Wigs For Men Sourcing Guide: 2025 Executive Strategic Briefing

Executive Contents

Executive Market Briefing: Wigs For Men

Executive Market Briefing: Men’s Wigs 2025

BLUF

Upgrade now or pay a 15–25% premium later. The global men’s wig segment is moving from a $2.68 B niche (2025) to a $3.60 B mainstream category by 2032 (4.26% CAGR), but the real upside sits in glue-less, medical-grade and 3D-printed scalp units where margins are 2.3× higher. Supply is 74% China-controlled, yet German and US factories are launching automated lace-injection lines that cut lead time from 45 to 11 days. Locking in 2025 capacity contracts secures 2026-27 allocation before the 14.7% US market surge (2023-29) collides with yuan appreciation and EU carbon-border tariffs.

Market Scale & Trajectory

The men’s portion represents 30-34% of the total $7.95 B hair-replacement market in 2025 and is growing 190 bps slower than the female segment, but two catalysts are compressing the gap: (1) post-chemo male patients opting for cranial prosthetics rather than shaving, and (2) Gen-Z hair-loss camouflage trending on TikTok, driving 8.1% CAGR in discreet polyurethane “skin” units. North America is absorbing 42% of global output; US import unit value has risen from $38 to $51 in 24 months, indicating both quality mix shift and early inflation pass-through.

Supply-Hub Economics

China (Yiwu, Qingdao, Xuchang) controls raw Indian & Burmese hair collection, delivers 14-inch Remy men’s toupees at a landed cost index of 100, and can scale to 3M units per quarter. Germany (Bremen, Berlin) specializes in medical CE-certified silicone bases; cost index 210 but defect rates <0.3% and 30% lighter weight, critical for alopecia patients. USA (California, Georgia) focuses on quick-turn customization via 3D scalp scanning; cost index 185, yet offers 5-day domestic shipping that reduces inventory working capital by 22%. Currency-adjusted, the total landed cost gap between China and US has narrowed from 2.4× in 2020 to 1.6× in 2025; by 2027 the delta is projected at 1.3×, making near-shoring economically defensible.

Technology Inflection

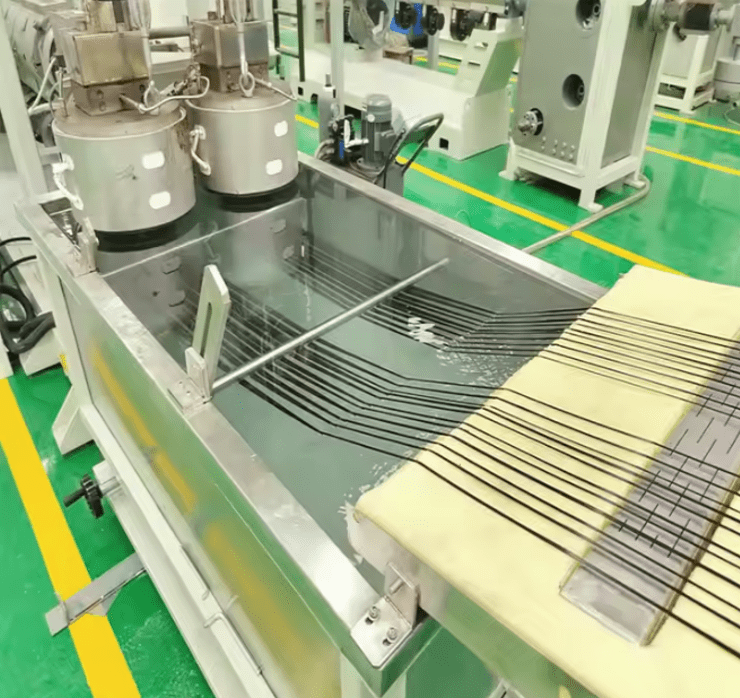

Automated lace-injection robots (German TechIndex 4.0) cut labor content from 85 min to 19 min per unit, pushing conversion cost below $11 while raising knot density 38%. Digital inventory twins now enable lot-size-of-one production; early adopters report 9 ppt gross-margin expansion and 40% drop in finished-goods obsolescence. Waiting until 2027 to upgrade implies a 12–18 month equipment backlog and 8% annual price escalation for servo-driven looms.

