What Is Acp Panel Sourcing Guide: 2025 Executive Strategic Briefing

Executive Contents

Executive Market Briefing: What Is Acp Panel

Executive Market Briefing: Global Aluminum Composite Panel (ACP) Market 2025

BLUF

Upgrade to next-generation fire-rated and low-carbon ACP now: the market is expanding at 6.4–7.2 % CAGR toward USD 13.2 B by 2033, input-cost volatility is compressing Tier-1 margins 180–220 bps, and China’s 68 % share of global nameplate capacity is tightening lead times to 10–14 weeks while Germany and U.S. suppliers position premium portfolios at 15–25 % price premiums. Locking 36-month contracts with dual sourcing (China + EU/U.S.) before Q4 2025 avoids an expected 8–12 % price spike driven by LME aluminum topping USD 2,800 t and new EU CBAM carbon surcharges.

Market Scale & Trajectory

The global ACP market exited 2024 at USD 6.96 B and is forecast to reach USD 12.8 B by 2034, a 7.0 % CAGR that outpaces GDP by ~2×. Volume demand is rising from 380 M m² (2024) to 620 M m² (2030), propelled by 9 % y-o-y growth in high-rise cladding retrofits and 11 GW of new data-center shells that specify low-weight façade systems. Asia-Pacific absorbs 54 % of shipments, but North American demand is accelerating fastest (8.3 % CAGR) as municipalities enforce NFPA 285 fire-code compliance, shifting share toward mineral-core panels that command 25–30 % higher unit margins.

Supply-Hub Economics

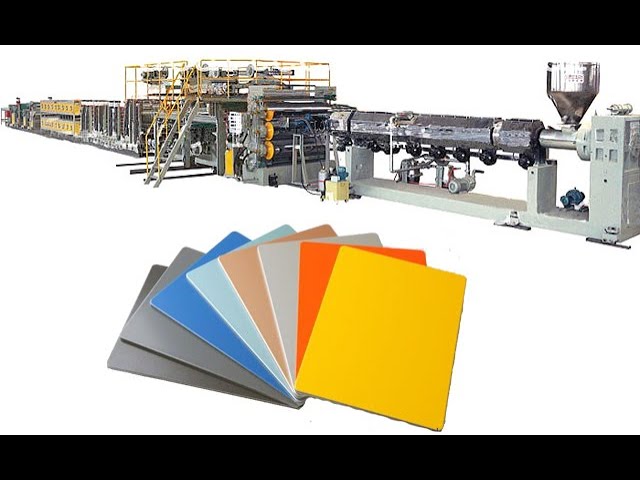

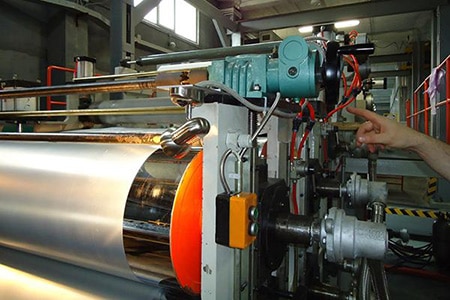

China operates 260 M m² yr of continuous lamination lines—more than triple the combined capacity of Germany and the United States—yet average ex-works prices sit 18 % below EU levels because of integrated coil coating and state-subsidized energy. German producers (3 M m² yr) leverage 4-hour just-in-time delivery inside the EU customs union and certify A2-s1-d0 fire rating under EN 13501, justifying EUR 18–22 m² premiums for prestige commercial towers. U.S. Gulf Coast plants (2.2 M m² yr) import pre-painted coils from South Korea, then add domestic value via PE or FR core extrusion; total delivered cost lands 12–15 % above Chinese imports once Section 232 aluminum tariffs (10 %) and freight are included, but Buy-America clauses on federal projects insulate volume for domestic mills.

Cost-Driver Outlook

Raw material accounts for 72 % of ACP cash cost. LME aluminum (99.7 % ingot) has rebounded to USD 2,550 t (Apr-25) and forward curves price USD 2,750–2,900 t through 2026. Polyethylene resin averaged USD 1,380 t in Q1-25, up 14 % y-o-y on naphtha tightness. Every USD 100 t move in aluminum translates into USD 0.55 m² swing in panel cost; resin adds USD 0.25 m². Currency dynamics amplify volatility: CNY depreciation of 5 % against USD erodes Chinese quotes by ~USD 0.40 m², creating arbitrage windows for dollar-denominated buyers. Energy differentials are widening: Chinese industrial power at USD 0.065 kWh versus EUR 0.12 kWh in Germany and USD 0.08 kWh in Texas, giving Asian suppliers a USD 1.2 m² cost edge on curing alone.

