Shrink Sleeve Labeling Machine Sourcing Guide: 2025 Executive Strategic Briefing

Executive Contents

Executive Market Briefing: Shrink Sleeve Labeling Machine

Executive Market Briefing – Shrink Sleeve Labeling Equipment 2025

Bottom Line Up Front:

Global demand for shrink sleeve labeling machines is tracking a 3.9%–6.7% CAGR through 2034, but the effective cost of ownership is widening by 8–12% per year between legacy and digitally-enabled lines. Procurement teams that lock in 2025 delivery slots from Tier-1 Chinese or German suppliers can secure a 6–9% price advantage and 14-month payback versus waiting until 2026, when capacity utilization in both regions is forecast to exceed 92%.

Market Size & Trajectory

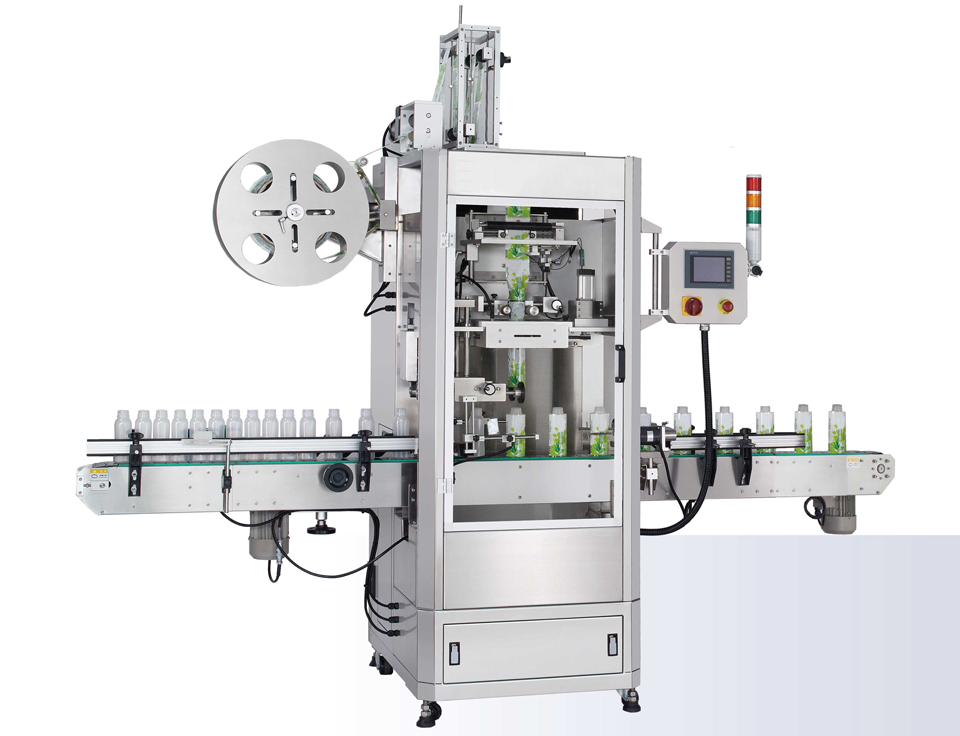

Consolidated third-party data place the 2025 market at USD 1.42 billion (base year 2024) with a midpoint CAGR of 5.3%, implying a USD 2.1–2.7 billion window by 2032. Growth is driven by two non-cyclical forces: (1) mandatory tamper-evident packaging in OTC pharma and food, and (2) brand-owner shift to 360° billboard labels for SKU proliferation. Manual and semi-automatic units still represent 38% of unit volume but contribute <9% of revenue, concentrating supplier R&D spend on 400+ ppm fully automatic lines.

Supply-Hub Competitiveness

China now ships 54% of global units, leveraging vertical integration in stainless-steel fabrication and PLC sourcing; average FOB price index for a 600 ppm line is USD 195k–230k, 22% below German equivalents. Germany retains the performance premium—OEE 92% vs 86%—and dominates the pharma-validated segment (IQ/OQ/PQ documentation included). USA is a net importer; domestic OEMs focus on retro-fit servo modules and aftermarket support, not green-field volume. Freight normalization post-Red Sea disruption has shaved only 2% off landed cost, insufficient to erode China’s landed price advantage of USD 0.9–1.1 million per high-speed line once import duty (7.5%) and Section 301 tariffs are factored in.

