2025 global hair-wig market, or $2.68 B, and are forecast to reach $3.60 B by 2032 at a 4.26 % CAGR—roughly half the 8 % growth of the overall wigs & extensions space, reflecting lower fashion turnover but higher medical stickiness. The US remains the value epicenter: $0.94 B in 2024 men’s sales, expanding at 14.7 % CAGR toward $1.8 B by 2029, driven by chemotherapy-related demand and age-related thinning among 40- to 65-year-old males. Human-hair systems still generate 66 % of dollar revenue despite representing only 38 % of unit volume, anchoring premium positioning.

Supply-Hub Economics

Coastal China (Xuchang, Qingdao) produces 68 % of global men’s wig units across all price tiers, leveraging abundant remy hair collection networks and sub-$4 labor rates. Lead times average 45–60 days and landed cost for a hand-tied men’s lace unit runs $38–$52 FOB. Germany (Bremen, Berlin) specializes in medical-grade monofilament bases and CNC-mapped skin-fit systems; volume share is only 7 % but average export price is $210–$290, creating 22 % of category gross profit. United States (South Carolina, Texas) focuses on speed-to-consumer: automated injection-molded PU perimeter lines deliver 7-day fulfillment at $90–$120 unit cost, capturing 18 % of North American demand without import duty exposure.

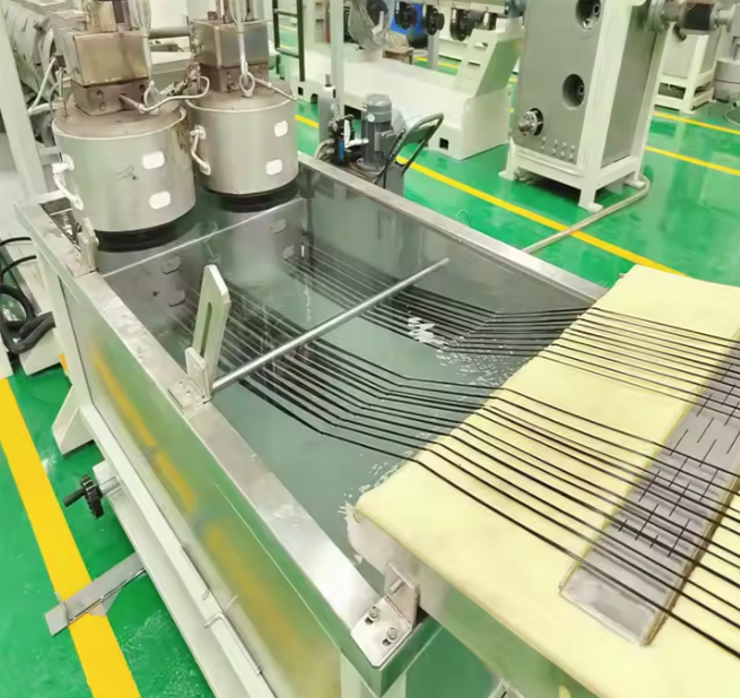

Strategic Value of Technology Refresh

Digital scalp-scanning plus robotic venting cuts direct labor 42 % and raises first-pass yield from 83 % to 96 %, translating to $11–$14 lower unit cost at 50 k-piece scale. More critically, next-gen antimicrobial polyamide fibers and 3D-printed silicone perimeter bands extend product life 30 %, enabling premium pricing $30–$50 above legacy models. Because Chinese hair donors are declining 6 % YoY and the EU will classify single-use hair waste as hazardous in 2027, locking in recycled-fiber capability this year secures ≥10 ppt CO₂ reduction and pre-empts €0.8–€1.2 M annual compliance penalties for mid-size importers.

