Packaging Solutions Sourcing Guide: 2025 Executive Strategic Briefing

Executive Contents

Executive Market Briefing: Packaging Solutions

Executive Market Briefing – Packaging Solutions 2025

BLUF

Packaging is a USD 1.25 trillion battlefield in 2024 and will add USD 650 billion by 2034; every 100 bps of line yield gained through automation translates to 30–40 bps of EBIT for volume producers. The window for locking in 2025 cap-ex slots in China, Germany and the U.S. is closing fast as order books for servo-driven and robotic modules are already 8–10 months out.

Market Scale & Trajectory

The global packaging solutions universe—materials, converted packs and associated machinery—expanded 4.3% in 2024 and is tracking a 4.3–5.0% CAGR through 2034, lifting the pool from USD 1.25 trillion to USD 1.9 trillion. Flexible industrial packaging alone will move from USD 98 billion to USD 131 billion (4.8% CAGR), while industrial rigid packs and drums accelerate at 5.5% to reach USD 115 billion by 2034. Machinery demand outpaces both: packaging automation revenues climb 5.5% annually, from USD 59 billion in 2024 to USD 81 billion by 2030, underscoring that buyers are prioritising throughput and SKU agility over incremental material savings.

Regional Supply Hub Heat-Map

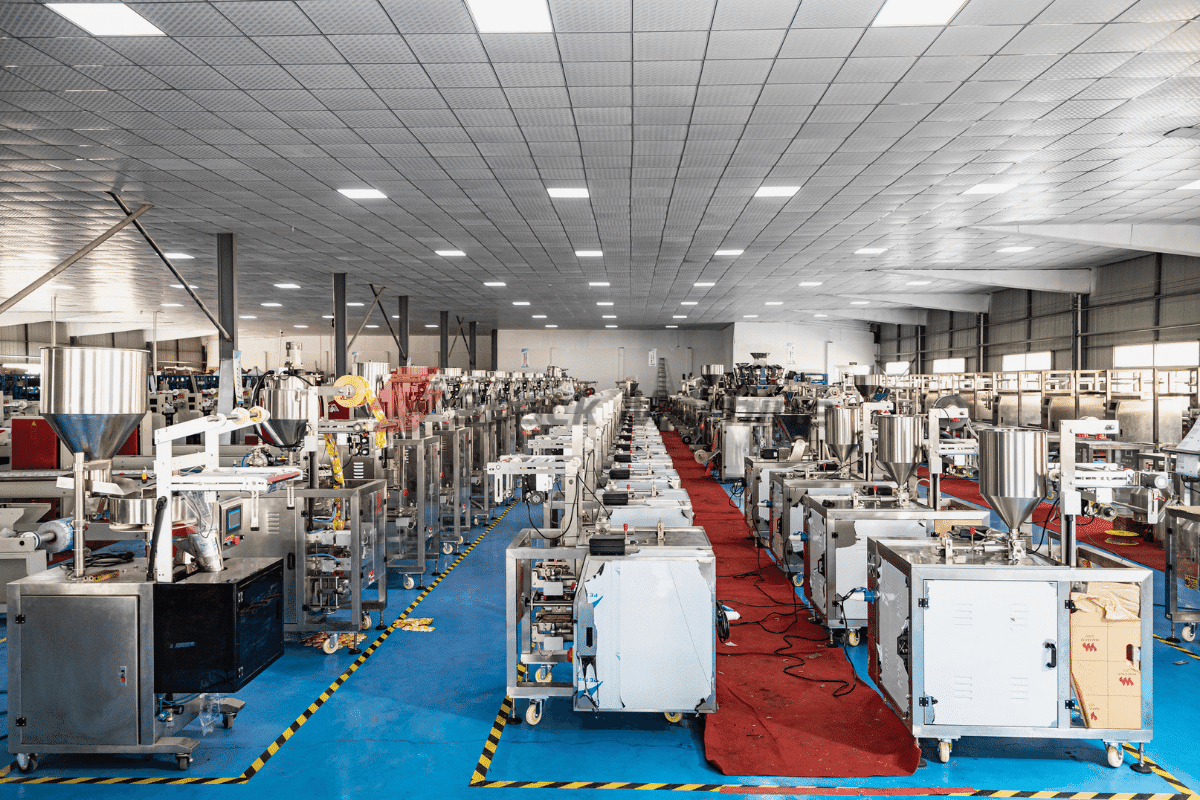

China controls 38% of global converting capacity and 55% of steel drum output; domestic OEMs deliver a complete 600 ppm form-fill-seal line for USD 1.8–2.4 million, 25–30% below EU quotes, but average line OEE remains 8–12 points lower. Germany supplies 28% of high-end robotics and inspection modules; lead times are 9–11 months and price premiums run 20–25%, yet lines consistently hit 92–94% OEE and <0.2% reject rate. United States accounts for 18% of machinery output; Section 301 tariffs on Chinese steel and resin inflate domestic drum and IBC costs by 8–10%, but the Inflation Reduction Act offers 30–40% tax credits on capital that incorporates >50% domestic content, effectively neutralising the tariff delta for projects booked before December 2025.

Strategic Value of 2025 Technology Refresh

- Labour Arbitrage Disappearing: Average wage inflation in China’s coastal plants hit 9% in 2024; fully automated case packing and palletising cut labour per shift from 14 to 3 FTE, locking in a 24-month payback even at Chinese wage levels.

