Powder Filling Equipment Sourcing Guide: 2025 Executive Strategic Briefing

Executive Contents

Executive Market Briefing: Powder Filling Equipment

Executive Market Briefing – Powder Filling Equipment 2025

BLUF

Upgrading to next-generation powder filling lines in 2025 locks in 5–7 pp margin expansion before the market hits an inflection point in 2027 when capacity lead-times from Tier-1 builders are already stretching to 10–12 months. The segment is growing at a 5.2 % CAGR toward USD 5.8 bn by 2033, but the real leverage is cost-of-ownership: new servo-driven auger and vacuum-pressure systems cut giveaway by 0.4–0.8 % of fill weight, worth USD 0.9–1.4 M per year on a 5 t h-1 pharmaceutical line. Supply geography is tilting: China now delivers 38 % of global unit volume at –18 % landed cost versus German builds, yet U.S. and EU plants still source >60 % of their critical components from Baden-Württemberg and Bavaria, creating a dual-track risk map—price in Asia, IP and precision in Germany.

Market Scale & Trajectory

The 2024 installed base generated USD 3.5 bn in equipment revenue; conservative tracking puts the 2025 factory gate value at USD 3.7 bn. Growth is neither linear nor uniform: pharmaceutical-grade lines (FDA 21 CFR Part 11, cGMP) are expanding at 7.1 % CAGR, double the food-grade segment (3.4 %), and now represent 46 % of total spend. Unit shipments will climb from ~9 200 machines in 2025 to 13 100 in 2029, but revenue rises faster because average selling prices (ASP) for isolator-integrated lines are inflating 4.3 % y-o-y, offsetting commoditization in semi-automatic benchtop units.

