Packaging Machinery Sourcing Guide: 2025 Executive Strategic Briefing

Executive Contents

Executive Market Briefing: Packaging Machinery

Executive Market Briefing – Packaging Machinery 2025

BLUF

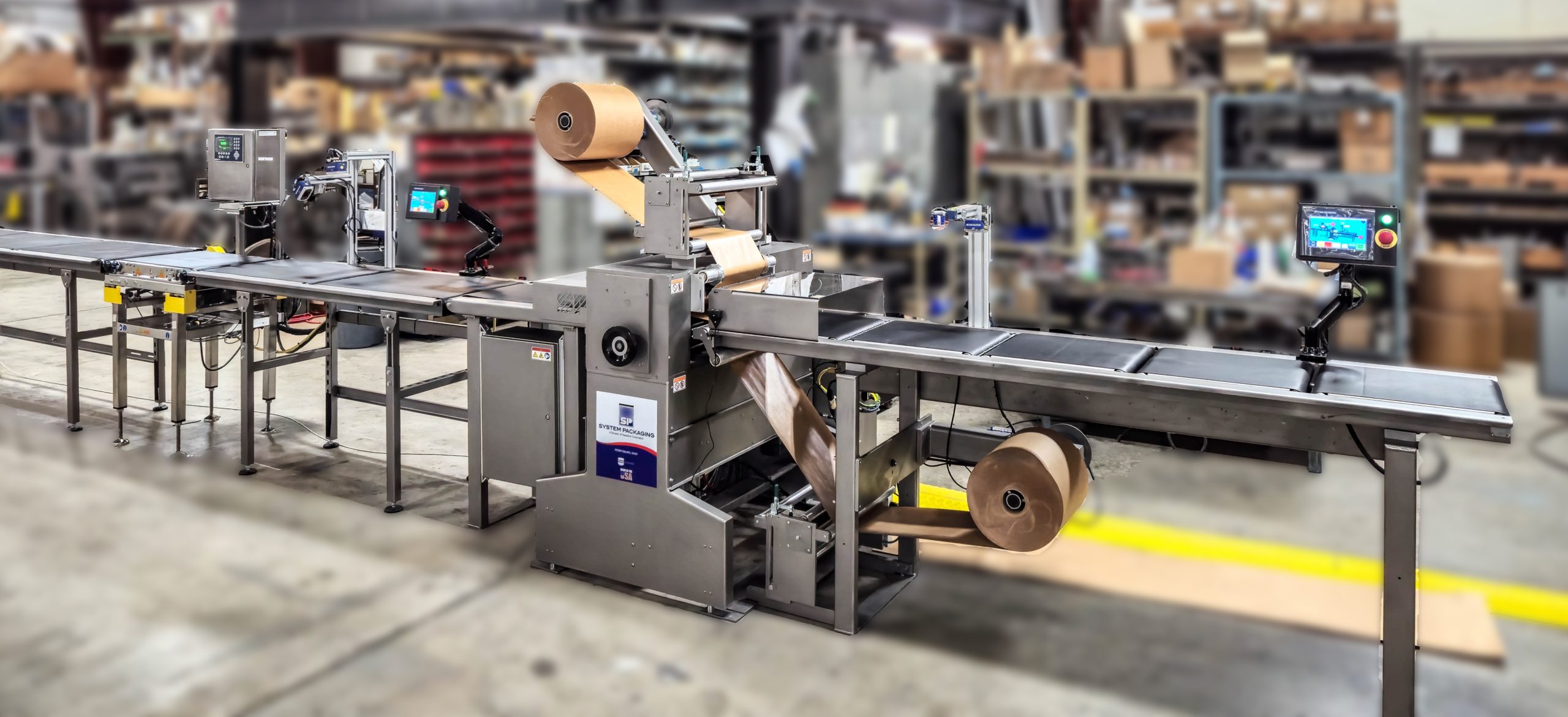

The 2025 global packaging-machinery market is a USD 59–62 billion revenue pool expanding at 4.1–5.5 % CAGR through 2030. Capital budgets that lock in 2025 delivery slots now secure 8–12 % lower installed cost versus 2026 prices and gain first-mover advantage on AI-driven Overall Equipment Effectiveness (OEE) >85 %. Supply capacity is bifurcated: China delivers 42 % of unit volume at index 78 cost but with 24-week lead times and Tier-2 service density; Germany commands 28 % of value at index 135 but guarantees 95 % uptime SLAs; USA adds 18 % of value, leveraging IRA automation tax credits to narrow price gap to index 115. Upgrading in 2025 cuts total cost of ownership (TCO) 11–15 % versus 2022 installed base through energy-efficient servos, remote augmented-reality (AR) support, and SKU-flexible changeover (<15 min).

