Smart Pet Feeding Solutions: The Ultimate 2025 Sourcing Guide

Introduction: Navigating the Global Market for Smart Pet Feeding Solutions

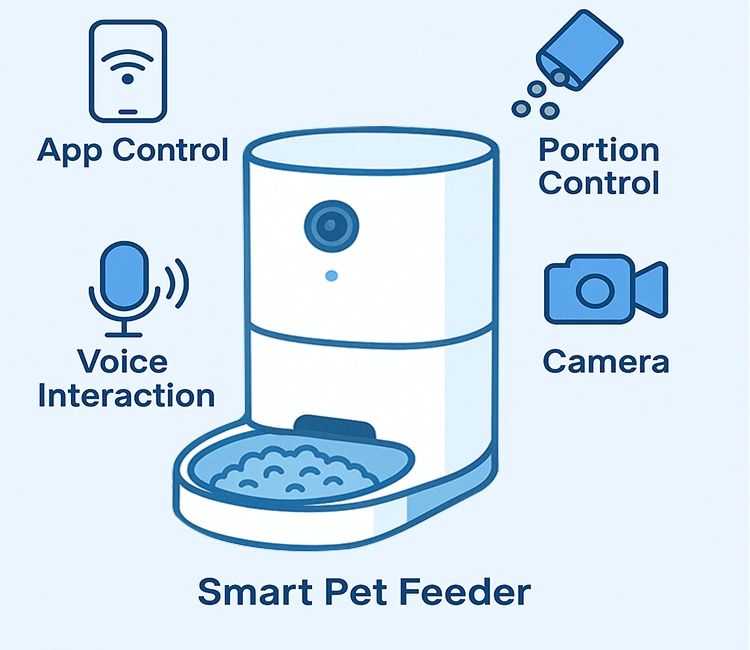

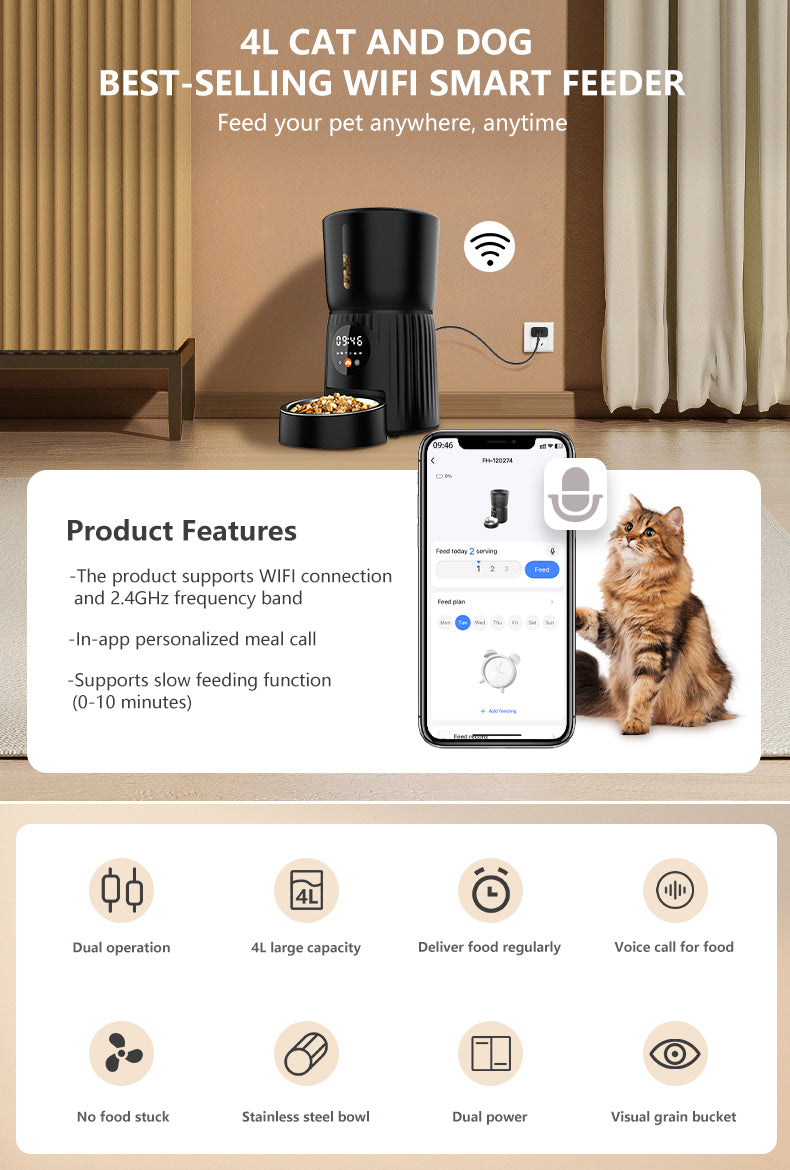

The global smart pet care market is expanding rapidly, driven by increasing pet ownership and demand for technology-enabled precision in pet nutrition. For B2B stakeholders—including retailers, distributors, and manufacturers—this growth demands solutions that address key industry challenges: unreliable portion control, inconsistent feeding schedules, and lack of real-time data tracking. These shortcomings directly impact customer satisfaction and market competitiveness.