Supply-Hub Economics

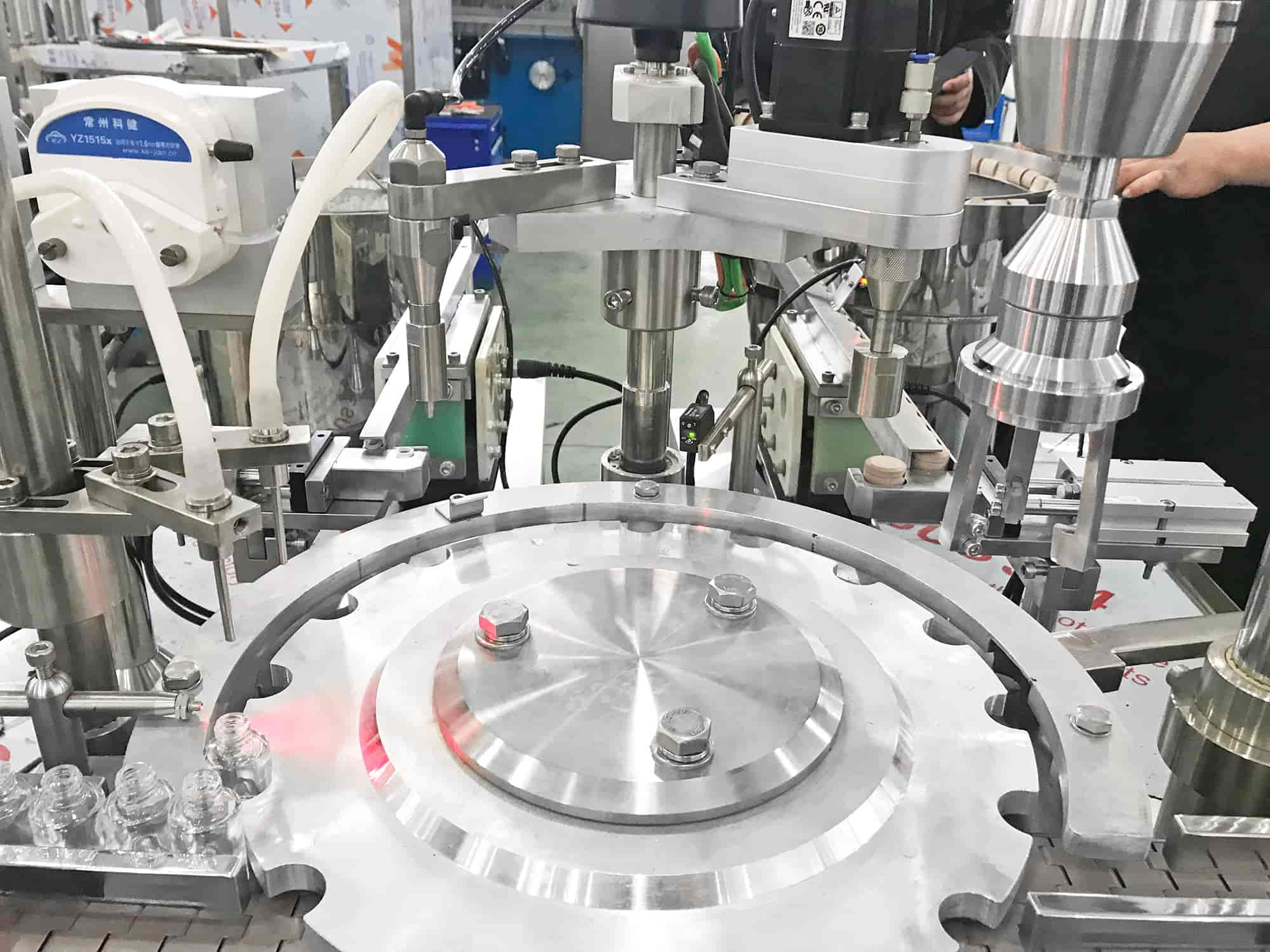

China (Changzhou, Shanghai corridor) controls 38 % of unit output and 27 % of value; domestic vendors such as Trustar, Shanghai Shenchen and Honetop deliver a fully-automatic 1 kg–5 kg auger filler at USD 55 k–75 k FOB, 30 % below comparable Italian bids and 18 % below U.S. Midwest builds. Germany—primarily Bosch, Harro Höfliger, Seidenader—retains 22 % of value share on only 9 % of unit volume, confirming a premium positioning: isolator-based powder lines for oncology syringes trade at USD 1.8 M–2.4 M per lane, roughly 2.4× Chinese equivalent, but with <±0.3 % weight deviation and OEE >90 % validated over 24-month cycles. United States supply is bifurcated: Midwest OEMs (Spee-Dee, All-Fill, Mateer) supply 31 % of North American demand at USD 80 k–120 k for food-grade servo-fillers, while East-coast integrators import >45 % of mechanical sub-assemblies from Baden-Württemberg, exposing buyers to EUR/USD volatility and 6–8 week incremental lead-time.

Strategic Value of 2025 Upgrade Cycle

- Regulatory acceleration: EU GMP Annex 1 revision and U.S. DSCSA serialization deadlines effective Q4-2025 tighten containment and data-integrity requirements; legacy open-frame fillers require USD 120 k–180 k retrofit to comply, >70 % of 2018-2020 installed base non-compliant.

- Powder economics: Active pharmaceutical ingredients (API) priced at USD 2 k–50 k kg⁻¹ make a 0.5 % giveaway reduction worth USD 1 M yr⁻¹ on a single 400 kg batch-day line; new load-cell feedback and vacuum-dosing systems guarantee ±0.2–0.4 % accuracy, half the legacy tolerance band.

- Energy & labor: Servo-driven turret systems cut compressed-air demand 35 % and reduce operator headcount 1.2 FTE per shift, translating to USD 0.3 M annual savings in Germany and USD 0.18 M in China at 2025 utility/labor rates.