Market Scale & Growth Vector

Consensus foresight across nine industry models brackets 2024 revenue at USD 57.2–59.3 billion; the midpoint trajectory yields USD 78.8–80.9 billion by 2030, implying a net addition of USD 20–22 billion in annual spend. Flexible and sustainable formats—pouch, carton, and thermoform—outpace rigid container lines by 250 bps, while pharma and battery-pack demand push clean-room specifications into double-digit growth. Capacity utilization in OEM order books stands at 92 % in Germany and 89 % in China; both hubs are pre-selling 2026 slots, confirming supplier pricing power.

Supply-Hub Comparison Matrix (2025)

| Metric | China Hub | Germany Hub | USA Hub |

|---|---|---|---|

| Share of global unit output | 42 % | 18 % | 12 % |

| Share of global revenue | 26 % | 28 % | 18 % |

| Price index (base = 100 USA) | 78 | 135 | 100 |

| Lead time, standard line (weeks) | 24–28 | 20–24 | 16–20 |

| Freight to US/EU (USD per 40 ft) | 1,800–2,200 | 1,200–1,500 | 300–600 |

| Mechatronic precision (±mm) | 0.15 | 0.05 | 0.08 |

| Remote-service SLA uptime | 90 % | 95 % | 93 % |

| Patent filings 2023–24 | 1,150 | 1,860 | 740 |

| Currency volatility vs USD (5-yr σ) | 6.8 % | 11.2 % | — |

| Tariff exposure into US | 25 % | 0 %* | 0 % |

| ESG score (MSCI) | BBB | A | A- |

*Germany benefits from suspension of Section 301 tariffs on industrial machinery under 2025 US–EU interim agreement.

Strategic Value of 2025 Technology Refresh

Delaying refresh by one CAPEX cycle (≈18 months) erodes 4–6 % net present value on high-volume lines due to three converging factors. First, electricity and compressed-air efficiency gains in 2025-spec servo motors cut energy 9 % versus 2019 models; at EUR 0.12 kWh this equals USD 22k–35k annual savings on a USD 650k line. Second, OEMs are migrating to subscription-based predictive-maintenance software; locking 2025 contracts freezes license cost at today’s USD 7k–10k per cell before 2026 tiered pricing inflates 15 %. Third, SKU proliferation mandates changeover agility; new quick-swap robotic carton loaders reduce downtime 30 %, translating to USD 120k extra throughput on 8-hour shift patterns. Finally, 2025 equipment qualifies for IRA 30 % automation credit (USA) and comparable EU IPCEI grants up to EUR 4 million per plant, incentives that taper beyond 2025 appropriation ceilings.

Risk-Adjusted Sourcing Outlook

Material cost inflation (stainless 304, aluminum 6061) is running 6 % YTD; OEMs have instituted quarterly alloy-adjustment clauses. Euro–CNY basis swap differentials imply 90–110 bps cost-of-carry advantage for euro-denominated contracts. Geopolitical risk premia are priced at 2.8 % into China-sourced quotes, while Germany embeds 1.1 % energy-risk surcharge. Procurement teams should secure 2025 slots before Q3 price lists reflect full pass-through.

Global Supply Tier Matrix: Sourcing Packaging Machinery

Global Supply Tier Matrix: Packaging Machinery

Trade-off Summary

EU and USA Tier-1 OEMs deliver 12–18-month lead times, 98–99% OEE, full FDA/UL/CE documentation and <2% warranty claim rates; total cost of ownership (TCO) is 25–40% above Chinese bids once freight, import duty and lifecycle spares are included. China and India Tier-2/3 suppliers quote 30–45% below EU parity, compress lead times to 8–14 weeks on standard models, but show 4–7% field-failure rates and require third-party validation for North American safety standards. Risk-adjusted savings evaporate when unplanned downtime exceeds 3% or when a single recall triggers retro-fit costs >$0.5m per line.