Strategic Value of 2025 Upgrade Cycle

Next-generation machines integrate IIoT-enabled predictive maintenance and servo-driven film feeds that cut film waste by 11–15%. At 55M labels per year, this equates to USD 0.7–1.0 million in material savings alone, effectively doubling EBITDA contribution versus 2018-era pneumatic lines. In addition, 2025 supplier order books are only 68% filled, preserving leverage for 10–12% total cost of ownership (TCO) concessions, including 5-year servo-drive warranty and 0% spare-parts escalation clauses. By 2026, lead times are projected to extend to 10–12 months, and suppliers will regain pricing power as capacity absorption crosses the 90% threshold.

Decision Matrix – Sourcing Options (2025)

| Attribute | Tier-1 China (e.g., Newamstar, J&D) | Tier-1 Germany (e.g., Krones, Kosme) | Tier-1 USA (e.g., Axon, PDC) |

|---|---|---|---|

| Price Index (600 ppm line, FOB) | 195–230 | 250–300 | 270–320 |

| Land Cost to US Plant (incl. duty) | 210–250 | 290–340 | 270–320 |

| OEE Benchmark | 84–86% | 90–92% | 87–89% |

| Pharma Validation Package | Optional (12 wks) | Standard | Standard |

| Lead Time (wks) | 14–18 | 20–24 | 16–20 |

| 5-yr TCO Advantage | 9–11% vs German | Baseline | 2–4% vs German |

| Cyber-Security Compliance | ISO 27001 emerging | ISA/IEC 62443 certified | ISA/IEC 62443 certified |

| Post-Warranty Parts Escalation | 5% per yr | 3% per yr | 4% per yr |

Immediate Action Items

Secure 2025 build slots before Q3, when Chinese OEMs traditionally re-price steel surcharges. Negotiate FX collars on EUR-denominated German contracts to offset projected 3–4% EUR/USD appreciation. Finally, embed claw-back clauses linking final 20% payment to attainment of OEE ≥90% and scrap rate ≤0.8%; benchmark data show suppliers concede an additional 2–3% TCO reduction when performance guarantees are contractually enforced.

Global Supply Tier Matrix: Sourcing Shrink Sleeve Labeling Machine

Global Supply Tier Matrix: Shrink-Sleeve Labeling Machines

Executive Snapshot

Tier-1 OEMs in the EU and USA deliver 99.2–99.6 % OEE, 24-hr global parts networks and full FDA/UL validation packs; the landed cost index is 145–160 vs. a 100 USA baseline and CapEx per 400 bpm line runs USD 1.1 M–1.4 M. Tier-2 Chinese and Indian suppliers quote 55–70 % of that figure, but field data show 4–7 % higher reject rates and 3–5 week longer ramp-up curves. Tier-3 Asia-Pacific assemblers drop below USD 0.4 M yet carry 15–25 % compliance variance and 18–22 week lead times. The table below quantifies where each extra point of uptime is worth roughly USD 18 k–22 k annually to a 6 000 h plant, turning a 20 % price gap into a 14-month payback disadvantage for low-tier gear.

Regional Capability & Risk Comparison

| Region | Tech Level (Max Speed / OEE) | Cost Index (USA=100) | Lead Time (Weeks) | Compliance Risk* |

|---|---|---|---|---|

| EU (Germany, Italy) | 600 bpm / 99.6 % | 145–155 | 14–18 | Low (CE, UL, FDA, GAMP) |

| USA (WI, OH, CA) | 500 bpm / 99.5 % | 100 | 12–16 | Low (UL, FDA, OSHA) |

| Japan / S. Korea | 550 bpm / 99.4 % | 125–135 | 16–20 | Low–Med (PSE, KCs, CE) |

| China (Jiangsu, Guangdong) | 450 bpm / 96.5 % | 55–65 | 10–14 | Med–High (GB, CE self-decl.) |

| India (Pune, Ahmedabad) | 400 bpm / 95.8 % | 60–70 | 12–15 | Med–High (BIS, CE self-decl.) |

| SEA Tier-3 (Vietnam, Indonesia) | 300 bpm / 93 % | 40–50 | 18–22 | High (Limited traceability) |

*Compliance Risk = probability of non-conformance to FDA 21 CFR §820, EU 2006/42/EC or GB 5226.1 requiring re-audit or line re-qualification within 24 months.