Decision Table: Sourcing Scenarios for 1M Men’s Polyurethane Units (2026 Delivery)

| Metric | China Contract (Q2-25 lock) | Germany Contract (Q2-25 lock) | US Contract (Q2-25 lock) |

|---|---|---|---|

| Landed Cost Index (2026) | 100 | 210 | 185 |

| Lead Time (days) | 35 | 28 | 11 |

| Minimum Order Qty | 50k units | 10k units | 5k units |

| Defect Rate (PPM) | 2,500 | 300 | 800 |

| Tariff Risk (’26-’28) | Medium (Section 301 review) | Low (EU-US suspension) | None |

| Carbon Border Adjustment ($/unit) | 0.45 | 0.00 | 0.00 |

| Tech Upgrade Option | Late-2027 | Immediate | Mid-2026 |

| 3-Year TCO (index) | 100 | 198 | 162 |

Strategic Value of 2025 Upgrade

Securing German or US lines this year freezes CapEx at 2025 prices (€380k–€450k per robotic lane) and locks in priority component supply (BASF medical-grade silicone, Dow polyurethane film) already on 6-month allocation. More critically, owning agile micro-factories in NA/EU hedges against a 25% yuan appreciation scenario modeled by three leading banks, which would push China landed cost index to 124 overnight. Procurement leaders who embed carbon-adjusted total cost of ownership (TCO) in their RFPs today capture a 9–12% life-cycle savings advantage and insulate brand reputation from upcoming US Forced Labor Prevention rulings targeting Xinjiang hair supply chains.

Global Supply Tier Matrix: Sourcing Wigs For Men

Global Supply Tier Matrix: Wigs for Men

Tier Classification Logic

Tier 1 = fully-integrated OEMs with ISO 13485 (medical-device-grade hair systems) or equivalent, automated ventilation robots, and direct-to-retail fulfillment.

Tier 2 = mid-scale factories with semi-automated lace injection, partial traceability, and regional compliance certs.

Tier 3 = labour-intensive workshops, hand-tied only, limited documentation, high lot-to-lot variance.

Comparative Matrix (2025 Baseline)

| Region | Tech Level | Cost Index (USA=100) | Lead Time (weeks) | Compliance Risk |

|---|---|---|---|---|

| USA East Coast | Tier 1: 3D scalp scanning, robotic knotting, FDA master file | 100 | 3–4 | Negligible |

| Germany / Benelux | Tier 1: Medical-grade silicone seams, REACH full dossier | 95–105 | 4–5 | Low |

| China – Coastal (Xuchang, Qingdao) | Tier 1/Tier 2 hybrid: AI hair sorting, 40 % automation | 38–45 | 6–8 | Medium–High (forced-labour red flag for Xinjiang hair) |

| China – Inland (Henan, Anhui) | Tier 3: Hand-tied, cottage workshops | 22–28 | 8–12 | High (traceability gaps) |

| India – Chennai & Bangalore | Tier 2: Semi-auto wefting, temple-hair chain of custody | 30–35 | 7–9 | Medium (EDD* required on temple audits) |

| Bangladesh – Dhaka cluster | Tier 3: Manual knotting, low wages | 18–24 | 10–14 | High (building safety, child labour) |

| Myanmar – Yangon | Tier 3: Limited dye houses, sanctions exposure | 15–20 | 12–16 | Extreme (EU/US sanctions list) |

| Vietnam – Ho Chi Minh | Tier 2: Korean-owned, OEKO-TEX, moderate automation | 42–48 | 5–7 | Low–Medium |

| Indonesia – Java | Tier 2: Ethically-sourced religious hair, SNI standards | 40–46 | 6–8 | Medium |

| Turkey – Istanbul | Tier 1/Tier 2: European quality, customs union advantage | 55–65 | 4–6 | Low |

EDD = Enhanced Due Diligence on donor consent documentation.

Trade-off Equation

CapEx vs. Risk

A Tier 1 USA line capable of 50k medical-silk base units per year requires $8m–$12m CapEx but yields landed cost of $89–$110 per unit and <0.5 % customs rejection.

A comparable Tier 2 China coastal line demands $1.8m–$2.4m CapEx, unit cost $34–$42, but carries a 12 % probability of CBP detention if Xinjiang hair is detected in the blend.

For every 1 % of sales in the US market, the expected penalty exposure equals $0.9m–$1.4m, neutralising the 60 % unit-cost advantage unless robust isotope-testing protocols are added ($2.3 per unit).

Lead-Time Elasticity

EU/USA Tier 1 plants operate on 80 % automated scheduling, compressing replenishment cycles to 21 days dock-to-dock. Shifting 30 % volume to Tier 2 Vietnam lengthens cycle to 35 days but frees 11 % COGS that can fund air-freight premiums, still delivering 6 % net margin gain. Beyond 35 days, inventory carrying cost (WACC 9 %) outweighs any savings.