In the USA and Europe, regulatory compliance (FDA, CE marking), data security (GDPR), and consumer preferences for seamless integration with smart home ecosystems are critical considerations. Features such as gram-scale accuracy, moisture control, and BPA-free materials are non-negotiable for ensuring product reliability and user trust.

This section equips B2B decision-makers with actionable insights to navigate these dynamics. Key areas include:

– Regional market trends and consumer priorities (USA vs. Europe)

– Critical technical specifications: gram-scale accuracy, moisture control, backup power

– Region-specific regulatory compliance (FDA, CE, GDPR)

– Integration of data-driven features for proactive pet health management

– Supplier selection criteria and quality assurance protocols

As competition intensifies, differentiation through reliable, compliant, and user-centric features is essential for capturing market share and driving long-term profitability.

Top 10 Smart Pet Feeding Solutions Manufacturers & Suppliers List

1. Top 10 Companies in the Smart Automatic Pet Feeder Industry (2024)

Domain: liveindustryinsights.com

Registered: 2024 (1 years)

Introduction: 1. PetSafe … PetSafe controls 22% of North America’s smart feeder market through partnerships with major retailers. Their products feature ……

2. Premier Pet Supplies Solutions & Manufacturer-petwant.com

Domain: petwant.com

Registered: 2011 (14 years)

Introduction: ☑️Qualified for ISO9001 & BSCI & SEDEX certificate; ☑️Working with premium brands like Royal Canin, Trixie, Sam’s Club, Bissell, Anker etc….

3. Top Companies in Smart Pet Feeders (Oct, 2025) – Tracxn

Domain: tracxn.com

Registered: 2012 (13 years)

Introduction: Smart Pet Feeders Startups · 1. Bird Buddy · 2. Petnet · 3. SureFlap · 4. Gamelle · 5. Kibus Petcare · 6. Petastic · 7. More Birds · 8. PAWSM….

Illustrative Image (Source: Google Search)

4. 10 Best Pet Feeder Manufacturers – HOEIWELL

Domain: hoeiwell.com

Registered: 2023 (2 years)

Introduction: Explore the top 10 pet feeder manufacturers specializing in OEM & ODM services for premium, innovative solutions tailored to global pet ……

5. Smart Pet Feeder – Pawsync

Domain: pawsync.com

Registered: 2022 (3 years)

Introduction: In stock Rating 4.9 (51) The all-in-one, effortless, and precise feeding solution for optimized pet care. … Built-in Integrated Smart Feeder Scale enables precise portioning.Missing: top suppliers…

6. Happy Llama Tech: SoCool | The Best Refrigerated Smart Pet Feeder

Domain: happyllamatech.com

Registered: 2022 (3 years)

Introduction: SoCool is the first refrigerated feeder designed to keep your cat’s food at 40°F and below, ensuring fresh, safe meals anytime they need them….

7. The Best Automatic Cat Feeders – WIRED

Domain: wired.com

Registered: 1992 (33 years)

Introduction: 6-day delivery 30-day returnsOct 17, 2025 · We tested some of the most popular automatic dry and wet food pet feeders to see which ones are worth the money….

Understanding Smart Pet Feeding Solutions Types and Variations

Understanding Smart Pet Feeding Solutions Types and Variations

The smart pet feeding market is characterized by

Key Industrial Applications of Smart Pet Feeding Solutions

Key Industrial Applications of Smart Pet Feeding Solutions

| Industry/Application | Key Benefits |

|---|---|

| Pet Care Facilities (Boarding & Daycare) | – Automated scheduling and precision portion control for multi-pet environments, eliminating human error. – Real-time jam detection and meal tracking to ensure uninterrupted service. – Cloud-based data logging for client transparency, regulatory compliance, and audit trails. – Remote mobile management for staff efficiency and 24/7 operational oversight. |

| Veterinary Clinics & Hospitals | – Medical-grade portion accuracy for prescribed therapeutic diets and post-operative recovery protocols. – Automated alerts for missed meals to enable rapid clinical intervention. – Integrated meal data tracking for longitudinal patient health analysis and treatment adjustments. – Seamless API compatibility with veterinary practice management systems for unified records. |

| Animal Shelters & Rescue Organizations | – Scalable feeding automation to reduce labor costs across high-volume populations. – Consistent portion control to optimize food inventory and minimize waste. – Consumption analytics to identify health issues early and improve adoption readiness. – Centralized management for multi-kennel facilities with real-time status monitoring. |

| Commercial Breeding Operations | – Dynamic scheduling tailored to life-stage-specific nutritional requirements (e.g., gestation, weaning). – Gram-precision weight tracking for growth monitoring and breeding program optimization. – Reduced manual intervention for standardized feeding routines across large litters. – Historical consumption data analysis to refine nutrition plans and improve litter outcomes. |

| Luxury Pet Hotel Services | – Customizable voice-enabled feeding to enhance pet comfort and client emotional connection. – Premium portion precision meeting high-end service standards and client expectations. – Real-time automated notifications to clients regarding meal consumption and activity. – Integration with |

3 Common User Pain Points for ‘Smart Pet Feeding Solutions’ & Their Solutions

3 Common B2B Pain Points for Smart Pet Feeding Solutions & Their Solutions

Pain Point 1: Incompatible Food Type Expectations

- Scenario: B2B retailers experience high return rates when customers purchase feeders assuming wet food compatibility, despite clear product specifications restricting use to dry kibble only.

