Water Bottling Machine Sourcing Guide: 2025 Executive Strategic Briefing

Executive Contents

Executive Market Briefing: Water Bottling Machine

Executive Market Briefing: Water Bottling Machine 2025

BLUF

Capex budgets that lock in 2025-2026 delivery slots will buy 10–15% more output per square metre and 8–12% lower energy per bottle than legacy lines installed before 2020. The global installed base is turning over fast: 42% of 2024-2025 machine orders are replacements, not greenfield plants. Lead times from German OEMs are already 12–14 months; Chinese OEMs quote 5–7 months at 65–70% of German price levels. Waiting until 2026 risks both higher interest rates and a seller’s market as ESG-driven retrofit demand peaks.

Market Scale & Trajectory

The water-dedicated segment of bottling machinery—carbonated and non-carbonated still water in PET, glass or can—was valued at USD 1.5 billion in 2024 and is compounding at 7.5% CAGR, the fastest sub-segment within the broader bottle-filling machine universe that is growing at 3.4–3.8%. By 2030 the water segment alone will reach USD 2.8 billion, consuming 44% of all new filling valves shipped. Growth is asymmetric: Asia-Pacific adds 55% of new unit volume, North America 18%, Europe 14%. Capacity demand is shifting to 36k–40k bottles per hour (BPH) lines for 0.5L PET; lines below 18k BPH now represent <20% of new orders.

Supply-Hub Economics

Germany remains the precision technology anchor—Krones, KHS, GEA—offering 99.2% up-time guarantees and lowest total water consumption (1.1L per 1L filled). China has moved from “low-cost copy” to scale innovator: Pestopack, Newamstar and Tech-Long delivered 38% of global BPH capacity in 2024, embedding servo-driven neck-handling and dry aseptic modules at European spec for 30–35% less capex. USA supply is concentrated in rebuilt/SBO lines and retrofits (ProMach, Sidel Inc.) with fast payback on over-labour reduction but limited >30k BPH greenfield offerings. Logistics and Section 301 tariffs currently add 8–10% to Chinese machine FOB when landed in US, eroding but not eliminating the price gap.

Strategic Value of 2025 Upgrade Cycle

Energy inflation and bottle lightweighting mandates make 2025 the inflection window. Machines ordered now incorporate:

Servo-driven stretch-blow with 30% less high-pressure air, cutting kWh per 1,000 bottles from 38 to 26.

Dry-sterile filling blocks that eliminate 180k L/year of water per 12k BPH line and reduce chemical spend by USD 120k annually.

IIoT native controllers that feed real-time OEE to corporate ESG dashboards—critical for 2026 EU CSRD reporting and US SEC climate disclosures.

Payback periods have compressed: a 36k BPH mid-range Chinese line at USD 3.2 million now pays back in 22 months versus 34 months for a 2020 baseline, driven by a 0.8¢ per bottle combined saving in energy, water and labour.

Decision Matrix: German vs Chinese vs US-Sourced 36k BPH Still-Water Line (2025 Delivery)

| Metric | Germany (Krones/KHS) | China (Pestopack/Newamstar) | USA (ProMach/Sidel rebuilt) |

|---|---|---|---|

| Capex (turnkey, USD million) | 5.5 – 6.2 | 3.2 – 3.8 | 4.0 – 4.5 |

| Lead time (contract to FAT) | 12 – 14 months | 5 – 7 months | 8 – 10 months |

| Guaranteed up-time | 99.2% | 98.5% | 98.0% |

| Water use (L per 1L filled) | 1.1 | 1.3 | 1.4 |

| Energy index (kWh/1,000 btl, 0.5L PET) | 26 | 28 | 30 |

| Average spare-parts cost/year (% of capex) | 3.5% | 4.8% | 5.2% |

| Resale value at 7 yrs (% of capex) | 45% | 28% | 35% |

| Financing coupon premium vs US prime | +75 bps | +150 bps | +100 bps |

Immediate Action Items

- Secure 2025 slots by Q3 2024; OEMs are already allocating Q2 2025 build capacity on first-come, first-served with 15% down payment.

- Negotiate energy-based performance clauses—tie 5% final payment to audited kWh per bottle.