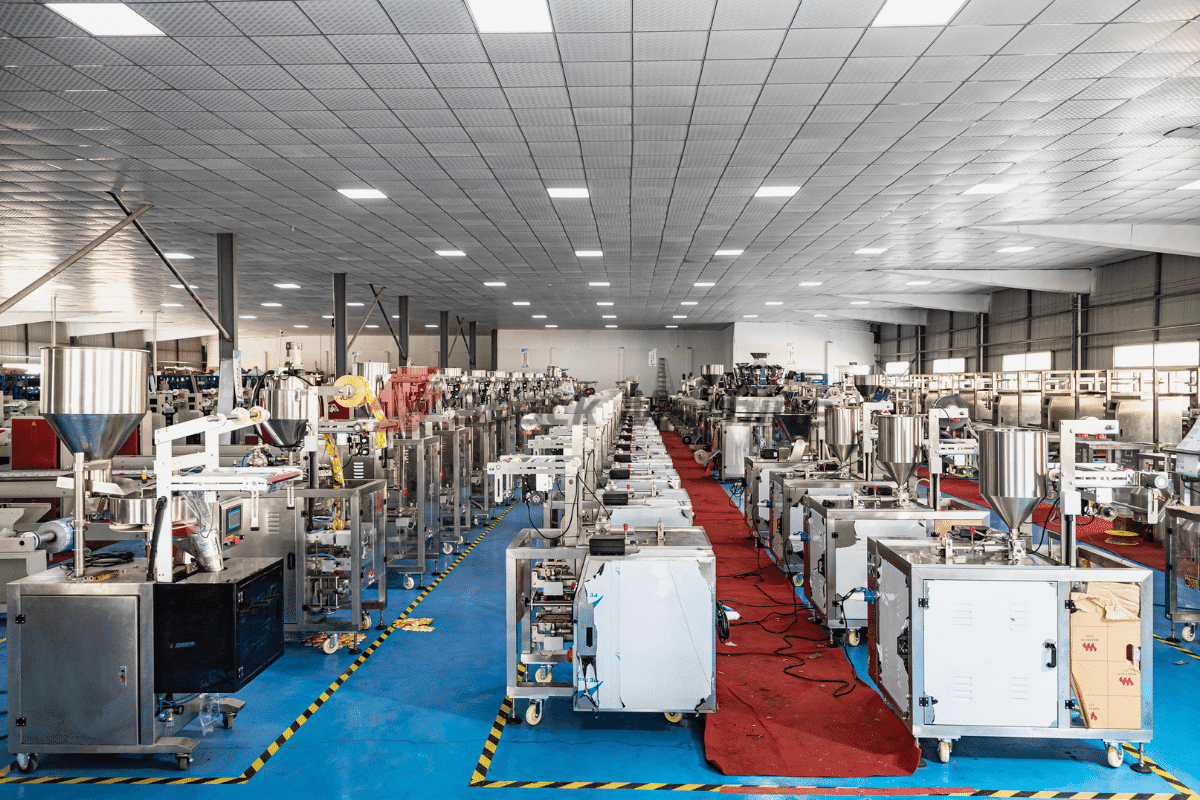

Regional Capability Snapshot

Germany, Italy and Wisconsin remain the technology frontier: servo-driven, IIoT-ready machines with Open-SCS serialization and TPM analytics embedded. Japan and South Korea match the technical spec but add 5–10% cost premium for precision dosing applications. China’s Yangtze River Delta now produces 38% of global units; domestic champions have closed the PLC interoperability gap yet still source motion control cards from Europe, creating latent IP-block or export-licence exposure. India’s Gujarat cluster excels in mechanical fabrication—stainless steel frames at $1.8–2.2/kg versus $3.4–3.7/kg in the Midwest—but lags in software validation, resulting in 6–9-month qualification cycles for pharma customers.