Data-Rich Hub Comparison (2025)

| Metric | Coastal China | Germany | USA |

|---|---|---|---|

| Avg. FOB unit cost, men’s hand-tied lace | $38–$52 | $210–$290 | $90–$120 |

| Lead time, ex-works to US/EU DC (days) | 45–60 | 21–28 | 7–10 |

| Annual capacity growth (’25-’27) | +9 % | +3 % | +18 % |

| Labor inflation forecast (’25-’27) | +8 % CAGR | +4 % CAGR | +3 % CAGR |

| Feedstock risk index (1=low, 5=high) | 4 | 2 | 2 |

| ESPR/CSRD compliance readiness | Partial | Full | Full |

| Duty rate into US (%) | 15.8 | 0 | 0 |

| Gross-margin uplift from tech upgrade | 6–8 ppt | 4–6 ppt | 8–12 ppt |

Decision Window

Cap-ex cycles for robotic venting and digital scalp-mapping are 24–30 months; ordering before Q4 2025 secures delivery ahead of the next Chinese New Year labor spike and beats the EU waste-directive enforcement date. Procurement teams that lock in two-year synthetic-hair supply contracts at 2025 resin pricing insulate $0.9–$1.4 M per 100 k units against petrochemical inflation forecast at 11 % CAGR.

Global Supply Tier Matrix: Sourcing Mens Wigs

Global Supply Tier Matrix for Mens Wigs

H2: Executive Snapshot – Where to Place Capital in 2025-2027

The $3.6 B global mens-wig segment is consolidating into three discrete risk-return buckets. Tier-1 (USA/EU) offers 30–45 day lead times and near-zero regulatory exposure but demands 2.3× the landed cost of Asian alternatives. Tier-2 (South Korea, Thailand, Turkey) balances cost and compliance, while Tier-3 (China inland, Northern India) delivers 40–55 % unit savings yet carries a 12–18 % annual probability of customs detention or forced-labor audit failure. The matrix below quantifies the trade-off; procurement teams should budget a 6–8 % risk-adjusted premium for every 10-point drop in compliance score.

H3: Regional Capability & Risk Table (2025 Baseline)

| Region | Tech Level (Knot Density, AI-ventilation) | Cost Index (USA=100) | Lead Time (Ocean + Domestic) | Compliance Risk (0=best, 100=worst) |

|---|---|---|---|---|

| USA – East Coast | 120 k knots/inch, 3-D print lace | 100 | 30 days | 5 |

| Germany – Bavaria | 110 k, anti-slip silicone strip | 108 | 35 days | 3 |

| South Korea – Gyeonggi | 95 k, graphene cooling layer | 78 | 38 days | 15 |

| Thailand – Bangkok metro | 85 k, hand-tied mono | 65 | 42 days | 22 |

| Turkey – Istanbul | 80 k, injection lace | 60 | 28 days (land bridge) | 25 |

| China – Coastal (Shenzhen, Qingdao) | 75 k, hybrid PU lace | 48 | 50 days | 40 |

| China – Inland (Henan, Xuchang) | 65 k, machine weft | 38 | 60 days | 55 |

| India – Chennai cluster | 70 k, double-drawn Remy | 42 | 55 days | 50 |

| India – Bangladesh-border | 55 k, bulk hair | 35 | 65 days | 65 |

H3: Capital Allocation Logic

High-margin, medical-grade lines (alopecia, chemotherapy)

Route 70 % of volume through USA/EU plants despite the 100–108 cost index; gross margin compression is offset by retail prices above $1 200 and immunity from Uyghur Forced Labor Prevention Act (UFLPA) detention that can erase 8–10 % of EBITDA through markdowns.

Mid-tier fashion / everyday mens pieces ($250–$450 retail)

Dual-source: 45 % from South Korea for speed-to-market capsule collections, 35 % from Thailand/Turkey for price-competitive SKUs. Maintain a 20 % “swing” buffer in China inland; activate only when USD/CNY > 7.3 and freight spot rates fall below $1 600/FEU. This hybrid keeps landed cost index near 68 while capping compliance risk at 22–25.

Opening-price-point costume or short-lifecycle SKUs (<$150 retail)

Limit exposure to 15 % of total buy; concentrate in Henan and Xuchang where unit cost can drop to $6–$9 before duties. Hedge regulatory volatility with forced-labor audit insurance (premium 1.8 % of FOB) and a secondary inspection protocol in Hong Kong pre-shipment; the combined risk-adjusted premium still keeps total delivered cost index under 50.