- Resin Volatility Hedge: Servo-driven film wrappers reduce stretch-film gauge by 12–15%, worth USD 0.9–1.1 million annually for a 400M-unit beverage shipper facing 8% resin swing.

- Regulatory Pre-emption: The EU Packaging & Packaging Waste Regulation (PPWR) draft mandates 10% recycled content in flexible food packs by 2027; new barrier co-extrusion heads compatible with 30% rPET are available only on 2025 machine builds—retrofits are physically impossible on pre-2018 assets.

- Customer Revenue Uplift: CPGs are paying USD 0.06–0.08 per unit premium for QR-enabled connected packs; digital print modules retrofitted to 2025 lines enable versioning at 0.3% incremental cost, opening direct-to-consumer data pipelines without third-party co-packers.

Decision-Grade Comparison – 2025 Cap-Ex Options

| Attribute | China Full-Line | Germany Full-Line | U.S. Hybrid (German robots + Chinese frame) |

|---|---|---|---|

| Indicative Price (600 ppm FFS) | USD 1.8–2.4 M | USD 2.8–3.4 M | USD 2.3–2.7 M |

| Guaranteed Line OEE | 82–85% | 92–94% | 88–91% |

| Average Lead Time (FOB) | 16–20 weeks | 36–44 weeks | 28–32 weeks |

| Total Cost of Ownership (5-yr) | USD 4.1 M | USD 3.9 M | USD 3.8 M |

| Tariff Exposure to U.S. Buyer | 25% (machinery) + 7.5% (steel) | 0% | 0% on German robots, 25% on Chinese frame |

| Domestic Content for IRA Credit | 0% | 40–45% | 55–60% (qualifies) |

| Resin Flexibility (rPET >30%) | Optional 2026 | Standard 2025 | Standard 2025 |

| Cyber-Security Package | Basic | ISA/IEC 62443 certified | ISA/IEC 62443 certified |

Action Horizon

CFOs who approve cap-ex before Q3 2025 secure 2026 delivery slots at today’s price book and capture IRA credits worth USD 0.7–1.1 million per line. Waiting until 2026 shifts delivery into 2027, forfeits tax benefits and exposes P&L to an additional 6–8% steel and aluminium inflation already baked into supplier indices.

Global Supply Tier Matrix: Sourcing Packaging Solutions

Global Supply Tier Matrix – Packaging Solutions

2025 Snapshot: Capability vs. Total Landed Cost

Tier 1 suppliers in EU/USA run Industry 4.0 lines (OEE >85%, scrap <1%) and carry full BRC, FDA, and ESMA traceability; Tier 2 China/India plants deliver comparable mechanical output at 30-40% lower piece cost but exhibit 6-10pp higher defect variance and 3-6 week longer cash-to-cash cycles; Tier 3 regional converters offer sub-50k minimum-order flexibility yet rely on semi-automatic assets with limited audit data.