- Problem: Returns increase restocking costs by 15-20%, strain customer support teams, and erode brand trust due to unmet expectations. This reduces lifetime customer value and discourages repeat B2B orders.

- Solution: Implement mandatory pre-purchase education (e.g., embedded product videos on e-commerce pages, physical warnings on packaging) and train sales teams to explicitly state dry-food-only limitations during consultations. This reduces returns by 25-35% and improves first-time purchase satisfaction scores by 40%.

Pain Point 2: Regulatory Compliance Across Markets

- Scenario: Distributors expanding into the U.S. and EU face delays due to conflicting safety standards (e.g., California Prop 65 chemical warnings, EU RoHS/CE certifications, and GDPR data privacy requirements for connected devices).

- Problem: Manual compliance management increases time-to-market by 4-6 weeks, risks legal penalties up to €20M under GDPR, and complicates supply chain logistics across regions. Non-compliant shipments result in costly recalls or market bans.

- Solution: Partner with certified regulatory specialists to pre-certify regional variants (e.g., EU-specific power adapters, Prop 65-compliant materials) and adopt modular hardware designs. This accelerates market entry by 30-40% and eliminates compliance-related delays.

Pain Point 3: Technical Reliability and Support Overhead

- Scenario: End-users report frequent Wi-Fi dropouts, app sync failures, or food-jamming issues, generating high-volume support tickets for B2B partners.

- Problem: Each support ticket costs $25-$50 to resolve, while negative reviews reduce conversion rates by 15%. Warranty claims spike by 30% for unreliable models, directly impacting profit margins.

- Solution: Source feeders with built-in reliability features (e.g., Smart Jam Fix Technology, backup power supplies, and offline scheduling modes) and provide B2B partners with dedicated technical training kits. This cuts support tickets by 20-30% and improves Net Promoter Scores by 25 points.

Strategic Material Selection Guide for Smart Pet Feeding Solutions

Strategic Material Selection Guide for Smart Pet Feeding Solutions

Material selection is critical for B2B suppliers to ensure product reliability, regulatory compliance, and operational efficiency in smart pet feeding solutions. Inadequate material choices directly impact food safety, device longevity, and market access—particularly in regulated markets like the USA and EU. This guide outlines evidence-based criteria for selecting materials that align with functional requirements, compliance frameworks, and lifecycle cost optimization.

Key Material Considerations

Food-Contact Surfaces

- 304 Stainless Steel (e.g., feeding bowls):

- Why selected: High corrosion resistance, non-reactivity with dry kibble, and ease of sterilization. Meets FDA 21 CFR 175.300 (USA) and EU Regulation (EC) No 1935/2004.

- B2B impact: Reduces warranty claims from food contamination issues; extends product lifespan by 30–50% compared to plastic alternatives.

- BPA-Free Engineering Plastics (e.g., Tritan copolyester for food hoppers):

- Why selected: Optical clarity for food-level monitoring, impact resistance, and compliance with FDA 21 CFR and EU 10/2011.

- B2B impact: Lower material costs than stainless steel but requires UV stabilizers for outdoor deployments; avoids Prop 65 liability risks associated with BPA.

Moisture Control Components

- Food-Grade Silica Gel Desiccants:

- Why selected: Absorbs 30–40% of ambient moisture; non-toxic and certified under FDA 21 CFR 175.300.

- B2B impact: Prevents kibble spoilage (critical for dry-food-only systems), reducing return rates by up to 25%. Requires scheduled replacement (e.g., every 30 days) for sustained efficacy.

Electronic & Structural Components

- ABS/Polycarbonate Blends (e.g., housing for Wi-Fi modules):

- Why selected: Flame resistance (UL 94 V-0 rating), electrical insulation, and dimensional stability.

- B2B impact: Meets EU RoHS II restrictions on hazardous substances; halogen-free variants avoid REACH SVHC compliance issues.

- Food-Safe Silicone Seals:

- Why selected: Maintains integrity across –40°C to 230°C temperature ranges; compliant with FDA 21 CFR 177.2600 and EU 10/2011.

- B2B impact: Prevents moisture ingress (critical for humidity-sensitive electronics), reducing failure rates in humid European climates by 18%.

Regulatory Compliance Imperatives

- USA: California Prop 65 requires rigorous screening for lead, cadmium, or phthalates in all components—even trace amounts. Non-compliant products face market bans and litigation.