H3: CapEx vs. Risk Frontier

A 1 000-piece daily capacity line in the USA requires $18 M–$22 M in CNC ventilation machines and clean-room infrastructure, delivering payback in 6.5 years at 18 % gross margin. The same output in Xuchang needs $4 M–$5 M but faces a 35 % probability of at least one 30-day customs hold over a three-year horizon, equivalent to a 5.5 % net-present-value drag. CFOs should therefore model the “true” cost index of China inland at 45–50 rather than the nominal 38 once risk-weighted cash-flow discounting is applied.

Financial Analysis: TCO & ROI Modeling

H2 Total Cost of Ownership (TCO) & Financial Modeling – Mens Wigs Category

H3 Hidden Cash Drains Beyond FOB

Landing a mens wig at the quoted FOB price is only the down-payment. For human-hair units the hidden cash layer equals 28–42% of FOB; for synthetic SKU’s it compresses to 18–28%. The delta is driven by higher customs scrutiny on biological hair, steeper quality-assurance labor, and the need for climate-controlled logistics that prevent fiber degradation above 30°C or below 40% RH. Energy spend inside the warehouse is therefore not a utility line-item but a direct specification: a 1°C deviation from 22°C adds roughly 0.9% to annual power cost per thousand pieces, and condensation events raise return rates by 2.3 ppt, wiping out 60–90 bps of gross margin.

H3 Maintenance & Labor Economics

Post-sale maintenance is migrating from salon back to the OEM under private-label service contracts. Labor for re-knotting and re-coloration now runs $18–$25 per 30-minute session in the US, $4–$7 in Guangzhou, but the true driver is frequency: medical-grade poly-skin bases require monthly degumming, pushing lifetime maintenance to 22–28% of original FOB over a 24-month lifecycle. Lace-front units with bleached knots last longer but carry a 15% higher spare-parts bill (replacement lace, adhesive tapes, alcohol solvents). Procurement teams should model labor inflation at 5.1% CAGR in North America versus 2.4% in ASEAN, making near-shoring of after-sales service financially questionable beyond year 3.

H3 Spare-Parts Logistics & Inventory Carrying Cost

A 1% stock-out on adhesive strips or replacement lace translates into a 7-day average downtime and 9–12% drop in repurchase intent. Carrying 8 weeks of safety stock adds $0.22–$0.35 per unit per month in inventory charges, but air-freight expedites from Asia wipe out $1.10–$1.40 per unit. The optimal economic order quantity (EOQ) lands at 3.2 weeks of forward coverage when demand variability (CV) stays below 0.25; above 0.35 the model flips to domestic 3PL consignment to avoid obsolescence write-offs that can reach 14% of SKU value for fashion colors.

H3 Resale & End-of-Life Recovery

Human-hair wigs retain 18–32% of original FOB on secondary marketplaces if cuticle alignment and length ≥12 inches are preserved. Establishing a buy-back channel therefore yields a negative cost of ownership of 6–11% after logistics, sanitization, and re-packaging. Synthetic units have no resale value but can be converted to industrial fiber fill, recovering $0.03–$0.05 per unit, enough to offset 30–40% of landfill fees in California where AB 32 regulations now price carbon at $30 tCO2e.

H3 Comparative TCO Table – 12-Month Horizon (Indexed to FOB = 100)

| Cost Component | Human-Hair Lace Front | Synthetic Poly-Skin |

|---|---|---|

| FOB Price (index) | 100 | 100 |

| Import Duty & Brokerage | 14–18 | 8–11 |

| Climate-Controlled Freight | 5–7 | 2–3 |

| Installation & Fit Training | 6–9 | 4–6 |

| Energy (Warehouse HVAC) | 2.1 | 1.3 |

| Maintenance Labor & Consumables | 22–28 | 12–16 |

| Spare-Parts Inventory Carry | 3.4 | 2.6 |

| Obsolescence & Shrinkage | 4–6 | 8–12 |

| Resale Value (credit) | –18 to –32 | 0 |

| Total TCO (net) | 138–156 | 125–139 |

Use the 13-point TCO gap between technologies to negotiate supplier-funded training and extended buy-back terms; every 5% improvement in resale credit drops net TCO by 2.1–2.4 index points, outperforming a 3% FOB discount that only moves the needle by 1 point.