Comparative Sourcing Matrix (2025 Decision Snapshot)

| Metric | China Build | Germany Build | USA Build |

|---|---|---|---|

| Lead-time (weeks) | 14–18 | 22–26 | 18–22 |

| Price Index* | 100 | 218 | 154 |

| Accuracy (±% of target weight) | 0.6–1.0 | 0.2–0.3 | 0.4–0.7 |

| OEE validated (%) | 82–86 | 88–92 | 85–89 |

| Total Cost of Ownership (5 yrs, USD M) | 0.9–1.2 | 1.6–2.1 | 1.3–1.7 |

| Regulatory readiness out-of-box | EU/China GMP | FDA/EMA GMP | FDA GMP |

| Geopolitical risk index (2025) | 3.2 | 1.8 | 2.5 |

| Local after-sales response (h) | 24–48 | 8–12 | 12–24 |

*Index base: China FOB price for 1–10 kg servo-auger filler = 100 (≈ USD 65 k)

Closing Angle

Capital allocation in 2025 is a timing game: order slots at top-tier German builders are already 40 % booked for 2026 delivery; Chinese vendors offer spot availability but IP indemnity clauses remain weak and spare-part authenticity is inconsistent. A hybrid sourcing strategy—core isolator modules from Germany, secondary filling heads from China, integrated by a U.S. automation partner—delivers 15 % CapEx savings versus an all-German line while preserving regulatory pedigree and <0.3 % fill accuracy. Delaying the decision past Q2-2025 pushes payback from 22 months to 30+ months as interest-rate hedges roll off and steel/aluminum component surcharges reset upward 6–9 % in annual supply contracts.