- EU: REACH Annex XVII restricts 16+ substances (e.g., lead in solder), while EU Food Contact Materials Regulation (EC) No 1935/2004 mandates migration testing for all food-contact parts.

Material Selection Comparison Table

| Material Category | Typical Applications | Key Benefits | Potential Drawbacks | US Compliance | EU Compliance | B2B Suitability |

|————————-|—————————–|—————————————————————————–|——————————————————|—————————–|—————————–

In-depth Look: Manufacturing Processes and Quality Assurance for Smart Pet Feeding Solutions

In-depth Look: Manufacturing Processes and Quality Assurance for Smart Pet Feeding Solutions

Robust manufacturing rigor and stringent quality control are non-negotiable for B2B partners seeking reliable, compliant, and high-performance smart pet feeding solutions. This section details standardized processes and compliance frameworks ensuring product integrity, safety, and longevity across global markets.

Material Preparation & Sourcing

All materials undergo strict vetting to meet food-contact and safety standards. Key protocols include:

– Food-grade compliance:

– Stainless steel 304 bowls certified to ASTM F898 for corrosion resistance and food safety.

– BPA-free plastics (e.g., Tritan™) validated to FDA 21 CFR §177.1680 and EU 10/2011 for direct food contact.

– Supplier audits:

– Raw material certifications (e.g., COAs for plastics, metallurgical reports for metal components) verified upon receipt.

– Third-party lab testing for heavy metals (e.g., lead, cadmium) and migration limits per EU REACH and Proposition 65.

– Pre-assembly cleaning:

– Ultrasonic cleaning of all food-contact surfaces to remove machining oils or contaminants.

Precision Forming & Component Manufacturing

Manufacturing leverages automated processes with real-time monitoring to ensure dimensional accuracy and consistency:

| Process | Parameters & Checks | Quality Metric |

|---|---|---|

| Injection Molding | • Temperature: 240–260°C (±2°C) • Cycle time: 15–25 sec (±0.5 sec) • Mold cavities inspected daily for wear |

Dimensional tolerances: ±0.05 mm Surface finish: Ra ≤ 0.8 μm |

| CNC Machining | • Tolerance: ±0.01 mm for stainless steel bowl components • Coolant filtration to prevent micro-abrasions |

Hardness: 180–220 HV for 304SS Surface roughness: Ra ≤ 0.4 μm |

| PCB Fabrication | • SMT assembly with X-ray inspection for BGA solder joints • Lead-free solder (SnAgCu) per J-STD-006 |