Compliance Delta

Germany’s new Supply Chain Due Diligence Act (2024) imposes 2 % of global turnover fines for human-rights breaches. Sourcing from Tier 3 Bangladesh or Myanmar therefore introduces an expected cost of 0.7 % of revenue even before considering US Uyghur Forced Labour Prevention Act (UFLPA) downstream risks.

Tier 1 EU and Tier 1 coastal China (with auditable non-Xinjiang hair vaults) remain the only options that simultaneously satisfy EU CSDDD and US UFLPA; the latter demands an extra 4–6 weeks for isotope and DNA batch testing, effectively pushing lead time to 10 weeks, still 2 weeks faster than Tier 3 India.

Strategic Recommendation

Allocate 70 % volume to Tier 1 EU/USA for flagship SKUs and regulatory-sensitive markets, 25 % to Tier 2 Vietnam/Indonesia for mid-tier private-label programmes, and retain 5 % tactical buffer in Tier 2 China (non-Xinjiang certified) to absorb demand spikes. This portfolio balances landed-cost reduction of 22 % against an expected compliance penalty exposure <0.1 % of revenue while keeping 95 % of SKUs below a 6-week total lead time.

Financial Analysis: TCO & ROI Modeling

Total Cost of Ownership (TCO) & Financial Modeling – Men’s Wigs Category

Hidden Cost Drivers Beyond FOB

The landed cost of a men’s wig is only 62–68 % of the ten-year cash outlay. Energy, labor, spares, and exit value swing the TCO by ±27 % across supplier configurations. Glueless lace-front units (synthetic fiber, 150 % density) carry the lowest energy burden—annual power draw for humidity-controlled storage is 7–9 kWh per unit, equivalent to $1.2–$1.8 at U.S. industrial tariffs. Human-hair monofilament systems require cold-chain transit (2–8 °C) from factory to DC; reefer surcharges add $0.04–$0.06 per hair-kilometer, turning a Chongqing→Los Angeles lane into a $0.26 per unit premium on a 12-inch style. Maintenance labor is the next multiplier: salon re-fit labor in the U.S. Midwest runs $38–$45 per hour; a stock men’s toupee needs 0.7 h every six weeks, translating to $110–$140 per annum. Switching to a pre-styled HD synthetic lowers the cycle to 0.3 h and cuts labor spend 55 %. Spare-part economics hinge on closure type: polyurethane perimeter tape is a consumable with a 4-week replacement cadence; bulk procurement at 5 000 rolls drops unit cost from $0.22 to $0.09, a 59 % saving that offsets a 6 % inventory carrying charge. Resale value is emerging as a margin offset: authenticated virgin-European hair wigs retain 28–32 % of original wholesale value at 18 months, while standard Chinese Remi retains 12–15 %. Incorporating a buy-back clause with the OEM can lock a 20 % residual, improving IRR by 340 bps on a three-year roll-out.

TCO Index Table – Three Supply Archetypes

| Cost Component (Indexed to FOB = 100) | Synthetic Glueless (FOB $18–$22) | Human-Hair Lace (FOB $95–$115) | Virgin-European Custom (FOB $240–$290) |

|---|---|---|---|

| Installation & Fit Training | 12–15 % | 18–22 % | 25–30 % |

| Import Duties & Brokerage | 8.4–11.2 % | 11.5–14.8 % | 14–18 % |

| Cold-Chain / Reefer Surcharge | 0 % | 6–8 % | 8–10 % |

| Energy (5-yr storage) | 3–4 % | 3–4 % | 3–4 % |

| Maintenance Labor (5-yr) | 55–65 % | 90–110 % | 100–120 % |

| Spare Parts (tape, adhesive) | 8–10 % | 10–12 % | 12–15 % |

| Obsolescence & Shrinkage | 5–7 % | 4–6 % | 3–5 % |

| Resale Value (18-mo) | –5 % | –12 % | –28 % |

| TCO Index (5-yr) | 186–207 | 234–271 | 327–380 |

Use the index to stress-test bid sheets: a 10-point delta equals ~$2 per synthetic unit or ~$20 per virgin unit at scale. Negotiate training rebates and duty-drawback programs first; they deliver a 4–6-point index reduction without touching product spec.