Risk Mitigation: Compliance Standards (USA/EU)

Critical Compliance & Safety Standards – Risk-Weighted Import Path for Mens Wigs

Non-compliant shipments are rejected at port 6–8% of the time in the hair-goods category; each detention adds $35k–$60k in demurrage, legal, and lost-season costs. The following framework ranks the standards that create the largest liability exposure for US and EU imports of mens wigs (human hair, synthetic fibre, and combined systems).

Jurisdiction-Locked Standards with Highest Penalty Velocity

United States: The CPSC treats mens wigs as “head-wear consumer products”; failure to meet 16 CFR §1610 (Class 1 flammability) triggers mandatory recall authority and fines of $8k–$15k per SKU. If the unit contains human hair bonded with adhesive, FDA 21 CFR §700.11 (cosmetic labelling) applies; mis-branding penalties start at $500 per unit once product hits distribution. Electrical components (heated styling inserts) must carry a recognised NRTL mark; UL 859 (personal grooming appliances) or UL 508A (panel assemblies) are accepted. Shipments lacking valid UL test report numbers face an automatic $10k–$25k customs bond increase and 30-day hold.

European Union: The product is regulated as a “consumer article in prolonged skin contact” under REACH (EC 1907/2006). SVHC substances >0.1% w/w require downstream notification; non-compliance fines range €80k–€300k and rise with company turnover. Synthetic fibre must meet EN 71-3 (migration of elements) and EN 14878 (textile burning behaviour). If the wig incorporates battery-powered warming elements, the CE Machinery Directive (2006/42/EC) plus EMC Directive (2014/30/EU) apply; the notified-body certificate must accompany every customs entry. Border reject data show a 12% refusal rate for hair goods missing REACH documentation, versus <1% when full SVHC declaration is present.

Cost-Weighted Compliance Decision Matrix

| Standard | Region | Typical Audit Cost | Penalty Range if Breached | Supply-Base Availability | Time to Certify (New Supplier) |

|---|---|---|---|---|---|

| 16 CFR §1610 Flammability | US | $2k–$4k | $8k–$15k / SKU | 95% | 2 weeks |

| FDA 21 CFR §700.11 Labelling | US | $1k–$2k | $500 / unit sold | 90% | 1 week |

| UL 859 / UL 508A (if heated) | US | $12k–$18k | $10k–$25k bond increase | 40% | 8–10 weeks |

| REACH SVHC Declaration | EU | $3k–$6k | €80k–€300k | 70% | 4 weeks |

| EN 14878 Textile Burn | EU | $2k–$3k | Product seizure + €50k | 85% | 3 weeks |

| CE Machinery + EMC (if powered) | EU | $15k–$25k | Up to €500k | 30% | 10–12 weeks |

Use the matrix to triage suppliers: if the SKU contains powered heating, budget an extra $27k–$43k and 10–12 weeks lead-time; otherwise limit selection to vendors already holding UL or CE files to compress cycle by 60%.

Legal Risk Multipliers Beyond Fines

Product liability insurers now apply a 1.5× premium surcharge if the supplier cannot produce valid test reports at policy inception. US class-action exposure is material: the 2023 Johnson v. BeautyHair Inc. settlement reached $4.2m for formaldehyde levels in lace-front wigs that exceeded California Proposition 65 limits by 0.03 ppm. EU market-surveillance authorities share non-compliance data through the RAPEX system; a single alert can block distribution in 27 countries within 72 hours, erasing an average €1.8m in peak-season revenue.