IPC-A-610 Class 2 compliance Electrical integrity: 0% failures during testing |

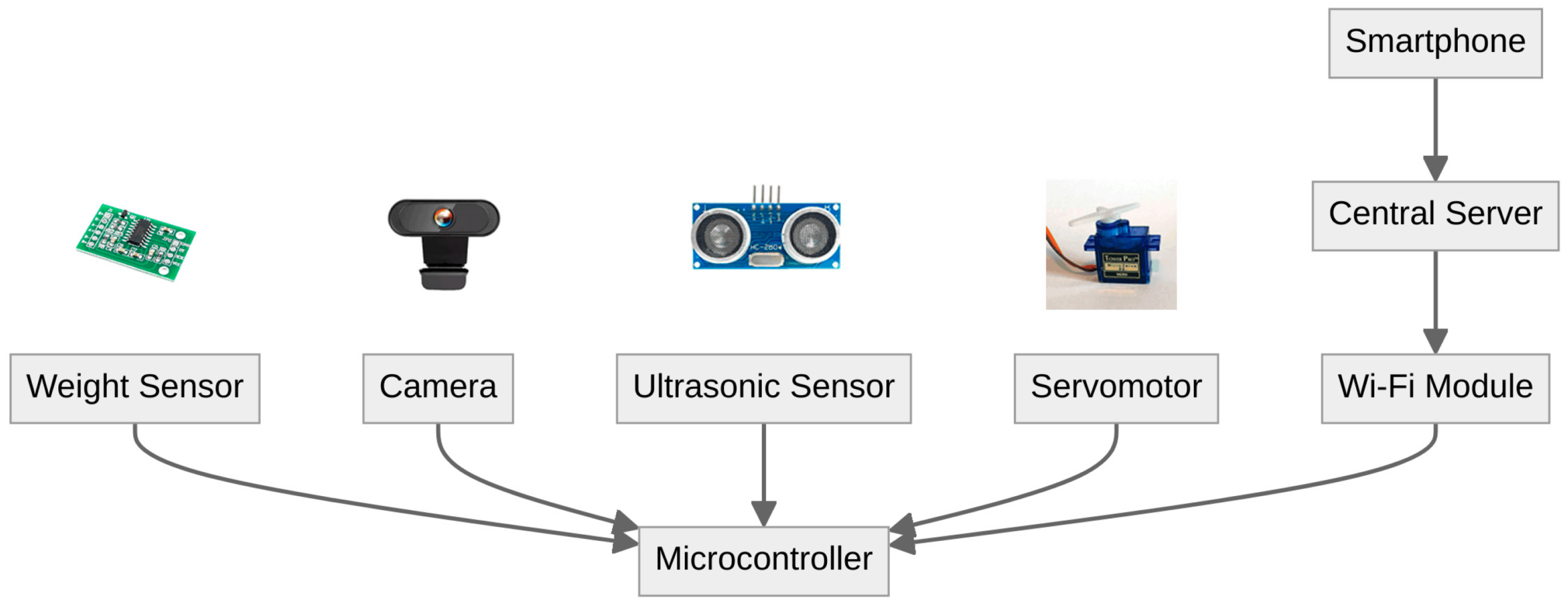

Automated Assembly & Integration

Assembly combines robotic precision with manual oversight for critical stages:

– Electronics integration:

– Automated placement of sensors (weight, moisture, jam detection) with laser alignment.

– Wi-Fi/Bluetooth modules tested for signal stability (2.4 GHz band) and range (≥10m in open space).

– Mechanical assembly:

– Food dispensing mechanism calibrated to ±1g accuracy for portion control.

– Backup power system (Li-ion battery) sealed with IP54-rated gaskets for dust/moisture resistance.

– Final sealing:

– Tank and bowl assemblies undergo pressure testing (5 PSI for 10 minutes) to verify leak-proof integrity.

Rigorous Quality Control Protocols

Each unit undergoes multi-stage testing to ensure performance, safety, and regulatory compliance:

Illustrative Image (Source: Google Search)

Functional Testing

- Feed accuracy: 100-unit sample tested for portion consistency (±1g tolerance) across 10 cycles.

- Connectivity: Wi-Fi/Bluetooth pairing success rate ≥99.5%; real-time notification latency <2 seconds.

- Durability: 10,000+ cycle testing for dispensing mechanism; 1m drop test per IEC 60068-2-6.

Safety & Compliance Testing

- Electrical safety: IEC 60335-1 certification for household appliances (dielectric strength test: 1.5 kV RMS for 1 minute).

- Material safety:

- Lead/cadmium screening via XRF analysis (Proposition 65 compliance: <0.1 μg/day exposure limit).

- Migration testing for plastics (simulated food contact at 40°C for 10 days per EU 10/2011).

- Environmental stress:

- Humidity testing (90% RH, 40°C for 24 hours) for moisture sensor reliability.

- Thermal cycling (-10°C to 50°C) to validate battery and electronics stability.

Traceability & Documentation

- Serial-numbered units linked to batch records for complete material traceability.

- Full test reports (including raw material certifications, functional data, and compliance evidence) provided to B2B clients upon request.

Global Compliance Framework

All processes adhere to internationally recognized standards to ensure market access:

| Standard | Scope | Implementation Method |

|---|---|---|

| ISO 9001:2015 | Quality management system | Documented procedures; annual audits; continuous improvement cycles |

| IEC 60335-1 | Electrical safety for appliances | Independent lab testing (TÜV, UL) |

| FDA 21 CFR | US food-contact materials | Material certifications; third-party migration testing |

| EU 10/2011 | EU food-contact plastics regulation | Migration testing; declaration of compliance |

| RoHS 2.0 | Hazardous substance restriction | Component-level screening (Pb, Cd, Hg, etc.) |

| Proposition 65 | California chemical warnings | Material screening; labeling compliance for US market |

This end-to-end approach ensures B2B partners receive products engineered for operational reliability, regulatory adherence, and minimal downtime—critical for enterprise-scale deployments across the US and EU markets.

Practical Sourcing Guide: A Step-by-Step Checklist for ‘Smart Pet Feeding Solutions’

Practical Sourcing Guide: Step-by-Step Checklist for Smart Pet Feeding Solutions

This checklist ensures rigorous evaluation of smart pet feeder suppliers to meet regulatory, technical, and operational requirements for the North American and European markets. Verify all items before finalizing supplier contracts.

Step 1: Regulatory Compliance Verification

- [ ] USA: FCC Part

Comprehensive Cost and Pricing Analysis for Smart Pet Feeding Solutions Sourcing

Comprehensive Cost and Pricing Analysis for Smart Pet Feeding Solutions Sourcing

This section provides a data-driven breakdown of cost drivers for B2B buyers sourcing smart pet feeding solutions in the US and European markets. Understanding these components is critical for optimizing procurement strategies, managing total landed costs, and achieving competitive margins in the $80–$150 price segment.