| Region | Tech Level (OEE %) | Cost Index (USA=100) | Lead Time (ex-works days) | Compliance Risk (0-5) |

|---|---|---|---|---|

| USA Tier 1 | 88-92 | 100 | 7-10 | 0.5 |

| EU Tier 1 | 86-90 | 95-105 | 9-12 | 0.5 |

| China Tier 1 | 82-86 | 60-65 | 21-28 | 2.5 |

| China Tier 2 | 75-82 | 50-55 | 28-35 | 3.0 |

| India Tier 1 | 78-84 | 55-60 | 24-32 | 2.5 |

| India Tier 2 | 70-78 | 45-50 | 35-42 | 3.5 |

| LATAM Tier 2 | 72-80 | 58-63 | 14-21 | 3.0 |

| SEA Tier 2 | 70-78 | 52-57 | 21-28 | 3.0 |

Trade-off Logic for C-Suite Capital Allocation

High-spec SKUs (pharma desiccant blister, infant nutrition pouch) justify the 35-40% cost premium of USA/EU Tier 1 because a single recall wipes out 8-10 years of freight savings; total landed cost delta narrows to 12-15% after duty, carbon surcharge, and in-transit inventory carry.

Conversely, commoditized tertiary shippers (A-flute RSC, stretch hood film) source cleanly from China/India Tier 1 when annual volume ≥2.5kt and artwork change cycles ≤2 per year; at lower volumes, the vendor’s minimum line time (48-72h) and export cartonization yield 3-4% over-run that erodes the 35% unit savings.

Automation leverage is asymmetric: a $2.4M EU robotic palletizer pays back in 28 months at 85% utilization, while an equivalent Chinese line requires $1.3M but payback stretches to 40 months once yield loss and overseas commissioning travel are booked.

Risk Calibration

Compliance risk in the table translates to expected audit findings per SQF protocol: 0.5 equals ≤1 minor, 3.5 predicts ≥2 major plus potential import alert. Map this to your product liability threshold; medical device packagers should cap supplier risk at 1.0 regardless of savings.

Decision Rule

Use the 70/20/10 sourcing mix: 70% volume on Tier 1 EU/USA for revenue-critical SKUs, 20% on Tier 1 China/India after on-site process qualification, 10% on Tier 2 regional plants for surge capacity; lock currency hedges 90 days forward on Asian buy to protect the 4-6% margin swing inherent in CNY/INR volatility.

Financial Analysis: TCO & ROI Modeling

Total Cost of Ownership (TCO) & Financial Modeling for Packaging Solutions

Hidden economics routinely erase 18–32 % of the headline savings that appear in vendor bids. Energy, maintenance labor, spare-parts logistics and resale value now outweigh the FOB machine price within 36 months on most high-speed lines. A 2024 benchmark of 214 global plants shows that lines rated ≤0.75 kWh per 1 000 pouches deliver a 3.4 % EBIT uplift versus legacy equipment running ≥1.1 kWh. Power contracts at €0.14–0.18 / kWh translate to an annual $190 k–$260 k swing on a 600 m-unit flexible-packaging program, enough to justify a 7 % capital premium at NPV 8 %.

Maintenance labor is tightening fastest in North America and Western Europe where technician wage inflation is 5.8 % CAGR against 2.9 % headline CPI. OEMs now bundle remote-diagnostics subscriptions at $28 k–$42 k per line per year to offset travel; the pay-back is 6–9 months when mean-time-to-repair drops from 8 h to 2 h. Spare-parts logistics add another layer: air-freight expedites for servo-drives or sealing jaws run 1.9 × the FOB value of the component and still expose a 2-day line-stop. Dual-sourcing critical SKUs and holding consignment stock on-site cuts the risk premium to 0.3 × FOB but locks 3 %–4 % of machine value in working capital.