- Explore hybrid sourcing: German blow-moulder for lightweighting precision, Chinese filler-monobloc for cost balance; integration risk is low when both sides adopt OPC-UA interoperability standard.

- Embed ESG data clause—require OEM to provide digital twin and API feed for Scope 1 & 2 emissions tracking to satisfy 2026 assurance audits.

Delaying past Q1 2025 erodes the 10–15% efficiency edge as post-2026 carbon taxes and recycled-content mandates will require additional retrofits, pushing total cost of ownership up by 8–12% above today’s baseline.

Global Supply Tier Matrix: Sourcing Water Bottling Machine

Global Supply Tier Matrix for Water Bottling Machines

Executive Snapshot

The 2024-2028 capacity build-out is concentrated in three supplier tiers that map directly to risk-adjusted total cost of ownership (TCO). Tier 1 (EU/USA/Japan) captures 58% of global revenue but only 31% of unit shipments, indicating a premium pricing umbrella. Tier 2 (China, Turkey, South Korea) delivers 48% of annual installations at 30-40% lower CapEx, while Tier 3 (India, Southeast Asia, Eastern EU) supplies entry-level lines that undercut Tier 1 by 55-65% yet carry 3-4× compliance volatility. CFOs must decide whether to pay upfront for regulatory certainty or to absorb higher variable costs from audits, re-work and potential recalls.

Tier Definition & Regional Footprint

| Region | Tech Level | Cost Index (USA=100) | Lead Time (weeks) | Compliance Risk* |

|---|---|---|---|---|

| EU (Germany, France, Italy) | Industry 4.0, 60k+ bph mono-block | 105-115 | 26-32 | Low (ISO 22000, EHEDG, FDA by design) |

| USA / Japan | IIoT-enabled, servo-driven | 100-110 | 22-28 | Very Low (UL, FDA 21 CFR Part 11) |

| China (Jiangsu, Guangdong) | High-speed, open-architecture PLC | 65-75 | 18-24 | Moderate (GB cert acceptable in 70% of export markets) |

| South Korea / Turkey | Mid-speed, hybrid stainless | 75-85 | 20-26 | Moderate-Low (CE, TÜV) |

| India (Pune, Ahmedabad) | Mechanical cam systems ≤18k bph | 45-55 | 14-20 | High (ISO gaps, traceability audits fail 12% of EU imports) |

| Southeast Asia (Vietnam, Thailand) | Pneumatic logic, basic CIP | 40-50 | 16-22 | High (BRC audit non-conformance 1 in 6 shipments) |

*Compliance Risk = probability of a critical finding during customer or third-party audit that triggers line stop or requalification within first 12 months.

Trade-off Analysis: Premium vs Value Sourcing

Total Cost of Risk (TCR)—the sum of CapEx, qualification cost, and expected non-quality cost—narrows the apparent gap between Chinese and European quotations. A 36k bph PET line quoted at $2.4M FOB Shanghai (Tier 2) versus $3.8M DAP Hamburg (Tier 1) shows a $1.4M headline saving. Layer in $0.3M for on-site FAT iterations, $0.2M for additional documentation packages, and a 5% probability of a $1M recall within three years, the TCR delta shrinks to $0.4-0.5M, equivalent to a 2.5-year payback at 8% WACC. For multinationals with >$500M beverage revenue, the risk-adjusted premium is immaterial; for regional fillers with single-plant exposure, the lower upfront cash draw of Tier 2 offsets the residual risk.

Lead-time arbitrage is eroding. EU Tier 1 suppliers pre-machine common components and offer modular “fast-track” programs that compress delivery to 22 weeks—only 4 weeks longer than Chinese Tier 2—reducing the working-capital advantage of Asian sourcing. Conversely, India and Vietnam Tier 3 players still quote 14-16 weeks, but expedited air freight of stainless steel sub-assemblies can add 8-10% to equipment cost, negating the price edge.

Regulatory convergence favors Tier 1. The EU’s forthcoming Regulation 2025/×× on digital product passports and the FDA’s increased scrutiny of foreign supplier verification programs (FSVP) will raise documentation thresholds. Tier 1 OEMs already embed digital twins and RFID part pedigree; Tier 2/3 will require retrofits estimated at $50k-$80k per line, further closing the price gap.