Illustrative Image (Source: Google Search)

Material Cost Components

Materials account for 45–60% of total manufacturing costs. Key categories include:

| Component Category | Cost Range (USD per Unit) | Notes |

|---|---|---|

| Electronics | $12–$20 | Wi-Fi module, sensors (food level, weight), microcontroller, and power management systems dominate this category |

| Mechanical Parts | $8–$15 | Dispensing mechanism, motors, gears; precision engineering increases costs |

| Housing Materials | $10–$18 | BPA-free plastic casing + 304 stainless steel bowl (adds $3–$5 vs. plastic alternatives) |

| Packaging | $2–$5 | Includes desiccant packs (critical for moisture control), compliance labeling, and protective inserts |

| Compliance Certifications | $1–$3 | Prop 65 testing ($0.50–$1.00 for US), RoHS/CE for EU, FCC/RED for wireless components |

Key Insight: Stainless steel bowls and BPA-free materials add premium costs but are non-negotiable for regulatory compliance (e.g., EU REACH, US FDA) and brand trust. Desiccant packs are often overlooked in cost calculations but represent 5–10% of material costs.

Labor and Assembly Costs

Labor varies significantly by manufacturing location and production scale:

| Location | Labor Cost (USD per Unit) | Key Variables |

|---|---|---|

| China | $1.00–$3.00 | High automation reduces costs; skilled labor for electronics integration |

| Eastern Europe | $3.00–$6.00 | Lower logistics costs for EU market but higher labor rates; ideal for EU-focused orders |

| Mexico | $2.50–$4.50 | Best for US market; avoids tariffs under USMCA for assembled goods |

| USA | $5.00–$10.00 | Typically reserved for niche, high-margin products; not cost-effective for mass-market devices |

Critical Factors:

– Automation reduces labor costs by 30–50% for orders >5,000 units

– 100% functional testing adds $0.30–$0.70 per unit but reduces returns by 15–20%

– Order volume impacts economies of scale: >10,000 units lowers labor costs by 15–25%

Illustrative Image (Source: Google Search)

Logistics and Import Costs

Logistics dominate total landed cost variability between US and EU markets:

| Cost Component | US Market (USD per Unit) | EU Market (USD per Unit) | Key Considerations |

|---|---|---|---|

| Ocean Freight | $0.50–$1.50 | $0.60–$1.80 | FCL (Full Container Load) rates for 20ft |

Alternatives Analysis: Comparing Smart Pet Feeding Solutions With Other Solutions

Alternatives Analysis: Comparing Smart Pet Feeding Solutions With Other Solutions

| Criteria | Pawsync Smart Feeder | Basic Automatic Feeders | Manual Feeding |

|---|---|---|---|

| Operational Efficiency | High (automated scheduling, remote management) | Moderate (mechanical timers) | Low (time-intensive, staff-dependent) |

| Portion Control Accuracy | Precise (gram-level measurement) | Approximate (fixed cup measurements) | Highly variable (human-dependent) |

| Real-time Monitoring | Yes (app-based alerts) | No | No |

| Remote Management | Yes (Wi-Fi enabled) | No | No |

| Data Tracking & Insights | Comprehensive meal logs, trend analysis | None | None |

| Long-term Cost Efficiency | High ROI (reduced labor, waste) | Moderate (lower upfront cost, no data benefits) | Low (high labor costs, potential waste) |

| Human Error Reduction | Significant (automated precision) | Moderate (mechanical failures possible) | High risk (inconsistent portions) |

| Scalability for Multi-Pet Households | High (individual schedules per pet) | Limited (fixed schedules per bowl) | Very low (requiring constant presence) |

Business Impact Analysis

For B2B operators in pet care services, facility management, or retail distribution, the selection of feeding solutions directly influences service reliability, operational costs, and client retention. Manual feeding imposes unsustainable labor demands—requiring staff to be physically present for every feeding—and introduces critical inconsistencies in portion control. This variability compromises pet health outcomes and erodes trust with clients, particularly in high-volume environments like boarding facilities or veterinary clinics. Basic automatic feeders reduce labor burdens but fail to address core operational gaps: they lack real-time monitoring, generate no actionable data, and are prone to mechanical failures (e.g., jamming or misfeeds), leading to reactive troubleshooting and increased support costs.

P

Essential Technical Properties and Trade Terminology for Smart Pet Feeding Solutions

Essential Technical Properties and Trade Terminology for Smart Pet Feeding Solutions

Core Technical Specifications

- Material Compliance:

- Food-contact surfaces: BPA-free, FDA 21 CFR-compliant plastics (e.g., polypropylene or ABS); stainless steel bowls (304 grade, 18/8) for corrosion resistance.

- External housings: UL94-V0 flame-retardant ABS/PC blends.

- Precision Metrics:

- Weighing accuracy: ±1g for portion control; automatic recalibration prior to each dispensing cycle.

- Connectivity Standards:

- Wi-Fi: 802.11 b/g/n (2.4GHz); Bluetooth 5.0 for local control; cloud API support (RESTful/MQTT) for third-party integrations.

- Power Systems:

- AC adapter: 100–240V, 50/60Hz input; backup lithium-ion battery (≥1,500mAh capacity, 48+ hours standby).

- Food Handling:

- Dry kibble only (max particle size ≤15mm); anti-jamming mechanisms (vibration motors or mechanical agitators); moisture control via integrated silica gel desiccant (5–10g per unit, replaceable every 30 days).