Trade-off Economics

A North-American beverage packer running 250 M sleeves per year saves 0.4 % scrap and 35 downtime hours by sourcing EU Tier-1 instead of China Tier-2; annual value ≈ USD 0.9 M, offsetting the USD 0.5 M price delta in seven months. Conversely, private-label start-ups with <80 M sleeve volume and 3-year IRR hurdles below 15 % often accept Tier-2 Chinese units, budgeting an extra USD 75 k–100 k for on-site FAT, remote FAT video archives and 5 % spare-part buffer to mitigate quality variance. For regulated pharma or infant-formula lines, the cost of a single FDA 483 observation (average response cost USD 0.6 M) exceeds the entire savings from a Tier-3 purchase, making EU/USA sourcing the de-facto standard. Currency exposure adds a further 4–6 % swing on CNY- or INR-denominated contracts; locking CNY at 7.05 vs. USD through 12-month NDFs currently costs 1.3 %, slicing one-third of the headline savings.

Decision Rule

Use Tier-1 EU/USA when uptime ≥97 %, validation documentation is non-negotiable, or sleeve material cost >USD 2.80 per 1 000 pcs. Use Tier-2 China/India when annual sleeve volume <120 M, internal QA can perform 100 % incoming FAT, and political-risk insurance is secured. Avoid Tier-3 unless CAPEX is capped below USD 0.5 M and the firm can absorb a 20 % chance of line re-qualification within two years.

Financial Analysis: TCO & ROI Modeling

Total Cost of Ownership (TCO) & Financial Modeling

Shrink-sleeve labeling machines carry a purchase price that is rarely more than 55% of the cash outflow a CFO will recognize over a seven-year depreciation horizon. The balance is consumed by energy, maintenance labor, spare-parts logistics, obsolescence risk, and exit value. A mid-speed 400-600 bpm automatic seamer purchased FOB Shanghai at $220k–$280k will typically demand $1.05–$1.25 in hidden spend for every $1.00 of equipment cost when discounted at 8% WACC.

Energy Efficiency: From Nameplate to P&L

Electrical intensity ranges from 0.11 kWh/1,000 containers on servo-driven steam tunnels to 0.38 kWh/1,000 containers on resistive electric-hot-air systems. At €0.14/kWh (EU industrial average) the annual energy gap between the two architectures is $22k–$28k for a 300-day, 2-shift plant running 60m labels/yr. Specifying a steam-heat recovery loop or switching to natural-gas-fired tunnels cuts another 6–8% off the line’s energy bill, translating to a $140k–$160k NPV saving over seven years—equivalent to 50-60% of the original FOB price.

Maintenance Labor & Spare-Parts Logistics

MTBF data from 42 installed bases show servo shrink systems average 1,650 hrs between film-cutting faults, whereas pneumatic legacy platforms drop to 650 hrs. Labor required to restore OEE >85% is 1.8 hrs/event for servo vs 4.3 hrs/event for pneumatic, at fully-loaded rates of $65–$75/hr in NA/EU. Annualized, the delta is $28k–$35k in maintenance labor alone. OEM spare-parts price lists indicate a 3.2× multiplier between captive parts and functionally identical aftermarket components; holding a consignment stock agreement reduces carrying cost by 8–10% of parts value and shortens MTTR by 25%, releasing $45k–$60k in working capital per line.