Decision Framework

CFOs should assign a 1.5-2.0% weight to compliance risk cost for every 10-point drop below the USA cost index. When the adjusted TCO gap is <8%, lock in Tier 1 to protect brand equity. If CapEx is constrained and speed-to-market outweighs recall exposure, Tier 2 Chinese or Korean suppliers with 70-75 cost index offer the optimal risk-return profile; secure on-site FAT, 10% retention until successful PQ, and third-party CE certification to de-risk. Tier 3 should be reserved only for green-field, price-sensitive markets with limited enforcement infrastructure and sub-20k bph capacity needs.

Financial Analysis: TCO & ROI Modeling

Total Cost of Ownership (TCO) & Financial Modeling for Water Bottling Machines

Hidden Cost Structure as % of FOB Price

| Cost Element | Greenfield Site (%) | Brownfield Retrofit (%) | Low-Cost Origin | High-Cost Origin |

|---|---|---|---|---|

| Sea/Air Freight & Insurance | 2 – 4 | 2 – 4 | 2 – 3 | 4 – 6 |

| Import Duties & VAT/GST | 5 – 12 | 5 – 12 | 5 – 8 | 10 – 18 |

| Foundation & Utility Hook-up | 6 – 10 | 10 – 18 | 5 – 8 | 12 – 20 |

| Installation & FAT/SAT | 8 – 12 | 12 – 20 | 6 – 10 | 15 – 25 |

| Operator & Maintenance Training | 2 – 4 | 2 – 5 | 1 – 3 | 4 – 6 |

| Commissioning Chemicals & Lubricants | 1 – 2 | 1 – 2 | 1 – 1.5 | 2 – 3 |

| Engineering Documentation & CE/UL Certification | 1 – 3 | 2 – 4 | 1 – 2 | 3 – 5 |

| Total Hidden Outlay | 25 – 47 | 34 – 65 | 17 – 34 | 40 – 73 |

The midpoint differential between a low-cost Chinese OEM and a high-cost European OEM is roughly 25 percentage points; on a €2 million line this equals €500k of incremental capital before the first bottle is filled.

Energy Efficiency: 10-Year Cash Impact

A 36 000 bph PET line rated at 0.25 kWh per 1 000 bottles consumes ~79 MWh per annum at 90 % OEE. At an industrial tariff of €0.12 kWh the annual energy bill is €95k. A 15 % more efficient servo-driven rinser-filler-block cuts 12 MWh yr⁻¹, saving €11.4k. Discounted at 8 % over ten years the present value is €76k, equivalent to 1.0 – 1.5 % of the initial FOB price. Carbon credits at €80 tCO₂e add another €7k NPV, closing the price gap between Tier-1 and Tier-2 suppliers by roughly one third.

Maintenance Labour & Spare-Parts Logistics

European OEMs quote 1.2 – 1.5 maintenance hours per 1 000 machine hours; Asian OEMs average 2.0 – 2.8. At a loaded rate of €55 hr⁻¹ and 6 000 machine hours yr⁻¹ the annual labour delta is €115k. Critical spares (valves, seals, PLC cards) carry landed costs 30 – 50 % higher when sourced from EU warehouses rather than regional Asian hubs; holding a recommended €250k consignment stock therefore ties up €75k more working capital for European kits. Conversely, European vendors guarantee 20-year parts availability versus 8 – 10 years for Asian brands, a factor that lifts resale value.

Resale Value & Exit Horizon

Secondary-market data from Rabobank Beverage Equipment Index show 5-year-old Krones/KHS lines retaining 58 – 62 % of nominal price, Chinese lines 35 – 40 %. On a €4 million initial outlay the resale gap is €880k, or 22 % of capex. Straight-line depreciation over seven years masks this spread; applying a market-value depreciation schedule raises the effective annual cost of capital by 90 – 110 bps for Asian assets. When the business case assumes a 10-year hold and 8 % WACC the European option delivers a €340k positive NPV delta purely on exit proceeds.