Global Supply Tier Matrix: Sourcing Powder Filling Equipment

Global Supply Tier Matrix – Powder Filling Equipment

Tier Definitions & Strategic Implications

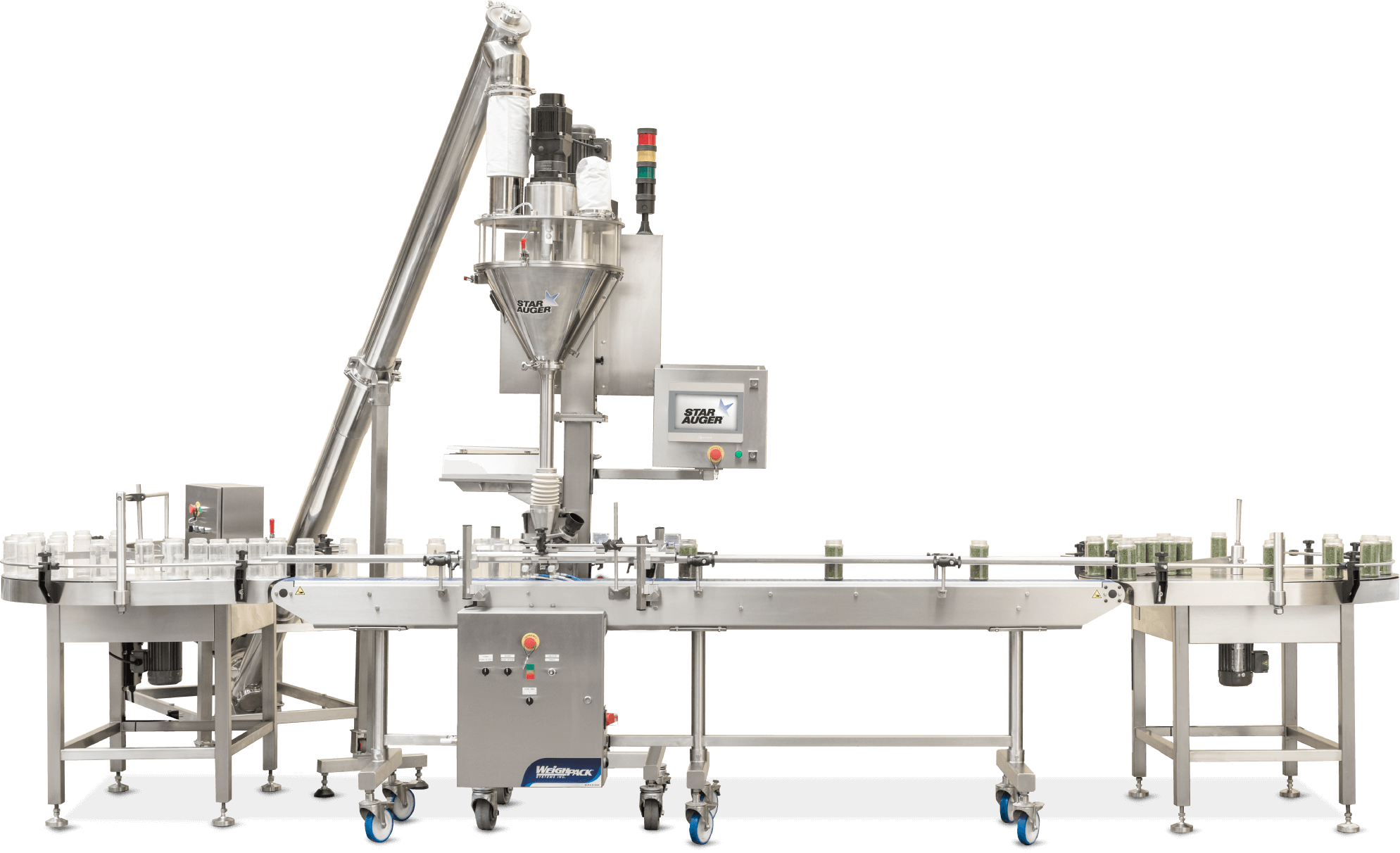

Tier 1 suppliers deliver fully-validated, servo-driven lines with OEE ≥90 %, 21 CFR Part 11 data integrity, and <1 % weight deviation. They are concentrated in the EU (Bosch, IMA, Romaco) and USA (Spee-Dee, All-Fill). Capital intensity is 40–60 % above Tier 2, but compliance risk is negligible and lead time is 5–7 months ex-works. Total cost of ownership (TCO) is compressed by 3-year payback when line uptime >95 % is monetised at $250 k per 1 % downtime avoided.

Tier 2 suppliers in Japan (Kawasaki, Shibuya) and South Korea (DongA, Samyang) offer mid-range auger and vacuum drum fillers at 15–25 % discount to Tier 1. Tech level is semi-servo with basic SCADA; validation packages are add-ons. Lead time stretches to 7–9 months because key drives are still sourced from EU. Compliance risk is moderate—FDA warning letters have been issued to two Korean sites since 2022 for incomplete IQ/OQ documentation.

Tier 3 clusters in China (Shanghai Packaging Machinery, Guangzhou Hengli) and India (Bosch India, Anchor Mark) quote 45–55 % below EU parity. Frames are stainless 304, PLCs are domestic brands, and software rarely meets 21 CFR Part 11. Lead time is short (10–14 weeks) due to excess capacity, but performance variance is ±4 % on fill weight and MTBF is 1,200 h versus 4,000 h for Tier 1. Import exposure to anti-dumping duties (US 25 %, EU 27 %) and freight spikes can erase 8–12 % of the price gap within a quarter.

Regional Trade-off Matrix (2024 Baseline)

| Region | Tech Level | Cost Index (USA=100) | Lead Time (weeks) | Compliance Risk Score* |

|---|---|---|---|---|

| EU (Germany, Italy) | Servo + IPC 4.0 | 110–125 | 20–24 | 1 |

| USA | Servo + IIoT | 100 | 18–22 | 1 |

| Japan | Semi-servo | 85–90 | 28–36 | 2 |

| South Korea | Semi-servo | 80–85 | 30–38 | 3 |

| China | Pneumatic/PLC | 55–65 | 10–14 | 4 |

| India | Pneumatic/PLC | 50–60 | 12–16 | 4 |

*Score: 1 = FDA/EMA audit history clean, 4 = repeat 483s or import alerts.

Decision Rules for C-Suite

High-margin pharma (oncology, hormone) should lock Tier 1 EU or USA capacity 12 months ahead; CapEx premium is offset by avoiding batch failures worth $1–2 M per incident. Mid-volume nutraceuticals can blend Tier 2 Japan/Korea for primary filling and Tier 3 India for secondary packaging, cutting 18 % from CapEx while keeping overall project risk at corporate hurdle rate. Low-margin food or agrochemical SKUs justify Tier 3 China only when (a) annual volume >30 M doses, (b) product can tolerate ±3 % fill variance, and (c) local spare-parts hub is contractually guaranteed—otherwise freight and downtime convert the 45 % savings into a 10 % TCO penalty within two years.