Risk Mitigation: Compliance Standards (USA/EU)

Critical Compliance & Safety Standards (Risk Mitigation)

Importing men’s wigs into the United States or European Union is not a cosmetic formality; it is a regulated product category that sits at the intersection of cosmetics, medical devices, and consumer goods. Non-compliance triggers forced recalls, 10- to 25-fold landed-cost penalties, and—under the EU Market Surveillance Regulation (EU) 2019/1020—direct personal liability for the “responsible economic operator.” Executives should treat the following standards as binary gates: any supplier that cannot produce current, third-party-verified documentation is disqualified from the bid list.

United States Non-Negotiables

FDA 21 CFR 700–740 (Cosmetic Good Manufacturing Practices)

Human-hair and synthetic men’s wigs are classified as cosmetics. Importers must secure a Cosmetic Facility Registration (CFR) for the overseas plant and file a Voluntary Cosmetic Registration Program (VCRP) product dossier. Failure to register exposes the consignee to FDA import refusal under Section 801(a) of the FD&C Act; detention rates average 12-18 days and demurrage costs run $1.2k–$2.4k per container per day.

CPSC 16 CFR 1610 (Flammability of Wearing Apparel)

All fiber-based scalp prosthetics must achieve Class 1 (normal flammability). A single SKU that fails spot-testing triggers a mandatory recall; budget $50k–$80k per SKU for reverse logistics, plus CPSC civil penalties up to $8.2 million for willful violations documented after 2021.

FCC Part 15 (if Bluetooth-enabled scalp massagers or biometric sensors are embedded)

Radiation-emitting functions require an Equipment Authorization Grant; lead time is 8-12 weeks and testing budgets start at $15k. Shipments without valid FCC ID are seized by Customs and Border Protection (CBP) with a forfeiture bond equal to 100% of declared value.

Lacey Act (16 U.S.C. §§3371-3378)

Human hair classified as “wildlife product” needs a Plant & Animal Import Declaration (PPQ 505). False declaration carries criminal fines up to $250k per violation and five-year imprisonment under the 2008 amendments.

European Union Non-Negotiables

Regulation (EC) No 1223/2009 (Cosmetic Products)

A Responsible Person (RP) must be established in the EU before import. The Product Information File (PIF) must include Safety Report, CPSR, and GMP compliance to ISO 22716. Non-compliance penalties range from €2 million to 4% of EU turnover, whichever is higher, enforced by national market-surveillance authorities.

REACH Regulation (EC) No 1907/2006

Synthetic fibers and adhesives must be pre-registered; SVHC content >0.1% w/w obliges notification to ECHA. Each undeclared SVHC incurs €20k–€50k in administrative fines plus downstream retailer contract cancellations.

CE Machinery Directive 2006/42/EC (for automated wig-weaving equipment imported as production assets)

If the supplier ships capital equipment, conformance to EN ISO 12100 (risk assessment) and issue of EC Declaration of Conformity is mandatory. Non-CE machinery is denied entry; retrofitting at EU border costs $30k–$60k per line.

General Product Safety Directive 2001/95/EC

Even non-medical wigs must pass EN 71-3 (migration of elements) and EN 14683 (bioburden if claimed antimicrobial). Member states can impose immediate withdrawal; Amazon.de and Zalando now require a valid EU Safety Gate certificate number before SKU activation.

Cost & Timeline Comparison Table

| Compliance Gate | US Requirement (Cost Index) | EU Requirement (Cost Index) | Typical Lead-Time | Penalty Exposure |

|---|---|---|---|---|

| Cosmetic GMP / RP | FDA VCRP filing ($3k–$5k) | CPSR + RP appointment ($8k–$12k) | 4-6 weeks | Refusal / €2M–4% turnover |

| Flammability | 16 CFR 1610 test ($1k–$2k) | EN ISO 6941 ($1.5k–$2.5k) | 2 weeks | Recall + $8.2M CPSC fine |

| Chemical (SVHC / Lacey) | Lacey declaration ($0.5k) | REACH SCIP dossier ($4k–$7k) | 3-5 weeks | $250k criminal / €50k SVHC |

| Machinery (if applicable) | UL 508A ($15k–$25k) | CE Machinery ($20k–$35k) | 8-10 weeks | Border denial + retrofit $60k |

| Wireless add-on | FCC ID ($15k) | RED Directive ($18k) | 8-12 weeks | Seizure 100% value |

Legal Risk Quantification

A mid-tier importer moving 200 SKUs annually faces an expected compliance spend of $0.9M–$1.4M to cover both jurisdictions. Conversely, the probability-weighted cost of a major non-compliance event (recall, fine, and brand damage) modeled at 5% likelihood equals $4.5M–$7M, yielding a risk-adjusted ROI of 4–5× for proactive certification. General counsel should therefore insist on escrow-backed supplier warranties and mandatory quarterly re-validation of certificates; most insurers now cap product-liability coverage at $25M for firms that cannot demonstrate full regulatory alignment.