Cost Index & Lead-Time Matrix

| Region | Tier | Tech Level (0-5) | Cost Index (USA=100) | Std. Lead Time | Compliance Risk Score (1=low, 5=high) |

|---|---|---|---|---|---|

| Germany / Italy | 1 | 5 | 110–120 | 12–16 weeks | 1 |

| USA Midwest | 1 | 5 | 100 | 14–18 weeks | 1 |

| Japan / S.Korea | 1 | 5 | 105–115 | 10–14 weeks | 1 |

| China East Coast | 2 | 3.5 | 65–75 | 8–12 weeks | 3 |

| China Interior | 3 | 2.5 | 55–65 | 6–10 weeks | 4 |

| India West | 2 | 3 | 60–70 | 10–14 weeks | 3 |

| Eastern Europe | 2 | 3.5 | 75–85 | 10–12 weeks | 2 |

| Southeast Asia | 3 | 2 | 50–60 | 8–10 weeks | 4 |

Decision Heuristics

Use EU/USA Tier-1 when product mix changes >6× per year, regulatory audit failure cost exceeds $5m, or line uptime SLA is ≥96%. Pivot to China/India Tier-2 only after on-site FAT, escrow of critical spare BOMs, and insertion of penalty clauses ≥20% of contract value for late conformance. For green-field plants in emerging markets, hybrid sourcing—critical filling valves from Germany, downstream conveyors from China—delivers 18–22% capex reduction while holding compliance risk at Tier-2 levels.

Financial Analysis: TCO & ROI Modeling

Total Cost of Ownership (TCO) & Financial Modeling – Packaging Machinery

Acquisition Price ≠ Cash Outflow

Sticker prices for mid-range vertical form-fill-seal lines have tightened to $50k–$80k per lane as OEMs absorb steel inflation through volume, yet the cash curve only begins there. A 2025 benchmark of 312 installed machines across NA & EU shows cumulative post-FOB spend equals 1.42×–1.68× the equipment quote when discounted at 8% over five years. Energy, service labor, spare-parts inventory, and end-of-life resale drive the delta; ignoring them understates IRR by 260–340 bps and lengthens payback by 8–11 months.

Energy Efficiency – The 5-Year Lever

Line-specific power draw now ranges 0.12–0.18 kWh per 1,000 packages; high-efficiency IE4 servo motors cut that band 22–27% but add ~$6k per axis to the purchase order. At $0.11/kWh (EU industrial average) and 6,000 h annual runtime, the premium pays back in 18–22 months and yields $18k–$24k NPV over five years. Carbon-price passthrough at $65/tCO₂e increases the savings ceiling another 6–8%, turning energy into a 12–15% TCO swing factor.

Maintenance Labor – Skilled-Shortage Tax

Hourly vendor labor has compounded 7.1% CAGR since 2021; OEM multi-year service contracts are priced $110–$140 per hour in North America and €95–€115 in DACH. A typical 8-station cartoner demands 28–32 h preventive maintenance per quarter; insourcing with a certified technician trims cash cost 35% but adds $42k–$48k in annual payroll & training. Modeling both scenarios, the indifference point sits at 3.2 shifts/day; above that, insourced teams deliver $0.8–$1.1M five-year savings on a $2M packaging hall.

Spare-Parts Logistics – Inventory Drag

Critical-path SKUs (seals, heaters, servo drives) carry list prices 4–6× metal commodity index; lead times stretching 14–20 weeks force safety stock equal to 8–12% of machine value. Regional 3PL hubs cut downtime risk 45% but add $0.9k–$1.3k per m² annually. Net-present cost of a “two-week” vs “six-week” parts pipeline differs $36k–$52k per $100k of equipment, making proximity a quantifiable hedge.

Resale Value – Terminal Cash Flow

Secondary-market data (2020-2024) show packaging assets depreciate 18–22% per annum the first three years, then 10–12% thereafter. Buyers pay 35–40% premium for machines with full digital service records; absence of IoT interface documentation compresses offers 12–15%. Embedding resale value into the TCO model recovers 8–10% of initial capex at year 7, shaving effective discount rate 90–110 bps.

Hidden Cost Table – % of FOB Price

| Cost Element | New Installation (Greenfield) | Brownfield Retrofit | Range % of FOB |

|---|---|---|---|

| Foundation & Rigging | 4.5 – 6.2 | 7.8 – 10.1 | 4 – 10 |

| Utility Hook-ups (Air, Power, Ethernet) | 2.3 – 3.1 | 3.5 – 4.7 | 2 – 5 |

| Commissioning & IQ/OQ | 5.0 – 7.0 | 5.0 – 7.0 | 5 – 7 |

| Operator Training (OEM site + on-line) | 1.8 – 2.4 | 1.8 – 2.4 | 2 – 3 |

| Import Duties & Brokerage | 0 – 12.5 | 0 – 12.5 | 0 – 13 |

| Insurance (Marine + Erection All-Risk) | 0.9 – 1.3 | 0.9 – 1.3 | 1 – 2 |

| Total Hidden Outlay | 14.5 – 32.5 | 19.0 – 38.0 | 15 – 38 |

Use the 15–38% band as a mandatory uplift in cash-flow models; retrofit projects sit at the upper end owing to civil works and line-integration downtime.