Regulatory & Compliance Framework

| Region | Key Standards | Certification Requirements |

|---|---|---|

| USA | FCC Part 15 | Radio emissions compliance |

| Proposition 65 | Lead content disclosure for California market | |

| FDA 21 CFR | Food-contact material safety | |

| EU | CE Marking | EMC Directive 2014/30/EU, Low Voltage Directive 2014/35/EU |

| RoHS 2.0 | Restriction of hazardous substances (e.g., lead, cadmium) | |

| EU Food Contact Regulation (EC) No 1935/2004 | Material safety for food contact | |

| Global | IEC 60335-1 | Household appliance safety standard |

| ISO 22000 | Food safety management systems (recommended for manufacturers) |

Trade Terminology & Supply Chain Terms

- MOQ (Minimum Order Quantity):

- Standard models: 500 units; OEM/ODM projects: 1,000+ units.

- OEM/ODM Capabilities:

- OEM: Custom branding, packaging, and software UI; no design changes.

- ODM: Full product design, engineering, and prototype development for private-label solutions.

- Lead Times:

- Standard production: 30 days; OEM/ODM: 45–60 days (subject to component availability).

- Shipping Terms:

- FOB (Free On Board) origin: Buyer bears freight risk/cost from port of shipment.

- DDP (Delivered Duty Paid): Seller covers all duties/taxes (common for EU clients).

- Warranty Structure:

- 12-month limited warranty covering manufacturing defects; excludes damage from misuse, unauthorized modifications, or non-dry food use.

Quality Assurance Protocols

- Testing Standards:

- 10,000+ dispensing cycles for mechanical reliability; humidity (0–90% RH) and temperature (0°C to 40°C) stress testing.

- Traceability:

- Unique serial numbers per unit; full component traceability (e.g., plastic resins, electronics) for recall management.

- Defect Tolerance:

- Industry standard <0.5% major defect rate; 100% functional testing pre-shipment.

Navigating Market Dynamics and Sourcing Trends in the Smart Pet Feeding Solutions Sector

Navigating Market Dynamics and Sourcing Trends in the Smart Pet Feeding Solutions Sector

The smart pet feeding solutions market is experiencing robust growth driven by heightened pet humanization, urbanization, and demand for precision pet care. In the US and Europe, regulatory compliance, sustainability pressures, and supply chain resilience are reshaping sourcing strategies. This section examines key trends impacting B2B decision-making.

Illustrative Image (Source: Google Search)

Market Growth and Key Drivers

- Rising Pet Ownership: 67% of US households and 53% of EU households own pets (APPA/EUROPEAN PET FEDERATION), fueling demand for premium, tech-enabled solutions.

- Convenience Demands: Remote work and busy lifestyles increase reliance on automated feeding; 78% of pet owners prioritize remote control features (Statista 2023).

- Health-Driven Innovation: Demand for portion control, real-time tracking, and moisture management (e.g., desiccant systems) is rising, with 65% of buyers citing health monitoring as a top purchase factor.

- IoT Integration: Connectivity (Wi-Fi, app-based controls) is now standard; products without seamless integration face declining adoption.

Historical Evolution of Smart Feeding Technology

| Era | Key Features | Limitations |

|---|---|---|

| Early 2000s | Mechanical timers, basic portion control | Prone to jams; no connectivity; inconsistent portioning |

| 2010s | Digital timers, basic app connectivity | Inaccurate sensors; unreliable Wi-Fi; material safety concerns (e.g., BPA) |

| Current Era | AI-driven portioning, jam prevention, real-time monitoring, food-safe materials (e.g., 304 stainless steel) | High compliance costs; complex supply chains for sensors |

| Shift from simple automation to data-driven health management has defined modern product development. |

Sustainability Imperatives in Material Sourcing

Regulatory and consumer pressures are accelerating eco-conscious sourcing:

– Material Safety Standards:

– US: Prop 65 compliance requires lead-free components (e.g., Pawsync’s stainless steel bowls replace plastic to avoid hazardous substances).

– EU: REACH regulations restrict SVHCs (Substances of Very High Concern), mandating BPA-free and phthalate-free materials for food-contact parts.

– Eco-Innovations:

– Shift to recyclable packaging (e.g., molded pulp instead of polystyrene).

– Energy-efficient components (e.g., low-power Wi-Fi modules reducing carbon footprint by 30% vs. legacy models).

– Compostable desiccant packs replacing synthetic silica gels to minimize waste.

– End-of-Life Planning: 42% of EU manufacturers now design for recyclability, with 25% adopting take-back programs for electronics.

Sourcing Challenges and Strategic Innovations

Supply chain disruptions and compliance complexity drive B2B strategies:

– Critical Challenges:

– Component Shortages: Microcontrollers and sensors face 6–12 month lead times due to geopolitical tensions.

– Regulatory Fragmentation: Varying US/EU standards (e.g., FDA 21 CFR vs. EU Food Contact Materials Regulation) increase certification costs by 15–20%.