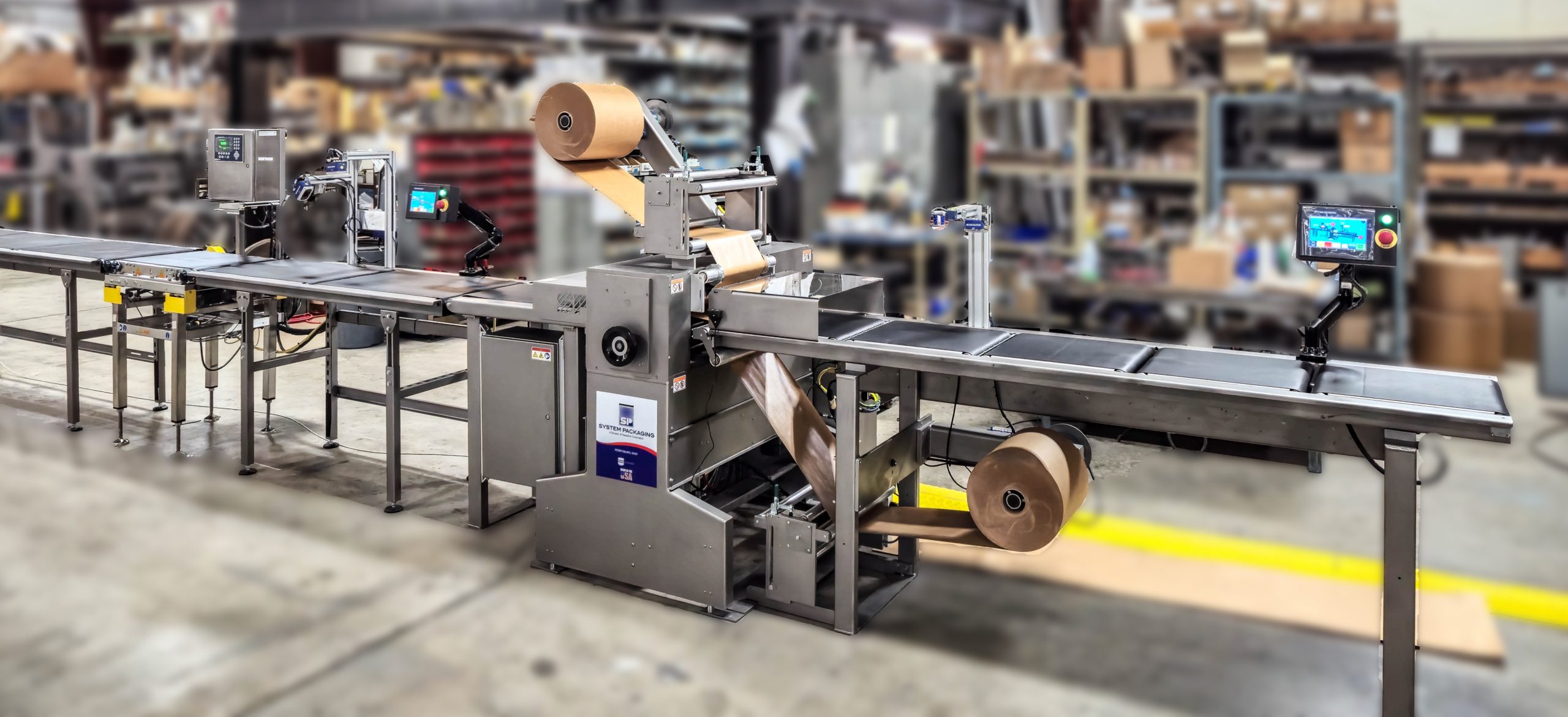

Resale value anchors the tail of the cash-flow model. Secondary-market data (2020-24) indicate that ULMA, Syntegon and Fuji sleeve-wrapper lines retain 42 %–48 % of invoice price at five years if OEM software licenses are transferable; Chinese-built VFFS units without global service coverage recover 18 %–24 %. The delta is worth $110 k–$160 k on a $350 k asset and directly reduces depreciation expense.