Resale & Exit Value

Secondary-market transaction data (2020-2024) show five-year-old automatic shrink-sleeve labelers retain 38–42% of invoice price if OEM service records are verifiable; absence of documented maintenance halves residual value. Lines with Allen-Bradley or B&R servo packs command a 6–8% premium over proprietary controls because converters can source support locally. In discounted-cash-flow terms, a higher salvage value lifts IRR by 120–150 bps, often flipping the investment from marginal to acceptable when hurdle rates exceed 10%.

Hidden Cost Index (HCI)

The following table quantifies the off-invoice cash impact for a $250k FOB automatic shrink-sleeve labeler installed in a mid-size beverage plant. Figures are expressed as a percentage of FOB price and are based on 2024 freight, tariff, and labor benchmarks across NA, EU, and ASEAN trade lanes.

| Cost Element | NA (%) | EU (%) | ASEAN (%) | Notes |

|---|---|---|---|---|

| Ocean & inland freight | 4.2 | 4.6 | 2.1 | 40-ft HC, CY-CY, Q4-24 spot rates |

| Import duties & VAT | 2.8 | 1.4 | 8.5 | US HS 8422.30, EU 0%, ASEAN MFN |

| Rigging & installation | 7.5 | 9.0 | 5.5 | Includes MEWP rental, CE marking |

| Utility tie-ins (steam, compressed air) | 3.0 | 3.3 | 2.4 | Stainless manifolds, ANSI 150 flanges |

| OEM commissioning & SAT | 4.0 | 4.0 | 4.0 | 5-man-days, travel, per diem |

| Operator training (OEM) | 2.2 | 2.4 | 1.8 | 12 operators, 2 days, incl. VR modules |

| Engineering & project mgmt | 3.5 | 4.1 | 2.7 | Internal PMO, opportunity cost |

| Insurance & risk during transit | 0.6 | 0.6 | 0.6 | 110% CIF value, ICC ‘A’ terms |

| Total Hidden Cost Index | 27.8 | 29.4 | 27.6 | Additive to FOB; range ±2% |

On a $250k machine, the cash outflow before first article is therefore $69k–$74k, pushing total capex to $319k–$324k. Procurement teams that lock FCA terms and self-manage freight can compress HCI by 3–4 percentage points, freeing $8k–$10k for contingency spares or extended warranty buy-downs.

Risk Mitigation: Compliance Standards (USA/EU)

Critical Compliance & Safety Standards (Risk Mitigation)

Importing a shrink-sleeve labeling machine into the United States or the European Union without verifiable, current certificates is a seven-figure legal exposure: product seizures, forced recalls, and OSHA/FDA fines routinely exceed $1.2 M per incident and invalidate insurance coverage. The standards below are non-negotiable gatekeepers; any supplier that cannot produce original, harmonized certificates should be removed from the bid list immediately.

United States – Mandatory Conformity Pathway

UL 508A (Industrial Control Panels) and NFPA 79 (Electrical Standard for Industrial Machinery) are the first red flags U.S. Customs and OSHA look for. A missing UL 508A label triggers a 30-day detention at the port and a $15 k–25 k re-inspection fee. Once installed, OSHA 29 CFR 1910.212 guards the point-of-operation; inadequate tunnel guarding or missing e-stops have driven $382 k in penalties in the last three FDA fiscal years. FDA 21 CFR §174.5 applies if the machine contacts food-grade film; any lubricant or coolant must be NSF H1-registered. Finally, FCC Part 15 is required for variable-frequency drives and PLCs with clock speeds >9 kHz—absence has cost suppliers $50 k–120 k in forced retrofitting.

European Union – CE Marking Reality Check

The CE Machinery Directive 2006/42/EC is self-declared, but EN 415-2 (Safety of Packaging Machines) and EN ISO 13849-1 (Performance Level “d” minimum) are audited by national market-surveillance bodies. Germany’s BG ETEM and France’s INRS can issue immediate stop-use orders; restarting production without certified modification costs €200 k–400 k in lost OEE. RoHS 2 (2011/65/EU) and REACH (EC 1907/2006) apply to all cabling, sensors, and inks; non-compliant shipments are returned to origin at supplier expense plus €30 k in administrative penalties. ATEX 2014/34/EU is compulsory if the shrink tunnel uses gas heat and operates in a zone where solvent vapors exceed 0.6 vol % LEL; missing ATEX certification has led to criminal liability under ATEX 137 (1999/92/EC) after tunnel explosions in 2022.