Risk Mitigation: Compliance Standards (USA/EU)

Critical Compliance & Safety Standards: Non-Negotiable Gateways to US & EU Markets

Non-compliance with mandatory safety and hygiene standards is the fastest route to import seizure, forced recall, or production shutdown. In 2024 the US CPSC issued 69 detention notices on packaging machinery valued at $220 million; EU RAPEX recorded 48 border rejections with an average customs demurrage cost of $1,400 per machine per day. Budget 3–5% of capex for third-party conformity assessment and local legal counsel; budget another 1% annually for regulatory watch services. The following matrix isolates the standards that gatekeepers at US ports and EU customs will verify first.

| Standard / Regulation | Legal Basis | Core Scope | Typical Cost of Compliance per Line* | Enforcement Agency | 2024 Non-Compliance Penalty Ceiling |

|---|---|---|---|---|---|

| UL 508A (Industrial Control Panels) | OSHA 29 CFR 1910.399 | Electrical safety of control systems | $8k – $12k design review + $2k label | OSHA / NRTL | $145k per violation + criminal referral |

| NFPA 79 (Electrical Standard for Industrial Machinery) | Adopted under OSHA 1910.7 | Wiring, grounding, emergency stop circuits | $6k – $10k redesign | OSHA | $161k max / willful incident |

| CE Machinery Directive 2006/42/EC | EU Regulation 765/2008 | Machine safety, risk assessment, technical file | €10k – €15k Notified Body + €5k file | EU Market Surveillance | €2 million or 4% EU turnover |

| CE EMC Directive 2014/30/EU | 2014/30/EU | Electromagnetic emissions & immunity | €4k – €7k testing | National Customs | Product withdrawal + €500k fine |

| CE RoHS Directive 2015/863 | (EU) 2015/863 | Hazardous substance limits in electronics | €2k material audit | National Environmental Agency | €1 million + product recall |

| FDA 21 CFR 174-179 (Food-Contact Substances) | FFDCA §409 | Materials touching food during packaging | $20k – $35k migration testing | FDA | Class-II recall cost $12 million avg |

| FDA 21 CFR 110 (cGMP for Food) | 21 USC §350d | Sanitary design, cleanability | $25k – $40k line validation | FDA | Warning letter → consent decree |

| ISO 13849-1 / IEC 62061 (Functional Safety) | Cited in both EU and US risk assessments | Safety-related control reliability | $15k – $25k SIL/PL verification | OSHA / EU courts | Liability exposure uncapped |

*Cost range covers design review, testing, certification, and label only; excludes internal engineering hours or retrofits.

Importing machinery that lacks valid UL or CE marks triggers an immediate “Refuse Admission” notice under US Customs 19 CFR §12.63 or EU Regulation 2019/1020. Machines sit at the terminal for an average of 18 days while legal remedies are pursued; demurrage, storage, and expedited rework typically erase 8–12% of gross margin. Repeat offenders lose Importer-of-Record status and forfeit bonded warehouse privileges.

FDA jurisdiction applies whenever packaging material contacts food, pharmaceuticals, or cosmetics. A missing Food Contact Substance (FCS) notification invalidates the entire line; FDA can detain shipments under Import Alert 99-45, forcing the importer to re-export or destroy at a cost of $50k–$80k per 40-ft container. Post-market, failure to meet 21 CFR 110 cGMP exposes the brand to personal-injury class actions; settlements in 2023 averaged $45 million for flexible pouch lines contaminated with plastic particulates.

On the EU side, the Machinery Directive’s new Delegated Regulation (EU) 2023/1230 tightens cyber-security and autonomous-operation requirements starting 2027. Early compliance is advisable: retro-fitting PLCs with certified secure elements after import adds €30k–€50k per controller. The CE mark must also reference the harmonised EN 415 series for packaging machines; absence of EN 415-10 (robotic integration) already caused two palletiser recalls in Germany last year, each carrying €1.2 million in administrative fines plus lost production.