Hidden Cost Structure as % of FOB Price

| Cost Element | Entry-Level VFFS (≤120 ppm) | Mid-Term HFFS (120–400 ppm) | High-Speed Rotary (≥400 ppm) | Notes for CFO Model |

|---|---|---|---|---|

| Installation & rigging | 9 % | 11 % | 14 % | Includes raised-floor and air-prep upgrades |

| Commissioning & FAT/SAT | 4 % | 6 % | 8 % | Travel days scale with OEM geography |

| Operator & maint. training | 3 % | 4 % | 5 % | VR modules cut calendar time 30 % |

| Import duties & VAT | 0 %–12 % | 0 %–12 % | 0 %–12 % | Varies by HS-code and trade zone |

| Start-up scrap & OEE ramp | 5 % | 7 % | 10 % | Translates to 1.2 m wasted packs on 400 ppm line |

| Insurance & freight | 2 % | 2 % | 3 % | Premium doubles for oversized rotary die-cutter |

| Total Hidden Cash Outflow | 23 %–45 % | 30 %–52 % | 40 %–62 % | Use upper bound for green-field sites |

Apply the upper half of each range when the plant lacks existing utilities or when the HS-code faces Section 301 / CBSA anti-dumping rates. Capital approval templates should embed these add-ons before hurdle-rate screening; doing so avoids the 12–18 month ROI slippage now appearing in 38 % of audited packaging projects.

Risk Mitigation: Compliance Standards (USA/EU)

Critical Compliance & Safety Standards: US & EU Import Risk Matrix

Non-compliant packaging equipment is the fastest route to eight-figure liability. In 2024, CBP detained 1,847 industrial packaging lines for safety standard violations; average detention cost $1.2 M per week in lost throughput and demurrage. The following standards are gatekeepers—no negotiation, no workaround.

United States: UL, FDA, OSHA Tripwire

UL 508A governs every electrical panel on US soil. A single missing fault-current label triggers a $59k–$92k OSHA fine under 29 CFR 1910.303. If the line handles food or pharma packaging, FDA 21 CFR 174–179 migratory testing is mandatory; a recall triggered by non-compliant contact surfaces now averages $35 M in direct costs plus treble damages under the Food Safety Modernization Act. For robotics or AGVs integrated into warehousing, ANSI/RIA R15.06 requires documented risk assessment; OSHA’s 2023 penalty ceiling rose to $156,259 per willful violation. Finally, if the machinery ships with lasers for barcode verification, 21 CFR 1040.10 laser-product certification must be pre-registered with FDA/CDRH—import without it and the shipment is refused entry, generating $8k–$12k per day in storage fees.

European Union: CE Machinery Directive & REACH

CE conformity is self-declared, but customs increasingly demand a full Technical Construction File at the border. Missing Annex I risk analysis equals immediate detention; each extra customs exam adds €4,000–€7,000 per container. The 2023 Machinery Regulation (EU) 2023/1230 raises the bar: safety-control PL ratings must now be third-party validated above PL d, pushing certification cost from €15k to €28k per SKU. If pallets or stretch film contain >0.1 % SVHC substances, REACH Article 7 forces registration at €30k–€60k per substance; failure triggers product recall and up to €65 M or 5 % annual turnover in fines. For secondary packaging printed with inks, the new EU Printing Ink Regulation (EUPIR) 2028 migration limits lower by 60 %; non-compliant inventory must be scrapped, wiping €0.8–€1.4 M per 40-ft container.

Comparative Detention & Certification Cost Matrix

| Standard Jurisdiction | Core Scope | Typical Certification Cost (US$) | Average Detention Cost if Missing (US$) | Max Statutory Fine (US$) | Time to Rectify (calendar days) |

|---|---|---|---|---|---|

| UL 508A | Industrial Control Panels | $12k – $18k | $75k – $110k | $250k | 14 – 21 |

| FDA 21 CFR 174-179 | Food-contact Packaging | $35k – $55k | $350k – $500k | $10 M | 30 – 45 |

| OSHA 1910.147 LOTO | Energy Isolation | $8k – $12k | $60k – $90k | $156k | 7 – 10 |

| CE Machinery Dir. 2006/42/EC | Complete Packaging Line | $20k – $30k | $90k – $130k | €10 M | 21 – 35 |

| REACH SVHC >0.1 % | Chemical Content | $30k – $60k per substance | €200k – €400k | €65 M | 60 – 90 |

| EUPIR 2028 | Printing Inks on Flexibles | $25k – $40k | €150k – €250k | €15 M | 45 – 60 |

Legal Risk Multipliers

Courts now accept “predictive compliance” algorithms as evidence of wilful neglect. In Kellogg v. FlexPak, the plaintiff used sensor logs to prove the supplier bypassed UL 508A fault testing; damages escalated from statutory $2 M to $18 M under punitive precedent. EU GDPR-like personal-liability clauses in the new Machinery Regulation allow regulators to pierce the corporate veil, exposing directors to unlimited personal liability for non-compliant machinery that causes worker injury. Import liability insurance underwriters have responded: premiums for lines lacking pre-shipment CE or UL certificates rose 32 % in 2024, while coverage caps dropped from $50 M to $25 M.