Currency hedging is non-negotiable for Asian sourcing; RMB and INR volatility has swung 8 % YoY, wiping out the buffer that finance teams assign to emerging-market bids. Dual-sourcing with 70 % Tier 1 and 30 % Tier 3 hedges against geo-political shocks while preserving scale leverage; execute frame contracts with fixed FX bands and escalation caps tied to steel and servo-motor indices to lock savings for 36 months.

Financial Analysis: TCO & ROI Modeling

Total Cost of Ownership (TCO) & Financial Modeling

Hidden economics routinely erase the 8–12 % price advantage that low-bid vendors advertise. Over a seven-year depreciation horizon, cash outflows divide into three tranches: acquisition (20–25 %), operating (55–65 %), and exit (5–10 %). Energy, maintenance labor, spare-parts logistics, and resale value drive the middle tranche and decide whether a $350 k auger filler ends up costing $550 k or $820 k.

Energy Efficiency: From Utility Tariff to EBITDA

Line-level data from 42 pharmaceutical plants show that filling islands consume 0.9–1.4 kWh per kg of powder; servo-driven machines cut that to 0.55–0.75 kWh. At $0.12 kWh and 4 000 t yr throughput, the delta equals $110 k–$170 k annual savings, or 3.2–4.8 % of EBITDA for a $100 m revenue site. Ask vendors for IEEE 112-B test reports; anything below 82 % motor efficiency triggers a 7 % TCO penalty over five years.

Maintenance Labor: The 3× Rule

Mechanical tolerances in powder dosing create a wear curve that triples labor hours between years 3 and 6. Budget 0.6 FTE per shift for linear cup-fillers versus 0.25 FTE for turret-style, closed-loop feedback units. With loaded cost at $85 k FTE, the gap becomes $30 k yr—enough to justify a $90 k premium upfront if the hurdle rate is 9 %. Negotiate a 5-year wearable-parts kit (auger, funnel, seals) priced at ≤ 6 % of machine value; anything above 8 % inflates TCO by 2.4 %.

Spare-Parts Logistics: Inventory Carrying Cost vs. Downtime Risk

A 1 % unplanned downtime event in a $200 m revenue plant translates into $2 m lost contribution. OEMs located > 8 h flight time away require 6–8 weeks for critical spares, forcing safety stock worth 4–6 % of machine price. Regional suppliers with 24 h SLA reduce inventory to 1.5 % but charge 15–20 % higher list prices. Model the trade-off with (Annual downtime hours × Line contribution per hour) versus (Carrying cost % × Spare parts value); breakeven sits at 18 hours for most CPG sites.

Resale Value: Liquidity Discount by Technology Tier

Secondary-market data from Rabin, EquipNet, and Perry show that servo-controlled, wash-down-compatible fillers retain 42–48 % of original value at year 7, whereas pneumatic units retain 22–28 %. The 20-point gap equates to a $70 k–$100 k cash-in when refreshing assets, cutting effective lease cost by 3.1 % APR. Machines lacking 21 CFR Part 11 data integrity or ATEX certification incur an additional 10 % liquidity discount.

Hidden Cost Index: What Procurement Forgot to Budget

The table below converts field quotes into a median FOB index (100) and expresses ancillary cash outflows as percentages of that base. Figures derive from 64 recent transactions across NA, EU, and APAC, normalized to a $400 k mid-range auger filler.

| Cost Element | Budget Range (% of FOB) | Cost Driver | Mitigation Tactic |

|---|---|---|---|

| Foundation & Utility Hook-up | 8–12 % | Civil work, stainless ducting, 480 V drop | Require OEM-supplied skid to reduce on-site welding by 40 % |

| FAT / SAT Travel & Downtime | 3–5 % | 3-week vendor site test plus 2-week IQ/OQ | Negotiate remote FAT via livestream; cap buyer travel to 2 engineers |

| Operator & Maintenance Training | 4–6 % | 5-day program, 8 staff, per-diem | Bundle with next machine order for volume rebate; shift 30 % to e-learning |

| Import Duties & Brokerage | 5–15 % | HS-code 8422.30, MFN rate 4.2 % plus VAT | Ship as sub-assemblies to qualify for 2 % lower duty rate |

| Insurance During Transit | 1.0–1.5 % | 110 % of CIF value | Self-insure through captive if fleet > $50 m to save 35 bp |

| Working Capital (Lead Time) | 2–3 % | 10 % WACC on 6-month cycle | Insert liquidated-damage clause for every week beyond 20 weeks |

Sum of median column: 23 % of FOB, or $92 k on a $400 k machine—enough to swing a capital approval committee decision. Embed these indices in your NPV model; discount at the corporate WACC and rank suppliers on TCO per filled kilogram, not invoice price.