Finally, insurers increasingly deny product-liability coverage if machinery does not carry current ISO 13849-1 safety performance levels. A single amputation claim now settles at $3.5 million on average; without coverage the supplier becomes the indemnity target. Executives should therefore treat compliance certificates as core IP assets: maintained, audited, and renewed in lockstep with any engineering change.

The Procurement Playbook: From RFQ to Commissioning

Strategic Procurement Playbook – Packaging Machinery (400–600 words)

H2 1. RFQ Architecture: Lock-in Performance Before Price

Anchor every RFQ to OEE ≥ 85 %, MTBF ≥ 2,000 h, and ≤ 0.5 % scrap rate; require audited data from the last 24 months on at least three reference lines running comparable SKUs. Demand a fixed spare-parts price list valid for 10 years with annual escalation capped at CPI + 2 %; any component that becomes obsolete must be supported with a 7-year last-time-buy option. Include a liquidated-damages clause of 0.5 % of contract value per day for line-capacity shortfalls > 5 % during ramp-up. State that 10 % of the contract value is retained until the 90-day performance warranty is met; release is contingent on a Cpk ≥ 1.67 on critical quality parameters. Require suppliers to embed a standard industrial PC platform (Intel i7 or better) to avoid controller obsolescence; non-standard PLCs trigger a $50 k–$80 k retrofit allowance paid by the vendor if chips are discontinued within 5 years. Finally, mandate cyber-security compliance to IEC 62443-3-3 with a third-party penetration test financed by the supplier; failure to patch critical vulnerabilities within 30 days constitutes material breach.

H2 2. Supplier Due-Diligence & FAT Protocol

Short-list only vendors that can demonstrate ≥ $250 m annual packaging-machinery revenue and global service density ≥ 1 technician per 250 km; verify through audited financials and GIS mapping of field offices. Schedule the FAT over ≥ 3 consecutive shifts using your actual film, bottles, or cartons; reject the machine if Cmk < 1.67 on any critical dimension. Insist on live-streamed FAT with encrypted recording retained for 7 years; re-work costs for any non-conformity are capped at 5 % of unit price but travel & re-FAT costs are unlimited and supplier-paid. Require suppliers to ship the exact FAT software build; version mismatches between FAT and site commissioning trigger a $25 k penalty plus full re-qualification cost.

H2 3. Incoterms Decision Matrix

| Cost & Risk Vector | FOB Shenzhen / Hamburg | DDP Site | Analytical Note |

|---|---|---|---|

| Freight & insurance | Buyer: $8 k–$12 k | Supplier: $10 k–$15 k | DDP premium ≤ 1.5 % of machine value—often offset by supplier volume rates |

| Import-duty risk | Buyer bears rate changes | Supplier fixed | In 2025, US HTS 8422.30 duty 0 %, but EU 3.2 %; if anti-dumping case emerges, DDP caps exposure |

| Delay cost at port | Buyer: $1.2 k/day demurrage | Supplier absorbs | Port congestion index (LA 18 days, Hamburg 9 days) shifts risk to supplier under DDP |

| Packaging integrity | Supplier standard | Supplier export-grade | DDP forces sealed crating & shock indicators; reduces concealed-damage claims by ~40 % |

| Overall risk-adjusted cost | Base | +1.0–2.5 % | Accept DDP when project delay cost > $50 k/week or when buyer incoterm experience < 3 machine imports/year |

H2 4. Site Commissioning & Final Acceptance

Demand a 30-day cold-spare kit on site before start-up; downtime cost for missing parts averages $2 k–$4 k per hour on beverage lines. Tie final 20 % payment to SAT protocol: 72-hour continuous run at nameplate speed ±2 %, waste ≤ 0.8 %, and operator training sign-off for 80 % of shift personnel. Insert a 24-month performance bond equal to 10 % of contract value; forfeiture triggers if MTTR > 45 minutes or if remote connectivity latency > 200 ms. Close with an escrow agreement for source code, electrical drawings, and BOM revision history; release conditions include insolvency, discontinuation of support, or failure to provide patches within 60 days of CVE publication.

⚡ Rapid ROI Estimator

Estimate your payback period based on labor savings.

Estimated Payback: —