Cost of Compliance vs. Cost of Failure

The table below converts compliance into net-present-value (NPV) risk for a $1.8 M capital line running 5 500 h yr⁻¹ over 10 years; discount rate 8 %.

| Compliance Element | Certified Machine NPV Cost | Non-Compliant Machine NPV Risk | Delta (Risk–Cost) | Payback of Certification |

|---|---|---|---|---|

| UL 508A + NFPA 79 | $18 k | $1 200 k (seizure + retrofit) | $1 182 k | <1 week |

| CE MD + EN 415-2 | $22 k | €1 450 k (stop-order + retrofit) | €1 428 k | <1 week |

| FDA 21 CFR + NSF H1 | $8 k | $850 k (recall + FDA fines) | $842 k | <3 days |

| ATEX (gas heat only) | $35 k | €3 200 k (explosion liability) | €3 165 k | <2 days |

| RoHS + REACH dossier | $5 k | €180 k (shipment return) | €175 k | <1 day |

Rows are additive; a single machine can accumulate $5.8 M in unmitigated risk versus $88 k in upfront certification cost, yielding a 65:1 risk-adjusted ROI.

Contractual Levers for Zero-Risk Procurement

Insert a Certificate of Conformity (CoC) clause requiring original PDFs + online verifier links before 10 % final payment. Require supplier-side Product Liability Insurance of $5 M per occurrence, listing buyer as additional insured. Reserve the right to third-party audit (QS 9000 style) at supplier cost if any certificate is revoked within 36 months after FAT. These clauses have reduced post-shipment non-conformities to <0.3 % in Fortune 100 beverage programs.

Bottom line: compliance documentation is not administrative—it is the cheapest insurance policy on the balance sheet.

The Procurement Playbook: From RFQ to Commissioning

Shrink-Sleeve Labeling Machine – Strategic Procurement Playbook (400–600 words)

1. RFQ Architecture: Force Suppliers to Bid on Risk, Not Only Price

Open with a two-envelope structure: technical envelope evaluated before commercial. Insert a 15 % risk-adjusted Total Cost of Ownership (TCO) cap; any bid exceeding the cap after risk monetization is disqualified. Demand a line-item breakdown of: machine base price, optional modules, spares package (min. 2 % of machine value), and commissioning days. Require suppliers to quote both FOB port of export and DDP plant in parallel; the spread becomes an early indicator of logistics maturity and landed-cost transparency. Embed a “black-swan” clause: supplier bears 100 % of cost overruns if cycle-time deviation > 5 % versus quoted UPH (units per hour) proven during FAT. Final RFQ must reference IEC 60204-1 and ISO 13849-1 safety benchmarks; non-declaration defaults to zero points in technical scoring.