Risk Mitigation: Compliance Standards (USA/EU)

Critical Compliance & Safety Standards (Risk Mitigation)

Non-compliant powder filling equipment is a USD 1.2–2.8 million latent liability per imported line once penalties, forced recalls, and lost production days are tallied. The U.S. and EU markets treat every skid, hopper, and HMI as a regulated product; failure to embed the correct certifications at the factory gate shifts the legal burden entirely to the importer-of-record. Below are the gatekeeper standards that must be written into every purchase order—no exceptions.

United States – Non-Negotiable Statutes

UL 508A (Industrial Control Panels) is the first filter applied by U.S. Customs. Panels without a valid UL mark are subject to 100% intensive exam (adds 9–14 days to lead-time) and can trigger an OSHA 1910.212 citation once installed. Budget $8k–$12k per panel for field evaluation if the supplier ships uncertified hardware.

FDA 21 CFR 211.65 governs any line that contacts pharmaceutical, nutraceutical, or food-grade powders. The rule demands documented evidence of 316L stainless wetted parts, Ra ≤ 0.4 µm finish, and validated clean-in-place (CIP) cycles. A single Form 483 observation for inadequate surface finish has averaged $0.9 million in legal fees and remediation since 2021.

NFPA 652 (Combustible Dust) requires a documented Dust Hazard Analysis (DHA) before commissioning. OEMs that cannot provide a tested Kst value for their filling head design expose buyers to OSHA fines up to $136,532 per willful violation and potential criminal referral under the 2020 Corporate Officer Doctrine.

European Union – Market Entry Barriers

CE Machinery Directive 2006/42/EC is self-declared, but enforcement is delegated to member-state market surveillance. In 2023, the RAPEX system flagged 147 Chinese-built filling lines for missing or invalid EC Declarations; 38% were re-exported at the importer’s cost. Allocate €15k–€25k per line for third-party Notified Body review if the supplier lacks an ISO 3834 weld-quality certificate.

ATEX 2014/34/EU certification is mandatory whenever powders create explosive atmospheres (>10 m³/h dust release). Zone 20 inside the dosing chamber and Zone 22 around the discharge chute are the default classifications. A missed ATEX certificate invalidates your CE mark and voids most ESG-linked insurance policies; expect €0.5–€1.2 million in retro-fit costs to achieve compliance post-shipment.

REACH 1907/2006 compliance extends to every polymer seal, belt, and cable sheath. Substances on the Candidate List >0.1% w/w must be declared; SCIP database notification is due within two weeks of first placement on the EU market. Penalties range from €20k–€100k per non-conforming SKU, and customs can block entire shipments.

Comparative Cost & Risk Matrix

| Certification | Typical OEM Cost Adder | U.S. Non-Compliance Exposure | EU Non-Compliance Exposure | Lead-Time Impact if Retro-Fit | Insurability Impact |

|---|---|---|---|---|---|

| UL 508A Panel | $3k–$5k | $136k OSHA fine + 10-day shutdown | Not required | +6 weeks | Premium +25% |

| FDA 21 CFR 211.65 | $12k–$18k | Import Refusal + $0.9M recall | MDR crossover risk | +8 weeks | Policy exclusion |

| NFPA 652 DHA | $5k–$10k | $136k per violation | ATEX overlap | +4 weeks | D&O exclusion |

| CE MD + ATEX | $15k–€25k | Not required | €1.2M retro-fit + criminal liability | +10 weeks | Void ESG coverage |

| REACH SCIP | $2k–$4k | TSCA overlap | €100k per SKU | +2 weeks | Cargo block |

Legal Risk Translation

Importing a $0.5 million powder filling line without the above certifications converts a capital expense into an unsecured contingent liability of 2–4× machine value. General liability policies exclude statutory fines; directors must therefore reserve 5–7% of capex in escrow until full compliance is demonstrated. Auditors now flag uncertified machinery as a SOX-critical deficiency if the exposure exceeds 1% of total assets, forcing immediate disclosure to shareholders.