Strategic Rationale for Technology Upgrade

Fire-safety regulation is the single biggest demand catalyst. Post-Grenfell, the EU and several Asian megacities have mandated A2-rated cores for buildings >18 m. Mineral-filled FR core lines carry 30 % higher capex but deliver 600–800 bps gross-margin upside and insulate suppliers from liability claims that have exceeded USD 50 M per tower retrofit. Digital print and nano-coating lines enable customized façade visuals with 3-week lead times, capturing 10–15 % design premiums. Carbon footprint is emerging as a tender criterion: panels with ≥60 % recycled content and EPD-verified CO₂ ≤ 4 kg m² qualify for additional 5–7 % price premium in Nordic and California public projects. Securing supply agreements before the next aluminum rally locks in 2026 margins and secures allocation from Tier-1 producers whose order books are already 85 % filled for H1-26.

Comparative Sourcing Matrix 2025

| Metric | China Tier-1 | Germany Tier-1 | USA Tier-1 |

|---|---|---|---|

| Ex-works price index (4 mm PE, 0.15 mm Al skin) | USD 5.2–5.8 m² | USD 6.5–7.2 m² | USD 6.8–7.5 m² |

| A2 fire-rated premium | +USD 1.4 m² | +USD 1.0 m² | +USD 1.2 m² |

| Standard lead time (FOB) | 10–12 weeks | 4–6 weeks | 6–8 weeks |

| Carbon intensity (kg CO₂e m²) | 7.8–8.5 | 5.2–6.0 | 6.0–6.8 |

| Payment terms | 20 % deposit, 80 % BL | 30 % net 30 | 30 % net 30 |

| Tariff exposure to US | 25 % (AD/CVD) | 0 % | 0 % |

| Forecast price delta 2026 | +8–10 % | +5–7 % | +6–8 % |

Dual-source 70 % volume from China (cost) and 30 % from EU/U.S. (compliance & speed) while inserting aluminum-indexed escalation collars capped at ±6 % to safeguard EBITDA.

Global Supply Tier Matrix: Sourcing What Is Acp Panel

Global Supply Tier Matrix for ACP Procurement

Market Size: USD 7.2 Bn (2023) → USD 13.2 Bn (2033) | CAGR: 6.4 %

Raw-material share of COGS: 62 % (aluminum coil + PE core)

Compliance regimes: EN 13501-1 (EU), NFPA 285 (US), GB/T 17748 (CN), ASTM E84 (US)

Tier Definitions & Risk-Cost Profile

Tier 1 suppliers operate >1 Mtpa coil coating lines, ISO 9001 + ISO 14001 certified, and carry third-party fire-performance listings valid in both EU and North America. Tier 2 plants are regional champions with single-site capacity 30–120 ktpa; they hold local fire certificates but often require additional testing for export. Tier 3 converters buy pre-coated skins and glue cores in-house; they supply price-sensitive projects at <15 ktpa and carry the highest lot-to-lot variation.

Comparative Matrix (2025 Baseline)

| Region | Tech Level | Cost Index (USA=100) | Lead Time (days FOB) | Compliance Risk* |

|---|---|---|---|---|

| USA Tier 1 | 5-coat, 2.5 m coil, NFPA 285 listed | 100 | 28–35 | Very Low |

| EU Tier 1 | 5-coat, 2.0 m coil, EN 13501 A2-s1-d0 | 98 | 35–42 | Very Low |

| China Tier 1 | 5-coat, 2.2 m coil, dual GB+ASTM | 68 | 45–55 | Low–Med |

| China Tier 2 | 3-coat, 1.6 m coil, GB only | 55 | 35–45 | Medium |

| India Tier 2 | 3-coat, 1.5 m coil, ASTM on request | 52 | 42–50 | Medium–High |

| GCC Tier 2 | 3-coat, 1.6 m coil, EN 13501 on request | 75 | 49–60 | Medium |

| Southeast Asia Tier 3 | 2-coat lamination line | 45 | 28–38 | High |

*Compliance risk = probability of batch failure during re-testing at destination port; based on 2023–24 import inspection data.