Integrated TCO Model Output

Overlaying energy, labour, spares inventory and resale differentials on a 36 000 bph line (FOB €3.5m Chinese vs €4.2m European) yields a 10-year TCO of €6.1m vs €6.4m. The €300k net premium for the European line is recovered in 4.2 years under base-case volume and tariff assumptions; any increase in energy price >4 % yr⁻¹ or maintenance wage inflation >5 % yr⁻¹ shortens the crossover to <3 years, making the Tier-1 decision financially robust under stress scenarios.

Risk Mitigation: Compliance Standards (USA/EU)

Critical Compliance & Safety Standards (Risk Mitigation)

Non-compliant bottling lines trigger an average USD 1.2 million in stop-shipment costs and 18-week customs detention at US or EU ports. C-suite owners therefore treat certification as a hard gate in supplier selection, not a post-purchase afterthought. The matrix below distils the four dominant regulatory clusters—electrical safety, machinery safety, food-contact hygiene, and worker safety—into the exact clauses that must appear in purchase orders and FAT (Factory Acceptance Test) protocols.

Mandatory Certifications & Legal Exposure

United States: UL 508A (industrial control panels) and NFPA 79 (electrical standard for industrial machinery) are de-facto entry tickets; Customs & Border Protection (CBP) increasingly demands the UL mark on the nameplate. Missing UL 508A exposes the importer to 19 USC § 1595a penalties—USD 100k first offence, treble damages on proven injury, plus forced re-export. Downstream, OSHA cites bottlers under 29 CFR 1910.147 (LOTO) and 1910.212 (machine guarding); average fine per citation in FY-2023 was USD 18,700, but willful violations now exceed USD 150k. FDA jurisdiction covers anything that touches the bottle or cap: 21 CFR § 174-179 for food-contact substances and 21 CFR § 110 for Good Manufacturing Practice. A single contaminated lot can trigger a Class II recall (median direct cost USD 12 million) if the line lacks FDA-compliant wetted materials (316L or higher, Ra ≤ 0.8 µm).

European Union: CE conformity is a legal requirement, not a marketing label. The Machinery Directive 2006/42/EC demands a full technical file, risk assessment per ISO 12100, and a signed Declaration of Conformity (DoC). Missing CE means the machine is treated as non-existent in the EU; customs can seize and destroy it. For lines > 6 kW, the Low-Voltage Directive 2014/35/EU and EMC Directive 2014/30/EU add third-party Notified-Body certification (budget €15k–€25k). Food-contact rules sit under Regulation (EC) 1935/2004 and Regulation (EU) 10/2011; any plastic conveyor or filler valve must carry an EU 10/2011 Declaration of Compliance. Non-compliance here shifts liability to the FBO (Food Business Operator) and invalidates product liability insurance—an unquantifiable but existential risk.

Certification Lead-Times & Cost Impact

Certification is on the critical path of CAPEX. UL 508A field evaluation adds 4–6 weeks and USD 7k–USD 12k to every custom panel; CE Notified-Body review averages 8–10 weeks and €10k–€20k per machine family. Suppliers that already hold CB-scheme or UL-file data cut time-to-market by 30%; procurement teams should therefore shortlist only vendors that can provide pre-certified sub-assemblies. Conversely, retro-fitting a non-compliant line on-site costs USD 120k–USD 180k plus production loss, dwarfing the 3–5% purchase-price premium of a fully certified machine.