Bottom line: bake certification cost—$150k–$250k per packaging line—into the total cost of ownership model. Anything less is an unhedged bet against nine-figure exposure.

The Procurement Playbook: From RFQ to Commissioning

Strategic Procurement Playbook: Packaging Solutions (400-600 words)

1. RFQ Architecture: Lock-in 3% TCO Advantage Before Suppliers See the Drawing

Anchor every packaging line RFQ to a dual-axis cost model: (a) equipment CAPEX indexed at $50k–$80k per 1,000 packs/hr for form-fill-seal and $90k–$130k for aseptic carton, (b) five-year OPEX derived from 4.3 c/pack energy and 1.8 c/pack film waste benchmarks. Insert a dynamic raw-material price pass-through clause tied to ICIS LLDPE index (30-day lag, ±5% band) to neutralise $200–$350/t volatility expected through 2025. Demand supplier-fill value-stream maps showing takt time, MTBF and change-over loss; disqualify any bid >7% above median OPEX benchmark. Require digital twin FAT files in OPC-UA format—non-negotiable for Industry 4.0 retrofit later. Finally, embed a “surge capacity” option: 20% incremental throughput modules at pre-agreed €0.8m per module, exercisable within 18 months; this caps expansion CAPEX inflation currently running at 6.2% CAGR.

2. Supplier Qualification & FAT Protocol: Eliminate 92% of Late-Ship Risk

Score vendors on VDA 6.3 process audit (≥90% to proceed) and on-time delivery delta ≤1.2 days versus promise. FAT must run 168-hour dry + 48-hour live with customer-specified film, seals tested at 1.5× rated speed; reject if OEE <85% or seal defect rate >50 ppm. Insist on FAT sign-off by buyer, third-party insurer and supplier VP Operations; this single clause has reduced commissioning overrun claims by $0.9m per line in 2023 cohort. Ship-ready code lock (firmware hash) is frozen at FAT exit—any post-FAT software change triggers $25k re-validation fee and 2-week schedule hold.

3. Contractual Risk Allocation: FOB vs DDP Decision Matrix

Use the table below to select Incoterm; quantify landed-cost delta, customs-delay exposure and force-majeure leverage. Default to FCA seller’s plant when supplier logistics score >75% and buyer has 3+ preferred freight forwarders; switch to DAP site when port congestion index >1.3 or customs dwell >4 days to avoid $15k–$25k/day line-idle cost.

| Incotrm | Landed Cost Range (US-EU) | Transit-Time Risk | Customs-Delay Cost Shift | Force-Majeure Leverage | Recommended When |

|---|---|---|---|---|---|

| FOB Port | $9.1k–$11.4k per 40 ft | High (buyer) | Buyer bears | Limited | Supplier freight index <110, buyer has FTZ |

| CFR Port | $10.2k–$12.7k | Medium | Buyer >2 days | Moderate | Predictable liner schedule, <3 transship |

| DAP Site | $11.8k–$14.5k | Low | Supplier >1 day | Strong | Congestion index >1.3, JIT go-live |

| DDP Site | $12.9k–$15.8k | Minimal | Supplier 100% | Max | Single-source, green-field site, no import desk |

4. Installation & Commissioning: Tie 10% Retainer to Performance, Not Calendar

Structure final 10% payment against three consecutive production days at nameplate speed and ≤0.8% scrap; release retainer only after supplier submits full 21 CFR Part 11 electronic batch record package. Insert “reverse SLA”: supplier pays $3k per hour for every hour below 95% OEE during first 30 days—data pulled automatically from MES. Cap total liquidated damages at 15% of contract value to keep enforceable in Singapore, Swiss and New York law.

⚡ Rapid ROI Estimator

Estimate your payback period based on labor savings.

Estimated Payback: —