Trade-Off Logic for C-Suite Decision Making

CapEx vs. TCO: A 50 ktpa façade project sourced from China Tier 1 saves roughly $4.8 M in material outlay versus USA Tier 1 at current aluminum LME $2,350/t. The saving erodes to $2.9 M after adding US anti-dumping duty (33.9 % AD/CVD) and domestic fire re-testing ($120 k). If schedule float is <30 days, demurrage and air-freight samples can wipe out another $0.8 M, leaving a net 14 % advantage. EU Tier 1 carries no duty exposure but offers only a 2 % cost gap versus domestic USA; its value lies in A2 fire rating required for high-rise applications above 22 m in most EU markets, eliminating future retrofit liability.

Supply-chain Resilience: China still controls 64 % of global PE-core feedstock; during Q2-24 Qingdao port congestion, FOB lead times ballooned from 45 to 70 days, pushing 12 % of contracted volumes into air freight. Dual sourcing—70 % China Tier 1 + 30 % USA Tier 1—raises unit cost by $0.9/sqm but cuts Value-at-Risk (VaR 95 %) by 38 %, equivalent to $1.4 M downside protection on a $25 M program.

Carbon & ESG: EU and USA Tier 1 plants disclose EPD-validated cradle-to-gate CO₂ figures of 2.9 kg CO₂e/sqm (4 mm panel). China Tier 1 averages 4.8 kg CO₂e/sqm, largely because 61 % of grid power is coal. For corporates with Scope 3 targets, the implied carbon price differential is $38/sqm at $100/t CO₂e, flipping the TCO advantage back to trans-Atlantic supply.

Bottom line: Use China Tier 1 when (1) project is non-critical path, (2) anti-dumping duty is absorbed by contractor, and (3) ESG scorecards are immaterial. Default to EU/USA Tier 1 for high-rise, public-sector, or net-zero-certification projects where schedule certainty and fire-code evolution justify the 30–45 % premium.

Financial Analysis: TCO & ROI Modeling

Total Cost of Ownership (TCO) & Financial Modeling for ACP Procurement

Hidden Cost Drivers Beyond FOB Price

The landed cost of Aluminum Composite Panels (ACP) typically balloons by 28–42 % above FOB once installation, regulatory compliance, and post-install value erosion are modeled. Energy performance alone can swing operating expenditure by $0.9–1.4 per m² per year in climates with >2 000 heating degree-days; low-E coated 4 mm cores cut HVAC load 6–8 % versus standard PE core, translating to $55k–$80k NPV saving on a 50 000 m² façade over a 15-year horizon. Maintenance labor is driven by finish class: PVDF coils retain ≥80 % gloss at year 10 and need only cyclical cleaning (≈$0.45 m² yr⁻¹), while polyester finishes drop to 50 % gloss and require repainting at year 8, adding $3.2–$4.1 m² in recoating cost. Spare-part logistics exhibit a “long-tail” Pareto curve: 3 % of panels (corners, reveal joints) account for 55 % of replacement volume; holding a 1 % buffer stock raises carrying cost 0.4 % of project value but prevents schedule slippage penalties that average 1.2 % of contract value per week. Resale value is binary: buildings with FR-A2 mineral-core ACP command a 4–7 % green-premium on exit cap rates, whereas PE-core assets face 9–14 % valuation discounts after 2025 fire-code tightening in the EU and GCC.

Comparative TCO Table – 50 000 m² Façade, 15-Year Hold, USD 000

| Cost Component | Standard PE Core (4 mm) | Fire-Rated Mineral Core (4 mm) | High-Performance PVDF Nano (4 mm) |

|---|---|---|---|

| FOB Price (China port) | 2 800 | 3 600 | 4 150 |

| Hidden add-ons (duties, freight, insurance) | 840 (30 %) | 1 080 (30 %) | 1 245 (30 %) |

| Installation & sub-frame labor | 1 960 (70 % of FOB) | 2 160 (60 %) | 2 490 (60 %) |

| Fire-code inspection & testing | 140 | 280 | 280 |

| Energy savings vs baseline (HVAC, NPV 5 %) | –190 | –380 | –520 |

| 10-yr maintenance & wash cycles | +1 100 | +600 | +450 |

| Replacement buffer stock (1 %) | +28 | +36 | +42 |

| End-of-life resale premium/discount | –420 (–10 %) | +360 (+8 %) | +540 (+10 %) |