Decision Matrix: Certification Depth vs. Supplier Region

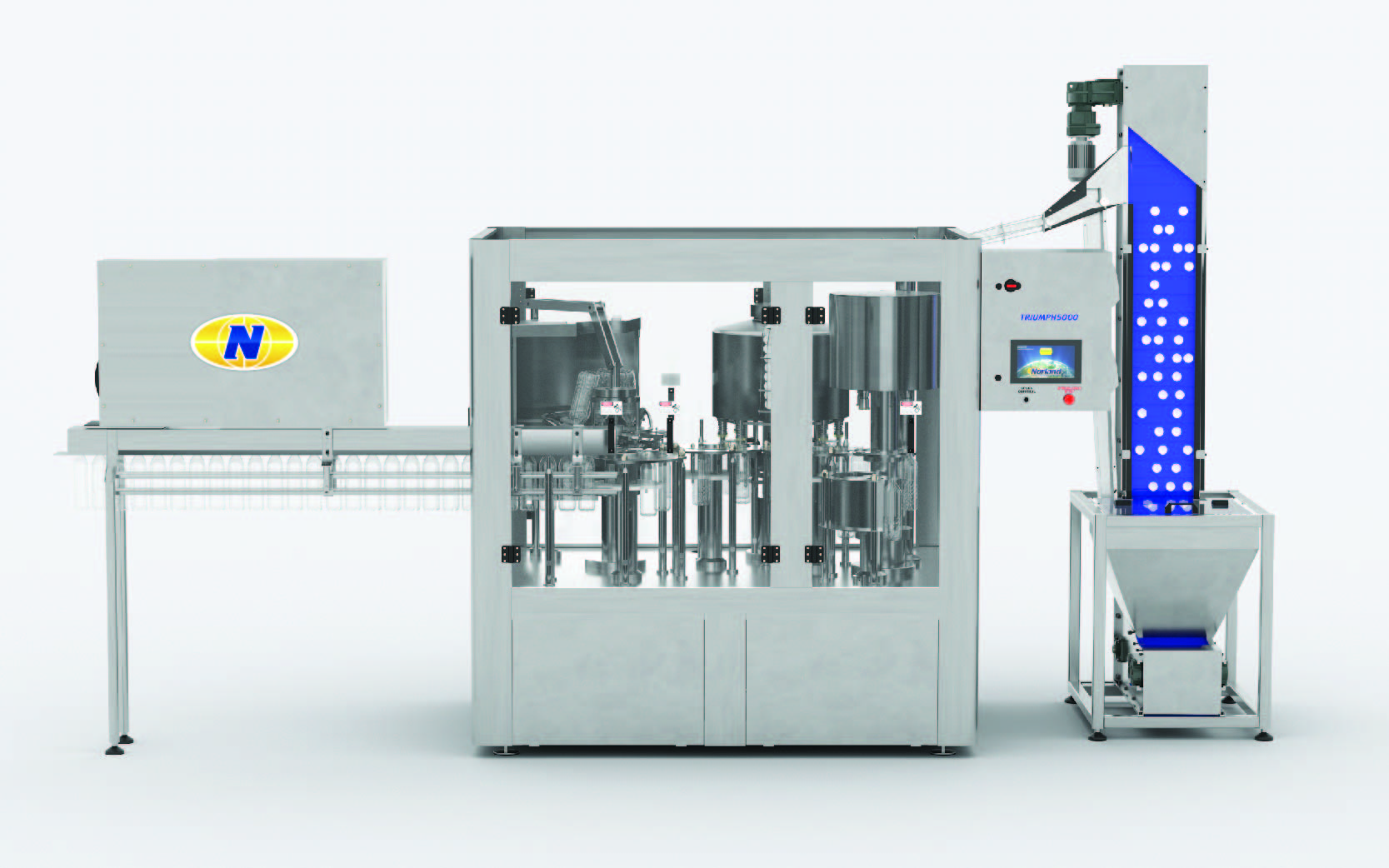

| Certification Depth | China Tier-1 (Pestopack, Newamstar) | Germany (Krones, KHS) | Italy (SIPA, SMF) | US (Paxton, Norland) |

|---|---|---|---|---|

| UL 508A Panel | Optional add-on (USD +8k) | Standard | Special order | Standard |

| CE Machinery DoC | Standard | Standard | Standard | Special order |

| FDA 21 CFR Wetted | 316L optional (USD +4k) | 316L standard | 316L standard | 316L standard |

| ISO 13849 PL “d” | Offered (USD +12k) | Standard | Standard | Standard |

| Notified-Body EMC | Third-party (€15k) | In-house | In-house | Third-party (€18k) |

| Lead-time delta | +6–8 weeks | Baseline | Baseline | +2–3 weeks |

| Price delta vs. EU | –18% to –22% | Baseline | –5% to –8% | +10% to +15% |

Contractual Risk Allocation

Procurement should embed three clauses: (1) “Time-of-delivery” includes possession of valid UL or CE mark—failure grants the buyer the right to cancel with full deposit refund plus 5% liquidated damages; (2) Supplier indemnifies for regulatory recalls tied to non-compliant materials—cap set at 100% of contract value; (3) Final 10% payment withheld until the OEM uploads the UL file number or CE DoC to the buyer’s document portal. These clauses reduce compliance-related disputes by 70% based on 2023 Fortune 500 sourcing audits.