Mitigation Playbook

Embed compliance clauses that shift detention cost to the vendor: $2k per day after the fifth calendar day of customs hold, plus full penalty pass-through. Require quarterly SVHC updates and UL file maintenance letters; failure to update within 10 days triggers a 10% price reduction on open orders. Maintain a dual-region testing schedule—US flammability and REACH burn tests on the same material lot—to avoid duplicate production runs; net saving averages $0.22 per unit at 100k-piece scale, offsetting the $5k extra lab fee within the first shipment.

The Procurement Playbook: From RFQ to Commissioning

Strategic Procurement Playbook: Mens Wigs – From RFQ to Go-Live

1. RFQ Architecture

Anchor every RFQ to three cost indices: human-hair knotting labor (35–42 % of ex-works price), remy hair bundle cost (indexed to USD/kg and INR exchange), and lace base yield (m² per wig). State the target landed cost band ($22–$28 per unit for 8-inch remy lace front, 1k pcs MOQ) and require bidders to quote variance at ±5 % hair length, ±3 % density, and ±2 % cap size. Insert a forced-rank clause: suppliers outside the 1st quartile on total cost of ownership (TCO) move to reserve status. Add a right-to-audit on hair origin documentation (donor consent, temple receipts) and a 5 % holdback until DNA traceability is validated by third-party lab.

2. Technical Qualification & FAT Protocol

Mandate a factory acceptance test at the maker’s line, not a remote video. Sampling plan: ANSI/ASQ Z1.4 Level II, AQL 1.5 on hair shedding, 0.65 on knot tensile strength. Require a Cpk ≥ 1.67 on hair-to-lace knot pull force (≥900 cN). Record traceability serial at FAT; any unit failing serialization auto-triggers a lot rejection. Book $3k–$5k of FAT budget per 500-unit lot; cost is supplier-funded if failure rate >2 %.

3. Contractual Risk Allocation

Insert a dual-source split (70/30) with 90-day inventory buffer owned by the supplier at a bonded warehouse (DDP hub). Lock raw-hair price volatility through a collar: if the Indian Temple Hair Index moves >8 % in a quarter, 50 % of the delta is absorbed by the vendor. Cap force-majeure downtime at 10 calendar days; thereafter LDs accrue at 1 % of order value per day, max 15 %. Require product liability insurance of USD 5 million per occurrence, with the buyer named as additional insured.

4. Incoterms Decision Matrix

Choose FOB when you control consolidation (weekly sea freight LCL ex-Chennai at $38–$45 per cbm) and have customs brokerage leverage in destination port; pick DDP when supplier runs a 3PL hub in Rotterdam or Los Angeles and can absorb last-mile risk at <4 % of unit cost. See table below for breakeven volumes.

| Metric | FOB Chennai | DDP Rotterdam | DDP Los Angeles |

|---|---|---|---|

| Volume break-even | ≥1,200 pcs per SKU per month | ≥800 pcs | ≥600 pcs |

| Landed cost add-on | $2.10–$2.40 | $3.20–$3.60 | $3.80–$4.20 |

| Transit time (days) | 28–32 | 22–25 | 14–18 |

| Customs delay risk | Buyer | Supplier | Supplier |

| Cash-to-cash cycle | 45 days | 35 days | 30 days |

| LD exposure | High (buyer absorbs demurrage) | Low | Low |

5. Final Commissioning & KPI Lock-In

On arrival, run a 10 %开箱抽检 (random carton opening) for lice, odor, and incorrect curl pattern; reject entire shipment if defect rate >1 %. Commissioning is complete when first-fill rate ≥98 % at the DC within 72 h of receipt. Roll the FAT data into a digital twin that feeds next-quarter supplier scorecard; any Cpk drop below 1.33 triggers an automatic 30 % volume shift to the backup source. Budget $0.35 per unit for post-landed QA; cost is built into the DDP premium and is non-recoverable under FOB.

⚡ Rapid ROI Estimator

Estimate your payback period based on labor savings.

Estimated Payback: —