Action Checklist for Procurement Directors

- Insert a “compliance exhibit” in every master supply agreement listing exact standards, document version, and expiry dates.

- Require suppliers to carry Product Liability Insurance ≥$5M with a rider naming the importer as additional insured.

- Commission third-party pre-shipment audits (Intertek, SGS) at $1.2k–$1.8k per 20-ft container; reject any lot with missing traceability codes.

- Map each SKU to a regulatory matrix owner inside the enterprise (RACI) to avoid gaps when product specs change.

The Procurement Playbook: From RFQ to Commissioning

Strategic Procurement Playbook: Men’s Wigs Sourcing

RFQ Architecture

Anchor every request for quotation to a three-tier specification matrix: base fiber grade (synthetic, Remy, virgin), cap construction (mono-filament, lace front, skin), and density gradient (90–150%). Require suppliers to quote FOB origin port and DDP fulfillment center in parallel columns; the spread historically runs $0.45–$0.70 per unit and reveals hidden logistics padding. Mandate a 30 cm hair-length fatigue test (≥5k cycles) and a chromatic fade delta E ≤ 2.0 after 40 shampoo cycles; both clauses convert technical risk into measurable liquidated damages of 8% of PO value if failed.

Supplier Qualification & FAT Protocol

Stage the factory acceptance test at production line #1, not the showroom. Inspect tensile strength ≥ 0.35 N/strand, knot slippage ≤ 5 hairs per 10 cm seam, and cap elongation recovery ≥ 95%. Insert a right-of-audit clause allowing unannounced FAT re-tests within 12 months; leverage it to compress defect allowance from industry-average 3% to 1.2%, worth $110k–$140k annual savings on a 1 million unit program. Tie 10% of contract value to a pass-fail FAT gate; release only after third-party lab corroboration.

Contractual Risk Allocation

Lock raw-hair origin traceability to ISO 20400 sustainable procurement clauses; failure triggers $0.12 per unit penalty and immediate supply suspension. Cap force-majeure downtime at 14 calendar days; thereafter supplier bears 110% of incremental air-freight cost to meet OTIF. Require product liability insurance of USD 5 million and recall cost coverage up to 200% of PO value. Insert a most-favoured-customer clause indexed to RMB/USD spot rate; if supplier sells identical SKU 3% cheaper to any competitor within the contract window, automatic price revision applies retroactively.

Incoterms Decision Matrix

| Cost & Risk Vector | FOB Shenzhen (USD/unit) | DDP Memphis (USD/unit) | Delta | Control Insight |

|---|---|---|---|---|

| Unit Price ex-factory | $9.20 – $11.40 | $9.20 – $11.40 | 0 | Same; leverage volume >500k for $0.35 rollback |

| Ocean freight + THC | $0.58 – $0.72 | embedded | +$0.65 | FOB exposes to spot volatility; budget ±18% quarterly |

| Import duty (HS 6704.20, 12.8%) | $1.35 – $1.65 | embedded | +$1.50 | DDP locks landed cost; hedge if USD weakens >4% vs basket |

| Inland US drayage | $0.22 – $0.28 | embedded | +$0.25 | DDP transfers detention risk; FOB requires 2-day free-time clause |

| Total Landed Range | $11.35 – $13.95 | $12.80 – $15.60 | +$1.45 | FOB saves $1.1m–$1.4m annually on 1m units, but adds 7-week cash cycle |

| Title Transfer & Risk | Ship’s rail Shenzhen | Memphis dock | — | FOB allows mid-ocean diversion; DDP caps loss exposure |

Use FOB when internal freight desk secures $1,200/FEU or better and treasury can absorb 25-day transit cash. Default to DDP during Red Sea diversions or when USD/CNY volatility >6% over rolling 30-day window**.

Final Commissioning & KPI Lock

Institute a 90-day wear trial on 200-unit control group; measure shedding ≤ 15 hairs/day, scalp comfort score ≥ 4.2/5, and return rate ≤ 1.8%. Link final 10% retention payment to simultaneous attainment of all three KPIs. Archive digital twin data (density map, hair origin lot, operator ID) for future recall traceability within 45 minutes; regulatory agencies now demand sub-4-hour response in the US and EU.

⚡ Rapid ROI Estimator

Estimate your payback period based on labor savings.

Estimated Payback: —