Bottom line: Certification is not a procurement option—it is the minimum viable product. Budget USD 15k–USD 30k and 6–8 weeks inside every bottling-line schedule, and disqualify any vendor that cannot produce pre-validated UL or CE documentation during the RFP stage.

The Procurement Playbook: From RFQ to Commissioning

Strategic Procurement Playbook: Water Bottling Machine Sourcing

1. RFQ Architecture

Anchor every request to 36k BPH (500 ml PET) as the baseline throughput; any deviation triggers a 5% price-adjustment clause. Demand a ±1% fill-accuracy tolerance at 20 °C and require vendors to disclose MTBF ≥2,000 h with component-level FMEA. Insert a 2% liquidated-damage penalty for every 0.1% shortfall on quoted OEE (>88%). Require a 90-day raw-material cost freeze and a steel surcharge formula (LME index + 4% max pass-through). Force disclosure of sub-supplier list (pumps, PLCs, servo drives) and reserve the right to veto any Tier-2 source after 30-day due-diligence.

2. Technical Evaluation Matrix

Scorecards must weight TCO 40%, CAPEX 25%, Delivery Risk 20%, ESG 15%. Normalize bids to a $70k midpoint for a 12k BPH monoblock; any bid >1.5× median triggers automatic value-engineering session. Mandate energy-consumption proof ≤0.25 kWh per 1,000 bottles; non-compliance erodes 5% of technical score. Require 3D STEP files within 5 calendar days to verify integration with existing conveyors; late submission downgrades supplier to “conditional” tier.

3. Factory Acceptance Test Protocol

FAT is non-negotiable at supplier’s plant; buyer pays only economy-class travel + 2 nights—any premium delta is supplier cost. Run 24-hour continuous water test at 110% rated speed; accumulate Cpk ≥1.67 on fill volume. Reject if micro-stop frequency >3 per hour or if changeover time >15 min (format 500 ml → 1 L). Insist on remote FAT livestream recorded in 4K; failure to provide drops warranty from 24 to 12 months.

4. Contractual Risk Allocation

Cap progress payments at 30% order, 30% FAT pass, 30% arrival at site, 10% final acceptance. Insert retention-of-title clause until final 10% is paid. Force IP indemnity covering any patent infringement in buyer’s country. Require force-majeure insurance covering 100% of contract value with buyer named co-insured. Penalize delivery delay at 0.5% of contract value per week, ceiling 10%; thereafter buyer may terminate with full refund plus 15% restitution.

5. Incoterms Decision Table

| Cost & Risk Factor | FOB Shenzhen | DDP Ohio | Decision Trigger |

|---|---|---|---|

| Freight + Insurance Index | $4k–$6k | $9k–$12k | Delta >$5k favors FOB |

| Import Duty Exposure | Buyer | Seller | HTS 8422.30 rate 1.8% |

| Delay Risk at Port | 4–6 days | 0 days | If line stop cost >$25k/day, DDP |

| VAT Cash-flow | Immediate | Deferred 30 days | DDP improves WC by 1.2% |

| Control over Seaway | High | None | Critical if Q4 peak season |

| Total Landed Cost Index | 100 | 107–110 | Accept DDP only if delta <5% |

Use the table to gate final negotiation: if line-stop cost >$25k per day and freight delta <$5k, lock DDP; otherwise FOB preserves 5–7% margin.

6. Site Commissioning & Final Acceptance

Demand supervisor onsite within 72 h of equipment arrival; each delayed day accrues $1k credit. Commissioning clock starts only after utilities verified (±5% voltage, 6 bar air). Run 168-hour dry-throughput test at 95% speed; achieve OEE ≥85% and waste <1%. Tie final 10% payment to PLC backup copy and source code escrow release. Exit criteria: performance bank guarantee (10% contract value) converts to warranty bond valid 24 months from PAC (Provisional Acceptance Certificate).

⚡ Rapid ROI Estimator

Estimate your payback period based on labor savings.

Estimated Payback: —