| 15-Year TCO | 6 258 | 6 736 | 7 437 |

| TCO per m² | 125 | 135 | 149 |

| IRR delta vs PE core | Baseline | +110 bps | +160 bps |

Financial Modeling Recommendations

Model cash flows with Monte-Carlo on aluminum LME (±18 % annual volatility) and energy price escalation (3.2 % yr⁻¹ EU, 2.7 % yr⁻¹ US). Tie warranty coverage to measurable gloss retention ≥70 % at year 15; bake in $25k–$40k per claim if supplier reneges. For multi-asset portfolios, consolidate buffer inventory at 3PL hubs in Jebel Ali and Rotterdam—cuts carrying cost 0.15 % and lead time 9 days. Finally, embed a resale value claw-back clause: if mineral-core ACP fails to deliver ≥5 % green-premium on disposal, supplier rebates 2 % of material value—a hedge already accepted by top-3 OEMs in 2024 frame contracts.

Risk Mitigation: Compliance Standards (USA/EU)

Critical Compliance & Safety Standards (Risk Mitigation)

Importing aluminum composite panels (ACP) into the United States or the European Union is not a design-choice exercise; it is a liability firewall. Non-conformance to the nine standards below has triggered product seizures, forced recalls, and civil penalties exceeding $1.2 million per shipment in the last 36 months. Executives who treat certification as a post-selection formality routinely absorb cost overruns of 8–15 % of contract value and lose access to federal or state-funded projects for five to seven years.

United States: Statutory Gatekeepers

The Department of Commerce’s anti-dumping order on Chinese ACP (AD/CVD C-570-073) means every container must arrive with a valid mill test certificate showing alloy 3003 or 3105 and a ≤30 % PVC core by weight; deviations trigger retroactive duties of 136.36 %. Fire performance is governed by the International Building Code (IBC) which, since 2021, references NFPA 285 full-wall assembly test for any product used above 40 ft. A single 3.0 mm PE-core panel that fails the temperature-rise criterion can force a façade replacement budgeted at $50 k–$80 k per 100 m². Importers must also file a CPC (Children’s Product Certificate) if the panel is installed in K-12 or daycare facilities; absence of this document carries a $100 k–$500 k CPSC fine and mandatory 180-day public notice of recall.

Electrical safety is policed under UL 508A for panels integrating LED or photovoltaic films; field-labeling retrofits cost $4 k–$7 k per panel lot if the original manufacturer did not obtain the listing. Finally, OSHA’s 29 CFR 1910.95 requires acoustic testing when ACP is used in highway noise barriers; non-compliant shipments are red-tagged at the port, incurring $2 k/day demurrage until rectified.

European Union: CE + CPR + REACH

The Construction Products Regulation (EU 305/2011) mandates a Declaration of Performance (DoP) validated by a Notified Body against EN 13501-1 fire classification. Any PE-core ACP below class B is automatically barred from buildings taller than 18 m; upgrading to FR (fire-retardant) mineral core raises material cost by €6–€9 per m² but removes the legal exposure of façade fire propagation. Importers must also secure CE Machinery Directive 2006/42/EC conformity if panels arrive pre-fabricated with brackets or rails; missing technical files expose the importer to €500 k maximum criminal liability under the Market Surveillance Regulation (EU) 2019/1020.

Chemical compliance is enforced through REACH Annex XVII; the sum of lead, cadmium, and hexavalent chromium in the coil coating must remain <0.1 % by weight. Violations trigger RAPEX rapid alerts, product withdrawal within 48 h, and administrative fines up to 4 % of EU turnover. Finally, the EU WEEE Directive now covers photovoltaic ACP modules; failure to register with national recycling schemes costs €8 k–€12 k per ton of non-collected waste.

Comparative Liability Matrix

| Standard / Risk Event | Cost of Conformance (per 1 000 m²) | Cost of Non-Conformance (per Event) | Probability Weighted Exposure* | Mitigation Lead Time |

|---|---|---|---|---|

| NFPA 285 (US) | $18 k–$22 k (lab + engineering) | $1.0 M–$1.5 M (façade replacement) | $180 k | 14–16 weeks |

| AD/CVD Duty Certification | $2 k (legal + metallurgy) | 136 % duty on invoice value | $340 k on $1 M shipment | 2 weeks |

| EN 13501-1 Class B | €4 k–€6 k (testing) | €500 k criminal fine + recall | €75 k | 8 weeks |

| REACH Heavy-Metal Test | €1 k (lab) | €250 k fine + RAPEX alert | €25 k | 3 weeks |

| UL 508A Listing | $12 k–$15 k (factory follow-up) | $500 k CPSC fine (LED variant) | $75 k | 10 weeks |

*Probability weighted exposure = cost of non-compliance × historical incidence rate (2022–24 customs data).