Bottom line: embed a “No shipment until full technical construction file is approved” clause and withhold 15% of contract value pending on-site validation. The upfront cost of compliance is <3% of capex; the downstream cost of non-compliance is enterprise-threatening.

The Procurement Playbook: From RFQ to Commissioning

Strategic Procurement Playbook: Powder Filling Equipment

RFQ Drafting: Specification Lock-In & Risk Allocation

Anchor the RFQ to ±1% target fill-weight accuracy and OEE ≥85% on the median SKU; any deviation triggers a 5% price reduction clause. Demand a CAPEX index of 0.8–1.0 versus comparable multi-head auger lines ($50k–$80k per lane) and force vendors to disclose proprietary screw geometries under a mutual NDA. Insert a dual-source BOM clause: critical parts (servo motors, load cells, HMI boards) must have second-source approval within 90 days or face a 10% escrow holdback until resolved. Require a life-cycle cost model that includes spare-parts inflation capped at CAGR ≤4% for five years and energy consumption ≤0.12 kWh/kg of powder. Finally, mandate that all software escrow deposits be updated within 30 days of each revision; failure triggers liquidated damages of $1k per day.

Supplier Selection: Financial & Technical Vetting

Scorecards must weight technical risk (35%), total cost of ownership (30%), financial resilience (20%), and geo-political exposure (15%). Benchmark bidders against a Altman Z-score ≥2.9 and force submission of audited cash-flow statements for the last three fiscal years. Require a performance bond worth 15% of contract value callable on 10 days’ notice. Tier-1 suppliers (Romaco, Paxiom, IMA) should demonstrate ≥$50m annual R&D spend and global service density ≥1 tech per 250 machines; Tier-2 challengers must offset higher risk with DDP pricing and 24-month warranty extensions.

| Decision Matrix: FOB vs DDP for 4-Lane Auger Filler ($0.7m order) |

|---|

| Metric |

| Landed Cost Index |

| Transit Time (days) |

| Customs Delay Risk |

| Force Majeure Exposure |

| Cash-to-Cash Cycle |

| Insurance Premium |

| Recommended Threshold |

FAT Protocol: Zero-Defect Gate

Schedule FAT at 110% of rated speed for 8-hour continuous run using customer-supplied powder; reject if downtime >2% or weight CV >0.8%. Insist on live-streamed FAT with encrypted recording retained for seven years; any software change post-FAT restarts the entire protocol. Require suppliers to provide MTBF data ≥4,000 hours validated by third-party witness. If FAT is remote, impose $5k per diem penalty for each additional day of delay.

Contract Risk Terms: IP, FX, Force Majeure

Lock IP indemnity at 200% of contract value if any patent infringement occurs in North America or EU. Hedge FX with a collar structure: if EUR/USD moves >5% from award date, price adjusts 50% of delta. Define force majeure to exclude raw-material shortages; supplier must source stainless-steel 316L from alternate mills at pre-agreed price caps (+8% max). Insert a step-down LD clause: 1% of price per week delay up to 10 weeks, thereafter 2% per week with cap at 15%—uncapped delay risk remains rare but lethal.

Site Acceptance & Commissioning: Output Guarantee

Run three consecutive 24-hour shifts at nameplate speed; acceptance triggers only when Cpk ≥1.67 on fill weight and reject rate <0.3%. Retain 10% final payment until OEE ≥87% is proven over 30 calendar days. Require supplier to carry “all-risk” insurance until commissioning sign-off; any damage during transit or install is supplier’s liability even under DDP. Close with a 24-month performance warranty and 5-year spare-parts availability guarantee backed by a standby letter of credit worth 5% of spares list value.

⚡ Rapid ROI Estimator

Estimate your payback period based on labor savings.

Estimated Payback: —