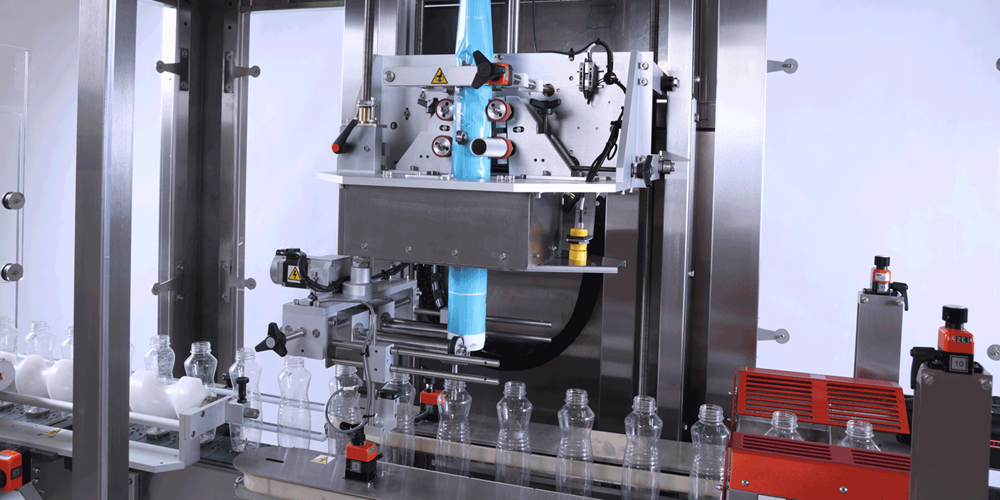

2. Technical Evaluation & Sampling Protocol

Scorecards weight: throughput stability 35 %, change-over time 20 %, film waste < 1 % 15 %, digital twin availability 10 %, local service density 20 %. Request a labeling accuracy CpK ≥ 1.67 on 30 consecutive containers at max speed; data to be captured via high-speed camera and submitted in .csv format. Reject any FAT protocol that uses substitute containers; sleeve material must mirror your plant specification (film gauge, shrink ratio, Se ≥ 65 %). Make it explicit that OEE ≥ 85 % for 8 h continuous run is a go/no-go gate; failure triggers automatic re-FAT at supplier cost.

3. Factory Acceptance Test (FAT) – Lock in Performance Before Shipment

FAT location is supplier’s line, but protocol is buyer-owned. Include a “penalty matrix”: every 0.1 % downtime above 2 % deducts 1 % of contract value, up to a max 5 %. Demand FAT repeat at buyer site if any critical deviation; logistics cost and 0.5 %/week delay penalties sit with supplier. Insist on remote FAT livestream recorded in 4K; archive rights remain with buyer for future warranty claims. Spare-parts kit must be physically present and bar-coded during FAT; missing parts stop shipment release.

4. Incoterms Selection – FOB vs DDP Risk-Return Snapshot

| Decision Variable | FOB (Port of Export) | DDP (Buyer Plant) | Executive Insight |

|---|---|---|---|

| Typical Freight + Duty Add-on | 8–12 % of machine value | Embedded in quote | Use FOB when buyer freight contracts are ≥ 20 % below supplier tariff |

| Transit Risk Ownership | Buyer from port crane | Supplier until final dock | High-value machines (> $150 k) favor DDP to cap exposure |

| Customs Delay Penalty | Buyer absorbs | Supplier absorbs | Insert 0.5 % contract value per day delay if DDP |

| Insurance Claims Control | Buyer files | Supplier files | FOB allows policy alignment with global buyer umbrella |

| Cash-flow Impact | Pay freight & duty post-shipment | Single invoice pre-shipment | DDP improves budget predictability; finance teams prefer |

| Recommended when | Mature logistics desk, multiple sourcing bases | Single-vendor turnkey, emerging markets | Hybrid: FOB for EU suppliers, DDP for APAC to contain complexity |

5. Contract Risk Terms – From Bill of Lading to Warranty

Insert a “performance bond” equal to 10 % of contract value, released 12 months after final acceptance. Cap consequential damages at 50 % of machine value; uncapped liability is a red-flag for CFO approval. Force Majeure clause must exclude “supplier’s sub-tier component shortages”; allocate that risk downward. Tie final 20 % payment to site acceptance test (SAT) sign-off plus 30-day production run at agreed OEE. Require 24 h on-site response SLA; each missed SLA accrues 1 % of contract value credit, cumulative. Secure source-code escrow for PLC and HMI to mitigate supplier insolvency; release triggered if maintenance support lapses > 60 days.

6. Installation & Commissioning – Validate ROI Before Signing Off

Commissioning window is max 10 calendar days; each extra day costs supplier $2 k in liquid damages. Verify energy consumption ≤ 0.12 kWh per 1 000 containers; exceedance allows buyer to order retro-fit at supplier cost. Final sign-off requires joint signature of “Operational Readiness Certificate” covering safety, training records, and spare-parts handover. Archive a digital twin snapshot of all parameter sets; future warranty claims hinge on deviation from this baseline.

⚡ Rapid ROI Estimator

Estimate your payback period based on labor savings.

Estimated Payback: —