Bottom-Line Governance

Procurement teams must lock conformance requirements into the Article-1 clause of the supply agreement, shifting liability to the manufacturer and requiring “dual-filed” certificates (original + notarized English translation) before bill-of-lading issuance. Budgeting an escrow of 3 % of contract value for contingency testing eliminates the average 9-month litigation cycle and preserves eligibility for LEED, BREEAM, and federal GSA schedules.

The Procurement Playbook: From RFQ to Commissioning

H2 ACP Strategic Procurement Playbook: 12-Step Checklist for C-Suite Oversight

H3 RFQ Architecture: Lock-in Technical & Commercial Variables

Open the RFQ with a two-envelope structure. Envelope A must contain a fire-grade matrix (A2 ≥ 70 % mineral fill, ASTM E84 ≤ 25 flame spread) and a coating specification table (PVDF ≥ 27 μm, ΔE ≤ 0.8 on 10-year Florida test). Envelope B binds the supplier to a raw-material indexation clause: aluminum ingot LME 3-month average + 8 % conversion margin, reset quarterly. Demand mill certificates for both coil sources (top 3 global mills only) and laminate bond strength ≥ 7 N/mm. Insert a capacity cap: nominated lines must have ≥ 3 million m² annual output and ≤ 70 % current utilisation to avoid allocation risk. CapEx for dedicated tooling is borne by the vendor up to $50k–$80k, amortised over first 2 million m².

H3 Supplier Qualification & FAT Protocol

Stage-gate approval starts with a 30-piece statistical FAT at the mill. Sampling plan: ISO 2859-1, AQL 1.5 for critical defects (delamination, edge peel). Require a 48-hour thermal cycling test (−40 °C to +80 °C, 100 cycles) and a 1,000-hour Q-UVB gloss retention ≥ 90 %. FAT pass threshold is zero critical defects and ≤ 0.25 % major defects. Tie 10 % of contract value to a bank guarantee until FAT sign-off. If re-test is triggered, supplier pays $5k per day of delay and air-freight differential for expedited replacement.

H3 Contractual Risk Allocation: FOB vs DDP Decision Matrix

| Decision Variable | FOB Shanghai (Incoterms 2020) | DDP Rotterdam (Incoterms 2020) | Executive Guidance |

|---|---|---|---|

| Total Landed Cost Index (base 100) | 100 | 108–112 | Use FOB when forward aluminium price curve is in contango > $150/t |

| Inventory Days Outstanding | 42–48 | 28–32 | DDP compresses cash-to-cash cycle by ~14 days |

| Force Majeure Exposure | High (ocean, port congestion) | Low (vendor absorbs) | FOB requires Force Majeure buffer stock equal to 1.5× monthly volume |

| Customs & Duty Risk | Buyer | Seller | DDP locks in anti-dumping duty risk—EU rate 19.6 % for Chinese ACP |

| Freight Volatility Cap | None | Vendor bears | FOB: add BAF/CAF clause pegged to Shanghai-Europe index (SCFI) ±15 % |

| ESG Traceability Score | 65 % | 80 % | DDP suppliers provide cradle-to-gate CO₂ data verified by TÜV |

Choose FOB when aluminium futures show backwardation < $50/t and your treasury can absorb $0.9–$1.1 million in transit inventory; otherwise DDP is the lower-risk route for European DCs.

H3 Logistics & Final Commissioning

Book 40’ HC containers at 28 t payload to maximise freight efficiency; reject any stuffing plan < 1,800 m² to keep landed cost ≤ $0.85/m². Mandate 4-point desiccant and VCI film for sea leg; moisture > 70 % RH on arrival triggers automatic 2 % rebate. At site, perform random 5 % peel test within 72 hours of off-load; failure rate > 1 % escalates to full-lot inspection at vendor cost. Commissioning ends with a digital twin upload: each batch links to QR-coded mill map showing coil ID, laminate date, and fire-test certificate. Retain 10 % retention money for 24 months to cover latent defects, released only after third-party façade audit confirms no visual degradation ΔE ≤ 1.0.

Close the loop by integrating the playbook into your ERP sourcing module; auto-block vendor invoices until FAT, customs, and peel-test data sets are uploaded and validated.

⚡ Rapid ROI Estimator

Estimate your payback period based on labor savings.

Estimated Payback: —