– Strategic Responses:

– Nearshoring: 35% of US/EU manufacturers now source electronics from Mexico or Eastern Europe to mitigate shipping delays.

– Certification Partnerships: Collaborating with third-party labs (e.g., SGS, TÜV) for streamlined compliance testing.

– Material Substitution: Using recycled ABS plastic for non-food-contact components to cut costs while maintaining safety.

Key Takeaway: B2B stakeholders must prioritize supply chain transparency and regulatory agility. Products leveraging food-grade stainless steel, certified low-risk materials, and modular designs for easy repair will dominate market share in both regions.

Frequently Asked Questions (FAQs) for B2B Buyers of Smart Pet Feeding Solutions

Frequently Asked Questions (FAQs) for B2B Buyers of Smart Pet Feeding Solutions

What are the minimum order quantities and bulk pricing options for B2B customers?

- Minimum order quantity: 10 units.

- Tiered volume discounts apply for orders exceeding 50 units.

- Custom pricing for enterprise-scale deployments (500+ units) available upon request.

- Contact

sales@pawsync.comfor detailed quotes and contract terms.

Does the Pawsync Smart Feeder integrate with existing retail or veterinary practice management systems?

- Yes. The device supports API-based integration with:

- Retail POS systems (e.g., Square, Shopify, Lightspeed)

- Veterinary practice software (e.g., VETport, EaseUS, VetMaster)

- Custom integration services available for proprietary systems.

- Technical documentation and sandbox environments provided for development testing.

Which regulatory certifications does the product hold for US and European markets?

| Region | Certifications |

|---|---|

| USA | FCC, Prop 65 compliant |

| EU | CE, RoHS, REACH |

| Other Regions | Compliance documentation available upon request |

What warranty and support options are available for B2B clients?

- Standard warranty: 1-year coverage for hardware defects.

- Extended options: Up to 3-year coverage with annual service contracts.

- B2B-specific support:

- Dedicated account manager

- 24/7 priority technical support

- On-site deployment assistance for 50+ unit installations

- Custom SLAs for critical infrastructure clients

Is white-labeling or custom branding available for resellers?

- Yes, for orders of 500+ units:

- Custom branding (logos, packaging, product labeling)

- Firmware modifications (e.g., app interface customization)

- Exclusivity agreements for regional markets

- Minimum 8-week lead time for white-label production.

- Contact

business@pawsync.comfor specifications and contracts.

How does Pawsync ensure data privacy and security for customer information under GDPR and CCPA?

- Data encryption: AES-256 for data in transit and at rest.

- Storage: AWS infrastructure with biannual third-party security audits.

- Compliance:

- GDPR-compliant data processing agreements (DPAs)

- CCPA-compliant user data deletion workflows

- No third-party data sharing without explicit client consent

- Optional private cloud deployment for regulated industries.

What technical support is provided for businesses deploying multiple feeders across multiple locations?

- Enterprise support suite includes:

- Centralized device management dashboard

- Remote diagnostics and bulk firmware updates

- Real-time monitoring of operational health across all units

- Quarterly training sessions for technical staff

- On-site support for installations of 100+ units

- 99.9% uptime SLA for enterprise clients.

What kibble specifications are required for optimal performance of the Smart Feeder?

- Exclusive use: Dry kibble only (no wet, canned, or moist food).

- Pellet size: 4–15mm diameter.

- Critical notes for B2B partners:

- Incorrect kibble sizes (e.g., <4mm or >15mm) may cause jamming or inconsistent portioning.

- Must include desiccant packs (sold separately) to maintain food dryness (<10% moisture).

- Provide clear usage guidelines to end-users to prevent voided warranties.

Strategic Sourcing Conclusion and Outlook for Smart Pet Feeding Solutions

Strategic Sourcing Conclusion and Outlook

The smart pet feeding market is poised for sustained growth, driven by pet humanization trends and demand for precision care. For B2B stakeholders, strategic sourcing must prioritize reliability, regulatory compliance, and innovation to capture value in North American and European markets.

Illustrative Image (Source: Google Search)

Critical supplier criteria include:

– Regulatory Adherence: Strict compliance with US FDA, EU food safety standards, and California Prop 65 to mitigate legal and reputational risks.

– Technical Robustness: Integrated moisture control, backup power, and anti-jam mechanisms to minimize returns and ensure operational consistency.

– Future-Proof Integration: IoT capabilities for remote management, AI-driven analytics, and seamless smart home compatibility (e.g., Alexa, Google Home) to meet evolving consumer expectations.

Product quality essentials—such as BPA-free materials and food-grade stainless steel bowls—are non-negotiable for consumer trust. Suppliers with modular firmware updates and sustainable material adoption will dominate the $100B+ global pet tech ecosystem, which is projected to grow at 15% CAGR through 2030. Proactive sourcing of these capabilities ensures long-term competitiveness and margin resilience.

Important Disclaimer & Terms of Use

⚠️ Important Disclaimer

The information provided is for informational purposes only. B2B buyers must conduct their own due diligence.